TIDMGILD

RNS Number : 8597Y

Guild Esports PLC

10 May 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014, as retained as part of

the law of England and Wales. Upon the publication of this

announcement via the Regulatory Information Service, this inside

information is now considered to be in the public domain.

Press release

10 May 2023

Guild Esports PLC

("Guild Esports", "Guild" or "the Company")

Interim results

Guild Esports, (LSE: GILD; OTCQB: GULDF), a global teams

organisation and lifestyle brand, is pleased to announce its

unaudited financial results for the six months ended 31 March

2023.

Financial highlights

-- Revenues increased by 241% to GBP3.7m (H1 2022: GBP1.1m), driven by strong growth in sponsorship

income;

-- Gross profit rose by 256% to GBP2.5m (H1 2022: GBP0.7m);

-- Loss before tax declined to GBP2.3m (H1 2022: GBP4.96m) reflecting increased sponsorship revenue

and a significant reduction in operating expenses;

-- Net cash of GBP1.1m as at 31 March 2023.

Operating highlights

-- Entered a four-year partnership with SCL Education to launch Guild College, providing a career

pathway for young people in the esports industry and a new revenue opportunity for Guild globally;

-- Launched in-house production and creative division, Guild Studios, to provide bespoke, campaign-led

solutions for brands. Since launching in February, Guild Studios has already signed contracts

with Samsung Mobile and blood cancer charity Anthony Nolan;

-- Strengthened the Board of Directors with appointments of Jasmine Skee as Chief Executive Officer

and Jocelin Caldwell as a Non-Executive Director ("NED"), to lead the next phase of the Company's

development;

-- Reinforced senior leadership team with appointments of Clare Jarvis as Chief Financial Officer

and Company Secretary, Luke Jones as Director of Esports and Gaming, Nick Westwood as Senior

Vice President of Creative and Strategy, and Matthew Charles as Director of Operations;

-- Entered Counter-Strike: Global Offensive ("CS:GO"), the world's second most popular esport

(source: Esports Charts, 2023), signing an all-female roster to represent Guild in international

tournaments. The new team is intended to grow Guild's owned audience and create further revenue-generating

opportunities;

-- Signed R&D partnership with artificial intelligence and data analytics company Gerford AI,

to utilise AI technologies to improve the discovery and development of professional esports

players;

-- Guild professional player Anas "Anas" El-Abd won global Fortnite competition MrBeast's Extreme

Survival Challenge, with a top prize of US$1m. Anas and Guild teammate Henrik "Hen" McLean

extended their contracts in February 2023 to remain with Guild until at least 2024.

Post-period highlights

-- Appointed hummel as Guild's Official Technical Kit Partner in a three-year deal valued at

up to GBP0.7m in sponsorship revenues in addition to a double-digit share of merchandising

sales;

-- Developed UK-focused esports competitions using established game IP, including world's first

mixed-gender VALORANT tournament in partnership with Coca-Cola, a women's European league

in Rocket League launched by Guild with Sky Broadband, and a new influencer-led esports competition

with Samsung;

-- Further development and enhancement of the Sky Guild Gaming Centre that will provide further

opportunities for public attendance, events and live broadcasting.

Outlook

-- Company continues to trade in line with expectations underpinned by a strong order book and

pipeline of potential new business;

-- Following a 23% reduction in administrative costs including staffing expenses, the net cash

used in operating activities declined by 58% in the first half, putting the Company on track

for a substantially lower cash burn for the full year;

-- Second half revenues are expected to show further growth compared with the corresponding period

in the previous year;

-- In January, Guild Esports committed to adding 2 million new followers to its owned audience.

After seeing success across the first three months of 2023, Guild has upgraded this audience

growth estimate to 5 million.

Commenting on the results, Jasmine Skee, Chief Executive

Officer, said: "Guild has navigated a challenging macroeconomic

environment to deliver triple-digit revenue growth, driven by

strong sponsorship income and relationships with our partners.

Combined with a significant reduction in operational expenses,

we've seen our gross profits rise and our loss cut in half. We're

keen to carry this positive momentum into the second half of 2023,

with ambitious revenue and audience-growth targets for the full

year.

