TIDMINSP

RNS Number : 0124M

Inspirit Energy Holdings PLC

09 January 2023

Inspirit Energy Holdings Plc

("Inspirit" or "the Company")

ANNUAL REPORT AND ACCOUNTS FOR THE YEARED 30 JUNE 2022

NOTICE OF ANNUAL GENERAL MEETING

Inspirit Energy Holdings Plc today announces its audited results

for the year ended 30 June 2022 (the "Accounts").

Copies of the Company's Annual Report and Accounts will be sent

to shareholders along with a Notice of AGM and will be available on

the Company's website www.inspirit-energy.com today.

The AGM will be held at 200 Aldersgate Street, London EC1A 4HD

at 11 am on 22 February 2023.

Further copies may be obtained directly from the Company's

Registered Office at Inspirit Energy Holdings plc, 200 Aldersgate

Street, London EC1A 4HD. Extracts of the Accounts are set out

below.

CHAIRMAN'S STATEMENT

Inspirit Energy Holdings plc (Inspirit) has successfully

maintained its focus on the application of the Stirling engine in

various sectors during the reporting year, and had been primarily

working with its engineering partners on the fine details of the

new Waste Heat Recovery (WHR) system for the application on the

Volvo marine engine. The unit was built and tested in Poland and

with the issues in neighbouring Ukraine, sourcing materials and

components had been challenging.

Despite the global slowdown and access to materials, the

operating Board believe that the Company has maintained positive

progress over the last year in the alternative applications of the

Stirling engine and there is strong evidence of the need to refocus

our strategic objectives towards these areas that include marine

and waste heat recovery. As mentioned last year, we wait to assess

the impact on government's ban on oil and gas boilers on new build

property from 2025, but there is no clear outcome with existing

households gas boiler heating. It should be noted that this is by

no means an abandonment of our MicroCHP boiler technology as the

underlying technology for the Inspirit charger is applicable to the

marine and waste heat recovery applications.

The Company's phase one trial in Poland managed by Inspirit's

engineering team, using a non-branded automotive engine, regularly

produced a power output of over 34kW during several weeks of

testing. This trial was conducted using an automotive engine with

the same horsepower as the Volvo Penta D13 Engine running at 2400

revolutions per minute.

Further phase two testing, again conducted in Poland, introduced

the use of the Company's technology, the Helix Accelerator. Use of

the Helix Accelerator resulted in a near doubling in the power

output achieved to 64kW, using the same automotive engine as the

phase one trial.

Further testing and development in Poland is currently being

undertaken, with an emphasis on endurance and stress testing,

simulating varying scenarios, which should be complete before the

end of 2022. Our engineering team will be adding additional

enhancements to the WHR system as part of this phase three trial

programme, where further improvements in the power output are

anticipated. To date the performance of the WHR system and its

robustness have exceeded the Company's expectations and we look

forward to shortly reporting on the results of the phase 3

trial.

Thereafter, Inspirit will seek to enter into a trial phase with

Volvo Marine. The board are also actively pursuing commercial

discussions with other parties that are active in the commercial

automotive sector and WHR.

The board of Inspirit are very pleased with the team's

achievements and the progress that has been made to date.

Additionally, the board are investigating the potential for the

unit to be incorporated as a retrofit for the commercial engine

market and in particular certain applications in the haulage

market. This includes widening the Company's traditional sphere of

operation in Europe and also in Asia and North America.

The operating Board believe that the WHR technology and the

application can be applied to marine, waste heat recycling from

energy generation, refrigerated transport that uses diesel engines

and many more applications.

As per previous years, the board are continuing to assess

funding options for the development and commercialisation of our

products and will continue to demonstrate prudence in our approach

to managing our current resources whilst pushing forward with our

product development.

I would like to thank my colleagues for their hard work and

commitment to driving the business forward during these challenging

times.

J Gunn

Chairman and Chief Executive Officer

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

More information on Inspirit Energy can be seen at:

www.inspirit-energy.com

For further information please contact:

Inspirit Energy Holdings plc

John Gunn, Chairman and CEO +44 (0) 207 048 9400

Beaumont Cornish Limited

www.beaumontcornish.com

(Nominated Advisor)

Roland Cornish / James Biddle +44 (0) 207 628 3396

Global Investment Strategy UK

Ltd

(Broker)

Samantha Esqulant +44 (0) 207 048 9045

STRATEGIC REPORT

FOR THE YEARED 30 June 2022

The Directors present their Strategic Report on Inspirit Energy

Holdings plc (the "Company") and its subsidiary undertakings

(together the "Group") for the year ended 30 June 2022.

REVIEW OF THE BUSINESS

Inspirit Energy Limited (IEL) continues to apply its expertise

in the application of the Stirling engine technology in different

sectors including Marine and Waste Heat Recovery.

The Company is also currently pursuing the development and

commercialisation of a world-leading micro-Combined Heat and Power

("mCHP") boiler for use in commercial and residential markets. The

mCHP boiler is powered by natural gas or hydrogen and designed to

produce hot water (for domestic hot water or central heating) and a

simultaneous electrical output that can be used locally or fed back

into the National Grid.

DEVELOPMENTS DURING THE YEAR

Despite COVID 19 still having an impact during the beginning of

the financial year with lockdowns, supply line issues and general

movement in Europe, IEL has been working with its engineering

partners on the fine details of the new WHR for the application on

the Volvo marine engine.

In addition, IEL successfully assembled and applied the first

phase of the WHR unit and with limited testing, the unit provided

the highest recorded output of over 34 kW in the first stage build

test period. The WHR is a major component in the application for

the Volvo Marine engine and other heat recovery applications the

Company has been working on whereby waste heat exhaust is recycled

and converted to energy.

PROMOTION OF THE COMPANY FOR THE BENEFIT OF THE MEMBERS AS A

WHOLE

The Director's believe they have acted in the way most likely to

promote the success of the Company for the benefit of its members

as a whole, as required by s172 of the Companies Act 2006, as

modified by the Companies ( Miscellaneous Reporting ) Regulations

2018 are outlined as follows:

a. Employee engagement

The quality, commitment and effectiveness of the Company's

current and future employees are crucial to its continued success.

Employee policies and programmes are designed to encourage

employees to become interested in the Company's activities and to

reward employees according to their contribution and capability and

the Company's financial performance. Employee communications are a

priority and regular briefings are used to disseminate relevant

information.

