TIDMGHH

RNS Number : 4719U

Gooch & Housego PLC

03 December 2013

For immediate release 3 December 2013

Gooch & Housego PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2013

Gooch & Housego PLC ("Gooch & Housego", or "G&H", or

the "Company", or the "Group"), the specialist manufacturer of

optical components and systems, today announces its preliminary

results for the year ended 30 September 2013.

Financial Highlights

Year ended 30 September 2013 2012 change

------------------------- ----- ------ -------

Revenue (GBPm) 63.3 60.9 3.9%

------------------------- ----- ------ -------

Adjusted profit before

tax (GBPm)* 9.7 8.2 18.3%

------------------------- ----- ------ -------

Adjusted basic earnings

per share (pence)* 32.0 28.2 13.5%

------------------------- ----- ------ -------

Total dividend per

share (pence) 6.3 5.2 21.2%

------------------------- ----- ------ -------

Net cash/(debt) (GBPm) 5.7 (0.3) 6.0

------------------------- ----- ------ -------

Statutory profit before

tax (GBPm) 8.3 7.1 16.9%

------------------------- ----- ------ -------

Basic earnings per

share (pence) 27.7 24.4 13.5%

------------------------- ----- ------ -------

*adjusted figures are stated after excluding the amortisation of

acquired intangible assets and exceptional items being acquisition

costs and restructuring costs.

Operating & Strategic Highlights

-- Efficiency and volume drive margin improvement from 13.5% to 15.3%

-- Strong cash performance results in net cash position at year end

-- 21% growth in the full year dividend reflecting the strength of the balance sheet

-- Systems Technology Group established to accelerate transition

from components supplier to solutions provider

-- Post period end: -

o Acquisition of Spanoptic opens up new opportunities in

Aerospace & Defence and brings supply chain and manufacturing

partner in China

o Acquisition of Constelex strengthens STG team and brings

satellite communications expertise

-- Increased geographical footprint established across the Far East

Gareth Jones, CEO commented

"Gooch & Housego has made considerable progress in line with

its strategic objectives to yield a better balanced business with

enhanced growth potential in diversified markets.

With excellent customer relationships and a strong pipeline of

new products the Company is well-positioned to deliver sustained

growth and continued margin improvement."

For further information please contact:

Gooch & Housego Gareth Jones /

PLC Andrew Boteler 01460 256 440

Tim Thompson /

Buchanan Gabriella Clinkard 020 7466 5000

Investec Bank

plc (Nomad & Broker) Patrick Robb 020 7597 5970

Expected Financial Calendar

Annual General Meeting 26 February 2014

Final dividend for the 28 February 2014

year ended 30 September

2013 payable to shareholders

on the register at close

of business on 7 February

2014. Subject to approval

by shareholders at the

Annual General Meeting

Interim Results announced June 2014

Financial Year End 30 September 2014

Preliminary announcement December 2014

of results for

the year ending 30 September

2014

Chairman's Statement

"Our consistent strategy of diversifying the company's product

range & customer base has been successful in the year"

I am pleased to report that your company made good strategic

progress in the last twelve months on many fronts, against a

challenging market backdrop.

While revenues showed some growth in the year, adjusted profit

before tax was 18.3% higher due to increased volumes and efficiency

savings. This was achieved despite an increase in our investment in

research and development. Cash management remains a focus for the

Group and at the year-end we were in a net cash position. Following

two acquisitions since the year end, this has moved to a very

manageable modest debt.

The Board's responsibilities include ensuring that; Gooch &

Housego has a robust and achievable strategy, investments are made

without undue risks, we have the resources to achieve our

objectives and that the Company operates efficiently. Our

consistent strategy of diversifying the Company's product range and

customer base was effective in the year with the establishment of

our new Systems Technology Group and the subsequent award of a

number of early stage development contracts in the Space sector. It

is expected that these activities will lead to business growth as

the products progress from the development phase and enter

production in the medium term. These contracts will assist in the

business moving up the value chain into subsystems in line with our

strategic objectives. Gooch & Housego's risks in this new

sector are also minimised as these new product developments are

mostly externally funded.

We continued to assess ways of improving the efficiency and the

effectiveness of the business and management changes and

organisational improvements were made this year to the marketing

and sales activities of the group. We are further exploring if

efficiency would benefit from a reduction in the number of sites in

the US by consolidating capabilities. Progress was also made in

sharing technology between operations, whilst recognising national

security constraints. In manufacturing, plans were made to increase

the use of our partner company in the Czech Republic where labour

costs are significantly lower, whilst maintaining product

quality.

The global environment in which we enter our new financial year

remains unclear. In the US, budget uncertainties continue to cloud

our vision and the reduction in Government spending could limit our

opportunities in Aerospace and Defence. It is however important to

note Gooch & Housego's technology has the advantage of being

relevant in areas where expenditure is likely to be least affected.

In the Far East and Europe, some improvement in the economic

situation is evident which we expect to benefit the Company in due

course.

Finally, on behalf of the Board, I would like to thank all

employees for their efforts and contribution during the year to the

success of the Company. With their support, the Board believes the

company is well placed to continue its growth into the future.

Dr Julian Blogh

CEO Review

"Despite what at times have been challenging market conditions,

Gooch & Housego has traded well, whilst investing in

initiatives that underpin long term growth"

Trading conditions during the year were broadly positive, albeit

set against a background of some uncertainty affecting most of the

sectors in which Gooch & Housego operates. Order intake was at

the level needed to sustain growth in the business. The order book

ended the year at GBP27.8 million, an increase of 12% from the

beginning of the year.

Gooch & Housego has seen continued growth in its Aerospace

and Defence business despite the headwinds affecting this sector.