"Guild Studios and Guild College present an opportunity to both

complement our sponsorship income, and appeal to new brands looking

to enter the esports space for the first time. With a strong

leadership team, high-level performances from our esports teams and

a growing audience, we are making excellent operational progress,

positioning the Company for another year of solid growth. As a

result, the Board looks to the future with confidence."

For further information, please contact:

Guild Esports

Jasmine Skee via Tancredi +44 207 887

Chief Executive 7633

Neil Thapar

Investor Relations

+44 7876 455 323

-------------------------

Tennyson Securities

-------------------------

Corporate Broker

Peter Krens +44 207 186 9030

-------------------------

Tancredi Intelligent Communication

Media Relations

-------------------------

Helen Humphrey

Charlie Hobbs +44 7449 226 720

Maddy Newman +44 7897 557 112

guild@tancredigroup.com +44 7380 127 135

-------------------------

About Guild Esports:

Guild Esports PLC is a global fan-focused team organisation and

lifestyle brand that fields professional players in gaming

competitions under the Guild banner. Our in-house training academy

aims to attract and nurture the best esports talent, and our goal

is to provide the ultimate entertainment experience alongside a

distinctive lifestyle brand authentic to the esports community

worldwide. Guild is led by an experienced management team of

entertainment sector and esports veterans and co-owned by David

Beckham. The Company is headquartered in the UK and its shares are

listed on the Main Market of the London Stock Exchange (ticker:

GILD) and on the OTCQB Venture Market in the United States (ticker:

GULDF). Please visit www.guildesports.com for more information.

Interim Management Report

Overview

Guild has continued to gain momentum into 2023 driven by a

strong contracted order book and a diversification of its revenue

streams, despite a challenging and uncertain macroeconomic

environment.

First half revenues more than tripled to GBP3.7m (H1 2022:

GBP1.1m), including GBP1.1m in prize money won by Guild's

professional players. Gross profit increased to GBP2.5m (H1 2022:

GBP0.7m).

In combination with these increasing revenues, Guild executed a

significant rationalisation of administrative costs which declined

from GBP5.6m to GBP4.3m, including an approximately 29% reduction

in staffing expenses compared with the corresponding period last

year.

As a result, the Company saw its loss before tax for the half

year decrease substantially to GBP2.28m from GBP4.96m.

The Company continues to review its contracted revenue,

pipeline, cash balances and committed expenditure. Based on the

directors' assessment of the Company's cash needs and the

availability of financing, the directors consider the Company to be

a going concern, though anticipate a fundraising may be required

during the year ahead. A further update will be provided in due

course.

Operating review

The Company delivered strong growth in sponsorship revenue,

reflecting continued progress with the fulfilment of existing

contracts as well as generation of revenue from new projects which

commenced in the period under review.

Guild has a strong contracted order book, which currently stands

at GBP5.8m, representing the total amounts remaining to be

recognised as revenues over the lifetime of contracts signed to

date.

Subsequent to the end of the first half, the Company won a new

three-year sponsorship and merchandising contract with hummel, a

well-known sports and lifestyle brand. hummel has been appointed as

Guild's first ever Technical Kit Partner, generating sponsorship

revenues of up to GBP0.7m over the three-year term for Guild, in

addition to a double-digit percentage of merchandising sales. The

Company expects to generate approximately GBP1m in revenue over the

course of the contract including certain performance targets being

achieved. The partnership will develop a new esports professional

performance line, as well as consumer-focused lifestyle ranges and

a dedicated kidswear line, with products potentially to be made

available in online stores globally and physical stores in the UK.

Similarly, Guild is in positive conversations with its existing

client base for further work and renewals.

New revenues in H2 through sponsorship will be targeted around

filling the remaining spots available to partners on the

professional jersey and in activation spaces across the Sky Guild

Gaming Centre. This includes naming rights to the newly formed

Guild College and targeted expansion of our esports division into

new gaming titles and virtual sport categories.

As well as generating significant sponsorship revenue, in the

first half Guild has taken steps to diversify revenue generation

through the launch of new partnerships and expansion of new

initiatives, notably in education, creative and production, and

AI.

In November 2022, Guild launched Guild College in a four-year

partnership with post-16 education provider SCL Education, to

provide BTEC Level 2 and Level 3 qualifications in esports. The

partnership generates four-figure revenues for each student

enrolled in the course, with an initial projection of 125 students

to enrol in the programme. The first course will begin in September

2023, and enrolments are progressing in-line with expectations.

