Tritax EuroBox PLC Land Sale in Bornem, Belgium (4210G)

March 17 2020 - 3:52AM

UK Regulatory

TIDMEBOX TIDMBOXE

RNS Number : 4210G

Tritax EuroBox PLC

17 March 2020

17 March 2020

Tritax EuroBox plc

(the "Company")

LAND SALE IN BORNEM, BELGIUM

The Board of Tritax Eurobox plc (tickers: EBOX (Sterling), BOXE

(Euro)) , which invests in Continental European logistics real

estate assets, announces it has sold a 16,400 sqm plot of

development land at its asset in Bornem, Belgium. The total

proceeds, after the deduction of transaction costs, amount to

EUR2.32 million, which reflect a premium of 53% to the book value

of EUR1.52 million.

Having acquired two modern warehouses, and three vacant plots of

land totalling 4.5 hectares at the site in 2018, the Company has

already carried out several asset management activities including

two leasing initiatives. The configuration of this plot of land was

not suitable for large format logistics development and was

therefore a non-core asset for the Company.

The Company continues to pursue additional opportunities to

optimise further value at this location and plans to recycle the

proceeds of the sale into the development of a new logistics unit

on site.

Nick Preston, Fund Manager of Tritax EuroBox, commented:

"This sale demonstrates our ability to identify and sell surplus

assets that sit outside our core strategy in a profitable way.

Working closely with our asset management team we have created

immediate value, and by investing the proceeds in the development

of the neighbouring site we are able to generate further returns

for our investors."

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group +44 (0) 20 7290 1616

Nick Preston

Mehdi Bourassi

Jefferies International Limited +44 (0) 20 7029 8000

Gary Gould

Stuart Klein

Tom Yeadon

Kempen & Co +31 (0) 20 348 8500

Dick Boer

Thomas ten Hoedt

Akur Limited +44 (0)20 7493 3631

Anthony Richardson

Tom Frost

Siobhan Sergeant

Maitland/AMO (Communications

Adviser) +44 (0) 20 7379 5151

James Benjamin tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

NOTES:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are expected to deliver an attractive capital

return and secure income to shareholders. These assets fulfil key

roles in the logistics and distribution supply-chain focused on the

most established logistics markets and on the major population

centres across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain optimisation,

set against a backdrop of resurgent economic growth across much of

Continental Europe.

The Company's Manager, Tritax Management LLP, has assembled a

full-service European logistics asset management capability

including specialist "on the ground" asset and property managers

with strong market standings in the Continental European logistics

sector.

The Company is targeting, on a fully invested and geared basis,

an initial Ordinary Share dividend yield of 4.75% p.a. (1) , which

is expected to increase progressively through regular indexation

events inherent in underlying lease agreements, and a total return

on the Ordinary Shares of 9.0% p.a. (1) over the medium-term. The

Company pays dividends on a quarterly basis with shareholders able

to receive dividends in Sterling or Euro.

Further information on Tritax EuroBox plc is available at

www.tri taxeurobox.co.uk

1. Euro denominated returns, by reference to IPO issue price.

These are targets only and not profit forecasts. There can be no

assurances that these targets will be met, and they should not be

taken as indications of the Company's expected or actual future

results. Accordingly, potential investors should not place any

reliance on the target in deciding whether or not to invest in the

Company and should not assume that the Company will make any

distributions at all and should decide themselves whether or not

the target is reasonable or achievable.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISDZGMFNNLGGZG

(END) Dow Jones Newswires

March 17, 2020 03:52 ET (07:52 GMT)

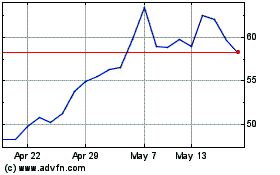

Tritax Eurobox (LSE:EBOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tritax Eurobox (LSE:EBOX)

Historical Stock Chart

From Jul 2023 to Jul 2024