Barkby Group PLC Update on debt refinancing and CSS (3158X)

December 19 2023 - 6:15AM

UK Regulatory

TIDMBARK

RNS Number : 3158X

Barkby Group PLC

19 December 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Barkby Group PLC

("Barkby", or the "Company")

Update on debt refinancing and Cambridge Sleep Sciences

Barkby, (AIM: BARK) the roadside real estate business, provides

an update on its intention to refinance its existing debt

facilities further to the announcement on 4 December 2023.

The Company has engaged in several constructive discussions with

prospective investors in relation to its proposed private debt

offering. It is currently envisaged that the Company's current

facilities will be refinanced via a private debt instrument, issued

at a coupon of 14% for a period of 24 months. This instrument would

be secured against the Company's wholly owned Real Estate assets

and its 75% shareholding in Cambridge Sleep Sciences, ("CSS"). The

terms of the debt may also bestow the right upon holders to

participate in an exit option of the Company's CSS shareholding

under preferential terms, or to benefit from a profit share

agreement. Final terms remain subject to negotiation.

Investors and existing Barkby shareholders who wish to

participate in the private debt offering should contact

ir@barkbygroup.com.

Cambridge Sleep Sciences

CSS has made encouraging progress on several new multi-year

licensing, streaming and royalty contracts with blue chip

multi-national customers across TVs, Smart Watches, Pillows,

Mattresses and Hotels. Since the last update on 29 September 2023,

CSS's pipeline has continued to strengthen and it is in the final

stages of negotiation on a number of new agreements. The Company

will continue to update shareholders as appropriate.

The Board continues to evaluate the best corporate setting to

maximise shareholder value from its investment in CSS and has begun

exploring opportunities for a potential trade sale and de-merger.

There can be no certainty that any de-merger or sale of CSS will

ultimately be made or the value of any such possible deal.

- Ends -

Enquiries:

Barkby Group PLC

Charles Dickson, Executive Chairman

c/o Montfort

+44 (0)78 1234

Montfort 5205

Olly Scott +44 (0)75 4284

Georgia Colkin 6844

Cavendish Capital Markets Limited (Nomad and

Broker)

Carl Holmes / Simon Hicks / Fergus Sullivan

(Corporate Finance) +44 (0)20 7220

Tim Redfern (ECM) 0500

Stifel Nicolaus Europe Limited (Financial Adviser

and Joint Corporate Broker)

Mark Young

Jonathan Wilkes-Green +44 (0)20 7710

Catriona Neville 7600

About Barkby

Barkby is a roadside real estate business focused on building

and scaling a high-quality portfolio of modern assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDTLBMTMTABBPJ

(END) Dow Jones Newswires

December 19, 2023 06:15 ET (11:15 GMT)

Barkby (LSE:BARK)

Historical Stock Chart

From Oct 2024 to Nov 2024

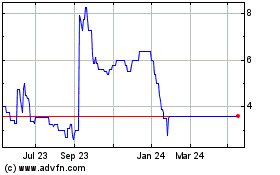

Barkby (LSE:BARK)

Historical Stock Chart

From Nov 2023 to Nov 2024