This was followed by the launch of Guild Studios, the Company's

in-house creative and production division, providing bespoke

campaign-led solutions for brands looking to connect with Guild's

audience. Guild Studios not only widens the Company's offering to

brands, but provides a lower barrier to entry, encouraging brands

not typically associated with esports to collaborate with Guild to

reach new audiences. Since Guild Studios' soft launch in January

2023, Guild has signed and delivered contracts for Samsung Mobile

and blood cancer charity Anthony Nolan. Guild Studios has already

generated six-figure revenues for the Company.

The Guild Studios team will be delivering campaigns and large

events for Coca-Cola, Samsung TV, Sky Broadband and Subway across

the summer as part of their existing sponsorship commitments. These

innovative campaigns will include the launch of the world's first

mixed-gender VALORANT tournament in partnership with Coca-Cola, the

launch of a women's European league in Rocket League, and the

launch of a new influencer-led competition with Samsung.

In March 2023, the Company signed an agreement with Gerford AI,

a leading developer of artificial intelligence and machine learning

technologies, to develop and utilise AI technologies for the

scouting and development of esports professional players. Guild

sees long-term potential in the licensing and sale of the

technologies developed by the partnership, intending to benefit

from a first-mover advantage in esports.

The Company continues to attract the interest of global brands

and has focused on developing a number of new partnership

opportunities across a variety of sectors, including automotive,

aviation, travel and finance. Guild's healthy pipeline consists of

discussions at a range of levels of investment, many of which are

at an advanced stage of progression.

On 25 April 2023, it was announced that Guild and Bitstamp had

mutually decided to end their sponsorship one year early. The

termination is not expected to impact Guild's revenues in the

current financial year. The release of inventory and other rights

from the Bitstamp deal will enable the Company to pursue similar

contracts with other sponsors. The Company has adapted its

contracting process to have more innovative and collaborative

relationships with its sponsors moving forward, which will allow

the Company to reduce the costs of servicing contracts in addition

to leveraging its inventory and sponsorship rights more effectively

with future sponsors.

Leadership team strengthened

Guild fortified both its Board-level and senior management

teams, appointing Jasmine Skee as Chief Executive Officer and

Jocelin Caldwell as Non-Executive Director in November 2022.

Ms Skee has taken steps to strengthen Guild's executive team

since her arrival, recruiting Clare Jarvis as Chief Financial

Officer and Company Secretary, Luke Jones as Director of Esports,

Nick Westwood as Senior Vice President of Creative and Strategy,

Georgia Morison as Head of Events and HQ, and Matthew "Charlie"

Charles as Director of Operations. Post period, Luke Jones has been

promoted to Vice President of Commercial, Esports and Gaming, owing

in part to his excellent performance in securing hummel as

Technical Kit Partner. Mr Jones (formerly Senior Gaming and Esports

Manager at Formula One team Red Bull Racing and Digital

Partnerships Director at live event company Live Nation

Entertainment) will help strengthen Guild's sponsorship team

leveraging his significant experience leading strategic planning,

new business development and high-level digital partnership

experience.

Audience

Guild refocused its audience-targeting strategies in January for

aggressive growth. In January, Guild committed to adding 2 million

new followers in 2023. This has been revised, following good growth

in the three months to March 2023, to adding five million new

followers.

Guild's channel growth will be driven by an always-on content

strategy that will utilise a variety of digital platforms. The

company is also developing its owned-and-operated site and

exploring more ways to deliver live esports and gaming

entertainment to UK fans.

Esports

The Company's athletes continue to compete at the highest levels

of esports, and Guild has been delighted with their success over

the half-year period. Guild Fortnite professional player Anas won

the MrBeast's Extreme Survival Challenge tournament in December

2022 (with official confirmation received in January 2023),

securing the entire prize pool of US$1m. Guild received a

percentage of these winnings in line with contractual agreements

with its pro-players.

Guild has looked to sign high-level players to secure the

Company's long-term future as a top-level esports brand. Anas and

Guild teammate Hen, who have won five tournaments between them for

Guild so far and have a combined social media reach of more than 1m

followers, extended their contracts until at least 2024. The

Company additionally signed an all-female CS:GO team, representing

its first entry into the esport. CS:GO is expected to create new

audience-growth and revenue-generation opportunities for the

Company.

