TIDMCRCL

RNS Number : 7842G

Corcel PLC

31 March 2022

Corcel PLC

("Corcel" or the "Company")

Half Year Report

31 March 2022

Corcel Plc ("Corcel" or the "Company"), the battery metals and

flexible grid solutions company announces its unaudited half-yearly

results for the six months ended 31 December 2021.

Board Statement

Dear Shareholders,

Corcel plc (the "Company, "Corcel") remains strategically

focused on all aspects of battery metals, spanning both the

upstream and downstream alongside energy generation and storage.

Our strategy was conceived two years ago in anticipation of a

structural supply price hike driven by the global push towards

electrification and decarbonisation. Whilst demand for battery

metals continues ever stronger, recent events in Ukraine appear to

have also accelerated the widely predicted supply squeeze. This has

resulted in immediate, significant and potentially permanent

structural price increases, with nickel markets, as an example,

having recently hit unprecedented highs. These events arrive on the

back of existing supply constraints and an acceleration of the

energy transition as countries look to increase energy security,

both by reducing hydrocarbon imports and by investing in domestic

low-carbon generation options.

The principal development during the period was the agreement

with Australian-registered Resource Mining Corporation Limited

(ASX: RMI) ("RMI") to acquire 100% of the issued share capital in

Australian-registered Niugini Nickel Pty Ltd, which owns 100% of

the Wowo Gap nickel-cobalt project in Papua New Guinea. This

followed our strategic acquisition of the majority of RMI's debt

during 2020, at a time when it was it was trading at a material

discount to par. The Wowo Gap acquisition has enabled the company

to approximately double its nickel and cobalt resources and

exposure at a heavily discounted price, and begins the journey of

building a leading regional battery metal and nickel /cobalt

business.

Following the development of the business over the last two

years and specifically the Wowo Gap acquisition, Corcel is

positioned to significantly benefit from recent market

developments. It is therefore moving to accelerate the development

of its two nickel deposits in Papua New Guinea, including a

fast-track Mining Lease application at the Wowo Gap project (where

JORC upgrade work and a Gap Analysis efforts are already ongoing).

The Company further expects the award of a Mining Lease at the

Mambare nickel project during 2022, and offtake discussions

continue with Shandong New Powder COSMO AM&T ("NPC") with a

view to supplying nickel to Chinese precursor plants, for ultimate

use in NPC's Chinese cathode plant.

During the last two years the Company has also taken its initial

steps towards building a UK based energy generation and storage

business with exposure to both battery storage and gas peaker

plants. The deployment of batteries and flexible energy generation

underpins the variable nature of the production of clean energies

(such as solar and wind), and is therefore a critical enabler for

the energy transition. In building this part of the business, the

Company recognises that it is selectively taking early-stage

development risk, which it looks to mitigate by diversifying across

multiple projects with varying timelines. The Company therefore

expects to make further project acquisitions in this space

alongside finalising the ongoing marketing process to secure

project finance for the gas peaker plant portfolio including

Avonmouth and Tring Road.

While the Company did not raise capital during the period, in

assessing alternative funding options, the Board has balanced the

often competing objectives of securing funding certainty,

minimising equity dilution and retaining near term upside exposure.

As a result of these funding choices, the Company remains well

funded and has recently refinanced debt obligations of GBP1.3M,

which expire in Q4 2022. Shortly after the period end, the Company

announced a combination of funding facilities that resulted in up

to an additional GBP1,050,000 of new funding becoming available to

the business, and of this total, GBP365,000 was subsequently

announced as having completed.

The Board and I want to thank our shareholders for their support

through this challenging and volatile period spanning both the

global pandemic and the ongoing conflict in Ukraine. The Board is

focused on continuing to build both firm and net asset value based

foundations for the future, alongside accelerating the development

of our battery metals deposits.

