TIDMHUW

RNS Number : 3803S

Hampden Underwriting Plc

18 May 2009

18 May 2009

Hampden Underwriting PLC

("Hampden Underwriting" or the "Company")

Preliminary results for the year ended 31 December 2008

Hampden Underwriting, which provides investors with a limited liability direct

investment into the Lloyd's insurance market, announces its preliminary results

for the year ended 31 December 2008.

Highlights

* Commenced underwriting with an allocated capacity of GBP5.1m

* Premium written during the period totalled GBP5.2m

* Group's first acquisition of a Lloyd's corporate member during the year

* Small loss of GBP48,000

* Net assets of GBP7.0m

Commenting upon these results Chairman, Sir Michael Oliver said:

"2008 was the first full year of trading and as with virtually all years of

account, is showing a small loss after 12 months. It is encouraging that at this

stage, albeit with the account still very much on risk, early forecasts suggest

a profitable outcome for both Hampden Corporate Member and Nameco (No. 365)

Limited, our two underwriting subsidiaries. In addition the Company's investment

income has continued to exceed cash operating expenses.

In our view, prospects for the London Insurance Market and specifically Lloyd's

look extremely promising and we look forward to generating attractive returns

for shareholders."

Enquiries

+-----------------------+------------------------+---------------------+

| Hampden Underwriting | Jeremy Evans | 020 7863 6567 |

| | | |

+-----------------------+------------------------+---------------------+

| Smith & Williamson | David Jones | 020 7131 4000 |

| Corporate Finance | Barrie Newton | |

| Limited | Joanne Royden-Turner | |

| | | |

+-----------------------+------------------------+---------------------+

Chairman's Statement

2008 was the first full year of trading and as with virtually all years of

account, is showing a small loss after 12 months. It is encouraging that at this

stage, albeit with the account still very much on risk, early forecasts suggest

a profitable outcome for both Hampden Corporate Member and Nameco (No. 365)

Limited, our two underwriting subsidiaries. In addition the Company's investment

income has continued to exceed cash operating expenses.

In February of 2009 we acquired Nameco (No. 605) Limited which currently

underwrites GBP2.7m which when added to the underwriting of Hampden Corporate

Member and Nameco (No. 365) Limited takes our overall premium income limit to

GBP7.6m. It has also given us valuable exposure to the highly profitable 2006

and 2007 years of account.

In April of this year our Members' Agent, Hampden Agencies Limited ("HAL"),

produced its Annual Market Report. In their Lloyd's Adviser's Report they

comment on market conditions in detail, but I would like to quote from it their

views on one aspect in particular. "Our view is that we have now entered the

hardening phase of the cycle with a potential hard market for 2010 and 2011. The

combination of a long-term loss of investment return and reduction in

policyholder surplus (a measure of the capital base of US insurers) now requires

an underwriting profit for investors to achieve an adequate return on equity.

Our view is that Lloyd's is favourably positioned to maintain its record of

strong profitability since 2002".

The rationale of establishing Hampden Underwriting was to provide an

opportunity to invest in a quoted company underwriting via a diverse spread of

syndicates through its own corporate member as well as by the acquisition of

others. We also undertook to look at other Lloyd's related opportunities. During

the course of the year we looked at several but felt that our capital was best

deployed directly supporting underwriting. We will continue to look at all

opportunities as well as considering the possibilities of raising further

capital from both existing shareholders and new investors. In our view,

prospects for the London Insurance Market and specifically Lloyd's look

extremely promising and we look forward to generating attractive returns for

shareholders.

Sir Michael Oliver

Non-executive Chairman

15 May 2009

Lloyd's Adviser's Report

Market outlook

During the 1980s and 1990s the US property casualty industry failed to make an

underwriting profit with the combined ratio (the standard measure of

profitability of the industry which excludes investment income) being

consistently above 100%. The reason was that underwriting losses could be

subsidised by investment returns generated by the bull market in both bonds and

equities, which lasted from 1982 to 2000. Already this decade, the US industry

has declared underwriting profits in three years and Lloyd's has made profits in

five successive years since the 2002 three-year account. We are now in a low

interest rate environment with a long term loss of investment return. No longer

can an underwriting loss be subsidised by investment return. It is for this

reason, perhaps more than any other, that non-life insurance and, in particular

Lloyd's, continues to be a favourable investment proposition.

The industry's underwriting capacity has been depleted by catastrophe losses

from Hurricane Ike and asset losses equivalent to a major catastrophe suffered

in 2008 which, taken together, are "market changing". According to Swiss Re's

Sigma research 2008 marked the second worst year on record for insured

catastrophe losses after 2005. In addition, investment losses are estimated by

the New York based Insurance Information Institute to have been the fourth

largest "capital event" over the past 20 years for the US insurance industry.

We see 2009 as a year of transition as the insurance and reinsurance markets

move to a rating environment where rate rises, not reductions, are becoming the

norm with a potential hard market in 2010 or 2011.