Employment policies do not discriminate between employees or

potential employees on the grounds of colour, race, ethnic or

natural origin, sex, marital status, sexual orientation, religious

beliefs or disability. If an employee were to become disabled

whilst in employment and as a result was unable to perform his or

her duties, every effort would be made to offer suitable

alternative employment and assistance with retraining.

b. Suppliers and customers

The Company maintains an ongoing dialogue with its potential

customers and suppliers and the Company engages in supplier

face-to-face meetings, email and telephone conversations with

directors and senior management of key suppliers. When selecting

suppliers and materials, issues such as the impact on the community

and the environment have actively been taken into

consideration.

The Company pays its employees and creditors promptly and keeps

its costs to a minimum to protect shareholders' funds. The

Executive Directors have agreed to accrue their fees in this

reporting period (note 5).

c. Shareholders and investors

The Company is quoted on AIM and its members will be fully

aware, through detailed announcements, shareholder meetings and

financial communications, of the Board's broad and specific

intentions and the rationale for its decisions.

Other developments during the year:

On 2nd November 2021, the Company announced that it was in

early-stage discussions with a view to entering into an agreement

with a British certification company Enertek International

Ltd. Enertek International have won several development contracts

from the government (BEIS) and have gained a vast knowledge

in developing backward compatible Hydrogen products such as:

domestic and commercial cookers, domestic and commercial heating

systems etc. They have now gained the knowledge which could

be very beneficial to Inspirit in developing a Hydrogen product,

with a view of also looking at our existing products to make

them hydrogen powered backwards compatible without the need

to redevelop the core technology.

On 27th June 2022 the company announced that on the first

phase of the development of the WHR unit and with limited

testing, the unit provided the highest recorded output of

over 34 kW in the first stage build test period. The WHR is

a major component in the application for the Volvo Marine

engine and other heat recovery applications the Company had

been working on whereby waste heat exhaust is recycled and

converted to energy.

BOARD CHANGES

None.

RESULTS AND DIVIDS

The Group made a loss after taxation of GBP233,000 (2021: loss

of GBP253,000) and net assets as at 30 June 2022 were GBP2,657,000

(2021: GBP2,890,000).

The Directors do not propose a dividend for the year to 30 June

2022 (2021: GBPnil).

KEY PERFORMANCE INDICATORS

The key performance indicators (KPI) used by the Board to

monitor the performance of the Group, are set out below:

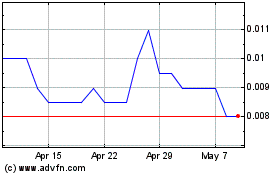

PLC S 30 June 30 June

2022 2021

------------------------------------ ------------ ------------

Net asset value GBP2,657,000 GBP2,890,000

Net asset value - fully diluted per

share 0.062p 0.074p

Closing share price 0.06p 0.05p

Market capitalisation GBP2,648,417 GBP2,135,820

------------------------------------ ------------ ------------

The Net asset value decreased but the Market capitalisation

increased during the reporting period. The closing share price was

0.06p compared to 0.05p in 2021.

COVID 19 ASSESMENT

During the reporting period, the Company continued to develop

its microCHP boiler, Marine engine and Waste Heat Recovery (WHR)

application with its European partners. Specifically, the Company

has spent time working to refine Inspirit's Stirling technology and

are continually reviewing the potential supply chain and detailing

the product specifics for potential commercial partners.

The Board recognises that these are still unprecedented times

and the risk of COVID-19 still remains current and that this may

still cause disruption to the economy and supply chain for

components. As with all businesses, we are not immune to this risk.

After disruption in the prior year to development and testing, this

recommenced in the year.

To mitigate any future impact of COVID 19, the Company has

maintained communication with its diversified supplier base with

multiple suppliers in different countries. In the event that any

country has further lock downs or restrictions we would be able to

swap supplier with minimal impact on our project plan .

KEY RISKS AND UNCERTAINTIES

Early stage product development carries a high level of risk and

uncertainty, although the rewards can be outstanding. At this

stage, there is a common risk associated with all pioneering

technologically advanced companies in their requirement to

continually invest in research and development. The Group has

already made significant investments in addressing opportunities in

the renewable energy sector.

Other risks and uncertainties within the Group are detailed in

principle 4 of the Corporate Governance Report.

GOING CONCERN RISK

The Group requires financing to fund its operations through to

commercialisation and the stage where it is profit generating and

the Group will seek to raise such funds via placings and short term

debt finance. There is the risk that the Group will not have access

to sufficient funds to achieve this. The Group seek to mitigate

through forecast preparation, monitoring and reducing discretionary

costs. Further details are below.

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The principal financial risk faced by the Group is liquidity

risk. The Group's financial instruments included borrowings and

cash which it used to finance its operations. At the year end,

borrowings did not include any borrowings supplied from the Group's

principal bank, Barclays Bank Plc. More information is given in

Note 3 to the Financial Statements. The Group has no significant

concentrations of credit risk.

CAPITAL RISK MANAGEMENT

The Group's objectives when managing capital are to safeguard

the Group's and Company's ability to continue its activities and

bring its products to market. Capital is defined based on the total

equity of the Company. The Company monitors its level of cash

resources available against future planned activities and may issue

new shares in order to raise further funds from time to time.

MANAGEMENT AND KEY PERSONNEL

The risk of high turnover of staff and other specialist staff

recruitment issues would have an impact on operation and

reputation. The Board provides recognition and support for well

performing existing employees and has implemented and monitors

robust health and safety measures at the workplace.

TECHNOLOGY RISK

The Group's success is dependent on its technology and

management's ability to market it successfully. There is the risk

that the technology could become obsolete or a rival could develop

an improved alternative. Management seek to mitigate this by

constantly seeking to improve the product, closing watching its

competitors and employing skilled personnel.

ASSESSMENT OF BUSINESS RISK

The Board regularly reviews operating and strategic risks. The

Group's operating procedures include a system for reporting

financial and non-financial information to the Board including:

-- reports from management with a review of the business at each

Board meeting, focusing on any new decisions/risks arising;

-- reports on the performance of its subsidiary;

-- reports on selection criteria on the applications of its technology;

-- discussion with senior personnel; and

-- consideration of reports prepared by third parties.

Details of other financial risks and their management are given

in Note 3 to the financial statements.

ON BEHALF OF THE BOARD

N Jagatia

Director

5 January 2023

REPORT OF THE DIRECTORS

FOR THE YEARED 30 June 2022

The Directors present their annual report on the affairs of the

Group and Company, together with the audited financial statements

for the year ended 30 June 2022.

PRINCIPAL ACTIVITIES

The principal activity of the Group and Company is that of

development and commercialisation of the mCHP boiler and

application of the stirling technology in other sectors such as

marine, waste energy recycling and automotive truck industries.

