TIDMENET

RNS Number : 4575E

Ethernity Networks Ltd

30 June 2023

30 June 2023

Ethernity Networks Ltd.

("Ethernity" or the "Company")

Results for the Year Ended 31 December 2022

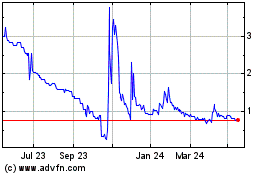

Ethernity Networks Ltd (AIM: ENET.L), a leading supplier of data

processing semiconductor technology for networking appliances,

today announces its audited results for the year ended 31 December

2022.

Financial Highlights

-- Revenues increased by 11.5% to $2.94m (2021: $2.64m)

-- Gross margins declined by 17.82% to $ 1.6m (2021: $1.9m)

-- Gross Margin percentage declined to 54.41% (2021: 73.80%)

-- Operating costs before amortisation of intangible assets,

depreciation charges, provisions and other non-operational charges

increased by 15.5% to $8.0m (2021: $6.9m)

-- EBITDA Loss increased by 27.6% to a loss of $ 6.4m (2021: $5.05m)

-- Cash funds raised during the year of $2m before costs (2021: $11.2m)

Operational Highlights

-- The Company's sales of its DPU SoC increased by 200% with the

majority being the shipment of the ENET DPU SoC to its U.S. fixed

wireless system provider customer, with 2023 orders remaining on

track for supply, and an increased forecast from the customer for

2024;

-- the Company signed a contract for a second-generation

platform, based on a scaled-up version of the Company's DPU SoC

offering, with its U.S. fixed wireless OEM customer;

-- the Company progressed with the delivery of the $3 million

GPON and XGS-PON OLT SoC contract for its Chinese/Indian OEM, and

is now progressing with the customer for deployment;

-- the Company signed a follow-on contract of $4.6 million with

that customer for delivery of a PON device for Fiber-to-the-Room

deployment;

-- the Company delivered a UEP2025 for testing and integration

with an existing prominent microwave wireless OEM customer and is

working with the customer on joint go-to-market plans.

Post-period Highlights

-- First release of the UEP bonding product provided to our

existing Bonding OEM customer, with the customer planning to

commence field trials during Q3 2023 and initiate deployment during

Q4 2023.

-- The Asian vendor's XGS-PON OLT platform, that embeds

Ethernity's XGSPON MAC FPGA SoC, plans to commence deployment

during this year.

-- The FTTR gateway was completed, however we expect delays in

deployment by the customer, due to the customer's own constraints,

therefore FTTR revenues for the current year from the customer are

uncertain.

-- The Company built a new plan for a two layer PON solution

that utilizes the FTTR platform with more functionality and at a

higher price to serve high-rise buildings such as

Multi-Dwelling-Units (MDUs).

-- Received a purchase order for $1.5 million from its existing

fixed wireless customer to supply the Company's data processing

system-on-chip (SoC) in staged deliveries during Q3 2023.

-- The Company is in discussions regarding the licensing of its

PON technology with other potential vendors.

David Levi, Chief Executive, said "While it is a challenging

period due to the world financial situation, I am encouraged by the

fact that there is demand for our PON offerings that have captured

interest from larger corporations, and I am hopeful that, with the

cost reductions implemented and the modified business plan,

engagement in multiple design wins for our PON technology will

fulfil our further anticipated growth."

Re-Election of Directors

In accordance with the Company's Articles of Association, the

Company's Directors serve for a period of three years. In terms of

the General Meeting of the Company held on 22 June 2020, the term

of David Levi and Shavit Baruch, in their capacity as directors,

had been extended until 22 June 2023, the term of Mark Reichenberg

in his capacity as director, had been extended until 28 June

2023.

The re-election of Messrs. Levi, Baruch and Reichenberg as

directors for a further three years was approved by the Board of

Directors on 29 June 2023 and are to be ratified at the Company's

2023 annual general meeting ("AGM").

Posting of Annual Report

The annual report and accounts for the year ended 31 December

2022 is being posted to shareholders shortly and will be available

on the Company's website at www.ethernitynet.com . The notice of

annual general meeting will be despatched in due course.

For further information, please contact:

Ethernity Networks Ltd Tel: +972 8 915 0392

David Levi, Chief Executive Officer

Mark Reichenberg, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Joint Broker) 5656

James Reeve / Piers Shimwell (Corporate

Finance)

Amrit Nahal / Stefano Aquilino (Sales and

Corporate Broking)

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0)20 7562

0930

Lucy Williams / Duncan Vasey / Eran Zucker

About Ethernity ( www.ethernitynet.com )

Ethernity Networks (AIM: ENET.L OTCQB: ENETF) provides

innovative, comprehensive networking and security solutions on

programmable hardware that increase telco/cloud network

infrastructure capacity. Ethernity's semiconductor logic offers

data processing functionality for different networking

applications, innovative patented wireless access technology, and

fibre access media controllers, all equipped with control software

with a rich set of networking features. Ethernity's solutions

quickly adapt to customers' changing needs, improving

time-to-market, and facilitating the deployment of 5G over wireless

and fibre infrastructure.

Chairman's Statement

I am pleased to present my report as Chairman of the Board.

Since my appointment as Chair on 10 March 2021, I have spent

considerable time with the CEO and members of the Board and

management both inside and outside of formal meetings so as to

fully understand the Company's strategy, the challenges and the

current dynamic environment in which the Company operates. I

believe that the general strategic direction the Company has taken

was in line with the market direction in the past year. The

continued level of interest and engagement with more significant

market players was proof to me that the strategic direction of the

Company was the right one.

2022 was not without its challenges for Ethernity, and while the

Company continued with its strategic direction, the remaining

impacts of COVID-19, the components shortage, the instability in

the world stock markets and the world financial economic inflation

and uncertainty had an effect on planned deliveries during the

year, resulting in revenue delays. Revenue increased by 11.46% for

the 2022 financial year to $2.94 million (FY 2021 $2.63 million),

while gross margin for the year was $1.60 million (2021 $1.94

million) and an operating loss of $8.70 million (2021 $6.32

million). This is further expanded upon in the Financial Report

section of the Annual Report.

Outlook

The first six months of the current year have presented

unexpected challenges, due to delays in expected orders from

existing customers. As a result, the Company was required to

undertake a placing in May 2023 to provide short term working

capital, and has taken several steps to reduce cash burn, including

cuts to resources. The Company is also changing its business model

to meet the current situation, as described by the CEO in his

report. Notwithstanding the challenging market conditions, positive

progress has been made in the current year with a number of

customer engagements, as recently demonstrated by our $1.5 million

order from our existing fixed wireless customer.

Yosi Albagli

Chairman

30 June 2023

Chief Executive's Statement

During 2021 and 2022, Ethernity Networks enjoyed very active

years in contracts signed and market acceptance of our product and

solutions offerings, as evidenced by the major growth in sales of

our DPU SoC during 2022 resulting in an increase in FPGA product

sales of 200%. Yet, on the other hand, the Company faced new

challenges due to the world wide component shortage, especially as

the Company had planned to introduce its complete system product to

the market, which required tight supply chain management.

During the year under review, the Company continued its main

focus of delivering complete solutions, including network operating

systems, and hardware. We further continued development of our ENET

5200 FPGA System-on-Chip (SoC) Quad XGS-PON OLT devices as per the

$3 million contract with an Asian broadband network OEM, first

announced on 18 October 2021, which will enable two types of PON

(XGS-PON and GPON) for use in the OEM's 5G fronthaul products, as

well as other fiber access deployments, which resulted in a follow

on $4.6 million contract for Fiber-To-The-Room FPGA SoC Device

(announced on 20 September 2022).