This change in trend is most marked in the retrocession and reinsurance markets,

particularly for catastrophe exposed US business. The 1 January renewal

season is the key bell-weather in assessing pricing trends and after two years

of rate reductions the reinsurance broker, Guy Carpenter, reported that the

overall increase for reinsurance programmes in the United States at 1 January

2009 was 11%. Our expectation is that increased reinsurance costs will feed

through into direct rates as the year progresses.

While insurance is not immune to recession related claims activity or reduced

demand for cover from lines of business which are turnover dependent or linked

to international trade, insurance is not a discretionary purchase. Increased

casualty claims activity is being seen in US E&O and D&O financial institutions

business as investors seek to recover financial losses but underwriters are now

charging significant rate increases. Overall, insurance is likely to be less

affected by the economic recession than banks and other financial services

businesses and, in fact, may benefit from the "credit crunch" as the

availability of risk bearing capital reduces.

Lloyd's outperforms its peer group competitors

As the world's leading subscription market for insurance and reinsurance risk,

Lloyd's market position is set to benefit from an increased flow of business as

insurers and risk managers look to lessen their counterparty risk and dependence

on any one carrier in an increasingly uncertain world.

Lloyd's strong operating performance continues to stand out. The traditional

method for performance comparisons of competing insurance businesses is an

analysis of the combined ratio, which is the ratio of net incurred claims plus

net operating expenses to net earned premiums. In 2008, Lloyd's combined ratio

was the best compared with its peer groups at 91%, with Lloyd's outperforming

its nearest competitor, Bermudian Reinsurers, by an aggregate of 7% over the

period 2004 to 2008. As well as strong operating performance for its investors,

Lloyd's security for policyholders is also recognised by the rating agencies

with Lloyd's being only one of three out of the top ten reinsurers whose current

rating of A+ from Standard & Poor's is the same as before the World Trade Centre

losses in 2001.

Lloyd's operating results have outperformed its main peer groups, while HAL's

managed portfolios continue to outperform Lloyd's. The portfolio of Lloyd's

syndicates managed by HAL for HCM is well positioned to take advantage of

opportunities for profitable growth into 2010, with many syndicates in the

portfolio expecting to increase their underwriting capacity for 2010 to take

advantage of improving market conditions and compensate for the decline in the

value of sterling against the US dollar.

HCM underwriting performance

HCM's first underwriting year is the 2008 Account, although its two Nameco

acquisitions have given exposure to the profitable 2006 and 2007 Accounts.

Estimates for all syndicates on the 2008 Account will not be available until the

end of May reflecting data at the end of Quarter 1 2009. Forecasts have been

received for 9 syndicates in HCM's portfolio for the 2008 Account representing

54% of capacity with an average mid-point forecast of 7.2% on capacity. It is

encouraging that at this early stage, despite the 2008 catastrophe losses, all

12 syndicates are forecasting profits. However, the 2008 Account is still on

risk with reinsurance exposed, in particular to earthquake, until 30 June 2009

while many insurance policies will be on risk until 31 December 2009. HAL

maintains its profit target of 0% to 5% of capacity, excluding prior year

releases.

Prospects for underwriting at Lloyd's in 2009 remain attractive. Our profit

target remains in a range of 5% to 10% of capacity, excluding prior year

releases, which reflects an improved potential reward for 2009 compared with

2008. Despite the improved potential reward for 2009, we view risk and potential

recession related claims as increasing due to increased costs for reinsurance

and, in particular, retrocession cover for reinsurers.

Top 10 Syndicate Holdings for 2009 Account

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| Syndicate | Managing Agent | 2009 | 2009 | 2009 | 2009 Major |

| | | Syndicate | Group | Group | Category |

| | | capacity | portfolio | portfolio | of business |

| | | GBP'000 | capacity | % of | |

| | | | GBP'000 | total | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 510 | R.J. Kiln & Co. Ltd | 630,000.0 | 983.0 | 13.0 | US$ Property |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 2791 | Managing Agency | 400,902.4 | 925.1 | 12.2 | Reinsurance |

| | Partners Ltd | | | | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 958 | Omega Underwriting | 249,432.4 | 820.0 | 10.8 | Reinsurance |

| | Agents Ltd | | | | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 623 | Beazley Furlonge Ltd | 149,899.8 | 623.7 | 8.2 | US$ Non-Marine |

| | | | | | Liability |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 2121 | Argenta Syndicate | 130,000.0 | 567.1 | 7.5 | US$ Property |

| | Mangement Ltd | | | | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 557 | R.J. Kiln & Co Ltd | 119,577.0 | 484.8 | 6.4 | Reinsurance |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 609 | Atrium Underwriters Ltd | 200,000.0 | 458.6 | 6.1 | Energy |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 33 | Hiscox Syndicates Ltd | 750,000.0 | 413.1 | 5.5 | US$ Property |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 218 | Equity Syndicate | 452,325.7 | 382.0 | 5.0 | Motor |

| | Mangement Ltd | | | | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| 260 | KGM Underwriting | 72,500.0 | 356.9 | 4.7 | Motor |

| | Agencies Ltd | | | | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| Subtotal | | | 6,014.3 | 79.4 | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

| Portfolio Total | | 7,575.6 | 100.0 | |

+-----------+-------------------------+-----------+-----------+-----------+--------------------+

