TIDMONE

RNS Number : 1232G

One Delta PLC

01 May 2014

1 May 2014

One Delta plc

("One Delta" or the "Company")

Audited Financial Statements for the year ended 30 November

2013

One Delta (AIM: ONE), which has conditionally agreed to acquire

digital social media audio platform, Audioboo Limited ("Audioboo"),

announces its audited financial results for the year ended 30

November 2013. The results show a loss before tax of GBP0.55

million on turnover of GBP0.02million.

Post-period end highlights

-- Secured funding for investment and development purposes of GBP3.5 million

-- Increased stake in One Delta Limited ("ODL") to 94.7%

-- Entered into a conditional agreement to acquire the entire

issued share capital of Audioboo by the issue of 174,537,998 new

shares and warrants to subscribe for a further 18,003,696 shares at

1.5p

About Audioboo

-- Social media audio platform that allows professional and

amateur content producers to create and broadcast audio content

-- Current channel partners include the BBC, the Telegraph and

Guardian newspapers, and the Premier League

-- 2.4 million registered users

Roger Maddock, Chairman of One Delta, commented:"The Company is

now well positioned with cash reserves and subsidiaries to develop

its investments. It is proposed that new members will join the

Board as directors as a result of the acquisition of Audioboo and

that the funding will be used to take the Audioboo product to its

next stage and increase its market penetration and user base.

"Audioboo is a fast growing Social Media technology company

which can be best described as the audio equivalent of YouTube.

With the market for Social Media continuing to experience rapid and

substantial growth on a global scale, Audioboo has identified many

opportunities to enhance Shareholder value.

"The Board is mindful of the possibilities afforded by the

existing ODL business and will continue to review the opportunities

provided by the strategies partnerships and business leads."

Enquiries:

One Delta plc www.onedeltaplc.com

Roger Maddock, Chairman Tel: 01534 753 400

Roger King, Director

Arden Partners plc Tel: 020 7614 5929

Chris Hardie, Corporate Finance

Walbrook PR Tel: 020 7933 8780 or onedelta@walbrookpr.com

Paul McManus Mob: 07980 541 893

Bob Huxford Mob: 07747 635 908

Chairman's Statement

I am pleased to present the audited results for the year ended

30 November 2013.

In its interim financial statements, announced on 29 August

2013, I reported that the Company had the ability to consider other

opportunities into which it might wish to diversify. I am pleased

to report that, having taken advantage of certain of these

opportunities, the Company is entering a new era.

Since November 2013, it has secured funding for investment and

development purposes of GBP3.5 million (see below) and increased

its stake in One Delta Limited ("ODL") to 94.6% (see below). It has

also entered into a conditional agreement to acquire the entire

issued share capital of Audioboo Limited ("Audioboo").

Issue of Shares

Since the year end the Company has raised a total of GBP3.58

million. In November 2013 it issued 15,000,000 shares held in

treasury, raising GBP80,000 and in March 2014 a further 254.4

million shares were issued raising GBP3.5 million.

These capital raisings were undertaken pursuant to the Company's

revised strategy, as set out in the Notice of General Meeting

posted to shareholders on 3 December 2013 and approved by

shareholders at the General Meeting on 18 December 2013. The

response from both new and existing investors to the capital raises

and the new strategy has proved very positive.

Expansion of Business

As announced on 1 May 2014 the Company has entered into a share

purchase agreement that, subject to shareholder approval, will

result in the acquisition of 100% of Audioboo.

Audioboo is a social media audio platform that allows

professional and amateur content producers to create and broadcast

audio content. Audioboo's current channel partners include the BBC,

the Telegraph and Guardian newspapers and the Premier League.

Audioboo has 2.3 million registered users.

The consideration payable by the Company in respect of the

Acquisition amounts to 174,537,998 new shares and warrants to

subscribe for a further 18,003,696 shares at 1.5p. This is being

treated as a reverse takeover pursuant to Rule 14 of the AIM Rules

for Companies. As a result the Acquisition requires the approval of

shareholders and an Admission Document dated 1 May 2014 has been

sent to shareholders with these financial statements for their

consideration together with a notice of the Annual General Meeting

to be held on 19 May 2014.