As at 31 March 2023, the Company has a roster comprising 17

pro-players.

Academy

Guild Academy's transition to a predominantly in-person

experience has served to provide a stream of owned talent for

Guild's professional teams and build a source of future revenue for

Guild through the scouting, development and subsequent sale and

transfer of professional players to other teams for profit.

Guild has taken great steps towards achieving both goals. The

Company has signed nine players to its Elite development Academy

squad.

Guild now fields Academy graduates "VoltiaX" and Max "Mayza" May

in its professional Fortnite teams, with both competing in this

year's Fortnite Champion Series (FNCS). These two were joined in

April 2023 by content creator Ruby "RubyPlays" Allenby, another

Academy graduate, who produces online content for her more than

50,000 followers as well as competing for Guild.

Outside of Fortnite, Guild Academy's young Rocket League team

continues to flourish. Two Academy players have been signed to

compete professionally for Guild and are competing at a high level

despite their young age. Furthermore, there was the recent success

of signing "BrigArmy17", a top 100 player in Europe, to head up the

Company's FIFA roster.

Guild has run community days to showcase its Academy to young

people, as well as generate interest in Guild College. More than

200 students have visited the Sky Guild Gaming Centre since

January, with Guild committed to giving Academy access to 1000

under 16s by the end of 2023, as well as developing and delivering

a programme of Academy events around the country.

Revenue generation via player sale and transfer has the ability

to create value from the 'path to pro' academy system by developing

select players from the esports talent pyramid that are currently

below the elite level. Guild Academy is helping to feed this

pipeline and increase the value of players. Guild has already sold

players for profit previously, selling Tai "TaySon" Starčič for

US$115,000 in 2021. More recently, former Guild professional player

Vivian "Roxi" Schilling was sold to G2 in March 2023, generating

one of the highest ever transfer fees for a female VALORANT

player.

Outlook

The Company has continued to benefit from positive trading

momentum in the first half of 2023, with strong revenue growth from

sponsorship deals and new initiatives, as well as a sharp reduction

in its cost base implemented under the new leadership team.

The Company continues to trade in line with expectations

underpinned by a strong order book and pipeline of potential new

business. The significant decline in administrative costs including

staffing expenses have helped to right size the business and

reduced cash used in operating activities by 58% in the first half,

putting the Company on track to achieve a substantial reduction in

cash burn for the full year. This cost cutting includes a

continuation of the strategic focus to shift away from employing

influencers on a full-time basis, and instead deploying content

creators and influencers selectively to boost specific campaigns

run with Guild's sponsorship partners.

Second half revenues are expected to show further growth

compared with the corresponding period in the previous year. With a

strong leadership team, high-level performances from our esports

teams and a growing audience, we are making excellent operational

progress, positioning the Company for another year of solid growth.

As a result, the Board looks to the future with confidence.

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with International Accounting Standards

34, Interim Financial Reporting, as adopted by the EU; and

-- gives a true and fair view of the assets, liabilities, financial position and profit/loss

of the Company; and

-- the Interim Report includes a fair review of the information required by DTR 4.2.7R of the

Disclosure and Transparency Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact on the set of interim financial

statements; and a description of the principal risks and uncertainties for the remaining six

months of the year.

-- the Interim Report includes a fair review of the information required by DTR 4.2.8R of the

Disclosure and Transparency Rules, being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by

Jasmine Skee (CEO), on 9 May 2023.

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

The unaudited condensed statement of comprehensive income of the

Company for the six months ended 31 March 2023 is set out

below.

