TIDMINSP

RNS Number : 8521U

Inspirit Energy Holdings PLC

31 March 2023

31 March 2023

Inspirit Energy Holdings PLC

("Inspirit Energy", the "Group" or the "Company")

Interim Results

Inspirit Energy Holdings PLC (AIM: INSP), the developer of micro

Combined Heat and Power (microCHP) boilers, is pleased to announce

its interim accounts for the six months ended 31 December 2022. The

interim financial information document will also be available on

the Company's website www.inspirit-energy.com .

Chairman's Statement:

In the period under review our engineering team have been

concluding the stage two build and testing and a number of tests

have been conducted under varying scenarios, each for a duration of

approximately one hour, with consistent performance with peak

output reaching 97kw.

Stage three build and testing should be complete by the 2nd

Quarter 2023, where the unit is targeted to achieve its intended

peak performance of 131kW.

While we have experienced minor delays, the result of extended

delivery times from suppliers of key components, the Inspirit WHR

unit has met all our expectations around reliability and

performance. Discussions are currently ongoing with both a major

automotive group and with an alternative combustion manufacturer to

potentially partner on exciting future developments relating to the

Charger. In addition, the Inspirit team is also exploring

opportunities to collaborate with other automotive groups, where

the potential exists to achieve the same significant performance

enhancements that we have achieved to date with automotive

combustions engines.

The board of Inspirit has no doubt that the technology the

Company has developed could have a significant impact on

applications within the automotive industry where manufacturers

seek to enhance performance from the recovery and electrification

of waste heat. The commercial potential would seem boundless and

Inspirit is extremely optimistic about the commercial prospects for

the business. To the best of our understanding, we remain unique in

this space at a time where manufactures of combustion engines are

seeking to create more efficient engines for commercial

vehicles.

Furthermore, the industrial sector is another requiring urgent

solutions for waste recovery technologies where Inspirit could

really apply its WHR technology. The general consensus is that the

world needs to decarbonise low temperature industrial waste heat to

achieve net-zero greenhouse gas emission targets. Industrial waste

heat production represents an opportunity for reduction in the use

of fossil fuels. Energy inefficient processes in addition to

increased emissions raises the cost of plant operation, -an

undesirable scenario for both industrial competitiveness and the

environment. The quantity and potential applications for recovered

low temperature industrial waste heat and the quantification

and

characterisation of the resource could provide the needed

impetus for the development and adoption of green technologies to

help achieve the 2050 Net-Zero target. Significant opportunities

exist in this low temperature range for waste heat recovery actions

at individual sites. Research and Development (R&D) into

alternative improved methods for waste heat recovery, storage, and

use technologies could also produce significant positive

environmental and industrial impact.

-ends-

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

More information on Inspirit Energy can be seen at:

www.inspirit-energy.com

For further information please contact:

Inspirit Energy Holdings plc

John Gunn, Chairman and CEO +44 (0) 207 048 9400

Beaumont Cornish Limited

www.beaumontcornish.com

(Nominated Advisor)

Roland Cornish / James Biddle +44 (0) 207 628 3396

Global Investment Strategy UK

Ltd

(Broker)

Samantha Esqulant +44 (0) 207 048 9045

INSPIRIT ENERGY HOLDINGS PLC

Consolidated

Statement of Comprehensive Income

for the six months ended 31 December 2022

Group Group Group

Six months Six months Year

to to to

31 December 31 December 30 June

2022 2021 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

---------------------------- ---------------- ---------------- ----------------

Revenue - - -

Administrative expenses (158) (137) (329)

---------------- ---------------- ----------------

Operating loss (158) (137) (329)

Finance costs - - -

---------------- ---------------- ----------------

Loss before tax (158) (137) (329)

Income tax credit 15 28 96

---------------- ---------------- ----------------

Loss for the period from

continuing

operations attributable to

shareholders (143) (109) (233)

Loss per share - Pence

Basic and diluted (0.003)p (0.003)p (0.005)p

INSPIRIT ENERGY HOLDINGS PLC

Consolidated

Statement of Financial Position as at 31 December 2022

Group Group Group

As at As at As at

31 December 31 December 30 June

2022 2021 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

------------------------------- ---------------- ---------------- ----------------------

