TIDMFOUR

RNS Number : 7008I

4imprint Group PLC

09 August 2023

9 August 2023

4imprint Group plc

Half year results for the 26 weeks ended 1 July 2023

(unaudited)

4imprint Group plc, (the "Group"), a leading direct marketer of

promotional products, today announces its half year results for the

26 weeks ended 1 July 2023.

Half year Half year

2023 2022

Financial Overview $m $m Change

------------ -----------

Revenue 635.5 515.5 +23%

Operating profit 63.8 44.0 +45%

Profit before tax 66.0 43.9 +50%

Cash and bank deposits 74.5 67.1 +11%

-------------------------------------- ------------ ----------- ----------------

Basic EPS (cents) 176.2 118.9 +48%

Interim dividend per share (cents) 65.0 40.0 +63%

Interim dividend per share (pence) 50.8 33.0 +54%

-------------------------------------- ------------ ----------- ----------------

The results for the half year and prior half year are

unaudited.

Operational Overview

* Customer demand at record levels:

* 1,047,000 total orders received in H1 2023 (H1 2022:

886,000)

* 158,000 new customers acquired in H1 2023 (H1 2022:

146,000)

* Net operating profit margin increased to 10.0% (2022:

8.5%), driven principally by improvement in gross

profit percentage and favourable returns on marketing

spend

* Supply chain challenges experienced in 2022 mostly

resolved

* Pension buy-in transaction in June 2023 insured

substantially all remaining pension benefits,

de-risking the balance sheet through the elimination

of inflation, interest rate and longevity risks

* Interim dividend of 65.0c per share declared (2022:

40.0c) reflects performance in the first half of the

year and the Group's strong financial position

Paul Moody, Chairman said:

"The Group's strong first half performance clearly demonstrates

that its strategy and business model are effective in delivering

profitable market share gains.

As a result, the Board's expectation, based on these latest

financial results together with recent internal forecasts, is that

full year 2023 Group revenue will now be slightly above $1.3bn,

with profit before tax not less than $125m.

Trading results in the month of July 2023 have been in line with

the Board's expectations."

For further information, please contact:

4imprint Group plc MHP Group

Tel. + 44 (0) 20 3709 9680 Tel. + 44 (0) 7884 494112

hq@4imprint.co.uk 4imprint@mhpg roup .com

Kevin Lyons-Tarr, Chief Executive

Officer

David Seekings, Chief Financial Katie Hunt

Officer Eleni Menikou

Chairman ' s Statement

Performance summary

Following a very satisfactory post-pandemic rebound in 2022, the

Group has delivered another remarkable operational and financial

performance in the first half of 2023.

Group revenue in the first half of 2023 was $635.5m, an increase

of $120.0m, or 23% over the same period in 2022. Profit before tax

for the period was $66.0m (2022: $43.9m), resulting in basic

earnings per share of 176.2c (2022: 118.9c). The business model

remains very cash-generative, leaving the Group with cash and bank

deposits at the half year of $74.5m (2 July 2022: $67.1m).

Trading momentum in the first half of 2023 was favourable, with

total orders received up 18% over 2022. This result should,

however, be set firmly in the context of relatively weak,

pandemic-affected comparatives in the first quarter of 2022.

Further market share gains are anticipated in the second half of

2023, although we expect the percentage increases in total order

activity seen in the first half to moderate in the second half as a

result of more challenging prior year comparatives.

Strategy

Our strategic direction is uncomplicated and has not changed. We

aim to deliver attractive organic revenue growth by increasing our

share in the fragmented yet substantial markets that we serve. The

Group's performance in the first half of 2023 directly reflects the

success of this strategy.

The development of the brand component of our marketing has been

a key growth driver in recent years. This investment continues as

we further explore the interactions of brand with the other

elements of the overall marketing mix.

Another key factor in the Group's success in the first half of

2023 has been the ability to attract and retain the depth of talent

required to underpin our growth. As ever, our team members are

absolutely essential to our success.

Pension

In June 2023, we took a significant further step in the Group's

long-term commitment to fully de-risk its legacy defined benefit

pension obligations. Through the purchase of a bulk annuity

'buy-in' insurance policy, we were able to eliminate inflation,

interest rate and longevity risks in respect of substantially all

remaining pension benefits. A cash lump sum of approximately $4m

was paid in July by way of a 'top-up' premium for the transaction,

after which balance sheet volatility will cease and future deficit

reduction contributions of around $4m per year will no longer be

required.

Dividend

With a substantial cash and bank deposits balance at the half

year, the Group is in a strong financial position. Consequently,

and in line with its balance sheet funding and capital allocation

guidelines, the Board has declared an interim dividend of 65.0c per

share (2022: 40.0c), an increase of 63%.

Outlook

The Group's strong first half performance clearly demonstrates

that its strategy and business model are effective in delivering

profitable market share gains.

As a result, the Board's expectation, based on these latest

financial results together with recent internal forecasts, is that

full year 2023 Group revenue will now be slightly above $1.3bn,

with profit before tax not less than $125m.

Trading results in the month of July 2023 have been in line with

the Board's expectations.

Paul Moody

Chairman

9 August 2023

Operating and Financial Review

Operating Review

Half

year Half year

2023 2022

Revenue $m $m

----------------------------- ------ ----------

North America 623.8 505.8

UK & Ireland 11.7 9.7

----------------------------- ------ ----------

Total 635.5 515.5

----------------------------- ------ ----------

Half

year Half year

2023 2022

Operating profit $m $m

----------------------------- ------ ----------

Direct Marketing operations 66.3 46.3

Head Office costs (2.5) (2.3)

----------------------------- ------ ----------

Total 63.8 44.0

----------------------------- ------ ----------

The results for the half year and prior half year are

unaudited.

Performance overview

The strong demand patterns seen in the business as 2022

progressed continued into the first half of 2023, producing further

record results.

We flagged in our AGM Trading Update on 24 May 2023 that the

total order count for the first four months of 2023 was running 22%

above the same period in 2022. These very strong demand numbers

were anticipated in the context of weak comparatives from the first

quarter of 2022, a period that included residual pandemic effects.

By the end of June 2023 the year-to-date order count had fallen to

18% above prior year, reflecting the more challenging prior year

comparatives in May and June. We expect that percentage increases

in total order activity over prior year will continue to moderate

for the remainder of the year.

In total, 1,047,000 orders were received in the first half of

2023. This represents an increase of 18% against 886,000 in 2022.

Importantly, we have continued to attract new customers at an

encouraging rate; in the first half of 2023 we acquired 158,000 new

customers, an 8% increase over the 146,000 acquired over the same

period in 2022. Orders from retained customers were stable,

settling back into predictable cohorts and showing typical or even

slightly improved retention characteristics after the major

disruption caused by the pandemic. Average order values were up by

1% in 2023, contributing to total demand revenue (value of orders

received) 20% greater than the same period in 2022.