While some significant programmes stalled or were subject to

delays, other more mature programmes proceeded as planned and

outweighed the setbacks. While this market continues to be

challenging, the Company remains optimistic about continued growth

prospects based on the strong customer relationships that have been

developed in recent years and the breadth of opportunities

currently being addressed.

In line with its strategy, the Company has continued to

diversify its activities in the Industrial sector, with sensors and

test and measurement systems growing in importance over the past

year. In the industrial laser market Gooch & Housego has kept

pace with the technology shift away from solid state lasers in

favour of fibre lasers for many routine materials processing

applications. The Company is now a major supplier to the fibre

laser market at both component and subsystem level.

In Life Sciences, the Company began to utilise its Systems

Technology Group (STG), established mid-way through the year, to

leverage Gooch & Housego's excellence in components to develop

subsystems-level products to address new opportunities in laser

surgery and to build upon its already strong presence in Optical

Coherence Tomography (OCT). These initiatives, combined with

established business in microscopy and research and development

work in diagnostics, have reinforced Life Sciences as one of the

Company's main growth markets.

Creating the means to deliver growth has been a primary

objective during the past year. The aim has been to build a

broadly-based business that can deliver sustainable growth in flat

economic conditions and is able to respond to economic recovery,

while being sufficiently well-balanced to minimise the effects of

market cyclicality. We have sought to deliver growth in a number of

ways:

-- Via organic growth and new product development

-- By moving up the value-chain from components to subsystems

-- By developing new application areas where Gooch & Housego

can take a market leading position

-- Through acquisitions, where they accelerate the delivery of our strategic objectives

-- By leveraging our supply chain and low-cost manufacturing

relationships to increase competitiveness

-- By strengthening our presence in geographical markets with significant growth potential

Organic New Product Development

A more focused approach to research & development has paid

dividends in 2013, with a significant number of new products being

brought to market. These new products have ranged from

acousto-optic, electro-optic and fibre optic devices, to

sophisticated laser sources and optical amplifiers, spanning a

broad range of application areas ranging from microelectronics to

satellite communications. By carefully selecting our projects,

based on enhanced market intelligence derived from increasingly

close relationships with our major customers, we have been able to

increase the success rate and value of the new products we have

developed.

Organic Growth - Moving up the Value Chain

The Systems Technology Group (STG) was established to drive

organic growth at the subsystems level. Recognising that it is

difficult to make the transition from components to systems, and

inefficient to try to do this at multiple locations, the STG

provides Gooch & Housego with a vehicle to undertake the

development of complex photonic sub-systems without the constraints

that apply to its component manufacturing operations. With optical,

mechanical, electronic and software design and modelling

capabilities, and the ability to integrate multiple photonic

component technologies (for example, fibre optics, semiconductor

lasers and acousto-optics), each of which may be manufactured at a

different Gooch & Housego facility, the STG is able to lead and

coordinate complex projects with commercial customers, space

agencies and collaborative partners. Although still a small team

(seven people at the year-end), the STG is expected to double in

headcount during 2014. The STG is also able to call upon

development and engineering resources from across Gooch &

Housego, and works with outside partners and consultants, with the

result that it is able to take on more demanding projects than its

small size would suggest.

The STG has initially focussed on space photonics and optical

coherence tomography (OCT). In both applications G&H is

experiencing customer pull to supply "black-box" solutions, rather

than low-level components. In these new markets G&H's customers

tend to be very large organisations that perform the role of

systems integrator, and they are not well-equipped to interact at

the component level.

In space applications, photonics technology has significant

advantages over the equivalent electronic systems that are the norm

today (specifically lower mass, higher bandwidth and reduced power

consumption, all of which contribute to lower cost). A major

technology shift in favour of photonics technology is taking place

and represents an opportunity for Gooch & Housego to take a

leading position in this rapidly developing new market. Gooch &

Housego has a strong heritage in space qualified photonic

components and the objective is to leverage this to develop a

family of subsystems for applications in telecommunications and

earth observation satellites. Once proven in satellite applications

it is anticipated that this technology with filter down to the much

larger commercial and military aerospace markets. (G&H has

already participated in several collaborative projects with

aerospace partners to investigate the application of fibre optic

networks for data, sensing and control systems in next generation

aircraft.) The STG has successfully bid for a number of European

Space Agency (ESA) and European Union Framework 7 (EU FP7)

collaborative programmes and has recently completed a programme to

design and demonstrate a fibre optic amplifier suitable for use in

a satellite laser communications system.

Acquisitive Growth

Shortly after the year end Gooch & Housego completed the

acquisition of Spanoptic Limited ("Spanoptic"), a manufacturer of

precision optical components based in Glenrothes, Scotland.

Spanoptic specialises in spherical and aspheric lenses and

diffractive optics for applications in the ultraviolet, visible and

infrared regions of the spectrum. This capability is highly

complementary to Gooch & Housego's predominantly planar optics

business and enhances the Company's ability to provide complete

subsystem solutions to its customers in line with its strategic

objectives. Spanoptic's capabilities in infrared optics and

coatings are particularly relevant to Gooch & Housego's

activities in the Aerospace and Defence sector.

In recent years Spanoptic has invested heavily in

state-of-the-art optical manufacturing, metrology and thin-film

coating equipment. These investments have enabled Spanoptic to

produce optical components at the upper end of the quality and

precision scale while maintaining highly competitive pricing. As a

result, Spanoptic has been able to win business and develop strong,

mainly European customer relationships across a broad range of

applications including analytical instrumentation, optical sensing,

security, imaging, life sciences and aerospace and defence.