The Company continued the UEP system product development

targeting the estimated $2 billion cell site router market, where

over and above the regular cell site routing functions, the UEP

differentiates itself by embedding the Company's patented link

bonding to allow transmission of higher speed throughput over

multiple wireless connections. In March 2023, the Company announced

the delivery of the first release of the product to an existing

microwave OEM customer, who plans commencing field trials during Q3

2023, with the initiation of deployment production targeted in Q4

2023.

Further to this, following on from the successful rollout of our

DPU SoC delivered for the Company's American fixed wireless

broadband solution customer, the customer signed a further $340k

contract to adapt Ethernity's solution for the customer's

first-generation product with extended performance into a

second-generation product.

Ethernity operates and sells its product through OEMs, and its

Radio Access Network offering includes a mix of FPGA SoCs embedding

our ENET network flow processor switch/router data plane, which is

deployed in our OEMs' products, FPGA SmartNIC for Fronthaul

aggregation, vRouter offload, Central Unit Data Plane offload and

UPF data plane offload, and a cell site gateway appliance under the

Universal Edge Platform (UEP) product family.

Over the last decade, the Company ENET DPU SoC devices have been

deployed into 850,000 systems over more than 20 different

platforms, with different solutions and configurations into

Ethernet access devices, broadband access, aggregation platforms,

wireless access, cellular base stations and the aviation

market.

The Company has built extensive knowledge in the wireless and

cellular market, and over the last decade signed multiple licensing

contracts for use of our ENET Flow Processor IP with vendors

developing products and systems. The Company has delivered

thousands of FPGA SoCs into this market, including fixed wireless

systems (proprietary and LTE) base stations, point-to-point

microwave systems and 4(th) gen LTE EPC data plane. All of which

are the backbone of our current 5G offering, with many of today's

OEMs that serve fixed wireless and wireless backhaul embedding

Ethernity's offering in their platforms.

Current Trading

During the first half of 2023, we continued to progress with

releases of our new products including 10G and GPON intellectual

property ported on FPGA, and the release of the UEP bonding

product.

Notably to date in 2023, the following has been achieved:

-- First release of the UEP bonding product provided to our

existing Bonding OEM customer, with the customer planning to

commence field trials during Q3 2023 and initiate deployment during

Q4 2023, followed by mass deployment during 2024.

-- The Asian vendor's XGS-PON OLT platform, that embeds

Ethernity's XGSPON MAC FPGA SoC, plans to commence deployment

during this year.

-- The FTTR gateway was completed, however we expect delays in

deployment by the customer, due to the customer's own constraints,

therefore FTTR revenues for the current year from the customer are

uncertain.

-- The Company built a new plan for a two layer PON solution

that utilizes the FTTR platform with more functionality and at a

higher price to serve high-rise buildings such as

Multi-Dwelling-Units (MDUs).

-- Received a purchase order for $1.5 million from its existing

fixed wireless customer to supply the Company's data processing

system-on-chip (SoC) in staged deliveries during Q3 2023.

-- The Company is in discussions regarding the licensing of its

PON technology with other potential vendors.

Outlook

The discounted fundraising undertaken in May 2023 resulted in

the Company modifying its business both in terms of costs and the

revenue model, to progress the Company towards generating positive

cash flows from operations in the latter half of 2023 without

requiring the need for further funding, as it has proven difficult

under current market conditions to raise funds at a fair value

representing the underlying IP and signed contracts. We appreciate

that raising funds under such conditions may impair existing

shareholder value.

With that in mind it was decided to take careful steps towards

generating positive cash flow from operations during FY2023, which

will include a combination of a modified business model, a

reduction in costs, combined with the anticipated growth in

licensing sales.

The PON technology business model will be converted into a

licensing model that will position the Company to generate 100%

gross margin on the licensing revenues and, together with the cost

reductions being implemented within the development area, it is

anticipated to reduce resource costs by 35%. Once these plans are

implemented, the Company anticipates it will be sufficiently funded

to allow it to generate further growth business for the UEP 2025

with link bonding.

While it is a challenging period due to the world financial

situation, I am encouraged by the fact that there is demand for our

PON offerings that have captured interest from larger corporations,

and I am hopeful to engage in multiple design wins for our PON

technology, that will fulfil our further anticipated growth during

2024.

David Levi

Chief Executive Officer

30 June 2023

Financial Review

Financial Performance

Through the past financial year we continued to progress our

current strategy of becoming a supplier of customised and

differentiated solutions and technology. The Company has made

significant progress during 2022 in the commercialisation of its

Data Processing Unit (DPU) System-on-Chip (SoC) devices with a 200%

growth over 2021 and the development of the Passive Optical

Networks (PON) SoC devices which has been proven in the

accomplishments, engagements, contracts and progress over the past

year.

During 2022, the following highlights were achieved that are

expected to support revenue growth in 2023 and onward:

-- The Company's sales of its DPU SoC increased by 200% with the

majority being the shipment of the ENET DPU SoC to its U.S. fixed

wireless system provider customer, with 2023 orders remaining on

track for supply, and an increased forecast from the customer for

2024;

-- the Company signed a contract for a second-generation

platform, based on a scaled-up version of the Company's DPU SoC

offering, with its U.S. fixed wireless OEM customer;

-- the Company progressed with the delivery of the $3 million

GPON and XGS-PON OLT SoC contract for its Chinese/Indian OEM, and

is now progressing with the customer for deployment;

-- the Company signed a follow-on contract of $4.6 million with

that customer for delivery of a PON device for Fiber-to-the-Room

deployment;

-- the Company delivered a UEP2025 for testing and integration

with an existing prominent microwave wireless OEM customer and is

working with the customer on joint go-to-market plans.

The knock-on effect of COVID-19 pandemic continued to create

challenges in aligning ourselves with the issues within the markets

in which we operate, and our customers goals. Planned deliveries

were affected, which was specifically caused by the worldwide

components shortage during the year and the supply of components in

all marketplaces continues to be an issue. Whilst the Company took

immediate steps to secure components needed for delivery on its

order commitments for its 2022 deliveries, the impact was also felt

by our customers and suppliers who inevitably pushed out their

planned deliveries. This did impact on the realisation of planned

revenues for 2022, resulting in approximately $0.6 million of

revenue delays for the remainder of the 2022 year as a result of

delays in projects resulting from component shortages, and certain

customers informing the Company that they were not ready to receive

milestone deliveries as had previously been anticipated.

Highlights

-- Revenues increased by 11.5% to $2.94m (2021: $2.64m)

-- Gross margins declined by 17.82% to $ 1.60m (2021: $1.94m)

-- Gross Margin percentage declined to 54.41% (2021: 73.80%)

-- Operating costs before amortisation of intangible assets,

depreciation charges, provisions and other non-operational charges

increased by 15.5% to $8.0m (2021: $6.9m)

-- EBITDA Loss increased by 29.27% to a loss of $ 6.4m (2021: loss of $ 4.98m)

-- Cash funds raised during the year of $2m before costs (2021: $11.2m)

Key financial results

Recognition of Research and Development Costs.

In line with the change in policy adopted by the Company from 1

July 2019 the Company continues with the policy of no longer

continuing to recognise the Research and Development costs as an

intangible asset but recognising these as an expense and charged

against income in the year incurred.