These very encouraging numbers at the demand level laid a solid

base for significant gains in year-on-year financial performance.

Group revenue for the 2023 half year was $635.5m (2022: $515.5m),

an increase of 23%. Operating profit for the period was $63.8m, an

increase of 45% compared to $44.0m in the first half of 2022.

Operating profit margin percentage for the Group increased into

double digits at 10.0% (2022: 8.5%). On a broad level, two major

factors contributed to this improvement:

-- A strengthening in gross margin percentages due to changes in

product mix, less friction in the supply environment, and careful

pricing adjustments.

-- Leverage from continuing favourable returns on marketing

spend, with our primary KPI, revenue per marketing dollar, at $8.22

(2022: $8.19).

The 4imprint direct marketing business model remains very cash

generative, with minimal working capital requirement and underlying

operating cash flow conversion of 152% in the period (H1 2022:

112%). Free cash flow of $80.8m was generated in the period (H1

2022: $33.6m), contributing to a cash and bank deposits balance at

the 2023 half year of $74.5m (2 July 2022: $67.1m).

Operational highlights

Progress has been made in the following operational areas in the

period.

-- People. Our people are integral to our success. In our 2022

Annual Report we identified our intention to make a significant

investment in the business in 2023, primarily in people, in order

to consolidate existing gains and strengthen our platform ready for

future profitable revenue growth. Despite a tight labour market, we

have been able to attract the high quality talent required to

service the increasing demand. We have continued steadily with the

development of our permanent 'hybrid' working environment for

office-based team members, improving the resilience of the business

in the process.

-- Marketing. The development of, and investment in, the brand

component of our marketing has resulted in materially improved

revenue per marketing dollar as compared to historical norms,

something that we always believed would be the case over time. As

the second half of the year unfolds and we move further away from

prior year comparatives that were influenced by the pandemic, we

will continue to follow our 'test, read, adjust' approach to our

marketing to identify the optimal mix.

-- Supply. The supply chain position so far in 2023 stands in

stark contrast to the same timeframe in 2022. The first half of

2022 saw acute pressure due to challenges around global logistics,

inventory availability and production capacity to keep up with

demand. We relied on the deep relationships that we have with our

key tier 1 suppliers to negotiate these supply chain issues as best

we could. Thankfully, these challenges have now largely been

resolved, taking delays and friction out of the process and

enabling us to deliver a much more predictable service for our

customers. In addition, inflationary pressure on cost of product

has receded along with improving market conditions, vindicating the

thoughtful approach to pricing that has been such an important

factor in enabling us to deliver the strong customer acquisition

and retention numbers described above.

-- Screen-printing. Our new screen-print facility in Appleton,

Wisconsin, went live for production in April 2023. We have been

able to recruit the team members required for the new operation.

Our intention is to scale up further in the coming months to

support our overall apparel decoration capability.

-- Oshkosh facilities. We are currently exploring options around

a further expansion at our distribution centre site in Oshkosh,

Wisconsin. This facility expansion will be aimed primarily at

supporting the continued growth of the apparel category of our

product range. It is anticipated that detailed plans will be

finalised before the end of 2023, with the associated capital

investment expected to be primarily in 2024.

Summary

We remain confident that significant market share opportunity

lies ahead.

Financial Review

Half

year Half year

2023 2022

$m $m

--------------------------- ------- ----------

Operating profit 63.8 44.0

Net finance income/(cost) 2.2 (0.1)

Profit before tax 66.0 43.9

Taxation (16.5) (10.5)

----------------------------- ------- ----------

Profit for the period 49.5 33.4

----------------------------- ------- ----------

The results for the half year and prior half year are

unaudited.

The Group's operating result in the period, summarising expense

by function, was as follows:

Half year Half year

2023 2022

$m $m

-------------------------------------------------------- ---------- ----------

Revenue 635.5 515.5

-------------------------------------------------------- ---------- ----------

Gross profit 193.3 147.9

Marketing costs (77.3) (62.9)

Selling costs (22.7) (18.0)

Administration and central costs (28.5) (22.3)

Share option charges and related social security costs (0.5) (0.5)

Defined benefit pension scheme administration costs (0.5) (0.2)

-------------------------------------------------------- ---------- ----------

Operating profit 63.8 44.0

-------------------------------------------------------- ---------- ----------

Operating result

Following a record year in 2022, the first six months of 2023

saw continued strong demand, particularly in the first quarter

against a relatively weak, pandemic-affected, 2022 comparative.

This led to a total increase at the demand revenue level (value of

orders received) of 20% over 2022, including an increase in average

order value of 1%. Reported revenue for the period was even higher

at 23% above 2022, benefitting from faster order cycle times, fewer

order cancellations and lower claims/credits in a much more robust

supply chain environment.

The gross profit percentage of 30.4% has improved markedly from

28.7% for H1 2022. Revenue gains and much improved supply chain

conditions over the period have resulted in lower transportation

costs, greater leverage over direct labour costs, and a carefully

managed balance between supplier cost increases and customer price

adjustments.

The step change in marketing productivity driven largely by

investment in the brand element of the marketing mix has been

maintained into 2023, with marketing costs representing a very

efficient 12% of revenue (H1 2022: 12%), producing revenue per

marketing dollar of $8.22 (H1 2022: $8.19).

Selling, administration, and central costs together have

increased 27% over H1 2022. This increase is mainly attributable to

investment in people, most notably customer service resource, and

higher incentive compensation accruals in line with trading

performance.

These factors, when combined, demonstrate the financial leverage

in the business model, delivering material uplifts in both

operating profit to $63.8m (H1 2022: $44.0m) and operating margin

to 10.0% (H1 2022: 8.5%).

Foreign exchange

The primary US dollar exchange rates relevant to the Group's

results were as follows:

Half year 2023 Half year 2022 Full year 2022

Period Average Period Average Period end Average

end end

---------- ------- -------- ------- -------- ----------- --------

Sterling 1.27 1.23 1.20 1.30 1.20 1.24

Canadian

dollars 0.76 0.74 0.77 0.79 0.74 0.77

---------- ------- -------- ------- -------- ----------- --------

The Group reports in US dollars, its primary trading currency.

It also transacts business in Canadian dollars, Sterling and Euros.

Sterling/US dollar is the exchange rate most likely to impact the

Group's financial performance.

The primary foreign exchange considerations relevant to the

Group's operations are as follows:

-- Translational risk in the income statement remains low with

the majority of the Group's revenue arising in US dollars, the

Group's reporting currency.

