Genel Energy PLC (GENL)

Genel Energy PLC: Half-Year Results

02-Aug-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

2 August 2023

Genel Energy plc

Unaudited results for the period ended 30 June 2023

Genel Energy plc ('Genel' or 'the Company') announces its unaudited results for the six months ended 30 June 2023.

Paul Weir, Chief Executive of Genel, said:

"The closure of the Iraq-Türkiye pipeline on 25 March 2023 has resulted in minimal sales and no payments from the KRG

since that date. This has materially impacted both our current and expected cash flows, with the current period seeing

a free cash out flow.

Approval of the Iraqi budget in June put in place a framework for the restart of payments and exports, with production

from Kurdistan incorporated in the budget, and this was an important step. Discussions are now ongoing between Iraq and

Türkiye regarding the commercial and political arrangements that would enable the resumption of exports.

As we await a positive outcome to discussions between Iraq and Türkiye, we retain a material cash position, prioritised

for investment in new assets, and remain clear and determined on our direction of travel. We have accelerated the

ongoing reshaping of our portfolio, organisation, and plans, and we continue to diligently review assets and businesses

that can support delivery of the business that we have framed over the past 12 months.

Given the USD170 million impact so far that the lack of payments and revenue is expected to have on our liquidity at

year-end, and with no clear line of sight on when either pipeline exports or payments will restart, we have taken the

decision to suspend the dividend. We remain committed to building a business with predictable, repeatable, and

diversified cash flows, which would ultimately support the re-establishment of a dividend programme."

Results summary (USD million unless stated)

H1 2023 H1 2022 FY 2022

Average Brent oil price (USD/bbl) 80 108 101

Production (bopd, working interest) 13,440 30,420 30,150

Revenue 51.3 245.6 432.7

EBITDAX1 19.4 212.3 361.6

Depreciation and amortisation (27.2) (84.4) (149.2)

Net impairment/write-off of oil and gas assets (17.7) - (201.3)

Net (Impairment)/reversal of impairment of receivables (9.9) 12.8 8.2

Exploration expense (0.3) - (1.0)

Operating (loss) / profit (35.7) 140.7 18.3

Cash flow from operating activities 39.2 216.3 412.4

Capital expenditure 47.5 74.7 143.1

Free cash flow2 (35.1) 128.7 234.8

Cash 425.0 412.1 494.6

Total debt 273.0 280.0 274.0

Net cash / (debt)3 158.2 141.3 228.0

Basic (LPS) / EPS (¢ per share) (14.6) 45.4 (2.6)

Dividends declared for the period (¢ per share) - 6 18 1. EBITDAX is operating (loss)/profit adjusted for the add back of depreciation and amortisation, impairmentof property, plant and equipment, impairment of intangible assets and impairment/reversal of impairment ofreceivables 2. Free cash flow is reconciled on page 7 3. Reported cash less debt reported under IFRS (page 7)

Summary

-- The prolonged closure of the Iraq-Türkiye pipeline has

materially impacted production, which averaged13,440 bopd in H1 (H1

2022: 30,420)

-- Two payments totalling USD61 million were received from the

Kurdistan Regional Government ('KRG') in theperiod, with USD110

million now overdue

-- Given the loss of cash flow in the period and the lack of

visibility on both the timing of pipelineexports resuming and the

re-establishment of a reliable record of payments, Genel has

suspended its dividendprogramme

-- In addition, the Company will assess the timing of further

investment in Somaliland following thecompletion of civil

engineering work, based on the financial outlook at the time

-- Work on assessing the future plans for Sarta, with a goal of

making operations profitable, has been mademore challenging by the

investment environment, and consequently Genel has informed the

Ministry of NaturalResources of its intention to surrender the

asset and terminate the Sarta PSC

-- Significant cash balance of USD425 million at 30 June 2023

(USD496 million at 31 March 2023) is prioritisedfor addition of new

assets

-- Net cash of USD158 million at 30 June 2023 (USD229 million at

31 March 2023)? Total debt of USD273 million at 30 June 2023

(USD274 million at 31 March 2023)

-- A socially responsible contributor to the global energy mix:?

Zero lost time injuries ('LTI') and zero tier one loss of primary

containment events at Genel andTTOPCO operations ? Three million

work hours since the last LTI

Outlook

-- As a consequence of the reduction in operational activity,

Genel has right-sized the organisation andreduced spend compared to

expectations at the start of 2023? Genel currently expects full

year capital expenditure to be c.USD70 million (original guidance

USD100-125million), with two thirds of this already spent

-- Limited local sales are ongoing from the Tawke licence

-- Genel continues to actively review and work up opportunities

to invest our cash to build a business thatdelivers resilient,

reliable, and diversified cash flows that support a repeatable

dividend programme in thelong-term

-- The London-seated international arbitration regarding Genel's

claim for substantial compensation from theKRG following the

termination of the Miran and Bina Bawi PSCs is progressing. The

trial remains scheduled forFebruary 2024

Enquiries:

Genel Energy

+44 20 7659 5100

Andrew Benbow, Head of Communications

Vigo Consulting

+44 20 7390 0230

Patrick d'Ancona

Genel will host a live presentation on the Investor Meet Company

platform on Wednesday 2 August at 1000 BST. The presentation is

open to all existing and potential shareholders. Questions can be

submitted at any time during the live presentation. Investors can

sign up to Investor Meet Company for free and add to meet Genel

Energy PLC via: https://

www.investormeetcompany.com/genel-energy-plc/register-investor

This announcement includes inside information.

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with the oil & gas exploration and production

business. While the Company believes the expectations reflected

herein to be reasonable in light of the information available to

them at this time, the actual outcome may be materially different

owing to factors beyond the Company's control or within the

Company's control where, for example, the Company decides on a

change of plan or strategy. Accordingly, no reliance may be placed

on the figures contained in such forward looking statements. The

information contained herein has not been audited and may be

subject to further review.

CEO STATEMENT

The first half of the year has been dominated by the lengthy

outage of the Iraq-Türkiye export pipeline, which has caused the

suspension of both our production and payments from the Kurdistan

Regional Government. Only two payments were received in the period

before the pipeline was shut. This has exacerbated our receivable

position and has led to a material decline in our expected cash

flows. Previous expectations for our year-end 2023 cash position

have been impacted by around USD170 million so far (USD110 million

outstanding for oil produced that was expected to be received this

year, and a loss of cash as a result of the lack of production for

the months from April to July 2023).

This lack of cash receipts has led to the suspension of the

dividend. The Company is committed to building a business with

predictable, repeatable, and diversified cash flows that would

support the re-establishment of a dividend programme.

We continue to see positive news flow about a potential restart

and it is reported that there has been inter-government dialogue,

but there remains no clear visibility on exactly when exports will

resume.

We remain of the belief that the shut-down will not continue in

the long-term, and the Prime Minister of the Kurdistan Region of

Iraq ('KRI') has committed to International Oil Companies operating

in Kurdistan that the terms under PSCs will not be reviewed, and

that all amounts owed will be paid.

The Federal Government of Iraq budget has been approved, which

puts in place a framework that should enable exports to restart

quickly once agreement has been reached between Türkiye and Iraq.

The budget states that Kurdistan production will be sold by the

Iraqi State Oil Marketing Organisation ('SOMO') and, in return, the

KRG will receive budget payments from the Federal Government of

Iraq. While agreements are in place on paper, we await to see how

they are practically implemented on the ground.

Given the ongoing uncertainty, we have made decisions to

minimise our spend, while accelerating our cost-reduction and

efficiency drive that was already underway.