James Parsons

Executive Chairman

Consolidated statement of financial position

as at 31 December 2021

Notes 31 December 31 December 30 June

2021 2020 2021

Unaudited, Unaudited, Audited,

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Investments in associates

and joint ventures 6 2,381 1,971 2,380

Exploration and evaluation

assets 8 1,067 - -

Goodwill - 29 -

Property, plant and equipment 110 62 62

FVTOCI financial assets 7 1 3 7

FVTPL financial assets 7 72 - 72

Trade and other receivables 1,416 2,310 1,362

------------

Total non-current assets 5,047 4,375 3,883

Current assets

Cash and cash equivalents 50 180 392

Trade and other receivables 178 179 1,215

------------

Total current assets 228 359 1,607

TOTAL ASSETS 5,275 4,734 5,490

EQUITY AND LIABILITIES

Equity attributable to

owners of the parent

Called up share capital 9 2,746 2,736 2,746

Share premium account 24,161 23,779 24,161

Shares to be issued 75 - 75

Other reserves 2,048 1,117 2,018

Retained earnings (25,245) (23,927) (24,630)

------------

Total equity attributable

to owners of the parent 3,785 3,705 4,370

Non-controlling interest - 11 -

------------ ------------ ---------

Total equity 3,785 3,716 4,370

------------ ------------ ---------

LIABILITIES

Non-current liabilities

Lease liability - 30 -

Total non-current liabilities - 30 -

Current liabilities

Trade and other payables 218 185 237

Lease liability - 12 -

Short term borrowings 1,272 791 883

------------

Total current liabilities 1,490 988 1,120

TOTAL EQUITY AND LIABILITIES 5,275 4,734 5,490

The accompanying notes form an integral part of these financial

statements.

Consolidated statement of income

for the period ended 31 December 2021

Notes 6 months 6 months

to 31 December to 31 December

2021 2020

Unaudited, Unaudited,

GBP'000 GBP'000

Administrative expenses 3 (507) (493)

Impairment of loans and receivables - -

Gain on sale of financial instruments

designated as FVTPL - (5)

Exploration expenses - -

Other operating income - 7

Foreign currency gain - -

Finance costs, net (105) (29)

Share of loss of associates and

joint ventures (2) (6)

Loss for the period before taxation (614) (526)

Tax expense - -

---------------- --------------------

Loss for the period after taxation (614) (526)

---------------- --------------------

(Loss)/profit for the period attributable

to:

Equity holders of the parent (614) (524)

Non-controlling interest - (2)

---------------- ----------------

(614) (526)

---------------- ----------------

Earnings per share

Loss per share - basic, pence 4 0.16 0.23

Loss per share - diluted, pence 4 0.16 0.23

Consolidated statement of comprehensive income

for the period ended 31 December 2021

6 months 6 months

to 31 December to 31 December

2021 2020

Unaudited, Unaudited,

GBP'000 GBP'000

(Loss)/profit for the period (614) (526)

Revaluation of FVTOCI investments 7 (6) (1)

Total comprehensive loss for the period (620) (527)

Total comprehensive loss attributable

to:

Equity holder of the Parent (620) (525)

Non-controlling interest - (2)

---------------- ----------------

(620) (527)

The accompanying notes form an integral part of these financial

statements.

Consolidated statement of changes in equity

for the period ended 31 December 2021

The movements in equity during the period were as follows:

Share Share Shares Retained Other Total Equity Non-controlling Total

capital premium to be earnings reserves attributable interests equity

account issued to owners

of the Parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July

2020 (audited) 2,726 23,032 - (23,403) 908 3,263 13 3,276

Changes in

equity

for six months

ended 31

December

2020

Profit/ (loss)

for the period - - - (524) - (524) (2) (526)

Other

comprehensive

(loss)/income

for the period - - - - (1) (1) - (1)

--------- --------- -------- ---------- ---------- --------------- ---------------- --------

Total

comprehensive

(loss)/income

for the period - - - (524) (1) (524) (2) (527)

Transactions

with owners

Issue of shares 10 1,002 - - - 1,012 - 1,012

Share issue

and fundraising

costs - (45) - - - (45) - (45)

Warrants issued - (210) - - 210 - - -

Total

Transactions

with owners 10 747 - - 210 967 - 967

--------- --------- -------- ---------- ---------- --------------- ---------------- --------

As at 31

December

2020

(unaudited) 2,736 23,779 - (23,927) 1,117 3,705 11 3,716

--------- --------- -------- ---------- ---------- --------------- ---------------- --------