-- Most of the constituent elements of the Group balance sheet are US dollar-based.

-- The Group generates cash mostly in US dollars, but its

primary applications of post-tax cash are Shareholder dividends,

some Head Office costs and, up until the end of July 2023, pension

deficit reduction contributions, all of which are paid in

Sterling.

As such, the Group's cash position is sensitive to Sterling/US

dollar exchange movements. To the extent that Sterling weakens

against the US dollar, more funds are available in payment currency

to fund these cash outflows.

Share option charges

A total of $0.5m (H1 2022: $0.5m) was charged in the period in

respect of IFRS 2 'Share-based Payments'. This was made up of two

elements: (i) executive awards under the 2015 Incentive Plan and

replacement Deferred Bonus Plan ("DBP"); and (ii) charges in

respect of the UK SAYE Scheme and US Employee Stock Purchase

Plan.

Current options and awards outstanding are 11,532 share options

under the UK SAYE scheme, 87,000 share options under the US

Employee Stock Purchase Plan, and 42,631 share awards under the

2015 Incentive Plan and DBP.

Net finance income/(cost)

Net finance income in the period was $2.2m (H1 2022: net finance

cost $0.1m). This comprises interest earned on cash deposits, lease

interest charges under IFRS 16, and the net finance income on the

defined benefit pension plan assets and liabilities. Improving

deposit rates, particularly in the US where interest rates have

been steadily increasing, combined with significant cash balances,

have driven the improvement in the net interest position over the

prior period.

Taxation

The tax charge for the half year was $16.5m (H1 2022: $10.5m),

giving an effective tax rate of 25% (H1 2022: 24%). The tax charge

relates principally to taxation payable on profits earned in North

America.

Earnings per share

Basic earnings per share was 176.2c (H1 2022: 118.9c). The

increase reflects the strong financial results in the period, a

consistent effective tax rate, and a weighted average number of

shares in issue similar to prior year.

Dividends

Dividends are determined in US dollars and paid in Sterling,

converted at the exchange rate on the date that the dividend is

declared.

The Board has declared an interim dividend per share of 65.0c,

(2022: 40.0c), an increase of 63%. In Sterling, the interim

dividend per share will be 50.8p (2022: 33.0p). The dividend will

be paid on 15 September 2023 to Shareholders on the register at the

close of business on 18 August 2023.

Defined benefit pension plan

The Group sponsors a legacy UK defined benefit pension plan (the

"Plan") which has been closed to new members and future accruals

for several years. The Plan has 120 pensioners and 202 deferred

members.

At the end of June 2023, the Trustee of the Plan entered into an

agreement with Legal and General Assurance Society Limited to

insure substantially all remaining pension benefits of the Plan

through the purchase of a bulk annuity policy. The transaction took

the form of a buy-in arrangement, with the insurer funding the Plan

for the future payment of liabilities. The fair value of the bulk

annuity policy matches the liabilities being insured, thus

eliminating inflation, interest rate and longevity risks. The

premium of GBP20.7m was settled by the transfer of the Plan's

existing investment portfolio valued at GBP17.5m and a cash amount

of GBP3.2m (c.$4m) paid by the Group after the date of these

interim financial statements in early July 2023.

This buy-in agreement was an investment decision for the Plan,

consistent with both the Trustee's overriding objective to enhance

the security of the benefits payable to members and the Group's

long-term commitment to the full de-risking of its legacy defined

benefit pension obligations. As a result of this transaction, the

Group will cease to make monthly deficit funding contributions to

the Plan from August 2023 but will still fund the ongoing

administration costs and settlement of residual liabilities.

At 1 July 2023, the surplus of the Plan on an IAS 19 basis was

$0.1m, compared to a surplus of $1.2m at 31 December 2022. Gross

Plan assets under IAS 19 were $22.1m, and liabilities were

$22.0m.

The change in the surplus is analysed as follows:

$m

--------------------------------------------------------------------------------- ------

IAS 19 surplus at 31 December 2022 1.2

Company contributions to the Plan 2.1

Company contributions to the Plan (buy-in premium shortfall) 4.0

Defined benefit pension scheme administration costs (0.5)

Pension finance income 0.1

Re-measurement loss due to changes in assumptions (0.7)

Return on scheme assets (excluding interest income and impact of buy-in policy) (1.5)

Return on scheme assets (in relation to buy-in policy) (4.6)

---------------------------------------------------------------------------------- ------

IAS 19 surplus at 1 July 2023 0.1

---------------------------------------------------------------------------------- ------

The surplus reduced by $1.1m in the period. This was mainly the

result of a negative return on assets in the period and the net

impact of entering the buy-in arrangement discussed above.

The preliminary results of the triennial actuarial valuation of

the Plan as at 30 September 2022 were used as the basis of the 2023

half year IAS 19 valuation. The triennial Plan valuation will be

finalised in the second half of the year.

Cash flow

The Group had cash and bank deposits of $74.5m at 1 July 2023 (2

July 2022: $67.1m; 31 December 2022: $86.8m).

Cash flow in the period is summarised as follows:

Half year Half year

2023 2022

$m $m

----------------------------------------------------- ---------- ----------

Operating profit 63.8 44.0

Share option charges 0.5 0.4

Defined benefit pension scheme administration costs 0.5 0.2

Depreciation and amortisation 2.3 2.0

Lease depreciation 0.9 0.7

Change in working capital 32.7 4.5

Capital expenditure (3.5) (2.4)

----------------------------------------------------- ---------- ----------

Underlying operating cash flow 97.2 49.4

Tax paid (16.5) (9.2)

Net interest received 2.1 (0.1)

Consideration for business combination - (1.7)

Defined benefit pension scheme contributions (2.1) (2.2)

Own share transactions (0.4) (1.0)

Capital element of lease payments (0.7) (0.6)

Exchange and other 1.2 (1.0)

----------------------------------------------------- ---------- ----------

Free cash flow 80.8 33.6

Dividends to Shareholders (93.0) (8.1)

----------------------------------------------------- ---------- ----------

Net cash (outflow)/inflow in the period (12.2) 25.5

----------------------------------------------------- ---------- ----------

The Group generated underlying operating cash flow of $97.2m (H1

2022: $49.4m), a conversion rate of 152% of operating profit. The

high conversion rate is due to the unwinding of the elevated net

working capital position from the 2022 year-end driven by the

significant improvement in supply chain conditions. Capital

expenditure includes investments in our screen-printing operations

(machinery and leasehold improvements) and embroidery machinery

.

Free cash flow improved by $47.2m to $80.8m (H1 2022: $33.6m).