In accordance with AIM Rules relating to such an acquisition the

Company requested the suspension of trading in its shares during

the period of the negotiations of the reverse takeover. This period

of suspension is expected to end on 2 May 2014, being the day

following the announcement of the Acquisition.

If the Acquisition receives shareholder consent it is proposed

that three new Directors will join the Board. Robert Proctor, CEO

of Audioboo, Rodger Sargent and Simon Cole will be appointed.

Financial Performance

In the year to 30 November 2013 the results show a turnover of

GBP22,022 and losses of GBP546,660 (predominantly the result of a

goodwill write-down relating to ODL).

Throughout the reporting period the Company continued to support

ODL in its effort to develop product likely to prove attractive to

companies operating in the UK fencing sector. The limited budget

and resources available made this a difficult task, as is reflected

in the annual results but ODL continues to pursue a number of

opportunities which might prove to be worthwhile and continues to

be operated on a tight budget.

Outlook

The Company is now well positioned with cash reserves and

subsidiaries to develop its investments.

It is proposed that new members will join the Board as directors

as a result of the acquisition of Audioboo and that the funding

will be used to take the Audioboo product to its next stage and

increase the market penetration and user base. The Board is mindful

of the possibilities afforded by the existing ODL business and will

review the opportunities provided by the strategies partnerships

and business leads.

Roger Maddock

Chairman

1 May 2014

Consolidated Statement of Comprehensive Income

Group Group Fourteen

Year ended months ended

30 November 30 November

2013 2012

Note GBP GBP

Revenue 22,022 33,318

Cost of sales (14,700) (39,773)

Gross profit/(loss) 7,322 (6,455)

Other income 5,667 478

Rental expenses 4 (8,546) (11,054)

Other administrative

expenses (246,103) (753,571)

Impairment of goodwill (295,000) (1,135,755)

Amortisation of intangible

asset 4 (10,000) (10,000)

Net loss on ordinary

activities

before taxation (546,660) (1,916,357)

Tax expense - -

Net loss and total

comprehensive income (546,660) (1,916,357)

Attributable to:

Owners of the Company (513,274) (1,916,357)

Non-controlling interest (33,386) -

(546,660) (1,916,357)

Basic (loss) per share

(pence) 2 (1.7) (7.3)

Diluted (loss) per

share (pence) 2 (1.7) (7.3)

Company Statement of Comprehensive Income

Company Company Fourteen

Year ended months ended

30 November 30 November

2013 2012

Note GBP GBP

Revenue - -

Cost of sales - -

Gross profit/(loss) - -

Other income 5,685 -

Rental expenses 4

Other administrative

expenses (181,708) (530,868)

Impairment of investment

in subsidiary (295,000) (1,360,000)

Amortisation of intangible

asset 4 (10,000) -

Net loss on ordinary

activities

before taxation (481,023) (1,890,868)

Tax expense - -

Net loss and total

comprehensive income (481,023) (1,890,868)

Attributable to:

Owners of the Company (481,023) (1,890,868)

Non-controlling interest -

(481,023) (1,890,868)

Basic (loss) per share

(pence) 2 (1.5) (7.2)

Diluted (loss) per

share (pence) 2 (1.5) (7.2)

Consolidated Statement of

Financial

Position

30 November 30 November

2013 2012

Notes GBP GBP

Non-current assets

Goodwill 10 5,000 300,000

Intangible asset 10 30,000 40,000

35,000 340,000

Current assets

Inventory 6,390 16,818

Other receivables 6 20,097 15,708

Cash and cash equivalents 1(i) 73,040 149,750

99,527 182,276

Liabilities - amounts falling

due within one year

Other payables 7 (133,110) (54,199)

Net current (liabilities)/assets (33,583) 128,077

Total net assets 1,417 468,077

Equity

Stated capital 8 5,406,952 5,326,952

Capital reserve 11 (706,395) (706,395)

Issue costs reserve 11 (679,868) (679,868)

