TIDMEOT

RNS Number : 6408V

European Opportunities Trust PLC

05 December 2023

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS RESTRICTED AND

IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION IN WHOLE OR IN PART

IN CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY

OTHER JURISDICTION WHERE ITS RELEASE, PUBLICATION OR DISTRIBUTION

IS OR MAY BE UNLAWFUL. THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN

INVITATION TO PARTICIPATE IN THE TER OFFER (AS DEFINED HEREIN) IN

OR FROM ANY JURISDICTION IN OR FROM WHICH, OR TO OR FROM ANY PERSON

TO OR FROM WHOM, IT IS UNLAWFUL TO MAKE SUCH OFFER UNDER APPLICABLE

SECURITIES LAWS OR OTHERWISE.

EUROPEAN OPPORTUNITIES TRUST PLC

("EOT" or the "Company")

TER OFFER

The Company has today published a circular to Shareholders (the

"Circular") which contains further details of the Tender Offer,

together with details of how Shareholders can tender Ordinary

Shares for purchase, if they wish to do so.

Background

On 6 November 2023, the Board announced that, following active

engagement with Shareholders, it had decided that the Company

should undertake a Tender Offer for up to 25 per cent. of the

issued share capital of the Company. The Tender Offer, which is

subject to Shareholder approval, is being made at a Tender Price

equal to a 2 per cent. discount to the prevailing Net Asset Value

per Share as at the Calculation Date, less the costs of

implementing the Tender Offer (as more precisely set out in Part 3

of the Circular). Completion of the Tender Offer is expected to

take place on 31 January 2024.

The Board had previously announced, on 12 October 2023,

proposals for a further performance related tender offer to be made

as soon as is practicable after the annual general meeting in 2026

if the Company's Net Asset Value total return does not equal or

exceed the Company's benchmark total return (MSCI Europe Index TR

in Sterling) over the three-year period beginning 1 June 2023 and

ending on 31 May 2026. For the avoidance of doubt, the Board's

intention to arrange for the conditional tender offer in 2026 is

not affected by the present Tender Offer.

The Tender Offer

The Board has arranged for Singer Capital Markets Securities

Limited to conduct the Tender Offer for up to 25 per cent. of the

Company's Shares in issue at the Tender Price. The Company will pay

the Tender Price in cash.

The maximum number of Shares to be acquired under the Tender

Offer is 24,074,080 Shares, representing 25 per cent. of the Shares

in issue (excluding Shares held in treasury) as at the Latest

Practicable Date. The Board will continue to make market purchases

of Shares pursuant to its stated discount management policy during

the Tender Offer period, to the extent that it has Shareholder

authority to do so, meaning that the 24,074,080 Shares to be

tendered may represent slightly more than 25 per cent. of the

Shares in issue on completion of the Tender Offer.

The Tender Offer will only be open to Shareholders on the

register at 6.00 p.m. on 29 January 2024 (the Tender Record Date).

For US Shareholders, the Tender Offer will be open solely to

Qualifying US Shareholders. The Tender Offer is subject to certain

conditions, and may be suspended or terminated in certain

circumstances, as set out in the Circular.

The Tender Offer is intended to enable those Shareholders (other

than Restricted Shareholders) who wish to sell some or all of their

Shares to elect to do so, subject to the overall limits of the

Tender Offer. Shareholders who successfully tender Shares will

receive the Tender Price per Share. The Tender Price has been set

at this level to allow Shareholders who wish to realise a portion

of their holding of Shares to do so at a price close to NAV whilst

providing for a modest uplift to NAV per Share for continuing

Shareholders.

An Eligible Shareholder tendering up to their Basic Entitlement

will have their tender satisfied in full. Any Eligible Shareholder

tendering more than their Basic Entitlement will have their Excess

Application satisfied if there are sufficient remaining Available

Shares. Such Available Shares shall be apportioned to Eligible

Shareholders pro rata to their Excess Applications should other

Eligible Shareholders not tender the full amount of their Basic

Entitlement and as a result of certain Overseas Shareholders not

being permitted to participate in the Tender Offer.

In making the Tender Offer, Singer Capital Markets will purchase

the Shares which have been validly tendered as principal by means

of an on-market purchase from tendering Shareholders and will sell

the tendered Shares acquired by it on to the Company pursuant to

the terms of the Repurchase Agreement. All Shares acquired by the

Company from Singer Capital Markets under the Repurchase Agreement

will be cancelled.

Share buy backs

In addition to the Tender Offer authority, the Board intends to

seek renewal of its authority to make market purchases of up to

14.99 per cent. of the Shares currently in issue at the General

Meeting. This authority would expire at the next annual general

meeting of the Company, at which the Board currently intends to

seek renewal of the authority.

General Meeting

The implementation of the Tender Offer requires the approval of

Shareholders. A notice convening a General Meeting of the Company,

which is to be held at 11.00 a.m. on 21 December 2023 at the

offices of Devon Equity Management Limited, 123 Victoria Street,

London, SW1E 6DE, is set out in Part 9 of the Circular.