2009 Portfolio analysis

The Group's core underwriting participation for the 2009 underwriting year is

through HAL's managed portfolio, MAPA 7208, which was originally acquired for

the 2008 underwriting year. This capacity of GBP4.4m reflects adjustments

through syndicate de-emptions and pre-emptions and the non-renewal of an annual

participation on Syndicate 6101.

During 2008 and 2009 the Group supplemented the MAPA capacity managed by HAL

through the purchases of Nameco 365 and Nameco 605. It also added four smaller

individual participations on MAP Syndicate 6103, Hiscox Syndicate 6104, Amlin

Syndicate 6106 and ICAT Syndicate 4242, all of which should benefit from higher

rates on US catastrophe exposed business. The Group's total participation for

2009 is GBP7.6m of capacity.

The spread of syndicates in MAPA 7208 is similar to those of HAL's existing

MAPAs with a weighting towards those syndicates which have historically

outperformed the broader Lloyd's market. The largest lines remain on Kiln

Syndicate 510, MAP Syndicate 2791 and Omega Syndicate 958, all of which are

syndicates with excellent track records and specialists in underwriting

reinsurance business, where rates are now increasing.

HAL considers that the portfolio provides a good spread of business across

managing agents and classes of business with motor and liability providing a

balance to the catastrophe exposed reinsurance and property business, as well as

contributing to lower capital requirements due to Lloyd's credits for

diversification.

Portfolio risk management

HAL manages the portfolio risk by diversification across classes of business,

syndicates and managing agents as well as controlling the downside, in the event

of a major loss, by monitoring the aggregate losses estimated by managing agents

to Realistic Disaster Scenarios. HAL considers risk in the context of potential

return and seeks to actively manage catastrophe exposure, dependent on market

conditions.

Lloyd's first utilised Realistic Disaster Scenarios in 1995 to evaluate exposure

at both syndicate and market level. These scenarios continue to be refined and

updated to take account of loss experience and exposure values. For 2009 the

largest loss modelled is a Florida windstorm totalling $125bn, which compares

with only $60bn in 2005 indicating additional conservatism. Exposure management

is a critical component of being able to manage the insurance cycle.

The Realistic Disaster Scenario chart (contained in the full Financial

Statements) shows the aggregated impact at portfolio level for the Group for the

ten largest net exposures (after reinsurance) to events modelled for 2009. These

exposures provide a guide to potential downside risk, but do not measure

potential loss since they exclude the results of the balance of the account. The

Group's largest modelled exposure net of reinsurance is to a two event scenario

at 18.8% of capacity, which has increased for 2009 as a result of the

acquisition of Nameco 605.

Group income statement

Year ended 31 December 2008

+----------------------------------------------+--------+--------------+--------------+

| | | | 17 months |

+----------------------------------------------+--------+--------------+--------------+

| | | Year ended | ended |

+----------------------------------------------+--------+--------------+--------------+

| | | 31 December | 31 December |

+----------------------------------------------+--------+--------------+--------------+

| | | 2008 | 2007 |

+----------------------------------------------+--------+--------------+--------------+

| | Note | GBP'000 | GBP'000 |

+----------------------------------------------+--------+--------------+--------------+

| Gross premium written | | 5,245 | - |

+----------------------------------------------+--------+--------------+--------------+

| Reinsurance premium ceded | | (854) | - |

+----------------------------------------------+--------+--------------+--------------+

| Net premiums written | | 4,391 | - |

+----------------------------------------------+--------+--------------+--------------+

| Change in unearned gross premium provision | | (1,982) | - |

+----------------------------------------------+--------+--------------+--------------+

| Change in unearned reinsurance premium | | 218 | - |

| provision | | | |

+----------------------------------------------+--------+--------------+--------------+

| | | (1,764) | - |

+----------------------------------------------+--------+--------------+--------------+

| Net earned premium | | 2,627 | - |

+----------------------------------------------+--------+--------------+--------------+

| Net investment income | 3 | 358 | 174 |

+----------------------------------------------+--------+--------------+--------------+

| Other underwriting income | | (1) | - |

+----------------------------------------------+--------+--------------+--------------+

| Other income | | 25 | - |

+----------------------------------------------+--------+--------------+--------------+

| | | 382 | 174 |

+----------------------------------------------+--------+--------------+--------------+

| Revenue | | 3,009 | 174 |

+----------------------------------------------+--------+--------------+--------------+

| Gross claims paid | | (670) | - |

+----------------------------------------------+--------+--------------+--------------+