Unaudited Unaudited Audited

Period ended Period ended 12 months to

31-Mar 2023 31-Mar 2022 30-Sep 2022

Note GBP'000 GBP'000 GBP'000

Revenue 3 3,702 1,086 4,453

Cost of sales 4 (1,165) (372) (1,686)

Gross profit 2,537 714 2,767

--------------------------------------------------------------- ----- -------------- -------------- --------------

Administrative expenses (4,281) (5,630) (10,913)

Depreciation & amortisation (417) (22) (430)

Operating loss (2,161) (4,938) (8,576)

--------------------------------------------------------------- ----- -------------- -------------- --------------

Finance costs (123) (17) (172)

Loss before taxation (2,284) (4,955) (8,748)

--------------------------------------------------------------- ----- -------------- -------------- --------------

Taxation - - -

Loss after taxation (2,284) (4,955) (8,748)

--------------------------------------------------------------- ----- -------------- -------------- --------------

Other comprehensive income - - -

Total comprehensive loss attributable to shareholders from

continuing operations (2,284) (4,955) (8,748)

--------------------------------------------------------------- ----- -------------- -------------- --------------

Basic and diluted earnings per share (pence) 6 (0.44) (0.96) (1.69)

--------------------------------------------------------------- ----- -------------- -------------- --------------

CONDENSED STATEMENT OF FINANCIAL POSITION

The unaudited condensed statement of financial position of the

Company as at 31 March 2023 is set out below.

Unaudited Unaudited Audited

As at As at As at

31-Mar 2023 31-Mar 2022 30-Sep 2022

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ------------- ------------- -------------

ASSETS

Non-current assets

Property, plant and equipment 1,408 478 1,552

Intangible assets 174 151 220

Right-of-use asset 9 3,241 498 3,457

Other receivables 143 - 143

------------------------------- ----- ------------- ------------- -------------

Total non-current assets 4,965 1,127 5,372

------------------------------- ----- ------------- ------------- -------------

Current assets

Cash and cash equivalents 1,050 6,110 2,730

Trade and other receivables 7 942 2,871 3,961

------------------------------- ----- ------------- ------------- -------------

Total current assets 1,992 8,981 6,691

------------------------------- ----- ------------- ------------- -------------

Total assets 6,957 10,108 12,063

------------------------------- ----- ------------- ------------- -------------

EQUITY AND LIABILITIES

Equity

Share capital 10 519 519 519

Share premium 10 22,644 22,643 22,644

Share-based payment reserve 731 419 650

Retained earnings (22,539) (16,462) (20,255)

------------------------------- ----- ------------- ------------- -------------

Total equity 1,355 7,119 3,558

------------------------------- ----- ------------- ------------- -------------

Non-current liabilities

Provisions 334 - 323

Lease liability 9 2,967 532 3,204

------------------------------- ----- ------------- ------------- -------------

Total non-current liabilities 3,301 532 3,527

------------------------------- ----- ------------- ------------- -------------

Current liabilities

Trade and other payables 8 1,117 1,148 3,401

Deferred revenue 787 1,309 1,318

Lease liability 397 - 259

------------------------------- ----- ------------- ------------- -------------

Total current liabilities 2,301 2,457 4,978

------------------------------- ----- ------------- ------------- -------------

Total liabilities 5,602 2,989 8,505

------------------------------- ----- ------------- ------------- -------------

Total equity and liabilities 6,957 10,108 12,063

------------------------------- ----- ------------- ------------- -------------

CONDENSED STATEMENT OF CHANGES IN EQUITY

The unaudited condensed statement of changes in equity of the

Company for the six months ended 31 March 2023 is set out

below.

Share Share premium Share-based Retained Total

capital account payment reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 1

October 2021 519 22,643 419 (11,507) 12,074

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

period - - - (4,955) (4,955)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (4,955) (4,955)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total - - - - -

transactions

with equity

owners

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 31

March 2022 519 22,643 419 (16,462) 7,119

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

period - - - (3,793) (3,793)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (3,793) (3,793)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Share-based

payments - - 232 - 232

Warrants

cancelled

during the

period - 1 (1) - -

Total

transactions

with equity

owners - 1 231 - 232

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 30

September

2022 519 22,644 650 (20,255) 3,558

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

period - - - (2,284) (2,284)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (2,284) (2,284)

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Share-based

payments - - 81 - 81

Transactions

with equity

owners - - 81 - 81

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 31

March 2023 519 22,644 731 (22,539) 1,355

--------------- ------------------- ------------------- ------------------- ------------------- -------------------

CONDENSED STATEMENT OF CASH FLOWS

The unaudited condensed statement of cash flows of the Company

for the six months ended 31 March 2023 is set out below.