For the years ending 31 December 2020 and 2021 management

performed their own internal assessment of the fair value of the

intangible asset and concluded that the value of the asset is fair

and no impairment of the intangible asset on the balance sheet is

required. This process was repeated by management for the financial

year under review, 31 December 2022, and the assertion that the

underlying value of the intangible asset exceeds the carrying value

on the balance sheet remains unchanged.

EBITDA

EBITDA, albeit it not a recognised reportable accounting

measure, provides a meaningful insight into the operations of a

company when removing the non-cash or intangible asset elements

from trading results along with recognising actual costs versus

some IFRS adjustments, in this case being the amortisation and

non-cash items charges in operating income and the effects of IFRS

16 treatment of operational leases.

The EBITDA for the financial year ended 31 December 2022 is

presented as follows:

EBITDA US Dollar Increase %

(Decrease)

------------------------------------- ---------

For the year ended

31 December

------------------------------------- ---------

2022 2021

------------------------------------- ----------- ---------

Revenues 2,937,424 2,635,420 302,004 11.46%

Gross Margin as presented 1,598,328 1,944,903 -346,575 -17.82%

Gross Margin % 54.41% 73.80% 0

----------- ------------ ---------

Operating (Loss) as presented -8,117,844 -6,327,475 -1,790,369 28.30%

Adjusted for:

Add back Amortisation of Intangible

Assets 961,380 961,380 0 0%

Add back Share based compensation

charges 221,362 77,583 143,779 185.32%

Add back vacation accrual charges 35,646 -27,519 63,165 -229.53%

Add back impairments 599,200 80,000 519,200 649.00%

Add back depreciation charges on

fixed assets 108,581 86,168 21,087 26.01%

Add back IFRS operating leases

depreciation 339,561 173,675 165,886 95.52%

------------------------------------- ---------

EBITDA -6,431,146 -4,976,188 -1,454,958 29.24%

------------------------------------- ---------

The EBITDA losses increased during the 2022 year from $4.98

million in 2021 to $6.43 million in 2022. The increase in the

EBITDA losses were driven mainly by increases in Research and

Development costs of $1.07m which arose largely as a result of

staff resources being increased for the new product developments

during the 2022 financial year. Increases in General and

Administrative costs of $236,000 before IFRS fixed assets and lease

depreciation derived mainly from increases in property costs and

the increase in listed company fees and costs. Marketing and Sales

expenses increased slightly by $123,000 as marketing activities

abroad increased as trade shows and conferences re-opened

subsequent to COVID-19.

These EBITDA losses are anticipated to start reducing during the

latter half of 2023 as the future gross margins and margin

percentages increase based on the revised business model are

realised.

Summarised trading results

Summarised Trading Results US Dollar Increase %

(Decrease)

------------------------ ---------

Audited

For the year ended

31 December

---------

2022 2021

----------- ----------- ---------

Revenues 2,937,424 2,635,420 302,004 11.46%

Gross Margin 1,598,328 1,944,903 -346,575 -17.82%

Gross Margin % 54.41% 73.80%

----------- ------------ ---------

Operating (Loss) -8,696,876 -6,327,475 -2,369,401 37.45%

Financing costs -573,388 -3,074,452 2,501,064 -81.35%

Financing income 1,267,652 228,404 1,039,248 455.00%

----------- ------------ ---------

(Loss) before tax -8,002,612 -9,173,523 1,170,911 -12.76%

Tax benefit (reversal of previous

deferred tax benefit) 0 -186,772 186,772 -100.00%

----------- ------------ ---------

Net comprehensive (loss) for the

year -8,002,612 -9,360,295 1,357,683 -14.50%

----------------------------------- ----------- ------------ ---------

The operating loss before finance charges and after IFRS

adjustments increased by $2.40 million over 2021, attributable

mainly as explained above to the increase in R&D costs, asset

impairments and a lower gross margin percentage. The effect of the

finance costs and incomes, which resulted in the Comprehensive loss

for the year reducing by $1.36 million over 2021, are based on IFRS

recognition, and not a cash cost, are expanded on further in this

report.

Revenue Analysis

Revenues for the twelve months ended 31 December 2022 increased

by 11.5% to $2.94 million (2021: $2.64 million) after additional

year end IFRS adjustments and deferrals of approximately $600,000

in revenues to 2023 as outlined above.

The revenue mix will continue to evolve as the Company

progresses in achieving the desired mix of the revenue streams from

the sale of products and solutions in addition to IP licenses and

services based on the revised business model as presented in the

CEO report.

Margins

The gross margin percentage reduced to 54.4% in 2022 from 73.8%

in 2021, related mainly to increased component costs incurred in

securing components for deliveries. The gross margin will vary

according to the revenue mix as IP Licensing, Royalty and Design

Win revenues generally achieve an approximate 100% gross margin

before any sales commissions are accounted for.

Operating Costs and Research & Development Costs

After adjusting for the amortisation of the capitalised Research

and Development Costs, Depreciation, IFRS Share Based Compensation

and payroll non-cash accruals adjustments, the resultant increases

(decreases) in Operating costs, as adjusted would have been:

Operating Costs US Dollar Increase %

(Decrease)

------------------------------------------ ---------------------- ---------

For the year ended

31 December

------------------------------------------ ---------

2022 2021

------------------------------------------ ---------- ---------- ---------

Total R&D Expenses 6,618,795 5,550,912 1,067,883 19.24%

R&D Intangible amortisation -961,380 -961,380

Vacation accrual expenses -21,700 33,921 -55,621 -163.97%

Share Based Compensation IFRS adjustment -160,134 -54,962 -105,172 191.35%

---------- ---------- ---------

Research and Development Costs

net of amortisation, Share Based

Compensation, IFRS adjustments and

Vacation accruals 5,475,581 4,568,491 907,090 19.86%

---------- ---------- ---------

Total G&A Expenses 2,523,916 1,721,873 802,043 46.58%

Share Based Compensation IFRS adjustment -51,627 -10,750 -40,877 380.25%

Vacation accrual expenses -3,189 2,181 -5,370 -246.22%

Impairment losses of financial assets -599,200 -80,000 -519,200 649.00%

Fixed Assets Depreciation Expense -108,581 -86,168 -21,087 24.08%

Depreciation Leases IFRS16 -339,561 -173,675 -165,886 95.52%

------------------------------------------ ---------- ---------

General and Administrative expenses,

net of depreciation, Share Based

Compensation, IFRS adjustments,

Vacation accruals and impairments. 1,421,758 1,373,461 48,297 3.62%

Total Marketing Expenses 1,167,534 1,044,905 122,629 11.74%

Share Based Compensation IFRS adjustment -9,601 -11,871 2,270 -19.12%

Vacation accrual expenses -10,757 -8,583 -2,174 25.33%

---------- ---------

Marketing expenses, net of Share

Based Compensation and Vacation

accruals. 1,147,176 1,024,451 122,725 11.98%

---------- ---------- ---------

Total 8,044,423 6,964,985 1,079,438 15.50%

----------

Research and Development costs after reducing the costs for the

amortisation of the capitalised Research and Development intangible

asset, depreciation, share based compensation and vacation accruals

increased by $907,090 against 2021. These increases were mainly

attributable to the increase in the basic payroll component as

planned of approximately $873,000 over 2021.