Also following the year end, in late November 2013 Gooch &

Housego, also completed the acquisition of Constelex Technology

Enablers Limited (Constelex), a small Athens, Greece, based

business specialising in the design and manufacture of low-noise,

high power optical fibre amplifiers and lasers for applications in

telecommunications, sensing and defence. The Constelex team will

relocate to the UK in early 2014 and will be based at Gooch &

Housego's Torquay facility as part of the STG. Constelex brings

highly relevant optical systems expertise to the STG plus a number

of ESA and EU funded collaborative projects in the space photonics

field. The acquisition of Constelex will add valuable skills and

experience to the STG and will help to accelerate the delivery of

the Company's strategic objective of becoming a leader in space

photonics.

Increasing Competitiveness

Spanoptic's competitive advantage is further enhanced by the

strategic alliance that it has with a Chinese manufacturer of

precision optics, optical sub-systems and instrumentation. This

alliance is being developed and extended to provide Gooch &

Housego with an enhanced foothold in the increasingly important

Chinese market and to serve as a high-quality, low-cost

manufacturing partner for both components and systems. With the

ability to manufacture photonic sub-systems and instrumentation in

higher volumes and at lower cost than would be possible elsewhere

within Gooch & Housego this relationship will enable the

Company to scale to higher volumes than would otherwise have been

possible.

Similarly, we have made greater use of our established European

contract manufacturing partner based in the Czech Republic to

enhance the competitiveness of our products, a process that will

continue in the current year.

Strengthening our Presence in Geographical Markets with

Significant Growth Potential

2013 has seen a number of initiatives to increase our

penetration of Far Eastern markets. Over the past 25 years Gooch

& Housego has grown its business in Japan with the assistance

of its distribution partners. In order to gain access to new

opportunities and to demonstrate commitment to this important

market Gooch & Housego Japan KK was established and an office

opened in Nagoya in April 2013. A number of significant new

opportunities are already under development. . In addition to the

new relationships in China that came with the acquisition of

Spanoptic, we have strengthened our applications engineering team

there and opened a sales office in Singapore during 2013.

Summary

During 2013, G&H has made considerable progress in line with

its strategic objectives to yield a better balanced business with

enhanced growth potential.

G&H has become a more vertically integrated business. At the

component end of the scale, the acquisition of Spanoptic has added

highly complementary capabilities in precision optics. The STG has

given G&H a vehicle with which to provide its customers with

sub-systems design and development services, and the acquisition of

Constelex has enhanced the ability of the STG to develop complex

systems for space and telecommunications applications.

Greater efficiency and volume has helped to deliver revenue

growth at improved margins, resulting in strong cash generation and

a net cash position at the year end.

Prospects

G&H has taken a number of important initiatives in the past

year - a re-focussing of Research & Development and Sales &

Marketing, the creation of the STG and the identification of new

markets such as space photonics. When combined with the

acquisitions of Spanoptic and Constelex, these initiatives provide

G&H with the means to deliver growth in a flat economy, and the

ability to respond to, and benefit from, market recovery.

With excellent customer relationships and a strong pipeline of

new products G&H is well-positioned to deliver sustained growth

and continued margin improvement.

Gareth Jones

Performance Overview

FINANCIAL PERFORMANCE

The business has delivered profitable growth and improving

margins whilst experiencing variable demand patterns within our

core markets. The trend towards a more evenly balanced business has

continued, reflecting our strategy of diversification and our

efforts to develop new opportunities in Aerospace and Defence and

Life Sciences.

Following a steady first half, the second half of this financial

year experienced strong sales into many of our market sectors. It

is particularly pleasing to report sales growth of 16.3%, in

aggregate, in our key target markets of Aerospace & Defence and

Life Sciences. These markets now account for 38.9% of Gooch &

Housego's total revenue.

In the financial year under review, margins benefited from the

greater operating leverage gained from increased volumes and from

efficiency gains made by the business this year. As a result

adjusted operating margins have increased to 16.2% (2012:

14.7%).

REVENUE

Year ended 30 2013 2012

September

---------------- ----------------

GBP000 % of GBP000 % of

total total

--------------------- ------- ------- ------- -------

Industrial 34,345 54% 35,789 59%

Aerospace and

Defence 17,273 27% 15,440 25%

--------------------- ------- ------- ------- -------

Life Sciences 7,353 12% 5,731 10%

--------------------- ------- ------- ------- -------

Scientific Research 4,281 7% 3,891 6%

--------------------- ------- ------- ------- -------

Group Revenue 63,252 100% 60,851 100%

--------------------- ------- ------- ------- -------

Group revenue for the year was a record GBP63.3m, an increase of

GBP2.4m, or 4% over the previous year of GBP60.9m. On a consistent

currency basis revenue was 3% higher than the previous year.

In our Aerospace & Defence business segment revenue grew by

11.9% from GBP15.4m last year to GBP17.3m this year. Similarly

revenue in our Life Sciences business grew by 28.3%, from GBP5.7m

to GBP7.4m. Sales into our industrial market fell by 4.0% this year

on the back of weaker business in our telecommunications and

traditional Q-switch markets.

A more detailed analysis of revenues by market was shown in the

Market Analysis section, later in this report.

