Comino Plc - Interim Results

November 26 1998 - 2:30AM

UK Regulatory

RNS No 1590c

COMINO PLC

26th November 1998

COMINO PLC

1998 INTERIM RESULTS

PBT up 52%; EPS up 37%; Maiden Interim Dividend; Strong Order Book

Comino plc ("Comino"), the supplier of software based business solutions for

the social housing, local authority, pensions and clothing sectors, announces

its Interim Results for the half year to 30 September 1998. The Interim

Results are the second set of half year figures made by Comino since it went

public in 1997. The profit for the six months represents 65% of the figure

achieved for the whole of last year.

Key Points from the Interim Results

1998 1997

* Turnover #8.72m #5.08m

* Profit before tax #1.27m #830,000 up 52%

* Earnings per share 7.24p 5.30p up 37%

* Maiden interim dividend 1.25p nil

* Results reflect improved performance from all operating

companies and benefits from last year's acquisitions

* New products and contract gains in all businesses

Regarding Prospects, Garth Selvey, Chief Executive said:

"Comino's financial and trading position at the half year is firmly on track.

Cash balances amounting to #5.86 million represent 43p per share and a strong

order book combined with solid recurring revenues gives high visibility for

the future.

Organic growth and acquisition both remain important elements of Comino's

strategy. Growth is not significantly dependent on any aspect of millennium

business and investment in product development will be maintained to ensure

that we continue to have effective solutions for the new century."

Enquiries :

Garth Selvey, Chief Executive

Paul Clifford, Finance Director

Comino plc

Tel: 0171 786 9600 until 11:30am; thereafter 01628 525433

Peter Binns

Jane Mallinson

Binns & Co

Tel: 0171 786 9600

Editor's note:

Comino has three operating companies: Context Computers based in

Buckinghamshire, Prologic based in Hertfordshire, and ISE based in Leeds.

Chief Executive's Statement

Effective business solutions derive from the skilled application of sector

knowledge and proven technology. Comino's results reflect the continuing

demand for such solutions and the Group's ability to provide them.

Comino is pleased to report results for the half year to 30 September 1998

which show a substantial increase in profit before tax and earnings per share

compared with the same period last year. The Board wishes to thank the

professional and hard working staff who have achieved performance improvements

in all of the operating companies.

Profit before tax for the period was #1.27 million, a 52% increase over the

same period last year and earnings per share were up by 37% at 7.24p. The

profit for the six months represents 65% of the figure achieved for the whole

of last year. In addition to solid organic growth the results reflect

acquisitions made during the course of last year.

Excelsis has been successfully integrated into Context's housing operation and

its new Aurora product is now widely installed. Prologic's breadth and

quality of product has won seven new contracts since the year end compared

with a total of five in the previous year.

The purchase last year of the minority interest in ISE has resulted in a

wholly owned high growth company whose application of workflow technology to

business solutions is foremost in the industry. Since the year end ISE has

won orders from nine Local Authorities including some of the country's largest

revenue and benefit operations.

A maiden interim dividend of 1.25p per share will be paid. The Company

expects to pursue a progressive dividend policy which will ordinarily be paid

in a one third to two thirds interim to final ratio.

Comino's financial and trading position at the half year is firmly on track.

Cash balances amounting to #5.86 million represent 43p per share and a strong

order book combined with solid recurring revenues gives high visibility for

the future.

Organic growth and acquisition both remain important elements of Comino's

strategy. Growth is not significantly dependent on any aspect of millennium

business and investment in product development will be maintained to ensure

that we continue to have effective solutions for the new century.

Garth Selvey

Chief Executive

Comino plc - Group Profit and Loss Account

6 months to 6 months to Year to

30 September 30 September 31 March

1998 1997 1998

#'000 #'000 #'000

Turnover 8,721 5,087 13,151

Cost of sales (2,620) (1,839) (4,089)

---------- ---------- ----------

Gross profit 6,101 3,248 9,062

Administrative expenses (4,981) (2,510) (7,285)

---------- ---------- ----------

Operating profit 1,120 738 1,777

Net interest receivable 146 92 173

--------- --------- ---------

Profit on ordinary activities

before taxation 1,266 830 1,950

Tax on profit on ordinary

activities (303) (201) (453)

--------- --------- ---------

Profit on ordinary activities

after taxation 963 629 1,497

Minority interest - equity 0 (54) (56)

-------- --------- ---------

Profit for the financial period 963 575 1,441

Dividend proposed (175) 0 (330)

--------- -------- ---------

Retained profit for the period 788 575 1,111

-------- -------- --------

Earnings per share 7.24p 5.30p 12.33p

--------- --------- ---------

Fully diluted earnings per share 6.94p 4.89p 11.46p

--------- --------- ---------

Dividend per share 1.25p 0 2.50p

======= ======= =======

The dividend of 1.25p per share will be paid on 28 January 1999. The dividend

record date is 11 December 1998.