The increase in General and Administrative costs over 2021 to

$1,421,666 after adjusting for depreciation, share based

compensation, IFRS adjustments, impairments and vacation accruals

amounted to approximately 3.62% or $49,623. A portion of this

increase of $31,800 resulted mainly from the increase in fees and

costs for UK Brokers/Nominated Advisers due to the Company's

previous Nominated Adviser foregoing their license in April 2022

with duplicated fees being paid in Q1 and Q2 of 2022. There were

increases in payroll costs of $44,495, with other increases in

costs offset by other savings. By the very nature of expenditure

accounted for under the General and Administrative costs there

remains little scope for further savings due to the fixed nature of

such expenses.

Following the significant decline in Sales and Marketing costs

during the 2020 financial year due to cessation of many marketing

travel and travel related activities as a result of the COVID-19

pandemic and the further modest decrease in 2021 over 2020 of

$27,931, Sales and Marketing costs increased marginally from 2021

by $122,725. This increase resulted mainly from increased marketing

activity and attendance at market events of approximately $95,000

while the return to 100% payroll and related costs accounted for an

increase of approximately $26,000.

Financing Costs

The continued material levels of financing costs and finance

income has come about due to the continued recognition and

realization of funds inflows, outflows and IFRS valuations of the

$2 million Subscription Agreement entered into with the 5G

Innovation Leaders Fund LLC on the 25 February 2022 referred to

below and under the section "Balance Sheet" along with the further

finance effects of the over-subscribed Placing and Broker option

along with the corresponding warrants issued in September 2021.

It is to be noted that the transactions detailed below, although

they are in essence based on raising funds via equity issues, are

nonstandard equity arrangements and have been dealt with in terms

of the guidance in IFRS9-Financial Instruments. This guidance,

which is significantly complex in its application, forces the

recognition of the fair value of the equity issues, and essentially

creating a recognition in differences between the market price of

the shares issued at the time of issue versus the actual price the

equity is allotted at. It is this differential or "derivative style

instrument" that needs to be subject to a fair value analysis, and

the instruments, the values received and outstanding values due

being separated into equity, assets, finance income and finance

charges in terms of the IFRS-9 guidance.

Referring to the fundraise deals the Company completed during

the year of 2021 and further in 2022 being;

a. The resulting issue of warrants at 60p (60p Warrants) from

the over-subscribed Placing and Subscription to raise GBP4.2

million, from the 27th to 29th of September 2021. It is to be noted

that these Warrants were not exercised and lapsed on 4 April

2023.

b. The Share Subscription Agreement with the 5G Innovation

Leaders Fund LLC of $2 million entered into on 25 February

2022.

It has been determined that in terms of IFRS-9, all the

transactions are to be recognised as equity and a liability of the

Company and all adjustments to the liability value are to be

recognised through the Income Statement. In all cases the equity

differential based on allotment price and fair value at time of

allotment is charged to the income statement. The liability in

respect of deal a. above represents the outstanding 60p Warrants

which have not been exercised as of 31 December 2022, however these

expired on 4 April 2023 and at the year ended 31 December 2022 had

a fair value of nil.

The above outlined treatment results in the finance expense

charged to the Income Statement, however it should be noted that

the expense is not an actual cash expense.

The Finance income $1,214,993 relates to the fair valuation

adjustment to the 60p Warrants referred to above having been

reduced to nil and the previous liability relating thereto being

reduced to nil. As stated above, any adjustments to the liabilities

are taken through the income statement, however these are non-cash

adjustments.

The Financing Expenses and Finance Income in the Income

Statement are thus summarised as follows:

Financing expenses for the full year ended December 31 2022

The Company completed a $2 million Subscription Agreement with the 5G

Innovation Leaders Fund LLC on the 25 February 2022.

5G Innovation Leaders $60,000 Face value premium of $60,000 on $2,000,000

Fund funded to the Company in February 2022

--------- ------------------------------------------------

$74,437 Adjustment to fair value of $320,000 settled

portion in October 2022

--------- ------------------------------------------------

$96,555 Adjustment to fair value of remaining unsettled

share subscription agreement as at December

31 2022

--------- ------------------------------------------------

Total 5G Fund $230,992

--------- ------------------------------------------------

Financing Income for the full year ended December 31 2022

Peterhouse Capital $1,214,993 Reversal of prior valuation of 60p Warrants

September 2021 issued

placing

----------- --------------------------------------------

Operating Loss and Net Comprehensive Loss for the Year

Whilst a portion of the revenues have been deferred from 2022 to

2023 due to the worldwide components shortage as previously noted,

the operating loss before financing expenses and the effect of the

equity transactions was in line with expectations.

Balance Sheet

During the year under review, the Company strengthened its

balance sheet via the $2 million Share Subscription Agreement

entered into with the 5G Innovation Leaders Fund LLC ("5G Fund"), a

U.S.-based specialist investor in February 2022.

Furthermore, there have been other changes on balance sheet

items as follows:

-- Increases in trade receivables reflect the activity in the

second half of the financial year from the announced contracts.

-- Inventories increased almost threefold, as a result of

procurement of components inventory due to the worldwide component

shortage.

-- Intangible assets continue to reduce in carrying value due to

the amortisation policy with an estimated 5.5 years of amortisation

remaining.

-- Trade payables increased by approximately $134,000 over 2021

due to advance purchasing of components for delivery commitments in

the latter portion of the reporting year and 2023.

-- Resulting from the funding received on the 5G Fund agreement

the liability on the convertible share subscription, including IFRS

adjustments increased from $0 at 31 December 2021 to $1,820,181 at

31 December 2022. The difference between the amount per the balance

sheet and the face value of the $1,740,000 unconverted liability at

31 December of $80,181 represents the IFRS valuation differential

of the liability at year end. This additional amount does not

however add to the face value of the liability for settlement

purposes, but rather is extinguished on the settlement and closure

of the instrument.

-- Other liabilities represent in the main the accrual of

payroll and the related costs, short term portion of the lease

liability and other accrued expenses at year end.

The balance sheet quick and current ratios of the Company for

2022, excluding the "liabilities" relating to the Share

Subscription Agreement and Warrants, reduced to 1.59 and 1.26

respectively (2021 4.20 and 4.07 respectively). This change is due

to the reduction of cash reserves at year end 31 December 2022

effecting both the quick and current ratios, while the increase in

inventories contributed further to the decline in the quick

ratio.

The net cash utilised and cash reserves are carefully monitored

by the Board. Cash utilised in operating activities for the year is

$8,333,302 (2021 $5,386,653), the increase in consumption being

mainly related to the increases in return to post COVID-19

operating levels, inventories and trade receivables. Gross cash

reserves remained positive at $715,815 as of 31 December 2022,

which have been bolstered by the fundraising activities carried out

during January and May of 2023.

Short term borrowings of $428,935 (2021 $422,633) arose mainly

from trade financing facilities via the Company's bankers. This is

a "rolling facility" and utilised by the Company on specific

customer transactions only.

The Intangible Asset on the Balance Sheet at a carrying value of

$5,462,800 (2021: $6,424,180) is a result of the Company having

adopted from 2015, the provisions of IAS38 relating to the

recognition of Development Expenses, which methodology as noted in

the 2019 Annual Report was ceased from 1 July 2019. The useful life

and the amortisation method of each of the intangible assets with

finite lives are reviewed at least at each financial year end. If

the expected useful life of an asset differs from the previous

estimate, the amortisation period is changed accordingly. Such

change is accounted for as a change in accounting estimate in

accordance with IAS 8. For the year ended 31 December 2022,

management performed their own internal assessment of the fair

value of the intangible asset and concluded that the value of the

asset is fair and no impairment of the intangible asset on the

Balance Sheet is required.