Revenue reserve (3,973,448) (3,472,612)

Equity attributable to owners

of the Company 47,241 468,077

Non-controlling interest (45,824) -

Total equity 1,417 468,077

Company Statement of Financial Position 30 November 30 November

2013 2012

Notes GBP GBP

Non-current assets

Investment in subsidiaries 9 35,002 340,000

Current assets

Other receivables 6 107,200 63,200

Cash and cash equivalents 71,303 125,733

178,503 188,933

Liabilities - amounts falling due

within one year

Other payables 7 (120,962) (35,367)

Net current assets 57,541 153,566

Total net assets 92,543 493,566

Equity

Stated capital 8 5,406,952 5,326,952

Capital reserve 11 (706,395) (706,395)

Issue costs reserve (679,868) (679,868)

Revenue reserve (3,928,146) (3,447,123)

Total shareholders' funds (all equity) 92,543 493,566

Consolidated Statement of Cash Flows

Group Group

Year ended Fourteen months

30 November ended 30 November

2013 2012

Notes GBP GBP

Net cash outflow from operating activities 12 (146,710) (579,667)

Cash flow from investing activities

Cash from acquisition of subsidiary - 107,832

Net cash inflow from investing activities - 107,832

Decrease in cash before financing (146,710) (471,835)

Cash flow from financing activities

Shares issued 70,000 223,750

Loan payments received / (issued) - 87,739

Net cash inflow from financing activities 70,000 311,489

Net decrease in cash and cash equivalents (76,710) (160,346)

Cash and cash equivalents at the

start of the period 149,750 310,096

Cash and cash equivalents at the

end of the period 73,040 149,750

Company Statement of Cash Flows

Company Company

Year ended Fourteen months

30 November ended 30 November

2013 2012

Notes GBP GBP

Net cash outflow from operating activities 12 (87,230) (329,913)

Decrease in cash before financing (87,230) (329,913)

Cash flow from financing activities

Shares issued 70,000 208,750

Loan payments received / (issued) (37,200) (63,200)

Net cash inflow from financing activities 32,800 145,550

Net decrease in cash and cash equivalents (54,430) (184,363)

Cash and cash equivalents at the

start of the period 125,733 310,096

Cash and cash equivalents at the

end of the period 71,303 125,733

Consolidated

Statement

of Changes in

Equity

Issue Non-controlling

Stated Capital costs Revenue interest Total

capital reserve reserve reserve Total equity

GBP GBP GBP GBP GBP GBP GBP

For the year ended

30 November 2013

At 1 December

2012 5,326,952 (706,395) (679,868) (3,472,612) 468,077 - 468,077

Loss for the year - - - (513,274) (513,274) (33,386) (546,660)

Issue of

participation

shares 80,000 - - - 80,000 - 80,000

Transfer to

non-controlling

interest - - - 12,438 12,438 (12,438) -

At 30 November

2013 5,406,952 (706,395) (679,868) (3,973,448) 47,241 (45,824) 1,417

For the fourteen

months ended

30 November 2012

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392 - 266,392

Loss for the period - - - (1,916,357) (1,916,357) - (1,916,357)

Issue of fee shares 209,292 - - - 209,292 - 209,292

Issue of

consolidation

shares 1,700,000 - - - 1,700,000 - 1,700,000

Issue of

participation

shares 208,750 - - - 208,750 - 208,750

At 30 November

2012 5,326,952 (706,395) (679,868) (3,472,612) 468,077 - 468,077

Company Statement

of Changes in Equity

Stated Capital Issue costs Revenue

capital reserve reserve reserve Total

GBP GBP GBP GBP GBP

For the year ended

30 November 2013

At 1 December 2012 5,326,952 (706,395) (679,868) (3,447,123) (493,566)

Loss for the year - - - (481,023) (481,023)

Issue of participation

shares 80,000 - - - 80,000

At 30 November 2013 5,406,952 (706,395) (679,868) (3,928,146) 92,543

For the fourteen

months ended

30 November 2012

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

Loss for the period - - - (1,890,868) (1,890,868)

Issue of fee shares 209,292 - - - 209,292

Issue of consolidation

shares 1,700,000 - - - 1,700,000

Issue of participation

shares 208,750 - - - 208,750

At 30 November 2012 5,326,952 (706,395) (679,868) (3,447,123) 493,566

Notes to the financial statements

1. Accounting policies

(a) Basis of preparation

The consolidated financial statements have been prepared under

the historical cost convention, as modified to include

revaluations, in accordance with applicable Accounting Standards as

adopted by the European Union. Applicable Accounting Standards for

these purposes are International Financial Reporting Standards

("IFRS"), as adopted by the European Union.