GROUP EARNINGS PERFORMANCE

All amounts in Adjusted Reported

GBP'000

------------------

Year ended 30 2013 2012 2013 2012

September

------------------- -------- -------- -------- --------

Operating profit 10,268 8,973 8,951 7,852

------------------- -------- -------- -------- --------

Net finance costs (608) (776) (608) (776)

------------------- -------- -------- -------- --------

Profit before

taxation 9,660 8,197 8,343 7,076

------------------- -------- -------- -------- --------

Taxation (2,490) (2,032) (2,151) (1,753)

------------------- -------- -------- -------- --------

Profit for the

period 7,170 6,165 6,192 5,323

Basic earnings

per share (p) 32.0p 28.2p 27.7p 24.4p

------------------- -------- -------- -------- --------

The Group adjusted profit before tax amounted to GBP9.7m (2012:

GBP8.2m) and represented a return on sales of 15.3% compared with

13.5% in the previous year. Statutory profit before tax was GBP8.3m

compared with GBP7.1m last year.

The effective rate of tax was 25.8% (2012: 24.8%), reflecting a

combination of the varying tax rates applicable throughout the

countries in which the Group operates, principally the UK and the

USA. The introduction of the patent box tax rate from April 2013

has not contributed to a lower tax rate in 2013 and will not in

2014. The effective rate of tax should benefit in the future from

further reductions in the UK tax rate.

Adjusted earnings per share (EPS) increased from 28.2p to 32.0p.

Basic EPS was 27.7p compared with 24.4p last year.

RECONCILIATION OF ADJUSTED PERFORMANCE MEASURES

Operating Net finance Taxation Earnings

Profit costs per share

--------------- ------------------ ------------------ ------------------ ----------------

Year ended 2013 2012 2013 2012 2013 2012 2013 2012

30 September GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 pence pence

--------------- -------- -------- -------- -------- -------- -------- ------- -------

Reported 8,951 7,852 (608) (776) (2,151) (1,753) 27.7p 24.4p

--------------- -------- -------- -------- -------- -------- -------- ------- -------

Amortisation

of acquired

intangible

assets 875 881 - - (225) (219) 2.9p 3.0p

--------------- -------- -------- -------- -------- -------- -------- ------- -------

Acquisition

costs 164 - - - (42) - 0.5p -

--------------- -------- -------- -------- -------- -------- -------- ------- -------

Restructuring

costs 278 240 - - (72) (60) 0.9p 0.8p

--------------- -------- -------- -------- -------- -------- -------- ------- -------

Adjusted 10,268 8,973 (608) (776) (2,490) (2,032) 32.0p 28.2p

--------------- -------- -------- -------- -------- -------- -------- ------- -------

NON GAAP MEASURES

The Company uses a number of non GAAP measures which are shown

in the table above and in the segmental analysis. These measures

are used to illustrate the impact of non-recurring and non-trading

items on the Company's financial results. These are the impact of

the amortisation of acquired intangible assets, acquisition costs

and costs associated with restructuring activities In addition, the

Company uses the term EBITDA (Earnings before interest, taxation,

depreciation and amortisation). This is a commonly used measure of

operating performance and cash flow.

SEGMENTAL ANALYSIS

Industrial

Our Industrial business fell marginally during the year, with

revenues of GBP34.3m, compared with GBP35.8m last year. Revenue

from the Group's traditional Q-switch product fell during the year,

as anticipated, and now represents 12.2% of total group revenues.

We believe this reflects the continuing shift towards the use of

fibre lasers in materials processing applications. This appears to

be supported by the significant increase in sales of fibre laser

components experienced by G&H in 2013. Telecommunications

revenues were down in 2013 following the completion of the London

Olympics, a one off benefit experienced in 2012 and the continuing

softness in the undersea components business.

Operating profit for the Industrial sector as a whole was 6.8%

higher at GBP7.0m, compared with GBP6.6m last year. This reflects a

combination of cost-saving initiatives and a better performance

from our Palo Alto facility, being offset to some extent by a

poorer product mix.

Aerospace & Defence (A&D)

Our A&D business revenue increased by 11.9% from GBP15.4m to

GBP17.3m in 2103. Despite a significant reduction in engineering

contracts, which were affected by US Government sequestration

issues, the business was able to deliver considerable growth in

this market sector. This was driven through the provision of both

components and systems to our UK and US A&D customers.

Operating margins in this sector were marginally down in percentage

terms, but increased absolutely. This reflected the combination of

mix and volume this year.

Life Sciences

Gooch & Housego grew its presence in the Life Sciences

sector in 2013 with revenues of GBP7.4m (2012: GBP5.7m). The growth

in this market was driven by the Optical Coherence Tomography (OCT)

and Microscopy markets. Operating margins in this sector were

marginally down in percentage terms, but increased absolutely. This

was mainly a reflection of the business having to absorb a larger

share of Group costs.

Scientific Research

Our activities in the Scientific Research market are dominated

by a small number of large, long-term programmes. This market saw

growth in 2013 on the back of increased business from laser fusion

projects. These programmes are now largely complete, although we do

expect on-going business to service replacement and maintenance

requirements.

RESEARCH & DEVELOPMENT (R&D)

Gooch & Housego continues to invest in R&D in all areas

of the business and regards this as fundamental to the continued

growth of the company. There were a large number of product

releases in 2013 and there is an extensive new product pipeline

with a number of new product introductions anticipated in the 2014

financial year.

Expenditure on R&D in the year to 30 September 2013

increased by 15% from GBP4.3m to GBP4.9m. A proportion of this

increase was funded through UK Government and European grant

funding. R&D expenditure represented 7.8% of revenue (2012:

7.0%). In addition the Group capitalised GBP0.03m (2012: GBP0.01m)

of R&D expenditure.

BALANCE SHEET

The Group's shareholder's funds at the end of the year were

GBP64.9m, an increase of GBP6.4m over the prior year. This increase

mainly comprised GBP1.1m from share capital / premium and GBP5.5m

from retained earnings.