Details of the Group's principal activity can be found in the

Strategic Report.

GREENHOUSE GAS (GHG) EMISSIONS

The Group is aware that it needs to measure its operational

carbon footprint in order to limit and control its environmental

impact. However, given the very limited nature of its direct

activities during the year under review, it has not been practical

to measure its carbon footprint.

The Group only measures the impact of its direct activities, as

the full impact of the entire supply chain

of its suppliers cannot be measured practically.

DIRECTORS

The Directors who held office in the period up to the date of

approval of the Financial Statements and their beneficial interests

in the Company's issued share capital at the beginning and end of

the accounting year were:

*861,403,363 Ordinary Shares (direct 657,981,981 Ordinary Shares

and indirect via GIS 203,421,382 Ordinary Shares)

SIGNIFICANT SHAREHOLDERS

INDEMNITY OF OFFICERS

The Company maintains appropriate insurance cover against legal

action brought against its Directors and officers.

RESEARCH AND DEVELOPMENT

For details of the development activities undertaken in the

year, please refer to principle 1 of the Corporate Governance

Report.

BOARD OF DIRECTORS

The Board is responsible for strategy and performance, approval

of major capital projects and the framework of internal controls.

To enable the Board to discharge its duties, all Directors receive

appropriate and timely information. All Directors have access to

the advice and services of the Company Secretary, who is

responsible for ensuring the Board procedures are followed and that

applicable rules and regulations are complied with.

COMMUNICATIONS WITH SHAREHOLDERS

Communications with shareholders are given a high priority. In

addition to the publication of an annual report and an interim

report, there is regular dialogue with shareholders and analysts.

The Annual General Meeting is viewed as a forum for communicating

with shareholders, particularly private investors. Shareholders may

question the Executive Chairman and other members of the Board at

the Annual General Meeting.

INTERNAL CONTROL

The Directors acknowledge they are responsible for the Group's

system of internal control and for reviewing the effectiveness of

these systems. The risk management process and systems of internal

control are designed to manage rather than eliminate the risk of

the Group failing to achieve its strategic objectives. It should be

recognised that such systems can only provide reasonable and not

absolute assurance against material misstatement or loss. The Group

has well established procedures which are considered adequate given

the size of the business.

MATTERS COVERED IN THE STRATEGIC REPORT

The business review, results, review of KPI's and future

developments are included in the Strategic Report and Chairman's

Statement.

GOING CONCERN

As at 30 June 2022 the Group had a cash balance of GBP160,000

(2021: GBP561,000), net current liabilities of GBP366,000 (2021:

net current assets of GBP87,000) and net assets of GBP2,657,000

(2021: GBP2,890,000). The Group has maintained its core spend

during the year whilst still managing to move its projects forward

and post year end secured a $250,000 loan facility. There can be no

assurance that the Group's projects will become fully developed and

reach commercialisation nor that there will be sufficient cash

resources available to the Group to do so.

The Directors have reviewed a detailed forecast based on the

funds expected to be raised and forecasted expenditure. Having made

due and careful enquiry, the Directors acknowledge that funds will

need to be raised within the next 12 months to enable the Group to

meets its obligations as they fall due, however, the Directors are

confident that the required funds will successfully be raised

through the issue of equity and/or debt to fund its operations over

the next 12 months.

The Directors, therefore, have made an informed judgement, at

the time of approving financial statements, that the Group is a

going concern but they acknowledge that the dependence on raising

further funds during the next 12 months represents a material

uncertainty. The Auditors have made reference to going concern by

way of a material uncertainty.

EVENTS AFTER THE REPORTING DATE

On 8th December 2022, the Company announced that it has entered

into a short-term, un-secured debt facility of up to US$250,000

(approximately GBP205,075) (the "Facility"). Under the Facility

Inspirit initially drew down US$80,000 (approximately GBP65,624)

(the "Initial Advance"). The Facility is with Riverfort Global

Opportunities PCC Limited, and the proceeds of the advance are for

general working capital.

The Facility has a 12-month term and allows Inspirit to draw

down funds ("Advances") which will be repayable within 6 months in

either cash or shares at the Noteholders' discretion in respect of

the Initial Advance and thereafter at the agreement of the Company

and Riverfort. If the debt is repaid in shares, they will be repaid

at 130% of the Reference Price being the average of the five (5)

daily VWAPs preceding the Drawdown Date in respect of the relevant

Advance (the "Fixed Premium Placing Price"). In the event that

Inspirit completes any share placing during the Term of the

relevant Advance and the share placing price is below the Fixed

Premium Placing Price, the Fixed Premium Placing Price will be

amended to be the relevant share placing price. Inspirit will issue

the Noteholder with warrants in respect of each Advance so as to

represent 50% of the value of the relevant Advance, divided by the

relevant Reference Price; the warrants will have an exercise price

of Fixed Premium Placing Price and a 48 month term.

Inspirit drew down US$80,000 as the Initial Advance and issued

Riverfort with warrants to the value of 50% of the Initial Advance

at the reference price of 0.03376 pence being 97,191,943 warrants.

These warrants will have a term of 48 months and will be

exercisable at 130% of the reference price being 0.04388 pence.

The Facility will attract 1.5% interest per month based on the

value of the outstanding indebtedness payable in cash and an

implementation fee of 6% of any Advances if settled in cash or 8%

if issued in Shares. Accordingly, Inspirit will issued 15,550,710

Ordinary Shares of 0.001p each ("Shares") at a price of 0.03376

pence each for the implementation fee in respect of the Initial

Advance (the "Initial Shares"). The Facility contains a right of

first refusal clause allowing Riverfort to match the terms of any

alternative debt/ structured funding the Company may seek during

the term of the Facility.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the directors

have prepared the group and parent company financial statements in

accordance with UK-adopted international accounting standards.

Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the group and the parent company

and of the profit or loss of the group and the parent company for

that period. In preparing these financial statements, the directors

are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgments and accounting estimates that are reasonable and prudent;

-- state whether applicable UK-adopted international accounting

standards have been followed, subject to any material departures

disclosed and explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the group and the parent

company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the group's and

company's transactions and disclose with reasonable accuracy at any

time the financial position of the group and the parent company and

enable them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the group and the parent company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions. The Company is compliant

with AIM Rule 26 regarding the Company's website. See

www.inspirit-energy.com .

DISCLOSURE OF INFORMATION TO AUDITOR

In the case of each person who was a Director at the time this

report was approved:

-- so far as that director is aware there is no relevant audit

information of which the Company's auditor is unaware; and

-- that director has taken all steps that the director ought to

have taken as a director to make himself aware of any relevant

audit information and to establish that the Company's auditor is

aware of that information.