As at 1 July

2021 (audited) 2,726 24,161 75 (24,630) 2,018 4,370 - 4,370

Changes in equity

for six months

ended 31 December

2021

Profit/ (loss)

for the period - - - (615) - (615) - (615)

Other comprehensive - - - - - - - -

(loss)/income

for the period

Revaluation of

FVTOCI investments - - - - (6) (6) - (6)

------- -------- ------------ --------- ------ ------ ------

Total comprehensive

(loss)/income

for the period - - - (615) (6) (621) - (621)

Transactions

with owners

Issue of shares - - - - - - - -

Share issue and - - - - - - - -

fundraising costs

Warrants issued - - - - 36 36 - 36

Total Transactions

with owners - - - (615) 30 (585) - (585)

As at 31 December

2021 (unaudited) 2,746 24,161 75 (25,245) 2,048 3,785 - 3,785

------- -------- ------------ --------- ------ ------ ------

FVTOCI Share-based Warrants Foreign Total

investments payments Reserve currency other

reserve reserve translation reserves

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2020 (audited) 1 99 273 535 908

Changes in equity for six

months ended 31 December 2020

Other Comprehensive income

Transfer of FVTOCI reserve

relating to impaired assets

and disposals (1) - - - (1)

Unrealised foreign currency - - - - -

gains arising upon retranslation

of foreign operations

------------- ------------ --------- ------------- ----------

Total comprehensive income/(loss)

for the period (1) - - - (1)

Warrants issued - - 210 - 210

Total transactions with shareholders - - 210 - 210

As at 30 June 2021 (audited) - 99 483 535 1,117

------------- ------------ --------- ------------- ----------

As at 1 July 2021 (audited) 4 99 1,380 535 2,018

Changes in equity for six

months ended 31 December 2021

Other Comprehensive income

Revaluation of FVTOCI investments (6) - - - (6)

Share options granted during - - - - -

the year

Warrants granted during the

year - - 36 - 36

Unrealised foreign currency - - - - -

gains arising upon retranslation

of foreign operations

---- --- ------ ---- ------

Total comprehensive income/(loss)

for the period (6) - 36 - 30

---- --- ------ ---- ------

As at 31 December 2021 (unaudited) (2) 99 1,416 535 2,048

---- --- ------ ---- ------

Consolidated statement of cash flows

for the period ended 31 December 2021

Note 6 months 6 months

to 31 December to 31 December

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit before taxation (614) (526)

Decrease/(increase) in receivables (14) (68)

Increase in payables (95) 23

Share-based payments 36 -

Finance cost, net 69 29

Share of loss of associates and

joint ventures, net of tax 2 6

Net cash flows from operations (616) (536)

Cash flows from investing activities

Proceeds from sale of FVTPL and

FVTOCI investments - 14

Additional investments in JVs and

investment in associates (3) (34)

Purchase of financial assets carried

at amortised cost (31) (355)

Purchase of property, plant and

equipment - (62)

Cash acquired on business combination 2 -

Net cash flows from investing activities (32) (437)

Cash flows from financing activities

Proceeds from issue of shares - 738

Interest paid (69) -

Proceeds of new borrowings, as received 475 -

net of associated fees

Repayment of borrowings (100) -

Net cash flows from financing activities 306 738

Net decrease in cash and cash equivalents (342) (235)

Cash and cash equivalents at the

beginning of period 392 415

Cash and cash equivalents at end

of period 50 180

Half-yearly report notes

for the period ended 31 December 2021

1 Company and Group

As at 30 June 2021 and 31 December 2021 the Company had one

or more operating subsidiaries and has therefore prepared

full and interim consolidated financial statements respectively.

The Company will report again for the full year ending 30

June 2022.

The financial information contained in this half yearly report

does not constitute statutory accounts as defined in section

435 of the Companies Act 2006. The financial information

for the year ended 30 June 2021 has been extracted from the

statutory accounts of the Group for that year. Statutory

accounts for the year ended 30 June 2021, upon which the

auditors gave an unqualified audit report which did not contain

a statement under Section 498(2) or (3) of the Companies

Act 2006, have been filed with the Registrar of Companies.

