DP Poland PLC Placing and Director appointments -2-

November 08 2012 - 2:01AM

UK Regulatory

undertakes any obligation (other than, in the case of DP Poland,

pursuant to the AIM Rules for Companies) to update publicly any of

the information contained in this Announcement, including any

forward-looking statements, in the light of new information, change

in circumstances or future events.

Appendix

The Placing

The Placing is conditional, amongst other things, on: (i)

Shareholders passing the Resolutions at the General Meeting; (ii)

the placing agreement between the Company and Peel Hunt (the

"Placing Agreement") becoming unconditional and not having been

terminated prior to Admission; and (iii) Admission having become

effective by no later than 8.00 am on 30 November 2012 (or such

later date as the Company and Peel Hunt may agree, not being later

than 14 December 2012).

Pursuant to the Placing Agreement, Peel Hunt has conditionally

agreed to use its reasonable endeavours, as agent for the Company,

to place the Placing Shares at the Placing Price. The Placing is

not being underwritten. The Company has agreed to pay Peel Hunt a

placing commission together with certain costs and expenses

incurred in connection with the Placing.

The Placing Agreement also contains warranties by the Company in

favour of Peel Hunt as to certain matters relating to the Company

and its business. In addition, the Company has given certain

undertakings to Peel Hunt and has agreed to indemnify Peel Hunt in

relation to certain liabilities it may incur in respect of the

Placing. Peel Hunt has the right to terminate the Placing Agreement

prior to Admission in certain circumstances.

EIS and VCT Schemes

The Company has applied for and obtained advanced assurance from

HMRC that the Placing Shares placed with VCT Schemes are expected

to constitute a qualifying holding for such VCT Schemes. HMRC has

also confirmed that the Placing Shares should satisfy the

requirements for tax relief under EIS.

Although the Company currently expects to satisfy the relevant

conditions for VCT investment and to remain a qualifying company

for EIS purposes, no guarantee or assurance can be given in that

regard.

Reasons for the Placing and use of proceeds

The Placing is being undertaken in order to provide DP Poland

with access to the additional capital resources required to

implement DP Poland's plans to open further Domino's Pizza branded

stores in Poland, to increase the marketing spend across all

existing and new DP Poland-owned stores and to provide funding for

its business through to anticipated EBITDA break even.

In deciding to structure the equity fundraising as a Placing,

and in determining the price at which the Placing would be

undertaken, the Directors considered a number of factors, including

the current financial and trading position of the Company and a

desire to achieve certainty within the shortest possible timeframe.

The Directors also took into consideration that the majority of the

Company's institutional Shareholders were given the opportunity to

participate in the Placing.

Related party transactions

JM Finn & Co Ltd ("JM Finn") has agreed to subscribe for a

total of 3,102,332 Placing Shares. As a result of their

participation in the Placing, JM Finn is deemed to be a "related

party" for the purposes of Rule 13 of the AIM Rules.

Accordingly, for the purposes of the AIM Rules, Peel Hunt, in

its capacity as the Company's nominated adviser, considers that the

terms on which JM Finn will participate in the Placing are fair and

reasonable insofar as Shareholders are concerned.

AIM Rule 17 disclosures

The following directorships and previous directorships are

notifiable for Chris Moore and Gerry Ford respectively:

Chris Moore

D.P. NEWCASTLE LIMITED

DOMINO'S PIZZA UK & IRELAND LIMITED*

DOMINO'S PIZZA GROUP PLC*

DP REALTY LIMITED*

AMERICAN PIZZA COMPANY LIMITED(THE)*

DP CAPITAL LIMITED*

DP GROUP DEVELOPMENTS LIMITED*

LIVE BAIT LIMITED*

DPG HOLDINGS LIMITED*

DOMINO'S LEASING LIMITED*

*No longer a director

Gerry Ford

PALADIN ASSOCIATES LIMITED

PALADIN PAUL HOLDINGS SARL

NERO HOLDINGS LIMITED

CAFFE NERO GROUP LIMITED

CAFFE NERO GIDA URUNLERI AS

AROMA LIMITED

ROME BIDCO LIMITED

ROME HOLDCO SARL

ROME INTERMEDIATE CO LIMITED

ROME INTERMEDIATE HOLDINGS SARL

ROME PIK HOLDCO LIMITED

ROME PIKCO LIMITED

ROME TOPCO UNLIMITED

CAFFE NERO INVESTMENTS LIMITED

CAFFE NERO VENTURES LIMITED

NERO COFFEE ROASTING LIMITED

GREEN COFFEE SP. z.o.o.

Shareholder approval and recommendation

The Placing is conditional upon, amongst other things, the

approval of Shareholders at the General Meeting. The Circular will

be posted to Shareholders today, providing further details of the

Placing and incorporating a notice convening the General Meeting at

which the Resolutions will be proposed. The Board believes that the

Placing is in the best interests of the Company and its

Shareholders, and recommends that Shareholders vote in favour of

the Resolutions at the General Meeting, as the Directors intend to

do in respect of their own beneficial holdings of 1,610,213

Ordinary Shares, representing approximately 6.3 per cent of the

existing Ordinary Shares.

The General Meeting will be held at 11.00 am on 26 November

2012.

The Company will also make copies of the Circular (including the

notice of General Meeting) available on its website at

www.dppoland.com.

Action to be taken

A Form of Proxy for use at the General Meeting will accompany

the Circular. The Form of Proxy should be completed in accordance

with the instructions thereon and returned to the Company's

Registrars, Capita Registrars, PXS, The Registry, 34 Beckenham

Road, Beckenham, Kent, BR3 4TU. The completion and return of a Form

of Proxy will not preclude Shareholders from attending the General

Meeting and voting in person should they wish to do so.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBIBDBCXGBGDR

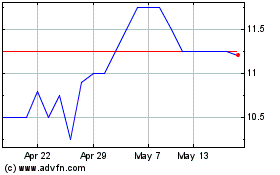

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jul 2023 to Jul 2024