Custodian REIT plc : Custodian REIT acquires pair of DFS retail warehouse assets for GBP9 million (1401435)

July 20 2022 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI) Custodian REIT plc : Custodian REIT

acquires pair of DFS retail warehouse assets for GBP9 million

20-Jul-2022 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

20 July 2022

Custodian REIT plc

("Custodian REIT" or the "Company")

Custodian REIT acquires pair of DFS retail warehouse assets for

GBP9 million

Custodian REIT (LSE: CREI), the UK property investment company

focused on smaller lot-sizes, is pleased to announce two further

property purchases.

The Company has acquired two retail warehouses in Measham,

Leicestershire, and Droitwich, Worcestershire, occupying an

aggregate 40,077 sq ft. The units are both let to DFS Furniture

with a weighted average unexpired term to first break or expiry of

8.0 years and an aggregate passing rent of GBP894,103 per annum,

reflecting a net initial yield1 of 9.43%.

The agreed purchase price of GBP8.9 million was funded from the

Company's existing debt resources, increasing net gearing2 to 23.4%

loan to value, which remains within the Company's target range.

Following this acquisition the Company's diversified portfolio's

weighting to retail warehouses has increased to 24%, with 38%

industrial, 16% office, 11% high street retail and 11% other,

comprising 164 properties located in strong economic areas across

the UK.

Commenting on the acquisition, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said:

"These high yielding assets let on long-term leases to a strong

covenant are a great addition to our portfolio. Retail warehouses

continue to demonstrate their relevance and appeal alongside the

continued rise of e-commerce, with one out of three sofas sold in

the UK purchased in-store, while the 'halo' effect of a physical

store supporting local online purchases is particularly strong for

furniture.

"The attractive entry yield will be accretive to dividend

capacity over the medium term. As bricks and mortar retail

undergoes a renaissance, and retail parks continue to outperform,

we anticipate future market rental growth which should mitigate

some of the acknowledged over-rent, support valuations and protect

long term income streams."

1 Passing rent divided by valuation plus assumed purchaser's

costs.

2 Gross borrowings less unrestricted cash divided by last

published property portfolio valuation.

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260 1000

www.numiscorp.com

FTI Consulting

Richard Sunderland / Ellie Sweeney Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, listed

on the main market of the London Stock Exchange. Its portfolio

comprises properties predominantly let to institutional grade

tenants on long leases throughout the UK and is principally

characterised by properties with individual values of less than

GBP10 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting sub GBP10 million lot size,

regional properties, the Company intends to provide investors with

an attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit custodianreit.com and

custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 175795

EQS News ID: 1401435

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1401435&application_name=news

(END) Dow Jones Newswires

July 20, 2022 02:00 ET (06:00 GMT)

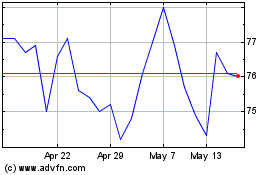

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

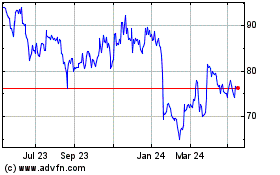

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024