| Reinsurance share of gross claims paid | | 108 | - |

+----------------------------------------------+--------+--------------+--------------+

| Claims paid, net of reinsurance | | (562) | - |

+----------------------------------------------+--------+--------------+--------------+

| Change in provision for gross claims | | (1,740) | - |

+----------------------------------------------+--------+--------------+--------------+

| Reinsurance share of change in provision for | | 378 | - |

| gross claims | | | |

+----------------------------------------------+--------+--------------+--------------+

| Net change in provision for claims | | (1,362) | - |

+----------------------------------------------+--------+--------------+--------------+

| Net insurance claims and loss adjustment | | (1,924) | - |

| expenses | | | |

+----------------------------------------------+--------+--------------+--------------+

| Expenses incurred in insurance activities | | (720) | - |

+----------------------------------------------+--------+--------------+--------------+

| Other operating expenses | | (450) | (85) |

+----------------------------------------------+--------+--------------+--------------+

| Operating expenses | | (1,170) | (85) |

+----------------------------------------------+--------+--------------+--------------+

| Operating (loss)/profit before tax | 4 | (85) | 89 |

+----------------------------------------------+--------+--------------+--------------+

| Income tax credit/(expense) | | 37 | (27) |

+----------------------------------------------+--------+--------------+--------------+

| (Loss)/profit attributable to equity | | (48) | 62 |

| shareholders | | | |

+----------------------------------------------+--------+--------------+--------------+

| Earnings per share attributable to equity | | | |

| shareholders | | | |

+----------------------------------------------+--------+--------------+--------------+

| Basic and diluted | 5 | (0.65)p | 0.83p |

+----------------------------------------------+--------+--------------+--------------+

The (loss)/profit attributable to equity shareholders and earnings per share set

out above are in respect of continuing operations.

The accounting policies and notes are an integral part of these financial

statements.

Group balance sheet

At 31 December 2008

+----------------------------------------------+-------+----------------+---------------+

| | | 31 December | 31 December |

+----------------------------------------------+-------+----------------+---------------+

| | | 2008 | 2007 |

+----------------------------------------------+-------+----------------+---------------+

| | Note | GBP'000 | GBP'000 |

+----------------------------------------------+-------+----------------+---------------+

| Assets | | | |

+----------------------------------------------+-------+----------------+---------------+

| Intangible assets | 6 | 920 | 981 |

+----------------------------------------------+-------+----------------+---------------+

| Financial investments | 7 | 4,131 | 2,486 |

+----------------------------------------------+-------+----------------+---------------+

| Reinsurance share of insurance liabilities | | | |

+----------------------------------------------+-------+----------------+---------------+

| - Reinsurers' share of outstanding claims | | 678 | - |

+----------------------------------------------+-------+----------------+---------------+

| - Reinsurers' share of unearned premiums | | 266 | - |

+----------------------------------------------+-------+----------------+---------------+

| Other receivables, including insurance | | 2,557 | 79 |

| receivables | | | |

+----------------------------------------------+-------+----------------+---------------+

| Prepayments and accrued income | | 612 | 33 |

+----------------------------------------------+-------+----------------+---------------+

| Deferred income tax assets | | 16 | - |

+----------------------------------------------+-------+----------------+---------------+

| Cash and cash equivalents | | 3,931 | 3,552 |

+----------------------------------------------+-------+----------------+---------------+

| Total assets | | 13,111 | 7,131 |

+----------------------------------------------+-------+----------------+---------------+

| Liabilities | | | |

+----------------------------------------------+-------+----------------+---------------+

| Insurance liabilities | | | |

+----------------------------------------------+-------+----------------+---------------+

| - Claims outstanding | | 2,879 | - |

+----------------------------------------------+-------+----------------+---------------+

| - Unearned premiums | | 2,366 | - |

+----------------------------------------------+-------+----------------+---------------+

| Other payables, including insurance payables | | 803 | - |

+----------------------------------------------+-------+----------------+---------------+

| Accruals and deferred income | | 26 | 40 |

+----------------------------------------------+-------+----------------+---------------+

| Current income tax liabilities | | - | 27 |

+----------------------------------------------+-------+----------------+---------------+

| Deferred income tax liabilities | | 21 | - |

+----------------------------------------------+-------+----------------+---------------+

| Total liabilities | | 6,095 | 67 |

+----------------------------------------------+-------+----------------+---------------+

| Shareholders' equity | | | |

+----------------------------------------------+-------+----------------+---------------+

| Share capital | 8 | 741 | 741 |

+----------------------------------------------+-------+----------------+---------------+

| Share premium | 8 | 6,261 | 6,261 |

+----------------------------------------------+-------+----------------+---------------+

| Retained earnings | 8 | 14 | 62 |

+----------------------------------------------+-------+----------------+---------------+

| Total shareholders' equity | | 7,016 | 7,064 |

+----------------------------------------------+-------+----------------+---------------+

| Total liabilities and shareholders' equity | | 13,111 | 7,131 |

+----------------------------------------------+-------+----------------+---------------+

The accounting policies and notes are an integral part of these financial

statements.

