Fresnillo 2018 Pretax Profit Fell; Guides for Challenging 2019

February 26 2019 - 2:58AM

Dow Jones News

By Carlo Martuscelli

Fresnillo PLC (FRES.LN) said Tuesday that pretax profit fell in

2018 despite increased production as the company faced a number of

headwinds, and guided for a difficult year ahead.

The company said profit before tax for the year totaled $483.9

million, compared with $741.5 million the year before, on revenue

that rose 0.5% to $2.10 billion.

A challenging operating environment hit earnings at the

precious-metal miner. A higher stripping ratio--a measure of how

much waste material must be processed to extract a given amount of

ore--at the Herradura mine in Mexico dampened profits, as did

inflation and depreciation.

Fresnillo said it expects 2019 to be a difficult year as a

result of lower precious-metal prices, as well as inflation.

"I also expect to see higher depreciation costs as a result of

the investments we have made in recent years into the operations,

while we continue to expect to work through operational issues and

lower grades at certain mines during the year," Chief Executive

Octavio Alvidrez said.

The FTSE 100-listed company declared a final dividend of 16.7

cents per share, bringing the total dividend to 27.4 cents.

Fresnillo previously said that while it achieved record

production in 2018, it still came in below guidance as a result of

lower-than-expected ore grades at its Fresnillo and Saucito mines

in Mexico.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

February 26, 2019 02:43 ET (07:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

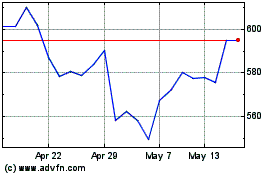

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jun 2024 to Jul 2024

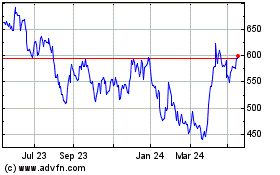

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jul 2023 to Jul 2024