TIDMHBR

RNS Number : 1461F

Harbour Energy PLC

03 November 2022

Harbour Energy plc

"Harbour" or the "Company" or the "Group"

Trading and Operations Update

3 November 2022

Harbour Energy plc provides the following unaudited Trading and

Operations Update for the nine months to 30 September 2022.

Operational highlights

-- Production of 207 kboepd, an increase of 27 per cent on the

corresponding prior period; full year production now expected to be

in the upper half of 200-210 kboepd guidance

-- Unit operating costs of $14/boe, a decrease of 18 per cent on

the corresponding prior period; forecast 2022 operating costs

reduced to c.$14/boe (versus previous guidance of the lower end of

$15-16/boe)

-- Improved safety record with total recordable injury rate of

0.78 per million hours worked

-- Successful drilling at J-Area and Catcher (UK) and Natuna Sea

Block A (Indonesia) supporting production; eight rigs currently

active including at J-Area and Beryl (UK) and Chim Sao

(Vietnam)

-- International projects progressed

- Mexico: Zama Unit development plan well-advanced

- Indonesia: Initial plan of development for the Tuna field

submitted; planning underway for further drilling across the

Andaman Sea acreage following the material Timpan gas discovery

-- Increased momentum on UK CCS projects including new Viking

CCS partnerships with West Burton Energy and Associated British

Ports

Financial highlights

-- Revenue of $4.1 billion with realised post-hedging oil and UK

gas prices of $80/bbl and 86 pence/therm versus the average Brent

price of $105/bbl and NBP gas price of 209 pence/therm

-- 2022 total capex guidance reduced to c.$1.0 billion from

c.$1.2 billion, primarily driven by the late arrival of drilling

rigs and the weaker pound sterling to US dollar exchange rate

-- 2022 total UK tax liability expected to be c.$900 million, of

which c.$400 million relates to the recently enacted UK Energy

Profits Levy

-- Forecast 2022 free cash flow increased to $2-2.2 billion(1)

(after c.$700 million of total cash tax payments)

-- Net debt of $1.1 billion as at period end; continue to expect

to be net debt free in 2023

-- Shareholder distributions of $500 million completed year to

date, including c.$100 million interim dividend paid on 19 October;

new $100 million buyback programme approved

Linda Z Cook, Chief Executive Officer, commented:

"Harbour is delivering operationally with higher production

volumes and lower costs, supported by improved efficiency and our

capital investment programme. We also remain focused on reducing

our own greenhouse gas emissions and advancing our two UK CCS

opportunities, Harbour-led Viking CCS in England and Acorn in

Scotland. Our company is proud to be the UK's largest oil and gas

producer and, through the combination of these activities,

contributing meaningfully to domestic energy security while at the

same time working to help realise a shared ambition of UK

leadership in CO(2) capture and storage.

However, the recently enacted UK Energy Profits Levy (EPL) and

speculation about further fiscal changes have created uncertainty

for independent oil and gas companies like Harbour. As a result,

evaluating expected returns from long term investments has become

more difficult and investors are advocating for geographic

diversification.

While we fully recognise the significant challenge in the UK to

put public finances on a sustainable footing, we urge the

government to carefully consider the consequences of any increase

in or extension of the EPL. At a time when oil and gas producers

are being asked to invest more to help ensure the UK's energy

security and are considering longer term, material investments in

CCS, additional taxes would run the risk of undermining our ability

to do either."

Enquiries

Harbour Energy plc Tel: +44 20 3833 2421

Elizabeth Brooks, Head of Investor Relations

Brunswick

Tel: +44 20 7404 5959

Patrick Handley, Will Medvei

(1) Assumes $90/bbl Brent, 220p/therm day ahead NBP and a pound

sterling to US dollar exchange rate of $1.1/GBP for the fourth

quarter; on a 2022 full year basis this equates to $102/bbl for

Brent, 212p/therm for NBP and a $1.2/GBP exchange rate.

This announcement contains inside information.

Operational review

Strong production performance

Production for the first nine months of the year averaged 207

kboepd (194 kboepd UK, 13 kboepd International), an increase of 27

per cent on the 2021 corresponding period. Production was split

approximately 51 per cent liquids and 49 per cent gas.

Production was underpinned by continued outperformance from the

Greater Britannia Area satellite fields, an active well

intervention programme and new wells, primarily gas, brought

on-line including at J-Area, Everest and Tolmount.

The Tolmount gas field reached plateau rates of 20 kboepd (net,

Harbour 50 per cent interest) in July and cash payback in

September, less than six months after first production in April.

While production remains above 20 kboepd today, pressure and other

performance data suggests the field will come off its production

plateau early next year. Tolmount activities in 2023 include

compression start-up, drilling of the Tolmount East well which is

expected online in 2024 and testing of the near field Earn prospect

which if successful would be tied into the existing Tolmount

infrastructure.