Expected timetable

2023

Publication of the Circular and Tender 5 December

Offer opens

Time and date of General Meeting 11.00 a.m. on 21 December

2024

Last time and date for receipt of Tender 1.00 p.m. on 29 January

Form, settlement of TTE Instruction(s)

from CREST and Tender Closing Date

Tender Record Date 6.00 p.m. on 29 January

Calculation Date 29 January

Completion of the Tender Offer 31 January

Announcement of the results of Tender Offer 31 January

CREST settlement date: Payments through 5 February

CREST made and CREST accounts settled

Cheques and balancing share certificates 5 February

despatched to certificated Shareholders

in the week commencing

The times and dates set out in the expected timetable and

mentioned throughout this document may, in certain circumstances,

be adjusted by the Board (subject to advice from Singer Capital

Markets), in which event, details of the new times and dates will

be notified, as required, to the London Stock Exchange and, where

appropriate, to Shareholders and an announcement will be made

through a Regulatory Information Service.

All references to times in this announcement are to London time

unless otherwise stated.

Circular

Capitalised terms shall have the meaning attributed to them in

the Circular unless otherwise defined in this announcement.

The Circular can be viewed on the Company's website at

https://www.devonem.com/european-opportunities-trust-plc/ and will

be submitted to the National Storage Mechanism and available for

inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

shortly. In addition, those Shareholders (other than Restricted

Shareholders) who have elected to receive hard copies of documents

will receive a copy of the Circular by post.

LEI: 549300XN7RXQWHN18849

For further information, please contact:

Devon Equity Management Limited - AIFM enquiries@devonem.com

Richard Pavry / Charles Bilger +44 (0)20 3985 0445

Singer Capital Markets - Corporate broker

Robert Peel / Angus Campbell (Investment

Banking)

Alan Geeves / James Waterlow / Sam Greatrex

(Sales) +44 (0)20 7496 3000

Buchanan Communications - PR Adviser eot@buchanancomms.co.uk

Henry Wilson +44 (0)7788 528143

Helen Tarbet +44 (0)7872 604453

George Beale +44 (0)7450 295099

IMPORTANT INFORMATION

This announcement contains forward-looking statements. These

forward-looking statements include all matters that are not

historical facts. These forward-looking statements are made based

upon the Company's expectations and beliefs concerning future

events impacting the Company and therefore involve a number of

risks and uncertainties. Forward-looking statements are not

guarantees of future performance, and the Company's actual results

of operations, financial condition and liquidity may differ

materially and adversely from the forward-looking statements

contained in this announcement. Forward-looking statements speak

only as of the day they are made and the Company does not undertake

to update its forward-looking statements unless required by

law.

Singer Capital Markets Securities Limited, which conducts its UK

investment banking activities as Singer Capital Markets ("Singer

Capital Markets"), is authorised and regulated in the United

Kingdom by the FCA, and is acting exclusively for the Company and

no-one else in relation to the Tender Offer or the matters referred

to in this announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to

customers of Singer Capital Markets nor for providing advice in

relation to the Tender Offer or the matters referred to in this

announcement. Nothing in this paragraph shall serve to exclude or

limit any responsibilities which Singer Capital Markets may have

under the Financial Services and Markets Act 2000 (as amended) or

the regulatory regime established thereunder. Offers to purchase

any Shares in the Tender Offer in the United States will be made in

accordance with Rule 15a-6 under the US Exchange Act of 1934, as

amended.

ANY DECISION TO PARTICIPATE IN THE TENDER OFFER SHOULD ONLY BE

MADE ON THE BASIS OF AN INDEPENDENT REVIEW BY AN ELIGIBLE

SHAREHOLDER OF THE COMPANY'S PUBLICLY AVAILABLE INFORMATION.

NEITHER SINGER CAPITAL MARKETS NOR ANY OF THEIR AFFILIATES ACCEPT

ANY LIABILITY ARISING FROM THE USE OF, OR MAKE ANY REPRESENTATION

AS TO THE ACCURACY OR COMPLETENESS OF, THIS ANNOUNCEMENT OR THE

COMPANY'S PUBLICLY AVAILABLE INFORMATION. THE INFORMATION CONTAINED

IN THIS ANNOUNCEMENT IS SUBJECT TO CHANGE IN ITS ENTIRETY WITHOUT

NOTICE UP TO THE CLOSING DATE.

Overseas Shareholders

The distribution of this announcement in certain jurisdictions

may be restricted by law. It is the responsibility of all Overseas

Shareholders to satisfy themselves as to the observance of any

legal requirements in their jurisdiction, including, without

limitation, any relevant requirements in relation to the ability of

such holders to participate in the Tender Offer.