The Right-of-use asset under Non-current assets and the

corresponding Lease liability under Non-current liabilities on the

balance sheet and as referred to in Note 11 of the financial

statements arises in terms of IFRS 16 which became effective from 1

January 2019. This accounting treatment relates to the recognition

of the operating leases of the company premises, and immaterially

to leased company vehicles. In terms of the applicable Standard,

the Company is required to recognise the "benefit" of such

operational leases as it enjoys the rights and benefits as if it

had ownership thereof. Correspondingly, in terms of the Standard,

the liability relating to the future payments under such operating

leases is required to be recognised. The accounting treatment,

simply put, then results in an amortisation of the asset over the

period of the operating lease as a charge to income, and payments

made are charged as a reduction against the liability, essentially

offsetting each other to zero. The liability is not an "amount due"

for repayment in full as a singular payment at any one time, and

both the asset and liability have no impact on planned and actual

cash flows as the real cash flow is the normal monthly instalments

for premises rentals and car leases paid in the normal course of

business as part of planned expenditures in cash flows.

The asset and liability referred to above in respect of the

Company premises is material in that it represents the remainder of

the 5 year lease commitment plus the 5 year renewal option that the

Company has the right to and benefit of.

Summary of Fundraising Transactions Liabilities in terms of IFRS

Recognition

At year end, the remaining $1,740,000 face value of the

$2,000,000 of the funding initiated in February 2022 relating to

the 5G Fund is recognised in the balance sheet.

The issue of the 60p Warrants in the September 2021 Share

placing created a liability as explained above in terms of IFRS

recognition principles. This liability reverses to equity once the

warrants are exercised.

As of 31 December 2022, the liability in terms of the financing

transaction entered into during the 2022 financial year is:

Liability as at 31 December 2022

5G Innovation $1,836,555 Remaining liability to 5G representing fair

Leaders Fund value of the shares not yet called for allocation

of the $2,000,000 share subscription funded

in February 2022.

The face value of the outstanding amount

at 31 December 2022 is $1,740,000 against

which future allotments of shares will be

made. The differential of $96,555 fair value

adjustment is recognised under the requirements

of IFRS as a finance cost, no shares are allotted

against this, nor is cash paid out for this.

----------- ---------------------------------------------------

$1,836,555

----------- ---------------------------------------------------

Subsequent Financial Events

Subsequent to the financial year end, the Company completed

fundraising transactions as follows:

a. On 17 to 19 January 2023, the Company completed a Placing and

the Broker Option raising a gross amount of million GBP1.65 million

(before expenses).

This included investors in the Placing receiving one warrant for

every placing share subscribed for, exercisable at a price of 15p

per share. These warrants will be exercisable for a period of 24

months from the date of grant.

In terms of the Placing and Broker Option, and under the

authorities granted to the directors at the EGM of 9 February 2023,

Company has granted 23,571,430 warrants to investors in the Placing

and Broker Option.

The warrants contain an accelerator clause such that the Company

may serve notice ("Notice") on the Warrant holders to exercise

their Warrants in the event that the closing mid-market share price

of the Company's Ordinary Shares trade at 20p or more over a

consecutive five-day trading period from date of Admission. In the

event the Company serves Notice, any Warrants remaining unexercised

after seven calendar days following the issue of the Notice will be

cancelled.

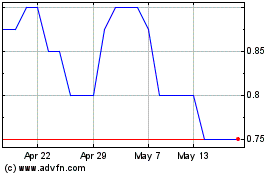

b. On 11 to 12 May 2023, the Company completed a further

Placing, Subscription and Broker Option raising a gross amount of

GBP783,500 (before expenses).

c. On 25 May 2023, the Company announced a variation of the

exercise price of the warrant instruments that were granted in

connection with the fundraise undertaken by the Company in January

2023 as per a. above.

The initial 15p exercise price of the Warrants represented a

premium of over 400% to the closing midmarket price of an Ordinary

Share on 24 May 2023. The Directors considered therefore that it

would be appropriate to amend the exercise price of the Warrants to

a level that is more attractive to Warrant holders and which would

still provide meaningful funding to the Company should the Warrants

be exercised in full.

The Company therefore on 24 May 2023, varied the exercise price

of the 23,571,430 Warrants from 15p to 6p per new ordinary share in

the Company, representing a 107% premium to the closing mid-market

price of an Ordinary Share on 24 May 2023. In addition, the

accelerator clause as noted under a. above, was varied from 20p to

7.5p, applicable on the same basis as outlined above.

All of the terms of the Warrants remain unchanged and as

announced on 17 January 2023. The expiry date of the Warrants

remains as 8 February 2025.

COVID-19 Impact and Going Concern

Currently, with the impact of COVID-19 worldwide reduced

significantly the Company has continued its planned strategies.

With the still ongoing worldwide components shortage we remain

acutely aware of the risk of an impact in delays in the timing of

revenues and cash inflows, as well as delays in supplies not only

to the Company but its customers, whose product deployment could be

materially impacted.

In the presentation of the annual financial statements for the

year ended 31 December 2022, the Company makes reference to going

concern within the audit report. Reference to this is further made

in Note 2 to the Annual Financial Statements presented herein.

Other than the points outlined above, there are no items on the

Balance Sheet that warrant further discussion outside of the

disclosures made in the Annual Financial statements of the Annual

Report.

Mark Reichenberg

Chief Financial Officer

30 June 2023

STATEMENTS OF FINANCIAL POSITION

US dollars

--------------------------

31 December

--------------------------

Notes 2022 2021

-------- ------------ ------------

ASSETS

Current

Cash 5 715,815 7,060,824

Trade receivables 6 1,299,072 1,545,598

Inventories 7 773,076 284,810

Other current assets 8 343,872 240,964

Current assets 3,131,835 9,132,196

Non-Current

Property and equipment 9 810,326 660,069

Intangible asset 10 5,462,800 6,424,180

Right -of -use asset 11 2,816,641 3,156,202

Other long term assets 35,689 38,956

Non-current assets 9,125,456 10,279,407

Total assets 12,257,291 19,411,603

============ ============

LIABILITIES AND EQUITY

Current

Short Term Borrowings 12 428,935 422,633

Trade payables 785,583 651,758

Liability related to share subscription agreement 15.F.[3] 1,836,555 -

Warrants liability 15.F.[2] - 1,214,993

Other current liabilities 11,13 1,121,909 1,097,359

------------ ------------

Current liabilities 4,172,982 3,386,743

Non-Current

Lease liability 11 2,505,777 3,069,721

------------ ------------

Non-current liabilities 2,505,777 3,069,721

Total liabilities 6,678,759 6,456,464

Equity 1 5

Share capital 21,904 21,140

Share premium 40,786,623 40,382,744

Other components of equity 1,225,391 1,004,029

Accumulated deficit (36,455,386) (28,452,774)

------------ ------------

Total equity 5,578,532 12,955,139

Total liabilities and equity 12,257,291 19,411,603

============ ============

The accompanying notes are an integral part of the financial

statements.

