Barclays' Investment Bank Struggles as Activist Investor Circles--Update

April 25 2019 - 3:28AM

Dow Jones News

By Margot Patrick

LONDON -- Barclays PLC reported weak first-quarter earnings in

its investment bank, days before shareholders are due to vote on a

board appointment for an activist investor who wants to shrink the

unit.

The British lender said net profit in its corporate and

investment bank fell 30% from the first-quarter 2018 to GBP582

million ($752 million) from GBP834 million, because of reduced

client activity, lower volatility and fewer corporate deals. The

bank's overall net profit in the quarter was GBP1.04 billion, up

from a GBP764 million net loss last year from regulatory

settlements.

The results ramp up pressure on Chief Executive Jes Staley to

prove the bank's strategic mix of consumer, business and investment

banking can work. Sherborne Investors is asking shareholders to

vote its founder, Edward Bramson, onto the board at an annual

meeting May 2 to trigger a change in strategy.

"We had a weak quarter in investment banking fees," Mr. Staley

said Thursday but noted that its markets business outperformed U.S.

rivals for a sixth consecutive quarter. Barclays, with large

trading businesses in New York and London, is one of the few

remaining European banks attempting to compete with Wall Street

giants such as JP Morgan Chase & Co. and Bank of America

Corp.

Barclays said it is sticking by a 9% target for return on

tangible equity this year and 10% by 2020. Some analysts downgraded

their expectations in recent weeks that the bank will meet those

targets. Barclays said it could cut costs below the current target

if revenue conditions continue to be challenging this year.

In the first quarter, the ROTE was 9.6%. That figure, and the

full-year ROTE targets, strip out litigation and conduct costs.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

April 25, 2019 03:13 ET (07:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

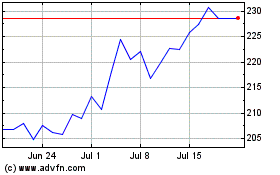

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2024 to May 2024

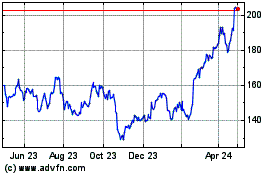

Barclays (LSE:BARC)

Historical Stock Chart

From May 2023 to May 2024