Additions to tangible fixed assets totalled GBP2.5m. The main

fixed asset additions were in response to the increase in aerospace

and defence business, where a further GBP1.0m has been invested in

extending coating and precision optics capabilities. GBP0.5m has

also been invested in expanding our Torquay facilities and

equipment in the establishment of the Systems Technology Group into

this site.

Working capital was 24.7% of revenue in the current year

compared to 21.3% in 2012. Inventories have increased by GBP0.6m

from GBP12.8m in 2012 to GBP13.4m at this year-end. This has been

driven by the necessity to hold safety stocks for our A&D

customers. Since the half-year the business has worked on

initiatives to reduce inventory. This has resulted in inventory

carrying values reducing by GBP0.8m from GBP14.2m as at 31 March

2013. Trade debtors increased from GBP9.2m to GBP10.2m following a

strong final quarter revenue performance.

Cash balances at 30 September 2013 were GBP14.6m, compared with

GBP11.7m at 30 September 2012. Net cash flows from operating

activities generated GBP9.2m, compared with GBP8.9m last year.

During the year the business moved from a net debt position of

GBP0.3m as at 30 September 2102, to a net cash position of

GBP5.7m.

MOVEMENT IN NET (DEBT)/FUNDS

All amounts in GBPm Net

Gross Gross (Debt)

Funds Debt /Funds

--------------------------- ------- ------- --------

At 1 October 2012 11.7 (12.0) (0.3)

Operating cash flows 12.4 - 12.4

Debt repayment (3.4) 3.4 -

Capital expenditure (2.2) - (2.2)

Working capital (2.2) - (2.2)

Proceeds from share issue 1.0 - 1.0

Interest, tax & dividends (2.6) - (2.6)

Exchange movement (0.1) (0.3) (0.4)

--------------------------- ------- ------- --------

At 30 September 2013 14.6 (8.9) 5.7

--------------------------- ------- ------- --------

ORDER BOOK

As at 30 September 2013, the Group order book stood at GBP27.8m,

compared to GBP24.9m at the end of the 2012 financial year, a 12%

increase. On a like for like basis, excluding the impact of foreign

exchange, the order book was 12% higher. Book to bill ratios for

the business as a whole were 0.98 times (six month rolling average)

as at 30 September 2013, compared to 1.01 times for the same period

last year.

STAFF

The Group workforce reduced slightly from 588 at 30 September

2012 to 581 at the end of September 2013, a fall of 7. This is a

net position and therefore reflects both the reductions in staffing

resulting from the work the business has done in integration and

rationalisation of sites and processes and the additional

investment that the business has made in engineering, business

development and senior management. During the year the Group

appointed Jon Fowler as EVP Commercial Development. Mr Fowler was

an internal appointment having previously held a general management

role in our US operations. Mr Fowler brings a wealth of customer

development experience to this role.

POST BALANCE SHEET EVENTS

On the 15 October 2013 Gooch & Housego announced that it has

completed the acquisition of Spanoptic Limited ("Spanoptic"), a

manufacturer of precision optical components, based in Glenrothes,

Scotland,

Founded in 1976, Spanoptic currently employs 62 people and in

the year ended 31 December 2012 had revenues of GBP7.7 million and

made a profit before tax of GBP1.0 million. Spanoptic had net

assets of GBP5.5 million at acquisition, including net cash of

GBP0.7 million. The gross cash consideration paid by Gooch &

Housego was GBP6.6 million, funded from existing cash and debt

facilities.

Spanoptic will continue to operate from its Glenrothes factory

as an integrated part of Gooch & Housego's UK precision optics

business. As a long-term supplier to G&H (Gooch & Housego

accounted for approximately 1.5% of Spanoptic's turnover in the

year to 31 December 2012), Spanoptic is well-known to the Gooch

& Housego management team and has been the subject of regular

quality and process audits in recent years.

On the 25 November 2013 Gooch & Housego announced that it

had completed the acquisition of Constelex Technology Enablers

Limited (Constelex), an Athens, Greece, based designer and

manufacturer of advanced photonic systems.

Constelex is a small, start-up company specialising in low-noise

optical fibre amplifiers. With a mission to become a world-leading

design-house and solution provider for photonic systems with

applications in telecommunications, space, defence and life

sciences, Constelex has built up a strong reputation for technical

excellence since it was founded in 2009. As a result, Constelex has

enjoyed considerable success in securing contracts from the

European Space Agency and attracting funding from the European

Union to develop complex photonic systems for predominantly space

and satellite applications.

DIVIDENDS

The Directors propose a final dividend of 4.0p per share making

a total dividend for the year of 6.3p (2012: 5.2p). The final

dividend will be payable on 28 February 2014 to shareholders on the

Company's share register as at close of business on 7 February

2014.

KEY PERFORMANCE INDICATORS (KPIs)

The Company's objective is to deliver sustainable, long-term

growth in revenue and profits. This is to be achieved through the

execution of the Board's strategies of market diversification, the

continued investment in R&D to support organic growth, the

acquisition of strategically complementary businesses and the

on-going drive to move up the value chain.

In striving to achieve these strategic objectives, the main

financial performance measures monitored by the Board are:

Total revenue growth 2013 2012 2011

---------------------- ----- ----- -----

At actual exchange

rates 4% 0% 37%

---------------------- ----- ----- -----

At constant exchange

rates 3% (1%) 40%

---------------------- ----- ----- -----

The Board is focused on delivering revenue growth by investing

both organically and through acquisitions. The Group business has

delivered underlying growth, whilst experiencing variable demand

patterns within its core markets.