2 Accounting Polices

Basis of preparation

The consolidated interim financial information has been

prepared in accordance with IAS 34 'Interim Financial

Reporting'.

The accounting policies applied by the Group in these

condensed

consolidated interim financial statements are the same as

those applied by the Group in its consolidated financial

statements as at and for the year ended 30 June 2021,

which

have been prepared in accordance with IFRS.

Business combinations

On the acquisition of a subsidiary, the business

combination

is accounted for using the acquisition method. In the

consolidated

statement of financial position, the acquiree's

identifiable

assets, liabilities are initially recognised at their

fair

values at the acquisition date. The cost of an

acquisition

is measured as the aggregated amount of the consideration

transferred, measured at the date of acquisition. The

consideration

paid is allocated to the assets acquired and liabilities

assumed on the basis of fair values at the date of

acquisition.

The results of acquired operations are included in the

consolidated

statement of comprehensive income from the date on which

control is obtained.

If the cost of acquisition exceeds the identifiable net

assets attributable to the Group, the difference is

considered

as purchased goodwill, which is not amortised but

annually

reviewed for impairment. In the case that the

identifiable

net assets attributable to the Group exceed the cost of

acquisition, the difference is recognised in profit or

loss

as a gain on bargain purchase.

If the initial accounting for a business combination

cannot

be completed by the end of the reporting period in which

the combination occurs, only provisional amounts are

reported,

which can be adjusted during the measurement period of 12

months after acquisition date.

After initial recognition, goodwill is measured at cost

less any accumulated impairment losses.

3 Administrative expenses

6 months to 6 months to

31 December 31 December

2021 2020

Unaudited Unaudited

GBP'000 GBP'000

Staff Costs:

Payroll 220 220

Pension 10 10

Share based Payments -Staff - -

Consultants - 10

Staff Welfare - -

HMRC / PAYE 26 26

------------- -------------

Total: 256 266

Professional Services:

Accounting 43 26

Legal 11 26

Business Development - -

Marketing & Investor Relations 20 43

Funding costs - 9

Other 12 34

------------- -------------

Total: 86 138

Regulatory Compliance 55 57

------------- -------------

Travel 4 2

------------- -------------

Office and Admin Costs:

General 18 8

IT costs 5 4

Depreciation - -

Rent - Main Office 6 12

Insurance 77 6

------------- -------------

Total: 106 89

Total administrative expenses 507 493

============= =============

4 Loss per share

The following reflects the loss and share data used in the

basic and diluted profit/(loss) per share computations:

6 months to 6 months to

31 December 31 December

2021 2020

Unaudited Unaudited

Loss attributable to equity holders

of the parent company, in Thousand

Sterling (GBP'000) 614 524

Weighted average number of Ordinary

shares of GBP0.0001 in issue,

used for basic and diluted EPS 384,787,602 225,302,423

Loss per share - basic and diluted,

pence 0.16 0.23

At 31 December 2021 and at 31 December 2020, the effect

of all the instruments is anti-dilutive as it would lead

to a further reduction of loss per share, therefore they

were not included into the diluted loss per share calculation.

Options and warrants that could potentially dilute basic

EPS in the future, but were not included in the calculation

of diluted EPS because they are anti-dilutive for the periods

presented:

6 months 6 months to

to 31 December

31 December 2020

2021

Unaudited Unaudited

Share options granted to employees

- total, of them 6,215,334 6,212,534

* Vested at the end of the reporting period 125,000 122,900

* Not vested at the end of the reporting period 6,090,334 6,089,634

Warrants given to shareholders

as a part of placing equity instruments

- not all conditions met and/or

out of the money 141,999,329 98,339,078

------------- -----------------

Total number of instruments in

issue not included into the fully

diluted EPS calculation 148,214,663 104,551,612

------------- -----------------

5 Segmental analysis

Since the last annual financial statements, the Group has

re-considered its operational segments.

