Gooch & Housego PLC - Interim Results

June 14 2000 - 3:02AM

UK Regulatory

RNS Number:2202M

Gooch & Housego PLC

14 June 2000

GOOCH & HOUSEGO PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 MARCH 2000

Gooch & Housego PLC, the specialist manufacturer of precision

optical components and bespoke glass engineering items,

acousto-optic devices and instruments for measuring optical

radiation, today announces interim results for the six months

ended 31 March 2000.

Highlights

* Record results for the six months to 31 March 2000

* Operating profits increased by 35% to #1.32m (1999

#0.85m)

* Earnings per share increased by 41% to 4.5p (1999 : 3.2p)

* Record order book with increase customer demand for

acousto-optics

* Development of a new range of crystals by CCI

* Interim dividend increased to 0.75p (1999 : 0.6p)

Archie Gooch, Chairman of Gooch & Housego commented, "The

difficulties experienced last year are now resolved. Our

Balance Sheet is strong, we continue to generate cash and are

well placed to finance new opportunities as they arise. The

results for the six months are most encouraging and with the

second half starting well I am confident that the growth shown

to date will be maintained".

For further information :

Archie Gooch/Ian Bayer 01460 52271

Gooch & Housego PLC

Tim Thompson 0207 466 5000

Buchanan Communications

GOOCH & HOUSEGO PLC

CHAIRMAN'S STATEMENT

I am pleased to report record results for the Group for the

six months ended 31 March 2000. The trading results show a

significant increase in profits over the same period last year

with each of the Group Companies contributing to the

improvement. I would like to thank all those employed by the

Gooch & Housego Group, for without their support these results

could not have been achieved.

Results

Overall Group results for the six months show turnover

increasing by 40% to #5.98m (1999 : #4.25m), operating profit

55% higher at #1.32m (1999 : #0.85m) and profit before tax

rising 43% to #1.19m (1999 : #0.83m). Earnings per share

improved by 41% to 4.5p (1999 : 3.2p).

Dividends

As a measure of the Board's confidence in the current and

future prospects of the Group, it is declaring an increased

interim dividend of 0.75p (1999 : 0.6p). The dividend will be

paid on 27th July 2000 to all shareholders on the register on

30 June 2000.

United Kingdom

Gooch & Housego PLC

Turnover for the period was up 16% at #2.65m (1999 : #2.29m)

while operating profits improved to #0.67m. The order book has

shown an appreciable increase from #1.6m at the start of the

financial year to its present value at #2.8m. The majority of

the increase is in annual acousto-optic contracts with

particularly high demand for our Q-switch. We are receiving

many new orders including some from China and the Far East as

well as our core overseas markets. The rest of the UK

business is performing satisfactorily, and we expect that

orders for two large contracts, which are currently on hold,

will be placed during this year.

In my last report I mentioned that the fibre-optic switch

development had made progress and considerable effort has been

expended. Whilst we continue to research this project, I must

re-state that we have not yet reached the stage where the

switch can be developed as a commercial product.

United States

Cleveland Crystals Inc

Cleveland Crystals Inc (CCI) continues to prove to be an

excellent acquisition for the Group. The contracts for the

growth and fabrication of crystals with the US Department of

Energy, under the guidance of the University of California's

National Ignition Facilty (NIF), are continuing to enhance

both sales and profits. The N.I.F. programme at Lawrence

Livermore National Laboratories (LLNL) is financed with a

$1.3 billion investment, and to emphasise the importance of

our work, LLNL have invested $6m in specialised equipment

located with CCI. In addition I have recently visited LLNL and

I believe that the Group is well placed to receive orders for

a range of optical components. Other countries throughout the

world are also working on their own comparable programmes in

co-operation with LLNL and this could lead to considerable

business for CCI in crystal growth and highly technical

finishing.

I continue to discuss with CCI the diversification of their

products. The development of a new range of crystals for

general commercial users has been well received and future

sales prospects for CCI are very encouraging. The manufacture

and sale of pockel cells, (electro-optic Q-switches) continues

to show growth and remains a key contributor to the Company's

profits.