Target market revenue 2013 2012 2011

----------------------- ----- ----- -----

Aerospace & Defence

(GBPm) 17.3 15.4 15.4

----------------------- ----- ----- -----

Life Sciences (GBPm) 7.4 5.7 5.7

----------------------- ----- ----- -----

The Company's target markets of Aerospace and Defence and Life

Science provide a route to sustainable growth, and a more

diversified revenue base. These markets also provided significant

opportunities for Gooch & Housego to migrate up the value-chain

from materials and components to higher value sub-assemblies,

modules and systems in response to the trend for our larger

customers to outsource increasingly complex parts of their

business. The business has made good progress in addressing its

target markets of Aerospace and Defence and Life Sciences which, in

aggregate, have increased by 16.3% in the 2013 financial year.

Net cash analysis 2013 2012 2011

------------------------ ----- ------ ------

Net cash/(debt) (GBPm) 5.7 (0.3) (1.8)

------------------------ ----- ------ ------

In order to balance business risk with the investment needs of

the Company, Gooch & Housego closely monitors and manages its

net debt. This year the business moved from a net debt position of

GBP0.3m as at 30 September 2102, to a net cash position of GBP5.7m,

putting the business in a strong position both in terms of headroom

for further investment and from the perspective of managing its

business risk.

Earnings per share 2013 2012 2011

(EPS)

---------------------- ----- ----- -----

Adjusted diluted EPS

(pence) 30.5 26.4 36.0

---------------------- ----- ----- -----

As a result of a strong trading performance, the business has

been able to deliver growth in adjusted diluted EPS of 15.5%, from

26.4p to 30.5p in 2013.

Group Income Statement

For the year ended 30 September 2013 (unaudited)

Note 2013 2012

GBP000 GBP000

--------- ---------

Revenue 2 63,252 60,851

Cost of revenue (37,635) (37,405)

--------- ---------

Gross profit 25,617 23,446

Research & Development (4,913) (4,277)

Sales & Marketing (4,666) (4,119)

Administration (8,814) (8,181)

Other income 1,727 983

--------- ---------

Operating profit 2 8,951 7,852

Finance income 15 24

Finance costs (623) (800)

--------- ---------

Profit before income tax

expense 8,343 7,076

Income tax expense 3 (2,151) (1,753)

--------- ---------

Profit for the year 6,192 5,323

--------- ---------

Basic earnings per share 4 27.7p 24.4p

--------- ---------

Diluted earnings per share 4 26.4p 22.8p

--------- ---------

Reconciliation of operating profit to adjusted operating

profit:

2013 2012

GBP000 GBP000

------- --------

Operating profit 8,951 7,852

Amortisation of acquired

intangible assets 875 881

Acquisition costs 164 -

Restructuring costs 278 240

------- --------

Adjusted operating

profit 10,268 8,973

------- --------

Group Balance Sheet

As at 30 September 2013 (unaudited)

2013 2012

GBP000 GBP000

--------- ---------

Non-current assets

Property, plant & equipment 21,456 21,405

Intangible assets 19,821 20,720

Deferred income tax assets 3,830 4,308

--------- ---------

45,107 46,433

Current assets

Inventories 13,390 12,802

Income tax assets 420 -

Trade and other receivables 12,706 11,062

Cash and cash equivalents 14,558 11,712

41,074 35,576

Current liabilities

Trade and other payables (10,461) (10,202)

Borrowings (5,726) (5,774)

Income tax liabilities (307) (17)

Provision for other liabilities

and charges (271) (357)

--------- ---------

(16,765) (16,350)

Net current assets 24,309 19,226

--------- ---------

Non-current liabilities

Borrowings (3,113) (6,261)

Deferred income tax liabilities (1,330) (698)

Derivative financial instruments (34) (134)

--------- ---------

(4,477) (7,093)

Net assets 64,939 58,566

--------- ---------

Shareholders' equity

Called up share capital 4,620 4,382

Share premium account 15,213 14,311

Merger reserve 2,671 2,671

Hedging reserve (79) (169)

Cumulative translation

reserve (859) (496)

Retained earnings 43,373 37,867

--------- ---------

Equity Shareholders' Funds 64,939 58,566

--------- ---------

Group Statement of Changes in Shareholders' Equity

For the year ended 30 September 2013 (unaudited)

Share Share

capital premium Merger Hedging Retained Total

account account reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- --------- ---------- ----------- ---------

At 1 October

2011 4,370 14,200 2,671 (264) 33,123 54,100

Profit for

the financial

year - - - - 5,323 5,323

Other comprehensive

income for

the year - - - 95 (1,084) (989)

--------- --------- --------- ---------- ----------- ---------

Total comprehensive

income for

the year - - - 95 4,239 4,334

--------- --------- --------- ---------- ----------- ---------

Dividends - - - - (1,093) (1,093)

Proceeds from

shares issued 12 111 - - - 123

Fair value

of employee

services - - - - 471 471

Tax credit

relating to

share option

schemes - - - - 631 631

Total contributions

by and distributions

to owners

of the parent

recognised

directly in

equity 12 111 - - 9 132

At 30 September

2012 4,382 14,311 2,671 (169) 37,371 58,566

At 1 October

2012 4,382 14,311 2,671 (169) 37,371 58,566

Profit for

the financial

year - - - - 6,192 6,192

Other comprehensive

income for

the year - - - 90 (364) (274)

--------- --------- --------- ---------- ----------- ---------

Total comprehensive

income for

the year - - - 90 5,828 5,918

--------- --------- --------- ---------- ----------- ---------

Dividends - - - - (1,229) (1,229)