INDEPENT AUDITOR

A resolution that PKF Littlejohn LLP be re-appointed will be

proposed at the annual general meeting. PKF Littlejohn LLP have

indicated their willingness to continue in office.

ON BEHALF OF THE BOARD

N Jagatia

Director

5 January 2023

CORPORATE GOVERNANCE REPORT

Inspirit Energy Holdings plc Quoted Companies Alliance Code ("QCA Code")

Principles: Application:

------------------------------------------------------------------------------------------

1) Strategy This section complies with the requirements

and business of the QCA Code.

model to promote

long-term values Inspirit Energy Holdings plc has maintained

for shareholders its focus on the application of the Stirling

engine in various sectors as well as progressing

the commercialisation efforts of the Group's

micro combined heat and power ("mCHP") boilers

and Waste Heat Recovery (WHR) applications.

Inspirit achieved a number of significant milestones

including increseing the output of its WHR to

over 30kW.

These milestones continue to demonstrate strategic

direction as an R&D company in this niche sector.

The operating Board has worked throughout to

identify differing potential applications for

the technology where there is significant potential

for growth, as well as considering the future

strategy and funding of its operating subsidiary..

The Directors believe that the positive progress

over the last year in the alternative applications

of the Stirling technology in the Marine and

Waste Heat Recovery (WHR) sectors is strong

evidence of the need to refocus our strategic

objectives towards these areas. It should be

noted that this is by no means an abandonment

of our MicroCHP boiler technology - on the contrary,

we are actively looking into the application

of the technology in the rapidly emerging hydrogen

market. Additionally, with the continued growth

demand for electric cars, the Board will be

looking at the automotive sector to utilise

the Stirling engine to provide a source of power

to charge electric motor cars.

The Group will also potentially make investments

in complementary areas and technologies that

will utilise the Group's existing technical

expertise.

------------------------------------------------------------------------------------------

This section complies with the requirements

2) Meeting and of the QCA Code.

understanding

shareholders

needs and The Company has a close and ongoing relationship

expectations with its shareholders. The Company also places

great importance on effective and timely communication

with its shareholders. Shareholders are encouraged

to attend the Company's meetings (including

the Annual General Meeting) to provide feedback

and to actively engage with the management on

a regular basis. Furthermore, the INSP's shareholders

and investors can keep themselves updated about

the current Company's position by visiting the

INSP's website http://www.inspirit-energy.com

.

------------------------------------------------------------------------------------------

This section complies with the requirements

3) Considering of the QCA Code.

stakeholders

and social The Board recognises that the long-term success

responsibilities of the Group is reliant on efforts of its employees,

and their consultants, suppliers, regulators and stakeholders.

implications

for long term Employees: In order to support employees' growth

success and enforce social responsibilities the Board

has implemented systems to monitor and evaluate

employees' performance and to encourage well

performing employees to progress further by

supporting them to attend courses. Employees'

performance is monitored through a process designed

to encourage open and confidential communication

between the management and the employees on

a regular basis.

Consultants: The Board recognises that consultants

play a vital part for INSP as they bring knowledge

and expertise for specific areas, and in some

instances, they also provide training for existing

staff.

Suppliers: INSP maintains a good working relationship

with its suppliers to provide for its growing

business and to support its existing needs.

Regulators: The Board monitors and implements

any legal or regulatory changes where possible

both domestically and overseas and is fully

committed to compliance.

Stakeholders: INSP encourages its shareholders

to actively participate in meetings and shareholders

are provided with the opportunity to give feedback

on a regular basis.

------------------------------------------------------------------------------------------

This section complies with the requirements

4) Risk of the QCA Code.

Management

The risks in the Group are managed by the audit

committee which is responsible to the Board

to work closely with the executive directors

to identify, implement and manage risks faced

by the Group.

INSP has robust controls and procedures in place

to manage internal controls of the Company and

these are considered to be appropriate to the

size and complexity of the organisation. The

audit committee has been set up to evaluate

and manage significant risks faced by the Group.

Control is established mainly through the Group's

directors who monitor and support the day to

day running of the Group and where possible

comply with the Board's and shareholders concerns

and requirements.

INSP has identified and implemented the following

risks and controls to mitigate risks:

Activity: Risk Impact Control(s)

Management High turnover of Operational Recognition

staff and other and reputational and support

recruitment issues. impact. for well performing

existing employees.

Implementing

and monitoring

of robust health

and safety

measures at

workplace.

--------------------- ------------------ ----------------------

Regulatory / legal Non-compliance. Loss of Robust policies

adherence licences and procedures

resulting to be followed.

in inability

to comply Maintaining

with the effective

regulatory communication

/ legal with the Company's

requirements. Auditors and

NOMAD on a

regular basis.

--------------------- ------------------ ----------------------

Strategic Failure of systems Loss of Disaster recovery

and controls. key data policy to be

and inability followed in

to operate case of crisis.

effectively.

Maintaining

strong IT systems

and controls

in place.

--------------------- ------------------ ----------------------

Financial Internal: Inadequate Loss of The Board to

systems and controls business. regularly review

of accounting in operating and

place and Inability strategic risks.

liquidity risk. to continue

trading The audit committee

External: as a going to provide

Market and credit concern. adequate and

crisis; sufficient

Short term liquidity information

freezes; to the Company's

Commercialisation external auditors.

Brexit.

Robust capital

Covid 19 and liquidity

levels in place

alongside effective

accounting

Delays systems and

in activity controls.

internally

and externally

would lead Large proportion

to consumption of the development

of working work is successfully

capital complete.

Diversification

of suppliers

and partners

to meet delivery

of activity.

--------------------- ------------------ ----------------------

Regulatory External: Potential Understanding

environment in Changes in to undermine regulatory

domestic power legislation microchip environment

market regarding domestic boiler and adapting

power market. product. system accordingly.

--------------------- ------------------ ----------------------

Product Risk Internal: Potential Testing of

Failure to develop for significant product

commercial product. financial Certification.

loss. Understanding

of market place

and competition.

--------------------- ------------------ ----------------------

The above matrix is kept up to date and regularly

reviewed as changes arise in order to mitigate

risks.

------------------------------------------------------------------------------------------

5) Maintain This section does not comply with the requirements

the board as of the QCA Code as the board composition does

a not include a Non-Executive Chairman and two

well-functioning Non-Executive Directors.

and balanced

team led by

the chair At the date of this publication the Board comprises

of the Chairman (John Gunn), the Chief Financial

Officer (Nilesh Jagatia) and the independent

Non-Executive Director (Anthony Samaha). Further

detail about the skills and capabilities of

these directors are set out in principle six

below.