Unaudited Unaudited Audited

Period ended Period ended 12 months to

31-Mar 2023 31-Mar 2022 30-Sep 2022

GBP'000 GBP'000 GBP'000

-------------------------------------------------- -------------- -------------- --------------

Cash flows from operating activities

Cash used by operations (1,456) (3,429) (5,370)

--------------------------------------------------- -------------- -------------- --------------

Net cash flow used in operating activities (1,456) (3,429) (5,370)

--------------------------------------------------- -------------- -------------- --------------

Cash flows from investing activities

-------------------------------------------------- -------------- -------------- --------------

Purchase of intangible assets - (101) (206)

Purchase of property, plant and equipment (4) (448) (1,620)

Interest accrued - 16 -

-------------------------------------------------- -------------- -------------- --------------

Net cash used in investing activities (4) (533) (1,826)

--------------------------------------------------- -------------- -------------- --------------

Cash flows from financing activities

-------------------------------------------------- -------------- -------------- --------------

Payment of lease liabilities (220) - (146)

--------------------------------------------------- -------------- -------------- --------------

Net cash generated from financing activities (220) - (146)

--------------------------------------------------- -------------- -------------- --------------

Net (decrease) in cash and cash equivalents (1,681) (3,962) (7,342)

Cash and cash equivalents at beginning of period 2,730 10,072 10,072

Cash and cash equivalents at end of period 1,050 6,110 2,730

--------------------------------------------------- -------------- -------------- --------------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 31 MARCH 2023

1 Accounting policies

IAS 8 requires that management shall use its judgement in

developing and applying accounting policies that result in

information which is relevant to the economic decision-making needs

of users, that are reliable, free from bias, prudent, complete and

represent faithfully the financial position, financial performance

and cash flows of the entity.

1.1 Basis of preparation

The condensed interim financial statements ("interim financial

statements") have been prepared in accordance with International

Accounting Standard 34 "Interim Financial Reporting" (IAS 34) as

adopted by the European Union (EU). The interim financial

statements have been prepared on the historical cost basis, except

for assets and liabilities measured at fair value through profit

and loss, and are presented in pounds sterling, which is the

currency of the primary economic environment in which the Company

operates. All amounts have been rounded to the nearest GBP'000,

unless otherwise stated. The financial information contained in the

interim financial statements is unaudited and does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The accounting policies are unchanged from

those disclosed in the previously filed audited financial

statements for the period ended 30 September 2022.

The interim financial statements are for the six months to 31

March 2023, being six months from the financial year end for Guild

Esports Plc ("Guild" or "the Company"), 30 September 2022. The

interim financial information does not include all the information

and disclosures required in the annual financial statements and

should be read in conjunction with the Company's annual audited

financial statements for the period ended 30 September 2022. The

Company has disclosed comparative data for the statement of

comprehensive income for the Company for the period from 1 October

2021 to 31 March 2022, being not materially different from

comparative data for the six months ended 31 March 2022.

The Company has adopted the applicable amendments to standards

effective for accounting periods commencing on 1 October 2021. The

nature and effect of these changes as a result of the adoption of

these amended standards did not have an impact on the financial

statements of the Company and hence have not been disclosed. The

Company has not early adopted any standards, interpretations or

amendments that have been issued but are not yet effective.

The condensed interim financial statements have not been

audited, nor have they been reviewed by the Company's auditors in

accordance with the International Standard on Review Engagements

2410 issued by the Auditing Practices Board. The figures have been

prepared using applicable accounting policies and practices

consistent with those adopted in the audited annual financial

statements for the year ended 30 September 2022.

1.2 Going concern

The preparation of financial statements requires an assessment

on the validity of the going concern assumption. The interim

financial statements have been prepared on a going concern basis,

which assumes that the Company will continue to meet its

liabilities as they fall due. In assessing whether the going

concern assumption is appropriate, the directors have taken into

account all relevant available information about the current and

future position of the Company. The directors have concluded that

the adoption of the going concern assumption is appropriate based

on the Company's contracted revenues, current cash balance and

committed expenditure, together with the directors' assessment of

the Company's ability to secure additional fundraising. However,

this does constitute a material uncertainty that may cast

significant doubt on the company's ability to continue as a going

concern.