Further investment in Sarta, already challenging from a

technical and economic point of view, is now not feasible, and we

have informed the Ministry of Natural Resources of our intention to

surrender the licence and terminate the PSC. This is a

disappointing outcome for an asset of which the field partners had

great expectations. The team did a great job in bringing it to

production quickly and professionally, but the geology was not what

had been expected, and the licence has been impaired

accordingly.

While we are confident that exports to Ceyhan will resume in the

future, we are focused on preserving maximum liquidity available to

invest in new production assets in order to diversify and increase

the resilience of our cash flows. This is of even greater

importance following the decision to exit Sarta.

We have a clear business model and plan and a remaining

liquidity balance that supports cash generative diversification of

the business. We have a dedicated team in place analysing

opportunities that will take the business in the right direction by

adding near-term income, diversifying our portfolio and delivering

reliable and repeatable cash flows.

OPERATING REVIEW

Production

Production in the first half of 2023 was negatively impacted by

the closure of the Iraq-Türkiye pipeline. Production continued

until storage capacity at fields was reached. For Tawke this was at

the end of March, Sarta 3 April, and Taq Taq 22 May.

Upon reopening of the export pipeline, Genel fields have the

potential to rapidly resume production. Sarta will remain shut-in

as Genel relinquishes the asset.

Gross production Net production Gross production Net production

(bopd)

Q2 2023 Q2 2023 H1 2023 H1 2023

Tawke 0 0 46,970 11,740

Taq Taq 1,884 829 2,760 1,220

Sarta 48 14 1,605 480

Total 1,932 843 51,335 13,440

PRODUCING ASSETS

Tawke PSC (25% working interest)

Gross production from the Tawke licence averaged 93,880 bopd

during the first quarter of 2023, with the Peshkabir field

contributing 49,480 bopd (59,360 bopd in Q4 2022) and the Tawke

field 44,400 bopd (47,140 bopd in Q4 2022) during this period.

Production in Q1 2023 was in line with expectations, and down

from the previous quarter due to planned well workovers initiated

in February. There was no production in Q2 due to the export

pipeline being closed.

Given the uncertain timing of export resumption and,

importantly, of payments by the KRG for previous oil sales, the

operator DNO (in full alignment with Genel) scaled back spend,

including drilling. While five wells were completed and another

three wells spudded in Q1 2023, no new wells have been spudded

since and the number of active rigs at the Tawke licence will drop

from four at the start of 2023 to none in the second half of the

year.

Limited local sales began in June, selling stored oil to the

local market.

Sarta (30% working interest)

Genel had previously stated that the Company's focus was on

making ongoing production from Sarta profitable. Given the

investment required to achieve this, and the current uncertainty

over a resumption of payments, Genel has informed the Ministry of

Natural Resources of its intention to surrender the asset and

thereby terminate the Sarta PSC.

Taq Taq (44% working interest, joint operator)

Prior to the closure of the Iraq-Türkiye pipeline, production

from Taq Taq was in line with expectations, having averaged 3,610

bopd in Q1. In line with Genel's focus on reducing costs, and lack

of clarity regarding the resumption of payments, the planned

drilling of a well at Taq Taq in 2023 has now been dropped.

PRE-PRODUCTION ASSETS

Somaliland

The Environmental, Social and Health Impact Assessment is now

complete, and civil work continues for the drilling of the Toosan-1

well on the highly prospective SL10B13 block (51% working interest

and operator).

Once civil works are complete, in line with Genel's focus on

reducing costs, the Company will assess timing of further

investment based on the financial outlook at the time.

Morocco

The farm-out programme on the Lagzira block (75% working

interest and operator) is ongoing.

FINANCIAL REVIEW

The ongoing closure of the Iraq-Türkiye pipeline resulted in no

sales for the period of pipe shutdown from the end of March to the

end of the period.

(all figures USD million) H1 2023 H1 2022 FY 2022

Brent average oil price USD80/bbl USD108/bbl USD101/bbl

Revenue 51.3 245.6 432.7

Production costs (21.7) (24.1) (51.1)

Cost recovered production asset capex (39.7) (41.3) (85.9)

Production business net (expense) / income after cost recovered capex (10.1) 180.2 295.7

G&A (excl. non-cash) (9.3) (8.6) (19.2)

Net cash interest1 (2.2) (12.5) (19.2)

Working capital 42.7 (38.2) (9.7)

Payments for deferred receivables 16.5 46.3 94.4

Payment delays (49.5) - (44.4)

Free cash flow before investment in growth (11.9) 167.2 297.6

Pre-production capex (7.8) (33.4) (57.2)

Working capital and other (15.4) (5.1) (5.6)

Free cash flow (35.1) 128.7 234.8

Dividend paid (33.5) (32.3) (47.9)

Other - 2.0 -

Purchases of own bonds (1.0) - (6.0)

Net change in cash (69.6) 98.4 180.9

Cash 425.0 412.1 494.6

1 Net cash interest is bond interest payable less bank interest

income (see note 5)

Financial priorities of 2023

The table below summarises our progress against the 2023

financial priorities of the Company as set out in our 2022

results.

2023 financial priorities Progress

-- In the face of a reduction in

-- Maintain business resilience and balance sheet strength income, capital expenditure materially

reduced, and interim dividend suspended

-- Put our significant cash balance to work, earning -- Genel continues to actively screen

appropriate returns to deliver value to shareholders primarily and work up opportunities

through our dividend programme and diversify our cash generation -- Final dividend paid

-- Deliver the 2023 work programme on time and on budget,

and continue simplification of the business with a focus on

optimisation and cost control and investment in business -- Work programme reduced due to

improvement external conditions

Financial results

Income statement

(all figures USD million) H1 2023 H1 2022 FY 2022

Brent average oil price USD80/bbl USD108/bbl USD101/bbl

Production (bopd, working interest) 13,440 30,420 30,150

Profit oil 18.2 88.4 149.2

Cost oil 31.3 70.8 141.1

Override royalty 1.8 86.4 142.4

Revenue 51.3 245.6 432.7

Production costs (21.7) (24.1) (51.1)

G&A (excl. depreciation and amortisation) (10.2) (9.2) (20.0)

EBITDAX 19.4 212.3 361.6

Depreciation and amortisation (27.2) (84.4) (149.2)

Exploration expense (0.3) - (1.0)

Net impairment / write-off of oil and gas assets (17.7) - (201.3)

Net (impairment) / reversal of impairment of receivables (9.9) 12.8 8.2

Net finance expense (5.0) (14.6) (25.4)

Income tax expense - - (0.2)

(Loss) / Profit (40.7) 126.1 (7.3)

H1 2023 production of 13,440 bopd is reduced from the

comparative period (H1 2022: 30,420 bopd) because of the pipeline

closure. This has resulted in a reduction in revenue from USD246

million to USD51 million alongside the change in pricing from Brent

to the realised sales price for Kurdistan blend crude ('KBT')

starting from September 2022 and the completion of Tawke overriding

royalty by July 2022.

Production costs of USD22 million decreased from the prior

period (H1 2022: USD24 million), with cost per barrel USD9.0/ bbl

in 2023 (H1 2022: USD4.4/bbl), principally caused by pipeline

closure, fixed costs, and Sarta being loss-making.

Corporate cash costs were USD9 million (H1 2022: USD9 million),

in line with previous period.

The decrease in revenue resulted in a similar decrease to

EBITDAX, which was USD19 million (H1 2022: USD212 million). EBITDAX

is presented in order to illustrate the cash profitability of the

Company and excludes the impact of costs attributable to

exploration activity, which tend to be one-off in nature, and the

non-cash costs relating to depreciation, amortisation, impairments

and write-offs.