Proceeds from

shares issued 238 902 - - (96) 1,044

Fair value

of employee

services - - - - 341 341

Tax credit

relating to

share option

schemes - - - - 299 299

Total contributions

by and distributions

to owners

of the parent

recognised

directly in

equity 238 902 - - (685) 455

--------- --------- --------- ---------- ----------- ---------

At 30 September

2013 4,620 15,213 2,671 (79) 42,514 64,939

--------- --------- --------- ---------- ----------- ---------

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2013 (unaudited)

2013 2012

GBP000 GBP000

------- ---------

Profit for the period 6,192 5,323

Other comprehensive income

- items that may be reclassified

subsequently to profit or

loss

Movement in the value of

derivative financial instruments 90 95

Currency translation differences (364) (1,084)

Other comprehensive (expense)

for the period net of tax (274) (989)

Total comprehensive income

for the period 5,918 4,334

------- ---------

Total comprehensive income

for the period is attributed

to:

Shareholders of Gooch &

Housego PLC 5,918 4,334

------- ---------

Group Cash Flow Statement

For the year ended 30 September 2013 (unaudited)

Note 2013 2012

GBP000 GBP000

-------- --------

Cash flows from operating

activities

Cash generated from operations 6 10,130 10,653

Income tax payments (882) (1,793)

-------- --------

Net cash generated from

operating activities 9,248 8,860

-------- --------

Cash flows from investing

activities

Acquisition of subsidiaries,

net of cash acquired (22) (2,061)

Purchase of property, plant

and equipment (2,032) (3,337)

Disposal of property, plant

and equipment 67 59

Purchase of intangible

assets (202) (405)

Interest received 15 24

-------- --------

Net cash used in investing

activities (2,174) (5,720)

-------- --------

Cash flows from financing

activities

Repayment of borrowings (3,394) (3,397)

Proceeds from issuance

of share capital 1,044 123

Dividends paid to ordinary

shareholders (1,229) (1,093)

Interest paid (505) (711)

Net cash used in financing

activities (4,084) (5,078)

-------- --------

Net increase / (decrease)

in cash, cash equivalents,

working capital facility

and bank overdraft 2,990 (1,938)

Cash, cash equivalents,

working capital facility

and bank overdraft at beginning

of the period 9,235 11,276

Exchange losses on cash

and bank overdraft (137) (103)

-------- --------

Cash, cash equivalents,

working capital facility

and bank overdraft at the

end of the period 12,088 9,235

-------- --------

Cash, cash equivalents, working capital facility and bank

overdrafts at the end of the period comprise:

2013 2012

GBP000 GBP000

-------- --------

Cash and cash equivalents 14,558 11,712

Bank borrowings and overdraft (2,470) (2,477)

-------- --------

Cash, cash equivalents,

working capital facility

and bank overdraft at the

end of the period 12,088 9,235

-------- --------

Notes to the Preliminary Report

1 Basis of Preparation

The unaudited Preliminary Report has been prepared under the

historical cost convention and in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union and interpretations in issue at 30 September 2013.

The Preliminary Report was approved by the Board of Directors

and the Audit Committee on 27 November 2013. The Preliminary Report

does not constitute statutory financial statements within the

meaning of section 434 of the Companies Act 2006 and has not been

audited.

Comparative figures in the Preliminary Report for the year ended

30 September 2012 have been taken from the Group's audited

statutory financial statements on which the Group's auditors,

PricewaterhouseCoopers LLP, expressed an unqualified opinion.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 September 2012,

as described in those financial statements. New standards or

interpretations which came into effect for the current reporting

period did not have a material impact on the net assets or results

of the Group.

The Preliminary Report will be announced to all shareholders on

the London Stock Exchange and published on the Group's website on 3

December 2013. Copies will be available to members of the public

upon application to the Company Secretary at Dowlish Ford,

Ilminster, Somerset, TA19 0PF.

2. Segmental analysis

The business of the Company is divided into four market sectors,

being Aerospace and Defence, Life Sciences, Industrial and

Scientific Research, together with a Corporate cost center.

The Industrial business segment primarily comprises the

industrial laser market for use in the semiconductor and

microelectronic industries, but also includes other industrial

applications such as metrology and telecommunications. Scientific

Research covers academic and government funded research including

major multi-national projects.

For the year

ended

30 September Aerospace Life Scientific

2013 & Defence Sciences Industrial Research Corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Total revenue 17,273 7,353 38,179 4,281 - 67,086

Inter and intra-division - - (3,834) - - (3,834)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

External revenue 17,273 7,353 34,345 4,281 - 63,252

Divisional

expenses (14,335) (5,664) (26,425) (3,600) (1,285) (51,308)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

EBITDA(1) 2,938 1,689 7,920 681 (1,285) 11,943

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

EBITDA % 17.0% 23.0% 23.1% 15.9% 0.0% 18.9%

Depreciation

& amortisation (550) (220) (907) (143) (299) (2,117)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit/(loss)

before amortisation

of acquired

intangible

assets 2,388 1,469 7,013 538 (1,582) 9,826

Acquired intangible

assets amortisation - - - - (875) (875)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit/(loss) 2,388 1,469 7,013 538 (2,457) 8,951

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit

margin % 13.8% 20.0% 20.4% 12.6% 0.0% 14.2%

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

2. Segmental analysis - continued

For the year

ended

30 September Aerospace Life Scientific

2012 & Defence Sciences Industrial Research Corporate Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Total revenue 15,440 5,731 39,067 3,912 - 64,150

Inter and intra-division - - (3,278) (21) - (3,299)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

External revenue 15,440 5,731 35,789 3,891 - 60,851

Divisional

expenses (12,712) (4,283) (28,045) (3,571) (1,119) (49,730)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

EBITDA(1) 2,728 1,448 7,744 320 (1,119) 11,121

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

EBITDA % 17.7% 25.3% 21.6% 8.2% 0.0% 18.3%

Depreciation

& amortisation (548) (231) (1,177) (88) (344) (2,388)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit/(loss)

before amortisation

of acquired

intangible

assets 2,180 1,217 6,567 232 (1,463) 8,733

Acquired intangible

assets amortisation - - - - (881) (881)

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit/(loss) 2,180 1,217 6,567 232 (2,344) 7,852

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

Operating profit

margin % 14.1% 21.2% 18.3% 6.0% 0.0% 12.9%

-------------------------- ----------- ---------- ----------- ----------- ---------- ---------

(1)EBITDA = Earnings before interest, tax, depreciation and

amortisation

All of the amounts recorded are in respect of continuing

operations.