Comino plc - Consolidated Balance Sheet

30 September 30 September 31 March

1998 1997 1998

#'000 #'000 #'000

Tangible fixed assets 692 254 714

Current assets

Stocks 376 226 291

Debtors 4,108 3,105 5,449

Cash at bank and in hand 5,859 4,005 4,329

--------- --------- ---------

10,343 7,336 10,069

Creditors falling due

within one year (3,877) (1,964) (4,245)

---------- ---------- ----------

Net current assets 6,466 5,372 5,824

--------- --------- ---------

Total assets less current

liabilities 7,158 5,626 6,538

Creditors falling due after more

than one year (381) (201) (118)

Deferred income (4,243) (2,003) (4,705)

---------- --------- ---------

2,534 3,422 1,715

======== ======= =======

Capital and reserves

Share capital 678 552 657

Share premium account 4,334 1,867 4,324

Goodwill reserve (5,174) (434) (5,174)

Profit and loss account 2,696 1,372 1,908

--------- -------- --------

Shareholders' funds 2,534 3,357 1,715

Minority interests 0 65 0

--------- -------- --------

2,534 3,422 1,715

======= ======= =======

Comino plc - Group Cash Flow Statement

6 months to 6 months to Year to

30 September 30 September 31 March

1998 1997 1998

#'000 #'000 #'000

Net cash inflow from

operating activities 1,918 589 3,344

Net returns on investments

and servicing of finance

Interest received 146 92 173

--------- --------- ----------

146 92 173

--------- --------- ----------

Tax paid 0 0 (299)

Capital expenditure

Purchase of tangible fixed assets (188) (81) (441)

Sale of tangible fixed assets 21 2 3

--------- -------- ---------

Net cash outflow from

capital expenditure (167) (79) (438)

---------- --------- ----------

Acquisitions and disposals

Acquisition of subsidiary

undertakings 0 0 (1,688)

--------- -------- ----------

Net cash inflow from

acquisitions 0 0 (1,688)

--------- -------- ----------

Equity dividends paid (334) 0 (201)

Financing

Issue of shares (net of costs) 31 1,514 1,521

Repayment of borrowings (64) (5) 62

---------- --------- ---------

Net cash inflow/(outflow)

from financing (33) 1,509 1,583

---------- -------- ---------

Management of liquid resources

Increase in short term deposits (1,800) (2,150) (1,200)

---------- --------- ----------

Increase/(decrease) in cash (270) (39) 1,274

======== ======== ========

Increase/(decrease) in cash

and liquid resources 1,530 2,111 2,474

Notes to the Interim Accounts

1. The charge for taxation is based on the estimated effective rate for the

financial year allowing for tax losses brought forward from prior

periods.

2. The calculation of earnings per share for the six months ended 30

September 1998 is based on the profit for the financial period of

#963,000 (1997 - #575,000) and on 13,291,187 (1997 - 10,860,917)

ordinary shares being the average number of shares in issue during the

period.

3. The interim statement, which has been prepared on the same accounting

basis as those set out in the financial statements for the year ended 31

March 1998, was approved by the Board on 25 November 1998. The

foregoing financial information does not represent accounts within S240

of the Companies Act 1985 and has not been reported on by the auditors

or delivered to the Registrar of Companies.

4. The above results for the year ended 31 March 1998 have been abridged

from the full Group accounts for that year, which received an

unqualified auditors' report and which have been delivered to the

Registrar of Companies.

Review Report by the Auditors to Comino plc

We have reviewed the interim financial information for the six months ended 30

September 1998 which is the responsibility of, and has been approved by, the

Directors. Our responsibility is to report on the results of our review.

Our review was carried out having regard to the Bulletin 'Review of Interim

Financial Information' issued by the Auditing Practices Board. This review

consisted principally of applying analytical procedures to the underlying

financial data, assessing whether accounting policies have been consistently

applied, and making enquiries of management responsible for financial

accounting matters. The review excluded audit procedures such as tests of

control and verification of assets and liabilities, and was therefore

substantially less in scope than an audit performed in accordance with

Auditing Standards. Accordingly, we do not express an opinion on the interim

financial information.

On the basis of our review:

i in our opinion the interim financial information has been prepared using

accounting policies consistent with those adopted by Comino plc in its

financial statements for the year ended 31 March 1998; and

ii we are not aware of any material modifications that should be made to the

interim financial information as presented.

Grant Thornton

Registered Auditors

Chartered Accountants

London

25 November 1998

END

IR VEFFLVFKZFKF

Cmo (LSE:CMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

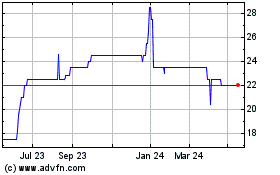

Cmo (LSE:CMO)

Historical Stock Chart

From Jul 2023 to Jul 2024