Following the group restructuring carried out after the year end

and a review of the business plan and related commitments, the

Directors have concluded that the Group has adequate financial

resources to continue in operational existence for the foreseeable

future and therefore continue to adopt the going concern basis in

preparing the financial statements.

(b) Basis of consolidation

The accompanying financial statements and related notes present

the consolidated financial position as of 30 November 2013 and the

consolidated cash flows and comprehensive income for the year ended

30 November 2013. The results of subsidiaries acquired during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition. Where necessary,

adjustments are made to the results and balances of the subsidiary

to bring their accounting policies into line with those used by the

Group. All intercompany transactions have been eliminated.

(c) Intangible assets

Intangible assets are initially recognised at cost. Patents and

trade-marks and development and other costs are then amortised over

their useful economic lives which are assessed to be 5 years.

Goodwill is not amortised but is subject to an annual impairment

test.

(d) Estimates and judgments

The preparation of financial statements requires management to

make judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates.

The most significant estimate for the company relates to the

carrying value of the investment and this is disclosed further in

note 9. Based on the current financial performance and future

prospects of One Delta Ltd management have decided to impair the

investment to GBP35,000, this represents the maximum potential

additional impairment.

The most significant estimate for the group relates to the

valuation of the goodwill and intangible assets and this is

disclosed further in note 10. Based on the current financial

performance and future prospects of One Delta Ltd, upon whose

acquisition the goodwill arose, management have decided to impair

the goodwill to GBP5,000 which represents the maximum potential

additional impairment. Management continues to seek to develop the

intellectual property of One Delta Ltd, represented by the

intangible assets, and remain of the opinion that a five year

useful life is appropriate. The intangible assets are valued at

GBP30,000 and this represents the maximum potential additional

write down should a successful development fail to occur.

(e) Inventory

Inventory is stated at the lower of cost and net realisable

value on a FIFO basis.

(f) Currency

The results and financial position of the Group and Company are

expressed in Pounds Sterling, which is the functional and

presentational currency of all group companies. There were no

foreign currency transactions during the current or previous

financial periods.

(g) Receivables

Receivables are of a short-term nature and are accordingly

stated at their nominal value as reduced by appropriate allowances

for estimated irrecoverable amounts.

(h) Share capital

Founder shares

Founder shares are classified as equity. Founder shares are not

eligible for participation in Company investments and carry no

voting rights at general meetings of the Company.

Participating shares

Participating shares are classified as equity. Participating

shares are eligible for participation in Company investments and

carry voting rights at general meetings of the Company.

(i) Cash and cash equivalents

Cash and cash equivalents in the Consolidated and Company

Statement of Financial Position comprise cash at banks with an

original maturity of three months or less.

(j) Loans and receivables

Loans and receivables are shown on a recoverable basis.

Receivables are of a short-term nature and are accordingly stated

at their nominal value as reduced by appropriate allowances for

estimated irrecoverable amounts.

(k) Rounding

Figures presented in the financial statements are rounded to the

nearest one Pound Sterling.

(l) Revenue recognition

Income from sales is measured on an accruals basis in respect of

goods supplied during the year exclusive of Value Added Tax.

(m) Changes in accounting policies

As at the date of approval of these financial statements some

standards and interpretations (not listed out in view of their lack

of materiality) were in issue but not yet effective. The Directors

expect that the adoption of these standards and interpretations in

future accounting periods will not have a material impact on the

Group or Company's results.