This is attributable to the strong trading performance during the

period and the much-improved net working capital position. The 2022

final and special dividends of $93.0m were paid to Shareholders in

June 2023.

Balance sheet and Shareholders' funds

Net assets at 1 July 2023 were $92.5m, compared to $140.2m at 31

December 2022. The balance sheet is summarised as follows:

1 July 31 December

2023 2022

$m $m

------------------------ ------- ------------

Non-current assets 47.9 46.7

Working capital (16.1) 20.8

Cash and bank deposits 74.5 86.8

Lease liabilities (13.0) (13.7)

Pension asset 0.1 1.2

Other liabilities (0.9) (1.6)

------------------------ ------- ------------

Net assets 92.5 140.2

------------------------ ------- ------------

Shareholders' funds decreased by $47.7m since the 2022 year-end.

The main constituent elements of the change were retained profit in

the period of $49.5m, net of equity dividends paid to Shareholders

of $(93.0)m.

The Group had a net negative working capital balance of $(16.1)m

at 1 July 2023 (31 December 2022: net positive working capital

balance $20.8m). The elevated position at the 2022 year-end

reflected the effects of global and local supply chain issues,

causing build-up of accrued revenue and inventory on orders being

processed. Significant improvements to supply chain conditions in

the period have driven the reduction in the working capital

balance. This normalised net negative position reflects the

strength of our business model, with a high proportion of customers

paying for orders by credit card and the payment of suppliers to

agreed terms.

Financing and liquidity

Full details of the Board's balance sheet funding guidelines and

capital allocation priorities are set out on pages 37 and 38 of the

2022 Annual Report. The Board retains the same guidelines in both

areas.

The primary aim of these guidelines is to provide operational

and financial flexibility through economic cycles, to be able to

invest in opportunities as they arise, and to meet commitments to

Shareholders through dividend payments and residual contributions

to the defined benefit pension plan.

The Group has a $20.0m working capital facility with its

principal US bank, JPMorgan Chase, N.A. The facility has minimum

net income and debt to EBITDA covenants. The interest rate is the

Secured Overnight Financing Rate ("SOFR") plus 1.6%, and the

facility expires on 31 May 2025. In addition, an overdraft facility

of GBP1.0m, with an interest rate of the Bank of England base rate

plus 2.0% (or 2.0% if higher), is available from the Group's

principal UK bank, Lloyds Bank plc, until 31 December 2023.

The Group had cash and bank deposits of $74.5m at the period end

and has no current requirement or plans to raise additional equity

or core debt funding.

Estimates and judgments

The preparation of the consolidated financial statements

requires management to make judgments and estimates that affect the

application of accounting policies, the amounts reported for assets

and liabilities as at the balance sheet date and the amounts

reported for revenues and expenses during the period.

Critical accounting judgments are those judgments, apart from

those involving estimations, that have been made in the process of

applying the Group's accounting policies and that have the most

significant effect on the amounts recognised in the financial

statements. Key assumptions and sources of estimation uncertainty

are those that have a significant risk of resulting in a material

adjustment to the carrying amounts of the Group's assets and

liabilities within the next financial year.

A new critical accounting judgment in relation to the purchase

of the bulk annuity policy (buy-in arrangement) and an update to

the pension assumptions are detailed in note 4 to the interim

condensed consolidated financial statements.

Principal risks and uncertainties

The Board has ultimate responsibility for oversight and

management of risk and control across the Group. The Audit

Committee assists the Board in fulfilling its responsibilities to

maintain effective governance and oversight of the Group's risk

management and internal controls.

Risks are identified on a top-down and bottom-up basis from many

sources, including internally, through the Board and operational

and functional management teams, and externally, to ensure that

emerging risks are considered. Risk identification focuses on those

risks which, if they occurred, have the potential to have a

material impact on the Group and the achievement of its strategic,

operational and compliance objectives. Risks are categorised into

the following groups: strategic risks; operational risks;

reputational risks; and environmental risks.

Management is responsible for evaluating each significant risk

and implementing specific risk mitigation activities and controls

with the aim of reducing the resulting residual risk to an

acceptable level, as determined in conjunction with the Group's

risk appetite. The Business Risk Management Committee reviews the

consolidated Group risk register and the mitigating actions and

controls at regular meetings and provides updates to the Audit

Committee on a bi-annual basis. This process is supplemented with

risk and control assessments completed by the operating locations

and Group function annually.

The current principal risks and uncertainties that would impact

the successful delivery of the Group's strategic goals are set out

on pages 42 to 49 of the 2022 Annual Report, a copy of which is

available on the Group's investor relations website at

https://investors.4imprint.com . These are:

1. Macroeconomic conditions.

2. Markets & competition.

3. Effectiveness of key marketing techniques and brand development.

4. Business facility disruption.

5. Domestic supply and delivery.

6. Failure or interruption of information technology systems and infrastructure.

7. Cyber threats.

8. Supply chain compliance & ethics.

9. Legal, regulatory, and compliance.

10. Climate change.

11. Products and market trends.

These risks have not changed materially since year-end. An

update to the risk environment in respect of the domestic supply

and delivery risk is provided below.

Domestic supply and delivery

Supply chain conditions, initially disrupted by the impact of

the pandemic and later compounded by challenges in the recruitment

of staff by both the Group and our supply partners, have improved

significantly over the period. This has led to shorter order cycle

times, lower order cancellations and a significant reduction to the

elevated year-end working capital position arising from a build-up

of accrued revenue and inventory on orders in process.

Going concern statement

In adopting the going concern basis for preparing these

condensed consolidated financial statements, the Directors have

carefully considered:

-- The Group's strategy, market position and business model, as

set out in the Strategic Report section on pages 9 to 19 of the

2022 Annual Report.

-- The principal risks and uncertainties facing the Group, as

outlined in the Principal risks and uncertainties section of this

Financial Review.

-- Information contained in this Financial Review concerning the

Group's financial position, cash flows and liquidity.

-- Regular management reporting and updates from the Executive Directors.

-- Recent detailed financial forecasts and analysis for the period to 28 December 2024.

Financial position

The Group had cash and bank deposits of $74.5m at 1 July 2023

(31 December 2022: $86.8m) and maintains a $20.0m working capital

facility with its principal US bank, JPMorgan Chase, N.A., which

expires on 31 May 2025, as well as an overdraft facility of GBP1.0m

with its principal UK bank, Lloyds Bank plc, which is available

until 31 December 2023. Based on our forecast, we have no

requirement to draw on either of these facilities.

