Admission to AIM

May 08 2006 - 3:03AM

UK Regulatory

RNS Number:5744C

H&T Group PLC

08 May 2006

8 May 2006

H&T Group plc

("H&T" or the "Company")

Admission to AIM - First Day of Dealings

The Placing:

* H&T, the UK's leading pawnbroking business by size of pledge book,

announces completion of its admission to AIM and that trading in its ordinary

shares commenced at 8.00am today.

* Numis Securities, the Company's broker, has placed 10,573,469 new

ordinary shares on behalf of the Company raising approximately #18.2 million

before expenses, and also placed 17,836,980 existing ordinary shares for

approximately #30.7 million on behalf of selling shareholders.

* The proceeds of the issue of new ordinary shares will be used in the

refinancing of H&T and the repayment of certain loan notes. H&T will have an

EPIC code of HAT.L.

* Hawkpoint is the nominated adviser and financial adviser to H&T and

Numis Securities is broker.

* Rutland backed the buyout of H&T in September 2004 and has supported

the Company through to a successful flotation.

Placing statistics:

Placing Price 172p

Number of New Shares 10,573,469

Number of Placing Shares 28,410,449

Number of Ordinary Shares in issue immediately following Admission 31,485,706

Market capitalisation at the Placing Price (approximate) #54 million

Percentage of issued share capital immediately following Admission subject to the 90%

Placing

Estimated net proceeds of the Placing receivable by the Selling Shareholders #28.6 million

Estimated net proceeds of the Placing receivable by the Company #14.8 million

Peter Middleton, Chairman, said:

"Under the stewardship of John and his team, H&T has performed strongly, growing

the number of shops and introducing new products. The success of the business

is testimony to the hard work of all of the staff in the company."

John Nichols, Chief Executive, said:

"H&T is the leading business in the fragmented UK pawnbroking market with a

pledge book of almost #25 million at the end of 2005. We feel we can take the

business much further in adding to our network in under-served regions and

capitalising on the start made in launching new products, such as loans and

pre-paid debit cards, which are ancillary to pawnbroking. Flotation is an

important milestone in the evolution of our group."

For further information please contact:

H&T Group plc 0870 9022 600

John Nichols, Chief Executive

Hawkpoint Partners Limited 020 7665 4500

Lawrence Guthrie / Sunil Duggal

Numis Securities Limited 020 7776 1500

Oliver Hemsley / Charles Farquhar

College Hill Associates 020 7457 2020

Gareth David / Paddy Blewer

Information on H&T

H&T is the UK's leading pawnbroking business by size of Pledge Book. The

business was founded in 1897 and now has 69 outlets across the UK and

approximately 300 employees.

The Company's core business remains pawnbroking although as the business has

grown, it has increased the revenue derived from other financial services

including cheque cashing and unsecured loans. The Company is also a retailer of

jewellery, second-hand items sourced from its pawnbroking operations and a

relatively small number of new products bought in for re-sale.

The Company provides lending solutions designed to meet the financing needs of

private individuals who may not satisfy the lending criteria of high street

banks. The Company targets a customer base of borrowers who are precluded from

accessing more traditional forms of finance, offering such customers a facility

to borrow money in a way which is quick and convenient and which demands neither

a bank account nor arrangement fees.

The Directors believe that the Company has developed strong client relationships

founded on its ability to reach lending decisions quickly and the emphasis on

customer service, evidenced by repeat business where a single item may be pawned

more than once. New customers are typically sourced through passing trade at the

Company's high street and shopping mall locations, introductions from existing

clients and advertising.

The Company deals principally with gold and, occasionally, diamond jewellery.

The Directors believe that these commodities do not suffer significantly from

obsolescence or degradation. While the vast majority of customers do redeem or

renew their pledge, these items are readily marketable, straightforward to value

and realisable in the second hand and scrap markets.

H&T has a strong financial record both in terms of revenue growth and

profitability. Based on audited financial statements, between 2001 and 2005, H&T

achieved successive year-on-year growth in both Net Revenues and operating

profits. During the same period, Net Revenues grew by 14.1 per cent. on a

compound annual basis and EBITDA by 14.9 per cent. on a compound annual basis.

H&T's objective is to capitalise on its position as one of the UK's largest

pawnbrokers. It intends to continue growing the business through expanding its

geographical footprint, establishing recently introduced products, developing

new products and services and rolling-out a new store format.

- ends -

Hawkpoint Partners Limited ("Hawkpoint") and Numis Securities Limited ("Numis"),

which are authorised and regulated in the United Kingdom by the Financial

Services Authority, are acting exclusively for H&T as its nominated adviser and

broker respectively, and for no one else in relation to the placing. Hawkpoint

and Numis will not regard any other person (whether or not a recipient of this

announcement) as their client in relation to the placing and will not be

responsible to anyone other than H&T for providing the protections afforded to

clients of Hawkpoint and Numis or for providing any advice in relation to the

placing, the contents of this announcement or any transaction or arrangement

referred to herein. The responsibility of Hawkpoint as nominated adviser is

owed solely to the London Stock Exchange and not to Numis or its directors or

any other person in respect of his decision to acquire shares in H&T in reliance

on any part of this announcement. Neither Hawkpoint nor Numis have authorised

the contents of this announcement or accepts liability for the accuracy of any

information or opinions contained therein, or for the omission of any

information from this announcement, for which H&T and its directors are solely

responsible.

No representation or warranty, express or implied, is made or given by or on

behalf of H&T, Hawkpoint or Numis or any of their respective directors,

partners, officers, employees, agents or advisers or any other person (whether

or not referred to in this announcement) as to the accuracy, completeness or

fairness of the information or opinions contained herein and no responsibility

or liability is accepted by any of them for any such information or opinions.

The Company has issued an Admission Document in connection with the admission of

its ordinary shares to trading on AIM. Copies of the Admission Document are

available free of charge from the offices of Eversheds LLP, 85 Queen Victoria

Street, London EC4V 4JL for a period of at least one month from the date of this

announcement.

This announcement does not constitute, or form part of, the placing or any offer

or invitation to sell or issue, or any solicitation of any offer to subscribe

for any ordinary shares in any jurisdiction, nor shall this announcement or any

part of it, or the fact of its distribution, form the basis of, or be relied

upon in connection with, or act as an inducement to enter into, any contract or

commitment whatsoever with respect to the placing or otherwise. No reliance may

be placed for any purpose whatsoever on the information contained in this

announcement or on its completeness.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAKSPESEKEEE

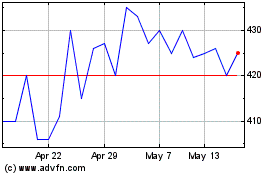

H&t (LSE:HAT)

Historical Stock Chart

From Dec 2024 to Jan 2025

H&t (LSE:HAT)

Historical Stock Chart

From Jan 2024 to Jan 2025