Depreciation of USD24 million (H1 2022: USD56 million) and Tawke

intangibles amortisation of USD3 million (H1 2022: USD28 million)

decreased due to lower production and pipeline closure.

The Company has reported an impairment expense of USD18 million

relating to Sarta. A net impairment expense of USD10 million has

been recognised relating to the expected credit loss on overdue

receivables. Further explanation is provided in note 2 to the

financial statements.

Interest income of USD11 million (H1 2022: USD0.5 million) has

significantly increased as a result of the increase in interest

rates, in turn reducing our cost of debt. Bond interest expense of

USD13 million (H1 2022: USD13 million) was in line with previous

period. Other finance expense of USD3 million (H1 2022: USD2

million) related to non-cash discount unwinding on provisions.

In relation to taxation, under the terms of KRI production

sharing contracts, corporate income tax due is paid on behalf of

the Company by the KRG from the KRG's own share of revenues,

resulting in no corporate income tax payment required or expected

to be made by the Company. Tax presented in the income statement

was related to taxation of the service companies (H1 2023: nil, H1

2022: nil).

Capital expenditure

Capital expenditure was reduced to USD48 million (H1 2022: USD75

million), with spend on production and pre-production assets

combined of USD44 million, and exploration assets of USD4

million:

(all figures USD million) H1 2023 H1 2022 FY 2022

Cost recovered production capex 39.7 41.4 85.9

Pre-production capex - oil 3.8 27.0 47.5

Other exploration and appraisal capex 4.0 6.3 9.7

Capital expenditure 47.5 74.7 143.1

Cash flow, cash, net cash and debt

Gross proceeds received totalled USD61 million (H1 2022: USD254

million).

(all figures USD million) H1 2023 H1 2022 FY 2022

Brent average oil price USD80/bbl USD108/bbl USD101/bbl

EBITDAX 19.4 212.3 361.6

Working capital 19.8 4.0 50.8

Operating cash flow 39.2 216.3 412.4

Producing asset cost recovered capex (37.9) (33.1) (77.8)

Development capex (16.0) (22.2) (50.4)

Exploration and appraisal capex (6.1) (17.7) (20.0)

Interest and other (14.3) (14.6) (29.4)

Free cash flow (35.1) 128.7 234.8

Free cash flow is presented in order to illustrate the free cash

generated for equity. Free cash outflow was USD35 million (H1 2022:

USD129 million inflow) with an overall decrease due to delay in

proceeds and lower Brent.

(all figures USD million) H1 2023 H1 2022 FY 2022

Free cash flow (35.1) 128.7 234.8

Dividend paid (33.5) (32.3) (47.9)

Other - 2.0 -

Bond repayment (1.0) - (6.0)

Net change in cash (69.6) 98.4 180.9

Opening cash 494.6 313.7 313.7

Closing cash 425.0 412.1 494.6

Debt reported under IFRS (266.8) (270.8) (266.6)

Net cash / (debt) 158.2 141.3 228.0

The 2025 bonds have two financial covenant maintenance

tests:

Financial covenant Test H1 2023

Equity ratio (Total equity/Total assets) > 40% 53%

Minimum liquidity > USD30m USD425m

Net assets

Net assets at 30 June 2023 were USD457 million (31 December

2022: USD528 million) and consist primarily of oil and gas assets

of USD330 million (31 December 2022: USD327 million), net trade

receivables of USD95 million (31 December 2022: USD117 million) and

net cash of USD158 million (31 December 2022: USD228 million).

Liquidity / cash counterparty risk management

The Company monitors its cash position, cash forecasts and

liquidity on a regular basis. The Company holds surplus cash in

treasury bills or on time deposits with a number of major financial

institutions. Suitability of banks is assessed using a combination

of sovereign risk, credit default swap pricing and credit

rating.

Going concern

The Directors have assessed that the Company's forecast

liquidity provides adequate headroom over forecast expenditure for

the 12 months following the signing of the half-year condensed

consolidated financial statements for the period ended 30 June 2023

and consequently that the Company is considered a going

concern.

The Company is in a net cash position with no near-term maturity

of liabilities.

Principal risks and uncertainties

The Company is exposed to a number of risks and uncertainties

that may seriously affect its performance, future prospects or

reputation and may threaten its business model, future performance,

solvency or liquidity. The following risks are the principal risks

and uncertainties of the Company, which are not all of the risks

and uncertainties faced by the Company: the KRI natural resources

industry and regional risk, notably the current closure of the

Iraq-Türkiye pipeline and lack of oil export payments, as well as

the recovery of the USD110 million outstanding receivable; the

development and recovery of oil reserves; reserve replacement;

M&A activity; corporate governance failure; capital structure

and financing; local community support; the environmental impact of

oil and gas extraction; and health and safety risks. Further detail

on many of these risks was provided in the 2022 Annual Report.

Statement of directors' responsibilities

The directors confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union and that the interim management report

includes a true and fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on thecondensed set of

financial statements, and a description of the principal risks and

uncertainties for the remainingsix months of the financial year;

and

-- material related-party transactions in the first six months

and any material changes in the related-partytransactions described

in the last annual report.

The directors of Genel Energy plc are listed in the Genel Energy

plc Annual Report for 31 December 2022. A list of current directors

is maintained on the Genel Energy plc website:

www.genelenergy.com

By order of the Board

Paul Weir

CEO

1 August 2023

Luke Clements

CFO

1 August 2023

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with the oil & gas exploration and production

business. Whilst the Company believes the expectations reflected

herein to be reasonable in light of the information available to

them at this time, the actual outcome may be materially different

owing to factors beyond the Company's control or within the

Company's control where, for example, the Company decides on a

change of plan or strategy. Accordingly, no reliance may be placed

on the figures contained in such forward looking statements.

Condensed consolidated statement of comprehensive income

For the period ended 30 June 2023

Audited

Unaudited Unaudited

Year

6 months to 30 June 6 months to 30 June

2023 2022 to 31 Dec

2022

Note USDm USDm USDm

Revenue 3 51.3 245.6 432.7

Production costs 4 (21.7) (24.1) (51.1)

Depreciation and amortisation of oil assets 4 (27.2) (84.3) (149.1)

Gross profit 2.4 137.2 232.5

Exploration expense 4 (0.3) - (1.0)

Net write-off of intangible assets 4,8 - - (75.8)

Impairment of property, plant and equipment 4,9 (17.7) - (125.5)

Net (impairment) / reversal of impairment of 4,10 (9.9) 12.8 8.2

receivables

General and administrative costs 4 (10.2) (9.3) (20.1)

Operating (loss) / profit (35.7) 140.7 18.3

Operating (loss) / profit is comprised of:

EBITDAX 19.4 212.3 361.6

Depreciation and amortisation 4 (27.2) (84.4) (149.2)

Exploration expense 4 (0.3) - (1.0)

Net write-off of intangible assets 4,8 - - (75.8)

Impairment of property, plant and equipment 4,9 (17.7) - (125.5)

Net (impairment) / reversal of impairment of 4,10 (9.9) 12.8 8.2

receivables

Finance income 5 10.5 0.5 6.7

Bond interest expense 5 (12.7) (13.0) (25.9)

Other finance expense 5 (2.8) (2.1) (6.2)

(Loss) / Profit before income tax (40.7) 126.1 (7.1)

Income tax expense 6 - - (0.2)

(Loss) / Profit and total comprehensive (expense) / (40.7) 126.1 (7.3)

income

Attributable to:

Owners of the parent (40.7) 126.1 (7.3)

(40.7) 126.1 (7.3)

(Loss) / Earnings per ordinary share ¢ ¢

Basic 7 (14.6) 45.4 (2.6)

Diluted 7 (14.6) 45.0 (2.6)

(LPS) / EPS excluding impairments1 (4.7) 40.8 66.7

1(LPS) / EPS excluding impairment is profit / (loss) and total

comprehensive income / (expense) adjusted for the add back of net

impairment/write-off of oil and gas assets and net

impairment/reversal of impairment of receivables divided by

weighted average number of ordinary shares.