Financial modelling

We undertake regular forecasting and budgeting exercises which

are reviewed and approved by the Board. On an annual basis and as

described in the Viability statement in the Financial Review

section on pages 38 to 40 of the 2022 Annual Report, we also model

a distressed scenario based upon severe, but plausible, downside

demand assumptions to support our assessment of viability. These

forecasts have demonstrated the Group's ability to flex its

marketing and other costs to mitigate the impact of falls in

revenue, whilst still retaining flexibility to further reduce costs

should the need arise.

Combined with a healthy cash and bank deposits position

maintained in accordance with our balance sheet funding guidelines,

the Board considers the Group to be in a strong position to

withstand severe economic stress and to take market share

opportunities as they arise.

Going concern

Based on their assessment, the Directors have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

Group's and Company's ability to continue as a going concern over

the period to 28 December 2024. Accordingly, they continue to adopt

the going concern basis in preparing these condensed consolidated

financial statements.

Kevin Lyons-Tarr David Seekings

Chief Executive Officer Chief Financial Officer

9 August 2023

Condensed Consolidated Income Statement

For the 26 weeks ended 1 July 2023

Half

year Half year Full year

2023 2022 2022

Unaudited Unaudited Audited

Note $'000 $'000 $'000

--------------------------- ------- ----------- ----------- ------------

Revenue 6 635,534 515,536 1,140,286

Operating expenses (571,733) (471,553) (1,037,384)

--------------------------- ------- ----------- ----------- ------------

Operating profit 6 63,801 43,983 102,902

Finance income 2,344 108 1,162

Finance costs (245) (205) (425)

Pension finance income 51 27 67

--------------------------- ------- ----------- ----------- ------------

Net finance income/(cost) 2,150 (70) 804

Profit before tax 65,951 43,913 103,706

Taxation 7 (16,488) (10,539) (23,563)

--------------------------- ------- ----------- ----------- ------------

Profit for the period 49,463 33,374 80,143

--------------------------- ------- ----------- ----------- ------------

Cents Cents Cents

--------------------------- ------- ----------- ----------- ------------

Earnings per share

Basic 8 176.23 118.90 285.57

Diluted 8 175.71 118.67 284.95

--------------------------- ------- ----------- ----------- ------------

Condensed Consolidated Statement of Comprehensive Income

For the 26 weeks ended 1 July 2023

Half year Half Full

2023 year year

Unaudited 2022 2022

Unaudited Audited

$'000 $'000 $'000

-------------------------------------------------- ----------- ----------- ---------

Profit for the period 49,463 33,374 80,143

--------------------------------------------------- ----------- ----------- ---------

Other comprehensive income

Items that may be reclassified subsequently

to the income statement:

Currency translation differences 1,452 (1,269) (1,614)

Items that will not be reclassified

subsequently to the income statement:

Return on pension scheme assets (excluding

interest income and impact of buy-in

policy) (1,548) (11,381) (16,374)

Re-measurement loss on buy-in policy

(note 10) (4,591) - -

Re-measurement (losses)/gains on post-employment

obligations (727) 8,201 11,916

Tax relating to components of other

comprehensive income 1,193 560 1,756

Other comprehensive income for the

period, net of tax (4,221) (3,889) (4,316)

--------------------------------------------------- ----------- ----------- ---------

Total comprehensive income for the

period, net of tax 45,242 29,485 75,827

--------------------------------------------------- ----------- ----------- ---------

Condensed Consolidated Balance Sheet

At 1 July 2023

1 July 2 July 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

Note $'000 $'000 $'000

---------------------------------- -------- ---------- ----------- ---------

Non-current assets

Property, plant and equipment 30,791 25,765 29,255

Intangible assets 770 1,002 957

Goodwill 1,010 1,010 1,010

Right-of-use assets 12,256 11,153 13,103

Deferred tax assets 3,034 579 2,381

Retirement benefit asset 10 53 717 1,234

---------------------------------- -------- ---------- -----------

47,914 40,226 47,940

---------------------------------- -------- ---------- ----------- ---------

Current assets

Inventories 18,332 22,726 18,090

Trade and other receivables 81,397 82,030 87,511

Current tax debtor - 1,331 -

Other financial assets - bank

deposits - - 34,913

Cash and cash equivalents 74,540 67,096 51,839

---------------------------------- -------- ---------- ----------- ---------

174,269 173,183 192,353

---------------------------------- -------- ---------- ----------- ---------

Current liabilities

Lease liabilities 11 (1,423) (1,246) (1,435)

Trade and other payables (115,807) (96,981) (84,761)

Current tax creditor (512) - (1,205)

(117,742) (98,227) (87,401)

---------------------------------- -------- ---------- -----------

Net current assets 56,527 74,956 104,952

---------------------------------- -------- ---------- ----------- ---------

Non-current liabilities

Lease liabilities 11 (11,610) (10,370) (12,315)

Deferred tax liabilities (358) (1,022) (357)

(11,968) (11,392) (12,672)

---------------------------------- -------- ---------- ----------- ---------

Net assets 92,473 103,790 140,220

---------------------------------- -------- ---------- ----------- ---------

Shareholders' equity

Share capital 18,842 18,842 18,842

Share premium reserve 68,451 68,451 68,451

Other reserves 5,858 4,751 4,406

Retained earnings (678) 11,746 48,521

---------------------------------- -------- ---------- ----------- ---------

Total Shareholders' equity 92,473 103,790 140,220

---------------------------------- -------- ---------- ----------- ---------

Condensed Consolidated Statement of Changes in Shareholders'

Equity (unaudited)

For the 26 weeks ended 1 July 2023

Retained earnings

--------------------

Share

Share premium Other Own Profit Total

capital reserve reserves shares and loss equity

$'000 $'000 $'000 $'000 $'000 $'000

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Balance at 2 January 2022 18,842 68,451 6,020 (851) (9,496) 82,966

---------------------------------

Profit for the period 33,374 33,374

Other comprehensive income (1,269) (2,620) (3,889)

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Total comprehensive income (1,269) 30,754 29,485

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Proceeds from options exercised 12 12

Own shares utilised 825 (825) -

Own shares purchased (980) (980)

Share-based payment charge 442 442

Dividends (8,135) (8,135)

At 2 July 2022 18,842 68,451 4,751 (1,006) 12,752 103,790

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Profit for the period 46,769 46,769

Other comprehensive income (345) (82) (427)

Total comprehensive income (345) 46,687 46,342

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Proceeds from options exercised 332 332

Own shares utilised 366 (366) -

Own shares purchased (230) (230)

Share-based payment charge 373 373

Deferred tax relating to

share options 52 52

Deferred tax relating to

UK tax losses 148 148

Dividends (10,587) (10,587)