The letter of appointment of the Company's Directors

and Secretary are available for inspection at

the Company's registered office and all directors

are subject to re-election at intervals of no

more than three years.

The Board is responsible for strategy and performance

of major capital projects and the framework

of internal controls. All directors have access

to seek independent advice should they feel

that their knowledge of the given task is insufficient.

There is a clear balance between the executive

director and the non-executive director.

Furthermore, the directors liaise with the Company

Secretary (Nilesh Jagatia), who is responsible

for compliance with the Board procedures and

that applicable rules and regulations are complied

with.

The Board meets quarterly. The Board established

the following committees; Audit Committee and

Remuneration Committee. All Directors are encouraged

to participate and attend meetings on a regular

basis and the attendance is closely monitored.

Despite the QCA recommendation of having two

independent directors INSP has opted to have

only one non-executive director and a joint

role of Chief Executive Director and the Chairman

as they feel that this is appropriate to the

current size and complexity of the organisation.

INSP is still in the R&D phase of its business

cycle and therefore relies on a team of consultants

in developing the product. Following conclusion

of this process, certification is managed externally,

and then commercial trials would commence. As

such the role of the Board, at this stage, is

to oversee this process, review strategy, hold

high level discussions regarding possible commercial

trials and ensure adequate funding. As such,

the current Board is deemed sufficient. As and

when the business develops beyond this stage

the Board will review its requirements at this

stage. The Group is actively looking to appoint

an additional non-executive director to provide

a balance of the non-executive directors and

executives as per the QCA.

------------------------------------------------------------------------------------------

6) Directors This section complies with the requirements

experience, of the QCA Code.

skills and

capabilities The Chairman: John Gunn

Mr Gunn is the founder of INSP and a 20.2% (

Direct and indirect) shareholder of the Company.

Mr Gunn is also the managing director and majority

shareholder of Global Investment Strategy UK

Limited and a majority shareholder of Octagonal

Plc. With a career spanning over 30 years in

the financial services industry, Mr Gunn began

his career in 1987 at Hoare Govett and has since

worked at Carr Sheppards Limited, Assicurazioni

Generali S.p.A. and Williams de Broe, where

he was a senior investment manager until 2002.

Chief Financial Officer: Nilesh Jagatia

Mr Jagatia currently serves as Finance Director

at INSP and also currently holds the Finance

Director position with a Financial Services

group Octagonal Ltd and AIM quoted Limitless

Earth Plc (LME). Nilesh has been involved with

several IPO's and was previously Group Finance

Director of an AIM quoted Online Media and Publishing

Company for a period of five years until July

2012. Nilesh has over 20 years' experience,

including senior financial roles in divisions

of both Universal Music Group and Sanctuary

Group plc. He served as a Finance Director for

an independent record label that expanded into

the US. Nilesh is a qualified accountant and

holds a degree in finance.

Non-Executive Director: Anthony Samaha

Mr Samaha is a Chartered Accountant (Australia)

who has over 20 years' experience in accounting

and corporate finance. Mr Samaha has worked

for over 10 years with international accounting

firms, including Ernst & Young, principally

in corporate finance, and mergers and acquisitions.

He has extensive experience in the listing and

management of AIM quoted companies and is currently

Executive Director of AIM traded Reabold Resources

Plc.

In addition to the Board directors above INSP

uses Beaumont Cornish Limited as their nominated

adviser (NOMAD), Hill Dickinson LLP to assist

with legal and regulatory matters and FTB ITC

Services Ltd to support the IT systems.

------------------------------------------------------------------------------------------

7) Evaluation This section complies with the requirements

of the Board's of the QCA Code.

performance

INSP is fully committed to uphold Directors'

independence and to regularly evaluate their

performance.

Where appropriate, INSP sets targets which the

Directors have to adhere to. Each Director is

assigned with an individual target which is

linked to the corporate and financial targets

of the Group. Career support, development and

training may also be provided to the Directors

where necessary.

------------------------------------------------------------------------------------------

8) Promoting This section complies with the requirements

corporate of the QCA Code.

culture,

ethical values INSP is committed to ethical conduct and to

and behaviours the governance structures that ensure that the

Group delivers long term value and earns the

trust of its shareholders. The shareholders

are encouraged at General Meetings to express

their views and expectations in an open and

respectful dialogue.

The Board is fully aware that their conduct

impacts the corporate culture of the Group as

a whole and that this will impact the future

performance of the Group. The Directors are

invited to provide an open comprehensive dialogue

and constructive feedback to the employees,

and to promote ethical values and behaviours

within the Group.

INSP also believes that doing business honestly,

ethically and with integrity helps to build

long-term, trusting relationship with our employees,

customers, suppliers and stakeholders. Our Code

of business Conduct means that our employees

understand that we pride ourselves in high ethical

standards. INSP has zero tolerance for bribery

and corruption among our employees.

------------------------------------------------------------------------------------------

9) Maintenance This section complies with the requirements

of governance of the QCA Code.

structures and

processes to The Board is responsible for the ultimate decision

support good making, the structures and processes adopted

decision making by INSP. The Board is headed by the Chairman.

by the board In order to comply with the Companies Act 2006

or QCA code the Board recognises that it must

comply with the following principles set out

by the Act:

* duty to exercise independent judgement;

* duty to exercise reasonable care, skill and due

diligence;

* duty to avoid conflicts of interest;

* duty not to accept benefits from third parties; and

* duty to declare interest in a proposed transaction or

arrangement.

The Chairman is responsible for leading the

Board, sets the agenda and ensures it is an

effecting working group at the head of the Company.

The Chairman is also responsible for promoting

a culture of openness and effective communication

with shareholders and to ensure that all board

members receive accurate, timely and clear information.

The Executive Directors are responsible for

day to day running of the Company and effective

communications with the Board and the Shareholders.

They represent the Company to ensure quality

of information provision, they challenge and

monitor performance of the teams, and they set

business plans and targets for the Company.

Non-Executive Director: INSP has one Non-Executive

Director who is an independent director. This

is to reinforce the Group's commitment to a

transparent and effective governance structure

which encourages and provides ample opportunity

for challenge and deliberation. The Non-Executive

Director's objective is to scrutinise the performance

of the Board and senior management as well as

to monitor performance, agree goals and objectives.

They will satisfy themselves on the integrity

of financial information and that financial

controls and systems of risk management are

robust and fit for purpose. The Non-Executive

Director is also closely working with the Remuneration

Committee as they are responsible for determining

appropriate levels of remuneration of Executive

Directors and have a prime role in appointing

/ removing senior management.