STATEMENTS OF COMPREHENSIVE LOSS

US dollars

------------------------

For the year ended

31 December

------------------------

Notes 2022 2021

------ ----------- -----------

Revenue 1 7,27 2,937,424 2,635,420

Cost of sales 1,339,096 690,517

----------- -----------

Gross margin 1,598,328 1,944,903

Research and development expenses 18 6,618,795 5,550,912

General and administrative expenses 19 2,523,916 1,721,873

Marketing expenses 20 1,167,534 1,044,905

Other income 21 (15,041) (45,312)

----------- -----------

Operating loss (8,696,876) (6,327,475)

Financing costs 22 (573,388) (3,074,452)

Financing income 23 1,267,652 228,404

----------- -----------

Loss before tax (8,002,612) (9,173,523)

Tax expense 24 - (186,772)

----------- -----------

Net comprehensive loss for the year (8,002,612) (9,360,295)

=========== ===========

Basic and diluted loss per ordinary share 25 (0.11) (0.14)

=========== ===========

Weighted average number of ordinary shares for basic loss per share 76,013,296 67,492,412

=========== ===========

The accompanying notes are an integral part of the financial

statements.

STATEMENTS OF CHANGES IN EQUITY

Number Other

of Share Share components Accumulated Total

Notes shares Capital premium of equity deficit equity

----------- -------- ----------- ----------- ------------- ------------

12,49

Balance at 1 January 2021 47,468,497 5 27 ,197,792 813,256 (19,092,479) 8 ,931,064

Employee share-based

compensation - - - 77,583 - 77,583

Exercise of

employee

options 15 .F.[1] 706,667 220 70,893 - - 71,113

Net proceeds

allocated to

the

issuance of

ordinary shares 15.F.[2] 13,149,943 4,053 4,280,265 - - 4,284,318

Exercise of

warrants 15.F.[2] 3,500,010 1,072 2,007,606 - - 2,008,678

Shares issued

pursuant to

share

subscription

agreement 15.F.[3] 10,221,621 3 ,204 6 ,742,848 - - 6 ,746,052

Expenses paid in

shares and

warrants 15.F.[5] 305,000 96 83,340 113,190 - 196 ,626

Net comprehensive loss for

the year - - - - (9,360,295) (9,360,295)

1,004

Balance at 31 December 2021 75,351,738 21,140 40,382,744 ,029 (28,452,774) 12,955,139

Employee share-based

compensation - - - 221,362 - 221,362

Exercise of 15.F.[1] - - - - - -

employee options

Shares issued

pursuant to

share

subscription

agreement 15.F.[3] 2,695,593 752 383,733 - - 384,485

Expenses paid in

shares and

warrants 15.F.[5] 37,106 12 20,146 - - 20,158

Net comprehensive loss for

the year - - - - (8,002,612) (8,002,612)

----------- -------- ----------- ----------- ------------- ------------

Balance at 31 December 2022 78,084,437 21,904 40,786,623 1,225,391 (36,455,386) 5,578,532

=========== ======== =========== =========== ============= ============

STATEMENTS OF CASH FLOWS

US dollars

--------------------------------

For the year ended 31 December

--------------------------------

2022 2021

--------------- ---------------

Operating activities

Net comprehensive loss for the year (8,002,612) (9,360,295)

Non-cash adjustments

Depreciation of property and equipment 108,581 86,168

Depreciation of right of use asset 339,561 173,675

Share-based compensation 221,362 77,583

Amortisation of intangible assets 961,380 961,380

Amortisation of liabilities (396,434) 39,042

Deferred tax expenses - 186,772

Foreign exchange losses on cash balances 381,480 30,214

Capital Loss - 70

Income from change of lease terms - (8,929)

Revaluation of financial instruments, net (984,001) 2,691,145

Expenses paid in shares and options 20,158 196 ,626

Net changes in working capital

Decrease (Increase) in trade receivables 246,526 (767,537)

Increase in inventories (488,266) (111,316)

Increase (decrease) in other current assets (102,908) 84,068

Increase (decrease) in other long-term assets 3,267 (2,831)

Increase in trade payables 133,825 361,583

Decrease in other liabilities (12,261) (24,071)

Net cash used in operating activities (7,570,342) (5,386,653)

Investing activities

Deposits to other long-term financial assets - (28,618)

Purchase of property and equipment (258,838) (194,195)

Net cash provided (used) by investing activities (258,838) (222,813)

Financing activities

Proceeds from share subscription agreement 2,000,000 3,177,306

Proceeds allocated to ordinary shares - 5,016,494

Proceeds allocated to warrants - 1,472,561

Issuance costs (9,952) (390,398)

Proceeds from exercise of warrants and options - 1,367,388

Proceeds from short term borrowings 527,790 900,192

Repayment of short-term borrowings (493,338) (887,585)

Repayment of lease liability (158,849) (136,180)

Net cash provided by financing activities 1,865,651 10,519,778

Net change in cash (5,963,529) 4,910,312

Cash beginning of year 7,060,824 2,180,726

Exchange differences on cash (381,480) (30,214)

Cash end of year 715,815 7,060,824

=============== ===============

Supplementary information:

Interest paid during the year 13,321 13,468

--------------- ---------------

Interest received during the year 1,507 41

--------------- ---------------

Supplementary information on non-cash activities:

Recognition of right-of-use asset and lease liability - 3,776,886

Shares issued pursuant to share subscription agreement 384,485 6,746,052

--------------- ---------------

Expenses paid in shares and warrants 20,158 83,436

--------------- ---------------

The accompanying notes are an integral part of the financial

statements.

NOTES TO THE FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS

ETHERNITY NETWORKS LTD. (hereinafter: the "Company"), was

incorporated in Israel on the 15th of December 2003 as Neracore

Ltd. The Company changed its name to ETHERNITY NETWORKS LTD. on the

10th of August 2004.

The Company provides innovative, comprehensive networking and

security solutions on programmable hardware for accelerating

telco/cloud networks performance. Ethernity's FPGA logic offers

complete Carrier Ethernet Switch Router data plane processing and

control software with a rich set of networking features, robust

security, and a wide range of virtual function accelerations to

optimise telecommunications networks. Ethernity's complete

solutions quickly adapt to customers' changing needs, improving

time-to-market and facilitating the deployment of 5G, edge

computing, and different NFV appliances including 5G UPF, SD-WAN,

vCMTS and vBNG with the current focus on 5G emerging appliances.

The Company's customers are situated worldwide.

In June 2017 the Company completed an Initial Public Offering

("IPO") together with being admitted to trading on the AIM Stock

Exchange and issued 10,714,286 ordinary shares at a price of

GBP1.40 per share, for a total consideration of approximately

$19,444,000 (GBP15,000,000) before underwriting and issuance

expenses. Total net proceeds from the issuance amounted to

approximately $17,800,000.

NOTE 2 - GOING CONCERN

The financial statements have been prepared assuming that the

Company will continue as a going concern. Under this assumption, an

entity is ordinarily viewed as continuing in business for the

foreseeable future unless management intends or has no realistic

alternative other than to liquidate the entity or to stop trading

for at least, but not limited to, 12 months from the reporting

date. An assessment has been made of the Company's prospects,

considering all available information about the future, which have

been included in the financial budget, from managing working

capital and among other factors such as debt repayment schedules.

Consideration has been given inter alia to revenues anticipated in

terms of the material contracts signed in the 2021 and 2022

financial years, the funds raised during the year ended 31 December

2022 and to date, expected inflows from the exercise of the 6p

(GBP0.06) Warrants, the current stage of the Company's life cycle,

its losses and cash outflows, including with respect to the

development of the Company's products, the expected timing and

amounts of future revenues.