2. Loss per share

Basic earnings per share amounts are calculated by dividing the

net loss for the year attributable to ordinary equity holders of

the Company by the weighted average number of participating shares

outstanding during the year.

Basic and Diluted earnings per share are the same as there are

no instruments in issue other than the shares used in calculating

Basic earnings per share.

The following reflects the income and share data used in the

basic earnings per share computation:

Group

Year ended Company Group Company

30 Year ended Year ended Year ended

November 30 November 30 November 30 November

2013 2013 2012 2012

Loss attributable to ordinary

shareholders GBP(546,660) GBP(481,023) GBP(1,916,357) GBP(1,916,357)

Weighted average of shares

in issue 21,464,767 21,464,767 26,366,056 26,366,056

Basic and diluted loss per

share (2.5)p (2.2)p (7.3)p (7.3)p

3. Operating segment

The subsidiary company, One Delta Limited, is currently in the

early stages of developing its technology and hence only has one

operating and geographical segment.

4. Other operating expenses

The loss for the year is stated after charging the

following:

Group Group Company

Year ended Company Fourteen Fourteen

30 Year ended months ended months ended

November 30 November 30 November 30 November

2013 2013 2012 2012

GBP GBP GBP GBP

Loss on part disposal of - 165,172 - -

subsidiary

Impairment of goodwill /

investment in subsidiary 295,000 139,828 1,135,755 1,360,000

Amortisation of intangible

assets 10,000 - 10,000 -

Director loans written off 3,529 - 80,509 -

Wages and salaries 37,314 - 69,945 -

Research and development - - 16,386 -

Auditors' fees - for audit

services 21,950 14,450 20,300 17,900

Other amounts due to auditors - - 3,600 3,600

Consultancy fees 35,690 35,400 - -

Directors' remuneration 31,860 31,860 62,616 62,616

Cost of inventories sold 14,700 - 39,773 -

Rental expenses 8,546 - 11,054 -

Acquisition costs - - 227,129 227,129

5. Taxation

Profits arising in the Company for the 2013 Year of Assessment

will be subject to Jersey Income Tax at the rate of Nil per cent

(2012: Nil per cent).

Fourteen

months

Year ended ended

30 November 30 November

2013 2012

Reconciliation of taxable profit GBP GBP

Net loss before taxation (546,660) (1,916,357)

Adjustment for disallowable income

and expenses (546,660) (1,916,357)

Taxable profit - -

6. Other receivables

Group Group Company Company

30 November 30 November 30 November 30 November

2013 2012 2013 2012

GBP GBP GBP GBP

Amounts due from subsidiary

undertaking - - 97,200 60,000

Accounts receivable 20,097 15,708 10,000 3,200

20,097 15,708 107,200 63,200

No receivables are impaired or past due.

7. Other payables

Group Group Company Company

30 November 30 November 30 November 30 November

2013 2012 2013 2012

Trade payables 22,583 - 17,935 -

Accruals 93,648 37,320 86,148 18,488

Tax 16,879 16,879 16,879 16,879

133,110 54,199 120,962 35,367

Trade payables and accruals principally comprise amounts

outstanding for trade purchases and ongoing costs.

Group Group Company Company

30 November 30 November 30 November 30 November

2013 2012 2013 2012

Other payables are due for

settlement in the following

periods

Within 0 - 30 Days 30,471 19,620 25,823 7,988

Between 3 months and 1 year 102,639 34,579 95,139 27,379

133,110 54,199 120,962 35,367

8. Stated capital

The Company is a no par value ('NPV') company

30 November 30 November

2013 2012

Authorised: Number Number

Founder shares 10 10

99,999,990 participating shares 99,999,990 99,999,990

100,000,000 100,000,000

Issued and fully paid: Number Number

Founder shares 2 2

Participating shares 31,574,356 31,574,356

All costs associated with the issue of shares have been taken to

the issue costs reserve.