Condensed consolidated balance sheet

At 30 June 2023

Unaudited Unaudited

Audited 31 Dec 2022

30 June 2023 30 June 2022

Note USDm USDm USDm

Assets

Non-current assets

Intangible assets 8 80.4 165.1 79.1

Property, plant and equipment 9 249.2 362.4 248.1

329.6 527.5 327.2

Current assets

Trade and other receivables 10 100.6 165.0 121.7

Cash and cash equivalents 425.0 412.1 494.6

525.6 577.1 616.3

Total assets 855.2 1,104.6 943.5

Liabilities

Non-current liabilities

Trade and other payables (0.8) (3.5) (1.2)

Deferred income (5.9) (10.0) (6.5)

Provisions (53.7) (45.4) (52.2)

Interest bearing loans 11 (266.8) (270.8) (266.6)

(327.2) (329.7) (326.5)

Current liabilities

Trade and other payables (64.9) (91.8) (82.4)

Deferred income (6.5) (6.5) (6.8)

(71.4) (98.3) (89.2)

Total liabilities (398.6) (428.0) (415.7)

Net assets 456.6 676.6 527.8

Owners of the parent

Share capital 43.8 43.8 43.8

Share premium account 3,863.9 3,914.1 3,897.4

Accumulated losses (3,451.1) (3,281.3) (3,413.4)

Total equity 456.6 676.6 527.8

Condensed consolidated statement of changes in equity

For the period ended 30 June 2023

Share Share premium Accumulated losses Total equity

capital

USDm USDm USDm

USDm

At 1 January 2022 43.8 3,947.5 (3,410.2) 581.1

Profit and total comprehensive income - - 126.1 126.1

Contributions by and distributions to owners

Share-based payments - - 2.8 2.8

Dividends paid1 - (33.4) - (33.4)

At 30 June 2022 (Unaudited) 43.8 3,914.1 (3,281.3) 676.6

At 1 January 2022 43.8 3,947.5 (3,410.2) 581.1

Loss and total comprehensive expense - - (7.3) (7.3)

Contributions by and distributions to owners

Share-based payments - - 4.1 4.1

Dividends provided for or paid1 - (50.1) - (50.1)

At 31 December 2022 (Audited) and 1 January 2022 43.8 3,897.4 (3,413.4) 527.8

Loss and total comprehensive expense - - (40.7) (40.7)

Contributions by and distributions to owners

Share-based payments - - 3.0 3.0

Dividends provided for or paid1 - (33.5) - (33.5)

At 30 June 2023 (Unaudited) 43.8 3,863.9 (3,451.1) 456.6

1 The Companies (Jersey) Law 1991 does not define the expression

"dividend" but refers instead to "distributions". Distributions may

be debited to any account or reserve of the Company (including

share premium account).

Condensed consolidated cash flow statement

For the period ended 30 June 2023

Audited

Unaudited Unaudited

Note 31 Dec

30 June 2023 30 June 2022

2022

USDm USDm USDm

Cash flows from operating activities

(Loss) / Profit for the period / year (40.7) 126.1 (7.3)

Adjustments for:

Net finance expense 5 5.0 14.6 25.4

Taxation 6 - - 0.2

Depreciation and amortisation 28.5 85.9 152.0

Exploration expense 4 0.3 - 1.0

Net impairments, write-offs / (write-backs) 4 27.6 (12.8) 193.1

Other non-cash items (royalty income and share-based cost) (0.9) (3.7) (7.4)

Changes in working capital:

Decrease in trade receivables 12.5 11.8 47.2

Decrease / (Increase) in other receivables 0.8 (0.5) -

(Decrease) / Increase in trade and other payables (4.3) (5.5) 1.7

Cash generated from operations 28.8 215.9 405.9

Interest received 5 10.5 0.5 6.7

Taxation paid (0.1) (0.1) (0.2)

Net cash generated from operating activities 39.2 216.3 412.4

Cash flows from investing activities

Net payments of intangible assets (6.1) (17.3) (20.0)

Net payments of property, plant and equipment (53.9) (55.3) (128.2)

Net cash used in investing activities (60.0) (72.6) (148.2)

Cash flows from financing activities

Dividends paid to company's shareholders (33.5) (32.3) (47.9)

Bond repayment 11 (1.0) - (6.0)

Lease payments (1.7) - (3.8)

Interest paid (12.6) (13.0) (25.6)

Net cash used in financing activities (48.8) (45.3) (83.3)

Net (decrease) / increase in cash and cash equivalents (69.6) 98.4 180.9

Cash and cash equivalents at the beginning of the period / year 494.6 313.7 313.7

Cash and cash equivalents at the end of the period / year 425.0 412.1 494.6

Notes to the consolidated financial statements

1. Basis of preparation

Genel Energy Plc - registration number: 107897 (the Company), is

a public limited company incorporated and domiciled in Jersey with

a listing on the London Stock Exchange. The address of its

registered office is 12 Castle Street, St Helier, Jersey, JE2

3RT.

The half-year condensed consolidated financial statements for

the six months ended 30 June 2023 are unaudited and have been

prepared in accordance with the Disclosure and Transparency Rules

of the Financial Conduct Authority, with Article of 106 of the

Companies (Jersey) Law 1991 and with IAS 34 'Interim Financial

Reporting' as adopted by the European Union and were approved for

issue on 1 August 2023. They do not comprise statutory accounts

within the meaning of Article 105 of the Companies (Jersey) Law

1991. The half-year condensed consolidated financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2022, which have been prepared in

accordance with IFRS as adopted by the European Union. The same

accounting policies and methods of computation are followed in the

interim financial report as compared with the 31 December 2022

annual financial statements. The annual financial statements for

the year ended 31 December 2022 were approved by the board of

directors on 21 March 2023. The report of the auditors was

unqualified, did not contain an emphasis of matter paragraph and

did not contain any statement under the Article 113A of Companies

(Jersey) Law 1991. The financial information for the year to 31

December 2022 has been extracted from the audited accounts.

Items included in the financial information of each of the

Company's entities are measured using the currency of the primary

economic environment in which the entity operates (the functional

currency). The consolidated financial statements are presented in

US dollars to the nearest million (USD million) rounded to one

decimal place, except where otherwise indicated.

Going concern

The Company regularly evaluates its financial position, cash

flow forecasts and its compliance with financial covenants by

considering multiple combinations of oil price, discount rates,

production volumes, payments, capital and operational spend

scenarios.

The Company has reported cash of USD425.0 million, with no debt

maturing until the second half of 2025 and significant headroom on

both the equity ratio and minimum liquidity financial

covenants.

The Federal Iraq Supreme Court majority decision in February

2022 regarding the Kurdistan Oil and Gas Law (2007) and the

subsequent actions taken by the Federal Minister of Oil in Baghdad

Commercial Court did not have a significant impact on the Company's

operations.

However, since then, the International Chamber of Commerce in

Paris ruling in favour of Iraq in the long running arbitration case

against Türkiye concerning the Iraqi-Turkish pipeline agreement

signed in 1973, resulted in Türkiye suspending exports through the

pipeline since 25 March 2023. The KRG has consistently reiterated

that it will pay IOCs all that it owes and fulfil its contractual

commitments under the PSCs. Management assess that exports and

payments will resume and the going concern status of the business

remains appropriate. To test the resilience of the business model,

an extreme downside scenario is considered where no proceeds for

the overdue or new invoices until the end of HY 2024. Breach of

covenants risk is assessed as remote in this scenario.