Group cash flow statement

Year ended 31 December 2008

+--------------------------------------------------+--------------+----------------+

| | | 17 months |

+--------------------------------------------------+--------------+----------------+

| | Year ended | ended |

+--------------------------------------------------+--------------+----------------+

| | 31 December | 31 December |

+--------------------------------------------------+--------------+----------------+

| | 2008 | 2007 |

+--------------------------------------------------+--------------+----------------+

| Cash flow from operating activities | GBP'000 | GBP'000 |

+--------------------------------------------------+--------------+----------------+

| Results of operating activities | (85) | 89 |

+--------------------------------------------------+--------------+----------------+

| Interest received | (264) | (73) |

+--------------------------------------------------+--------------+----------------+

| Investment income | (49) | - |

+--------------------------------------------------+--------------+----------------+

| Dividend received | (18) | - |

+--------------------------------------------------+--------------+----------------+

| Income tax paid | 11 | - |

+--------------------------------------------------+--------------+----------------+

| Recognition of negative goodwill | (25) | - |

+--------------------------------------------------+--------------+----------------+

| Amortisation of intangible assets | 150 | - |

+--------------------------------------------------+--------------+----------------+

| Change in fair value of investments recognised | 17 | (101) |

| in the income statement | | |

+--------------------------------------------------+--------------+----------------+

| Changes in working capital: | | |

+--------------------------------------------------+--------------+----------------+

| Increase in other receivables | (3,057) | (112) |

+--------------------------------------------------+--------------+----------------+

| Increase in other payables | 810 | 40 |

+--------------------------------------------------+--------------+----------------+

| Net increase in technical provisions | 4,301 | - |

+--------------------------------------------------+--------------+----------------+

| Net cash inflow/(outflow) from operating | 1,791 | (157) |

| activities | | |

+--------------------------------------------------+--------------+----------------+

| Cash flows from investing activities | | |

+--------------------------------------------------+--------------+----------------+

| Interest received | 264 | 73 |

+--------------------------------------------------+--------------+----------------+

| Investment income | 49 | - |

+--------------------------------------------------+--------------+----------------+

| Dividend received | 18 | - |

+--------------------------------------------------+--------------+----------------+

| Purchase of intangible assets | (17) | (981) |

+--------------------------------------------------+--------------+----------------+

| Proceeds from disposal of intangible assets | 3 | - |

+--------------------------------------------------+--------------+----------------+

| Purchase of financial investments | (1,645) | (2,385) |

+--------------------------------------------------+--------------+----------------+

| Acquisition of subsidiary, net of cash acquired | (84) | - |

+--------------------------------------------------+--------------+----------------+

| Net cash outflow from investing activities | (1,412) | (3,293) |

+--------------------------------------------------+--------------+----------------+

| Cash flows from financing activities | | |

+--------------------------------------------------+--------------+----------------+

| Net proceeds from issue of ordinary share | - | 7,002 |

| capital | | |

+--------------------------------------------------+--------------+----------------+

| Net cash inflow from financing activities | - | 7,002 |

+--------------------------------------------------+--------------+----------------+

| Net increase in cash, cash equivalents and bank | 379 | 3,552 |

| overdrafts | | |

+--------------------------------------------------+--------------+----------------+

| Cash, cash equivalents and bank overdrafts at | 3,552 | - |

| beginning of year/period | | |

+--------------------------------------------------+--------------+----------------+

| Cash, cash equivalents and bank overdrafts at | 3,931 | 3,552 |

| end of year/period | | |

+--------------------------------------------------+--------------+----------------+

The accounting policies and notes are an integral part of these financial

statements.

Statement of changes in shareholders' equity

Year ended 31 December 2008

+-----------------------------------+----------+-------------+----------+----------+---------+

| | Ordinary | Preference | Share | Retained | |

| | | | | | |

+-----------------------------------+----------+-------------+----------+----------+---------+

| | share | share | premium | earnings | Total |

| | capital | capital | | | |

+-----------------------------------+----------+-------------+----------+----------+---------+

| Group | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| Profit for the period | - | - | - | 62 | 62 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| Share issue expense charged to | - | - | (411) | - | (411) |

| equity | | | | | |

+-----------------------------------+----------+-------------+----------+----------+---------+

| New preference shares issued | - | 50 | - | - | 50 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| New ordinary shares issued | 741 | - | 6,672 | - | 7,413 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| Preference shares redeemed | - | (50) | - | - | (50) |

+-----------------------------------+----------+-------------+----------+----------+---------+

| At 31 December 2007 | 741 | - | 6,261 | 62 | 7,064 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| At 1 January 2008 | 741 | - | 6,261 | 62 | 7,064 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| Loss for the year attributable to | - | - | - | (48) | (48) |

| equity shareholders | | | | | |

+-----------------------------------+----------+-------------+----------+----------+---------+

| At 31 December 2008 | 741 | - | 6,261 | 14 | 7,016 |

+-----------------------------------+----------+-------------+----------+----------+---------+

| | | | | | |

+-----------------------------------+----------+-------------+----------+----------+---------+

The accounting policies and notes are an integral part of these financial

statements.