Note Number Share

of shares Capital

GBP

Opening balance at 1 October 2011 5,098,830 3,208,910

On 23 December 2011 (i) 21,250,002 1,700,000

On 23 December 2011 (ii) 3,446,875 275,750

On 23 December 2011 (iii) 1,778,649 142,292

At 30 November 2012 31,574,356 5,326,952

Note Number Share

of shares Capital

GBP

Opening balance at 1 December 2012 31,574,356 5,326,952

On 28 March 2013 (iv) (15,000,000) -

On 29 November 2013 (v) 15,000,000 80,000

At 30 November 2013 31,574,356 5,406,952

(i) Refer to note 9 for details of shares issued in acquisition of One Delta Limited.

(ii) On 23 December 2011, the Group made an Offer for

Subscription and raised GBP275,750 before expenses by issuing

3,446,875 shares at GBP0.08 per share.

(iii) On 23 December 2011, the Group issued 1,778,649 shares in

exchange for fees valued at GBP142,292 which were recognised

immediately in the statement of comprehensive income.

(iv) On 28 March 2013 the Company acquired 15,000,000 shares in

exchange for 57 shares in One Delta Limited (being 47.5%) and then

held in Treasury

(v) On 29 November 2013 the Company sold 15,000,000 shares out

of Treasury for a total consideration of GBP80,000.

(vi) On 17 March 2014 the Company issued 233,333,333 shares to

raise GBP3.5 million.

9. Investment in subsidiaries

The Company has the following investments in subsidiaries:

Country of Class of

Incorporation shares held %

England and

One Delta Limited Wales Ordinary 51.42%

England and

Fusion Delta Limited Wales Ordinary 100%

On 23 April 2013 the Company transferred 48.58% of One Delta

Limited to key employees and subsequently is 51.42% owned by One

Delta Plc.

The results of One Delta Limited are included within these

financial statements.

The Directors have re-assessed the cost of One Delta Limited to

include Intellectual Property at GBP50,000, to be amortised over 5

years, and have impaired the value of goodwill to GBP30,000 (see

note 10). Goodwill will be reviewed for impairment on an annual

basis.

GBP

1 October 2011 -

Acquisition of One Delta Ltd 1,700,000

Impairment (1,360,000)

30 November 2012 340,000

Disposal of 48.58% of One Delta

Ltd (165,172)

Impairment (139,828)

Acquisition of Fusion Delta Ltd 2

30 November 2013 35,002

10. Intangible assets

Included in the financial statements is Intellectual Property

which has an amortised carrying value of GBP30,000 at the year

end.

One Delta Limited has developed a portfolio of products that can

be produced from waste plastic. No similar products have been sold

therefore the valuation is based on known costs of GBP30,248 plus

some unaccounted costs.

Goodwill Patents and Development Total

trade-marks and other other

costs intangible

assets

Cost GBP GBP GBP GBP

Balance at 1 December

2012 1,435,755 7,020 42,980 50,000

Balance at 30 November

2013 1,435,755 7,020 42,980 50,000

Impairment and amortisation

Balance at 1 December

2012 1,135,755 1,404 8,596 (10,000)

Impairment for the year 295,000 - - -

Amortisation for the year - 1,404 8,596 (10,000)

Balance at 30 November

2013 1,430,755 2,808 17,192 (20,000)

Net book value

Balance at 1 December

2012 300,000 5,616 34,384 40,000

Balance at 30 November

2013 5,000 4,212 25,788 30,000

It has been estimated that the intangible asset has a useful

life of 5 years and is therefore being amortised on a straight line

basis at GBP10,000 per year with the carrying value at 30 November

2013 being GBP30,000.

The Directors have carefully considered both the record of sales

for the Company over the accounting period and the prospect for

sales in the future and consider that, in the light of the current

actual level of sales of instant sandbags and the potential for the

sale of specialist fencing to a major UK utility, the goodwill is

more reasonably be valued at GBP5,000 and hence an impairment

charge of GBP295,000 has been accounted for in the year ended 30

November 2013.

The amortisation and impairment charges are shown separately in

the Company Consolidated Statement of Comprehensive Income and

Consolidated Statement of Comprehensive Income.