Once production and payments restart, the Company's low-cost

assets and flexibility on commitment of capital mean that it is

resilient to low oil prices, with the only customer, the KRG,

demonstrating its ability to pay consistently in times of financial

stress.

Longer term, our low-cost, low-carbon assets, located in a

region where oil revenues provide a material proportion of funding

to the government and its people means that we are well positioned

to address the appropriate challenges and demands that climate

change initiatives are bringing to the sector. Given the footprint

and the benefit to society generated, we see our portfolio as being

well-positioned for a future of fewer and better natural resources

projects, while the global energy mix continues to require

hydrocarbons.

As a result, the Directors have assessed that the Company's

forecast liquidity provides adequate headroom over its forecast

expenditure for the 12 months following the signing of the

half-year condensed consolidated financial statements for the

period ended 30 June 2023 and consequently that the Company is

considered a going concern.

2. Summary of significant accounting policies

The accounting policies adopted in preparation of these

half-year condensed consolidated financial statements are

consistent with those used in preparation of the annual financial

statements for the year ended 31 December 2022.

The preparation of these half-year condensed consolidated

financial statements in accordance with IFRS requires the Company

to make judgements and assumptions that affect the reported

results, assets and liabilities. Where judgements and estimates are

made, there is a risk that the actual outcome could differ from the

judgement or estimate made. The Company has assessed the following

as being areas where changes in judgements or estimates could have

a significant impact on the financial statements.

Significant estimates

The following are the critical estimates that the directors have

made in the process of applying the Company's accounting policies

and that have the most significant effect on the amounts recognised

in the financial statements.

Estimation of hydrocarbon reserves and resources and associated

production profiles and costs

Estimates of hydrocarbon reserves and resources are inherently

imprecise and are subject to future revision. The Company's

estimation of the quantum of oil and gas reserves and resources and

the timing of its production, cost and monetisation impact the

Company's financial statements in a number of ways, including:

testing recoverable values for impairment; the calculation of

depreciation, amortisation and assessing the cost and likely timing

of decommissioning activity and associated costs. This estimation

also impacts the assessment of going concern.

Proved and probable reserves are estimates of the amount of

hydrocarbons that can be economically extracted from the Company's

assets. The Company estimates its reserves using standard

recognised evaluation techniques which are based on Petroleum

Resources Management System 2018. Assets assessed as having proven

and probable reserves are generally classified as property, plant

and equipment as development or producing assets and depreciated

using the units of production methodology. The Company considers

its best estimate for future production and quantity of oil within

an asset based on a combination of internal and external

evaluations and uses this as the basis of calculating depreciation

and amortisation of oil and gas assets and testing for impairment

under IAS 36.

Hydrocarbons that are not assessed as reserves are considered to

be resources and the related assets are classified as exploration

and evaluation assets. These assets are expenditures incurred

before technical feasibility and commercial viability is

demonstrable. Estimates of resources for undeveloped or partially

developed fields are subject to greater uncertainty over their

future life than estimates of reserves for fields that are

substantially developed and being depleted and are likely to

contain estimates and judgements with a wide range of

possibilities. These assets are considered for impairment under

IFRS 6.

Once a field commences production, the amount of proved reserves

will be subject to future revision once additional information

becomes available through, for example, the drilling of additional

wells or the observation of long-term reservoir performance under

producing conditions. As those fields are further developed, new

information may lead to revisions.

Assessment of reserves and resources are determined using

estimates of oil and gas in place, recovery factors and future

commodity prices, the latter having an impact on the total amount

of recoverable reserves.

Change in accounting estimate

Where the Company has updated its estimated reserves and

resources any required disclosure of the impact on the financial

statements is provided in the following sections. Estimation of oil

and gas asset values (note 8 and 9)

Estimation of the asset value of oil and gas assets is

calculated from a number of inputs that require varying degrees of

estimation. Principally oil and gas assets are valued by estimating

the future cash flows based on a combination of reserves and

resources, costs of appraisal, development and production,

production profile and future sales price and discounting those

cash flows at an appropriate discount rate.

Future costs of appraisal, development and production are

estimated taking into account the level of development required to

produce those reserves and are based on past costs, experience and

data from similar assets in the region, future petroleum prices and

the planned development of the asset. However, actual costs may be

different from those estimated.

Discount rate is assessed by the Company using various inputs

from market data, external advisers and internal calculations. A

post tax nominal discount rate of 14% derived from the Company's

weighted average cost of capital (WACC) is used when assessing the

impairment testing of the Company's oil assets at year-end. Risking

factors are also used alongside the discount rate when the Company

is assessing exploration and appraisal assets.

Estimation of future oil price and netback price

The estimation of future oil price has a significant impact

throughout the financial statements, primarily in relation to the

estimation of the recoverable value of property, plant and

equipment and intangible assets. It is also relevant to the

assessment of ECL and going concern.

The Company's forecast of average Brent oil price for future

years is based on a range of publicly available market estimates

and is summarised in the table below.

USD/bbl 2023 2024 2025 2026

HY2023 forecast 82 78 74 70

FY2022 forecast 82 78 74 70

HY2022 forecast 90 80 70 70

The netback price is used to value the Company's revenue, trade

receivables and its forecast cash flows used for impairment

testing. It is the aggregation of reference oil price average less

transportation costs, handling costs and quality adjustments.

Effective from 1 September 2022, sales have been priced by the MNR

under a new pricing formula based on the realised sales price for

Kurdistan blend crude ('KBT') during the delivery month, rather

than on dated Brent. The Company does not have direct visibility on

the components of the netback price realised for its oil because

sales are managed by the KRG, but invoices are currently raised for

payments on account using a netback price provided by the KRG. Due

to lack of this visibility, the Company has used an estimated

c.USD12/bbl discount on its Brent forecast based on the realised

price in 2023 for its impairment testing. A sensitivity analysis of

netback price on producing asset values has been provided in note

9.

Change in accounting estimate - Sarta PSC (note 9)

At 31 December 2022, the Company's assessment on the recoverable

value of the Sarta PSC had resulted with an impairment expense of

USD125.5 million following the disappointing results of the two

appraisal well and pilot production.

In 2023, the Company has informed the KRG of its intention to

exit the Sarta licence as it sees no line of sight on either making

the extant production profitable or the combination of macro and

asset specific conditions supporting risking of further capital.

Therefore, the remaining recoverable value of the Sarta PSC has

been reduced to nil and an impairment expense of USD17.7 million

has been booked at 30 June 2023.

Estimation of the recoverable value of deferred receivables and

trade receivables (note 10)

As of 31 December 2022, all amounts owed for deferred

receivables have been collected and as a result the Company has

released the expected credit loss (ECL) provision of USD10.8

million and booked another USD4.6 million ECL provision for the

outstanding five months of export payments.

As of 30 June 2023, the Company is owed six months of payments.

Management has compared the carrying value of trade receivables

with the present value of the estimated future cash flows based on

a discount rate of 14% and a number of collection scenarios. The

ECL is the weighted average of these scenarios and is recognised in

the income statement. The weighting is applied based on expected

repayment timing by considering the recovery of previous deferred

receivables. The result of this assessment is an ECL provision of

USD14.5 million. Sensitivity of the calculation to difference

scenarios has been provided in note 10.