Production continues to be supported by high reliability across

our asset base with three of our hubs - Greater Britannia, J-Area

and Elgin Franklin - each achieving operating efficiency in excess

of 95 per cent for the period. The planned maintenance programmes,

including a ten-day shut down at the Tolmount field post period end

in October, have now been completed. No major campaigns are planned

for the remainder of the year.

2022 full year production is now expected to be in the upper

half of 200-210 kboepd guidance.

Targeted high return, short cycle investment

The bulk of Harbour's capex programme is targeted at high

return, short cycle, infrastructure-led investment opportunities to

help support near term production levels.

Activity increased in the third quarter with eight rigs

currently active across the portfolio. At J-Area, the Jade-JM well

was brought on-stream in October and the Judy-RD well was

successfully tested and is expected online before year end. The

Catcher Area drilling programme recently concluded with Catcher

North now tied into production and Burgman Far East due online in

early 2023. At Beryl, drilling is ongoing at Buckland South West

following the delayed arrival of the rig while platform drilling

from Beryl Bravo has been deferred to early next year. In

Indonesia, the rig programme at Natuna Sea Block A was successfully

completed and the two well programme at Chim Sao in Vietnam

commenced in October following late delivery of the rig.

Harbour is making good progress on its UK organic projects,

Talbot and Leverett. On Talbot, drilling of the three development

wells to be tied back to J-Area infrastructure is expected to

commence shortly while the Leverett appraisal well, close to

Harbour's Greater Britannia Area, is expected to spud in the first

half of 2023.

International growth opportunities

Harbour's international growth opportunities include the Zama

project in Mexico where Harbour and its partners are nearing

agreement on a unit development plan which will be submitted to the

Mexican National Hydrocarbon Commission for review. FEED is planned

for 2023, followed by a final investment decision possibly as early

as the end of next year. To the southwest of Zama at Block 30, a

two well, non-operated exploration campaign commenced in October,

later than anticipated due to a prolonged rig acceptance process.

The first well is currently drilling ahead and targeting the

amplitude-supported Kan prospect.

In Indonesia, Harbour submitted an initial plan of development

for the Tuna field in October for government review. Elsewhere in

Indonesia, following the Timpan discovery earlier this year,

Harbour is acquiring 3D seismic across the eastern part of its

Andaman II licence. Planning is also underway with partners for

further drilling activity across the Andaman Sea acreage which is

anticipated to commence in late 2023, targeting amplitude-supported

prospects which have been de-risked by the Timpan discovery.

Positioning for the Energy Transition

During the period we have made good progress on our Viking CCS

project in the UK Humber region where we can leverage our extensive

subsurface and offshore expertise and existing asset base. Through

Viking and our interest in Acorn in Scotland, our UK CCS projects

could capture and store multiple times Harbour's annual CO(2)

emissions and play a critical role in achieving the UK's net zero

emissions targets.

Over the past few months, the Harbour-led Viking CCS network has

grown significantly to include West Burton Energy's West Burton B

power station which expands Viking's geographic footprint beyond

the Humber region to inland emitters in Nottinghamshire. In

addition, Harbour has entered into an exclusive commercial

relationship with Associated British Ports who plan to develop a

CO(2) import terminal at Immingham enabling Viking CCS to offer a

solution for stranded CO(2) emissions across the UK. Separately,

statutory consultation for the Viking CCS onshore pipeline which

will connect the Humber region to Theddlethorpe on the Lincolnshire

coast is scheduled to commence later this year ahead of the

submission of a planning application in 2023.

Subject to government progress related to the regulatory

framework, Harbour is aiming to progress both Viking CCS and Acorn

to a final investment decision in 2024 with first CO(2) injection

as early as 2027.

Financial review

Estimated revenue for the first nine months of the year was $4.1

billion. Harbour realised oil prices pre- and post-hedging of

$103/bbl and $80/bbl respectively for the period versus the average

Brent market price of $105/bbl. Harbour realised UK gas price pre-

and post-hedging of 200p/therm and 86p/therm respectively versus

the average NBP market price of 209p/therm. We continue to secure

incremental hedges where future pricing is attractive, via swaps

for oil and through zero cost collars for gas. A full schedule of

the Group's hedging position is set out in the Appendix 2.

Operating costs for the first nine months were $800 million and

$14/boe on a unit of production basis, reflecting a weaker pound

sterling to US dollar exchange rate and robust production volumes

which together have more than offset inflationary pressures. We now

expect operating costs on a full year basis to be c.$14/boe,

compared to previous guidance of the lower end of $15-16/boe. This

assumes a $1.10/GBP exchange rate for the remainder of the

year.