There is only one cash generating unit thus the figures above

represent the total amortisation and impairment deductions for the

Company. The recoverable amount of goodwill is forecast to be

GBP5,000 and has been calculated with reference to its value in

use. The directors consider 12% to be appropriate for One Delta

Limited on the basis of the anticipated risk and return.

Management forecasts are based on a 5 year period with sales

expected to increase at 30% per annum until the trading year

2015/16 and at 50% per annum thereafter. Costs of sales are

expected to remain at a constant percentage of sales whilst other

costs are expected to increase at between 10% and 20% over the same

5 year period. Management have assumed that any future price rises

in cost of sales will be negated by the ability to purchase with

volume discounts.

The growth rates used in the value in use calculation reflect

the rates currently experienced in the construction sector.

11. Reserves

2013 2012

Capital Reserve GBP GBP

At 1 December 2012 and 30 November

2013 (706,395) (706,395)

The capital reserve arose from recognised losses on property

development and holding.

2013 2012

Issue Costs Reserve GBP GBP

At 1 December 2012 and 30 November

2013 (679,868) (679,868)

The issue costs reserve arose from expenses incurred on a share

issue in 2006.

12. Net cash outflow from operating activities

Group Fourteen

Group Company months ended Company Fourteen

Year ended Year ended 30 November months ended

30 November 30 November 2012 30 November

2013 2013 2012

GBP GBP GBP GBP

Rental income received 5,685 5,685 - -

Sales income 22,004 - 33,538 -

Other income - - 478 -

Cost of sales (14,700) - (15) -

Rental expenses - - (10,445) -

Other expenses (165,526) (92,915) (603,233) (329,913)

Movement in inventory 10,428 - - -

Movement in other receivables 2,082 - - -

Movement in other payables (6,683) - - -

Net cash outflow from

operating activities (146,710) (87,230) (579,667) (329,913)

13. Financial instruments

The Company's financial instruments comprise fixed interest

securities, cash balances and debtors and creditors that arise

directly from its operations, for example, in respect of sales and

purchases awaiting settlement, and debtors for accrued income.

The main risks the Company faces from its financial instruments

are (i) market price risk (comprising interest rate risk and other

price risk), (ii) liquidity risk and (iii) credit risk.

The Board regularly reviews and agrees on policies for managing

each of these risks. The policies for managing these risks are

summarised below and have been applied throughout the year. The

numerical disclosures exclude short-term receivables and

payables.

(i) Interest rate risk

Interest rate movements may affect: (i) the fair value of the

investments in fixed interest rate securities, and (ii) the level

of income receivable on cash deposits.

The interest rate profile of the Company excluding short term

receivables and payables at 30 November 2013 was as follows:

30 November 2013 Group

Non-interest Company

bearing Non-interest

GBP bearing

GBP

Assets

Intercompany loan - 97,200

Sterling cash deposit 73,040 71,303

Other receivables 20,097 -

93,137 168,503

30 November 2012 Group

Non-interest Company

bearing Non-interest

GBP bearing

GBP

Assets

Intercompany loan - 60,000

Sterling cash deposit 149,750 125,733

Other receivables 15,708 3,200

165,458 188,933

All assets above are due within one year. The intercompany loan

is interest free and payable on demand.

Interest rate sensitivity

We have assumed that interest rates are unlikely to change more

than 100 basis points over the next year. Likely changes in

interest rates would not have a material impact on the Company.

(ii) Liquidity risk

As at 30 November 2013 the Company did not have any significant

liabilities payable.

(iii) Credit risk

The Company places funds with third parties and is therefore

potentially at risk from the failure of any such third party of

which it is a creditor. The Company expects to place any such funds

on a short-term basis only and spread these over a number of

years.

Management has a credit policy in place and the exposure to

credit risk is monitored on an ongoing basis.

The Company's principal financial assets are fixed interest

securities, other receivables and cash and cash equivalents. The

maximum exposure of the Company to the credit risk is the carrying

amount of each class of financial assets.

The Company has a concentration of credit risk arising from cash

and cash equivalents which is all maintained with RBS

International, Jersey.