During the latter portion of 2021 and through 2022, the Company

entered into new contracts for supply of the Company solutions and

products along with deployment orders from existing customers, all

of which including customer indications for significant amounts of

revenue billings for the latter portion of the 2022 and 2023

financial years, and into 2024. In September 2022, the Company

noted that its cash reserves were approximately $4.2m at 30 June

2022. During the year ended December 31, 2022, the Company incurred

a net comprehensive loss of $ 8 million and negative cash flows

from operating activities of $7.6million. The Company recognises

that its cash reserves remain under pressure until the customer

commitments in terms of the signed contracts are met from the end

of H1 2023 and in mitigating this, in January 2023 the Company

raised net funds (after costs) of $1.9m via both a Placing and

Subscription with associated Warrants, and further in May 2023,

raised further net funds via a Placing of $0.9m.

Further to this, in May and June 2023 the Company entered into

significant cost reduction exercises to align the internal

resources with the current contracts and expected deliveries

thereon, with further cost reductions to be implemented in July and

August 2023 as the demand on resources reduces. These steps, in

conjunction with the reasonable expectation that the Company has

reasonable access to raise further financing and funding during the

year, are expected to produce short to medium term reductions in

the use of cash resources as well as boost the cash reserves, with

the anticipation that the resultant revenue flows in the second

half of 2023 will start producing positive monthly cash flows

during this period continuing in to 2024.

Based on the abovementioned cash position, signed contracts,

cost reduction measures undertaken, and in the light of enquiries

made by the Directors as to the current liquidity position of the

Company, as well as bearing in mind the ability and success of the

Company to raise funds previously, the Directors have a reasonable

expectation that the Company will have access to adequate resources

to continue in operational existence for the foreseeable future and

therefore have adopted the going concern basis of preparation in

the financial statements. The Directors recognise that their

expectations are based on the projected revenues and expenses

remaining as forecast, however should events occur that could

materially impact the forecasts and cashflows of the Company,

including but not limited to disruptions in the supply of

inventories or delays imposed by customers, as a result a material

uncertainty exists that may cast a significant doubt on the

Company's ability to continue as a going concern and fulfil its

obligations and liabilities in the normal course of business in the

future.

NOTE 3 - SUMMARY OF ACCOUNTING POLICIES

The following accounting policies have been consistently applied

in the preparation and presentation of these financial statements

for all of the periods presented, unless otherwise stated. In 2022,

no new standards that had a material effect on these financial

statements become effective.

A. Basis of presentation of the financial statements and statement of compliance with IFRS

These financial statements have been prepared in accordance with

International Financial Reporting Standards (hereinafter - "IFRS"),

as issued by the International Accounting Standards Board

("IASB").

The financial statements have been prepared on an accrual basis

and under the historical cost convention, except for financial

instruments measured at fair value through profit and loss.

The Company has elected to present profit or loss items using

the function of expense method. Additional information regarding

the nature of the expenses is included in the notes to the

financial statements.

The financial statements for the year ended 31 December were

approved and authorised for issue by the board of directors on 30

June 2023.

B. Use of significant accounting estimates, assumptions, and judgements

The preparation of financial statements in conformity with IFRS

requires management to make accounting estimates and assessments

that involve use of judgment and that affect the amounts of assets

and liabilities presented in the financial statements, the

disclosure of contingent assets and liabilities at the dates of the

financial statements, the amounts of revenues and expenses during

the reporting periods and the accounting policies adopted by the

Company. Actual results could differ from those estimates.

Estimates and judgements are continually evaluated and are based

on prior experiences, various facts, external items and reasonable

assumptions in accordance with the circumstances related to each

assumption.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

Regarding significant judgements and estimate uncertainties, see

Note 4.

C. Functional and presentation currency

The Company prepares its financial statements on the basis of

the principal currency and economic environment in which it

operates (hereinafter - the "functional currency").

The Company's financial statements are presented in US dollars

("US$") which constitutes the functional currency of the Company

and the presentation currency of the Company.

D. Foreign currency transactions and balances

Specifically identifiable transactions denominated in foreign

currency are recorded upon initial recognition at the exchange

rates prevailing on the date of the transaction. Exchange rate

differences deriving from the settlement of monetary items, at

exchange rates that are different than those used in the initial

recording during the period, or than those reported in previous

financial statements, are recognised in the statement of

comprehensive income in the year of settlement of the monetary

item. Other profit or loss items are translated at average exchange

rates for the relevant financial year.

Assets and liabilities denominated in or linked to foreign

currency are presented on the basis of the representative rate of

exchange as of the date of the statement of financial position.

Exchange rate differentials are recognised in the financial

statements when incurred, as part of financing expenses or

financing income, as applicable.

The exchange rates as at the 31st of December, of one unit of

foreign currency to each US dollar, were:

2022 2021

New Israeli Shekel

("NIS") 0.284 0.322

Sterling 1.204 1.351

Euro 1.066 1.132

E. Cash and cash equivalents

Cash and cash equivalents include cash on hand, call deposits

and highly liquid investments, including short-term bank deposits

(with original maturity dates of up to three months from the date

of deposit), that are subject to an insignificant risk of changes

in their fair value and which do not have restrictions as to what

it may be used for.

F. Inventories

Inventories are stated at the lower of cost and net realisable

value. Cost includes all expenses directly attributable to the

manufacturing process as well as suitable portions of related

production overheads, based on normal operating capacity. Costs of

ordinarily interchangeable items are assigned using the first in,

first out cost formula. Net realisable value is the estimated

selling price in the ordinary course of business less any directly

attributable selling expenses.

G. Property and equipment

Property and equipment items are presented at cost, less

accumulated depreciation and net of accrued impairment losses. Cost

includes, in addition to the acquisition cost, all of the costs

that can be directly attributed to the bringing of the item to the

location and condition necessary for the item to operate in

accordance with the intentions of management.

The residual value, useful life span and depreciation method of

fixed asset items are tested at least at the end of the fiscal year

and any changes are treated as changes in accounting estimate.

Depreciation is calculated on the straight -- line method, based

on the estimated useful life of the fixed asset item or of the

distinguishable component, at annual depreciation rates as

follows:

%

Computers 33

Testing equipment 10-33

Furniture and equipment 6-15

Leasehold improvements Over period

of lease

Leasehold improvements are depreciated on a straight-line basis

over the shorter of the lease term (including any extension option

held by the Company and intended to be exercised) and the expected

life of the improvement.

Depreciation of an asset ceases at the earlier of the date that

the asset is classified as held for sale and the date that the

asset is derecognised. An asset is derecognised on disposal or when

no further economic benefits are expected from its use.

H. Basic and diluted earnings (loss) per share

Basic and diluted earnings (loss) per share is computed by

dividing the earnings (loss) for the period applicable to Ordinary

Shares by the weighted average number of ordinary shares

outstanding during the period.

In computing diluted earnings per share, basic earnings per

share are adjusted to reflect the potential dilution that could

occur upon the exercise of options or warrants issued or granted

using the "treasury stock method" and upon the settlement of other

financial instruments convertible or settleable with ordinary

shares using the "if-converted method".

I. Severance pay liability

The Company's liability for severance pay pursuant to Israel's

Severance Pay Law is based on the last monthly salary of the

employee multiplied by the number of years of employment, as of the

date of severance.

Pursuant to section 14 of Severance Pay Law, which covers the

Company's employees, monthly deposits with insurance companies

release the Company from any future severance obligations in

respect of those employees (defined contribution). Deposits under

section 14 are recorded as an expense in the Company's statement of

comprehensive income.

J. Research and development expenses

Expenditures on the research phase of projects to develop new

products and processes are recognised as an expense as

incurred.

Development activities involve a plan or a design for the

production of new or substantially improved products and processes.

Development costs that are directly attributable to a project's

development phase are recognised as intangible assets, provided

they meet all of the following recognition requirements:

-- the technical feasibility of completing the intangible asset

so that it will be available for use or sale.

