TIDMCLCO

RNS Number : 5633S

Cloudcoco Group PLC

07 November 2023

The information contained within this announcement is deemed by

CloudCoCo to constitute inside information pursuant to Article 7 of

EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

7 November 2023

CloudCoCo Group plc

("CloudCoCo", the "Company" or the "Group")

Year End Trading Update

Performance in line with market expectations

CloudCoCo (AIM: CLCO), a leading UK provider of Managed IT

services and communications solutions to private and public sector

organisations, is pleased to provide an update on its trading for

the year ended 30 September 2023 ("FY23").

Highlights:

-- Revenue expected to be no less than GBP26.0m (FY22: GBP24.2m)

-- Trading Group EBITDA(1) expected to be in the region of

GBP1.9m (FY22: GBP1.6m)

-- Signed 42 new logo customers in the year (FY22: 39)

-- 110% increase in MoreCoCo ecommerce sales to GBP4.2m following

growth initiatives

-- Identified significant monthly cost savings and efficiencies

in acquired businesses

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, exceptional costs and share-based

payments.

The Group delivered a solid performance in line with market

expectations against a backdrop of a challenging macroeconomic

environment, with revenue expected to have increased to at least

GBP26.0 million (unaudited), growth of 7% over FY22. Trading Group

EBITDA(1) is expected to have increased by at least 18% to GBP1.9m

(unaudited). The trading performance has been supported by an

increase in MoreCoCo ecommerce sales and further cost savings and

efficiencies.

With a number of the Group's business customers closing their

operating locations, consolidating operations and reducing their

employee headcount, the Group has exceeded its expectations in the

number of customer contract renewals signed in the year, alongside

further growth in new customers. The success of MoreCoCo, the

Group's ecommerce website, is a particular highlight, with the

initiatives to increases visitors and conversions leading to a 110%

increase in sales to GBP4.2m (FY22: GBP2.0m) reflecting the global

trend towards a next-day ecommerce sales experience for technology

goods.

Despite the global economic and political challenges, the Group

continued to make significant operational progress in preparation

for an acceleration of growth when conditions permit. The Group's

sales and support functions have been reorganised and optimised,

enabling greater focus and collaboration across the different parts

of the business.

In line with long-term market trends, a key focus in the year

has been on strengthening the Group's Cybersecurity and Multi-cloud

practices through the addition of new talent and partners. The

Board believes these to be particularly attractive near-term growth

opportunities and is investing the Group's resources in order to

capitalise on them. Underlining our confidence in the opportunity

ahead, independent sources estimate the UK's cybersecurity market

to reach a value of $23.4bn by 2028, registering a CAGR of over

10%(2) . Similarly, the UK's multi-cloud computing market is cited

as the fastest growing in Europe, with the worldwide market set to

be worth $76.3bn by 2023, registering a CAGR of 28.3%(3) .

The Group's previously announced strategic partnership with

Ingram Micro has progressed well and is now contributing to the

Group's pipeline of multi-cloud opportunities.

Management continued to be proactive in reducing costs and

improving efficiency across the Group in the year. The newly formed

commercial team has reviewed all supplier relationships and

successfully reduced the number of suppliers from 450 to 220 while

identifying over GBP50k of ongoing monthly savings which will

further enhance our profitability in FY24.

Outlook

While the current economic climate will continue to present

near-term challenges, the work that has been completed to

streamline and focus the Group positions it well for continued

progress in FY24, particularly in the areas of Cybersecurity and

Multi-cloud.

In addition to strengthening our organic sales capabilities, the

Group continues to appraise opportunities to accelerate growth

through acquisition. The Directors are currently in discussion with

several parties regarding potential options to refinance or repay

its loan notes, which currently sit at GBP5.5m, ahead of the

October 2024 repayment date.

Mark Halpin, CEO of CloudCoCo, commented:

"It's been a challenging year as anyone in the industry will

tell you, so we're pleased to have delivered a performance in line

with market expectations while continuing to lay the groundwork for

our long-term success.

"We recognised the changing IT landscape was creating huge

opportunities in Cybersecurity and Multi-cloud and have responded

by bolstering our capability in these core pillars. Pipelines are

growing at a healthy rate as a result and we're confident in our

ability to gain further traction in FY24.

"I would like to reassure investors that refinancing the debt is

a key priority for the Board allowing CloudCoCo to continue to make

progress both organically and through acquisition towards its

ambition of becoming a GBP100m revenue company."

References

(2)

https://www.mordorintelligence.com/industry-reports/uk-cybersecurity-market/market-size

(3)

https://www.marketresearchfuture.com/reports/multi-cloud-computing-market-12222

Note: the figures for FY23 provided above are unaudited. The

Group expects to announce full audited results for FY23 in February

2024.

Contacts:

CloudCoCo Group plc Via Alma

Mark Halpin (CEO)

Darron Giddens (CFO)

Allenby Capital Limited - (Nominated Adviser & Broker) Tel: +44 (0)20 3328 5656

Jeremy Porter/Daniel Dearden-Williams (Corporate Finance)

Tony Quirke/Amrit Nahal (Equity Sales)

Alma - (Financial PR) Tel: +44 (0)20 3405 0205

David Ison cloudcoco@almastrategic.com

Kieran Breheny

About CloudCoCo

Supported by a team of industry experts and harnessing a diverse

ecosystem of partnerships with blue-chip technology vendors,

CloudCoCo makes it easy for private and public sector organisations

to work smarter, faster and more securely by providing a single

point of purchase for their Connectivity, Multi-Cloud,

Collaboration, Cyber Security, IT Hardware, Licencing, Support and

Professional Services.

CloudCoCo has headquarters in Leeds and regional offices in

Warrington, Sheffield and Bournemouth.

www.cloudcoco.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKABKBBDBDDK

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

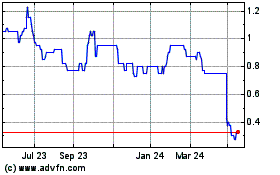

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

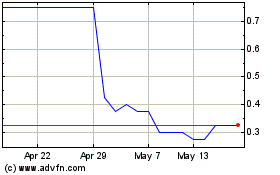

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Dec 2023 to Dec 2024