This announcement does not constitute any offer for or

invitation to sell or purchase any securities, or any solicitation

of any offer for, securities in any Restricted Jurisdiction. Any

acceptance or other response to the Tender Offer should be made

only on the basis of information contained in or referred to in a

circular to be circulated. Such a circular will contain important

information, including the full terms and conditions of the Tender

Offer, which Shareholders are urged to read carefully. Any circular

will not be distributed or sent in or into any Restricted

Jurisdiction and the Tender Offer will not be made, directly or

indirectly, in or into, or by use of the mails of, or by any means

or instrumentality of interstate or foreign commerce of, or any

facilities of a national securities exchange of, Australia, Canada,

Japan, New Zealand, the Republic of South Africa, any member state

of the European Economic Area and any other jurisdiction into which

the making of the Tender Offer would constitute a violation of the

laws of such jurisdiction (each a "Restricted Jurisdiction", and

any Shareholders who are resident in, or citizens of, any of the

foregoing jurisdictions, "Restricted Shareholders").

US Shareholders

The Tender Offer relates to securities in a non -- US company

and is subject to the disclosure requirements, rules and practices

applicable to companies listed in the UK, which differ from those

of the United States in certain material respects. Any circular

will have been prepared in accordance with the UK style and

practice for the purpose of complying with English law. The

financial information relating to the Company will not have been

prepared in accordance with generally accepted accounting

principles in the United States and thus may not be comparable to

financial information relating to US companies. The Tender Offer

will not be subject to the disclosure and other procedural

requirements of Regulation 14D under the Exchange Act. The Tender

Offer will be made in the United States in accordance with the

requirements of Regulation 14E under the Exchange Act to the extent

applicable. Certain provisions of Regulation 14E under the Exchange

Act are not applicable to the Tender Offer by virtue of Rule 14d --

1(d) under the Exchange Act. US Shareholders should note that the

shares are not listed on a US securities exchange and the Company

is not subject to the periodic reporting requirements of the

Exchange Act and is not required to, and does not, file any reports

with the US Securities and Exchange Commission thereunder.

The Company has not been, and will not be, registered in the

United States as an investment company under the United States

Investment Company Act of 1940 (the "Investment Company Act"). In

order to avoid being required to register under, or otherwise

violating, the Investment Company Act, the Company has implemented

restrictions on the ownership and transfer of its Shares. As such,

the Tender Offer will be made solely to US Shareholders who are

both qualified institutional buyers as defined in Rule 144A under

the US Securities Act of 1933, as amended, and qualified purchasers

as defined in section 2(a)(51) of the Investment Company Act.

It may be difficult for US Shareholders to enforce certain

rights and claims arising in connection with the Tender Offer under

US federal securities laws since the Company is located outside the

United States and its officers and directors reside outside the

United States. It may not be possible to sue a non -- US company or

its officers or directors in a non -- US court for violations of US

securities laws. It also may not be possible to compel a non -- US

company or its affiliates to subject themselves to a US court's

judgment.

The receipt of cash pursuant to the Tender Offer may be a

taxable transaction for US federal income tax purposes. In

addition, holders may be subject to US backup withholding and

information reporting on payments with respect to the Tender Offer

made (or deemed made) within the United States. Each US Shareholder

should consult and seek individual tax advice from an appropriate

professional adviser.

To the extent permitted by applicable law and in accordance with

normal UK practice, the Company, Singer Capital Markets or any of

their respective affiliates, may make certain purchases of, or

arrangements to purchase, shares outside the United States during

the period in which any tender offer remains open for

participation, including sales and purchases of shares effected by

Singer Capital Markets acting as market maker in the shares. These

purchases, or other arrangements, may occur either in the open

market at prevailing prices or in private transactions at

negotiated prices. In order to be excepted from the requirements of

Rule 14e -- 5 under the Exchange Act by virtue of Rule 14e --

5(b)(12) thereunder, such purchases, or arrangements to purchase,

must comply with applicable English law and regulation, including

the listing rules of the FCA, and the relevant provisions of the

Exchange Act. Any information about such purchases will be

disclosed as required in the UK and the US and, if required, will

be reported via a Regulatory Information Service and will be

available on the London Stock Exchange website at

http://www.londonstockexchange.com .

The Tender Offer, the Circular and this announcement have not

been approved, disapproved or otherwise recommended by the SEC, any

US state securities commission or any other US regulatory

authority, nor have such authorities passed upon the merits or

fairness of the Tender Offer or determined the adequacy of the

information contained in the Circular. Any representation to the

contrary is a criminal offence in the United States.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENNKQBNDBDBDBK

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

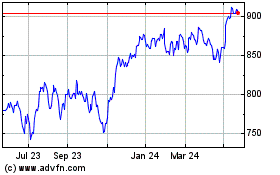

European Opportunities (LSE:EOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

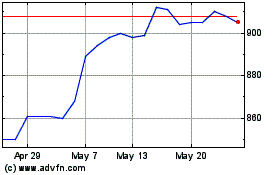

European Opportunities (LSE:EOT)

Historical Stock Chart

From Nov 2023 to Nov 2024