Other estimates

The following are the other estimates that the directors have

made in the process of applying the Company's accounting policies

and that have effect on the amounts recognised in the financial

statements.

Decommissioning provision

Decommissioning provisions are calculated from a number of

inputs such as costs to be incurred in removing production

facilities and site restoration at the end of the producing life of

each field which is considered as the mid-point of a range of cost

estimation. These inputs are based on the Company's best estimate

of the expenditure required to settle the present obligation at the

end of the period inflated at 2% (2022: 2%) and discounted at 4%

(2022: 4%). 10% increase in cost estimates would increase the

existing provision by c.USD5 million and 1% increase in discount

rate would decrease the existing provision by c.USD4 million, the

combined impact would be c.USD1 million. The cash flows relating to

the decommissioning and abandonment provisions are expected to

occur between 2028 and 2036.

Taxation

Under the terms of KRI PSC's, corporate income tax due is paid

on behalf of the Company by the KRG from the KRG's own share of

revenues, resulting in no corporate income tax payment required or

expected to be made by the Company. It is not known at what rate

tax is paid, but it is estimated that the current tax rate would be

between 15% and 40%. If this was known, it would result in a gross

up of revenue with a corresponding debit entry to taxation expense

with no net impact on the income statement or on cash. In addition,

it would be necessary to assess whether any deferred tax asset or

liability was required to be recognised.

New standards

The following new accounting standards, amendments to existing

standards and interpretations are effective on 1 January 2023.

Amendments to IFRS 17 Insurance contracts: Initial Application of

IFRS 17 and IFRS 9 - Comparative Information (issued on 9 December

2021), Amendments to IAS 12 Income Taxes: Deferred Tax related to

Assets and Liabilities arising from a Single Transaction (issued on

7 May 2021), Amendments to IAS 1 Presentation of Financial

Statements and IFRS Practice Statement 2: Disclosure of Accounting

policies (issued on 12 February 2021), Amendments to IAS 8

Accounting policies, Changes in Accounting Estimates and Errors:

Definition of Accounting Estimates (issued on 12 February 2021),

IFRS 17 Insurance Contracts (issued on 18 May 2017); including

Amendments to IFRS 17 (issued on 25 June 2020) . These standards

did not have a material impact on the Company's results or

financial statements disclosures in the current reporting

period.

The following new accounting standards, amendments to existing

standards and interpretations have been issued but are not yet

effective and/or have not yet been endorsed by the EU: Amendments

to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments:

Disclosures: Supplier Finance Arrangements (Issued on 25 May 2023),

Amendments to IAS 12 Income taxes: International Tax Reform -

Pillar Two Model Rules (issued 23 May 2023), Amendments to IAS 1

Presentation of Financial Statements: Classification of Liabilities

as Current or Non-current - Deferral of Effective Date (issued on

15 July 2020); and Non-current Liabilities with Covenants (issued

on 31 October 2022), Amendments to IFRS 16 Leases: Lease Liability

in a Sale and Leaseback (issued on 22 September 2022). Nothing has

been early adopted, and these standards are not expected to have a

material impact on the Company's results or financials statement

disclosures in the periods they become effective. 3. Segmental

information

The Company has two reportable business segments: Production and

Pre-production. Capital allocation decisions for the production

segment are considered in the context of the cash flows expected

from the production and sale of crude oil. The production segment

is comprised of the producing fields on the Tawke PSC (Tawke and

Peshkabir), the Taq Taq PSC (Taq Taq) and the Sarta PSC (Sarta)

which are located in the KRI and make sales predominantly to the

KRG. The pre-production segment is comprised of discovered resource

held under the Qara Dagh PSC (written-off in 2022) located in the

KRI and exploration activity, principally located in Somaliland and

Morocco. 'Other' includes corporate assets, liabilities and costs,

elimination of intercompany receivables and intercompany payables,

which are non-segment items.

For the 6-month period ended 30 June 2023

Pre-production Total

Production Other

USDm USDm USDm USDm

Revenue from contracts with customers 49.5 - - 49.5

Revenue from other sources 1.8 - - 1.8

Cost of sales (48.9) - - (48.9)

Gross profit 2.4 - - 2.4

Exploration expense - (0.3) - (0.3)

Impairment of property, plant and equipment (17.7) - - (17.7)

Net impairment of receivables (9.9) - - (9.9)

General and administrative costs - - (10.2) (10.2)

Operating loss (25.2) (0.3) (10.2) (35.7)

Operating loss is comprised of

EBITDAX 29.6 - (10.2) 19.4

Depreciation and amortisation (27.2) - - (27.2)

Exploration expense - (0.3) - (0.3)

Impairment of property, plant and equipment (17.7) - - (17.7)

Net impairment of receivables (9.9) - - (9.9)

Finance income - - 10.5 10.5

Bond interest expense - - (12.7) (12.7)

Other finance expense (1.7) - (1.1) (2.8)

Loss before income tax (26.9) (0.3) (13.5) (40.7)

Capital expenditure 43.5 4.0 - 47.5

Total assets 412.6 29.4 413.2 855.2

Total liabilities (99.1) (18.6) (280.9) (398.6)

Total assets and liabilities in the 'Other' column are

predominantly cash and debt balances.

For the 6-month period ended 30 June 2022

Pre-production Total

Production Other

USDm USDm USDm USDm

Revenue from contracts with customers 238.8 - - 238.8

Revenue from other sources 6.8 - - 6.8

Cost of sales (108.4) - - (108.4)

Gross profit 137.2 - - 137.2

Reversal of impairment of receivables 10.8 - 2.0 12.8

General and administrative costs - - (9.3) (9.3)

Operating profit / (loss) 148.0 - (7.3) 140.7

Operating profit / (loss) is comprised of

EBITDAX 221.5 - (9.2) 212.3

Depreciation and amortisation (84.3) - (0.1) (84.4)

Reversal of impairment of receivables 10.8 - 2.0 12.8

Finance income - - 0.5 0.5

Bond interest expense - - (13.0) (13.0)

Other finance expense (1.2) (0.1) (0.8) (2.1)

Profit / (Loss) before income tax 146.8 (0.1) (20.6) 126.1

Capital expenditure 68.4 6.3 - 74.7

Total assets 626.1 97.1 381.4 1,104.6

Total liabilities (120.5) (17.6) (289.9) (428.0)

Revenue from contracts with customers includes USD79.5 million

arising from the 4.5% royalty interest on gross Tawke PSC revenue

("the ORRI").

Total assets and liabilities in the 'Other' column are

predominantly cash and debt balances.

For the 12-month period ended 31 December 2022

Total

Production Pre-production Other

USDm USDm USDm USDm

Revenue from contracts with customers 419.5 - - 419.5

Revenue from other sources 13.2 - - 13.2

Cost of sales (200.2) - - (200.2)

Gross profit 232.5 - - 232.5

Exploration expense - (1.0) - (1.0)

Net write-off of intangible asset - (75.8) - (75.8)

Impairment of property, plant and equipment (125.5) - - (125.5)

Reversal of impairment of receivables 10.8 - 2.0 12.8

Impairment of receivables (4.6) - - (4.6)

General and administrative costs - - (20.1) (20.1)

Operating profit / (loss) 113.2 (76.8) (18.1) 18.3

Operating profit / (loss) is comprised of

EBITDAX 381.6 - (20.0) 361.6

Depreciation and amortisation (149.1) - (0.1) (149.2)

Exploration expense - (1.0) - (1.0)

Net write-off of intangible assets - (75.8) - (75.8)

Impairment of property, plant and equipment (125.5) - - (125.5)

Reversal of impairment of receivables 10.8 - 2.0 12.8

Impairment of receivables (4.6) - - (4.6)

Finance income - - 6.7 6.7

Bond interest expense - - (25.9) (25.9)

Other finance expense (3.3) (0.4) (2.5) (6.2)

Profit / (Loss) before income tax 109.9 (77.2) (39.8) (7.1)

Capital expenditure 133.4 9.7 - 143.1

Total assets 447.3 23.5 472.7 943.5

Total liabilities (111.9) (17.7) (286.1) (415.7)

Revenue from contracts with customers includes USD94.5 million

arising from the ORRI and USD34.7 million in relation to the

suspended ORRI.