The Company established the following committees

to help with processes, structures and support

good decision making by the Board.

Audit Committee - The Audit Committee is currently

chaired by Anthony Samaha and its other member

is Nilesh Jagatia. The Committee provides a

forum for reporting by the Group's external

auditors. The committee is also responsible

for reviewing a wider range of matters, including

half-year and annual results before their submission

to the board, as well as monitoring the controls

that are in force to ensure the integrity of

information reported to shareholders. The Audit

Committee will advise the Board on the appointment

of external auditors and on their remuneration

for both audit and non-audit work, and it will

also discuss the nature, scope and results of

the audit with the external auditors. The committee

will keep under review the cost effectiveness,

the independence and objectivity of the external

auditors.

Remuneration Committee - The Remuneration Committee

is currently chaired by Anthony Samaha and its

other member is John Gunn. The Committee is

responsible for making recommendations to the

Board, within agreed terms of reference, on

the Company's framework of executive remuneration

and costs. The Remuneration Committee determines

the contract terms, remuneration and other benefits

for the Executive Directors, including performance

related bonus schemes and compensation payments.

The Board itself determines the remuneration

of the non-executive directors.

It is recognised that if the Group grows, it

may be necessary to review the current structure

in order to provide better segregation of the

responsibilities and clear lines of reporting,

that are consistent with industry standards.

------------------------------------------------------------------------------------------

10) Shareholders This section complies with the requirements

communication of the QCA Code.

The Company recognises that its shareholders

are imperative for future growth and prosperity

of the Company. The Shareholders are treated

equally both in relation to participation at

meetings and in the exercising of voting rights.

INSP's shareholders are encouraged to attend

the annual general meetings and the Company

provides regulatory news updates and any other

matters the Board feels fit. The Company maintains

the following website https://www.inspirit-energy.com/investors

for investor relations.

------------------------------------------------------------------------------------------

INDEPENT AUDITOR'S REPORT

TO THE MEMBERS OF INSPIRIT ENERGY HOLDINGS PLC

FOR THE YEARED 30 June 2022

Opinion

We have audited the financial statements of Inspirit Energy

Holdings Plc (the 'parent company') and its subsidiaries (the

'group') for the year ended 30 June 2022 which comprise the

Consolidated Statement of Comprehensive Income, the Consolidated

and Company Statements of Financial Position, the Consolidated and

Company Statements of Changes in Equity, the Consolidated and

Company Statements of Cash Flows and notes to the financial

statements, including significant accounting policies. The

financial reporting framework that has been applied in their

preparation is applicable law and UK-adopted international

accounting standards and as regards the parent company financial

statements, as applied in accordance with the provisions of the

Companies Act 2006.

In our opinion:

-- the financial statements give a true and fair view of the

state of the group's and of the parent company's affairs as at 30

June 2022 and of the group's loss for the year then ended;

-- the group financial statements have been properly prepared in

accordance with UK-adopted international accounting standards;

-- the parent company financial statements have been properly

prepared in accordance with UK-adopted international accounting

standards and as applied in accordance with the provisions of the

Companies Act 2006; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

and parent company in accordance with the ethical requirements that

are relevant to our audit of the financial statements in the UK,

including the FRC's Ethical Standard as applied to listed entities,

and we have fulfilled our other ethical responsibilities in

accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 2 in the financial statements, which

indicates that the group incurred a loss of GBP233k during the year

ended 30 June 2022, the group's current liabilities exceeded its

total assets by GBP366k at that date and that the group and company

are reliant on raising further finance in the next 12 months in

order to fund forecasted expenditure over this period. As stated in

note 2, these events or conditions, along with the other matters as

set forth in note 2, indicate that a material uncertainty exists

that may cast significant doubt on the company's ability to

continue as a going concern. Our opinion is not modified in respect

of this matter.

In auditing the financial statements, we have concluded that the

director's use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the directors' assessment of the company's ability to

continue to adopt the going concern basis of accounting included

reviewing and challenging cashflow forecasts, and related key

assumptions, prepared by management covering the going concern

period, discussing their strategies regarding future fund raises

and assessing the likelihood of the required funds being

successfully raised by considering the funds required and the group

and company's ability to raise such funds.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Our application of materiality

The scope of our audit was influenced by our application of

materiality. The quantitative and qualitative thresholds for

materiality determine the scope of our audit and the nature, timing

and extent of our audit procedures. We also determine a level of

performance materiality which we use to assess the extent of

testing needed to reduce to an appropriately low level the

probability that the aggregate of uncorrected and undetected

misstatements exceeds materiality for the financial statements as a

whole. In determining our overall audit strategy, we assessed the

level of uncorrected misstatements that would be material for the

financial statements as a whole.

Materiality for the consolidated financial statements was set as

GBP79,000 (2021: GBP87,000) based upon net assets. Materiality has

been based upon net assets which we determined, in our professional

judgement, to be the key principal benchmark relevant to members of

the parent company in assessing the financial performance of the

group due to the number of risks identified relating to assets

within the Consolidated Statement of Financial Position and the

relative size of gross assets, liabilities and equity compared to

the Consolidated Statement of Comprehensive Income. Performance

materiality and the triviality threshold for the consolidated

financial statements was set at GBP63,200 (2021: GBP69,600) and

GBP3,950 (2021: GBP4,350) respectively given our accumulated

knowledge of the group, the number of risks identified and the

assessed risk level.

Materiality for the parent company was set as GBP64,000 (2021:

GBP86,000) based upon net assets. Net assets was considered to be

an appropriate basis due to the fact that the parent company is

non-revenue earning and holds significant material balances through

investments in its subsidiaries and other assets and cash held.

Performance materiality and the triviality threshold for the parent

company was set at GBP51,200 (2021: GBP68,800) and GBP3,200 (2021:

GBP4,300) respectively given our accumulated knowledge of the

group, the number of risks identified and the assessed risk

level.

We also agreed to report any other differences below that

threshold that we believe warranted reporting on qualitative

grounds.

Our approach to the audit

In designing our audit, we determined materiality and assessed

the risks of material misstatement in the financial statements. In

particular we looked at areas involving significant accounting

estimates and judgements by the directors and considered future

events that are inherently uncertain, such as the recoverable value

of the capitalised development costs. We also addressed the risk of

management override of internal controls, including among other

matters consideration of whether there was evidence of bias that

represented a risk of material misstatement due to fraud.

A full scope audit was performed on the complete financial

information of both components of the group.