At 31 December 2022 18,842 68,451 4,406 (870) 49,391 140,220

--------- --------- ---------- -------- ---------- ---------

Profit for the period 49,463 49,463

Other comprehensive income 1,452 (5,673) (4,221)

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Total comprehensive income 1,452 43,790 45,242

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Proceeds from options exercised 67 67

Own shares utilised 607 (607) -

Own shares purchased (501) (501)

Share-based payment charge 486 486

Dividends (93,041) (93,041)

Balance at 1 July 2023 18,842 68,451 5,858 (764) 86 92,473

--------------------------------- --------- --------- ---------- -------- ---------- ---------

Condensed Consolidated Cash Flow Statement

For the 26 weeks ended 1 July 2023

Half year Half year Full year

2023 2022 2022

Unaudited Unaudited Audited

Note $'000 $'000 $'000

------------------------------------------- ----- ----------- ----------- ----------

Cash flows from operating activities

Cash generated from operations 12 98,381 49,639 97,040

Tax paid (16,515) (9,151) (20,755)

Finance income received 2,376 108 1,130

Finance costs paid (20) (35) (33)

Lease interest (225) (176) (398)

------------------------------------------- ----- ----------- ----------- ----------

Net cash generated from operating

activities 83,997 40,385 76,984

------------------------------------------- ----- ----------- ----------- ----------

Cash flows from investing activities

Purchases of property, plant and

equipment (3,580) (2,263) (7,719)

Purchases of intangible assets - (179) (341)

Proceeds from sale of property, plant

and equipment 124 3 49

Consideration for business combination - (1,700) (1,700)

Decrease/(increase) in current asset

investments - bank deposits 36,151 - (35,003)

----------

Net cash used in investing activities 32,695 (4,139) (44,714)

------------------------------------------- ----- ----------- -----------

Cash flows from financing activities

Capital element of lease payments (717) (584) (1,225)

Proceeds from share options exercised 67 12 344

Purchases of own shares (501) (980) (1,210)

Dividends paid to Shareholders 9 (93,041) (8,135) (18,722)

------------------------------------------- ----- ----------- ----------- ----------

Net cash used in financing activities (94,192) (9,687) (20,813)

------------------------------------------- ----- ----------- ----------- ----------

Net movement in cash and cash equivalents 22,500 26,559 11,457

Cash and cash equivalents at beginning

of the period 51,839 41,589 41,589

Exchange gains/(losses) on cash and

cash equivalents 201 (1,052) (1,207)

------------------------------------------- ----- ----------- ----------- ----------

Cash and cash equivalents at end

of the period 74,540 67,096 51,839

------------------------------------------- ----- ----------- ----------- ----------

Notes to the Interim Financial Statements

1 General information

4imprint Group plc is a public limited company incorporated in

England and Wales, domiciled in the UK and listed on the London

Stock Exchange. Its registered office is 25 Southampton Buildings,

London, WC2A 1AL.

These interim condensed consolidated financial statements, which

were authorised for issue in accordance with a resolution of the

Directors on 8 August 2023, do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the period ended 31 December 2022 were

approved by the Board of Directors on 14 March 2023 and delivered

to the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 of

the Companies Act 2006.

The financial information contained in this report has neither

been audited nor reviewed by the auditors, pursuant to Auditing

Practices Board guidance on Review of Interim Financial

Information.

2 Basis of preparation

These interim condensed consolidated financial statements for

the 26 weeks ended 1 July 2023 have been prepared, in US dollars,

in accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and IAS 34 'Interim Financial

Reporting', as adopted by the United Kingdom, and should be read in

conjunction with the Group's financial statements for the period

ended 31 December 2022, which were prepared in accordance with

UK-adopted International Accounting Standards.

As outlined in the Going concern section of the Financial

Review, the Directors consider it appropriate to continue to adopt

the going concern basis in preparing these interim condensed

consolidated financial statements.

The tax charge for the interim period is accrued based on the

best estimate of the tax charge for the full financial year.

3 Accounting policies

The accounting policies applied in these interim condensed

consolidated financial statements are consistent with those

followed in the preparation of the Group's annual consolidated

financial statements for the period ended 31 December 2022, as

described in those annual financial statements. New accounting

standards applicable for the first time in this reporting period

have no impact on the Group's results or balance sheet.

On 20 June 2023 the UK Finance Bill was substantively enacted in

the UK, including legislation to implement the OECD Pillar Two

income taxes for periods beginning on or after 31 December 2023.

The Group has applied the exception in the Amendments to IAS 12

issued in May 2023 and endorsed in July 2023 and has neither

recognised nor disclosed information about deferred tax assets or

liabilities relating to Pillar Two income taxes.

4 Estimates and judgments

The critical accounting judgments and key assumptions and

sources of estimation uncertainty were the same as those applied to

the Group's annual consolidated financial statements for the period

ended 31 December 2022, except for the new critical accounting

judgment in relation to the purchase of a bulk annuity policy and

an update to the pensions assumptions, as detailed below.

Critical accounting judgments

Purchase of a bulk annuity policy

During the period the Trustee of the 4imprint 2016 Pension Plan

(the "Plan") exchanged the existing investment portfolio, including

a further cash lump sum contribution from the Group, for a bulk

purchase annuity policy. This policy funds most of the Plan's

defined benefit obligations (a buy-in policy). This was an

investment decision made in line with the stated objective of

further de-risking the Plan's obligations. The Plan retains the

legal and constructive obligation to pay the benefits and the

Trustee continues to administer the Plan.

Based upon the above, management's judgment was that the

purchase of the policy did not constitute a settlement, as defined

by IAS 19, and the excess of the cost of the annuity over the IAS

19 valuation of the obligations covered has been recorded in other

comprehensive income.

Key assumptions and sources of estimation uncertainty

Pensions

As detailed in note 10, the Group sponsors a defined benefit

pension plan (the "Plan") closed to new members and future accrual.

Most of the obligations of the plan are funded by a bulk purchase

annuity policy, the fair value of which, on an IAS 19 basis,

matches the present value of the obligations being covered.

Period-end valuation of the obligations of the Plan requires a

number of significant actuarial assumptions to be made, including

inflation rate, discount rate and mortality rates. Small changes in

assumptions can have a significant impact on the amounts recorded

in other comprehensive income and on the pension obligations and

annuity asset in the balance sheet. Sensitivities to changes in

these assumptions are disclosed in note 10.

5 Financial risk management

The Group's activities expose it to a variety of financial

risks: currency risk; credit risk; liquidity risk; and capital

risk. These interim condensed consolidated financial statements do

not include all financial risk management information and

disclosures required in the annual financial statements; they

should be read in conjunction with the Group's annual consolidated

financial statements for the period ended 31 December 2022. There

have been no changes in any financial risk management policies

since that date.