Analysis of revenue by destination and net assets by

origination:

for year ended 30 September

Revenue Net Assets

---------------- ----------------

2013 2012 2013 2012

GBP000 GBP000 GBP000 GBP000

------- ------- ------- -------

United Kingdom 9,481 8,644 26,840 20,660

North America 30,213 28,443 37,975 37,852

Continental

Europe 13,821 14,343 120 54

Asia Pacific

& Other 9,737 9,421 4 -

Total 63,252 60,851 64,939 58,566

------- ------- ------- -------

3. Income tax expense

The income tax expense for the year to 30 September 2013 is set

out below.

2013 2012

GBP000 GBP000

--------

Current taxation

UK Corporation tax 1,263 1,264

Overseas tax 238 491

Adjustments in respect

of prior year tax charge (304) (395)

-------- --------

Total current tax 1,197 1,360

Deferred tax

Origination and reversal

of temporary differences 1,099 32

Adjustments in respect

of prior year deferred

tax (188) 307

Impact of tax rate change

to 23% (2012: 23%) 43 54

--------

Total deferred tax 954 393

Total income tax expense

per income statement 2,151 1,753

-------- --------

4. Earnings per share

The calculation of earnings per 20p Ordinary Share is based on

the profit for the period using the weighted average number of

Ordinary Shares in issue during the period as a divisor. The

weighted average number of shares for the year ending 30 September

is given below:

2013 2012

Number Number

Number of shares used for

basic earnings per share 22,376,650 21,860,241

Dilutive shares 1,097,927 1,531,993

Number of shares used for

dilutive earnings per share 23,474,577 23,392,234

----------- -----------

A reconciliation of the earnings used in the earnings per share

calculation is set out below:

2013 2012

pence

pence per

GBP000 per share GBP000 share

------- ----------- ------- -------

Basic earnings per

share 6,192 27.7 5,323 24.4p

Acquired intangible

assets amortisation

(net of tax) 650 2.9p 662 3.0p

Acquisition costs (net

of tax) 122 0.5p - -

Restructuring costs

(net of tax) 206 0.9p 180 0.8p

------- ----------- ------- -------

Total adjustments net

of income tax expense: 978 4.3p 842 3.8p

------- ----------- ------- -------

Adjusted basic earnings

per share 7,170 32.0p 6,165 28.2p

------- ----------- ------- -------

Diluted earnings per

share 6,192 26.4p 5,323 22.8p

------- ----------- ------- -------

Adjusted diluted earnings

per share 7,169 30.5p 6,165 26.4p

------- ----------- ------- -------

Basic and diluted earnings per share before amortisation and

adjustments have been shown because, in the opinion of the

Directors, it provides a useful measure of the trading performance

of the Group.

5. Dividend

2013 2012

GBP000 GBP000

-------- --------

Final 2012 dividend paid

in 2013: 3.2p per share.

(Final 2011 dividend paid

in 2012: 3.0p per share) 712 656

2013 Interim dividend paid:

2.3p per share (2012: 2.0p) 517 437

-------- --------

1,229 1,093

-------- --------

The Directors propose a final dividend of 4.0p per share making

the total dividend paid and proposed in respect of the 2013

financial year 6.3p (2012: 5.2p).

6. Cash generated from operating activities

2013 2012

GBP000 GBP000

-------- --------

Profit before income tax 8,343 7,076

Adjustments for:

- Amortisation of acquired

intangible assets 875 881

- Amortisation of other

intangible assets 168 296

- Depreciation 1,949 2,092

- Loss on disposal of property,

plant and equipment 91 48

- Share-based payment charges 341 471

- Finance income (15) (24)

- Finance costs 623 800

-------- --------

Total 4,032 4,564

Changes in working capital

- Increases in inventories (1,328) (1,465)

- (Increase)/decrease in

trade and other receivables (1,208) 1,351

- Decrease in trade and

other payables (538) (327)

- Increase/(decrease) in

provisions 829 (546)

-------- --------

Total (2,245) (987)

Cash generated from operating

activities 10,130 10,653

-------- --------

7. Events after the reporting date

The group acquired 100% of the share capital of Spanoptic

Limited a Glenrothes, Scotland, based manufacturer of precision

optical components for a gross consideration of GBP6.6m, funded

from existing cash and debt facilities on 15 October 2013.

On 26 November 2013 the group acquired 100% of the share capital

of Constelex Technology Enablers Limited, an Athens, Greece, based

designer and manufacturer of advanced photonic systems. The gross

consideration will be EUR650,000, comprising EUR400,000 in cash,

funded from existing cash and debt facilities, at completion,

followed by EUR250,000 in Gooch & Housego shares once

activities are relocated to the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UGGRPPUPWGCP

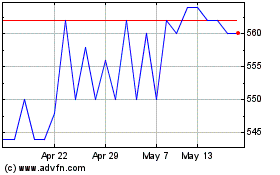

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024