Crystal Amber Fund Limited Monthly Net Asset Value

January 14 2019 - 2:00AM

UK Regulatory

TIDMCRS

14 January 2019

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share at 31 December 2018 was 221.67 pence (30 November 2018: 222.44 pence per

share).

The proportion of the Fund's NAV at 31 December 2018 represented by the ten

largest shareholdings, other investments and cash (including accruals), was as

follows:

Ten largest shareholdings Pence per share Percentage of investee equity

held

Hurricane Energy plc 45.0 5.1%

FairFX Group plc 38.7 20.2%

Northgate plc 32.7 6.4%

STV Group plc 27.7 19.7%

De La Rue plc 24.3 5.4%

Board Intelligence Ltd* 4.8 *

GI Dynamics Inc. 4.6 48.4%

Sutton Harbour Holdings plc 3.1 10.0%

Cenkos plc 2.8 6.9%

Leaf Clean Energy Co 2.8 30.0%

Total of ten largest 186.5

shareholdings

Other investments 28.6

Cash and accruals 6.6

Total NAV 221.7

*Board Intelligence Ltd is a private company and its shares are not listed on a

stock exchange. Therefore, the percentage held is not disclosed.

Investment adviser's commentary on the portfolio

Over the quarter to 31 December 2018, NAV per share declined by 13.6%, or by

12.6% adjusting for the 2.5p dividend accrued during the period. The dividend

was declared on 13 December 2018 and will be paid on 18 January 2019.

Over the 2018 calendar year, the Fund's NAV grew by 16.2%, or by 18.9%

adjusting for the two dividends paid during the year. The total return of the

Numis Small Caps Index was a negative 11.0%.

The top positive contributor to NAV growth over the quarter to 31 December 2018

was Board Intelligence Ltd (0.4%). Top detractors were Hurricane Energy plc

(-6.7%), FairFX Group plc (-4.1%) and Northgate Group plc (-1.3%). The Fund's

put options contributed 1.8% to the NAV.

Hurricane Energy plc ("Hurricane")

Hurricane's Early Production System ("EPS") for its Lancaster asset continued

to make progress over the period. The EPS' Floating Production and Storage

Vessel ("FPSO") Aoka Mizu sailed away from Dubai in October after completing a

programme of repair, upgrade and life extension. The FPSO is now at the port of

Cromarty, near Inverness, awaiting a favourable weather window to initiate

commissioning.

Hurricane's share price fell by 24.5% over the period. In the early weeks of

the quarter, the Fund continued to reduce its position and sold shares to the

value of GBP3.5 million. Following subsequent share price weakness, the Fund

reinvested GBP3 million, growing its position by one million shares over the

period.

Board Intelligence Ltd

The Fund invested in Board Intelligence Ltd in March 2018 and carried the

investment in this private company at cost. The holding was revalued at the end

of December resulting in an increase in its value. This reflects the

acceleration in revenue growth achieved by the business.

STV Group plc ("STV")

In December 2018, STV announced the launch of its Player on the Virgin TV

platform. This month, STV announced that its Player would also become available

on the Sky platform from the second half of 2019. The availability of STV's own

Player product on those platforms will give the company additional digital

video advertising inventory to sell. Such inventory has been achieved and has

sustained premium rates relative to other digital channels and is core to STV's

growth plans.

Over the quarter, STV's share price fell by 9.1%.

Sutton Harbour Holdings plc ("Sutton Harbour")

In November 2018, Sutton Harbour received planning approval for its Sugar Quay

project. Interim results reported 37.4p NAV per share versus a share price of

28.5p at the time of the announcement, when the company launched a GBP3 million

open offer. This will be used to fund post planning pre-construction phase

project costs, capital maintenance project costs and to provide cash headroom.

The Fund took its full entitlement and continued to grow its position.

Over the quarter, Sutton Harbour's share price fell by 13.1%.

FairFX Group plc ("FairFX")

In December 2018, FairFX announced an agreement with Metropolitan Commercial

Bank to offer its services to the US market. The agreement is subject to

additional due diligence and will cover FairFX's Corporate Expense platform as

well as its international payments service. Both are expected to go live over

the first half of 2019.

Over the quarter, FairFX's share price fell by 20.3%.

Transactions in Own Shares

The Fund bought back 895,000 of its own ordinary shares at an average price of

213p per share as part of its buyback programme.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

(END) Dow Jones Newswires

January 14, 2019 02:00 ET (07:00 GMT)

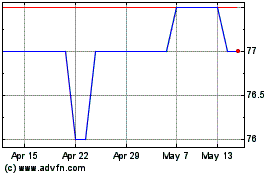

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024