Key audit matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters. In addition to

the matter described in the Material uncertainty related to going

concern section we have determined the matters described below to

be the key audit matters to be communicated in our report.

Key Audit Matter How our scope addressed this

matter

Carrying value of Intangible

Assets

==============================================================

Carrying value of intangible Our work in this area included:

assets of GBP3.0m (2021: GBP2.8m). * Obtaining management's assessment of impairment and

Refer to Note 4: Critical Accounting reviewing and challenging the key estimates and

Estimates. judgements used therein;

Intangible Assets is the largest

asset within the financial statements * Performing sensitivity analysis on the key areas of

and represents the asset (development estimation/judgement and verifying to supporting

of its Stirling technology) documentation where possible including benchmarking

from which, if successful, the against companies in the same industry;

group will generate revenue.

There is a risk that the development * Substantive testing of the additions to intangible

costs capitalised during the assets to ensure they are eligible to be capitalised

year do not meet the recognition under IAS 38; and

criteria of IAS 38 Intangible

Assets .

* Reviewing disclosures in the financial statements to

Since the Group are still in ensure compliance with IFRS.

the process of developing their

technology and have not yet

begun generating revenue from

said technology, there is also The positive developments in

the risk that the carrying value the year with respect to the

of the intangible asset is impaired. application of the Stirling technology

to the marine industry demonstrated

the commercial potential of Inspirit's

technology and thus indicate

that the capitalised development

costs as at 30 June 2022 are

materially recoverable.

Successful commercialisation

of the group's Stirling technology

is reliant on project completion,

the availability of sufficient

funds (see the "Material uncertainty

related to going concern" section

above for our conclusion in respect

of the directors' use of the

going concern basis of accounting

in the preparation of the financial

statements) and the required

regulatory approvals being obtained.

It is drawn to the users' attention

that none of these matters are

certain. Failure to achieve the

above may result in an impairment

to the assets capitalised.

==============================================================

Carrying Value of Investment

in Subsidiaries

==============================================================

Carrying value of investment Our work in this area included:

in subsidiaries of GBP2.4m (2021: * Obtaining the directors' assessment of impairment and

GBP2.4m). Refer to Note 4: Critical reviewing and challenging the key estimates and

Accounting Estimates. judgements used therein; and

Investments in subsidiaries

is the largest asset within * Performing sensitivity analysis on the key areas of

the Parent Company's Statement estimation/judgement and verifying to supporting

of Financial Position and represents documentation where possible including benchmarking

its investment in the subsidiary against companies in the same industry.

whose principal activity is

the development of its Stirling

technology from which, if successful,

the group will generate revenue. The positive developments in

the year with respect to the

There is the risk that the application of the Stirling technology

carrying value of the investment to the marine industries demonstrated

in subsidiary is impaired since the commercial potential of Inspirit's

the subsidiary is loss making technology and thus indicate

and has yet to become revenue that the investment in the subsidiary,

generating. the entity conducting said development,

as at 30 June 2022 is materially

recoverable.

Successful commercialisation

of the group's Stirling technology

is reliant on project completion,

the availability of sufficient

funds (see the "Material uncertainty

related to going concern" section

above for our conclusion in respect

of the directors' use of the

going concern basis of accounting

in the preparation of the financial

statements) and the required

regulatory approvals being obtained.

It is drawn to the users' attention

that none of these matters is

certain. Failure to achieve the

above may result in an impairment

to the carrying value of investments.

==============================================================

Other information

The other information comprises the information included in the

annual report, other than the financial statements and our

auditor's report thereon. The directors are responsible for the

other information contained within the annual report. Our opinion

on the group and parent company financial statements does not cover

the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon. Our responsibility is to read the

other information and, in doing so, consider whether the other

information is materially inconsistent with the financial

statements or our knowledge obtained in the course of the audit, or

otherwise appears to be materially misstated. If we identify such

material inconsistencies or apparent material misstatements, we are

required to determine whether this gives rise to a material

misstatement in the financial statements themselves. If, based on

the work we have performed, we conclude that there is a material

misstatement of this other information, we are required to report

that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the strategic report and the

directors' report for the financial year for which the financial

statements are prepared is consistent with the financial

statements; and

-- the strategic report and the directors' report have been

prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and

the parent company and their environment obtained in the course of

the audit, we have not identified material misstatements in the

strategic report or the directors' report.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

-- adequate accounting records have not been kept by the parent

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- the parent company financial statements are not in agreement

with the accounting records and returns; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the statement of directors'

responsibilities, the directors are responsible for the preparation

of the group and parent company financial statements and for being

satisfied that they give a true and fair view, and for such

internal control as the directors determine is necessary to enable

the preparation of financial statements that are free from material

misstatement, whether due to fraud or error.

In preparing the group and parent company financial statements,

the directors are responsible for assessing the group and the

parent company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern and

using the going concern basis of accounting unless the directors

either intend to liquidate the group or the parent company or to

cease operations, or have no realistic alternative but to do

so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below:

-- We obtained an understanding of the group and parent company

and the sector in which they operate to identify laws and

regulations that could reasonably be expected to have a direct

effect on the financial statements. We obtained our understanding

in this regard through management, industry research and experience

of the sector.

-- We determined the principal laws and regulations relevant to

the group and parent company in this regard to be those arising

from UK Company Law, rules applicable to issuers on the AIM Market

and UK-adopted international accounting standards.

-- We identified areas of laws and regulations that could

reasonably be expected to have a material effect on the financial

statements from our sector experience and through discussion with

the directors. We considered the event of compliance with those

laws and regulations as part of our procedures on the related

financial statement items. We communicated laws and regulations

throughout our audit team and remained alert to any indications of

non-compliance throughout the audit of the group.

-- We designed our audit procedures to ensure the audit team

considered whether there were any indications of non-compliance by

the group and parent company with those laws and regulations. These

procedures included, but were not limited to:

o Discussions with management regarding compliance with laws and

regulations by the parent company and the subsidiary;

o Reviewing legal expenses incurred in the year;

o Reviewing board minutes; and

o Review of regulatory news announcements made.

-- We also identified the risks of material misstatement of the

financial statements due to fraud. We considered, in addition to

the non-rebuttable presumption of a risk of fraud arising from

management override of controls, that there was potential for

management bias in relation to the impairment of capitalised

development costs and investments in subsidiaries and we addressed

this by challenging the assumptions and judgements made by

management when auditing these significant accounting

estimates.

-- As in all of our audits, we addressed the risk of fraud

arising from management override of controls by performing audit

procedures which included, but were not limited to: the testing of

journals; reviewing accounting estimates for evidence of bias;

discussing with management as to whether there had been any

instances or suspicions of fraud within the subsidiaries and

evaluating the business rationale of any significant transactions

that are unusual or outside the normal course of business.