6 Segmental analysis

The chief operating decision maker has been identified as the

Board of Directors and the segmental analysis is presented based on

the Group's internal reporting to the Board.

At 1 July 2023, the Group had two operating segments, North

America and UK & Ireland. The costs of the Head Office are

reported separately to the Board, but this is not an operating

segment.

Half Half Full

year year year

2022 2022

2023 $'000 $'000

Revenue $'000

--------------------- -------- -------- ----------

North America 623,797 505,864 1,120,517

UK & Ireland 11,737 9,672 19,769

--------------------- -------- -------- ----------

Total Group revenue 635,534 515,536 1,140,286

--------------------- -------- -------- ----------

Half Half Full

year 2023 year year

2022 2022

Profit $'000 $'000 $000

--------------------------------------------------- ----------- -------- --------

North America 66,290 46,420 107,965

UK & Ireland 31 (132) (54)

--------------------------------------------------- ----------- -------- --------

Operating profit from Direct Marketing operations 66,321 46,288 107,911

Head Office costs (2,520) (2,305) (5,009)

--------------------------------------------------- ----------- -------- --------

Operating profit 63,801 43,983 102,902

Net finance income/(cost) 2,150 (70) 804

--------------------------------------------------- ----------- -------- --------

Profit before tax 65,951 43,913 103,706

--------------------------------------------------- ----------- -------- --------

Other segmental information

Assets Liabilities

---------------------------- ----------------------------------

1 July 2 July 31 Dec 1 July 2 July 31 Dec

2023 2022 2022

$'000 $'000 2022 2023 $'000 2022

$'000 $'000 $'000

--------------- -------- -------- -------- ---------- ---------- ----------

North America 139,678 140,731 146,401 (120,496) (105,346) (95,817)

UK & Ireland 4,381 3,948 3,175 (4,446) (3,798) (3,345)

Head Office 78,124 68,730 90,717 (4,768) (475) (911)

--------------- -------- -------- -------- ---------- ---------- ----------

222,183 213,409 240,293 (129,710) (109,619) (100,073)

--------------- -------- -------- -------- ---------- ---------- ----------

Head Office assets include other financial assets - bank

deposits, cash and cash equivalents, deferred tax assets and the

retirement benefit asset. Head Office liabilities include other

payables and accruals.

7 Taxation

The taxation rate was 25%, based on the estimated rate for the

full year (H1 2022: 24%; FY 2022: 23%). Tax paid in the period was

$16.5m (H1 2022: $9.2m; FY 2022: $20.8m).

The deferred tax assets/liabilities at 1 July 2023 have been

calculated at a tax rate of 25% (19% in respect of deferred tax

items that were expected to reverse before 1 April 2023 for H1 2022

and FY 2022, and 25% in respect of deferred tax items expected to

reverse after 1 April 2023 for H1 2022 and FY 2022) for UK deferred

tax items, and 25% (H1 2022: 25%; FY 2022: 25%) in respect of US

deferred tax items.

8 Earnings per share

Basic and diluted

The basic and diluted earnings per share are calculated based on

the following data:

Half Half Full

year year year

2023 2022 2022

$'000 $'000 $'000

------------------ ------- ------- -------

Profit after tax 49,463 33,374 80,143

------------------ ------- ------- -------

Half Half Full

year year year

2023 2022 2022

Number Number Number

000's 000's 000's

------------------------------------------- ------- ------- -------

Basic weighted average number of shares 28,068 28,070 28,064

Adjustment for employee share options 82 53 61

------------------------------------------- ------- ------- -------

Diluted weighted average number of shares 28,150 28,123 28,125

------------------------------------------- ------- ------- -------

Cents Cents Cents

------------------------------------------- ------- ------- -------

Basic earnings per share 176.23 118.90 285.57

------------------------------------------- ------- ------- -------

Diluted earnings per share 175.71 118.67 284.95

------------------------------------------- ------- ------- -------

The basic weighted average number of shares excludes shares held

in the 4imprint Group plc employee benefit trust. The effect of

this is to reduce the average by 17,444 (H1 2022: 15,931; FY 2022:

21,632).

9 Dividends Half Half Full

year year year

2023 2022 2022

$'000 $'000 $'000

---------------------------------- ------- ------ -------

Dividends paid in the period 93,041 8,135 18,722

---------------------------------- ------- ------ -------

Cents Cents Cents

---------------------------------- ------- ------ -------

Dividends per share

declared - Interim 65.00 40.00 40.00

- Final - - 120.00

- Special - - 200.00

--------------------------------- ------- ------ -------

The interim dividend for 2023 of 65.00c per ordinary share

(interim 2022: 40.00c; final 2022: 120.00c; special 2022: 200.00c)

will be paid on 15 September 2023 to Shareholders on the register

at the close of business on 18 August 2023.

10 Employee pension schemes

The Group operates defined contribution pension schemes for its

UK and US employees. The regular contributions are charged to the

income statement as they are incurred.

The Group also sponsors a UK defined benefit pension scheme (the

"Plan") which is closed to new members and future accrual. The

funds of the scheme are held in trust, administered by a corporate

Trustee, and are independent of the Group's finances.

The preliminary results of the triennial actuarial valuation of

the Plan as at 30 September 2022 have been updated on an

approximate basis to 1 July 2023 in accordance with IAS 19. There

have been no changes in the valuation methodology adopted for this

period's disclosures compared to previous periods' disclosures.

The Plan entered a GBP20.7m buy-in transaction on 27 June 2023

with Legal and General Assurance Society Limited to insure

substantially all remaining pension benefits of the Plan through

the purchase of a bulk annuity policy. The premium of GBP20.7m was

settled by the transfer of the Plan's existing investment portfolio

valued at GBP17.5m and a cash amount of GBP3.2m (c.$4m) paid by the

Group after the date of these interim financial statements in early

July 2023. The difference between the cost of the insurance policy

and the IAS 19 accounting value of the liabilities secured was

GBP3.7m ($4.6m) and has been recorded within other comprehensive

income.

The principal assumptions applied by the actuaries at 1 July

2023 were:

Half Half Full

year year year

2023 2022 2022

----------------------------------------- ------ ------ ------

Rate of increase in pensions in payment 3.12% 3.10% 3.08%

Rate of increase in deferred pensions 2.71% 2.60% 2.66%

Discount rate 5.26% 3.55% 4.82%

Inflation assumption - RPI 3.21% 3.20% 3.16%

Inflation assumption - CPI 2.71% 2.60% 2.66%

----------------------------------------- ------ ------ ------

The mortality assumptions adopted at 1 July 2023 imply the

following life expectancies at age 65:

Half Half Full

year year year

2023 2022 2022

Years Years Years

Male currently aged 45 22.4 22.3 22.3

Female currently aged 45 24.3 24.3 24.2

Male currently aged 65 21.4 21.3 21.3

Female currently aged 65 23.1 23.1 23.1

-------------------------- ------- ------- -------

The movement on the net retirement benefit asset, and the value

of the gross scheme assets and liabilities, are shown in the

Financial Review.