Total assets and liabilities in the 'Other' column are

predominantly cash and debt balances. 4. Operating (loss) /

profit

6 months to 30 6 months to 30

June June Year to 31 December

2022

2023 2022

USDm USDm USDm

Operating costs (21.6) (23.9) (50.7)

Trucking costs (0.1) (0.2) (0.4)

Production cost (21.7) (24.1) (51.1)

Depreciation of oil and gas property, plant and equipment (excl. (24.7) (56.3) (109.9)

RoU assets)

Amortisation of oil and gas intangible assets (2.5) (28.0) (39.2)

Cost of sales (48.9) (108.4) (200.2)

Exploration expense (0.3) - (1.0)

Write-off of intangible assets (note 8) - - (78.0)

Net reversal of accruals - - 2.2

Net write-off of intangible assets - - (75.8)

Impairment of property, plant and equipment (note 2,9) (17.7) - (125.5)

Reversal of impairment of other receivables - - 2.0

Reversal of impairment of trade receivables (note 2,10) 4.6 12.8 10.8

Impairment of receivables (note 2,10) (14.5) - (4.6)

Corporate cash costs (9.1) (8.6) (18.1)

Other operating expenses (0.2) - (1.1)

Corporate share-based payment expense (0.9) (0.6) (0.8)

Depreciation and amortisation of corporate assets (excl. RoU - (0.1) (0.1)

assets)

General and administrative expenses (10.2) (9.3) (20.1)

Trucking costs are not cost-recoverable and relate to the Sarta

licence only.

5. Finance expense and income

6 months to 30 June 6 months to 30 June

Year to 31 December 2022

2023 2022

USDm USDm USDm

Bond interest (12.7) (13.0) (25.9)

Other finance expense (non-cash) (2.8) (2.1) (6.2)

Finance expense (15.5) (15.1) (32.1)

Bank interest income 10.5 0.5 6.7

Finance income 10.5 0.5 6.7

Net finance expense (5.0) (14.6) (25.4)

Bond interest payable is the cash interest cost of the Company's

bond debt. Other finance expense (non-cash) primarily relates to

the discount unwind on the bond and the asset retirement obligation

provision. 6. Income tax expense

Current tax expense is incurred on profits of service companies.

Under the terms of the KRI PSCs, the Company is not required to pay

any cash corporate income taxes as explained in note 2. 7. (Loss) /

Earnings per share

Basic

Basic (loss) / earnings per share is calculated by dividing the

(loss) / profit attributable to owners of the parent by the

weighted average number of shares in issue during the period.

6 months to 30

June 6 months to 30 June Year to 31 December

2022 2022

2023

(Loss) / Profit attributable to owners of the parent (40.7) 126.1 (7.3)

(USDm)

Weighted average number of ordinary shares - number 1 278,923,402 277,842,136 278,654,909

Basic (loss) / earnings per share - cents per share (14.6) 45.4 (2.6)

1 Excluding shares held as treasury shares

Diluted

The Company purchases shares in the market to satisfy share plan

requirements so diluted earnings per share is adjusted for

performance shares, restricted shares, share options and deferred

bonus plans not included in the calculation of basic earnings per

share. Because the Company reported a loss for the period ended 30

June 2023, the performance shares, restricted shares and share

options are anti-dilutive and therefore diluted LPS is the same as

basic LPS:

6 months to 30

June 6 months to 30 Year to 31

June 2022 December 2022

2023

(Loss) / Profit attributable to owners of the parent (USDm) (40.7) 126.1 (7.3)

Weighted average number of ordinary shares - number1 278,923,402 277,842,136 278,654,909

Adjustment for performance shares, restricted shares, share options - 2,222,629 -

and deferred bonus plans

Weighted average number of ordinary shares and potential ordinary 278,923,402 280,064,765 278,654,909

shares

Diluted (loss) / earnings per share - cents per share (14.6) 45.0 (2.6)

1 Excluding shares held as treasury shares 8. Intangible

assets

Other

Exploration and evaluation assets Tawke Total

assets

RSA

USDm USDm USDm USDm

Cost

At 1 January 2022 81.4 425.1 7.5 514.0

Additions 6.3 - - 6.3

At 30 June 2022 87.7 425.1 7.5 520.3

At 1 January 2022 81.4 425.1 7.5 514.0

Additions 9.7 - - 9.7

Write-off in the year (78.0) - - (78.0)

Other (0.2) - - (0.2)

At 31 December 2022 and 1 January 2023 12.9 425.1 7.5 445.5

Additions 4.0 - - 4.0

Other (0.2) - - (0.2)

At 30 June 2023 16.7 425.1 7.5 449.3

Accumulated amortisation and impairment

At 1 January 2022 - (319.7) (7.5) (327.2)

Amortisation charge for the period - (28.0) - (28.0)

At 30 June 2022 - (347.7) (7.5) (355.2)

At 1 January 2022 - (319.7) (7.5) (327.2)

Amortisation charge for the year - (39.2) - (39.2)

At 31 December 2022 and 1 January 2023 - (358.9) (7.5) (366.4)

Amortisation charge for the period - (2.5) - (2.5)

At 30 June 2023 - (361.4) (7.5) (368.9)

Net book value

At 1 January 2022 81.4 105.4 - 186.8

At 30 June 2022 87.7 77.4 - 165.1

At 31 December 2022 and 1 January 2023 12.9 66.2 - 79.1

At 30 June 2023 16.7 63.7 - 80.4

30 June 2023 30 June 2022 31 Dec 2022

Book value USDm USDm USDm

Somaliland PSC Exploration 16.7 11.0 12.9

Qara Dagh PSC Exploration / Appraisal - 76.7 -

Exploration and evaluation assets 16.7 87.7 12.9

Tawke overriding royalty - 5.2 -

Tawke capacity building payment waiver 63.7 72.2 66.2

Tawke RSA assets 63.7 77.4 66.2

9. Property, plant and equipment

Other

Producing assets

assets Total

USDm USDm USDm

Cost

At 1 January 2022 3,117.2 17.1 3,134.3

Net additions 64.0 0.9 64.9

Other1 3.6 - 3.6

At 30 June 2022 3,184.8 18.0 3,202.8

At 1 January 2022 3,117.2 17.1 3,134.3

Net additions 129.1 0.9 130.0

Right-of-use assets - (0.4) (0.4)

Other1 5.9 - 5.9

At 31 December 2022 and 1 January 2023 3,252.2 17.6 3,269.8

Net additions 43.5 (0.1) 43.4

Other1 2.0 - 2.0

At 30 June 2023 3,297.7 17.5 3,315.2

Accumulated depreciation and impairment

At 1 January 2022 (2,769.2) (12.6) (2,781.8)

Depreciation charge for the period (57.7) (0.9) (58.6)

At 30 June 2022 (2,826.9) (13.5) (2,840.4)

At 1 January 2022 (2,769.2) (12.6) (2,781.8)

Depreciation charge for the year (112.8) (1.6) (114.4)

Impairment (note 2) (125.5) - (125.5)

At 31 December 2022 and 1 January 2023 (3,007.5) (14.2) (3,021.7)

Depreciation charge for the period (26.0) (0.6) (26.6)

Impairment (note 2) (17.7) - (17.7)

At 30 June 2023 (3,051.2) (14.8) (3,066.0)

Net book value

At 1 January 2022 348.0 4.5 352.5

At 30 June 2022 357.9 4.5 362.4

At 31 December 2022 and 1 January 2023 244.7 3.4 248.1

At 30 June 2023 246.5 2.7 249.2

1 Other line includes non-cash asset retirement obligation

provision and share-based payment costs.