2 Critical accounting judgements and key sources of estimation uncertainty

The preparation of the financial statements requires management

to make estimates and judgements and form assumptions that affects

the reported amounts of the assets, liabilities, revenue and costs

during the periods presented therein, and the disclosure of

contingent liabilities at the date of the financial information.

Estimates and judgements are continually evaluated and based on

management's historical experience and other factors, including

future expectations and events that are believed to be

reasonable.

During the period, the Company issued warrants. The directors

have applied the Black--Scholes pricing model to assess the costs

associated with the share--based payments. The Black--Scholes model

is dependent upon several inputs where the directors must exercise

their judgement, specifically: risk--free investment rate; expected

share price volatility at the time of the grant; and expected level

of redemption. The assumptions applied by the directors, and the

associated costs recognised in the financial statements are

outlined in these financial statements.

3 Revenue

The Company derives revenue from various sources, including

revenue from contracts with customers. These revenue sources

involve the transfer of goods and/or services over time and at a

point in time in the following major product lines.

Unaudited period Unaudited period Audited

ended 31 Mar 2023 ended 31 Mar 2022 period

ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

--------------------- ------------------- ------------------- -------------------

Sponsorship revenue 2,490 1,077 3,148

Prize money 1,055 9 1,275

Other revenue 157 - 30

--------------------- ------------------- ------------------- -------------------

Total revenue 3,702 1,086 4,453

--------------------- ------------------- ------------------- -------------------

4 Cost of sales

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP GBP GBP

--------------------------------- ------------------- ------------------- -------------------

Prize money payments to players 899 351 1,190

Sponsorship direct costs 227 - 477

Other direct costs 39 13 19

Opening inventory - - -

Inventory purchases - 8 -

Closing inventory - - -

---------------------------------

Total cost of sales 1,165 372 1,686

--------------------------------- ------------------- ------------------- -------------------

5 Employees

The average monthly number of persons (excluding directors)

employed by the Company during the period was 32 (2022: 45).

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

Senior management 6 11 5

Operations 26 34 31

The aggregate remuneration of employees and directors

comprised:

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

----------------------- ------------------- ------------------- -------------------

Wages & salaries 789 1,128 1,654

Social security costs 93 113 220

Pension costs 11 15 26

894 1,256 1,900

------------------- ------------------- -------------------

6 Earnings per share

The basic earnings per share is calculated by dividing the

profit/(loss) attributable to equity shareholders by the weighted

average number of shares in issue.

Unaudited Unaudited Audited

At 31 Mar At 31 Mar At 30 Sep

2023 2022 2022

Loss for the year from continuing operations (GBP'000) (2,284) (4,955) (8,748)

Weighted average number of ordinary shares in issue 518,617,362 518,617,362 518,617,362

------------------------------------------------------------------------ ------------ ------------ ------------

Basic and diluted earnings per share for continuing operations (pence) (0.44) (0.96) (1.69)

------------------------------------------------------------------------ ------------ ------------ ------------

The Company had in issue 77,595,228 warrants and options at 31

March 2023 (37,914,360 at 31 March 2022). The loss attributable to

equity holders and weighted average number of ordinary shares for

the purposes of calculating diluted earnings per ordinary share are

identical to those used for basic earnings per ordinary share. This

is because the exercise of warrants and options would have the

effect of reducing the loss per ordinary share and is therefore

anti-dilutive.

7 Trade and other receivables

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

--------------------------------- ------------------- ------------------- -------------------

Trade debtors 552 909 1,375

Accrued revenue 5 153 -

Other receivables 12 12 56

Prepayments 368 298 1,870

VAT recoverable 6 1,356 660

Rental deposit - 142 -

Total trade & other receivables 942 2,870 3,961

--------------------------------- ------------------- ------------------- -------------------

The directors consider that the carrying amount of trade and

other receivables is approximately equal to their fair value.

8 Trade and other payables

Unaudited period Unaudited period Audited

ended 31 Mar 2023 ended 31 Mar 2022 period

ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

------------------------------------ ------------------- ------------------- -------------------

Trade creditors 965 755 3,150

Accruals 86 306 242

Other payables 4 - 9

Other taxation and social security 62 87 -

Total trade and other payables 1,117 1,148 3,401

------------------------------------ ------------------- ------------------- -------------------

The directors consider that the carrying value of trade and

other payables is approximately equal to their fair value.