For the six-month period Battery Flexible Grid Corporate

to 31 December 2021 Metals (Nickel Solutions and unallocated

and Vanadium) (FGS and WDD) Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue - - - -

Result

Segment results (5) (24) (480) (509)

---------------- --------------- ----------------- --------

Loss before tax and

finance costs

Finance costs - - (105) (105)

---------------- --------------- ----------------- --------

Loss for the period

before taxation

Taxation expense - - - -

---------------- --------------- ----------------- --------

Loss for the period

after taxation (5) (24) (585) (614)

Total assets at 31

December 2021 4,497 487 291 5,275

---------------- --------------- ----------------- --------

For the six-month period Battery Flexible Grid Corporate

to 31 December 2020 Metals (Nickel Solutions and unallocated

and Vanadium) Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue - - - -

Result

Segment results (10) (30) (454) (494)

---------------- -------------- ----------------- --------

Loss before tax and

finance costs

Finance costs - (30) (30)

---------------- -------------- ----------------- --------

Loss for the period

before taxation

Taxation expense - - - -

---------------- -------------- ----------------- --------

Loss for the period

after taxation (524)

Total assets at 31

December 2020 4,281 158 295 4,734

---------------- -------------- ----------------- --------

6 Investments in associates and joint ventures

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

At the beginning of the period 2,380 1,947 1,947

Additional investments in JVs 3 30 439

Share of loss for the period

using equity method (2) (6) (6)

At the end of the period 2,381 1,971 2,380

------------ ------------ ---------

7 Financial assets

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

FVTOCI financial instruments

at the beginning of the period 7 4 4

Disposals - - -

Revaluations and impairment (6) (1) 3

FVTOCI financial assets at

the end of the period (unaudited) 1 3 7

------------ ------------ ---------

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

GBP GBP GBP

FVTPL financial instruments

at the beginning of the period 72 5 5

Additions 72

Disposals - (5) (5)

FVTPL financial assets at

the end of the period (unaudited) 72 - 72

------------ ------------ ---------

8 Business Combination - Niugini Nickel Pty Ltd

On 18 October 2021 the Company, via its 100% owned subsidiary

Corcel Australasia Pty Ltd, completed the acquisition of

100% of the shares in Niugini Nickel Pty Ltd ("NN") from

Resource Mining Corporation Pty Ltd ("RMC"). Consideration

paid by the Company for the acquisition of NN was the forgiveness

of the corporate debt held by the Company and payable by

RMC totalling AUD 4,761,087. The Company has accounted for

the fair value of this consideration based on the cost to

acquire the debt, at a substantial discount to face value,

plus transaction costs. As at 18 October 2021 the total cost

of acquisition of the debt payable by RMC stood at GBP1,013,302.

The Company has determined the fair value of the assets and

liabilities of NN to be recognised in these consolidated

interim financial statements as follows:

Fair value

recognised

on acquisition

GBP(000's)

Assets

Cash 2

Receivables 15

Property, plant and equipment 47

Exploration and evaluation assets 1,067

----------------

Total Assets 1,131

Liabilities

Trade and other payables (63)

Non current loans payable (55)

----------------

Total liabilities (118)

----------------

Total identifiable net assets at fair value 1,013

----------------

Purchase consideration 1,013

----------------

9 Share Capital of the company

The share capital of the Company is as follows:

Number of Nominal,

shares GBP'000

Allotted, issued and fully paid

Deferred shares of GBP0.0009 each 1,788,918,926 1,610

A Deferred shares of GBP0.000095 each 2,497,434,980 237

B Deferred shares of GBP0.000099 each 8,687,335,200 860

Ordinary shares of GBP0.0001 each 384,787,602 39

---------

As at 1 July 2021 (Audited) and 31

December 2021 (Unaudited) 2,746

10 Capital Management

Management controls the capital of the Group in order to control

risks, provide the shareholders with adequate returns and ensure

that the Group can fund its operations and continue as a going

concern.

The Group's debt and capital includes ordinary share capital and

financial liabilities, supported by financial assets.

There are no externally imposed capital requirements.

Management effectively manages the Group's capital by assessing

the Group's financial risks and adjusting its capital structure in

response to changes in these risks and in the market. These

responses include the management of debt levels, distributions to

shareholders and share issues.

There have been no changes in the strategy adopted by management

to control the capital of the Group since the prior year.