Total capital expenditure to the end of September was $700

million, lower than anticipated due to the late arrival of drilling

rigs, including at Beryl (UK), Block 30 (Mexico), Chim Sao

(Vietnam) and for our UK Southern North Sea decommissioning

programme. Capital expenditure is also lower resulting from the

decision not to proceed with several North Sea exploration and

appraisal wells following further technical analysis and risk

assessment. In addition, with a significant portion of our total

capex being sterling denominated, the weaker pound sterling to US

dollar exchange rate has also impacted capex levels. As a result,

full year 2022 total capex is now expected to be c. $1.0 billion,

reduced from prior guidance of $1.2 billion.

Assuming Brent oil and UK gas market prices average $90/bbl and

220p/therm for the fourth quarter, resulting in $102/bbl and

212p/therm for the full year, and assuming no further changes to

the UK fiscal regime, we forecast 2022 free cash flow (after tax

and before shareholder distributions) of $2-2.2 billion, compared

to previous guidance of $1.8-2.0 billion. The c.$200 million

increase is driven by improved production levels, lower capital

expenditure and higher commodity prices partially offset by the

resulting higher UK cash tax payments, now forecast at c.$650

million. This includes c.$240 million relating to the December

payment of Harbour's 2022 UK EPL liability now forecast to be

c.$400 million with the c.$160 million balance to be paid in

January 2023.

Harbour continues to forecast to be net debt free in 2023. This

financial position together with our strong cash flow continues to

allow us significant optionality over future capital allocation,

including for value accretive M&A and additional shareholder

returns. As a result, we have approved a new buyback programme for

a maximum aggregate consideration of $100 million to be completed

by no later than 28 February 2023.

Year-to-date we have returned c.$500 million to shareholders.

This comprises our c.$200 million annual dividend, including a

c.$100 million interim dividend which was paid on 19 October, and

the previously announced c.$300 million share buyback programme.

This programme, which completed in September, resulted in the

purchase and cancellation of c.63 million shares, representing c. 7

per cent of our issued share capital.

Appendix 1: Group production(1)

1 Jan - 30 Sept 2022 1 Jan - 30 Sept 2021

(net, kboepd) (net, kboepd)

Greater Britannia

Area 37 31

--------------------- ---------------------

J-Area 29 26

--------------------- ---------------------

AELE hub 27 22

--------------------- ---------------------

Catcher 19 16

--------------------- ---------------------

Tolmount 12 -

--------------------- ---------------------

East Irish Sea 8 4

--------------------- ---------------------

Elgin Franklin(1) 24 15

--------------------- ---------------------

Buzzard 15 13

--------------------- ---------------------

Beryl 11 12

--------------------- ---------------------

West of Shetlands(1) 10 12

--------------------- ---------------------

Other North Sea(2) 2 2

--------------------- ---------------------

North Sea 194 153

--------------------- ---------------------

International 13 10

--------------------- ---------------------

Total Group 207 163

--------------------- ---------------------

(1) West of Shetlands comprises Clair, Schiehallion and Solan.

Other Europe includes Galleon and Ravenspurn North. 2021 production

provided on a reported basis and includes the contribution from

Premier's portfolio from 31 March 2021.

Appendix 2: Hedging schedule(1)

FY 2022 FY 2023 FY 2024 FY 2025

Volume Av.

Av. price Av. price (mmboe price Av. price

Volume (p/th, Volume (p/th, p/th, Volume p/th,

(mmboe) $/bbl) (mmboe) $/bbl) $/bbl mmboe $/bbl

UK

gas

Swaps 19.3 42 21.5 40 9.9 52 1.6 45

Collars 5.0 50-62 1.6 55-69 1.3 135-292 0.4 140-325

Options 1.1 34 - - - - - -

Oil

Swaps 18.8 61 11.0 74 7.3 84 2.4 81

--------- ---------- --------- ---------- -------- -------- ------- ----------

(1) As at 30 September 2022

Appendix 3: 2022 guidance

2022 Guidance Actual 2022 Guidance

(as at Aug (1 Jan to 30 (as at Nov 22)

22) Sept 2022)

Upper half of

Production (kboepd) 200-210 207 200-210

--------------- ------------- ----------------

Operating costs ($/boe) Lower end of

15-16 c.14 c.14

--------------- ------------- ----------------

Total capex ($ billion) c.1.2 c.0.7 c.1.0

--------------- ------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGZMGMFZNGZZZ

(END) Dow Jones Newswires

November 03, 2022 03:00 ET (07:00 GMT)

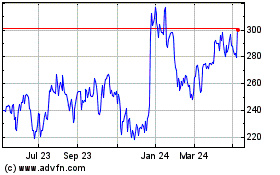

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

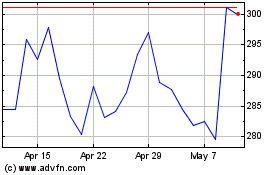

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Nov 2023 to Nov 2024