Notes to the Financial Statements

1. Accounting policies

The principal accounting policies adopted in the preparation of the financial

information set out in the announcement are set out in the full financial

statements for the year ended 31 December 2008 (the "Financial Statements").

Basis of preparation

The Financial Statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS"), incorporating IFRIC interpretations

endorsed by the European Union (EU) and with those parts of the Companies Act

1985, applicable to companies reporting under IFRS. The Financial Statements

comply with Article 4 of the EU IAS regulation. The Financial Statements have

been prepared under the historical cost convention.

The preparation of Financial Statements in conformity with generally accepted

accounting principles requires the use of estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during the

reporting period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results ultimately may differ

from these estimates. The Group participates in insurance business through its

Lloyd's corporate member. Accounting information in respect of syndicate

participations is provided by the syndicate managing agents and is reported upon

by the syndicate auditors.

International Financial Reporting Standards

At the date of authorisation of the Financial Statements the following standards

and interpretations had been published by the International Accounting Standards

Board ("IASB") but were not yet effective and have therefore not been adopted in

the Financial Statements:

* IAS 1 Presentation of Financial Statements (Revised);

* IAS 23 Borrowing Costs (Revised);

* IAS 1 and IAS 32 Puttable Financial Instruments and Obligations Arising on

Liquidation (Amended);

* IFRS 1 and IAS 27 Cost of an Investment in a Subsidiary, Jointly Controlled

Entity or Associate (Amended);

* IFRS 2 Share-based Payment (Amended);

* IFRS 8 Operating Segments;

* IFRIC 13 Customer Loyalty Programmes.

The Directors anticipate that the adoption of the above in future years will not

have a material impact on the Financial Statements except for additional

disclosures.

2. Segmental information

Primary segment information

The Group has three primary segments which represent the primary way in which

the Group is managed:

+-----+------------------------------------------------------------------------------------+

| - | Syndicate participation; |

+-----+------------------------------------------------------------------------------------+

| - | Investment management; |

+-----+------------------------------------------------------------------------------------+

| - | Other corporate activities. |

+-----+------------------------------------------------------------------------------------+

+-------------------------------------------+---------------+------------+------------+-----------+

| | | | Other | |

+-------------------------------------------+---------------+------------+------------+-----------+

| | Syndicate | Investment | corporate | |

+-------------------------------------------+---------------+------------+------------+-----------+

| | participation | management | activities | Total |

+-------------------------------------------+---------------+------------+------------+-----------+

| Year ended 31 December 2008 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net earned premium | 2,627 | - | - | 2,627 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net investment income | 134 | 224 | - | 358 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Other underwriting income | (1) | - | - | (1) |

+-------------------------------------------+---------------+------------+------------+-----------+

| Other income | - | - | 25 | 25 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net insurance claims and loss adjustment | (1,924) | - | - | (1,924) |

| expenses | | | | |

+-------------------------------------------+---------------+------------+------------+-----------+

| Expenses incurred in insurance activities | (720) | - | - | (720) |

+-------------------------------------------+---------------+------------+------------+-----------+

| Amortisation of syndicate capacity | - | - | (150) | (150) |

+-------------------------------------------+---------------+------------+------------+-----------+

| Other operating expenses | - | - | (300) | (300) |

+-------------------------------------------+---------------+------------+------------+-----------+

| Results of operating activities | 116 | 224 | (425) | (85) |

+-------------------------------------------+---------------+------------+------------+-----------+

+-------------------------------------------+---------------+------------+------------+-----------+

| | | | Other | |

+-------------------------------------------+---------------+------------+------------+-----------+

| | Syndicate | Investment | corporate | |

+-------------------------------------------+---------------+------------+------------+-----------+

| | participation | management | activities | Total |

+-------------------------------------------+---------------+------------+------------+-----------+

| 17 months ended 31 December 2007 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net earned premium | - | - | - | - |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net investment income | - | 174 | - | 174 |

+-------------------------------------------+---------------+------------+------------+-----------+

| Other income | - | - | - | - |

+-------------------------------------------+---------------+------------+------------+-----------+

| Net insurance claims and loss adjustment | - | - | - | - |

| expenses | | | | |

+-------------------------------------------+---------------+------------+------------+-----------+

| Expenses incurred in insurance activities | - | - | - | - |

+-------------------------------------------+---------------+------------+------------+-----------+

| Other operating expenses | - | - | (85) | (85) |

+-------------------------------------------+---------------+------------+------------+-----------+

| Results of operating activities | - | 174 | (85) | 89 |

+-------------------------------------------+---------------+------------+------------+-----------+

Secondary segment information

The Group does not have any secondary segments as it considers all of its

activities to arise from trading within the UK.