Because of the inherent limitations of an audit, there is a risk

that we will not detect all irregularities, including those leading

to a material misstatement in the financial statements or

non-compliance with regulation. This risk increases the more that

compliance with a law or regulation is removed from the events and

transactions reflected in the financial statements, as we will be

less likely to become aware of instances of non-compliance. The

risk is also greater regarding irregularities occurring due to

fraud rather than error, as fraud involves intentional concealment,

forgery, collusion, omission or misrepresentation.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities .

This description forms part of our auditor's report.

Use of our report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone, other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Joseph Archer (Senior Statutory Auditor) 15 Westferry Circus

For and on behalf of PKF Littlejohn LLP Canary Wharf

Statutory Auditor London E14 4HD

05 January 2023

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 June 2022

2022 2021

Note GBP'000 GBP'000

---------------------------------- ----- ---------- ---------

CONTINUING OPERATIONS:

Administrative expenses 7 (329) (277)

OPERATING LOSS (329) (277)

LOSS BEFORE INCOME TAX (329) (277)

Income tax credit 8 96 24

---------------------------------- ----- ---------- ---------

NET LOSS AND TOTAL COMPREHENSIVE

INCOME LOSS FOR THE YEAR

ATTRIBUTABLE TO THE OWNERS

OF THE PARENT (233) (253)

---------------------------------- ----- ---------- ---------

EARNINGS PER SHARE

- Basic and diluted earnings

per share 9 (0.005p) (0.007p)

(attributable to owners

of the parent)

---------------------------------- ----- ---------- ---------

STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 30 June 2022

Company Number: GROUP COMPANY

05075088

-------- -------- --------- ---------

2022 2021 2022 2021

Note GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ----- -------- -------- --------- ---------

NON-CURRENT ASSETS

Intangible assets 10 2,998 2,773 - -

Property, plant

and equipment 11 25 30 1 1

Investment in subsidiaries 12 - - 2,440 2,440

3,023 2,803 2,441 2,441

---------------------------- ----- -------- -------- --------- ---------

CURRENT ASSETS

Trade and other

receivables 13 107 37 6 7

Cash and cash equivalents 14 160 561 158 554

---------------------------- ----- -------- -------- --------- ---------

267 598 164 561

---------------------------- ----- -------- -------- --------- ---------

TOTAL ASSETS 3,290 3,401 2,605 3,002

---------------------------- ----- -------- -------- --------- ---------

EQUITY ATTRIBUTABLE

TO OWNERS OF THE

PARENT

Share capital 15 2,103 2,103 2,103 2,103

Share premium 15 9,783 9,783 9,783 9,783

Merger reserve 3,150 3,150 3,150 3,150

Other reserves 3 3 3 3

Reverse acquisition

reserve (7,361) (7,361) - -

Retained losses (5,021) (4,788) (12,994) (12,463)

---------------------------- ----- -------- -------- --------- ---------

TOTAL EQUITY 2,657 2,890 2,045 2,576

---------------------------- ----- -------- -------- --------- ---------

CURRENT LIABILITIES

Trade and other

payables 17 533 411 460 326

Borrowings 18 100 100 100 100

---------------------------- ----- -------- -------- --------- ---------

633 511 560 426

TOTAL LIABILITIES 633 511 560 426

---------------------------- ----- -------- -------- --------- ---------

TOTAL EQUITY AND

LIABILITIES 3,290 3,401 2,605 3,002

---------------------------- ----- -------- -------- --------- ---------

The Company has elected to take the exemption under section 408

of the Companies Act 2006 not to present the Parent Company

Statement of Comprehensive Income.

The loss for the Parent Company for the year was GBP531,000

(2021: loss of GBP331,000).

These Financial Statements were approved by the Board of

Directors on 5 January 2023 and were signed on its behalf by

N Jagatia

Director

GROUP STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 June 2022

Attributable to the owners of the parent

-------------------------------------------------------------------------------

Share Share Other Merger Reverse Retained Total

capital premium reserves reserve acquisition losses Equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- ---------- --------- ------------- --------- --------

BALANCE AT 30 June

2020 1,967 9,192 3 3,150 (7,361) (4,535) 2,416

---------------------- --------- --------- ---------- --------- ------------- --------- --------

Loss for the year - - - - - (253) (253)

--------

TOTAL COMPREHENSIVE

INCOME FOR THE YEAR - - - - - (253) (253)

---------------------- --------- --------- ---------- --------- ------------- --------- --------

Share issues 136 621 - - - - 757

Share issue costs - (30) - - - (30)

TRANSACTIONS WITH

OWNERS RECOGNISED

DIRECTLY IN EQUITY 136 591 - - - - 727

---------------------- --------- --------- ---------- --------- ------------- --------- --------

BALANCE AT 30 June

2021 2,103 9,783 3 3,150 (7,361) (4,788) 2,890

---------------------- --------- --------- ---------- --------- ------------- --------- --------

Loss for the year - - - - - (233) (233)

--------

TOTAL COMPREHENSIVE

INCOME FOR THE YEAR - - - - - (233) (233)

---------------------- --------- --------- ---------- --------- ------------- --------- --------

BALANCE AT 30 June

2022 2,103 9,783 3 3,150 (7,361) (5,021) 2,657

---------------------- --------- --------- ---------- --------- ------------- --------- --------

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 June 2022

Attributable to equity shareholders

----------------------------------------------------------------

Share Share Merger Other Retained Total

capital premium Reserve reserves losses Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- --------- ---------- --------- --------

BALANCE AT 30 June

2020 1,967 9,192 3,150 3 (12,132) 2,180

---------------------- --------- --------- --------- ---------- --------- --------

Loss for the year - - - - (331) (331)

---------

TOTAL COMPREHENSIVE

INCOME FOR THE YEAR - - - - (331) (331)

---------------------- --------- --------- --------- ---------- --------- --------

Share issues 136 621 - - 757

Share issue costs - (30) - - (30)

---------

TRANSACTIONS WITH

OWNERS RECOGNISED

DIRECTLY IN EQUITY 136 591 - - - 727

---------------------- --------- --------- --------- ---------- --------- --------

BALANCE AT 30 June

2021 2,103 9,783 3,150 3 (12,463) 2,576

---------------------- --------- --------- --------- ---------- --------- --------

Loss for the year - - - - (531) (531)

---------

TOTAL COMPREHENSIVE

LOSS FOR THE YEAR - - - - (531) (531)