11 Events after the reporting period

Shandong New Powder COSMO AM&T ("NPC") - MOU on Nickel

Offtake Agreement

On 10 January 2022, the Company announced that it had executed

an MOU with NPC for the entering into a nickel offtake agreement

for up to 0.5 Mt per annum, to be supplied from the Company's

Mambare and Wowo gap nickel projects in Papua New Guinea. The term

of the MOU is 12 months, during which time both parties will seek

to negotiate a binding offtake agreement, intended to operate for a

period of 3-5 years.

Avonmouth and Tring Road Gas Peaker Project Extensions

On 4 February 2022, the Company announced that its rights to

participate in the Avonmouth and Tring Road Gas Peaker projects had

each been extended, by mutual indication and formal lease extension

respectively, to allow the parties more time to conclude the

financing arrangements necessary to take the projects to financial

close and then construction.

Debt Conversion, Funding & Refinancing and Equity Share

Agreement

On 21 February 2022, the Company announced the restructuring of

a portion of its existing debt facility with Align Research and

Riverfort Global Opportunities PCC Limited (the "Funding Parties")

including:

-- Entering into of a new debt facility of up to GBP450,000 -

including the issuance of warrants exercisable at GBP0.015

-- Entering into an Equity Share Agreement for up to GBP600,000 with a floor price of GBP0.015

-- Conversion of GBP135,000 of the existing drawn down debt with the Funding Parties and

-- Refinancing of GBP270,000 of drawn down debt to mature at the end of October 2022

The conversion, refinancing, new debt facility and new equity

share facility has resulted in up to an additional GBP1,050,000 of

new funding becoming available to the Company with the majority of

the existing debt refinanced to October 2022.

On 16 March 2022, the Company further announced that the

GBP135,000 debt previously agreed to be converted, plus an

additional amount of GBP35,000 due 30 April 2022, was converted

into 11,333,333 Company shares. This left GBP270,000 of debt due

for settlement by the end of October 2022 and GBP100,000 due for

settlement on 30 April 2022.

T-4 Capacity Market Auction

On 24 February 2022 the Company announced that its Avonmouth gas

peaker project had been provisionally awarded a 15-year Capacity

Market contract with National Grid, for commencement in 2025/26.

The clearing price of the auction was GBP30.59/kW/annum which,

following formal award and completion of the peaker project, would

equate to approx. GBP1.5 million per annum in revenue for the 50MW

project.

Debt Conversion and Option Awards

On 28 February 2022, the Company announced that GBP128,586 of

Company debt held by C4 Energy Limited, a company controlled by the

Company's chairman Mr James Parsons, had agreed to convert the

entirety of its holding of Company debt into 8,572,400 new ordinary

shares in the Company with an 18-month lock-in period.

Also on 28 February 2022, the Company announced the issuance of

20,606,278 options to subscribe for Company shares at a strike

price of GBP0.017 per share and for an exercise period of 5 years.

The Options vest only after both (a) the awarding of a mining lease

at the Company's Mambare Nickel project in Papua New Guinea and (b)

following 3 years of the date of grant.

Equity Fundraising

On 16 March 2022 the Company announced that it had raised a

further GBP365,000 in funding by the placing of 24,333,332 new

ordinary shares in the Company at a price of GBP0.015 per

share.

For further information, please contact:

Scott Kaintz 020 7747 9960 Corcel Plc CEO

James Joyce / Andrew de Andrade 0207 220 1666 WH Ireland Ltd

NOMAD & Broker

Simon Woods 0207 3900 230 Vigo Consulting IR

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BGGDXDUXDGDB

(END) Dow Jones Newswires

March 31, 2022 06:54 ET (10:54 GMT)

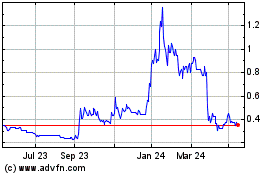

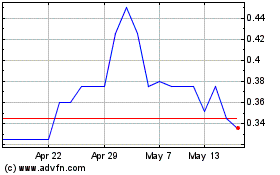

Corcel (LSE:CRCL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Corcel (LSE:CRCL)

Historical Stock Chart

From Jul 2023 to Jul 2024