Since the acquisition of CCI a new management structure has

been formed under the Presidency of Jeff Luken, and on behalf

of the Board I thank him, his staff and employees for their

continued support, which augurs well for the future.

Optronic Laboratories Inc

The Company has performed satisfactorily for the six months to

31 March 2000 with sales increasing from #1.32m to #1.41m.

Operating profits of #101,000 were achieved in the period

compared to the full year contribution to 30 September 1999 of

#66,000. The optics facility is now showing signs of gaining

significant customer orders and will soon be making a material

contribution to the profits of OLI. The efforts of the

President Steve Denomme continue to be appreciated.

Prospects

The difficulties experienced last year are now resolved. Our

Balance Sheet is strong, we continue to generate cash and are

well placed to finance new opportunities as they arise.

The results for the six months are most encouraging and with

the second half starting well I am confident that the growth

shown to date will be maintained.

Gooch & Housego PLC

Archie Gooch MBE JP

Executive Chairman

14 June 2000

Unaudited Group Profit and Loss Account

for the six months ended 31 March 2000

6 months 6months 12 months

ended ended ended

31 March 31 March30 September

2000 1999 1999

(Unaudited) (Unaudited) (audited)

# 000 #000 # 000

______________________________________________________________

Turnover 5976 4254 10377

-----------------------------

Operating profit 1318 852 2001

Net interest payable (130) (19) (150)

-----------------------------

Profit on ordinary activities

before taxation 1188 833 1851

Taxation (433) (291) (756)

-----------------------------

Profit on ordinary activities

after taxation 755 542 1095

Dividends (127) (101) (321)

-----------------------------

Retained profit 628 441 774

-----------------------------

Earnings per share 4.5p 3.2p 6.5p

Dividends per share 0.75p 0.6p 1.9p

-----------------------------

Statement Of Total Recognised Gains And Losses

Profit for the financial period 755 542 1095

Currency translation difference

on foreign Currency net

investments 94 112 16

______________________________________________________________

Total gains and losses for

the financial period 849 654 1111

______________________________________________________________

Unaudited Group Balance Sheet

as at 31st March 2000

As at As at As at

31 March 31 March 30 September

2000 1999 1999

(Unaudited) (Unaudited) (audited)

# 000 #000 # 000

______________________________________________________________

Fixed assets

Intangible assets 3250 3412 3336

Tangible assets 3598 3337 3497

----------------------------

6848 6749 6833

----------------------------

Current assets

Stock 1602 1777 1440

Debtors 2688 2302 3238

Cash at Bank and in hand 1000 735 269

----------------------------

5290 4814 4947

----------------------------

Creditors

Amounts falling due within

one year (2781) (2443) (2806)

-----------------------------

Net current assets 2509 2371 2141

-----------------------------

Total assets less current

liabilities 9357 9120 8974

-----------------------------

Creditors

Amounts falling due in more

than one year (2573) (3299) (2916)

-----------------------------

6784 5821 6058

=============================

Capital and reserves

Called up share capital 3381 3381 3381

Share premium 1113 1113 1113

Revaluation reserve 308 308 308

Profit and Loss account 1982 1019 1256

-----------------------------

6784 5821 6058

=============================

Consolidated Cash Flow Statement

For the six months ended 31 March 2000

6 months 6months 12 months

ended ended ended

31 March 31 March 30 September

2000 1999 1999

Note (Unaudited) (Unaudited) (audited)

# 000 #000 # 000

Cash flow from

operating activities (i) 2157 672 1592

Returns on investments

and servicing of finance

Interest received 14 31 41

Interest paid (143) (33) (173)

Interest element of hire

purchase contracts (1) (2) (1)

______________________________________________________________

Net cash outflow from

returns on Investments

and servicing of finance (130) (4) (133)

Taxation (78) (51) (522)

Overseas tax paid (230) (40) (251)

______________________________________________________________

Cash outflow from taxation (308) (91) (773)