Non-Current Assets

Intangible assets 3,069 2,851 2,998

Tangible assets 23 28 25

-------------- -------------- --------------

3,092 2,879 3,023

Current assets

Trade and other receivables 120 49 107

Cash and cash equivalents 66 348 160

-------------- -------------- --------------

186 397 267

-------------- -------------- --------------

Current liabilities

Trade and other payables (600) (395) (533)

Other borrowing (164) (100) (100)

-------------- -------------- --------------

(495) (495) (633)

-------------- -------------- --------------

Net Current Liabilities (578) (98) (366)

Non-Current Liabilities

Borrowings - - -

-------------- -------------- --------------

2,514 2,781 2,657

Equity

Share capital 2,103 2,103 2,103

Share premium 9,783 9,783 9,783

Other reserves 3 3 3

Merger reserve 3,150 3,150 3,150

Reverse acquisition reserve (7,361) (7,361) (7,361)

Retained losses (5,164) (4,897) (5,021)

-------------- -------------- --------------

Total 2,514 2,781 2,657

INSPIRIT ENERGY HOLDINGS PLC

Consolidated

Statement of Changes in Equity

For the six months ended 31 December 2022

Attributable to the owners of the parent

---------------------------------------------------------------------------------

Share Share Other Merger Reverse Retained Total

premium reserves reserve acquisition

reserve

capital losses Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- --------- ------------- --------- ------------- --------- --------

BALANCE AT 30 June

2020 (Audited) 1,967 9,192 3 3,150 (7,361) (4,535) 2,417

------------------------ -------- --------- ------------- --------- ------------- --------- --------

Loss for the period - - - - - (253) (253)

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD - - - - - (253) (253)

------------------------ -------- --------- ------------- --------- ------------- --------- --------

Share issues 136 621 - - - 757

Share issue costs - (30) - - - - (30)

------------------------ -------- --------- ------------- --------- ------------- --------- --------

TRANSACTIONS WITH

OWNERS 136 591 - - - - 727

------------------------ -------- --------- ------------- --------- ------------- --------- --------

BALANCE AT 30 June

2021 (Audited) 2,103 9,783 3 3,150 (7,361) (4,788) 2,890

------------------------ -------- --------- ------------- --------- ------------- --------- --------

Loss for the period - - - - - (233) (233)

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD - - - - - (233) (253)

------------------------ -------- --------- ------------- --------- ------------- --------- --------

BALANCE AT 30 June

2022 (Audited) 2,103 9,783 3 3,150 (7,361) (5,021) 2,657

------------------------ -------- --------- ------------- --------- ------------- --------- --------

Loss for the period - - - - - (143) (143)

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD - - - - - (143) (143)

------------------------ -------- --------- ------------- --------- ------------- --------- --------

Share issues - - - - - - -

Share issue costs - - - - - -

------------------------ -------- --------- ------------- --------- ------------- --------- --------

TRANSACTIONS WITH - - - - - - -

OWNERS

------------------------ -------- --------- ------------- --------- ------------- --------- --------

BALANCE AT 31 December

2022 2,103 9,783 3 3,150 (7,361) (5,164) 2,514

------------------------ -------- --------- ------------- --------- ------------- --------- --------

INSPIRIT ENERGY HOLDINGS PLC

Consolidated

Statement of Cash Flows

For the six months ended 31 December 2022

Group Group Group

Six months Six months Year

to to to

31 December 31 December 30 June

2022 2021 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------- ----- --------------- --------------- --------------------

Operating activities

Net cash from operating

activities 6 (86) (135) (176)

-------------- -------------- --------------

Net cash generated/(used)

in operating activities (86) (135) (176)

-------------- -------------- --------------

Investing activities

Acquisition of intangible

assets (72) (78) (225)

Acquisition of plant - - -

and equipment

-------------- -------------- --------------

Net cash from financing

activities (72) (78) (225)

-------------- -------------- --------------

Financing activities

Loan Note 64 - -

-------------- -------------- --------------

Net cash from financing

activities 64 - 727

-------------- -------------- --------------

Net cash outflow (94) (213) (401)

Cash and cash equivalents

at the beginning of the

period 160 561 561

-------------- -------------- --------------

Cash and cash equivalents

at the end of the period 66 348 561

INSPIRIT ENERGY HOLDINGS PLC

Consolidated Notes to the Interim Financial Information

1. General Information

The principal activity of Inspirit Energy Holdings PLC ("the

Company") during the period was that of an investment company which

aims to invest in disruptive products or technologies that are

either proven or at the later stages of development, which own or

have exclusive licence to the relevant intellectual property.

