West End Sale Announcement

July 20 2009 - 2:00AM

UK Regulatory

TIDMDLN

RNS Number : 9002V

Derwent London PLC

20 July 2009

3PRESS RELEASE

20 JULY 2009

Derwent London plc ("Derwent London" / "Company")

DERWENT LONDON ANNOUNCES WEST END SALE

13-17 FITZROY STREET, LONDON W1

Derwent London has exchanged contracts on the sale of its freehold interest

at 13-17 Fitzroy Street, London W1 to a member of the Arup group of

companies ("Arup") for GBP60 million, which reflects a net initial yield of 7%.

The sale price represents a decrease of 10% from the 31 December 2008 valuation,

which compares to the IPD UK Monthly Property Index for West End & Midtown

offices which showed a decline of 14.8% for the first six months of 2009.

The property is fully let to Arup on a lease expiring 2023 at a rent of GBP4.46

million per annum, subject to five-yearly upward only rent reviews.

Prominently located on the corner of Fitzroy and Howland Street, the eight

storey office building totals 90,420 sq ft (8,400 sq m). The property underwent

a comprehensive redevelopment which completed in 2003 as the first of a three

phase scheme to provide Arup's new global headquarters. Following the sale of

Phase I Derwent London will retain the ownership of Phases II and III, with Arup

occupying the remaining 147,700 sq ft (13,720 sq m) in its entirety.

John Burns, Chief Executive of Derwent London said:

"We are pleased to have agreed this significant sale which forms part of our

programme to recycle capital. Arup is an important tenant on our Fitzrovia

Estate with whom we have a long standing relationship. We are committed to the

strategic regeneration of the Fitzrovia area, where our ownership extends to

over one million sq ft and where we look forward to continuing to work closely

with Arup."

-ends-

For further information please contact:

Derwent London

John Burns, Chief Executive,

Tel - 020 7659 3000

Brunswick Group

Andrew Fenwick / James Rossiter

Tel - 020 7404 5959

Notes to editors:

Derwent London plc

Derwent London plc is the largest central London focussed REIT with an

investment portfolio of GBP2.1 billion as at 31 December 2008. The group is one

of London's most innovative office regenerators and investors, well known for

its established design-led philosophy and creative approach to development. In

April, Derwent London was awarded the Property Week Property Company of the Year

2009.

Derwent London's core strategy is to acquire and own a portfolio of central

London property that has reversionary rents and significant opportunities to

enhance and extract value through refurbishment and redevelopment. The group

owns and manages an investment portfolio, of which 94% is located in central

London, with a specific focus on the West End and the areas bordering the City

of London.

Landmark schemes by Derwent London include: Qube W1, Horseferry House SW1,

Johnson Building EC1, Davidson Building WC2 and Tea Building E1.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISILFESDEIDLIA

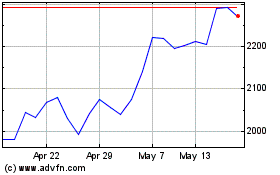

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

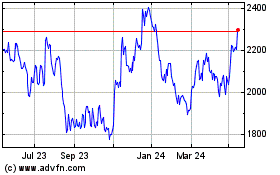

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024