3.Net investment income

+--------------------------------------------------------+----------------+----------------+

| | | 17 months |

+--------------------------------------------------------+----------------+----------------+

| | Year ended | ended |

+--------------------------------------------------------+----------------+----------------+

| | 31 December | 31 December |

+--------------------------------------------------------+----------------+----------------+

| | 2008 | 2007 |

+--------------------------------------------------------+----------------+----------------+

| | GBP'000 | GBP'000 |

+--------------------------------------------------------+----------------+----------------+

| Investment income at fair value through income | 67 | - |

| statement | | |

+--------------------------------------------------------+----------------+----------------+

| Realised gains on financial investments at fair value | 92 | - |

| through income statement | | |

+--------------------------------------------------------+----------------+----------------+

| Unrealised (losses)/gains on financial investments at | (17) | 101 |

| fair value through income statement | | |

+--------------------------------------------------------+----------------+----------------+

| Investment management expenses | (48) | - |

+--------------------------------------------------------+----------------+----------------+

| Bank interest | 264 | 73 |

+--------------------------------------------------------+----------------+----------------+

| Net investment income | 358 | 174 |

+--------------------------------------------------------+----------------+----------------+

4. Operating (loss)/profit before tax

+------------------------------------------------------------+---------------+---------------+

| | | 17 months |

+------------------------------------------------------------+---------------+---------------+

| | Year ended | ended |

+------------------------------------------------------------+---------------+---------------+

| | 31 December | 31 December |

+------------------------------------------------------------+---------------+---------------+

| | 2008 | 2007 |

+------------------------------------------------------------+---------------+---------------+

| | GBP'000 | GBP'000 |

+------------------------------------------------------------+---------------+---------------+

| Operating (loss)/profit before tax is stated after | | |

| charging: | | |

+------------------------------------------------------------+---------------+---------------+

| Directors' remuneration | 74 | 26 |

+------------------------------------------------------------+---------------+---------------+

| Amortisation of intangible assets | 150 | - |

+------------------------------------------------------------+---------------+---------------+

| Auditors' remuneration: | | |

+------------------------------------------------------------+---------------+---------------+

| - audit of the Parent Company and Group Financial | 12 | 12 |

| Statements | | |

+------------------------------------------------------------+---------------+---------------+

| - audit of subsidiary company Financial Statements | 2 | - |

+------------------------------------------------------------+---------------+---------------+

| - services relating to taxation | 2 | 2 |

+------------------------------------------------------------+---------------+---------------+

| - other services pursuant to legislation | 15 | - |

+------------------------------------------------------------+---------------+---------------+

5. Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period. The Group has no dilutive potential ordinary

shares.

Earnings per share have been calculated in accordance with IAS 33.

Reconciliation of the earnings and weighted average number of shares used in the

calculation is set out below.

+-----------------------------------------------------------+---------------+---------------+

| | | 17 months |

+-----------------------------------------------------------+---------------+---------------+

| | Year ended | ended |

+-----------------------------------------------------------+---------------+---------------+

| | 31 December | 31 December |

+-----------------------------------------------------------+---------------+---------------+

| | 2008 | 2007 |

+-----------------------------------------------------------+---------------+---------------+

| | GBP'000 | GBP'000 |

+-----------------------------------------------------------+---------------+---------------+

| (Loss)/profit for the period (GBP) | (48,000) | 62,000 |

+-----------------------------------------------------------+---------------+---------------+

| Weighted average number of shares in issue | 7,413,376 | 7,413,376 |

+-----------------------------------------------------------+---------------+---------------+

| Basic and diluted (loss)/earnings per share (p) | (0.65) | 0.83 |

+-----------------------------------------------------------+---------------+---------------+

6. Intangible assets

+----------------------------------------------------------+-------------------------------+

| | Syndicate |

+----------------------------------------------------------+-------------------------------+

| | capacity |

+----------------------------------------------------------+-------------------------------+

| | GBP'000 |

+----------------------------------------------------------+-------------------------------+

| Cost | |

+----------------------------------------------------------+-------------------------------+

| At 1 January 2008 | 981 |

+----------------------------------------------------------+-------------------------------+

| Additions | 17 |

+----------------------------------------------------------+-------------------------------+

| Disposals | (3) |

+----------------------------------------------------------+-------------------------------+

| Acquired with subsidiary undertaking | 86 |

+----------------------------------------------------------+-------------------------------+

| At 31 December 2008 | 1,081 |

+----------------------------------------------------------+-------------------------------+

| Amortisation | |

+----------------------------------------------------------+-------------------------------+

| At 1 January 2008 | - |

+----------------------------------------------------------+-------------------------------+

| Charge for the year | 150 |

+----------------------------------------------------------+-------------------------------+

| Acquired with subsidiary undertaking | 11 |

+----------------------------------------------------------+-------------------------------+

| At 31 December 2008 | 161 |

+----------------------------------------------------------+-------------------------------+

| Net book value | |

+----------------------------------------------------------+-------------------------------+

| As at 31 December 2008 | 920 |

+----------------------------------------------------------+-------------------------------+

| As at 31 December 2007 | 981 |

+----------------------------------------------------------+-------------------------------+