Inspirit Energy Holdings PLC is a company incorporated and

domiciled in England and Wales and quoted on AIM, a market operated

by the London Stock Exchange. The address of its registered office

is 200 Aldersgate Street, London EC1A 4HD, United Kingdom.

2. Basis of Preparation

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS) as adopted by

the European Union. Statutory financial statements for the year

ended 30 June 2022 were approved by the Board of Directors on 5

January 2023 and delivered to the Registrar of Companies. The

report of the auditors on those financial statements was

unqualified.

The interim financial information for the six months ended 31

December 2022 has not been reviewed or audited. The interim

financial report has been approved by the Board on 30 March

2023.

Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Company to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

interim financial statements for the period ended 31 December

2022.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Company's

2022 Annual Report and Financial Statements, a copy of which is

available on the Company's website: www.inspirit-energy.com. The

key financial risks are liquidity and credit risk.

Critical accounting estimates

The preparation of interim financial statements requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in note 2 of the Company's 2022 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

3. Significant Accounting Policies

The accounting policies applied are consistent with those of the

annual nancial statements for the year ended 30 June 2022, as

described in those annual nancial statements.

4. Segmental Analysis

The Company's primary reporting format is business segments and

its secondary format is geographical segments. The Company only

operates in a single business and geographical segment.

Accordingly, no segmental information for business segment or

geographical segment is required.

5. Loss per Share

The loss per ordinary share is based on the Group's loss for the

period of GBP143,000 (company's loss - 6 months to 31 December 2021

GBP109,000; year ended 30 June 2022 - GBP233,000) and a basic and

diluted weighted average number of ordinary shares of GBP0.0001

each in issue of 4,271,640,183 (same for 31 December 2021and 30

June 2022).

6. Reconciliation of Operating Loss to Net Cash Outflow from Operating Activities

Group Group Group

Six months Six months Year

to to to

31 December 31 December 30 June

2022 2021 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

------------------------ -------------- -------------- --------------

Operating Loss for the

period (143) (137) (233)

Adjustments for :

(Increase)/Decrease in

receivables (11) (12) 3

(Decrease)/Increase in

payables 69 (16) 121

Depreciation 2 2 7

Finance expense - - -

Tax credit - - (96)

Tax Received (3) 28 42

-------------- -------------- --------------

Net cash from operating

activities (86) (135) (176)

7. Issued and fully paid

The issued share capital is as follows

Number of Number Ordinary Deferred New Deferred Share premium Total

ordinary of deferred shares shares B shares

shares shares

GBP GBP GBP GBP GBP

---------------- -------------- ------------- --------- --------- ------------- -------------- -----------

At 30 June

2020 2,903,783,047 400,932 162,506 396,923 1,406,599 12,342,733 14,308,761

---------------- -------------- ------------- --------- --------- ------------- -------------- -----------

Issue of new

shares 1,367,857,139 - 136,786 - - 620,714 757,500

Issue costs - - - - - (30,000) (30,000)

At 30 June

2021/2022 4,271,640,186 400,932 299,292 396,923 1,406,599 12,933,447 15,036,261

---------------- -------------- ------------- --------- --------- ------------- -------------- -----------

At 31 December

2021/2022 4,271,640,186 400,932 299,292 396,923 1,406,599 12,933,447 15,036,261

---------------- -------------- ------------- --------- --------- ------------- -------------- -----------

8. Subsequent events after the reporting period

On 13(th) February 2023, the company announced that Paul Needley

was appointed as an independent Non-Executive Director and Anthony

Samaha stepped down from the board to pursue other corporate

activities.

9. Copies of this interim financial information document are

available from the Company at its registered office at 200

Aldersgate Street, London EC1A 4HD. The interim financial

information document will also be available on the Company's

website www.inspirit-energy.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDXCBXDGXG

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

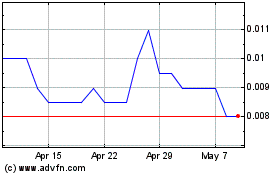

Inspirit Energy (LSE:INSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inspirit Energy (LSE:INSP)

Historical Stock Chart

From Nov 2023 to Nov 2024