14. Related party transactions

The compensation of key management personnel, including the

Directors, is as follows:

2013 2012

GBP GBP

Director fees 31,860 1,616

Consultancy fees 35,400 -

Share based payments - 61,000

Roger King and Roger Maddock beneficially hold 583,973 shares

and 5,273,556 shares respectively and are Directors of the Company.

At 30 November 2013 Roger King and Roger Maddock were each due

GBP15,930.

Roger King is a Director of Anglo Saxon Trust Limited and AST

Secretaries Limited, who act as administrators and company

secretary respectively to the Company. Fees payable to Anglo Saxon

Trust Limited for administration and accountancy services and AST

Secretaries Limited for secretarial services during the year

amounted to GBP40,285 (2012:GBP46,200). Balances due to Anglo Saxon

Trust Limited at the year end amounted to GBP11,400 (2012:GBP2,093)

and no fees were payable to AST Secretaries Limited at the year end

(2012: Nil.)

At the year end One Delta Plc was owed GBP97,200 by One Delta

Ltd (2012: GBP60,000.) Subsequent to the year end the loan has been

capitalized and the Group's interest in the share capital of One

Delta Limited increased to 94.7%.

15. Ultimate controlling party

There is no one ultimate controlling party.

16. Capital management

As a result of the ability to issue, repurchase and resell

participating shares, the capital of the Company can vary depending

on subscriptions to the Company and repurchases by the Company. The

Company is not subject to externally imposed capital requirements

and has no restrictions on the issue, repurchase and resale of

participating shares. The primary objective of the Company's

capital management is to ensure that it retains sufficient

liquidity to enable it to meet its ongoing expense obligations in a

timely manner and to ensure that there is a reasonable buffer

amount available at any one time. The Company includes cash and

debtors in its resources to meet its objective and generally relies

on the cash flows from rental income to support this.

The Company is able to reduce its liquidity by returning cash to

the shareholders in the form of a dividend or, by redeeming a

portion of the Participating Shares in issue.

17. Events after the reporting period

Acquisition of Audioboo Limited

The Company has conditionally agreed to acquire Audioboo,

subject to shareholder approval. The consideration payable in

respect of the acquisition amounts to 174,537,998 new shares and

warrants to subscribe for a further 18,003,696 shares at 1.5p.

Audioboo is a social media, Software as a Service ("SaaS")

based, digital audio platform which enables the creation, broadcast

and consumption of audio content across multiple global media

platforms. The Directors believe that Audioboo's operations are

compatible with the investment objectives of the Company.

Audioboo was formed in 2009 and its digital audio platform

allows professional and amateur content producers to create and

broadcast audio content; the audio equivalent of YouTube. Users

listen to content via i) the Audioboo app or website; ii) embedded

Audioboo proprietary software within the content partner's website

and iii) social media sites such as Twitter and Facebook.

Financed by funds raised by the Company in March 2014, Audioboo

will seek to rapidly grow the volume of content through the

development of existing channels and the attraction of new content

partner relationships. Enhanced content and the consequent growth

of unique monthly listens from their current volume of 20 million

per month will position Audioboo as a key destination site for

users, social media partners and advertisers. Funds will also be

applied to upgrading back-end technology infrastructure to enhance

resilience, latency and capacity.

In view of the size and nature of the acquisition, which

constitutes a reverse takeover of the Company under the AIM Rules,

completion of the acquisition is conditional on receiving the

approval of shareholders on the Admission of the enlarged share

capital to AIM, such approval to be sought at the AGM.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLGDUGBGBGSB

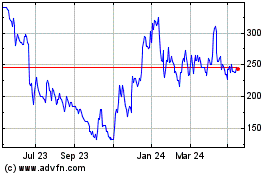

Audioboom (LSE:BOOM)

Historical Stock Chart

From Sep 2024 to Oct 2024

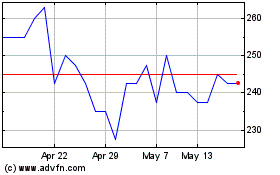

Audioboom (LSE:BOOM)

Historical Stock Chart

From Oct 2023 to Oct 2024