7. Financial investments

+----------------------------------------------------------+-----------------+-------------+

| | 31 December | 31 December |

+----------------------------------------------------------+-----------------+-------------+

| | 2008 | 2007 |

+----------------------------------------------------------+-----------------+-------------+

| Group | GBP'000 | GBP'000 |

+----------------------------------------------------------+-----------------+-------------+

| Shares and other variable yield securities | 124 | 435 |

+----------------------------------------------------------+-----------------+-------------+

| Debt securities and other fixed income securities | 1,683 | - |

+----------------------------------------------------------+-----------------+-------------+

| Holdings in collective investment schemes | 23 | - |

+----------------------------------------------------------+-----------------+-------------+

| Deposits with credit institutions | 32 | - |

+----------------------------------------------------------+-----------------+-------------+

| Funds held at Lloyd's | 2,258 | 2,051 |

+----------------------------------------------------------+-----------------+-------------+

| Other | 11 | - |

+----------------------------------------------------------+-----------------+-------------+

| Market value | 4,131 | 2,486 |

+----------------------------------------------------------+-----------------+-------------+

| Cost | 4,155 | 2,385 |

+----------------------------------------------------------+-----------------+-------------+

| Listed investments included in the above | 1,830 | 435 |

+----------------------------------------------------------+-----------------+-------------+

8. Share capital and share premium

+---------------------------------------------------------+----------+------------+---------+

| | Ordinary | Preference | |

| | | | |

+---------------------------------------------------------+----------+------------+---------+

| | share | share | |

+---------------------------------------------------------+----------+------------+---------+

| | capital | capital | Total |

+---------------------------------------------------------+----------+------------+---------+

| Authorised | GBP'000 | GBP'000 | GBP'000 |

+---------------------------------------------------------+----------+------------+---------+

| 29,500,000 ordinary shares of 10p each and 100,000 | 2,950 | 50 | 3,000 |

| preference shares of 50p each at 1 January 2008 | | | |

+---------------------------------------------------------+----------+------------+---------+

| 29,500,000 ordinary shares of 10p each and 100,000 | 2,950 | 50 | 3,000 |

| preference shares of 50p each at 31 December 2008 | | | |

+---------------------------------------------------------+----------+------------+---------+

| | | | |

+---------------------------------------------------------+----------+------------+---------+

| | Ordinary | | |

| | | | |

+---------------------------------------------------------+----------+------------+---------+

| | share | Share | |

+---------------------------------------------------------+----------+------------+---------+

| | capital | premium | Total |

+---------------------------------------------------------+----------+------------+---------+

| Allotted, called up and fully paid | GBP'000 | GBP'000 | GBP'000 |

+---------------------------------------------------------+----------+------------+---------+

| 7,413,376 ordinary shares of 10p each and share premium | 741 | 6,261 | 7,002 |

| at 1 January 2008 | | | |

+---------------------------------------------------------+----------+------------+---------+

| 7,413,376 ordinary shares of 10p each and share premium | 741 | 6,261 | 7,002 |

| at 31 December 2008 | | | |

+---------------------------------------------------------+----------+------------+---------+

9. Events after the balance sheet date

On 16 February 2009 Hampden Underwriting plc acquired 100% of the issued share

capital of GBP1 ordinary shares of Nameco (No. 605) Limited for GBP497,000.

Nameco (No. 605) Limited is a corporate member of Lloyd's. It is not practicable

to disclose further details of the financial effect of this acquisition as the

financial statements of Nameco (No. 605) Limited are not yet available.

In order to support the underwriting of Nameco (No. 605) Limited, the Group

deposited Funds at Lloyd's of GBP892,455 on 16 February 2009. In addition in

order to support the existing underwriting capacity of the Group's subsidiaries,

a further GBP544,576 will be required to be deposited with Lloyd's by 30 June

2009.

10.Financial statements

The financial information set out in this announcement does not constitute

statutory accounts but has been extracted from the Group's Financial Statements

which have not yet been delivered to the Registrar. The Group's annual report

and Financial Statements will be posted to shareholders shortly. Further copies

will be available from the Company's registered office: Hampden House, Great

Hampden, Great Missenden, Buckinghamshire, HP16 9RD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFEFWISUSEFI

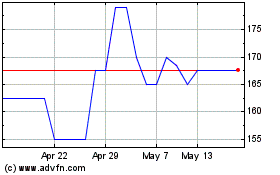

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024