Capital expenditure and

financial investment

Acquisition of subsidiary - (4089) (4272)

Cash acquired on acquisition - 55 55

Purchase of tangible fixed

assets (215) (245) (612)

Sale of tangible fixed assets - 3 15

______________________________________________________________

Net cash outflow from capital

expenditure and Financial

investment (215) (4276) (4814)

Equity dividends paid (220) (203) (304)

______________________________________________________________

Net cash inflow(outflow)

before financing 1284 (3902) (4432)

Financing

New bank loans - 3338 3411

Repayment of bank loan (421) (105) (202)

Hire purchase repayment (34) (28) (49)

______________________________________________________________

Net cash (outflow)/inflow

from financing (455) 3205 3160

Increase/(Decrease)

in cash in the period (ii) 829 (697) (1272)

______________________________________________________________

Notes To The Cash Flow Statement

(i) Reconciliation of operating profit to operating cash

flows

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2000 1999 1999

(Unaudited) (Unaudited) (audited)

# 000 #000 # 000

Operating profit 1318 852 2001

Depreciation 209 165 362

Amortisation of goodwill 86 28 115

Loss on sale of fixed assets 22 - -

(Increase)/Decrease in stock (224) (115) 203

Decrease/(increase) in debtors 661 (282) (1290)

Increase/(decrease) in creditors 85 24 201

______________________________________________________________

2157 672 1592

______________________________________________________________

(ii) Reconciliation of net

cash inflow to movement

in net debt

Increase/(Decrease) in cash

in the period 829 (697) (1272)

Cash outflow/(inflow) from

decrease/(increase) in debt

and lease financing 455 133 (3160)

______________________________________________________________

Changes in net debt resulting

from cashflows 1284 (564) (4432)

New bank loans - (3338) -

New hire purchase and finance

lease contracts - - (66)

Translation difference 13 (17) 23

______________________________________________________________

Movement in net debt in the

period 1297 (3919) (4475)

Net debt at 1 October 1999 (3582) 893 893

______________________________________________________________

Net debt at 31 March 2000 (2285) (3026) (3582)

______________________________________________________________

(iii) Analysis of net (debt)/funds

At At

1 October Exchange 31 March

1999 Cash flow movement 2000

# 000 # 000 # 000 # 000

______________________________________________________________

Cash in hand at bank 269 715 16 1000

Overdrafts (114) 114 - -

______________________________________________________________

155 829 16 1000

Debt due after

1 year (2900) 329 (2) (2573)

Debt due within

1 year (763) 92 (1) (672)

Hire Purchase (74) 34 - (40)

______________________________________________________________

(3582) 1284 13 (2285)

______________________________________________________________

Notes to the Financial statements

for the six months ended 31 March 2000

1. The summarised results for the six months ended 31 March

2000 and the comparative figures for the six months ended 31

March 1999 are unaudited. The figures for the year ended 30

September 1999 have been extracted from the group statutory

accounts, which have been filed with the Registrar of

Companies and contain an unqualified audit report.

2. Taxation for the six months ended 31 March 2000 and 31

March 1999 has been estimated at prevailing tax rates.

Taxation for the year ended 30 September 1999 is the actual

provision for that year.

3. Earnings per share have been calculated on the total of

16,904,162 shares, being the number of shares in issue

throughout the periods reported above.

4. All of the amounts above are in respect of continuing

operations.

5. Accounting policies are consistent with those applied in

previous years and are as set out in the Group's audited

accounts at 30 September 1999.

6. The interim dividend will be paid on 27 July 2000 to

shareholders on the register at close of business on 30 June

2000.

7. Copies of the Interim Statement will be despatched to

shareholders during the week commencing 19 June 2000 and are

available from the Company Secretary, Gooch & Housego PLC, The

Old Magistrates Court, Ilminster, Somerset. TA19 0AB.

END

IR IFFLFRLIVLII

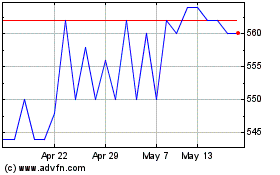

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024