30 June 2023 30 June 2022 31 Dec 2022

Book value USDm USDm USDm

Tawke PSC Oil production 215.2 197.1 199.1

Taq Taq PSC Oil production 31.3 31.8 28.8

Sarta PSC Oil production/development - 129.0 16.8

Producing assets 246.5 357.9 244.7

An impairment review was conducted by Management and the Board

which resulted in a reduction in the carrying value of the Sarta

PSC to nil and in an impairment expense of USD17.7 million as of 30

June 2023. Further explanation is provided in note 2.

The sensitivities below provide an indicative impact on net

asset value of a change in netback price, discount rate, production

or pipeline reopening, assuming no change to any other inputs.

Taq Taq Tawke

Sensitivities USDm USDm

Netback price +/- USD5/bbl +/- 2 +/- 29

Discount rate +/- 1% +/- 0 +/- 8

Production +/- 10% +/- 2 +/- 31

10. Trade and other receivables

30 June 2023 30 June 2022 31 Dec 2022

USDm USDm USDm

Trade receivables - current 95.1 157.0 117.0

Other receivables and prepayments 5.5 8.0 4.7

100.6 165.0 121.7

As of 30 June 2023, the Company is owed six months of payments

(31 December 2022: five months).

Period when sale made

Deferred

receivables

Not due Overdue 2023 Overdue 2022 2020 2019 Total nominal ECL provision Trade

receivables

USDm USDm USDm USDm USDm USDm USDm USDm

30 June 2022 126.5 - - 30.5 - 157.0 - 157.0

31 December 60.7 - 44.4 16.5 - 121.6 (4.6) 117.0

2022

30 June 2023 - 49.3 60.3 - - 109.6 (14.5) 95.1

30 June 2023 30 June 2022 31 Dec 2022

Movement on trade receivables in the period

USDm USDm USDm

Carrying value at the beginning of the period 117.0 158.1 158.1

Revenue from contracts with customers 49.5 238.8 384.8

Revenue recognised for suspended ORRI - - 34.7

Cash proceeds (61.2) (254.0) (473.3)

Cash for local sales (0.6) - -

Offset of payables due to the KRG - - (0.1)

Reversal of previous year's expected credit loss (note 2) 4.6 - 10.8

Expected credit loss for current period (note 2) (14.5) 10.8 (4.6)

Capacity building payments 0.2 3.3 5.2

Sarta processing fee payments 0.1 - 1.4

Carrying value at the end of the period 95.1 157.0 117.0

Recovery of the carrying value of the receivable

The Company expects to recover the full nominal value of

USD109.6 million receivables owed from the KRG, but the terms of

recovery are not determined. An explanation of the assumptions and

estimates in assessing the net present value of the deferred

receivables are provided in note 2.

Total

USDm

Nominal balance to be recovered 109.6

Estimated net present value of total cash flows 95.1

Sensitivities/Scenarios

The table below shows the sensitivity of the net present value

of the overdue trade receivables to start and timing of repayment

that the company has used during its ECL assessment. Each scenario

has been weighted in accordance with the management's expected

outcome.

Months it takes to recover the nominal amount owed

NPV14.0 (USDm)

0 3 6 9 12 15 18 21 24

0 110 107 105 104 102 101 99 97 96

3 106 105 103 102 100 98 97 95 94

Months until repayment commences

6 103 102 100 98 97 95 94 92 91

9 99 98 97 95 94 92 91 89 88

11. Interest bearing loans and net cash

Net other

1 Jan 2023 Discount unwind Dividend paid 30 June 2023

Repurchase changes

USDm USDm USDm USDm USDm USDm

2025 Bond 9.25% (non-current) (266.6) (1.1) 0.9 - - (266.8)

Cash 494.6 - (1.0) (33.5) (35.1) 425.0

Net cash 228.0 (1.1) (0.1) (33.5) (35.1) 158.2

As of 30 June 2023, the fair value of the USD273 million of

bonds held by third parties is USD256.6 million (30 June 2022:

USD276.6 million, 31 December 2022: USD257.6 million).

The Company repurchased USD1 million of its existing USD274

million senior unsecured bond at a price equal to 95% of the

nominal amount.

The bonds maturing in 2025 have two financial covenant

maintenance tests:

Financial covenant Test H1 2023 H1 2022 FY 2022

Equity ratio (Total equity/Total assets) > 40% 53% 61% 56%

Minimum liquidity > USD30m USD425.0m USD412.1m USD494.6m

1 Jan Dividend

Discount unwind Net other changes 30 June 2022

2022 paid

USDm USDm USDm USDm USDm

2025 Bond 9.25% (non-current) (269.8) (1.0) - - (270.8)

Cash 313.7 - (32.3) 130.7 412.1

Net cash 43.9 (1.0) (32.3) 130.7 141.3

1 Jan 2022 Discount unwind Dividend paid Net other changes 31 Dec 2022

Repurchase

USDm USDm USDm USDm USDm USDm

2025 Bond 9.25% (non-current) (269.8) (2.5) 5.7 - - (266.6)

Cash 313.7 - (6.0) (47.9) 234.8 494.6

Net cash 43.9 (2.5) (0.3) (47.9) 234.8 228.0

12. Capital commitments

Under the terms of its production sharing contracts ('PSC's) and

joint operating agreements ('JOA's), the Company has certain

commitments that are generally defined by activity rather than

spend. The Company's capital programme for the next few years is

explained in the operating review and is in excess of the activity

required by its PSCs and JOAs.

INDEPENT REVIEW REPORT TO GENEL ENERGY PLC

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, "Interim Financial

Reporting" and the requirements of the Disclosure and Transparency

Rules of the Financial Conduct Authority.

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises the condensed

consolidated statement of comprehensive income, the condensed

consolidated balance sheet, the condensed consolidated statement of

changes in equity, the condensed consolidated cash flow statement

and the notes to the interim financial statements.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with International Financial

Reporting Standards as adopted by the European Union. The condensed

set of financial statements included in this half-yearly financial

report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting" and the

requirements of the Disclosure and Transparency Rules of the

Financial Conduct Authority.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority and the Companies (Jersey) Law 1991.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

London

1 August 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: JE00B55Q3P39, NO0010894330

Category Code: IR

TIDM: GENL

LEI Code: 549300IVCJDWC3LR8F94

Sequence No.: 261683

EQS News ID: 1693649

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1693649&application_name=news

(END) Dow Jones Newswires

August 02, 2023 02:00 ET (06:00 GMT)

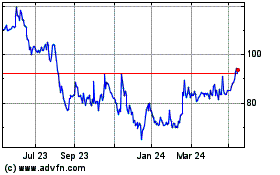

Genel Energy (LSE:GENL)

Historical Stock Chart

From Dec 2024 to Jan 2025

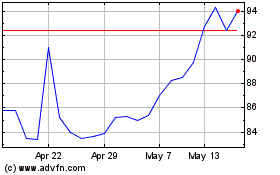

Genel Energy (LSE:GENL)

Historical Stock Chart

From Jan 2024 to Jan 2025