9 Leases

The Group had the following lease assets and liabilities:

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

--------------------- ------------------- ------------------- -------------------

Right-of-use assets

Properties 2,852 498 3,010

Equipment 388 - 447

-------------------

3,240 498 3,457

------------------- ------------------- -------------------

Lease liabilities

Current 397 82 259

Non-current 2,967 450 3,204

------------------- ------------------- -------------------

3,364 532 3,463

------------------- ------------------- -------------------

Right of use assets

A reconciliation of the carrying amount of the right-of-use

asset is as follows:

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

------------------ ------------------- ------------------- -------------------

Properties

Opening balance 3,010 - -

Additions 9 515 3,284

Depreciation (167) (17) (274)

------------------- ------------------- -------------------

2,852 498 3,010

------------------- ------------------- -------------------

Equipment

Opening balance 477 - -

Additions - - 477

Depreciation (59) - (30)

------------------- ------------------- -------------------

388 - 447

------------------- ------------------- -------------------

Total 3,240 498 3,457

------------------- ------------------- -------------------

Lease liabilities

A reconciliation of the carrying amount of the lease liabilities

is as follows:

Unaudited period Unaudited period Audited period

ended 31 Mar 2023 ended 31 Mar 2022 ended 30 Sep 2022

GBP'000 GBP'000 GBP'000

------------------ ------------------- ------------------- -------------------

Opening balance 3,463 - -

Additions 9 519 3,356

Payment made (220) - (50)

Finance charge 112 17 157

------------------- ------------------- -------------------

3,364 536 3,463

------------------- ------------------- -------------------

10 Share-based payments

The following options and warrants over ordinary shares have

been granted by the Company and are outstanding:

Grant Date Outstanding Warrants Exercise Price Expiry date

------------------ --------------------- --------------- --------------------------------------------------

18-Feb-20 3,250,000 GBP0.01 24 months from the first anniversary of admission

13-Mar-20 75,000 GBP0.01 36 months from the first vesting date

09-Jun-20 250,000 GBP0.01 36 months from the first vesting date

18-Jun-20 1,666,666 GBP0.06 36 months from the first vesting date

19-Jun-20 6,963,000 GBP0.06 5 years from issue

29-Jun-20 250,000 GBP0.06 36 months from the first vesting date

07-Jul-20 225,000 GBP0.06 36 months from the first vesting date

05-Aug-20 250,000 GBP0.06 36 months

07-Aug-20 500,000 GBP0.06 36 months from the first vesting date

14-Aug-20 750,000 GBP0.06 36 months from the first vesting date

17-Aug-20 1,000,000 GBP0.06 36 months from the first vesting date

20-Aug-20 1,000,000 GBP0.06 36 months from the first vesting date

28-Aug-20 150,000 GBP0.06 36 months from the first vesting date

02-Oct-20 20,584,694 GBP0.104 5 years from issue

27-Sep-22 25,930,868 GBP0.027 5 years from grant

01-Nov-22 14,750,000 GBP0.014 5 years from issue

------------------ ---------------------

At 31 March 2023 77,595,228

------------------ ---------------------

At the grant date, the fair value of the warrants issued have

been determined using the Black-Scholes option pricing model.

Volatility was calculated based on data from comparable esports

companies, with an appropriate discount applied due to being an

unlisted entity at the grant date, if applicable. Risk-free

interest has been based on UK Government Gilt rates.

11 Share capital and share premium

Shares Share Share

Capital Premium Total

No. GBP'000 GBP'000 GBP'000

---------------------- ----------- -------- -------- -------

At 30 September 2022 518,617,362 519 22,644 23,163

---------------------- ----------- -------- -------- -------

At 31 March 2023 518,617,362 519 22,644 23,163

---------------------- ----------- -------- -------- -------

No shares were issued in the period from the Company's last

annual report on 30 September 2022 to 31 March 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKCBKCBKDCPK

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

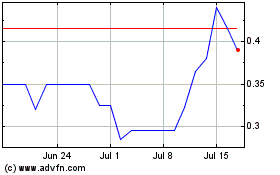

Guild Esports (LSE:GILD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Guild Esports (LSE:GILD)

Historical Stock Chart

From Nov 2023 to Nov 2024