-- intention to complete the intangible asset and use or sell

it.

-- ability to use or sell the intangible asset.

-- ability to demonstrate how the intangible asset will generate

probable future economic benefits. Among other things, the entity

can demonstrate the existence of a market for the output of the

intangible asset or the intangible asset itself or, if it is to be

used internally, the usefulness of the intangible asset.

-- the availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset.

-- ability to measure reliably the expenditure attributable to

the intangible asset during its development.

Development costs not meeting these criteria for capitalisation

are expensed as incurred.

Directly attributable costs include (if relevant) employee costs

incurred on software development along with an appropriate portion

of relevant overheads and borrowing costs.

The Company maintained the policy of recognising as an

intangible asset the costs arising from the development of its

solutions, specifically the directly associated costs of its

Research and Development center.

The Company periodically reviews the principles and criteria of

IAS 38 as outlined above. Up to and until June 2019, the Company

has determined that all the above criteria were met.

Effective as from 1 July 2019 and thereafter, the Company

concluded that it would no longer continue recognising these costs

as an intangible asset due to the fact that the criteria in IAS38

was not met.

An intangible asset that was capitalised but not yet available

for use, is not amortised and is subject to impairment testing once

a year or more frequently if indications exist that there may be a

decline in the value of the asset until the date on which it

becomes available for use (see also Note 10).

The amortisation of an intangible asset begins when the asset is

available for use, i.e., it is in the location and condition needed

for it to operate in the manner intended by management. The

development asset is amortised on the straight-line method, over

its estimated useful life, which is estimated to be ten years.

The useful life and the amortisation method of each of the

intangible assets with finite lives are reviewed at least at each

financial year end. If the expected useful life of an asset differs

from the previous estimate, the amortisation period is changed

accordingly. Such a change is accounted for as a change in

accounting estimate in accordance with IAS 8.

K. Government grants

Government grants are recognised where there is reasonable

assurance that the grant will be received and all attached

conditions will be complied with. When the grant relates to an

expense item (such as research and development of an intangible

asset), it is recognised as 'other income' on a systematic basis

over the periods that the costs, which it is intended to

compensate, are expensed.

Where the grant relates to an asset (such as development

expenses that were recognised as an intangible asset), it is

recognised as deduction of the related asset.

Grants from the Israeli Innovation Authority of the Ministry of

Economy (hereinafter - the "IIA") in respect of research and

development projects are accounted for as forgivable loans

according to IAS 20 Accounting for Government Grants and Disclosure

of Government Assistance, as the company might be required to

refund such amount through payment of royalties.

Grants received from the IIA are recognised as a liability

according to their fair value on the date of their receipt, unless

there is a reasonable assurance that the amount received will not

be refunded. The fair value is calculated using a discount rate

that reflects a market rate of interest at the date of initial

recognition. The difference between the amount received and the

fair value on the date of receiving the grant is recognised as a

deduction from the cost of the related intangible asset or as other

income, as applicable.

The amount of the liability is re-examined each period, and any

changes in the present value of the cash flows discounted at the

original interest rate of the grant are recognised in profit or

loss.

Grants which do not include an obligation to pay royalties are

recognised as a deduction of the related asset or as other income,

as applicable (See Note 21).

L. Financial instruments

A financial instrument is any contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity.

1. Classification and measurement of financial assets and financial liabilities

Initial recognition and measurement

The Company initially recognises trade receivables on the date

that they originated. All other financial assets and financial

liabilities are initially recognised on the date on which the

Company becomes a party to the contractual provisions of the

instrument. A financial asset or a financial liability are

initially measured at fair value with the addition, for a financial

asset or a financial liability that are not presented at fair value

through profit or loss, of transaction costs that can be directly

attributed to the acquisition or the issuance of the financial

asset or the financial liability. Trade receivables that do not

contain a significant financing component are initially measured at

the price of the related transaction.

Financial assets - subsequent classification and measurement

A financial asset is measured at amortised cost if it meets the

two following cumulative conditions and is not designated for

measurement at fair value through profit or loss:

-- The objective of the entity's business model is to hold the

financial asset to collect the contractual cash flows; and

-- The contractual terms of the financial asset create

entitlement on specified dates to cash flows that are solely

payments of principal and interest on the principal amount

outstanding.

On initial recognition, financial assets that do not meet the

above criteria are classified to measurement at fair value through

profit or loss (FVTPL). Further, irrespective of the business

model, financial assets whose contractual cash flows are not solely

payments of principal and interest are accounted for at FVTPL. All

derivative financial instruments fall into this category.

Financial assets are not reclassified in subsequent periods,

unless, and only to the extent that the Company changes its

business model for the management of financial debt assets, in

which case the affected financial debt assets are reclassified at

the beginning of the reporting period following the change in the

business model.

Financial assets at amortised cost

The Company has balances of trade and other receivables and

deposits that are held under a business model, the objective of

which is collection of the contractual cash flows. The contractual

cash flows in respect of such financial assets comprise solely

payments of principal and interest that reflects consideration for

the time-value of the money and the credit risk. Accordingly, such

financial assets are measured at amortised cost.

In subsequent periods, these assets are measured at amortised

cost, using the effective interest method and net of impairment

losses. Interest income, currency exchange gains or losses and

impairment are recognised in profit or loss. Any gains or losses on

derecognition are also carried to profit or loss.

Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss are

carried in the statement of financial position at fair value with

all gains and losses and net changes in fair value recognised in

the statement of comprehensive loss as financing income or cost.

This category includes derivative instruments (including embedded

derivatives that were separated from the host contract).

Financial liabilities - classification, subsequent measurement

and gains and losses

Financial liabilities are classified to measurement at amortised

cost or at fair value through profit or loss. All financial

liabilities are recognised initially at fair value and, in the case

of loans, borrowings, and payables, net of directly attributable

transaction costs.

Financial liabilities are measured at amortised cost

This category includes trade and other payables, loans and

borrowings including bank overdrafts. These financial liabilities

are measured at amortised cost in subsequent periods, using the

effective interest method. Interest expenses and currency exchange

gains and losses are recognised in profit or loss. Any gains or

losses on derecognition are also carried to profit or loss.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest method. The effective interest

method amortisation is included as finance costs in profit or

loss.

Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss are

measured at fair value, and any net gains and losses, including any

interest expenses, are recognised in profit or loss.

Financial liabilities at fair value through profit or loss

include financial liabilities held for trading and financial

liabilities designated upon initial recognition as at fair value

through profit or loss, including derivative financial instruments

entered into by the Company, including warrants derivative

liability related to warrants with an exercise price denominated in

a currency other than the Company's functional currency and also

including the Company's liability to issue a variable number of

shares, which include certain embedded derivatives (such as

prepayment options) under a share subscription agreement - see Note

15.

Separated embedded derivatives are classified as held for

trading.

Financial liabilities designated upon initial recognition at

fair value through profit or loss are designated at the initial

date of recognition, and only if the criteria in IFRS 9 are

satisfied.

2. Derecognition of financial liabilities

Financial liabilities are derecognised when the contractual

obligation of the Company expires or when it is discharged or

cancelled.

3. Impairment

Financial assets and contract assets

The Company creates a provision for expected credit losses in

respect of Financial assets measured at amortised cost.

Expected credit losses are recognised in two stages. For credit

exposures for which there has not been a significant increase in

credit risk since initial recognition, expected credit losses are

provided for credit losses that result from default events that are