The sensitivities on key actuarial assumptions at the end of the

period were:

Change in defined benefit

Change in assumption obligation

------------------- ----------------------------- --------------------------

Discount rate Decrease of 1.00% +12.9%

Rate of inflation Increase of 1.00% +4.5%

Increase in life expectancy

Rate of mortality of one year +2.8%

------------------- ----------------------------- --------------------------

11 Leases

The Group leases office and industrial space in Oshkosh and

Appleton, Wisconsin. The movement in lease liabilities in the

period is shown below:

Half Full

Half year year year

2023 2022 2022

$'000 $'000 $'000

------------------------------------------ ----------- ------- --------

At start of period 13,750 12,089 12,089

Additions - 111 2,886

Interest charge 225 176 398

Lease interest payments - operating cash

flow (225) (176) (398)

Lease capital payments - financing cash

flow (717) (584) (1,225)

At end of period 13,033 11,616 13,750

------------------------------------------ ----------- ------- --------

12 Cash generated from operations

Half Half Full

year year year

2023 2022 2022

$'000 $'000 $'000

---------------------------------------------------- -------- --------- ---------

Profit before tax 65,951 43,913 103,706

Adjustments for:

Depreciation of property, plant and equipment 2,081 1,757 3,594

Amortisation of intangible assets 189 216 424

Amortisation of right-of-use assets 847 683 1,508

(Profit)/loss on disposal of property, plant

and equipment (118) 3 84

Share option charges 486 442 815

Net finance (income)/cost (2,150) 70 (804)

Defined benefit pension administration charge 470 175 521

Contributions to defined benefit pension

scheme (2,121) (2,202) (4,367)

Changes in working capital:

(Increase)/decrease in inventories (277) (2,167) 2,469

Decrease/(increase) in trade and other receivables 3,803 (18,587) (24,164)

Increase in trade and other payables 29,220 25,336 13,254

Cash generated from operations 98,381 49,639 97,040

---------------------------------------------------- -------- --------- ---------

13 Capital commitments

The Group had capital commitments contracted but not provided

for in these financial statements for property, plant and equipment

of $1.6m (2 July 2022: $4.1m; 31 December 2022: $2.7m).

14 Related party transactions

Transactions and balances between the Company and its

subsidiaries have been eliminated on consolidation. The Group did

not participate in any related party transactions with parties

outside of the Group.

15 Post balance sheet events

On 25 July 2023, the Company issued 87,000 ordinary shares for a

consideration of GBP1.9m to satisfy option exercises under the 2021

US Employee Stock Purchase Plan. Full details of the Company's

share option schemes are given in notes 22 and 23 of the Company's

Annual Report and Accounts 2022.

Alternative Performance Measures

An Alternative Performance Measure ("APM") is a financial

measure of historical or future financial performance, financial

position, or cash flows, other than a financial measure defined or

specified within IFRS.

The Group uses APMs to supplement standard IFRS measures to

provide users with information on underlying trends and additional

financial measures, which the Group considers will aid users'

understanding of the business.

Definitions of the Group's APMs can be found on pages 142 and

143 of the 2022 Annual Report.

Reconciliations of the free cash flow, capital expenditure,

underlying operating cash flow, and cash and bank deposits APMs to

their closest IFRS measures are provided below:

Half

Half year

year 2023 2022

$m $m

------------------------------------------------------- ----------- ------

Net movement in cash and cash equivalents 22.5 26.6

Less: Decrease in current asset investments - bank

deposits (36.1) -

Less: Exchange gain on decrease in current asset

investments - bank deposits 1.2 -

Add back: Dividends paid to Shareholders 93.0 8.1

Add back: Exchange gains on cash and cash equivalents 0.2 (1.1)

------------------------------------------------------- ----------- ------

Free cash flow 80.8 33.6

------------------------------------------------------- ----------- ------

Half

Half year

year 2023 2022

$m $m

----------------------------------------------------- ----------- ------

Purchase of property, plant and equipment (3.6) (2.2)

Purchase of intangible assets - (0.2)

Proceeds from sale of property, plant and equipment 0.1 -

Capital expenditure (3.5) (2.4)

----------------------------------------------------- ----------- ------

Half

Half year

year 2023 2022

$m $m

---------------------------------------------------- ----------- ------

Cash generated from operations 98.4 49.6

Add back: Contributions to defined benefit pension

scheme 2.1 2.2

Add back: Profit on disposal of property, plant

and equipment 0.2 -

Less: Purchases of property, plant and equipment

and intangible assets (3.6) (2.4)

Add back: Proceeds from sale of property, plant

and equipment 0.1 -

Underlying operating cash flow 97.2 49.4

---------------------------------------------------- ----------- ------

1 July 2 July 31 Dec

2023 2022 2022

$m $m $m

---------------------------------------- ------- ------- -------

Cash and cash equivalents 74.5 67.1 51.9

Other financial assets - bank deposits - - 34.9

Cash and bank deposits 74.5 67.1 86.8

---------------------------------------- ------- ------- -------

Statement of Directors' Responsibilities

The Directors confirm that, to the best of their knowledge,

these interim condensed consolidated financial statements have been

prepared in accordance with IAS 34 as adopted by the United Kingdom

and that the interim management report includes a fair review of

the information required by DTR 4.2.7 and 4.2.8, namely:

-- An indication of the important events that have occurred

during the first half of the year and their impact on the interim

condensed consolidated financial statements, and a description of

the principal risks and uncertainties for the remaining six months

of the financial year; and

-- Material related party transactions in the first half of the

year and any material changes in the related party transactions

described in the last annual report.

The Directors of 4imprint Group plc are as listed in the Group's

Annual Report and Accounts 2022.

By order of the Board

Kevin Lyons-Tarr David Seekings

Chief Executive Chief Financial

Officer Officer

9 August 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRTEITIIV

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

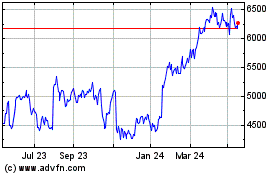

4imprint (LSE:FOUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

4imprint (LSE:FOUR)

Historical Stock Chart

From Dec 2023 to Dec 2024