TIDMSWL

RNS Number : 9763F

Swallowfield PLC

27 February 2018

Swallowfield plc

("Swallowfield" or the "Group")

Interim results

Swallowfield plc, a market leader in the development,

formulation, and supply of personal care and beauty products,

including its own portfolio of brands, announces its interim

results for the 28 weeks ended 6 January 2018

GBPm unless otherwise stated 2018 2017

------------------------------- --------- ---------

Reported results (1)

------------------------------- --------- ---------

Revenue GBP40.0m GBP39.7m

------------------------------- --------- ---------

Underlying operating profit GBP3.40m GBP3.07m

(1)

------------------------------- --------- ---------

Adjusted basic earnings per

share (1) 13.7p 11.8p

------------------------------- --------- ---------

Statutory results

------------------------------- --------- ---------

Revenue GBP40.0m GBP39.7m

------------------------------- --------- ---------

Operating profit GBP3.00m GBP2.20m

------------------------------- --------- ---------

Basic earnings per share 13.1p 9.7p

------------------------------- --------- ---------

Total dividend per share 2.0p 1.7p

------------------------------- --------- ---------

Net debt GBP7.0m GBP5.5m

------------------------------- --------- ---------

(1) Underlying operating profit is calculated before exceptional

items, amortisation of acquisition related intangibles and LTIP

charges. Adjusted earnings per share is calculated using adjusted

operating profit, which is underlying operating profit less LTIP

charges.

Financial highlights

-- Group revenues increased to GBP40.0m (2017: GBP39.7m), as

expected and against a strong comparative period, driven by strong

growth (+25%) in owned brands.

-- Owned brands now representing 31% of Group revenues.

-- Manufacturing sales decreased by 6% against strong prior year

comparators as prior year launch volumes normalised as previously

signalled.

-- Contribution margin % improved, primarily due to increased owned brand sales.

-- Underlying operating profit increased by 11% year on year to GBP3.40m (2017: GBP3.07m).

-- Adjusted EPS increased by 16% year on year to 13.7 pence (2017: 11.8 pence).

-- Net Debt of GBP7.0m (2017: GBP5.5m), after final payment of

GBP1.85m deferred consideration on The Brand Architekts ("Brand

Architekts") acquisition.

-- Interim dividend increased by 18% to 2.0 pence (2017: 1.7 pence).

CEO Succession and Acquisition

-- A well-planned CEO succession process has been put in place

following Chris How's decision to step down from the Board to

pursue a non-executive portfolio career later in the year. His

successor, Tim Perman (currently group Brand Director, PZ Cussons

plc), will become Chief Executive on 1 July 2018. Chris will

continue full time until the end of the current financial year

during which he will assist and support the Company and Tim through

the handover process.

-- Acquisition of men's grooming brand 'Fish', a

well-established and successful style-led brand with distribution

in many UK retailers, financed via a new term loan.

Brendan Hynes, Non-executive Chairman, commented: "The first

half year has seen further, positive progress which continues to

make Swallowfield plc a stronger, more profitable business and

provides a solid platform for a well-planned CEO succession. Strong

momentum in our branded business, which will be enhanced by the

acquisition of the Fish brand and the steady underlying performance

in our manufacturing business, means Swallowfield is well

positioned to maintain its positive momentum."

Chris How, Chief Executive, commented: "We are pleased with the

continuing strong performance of the Group. Brand Architekts is

performing positively and combining well with the supply chain

expertise of Swallowfield to deliver, at pace, a stream of consumer

relevant new products to market which has translated into improved

profit margins for the Group. The exciting acquisition of the Fish

brand will further accelerate this positive momentum. The

capability within the manufacturing business to satisfy the

innovation, service and quality requirements of our customer base

has enabled us to secure a number of new contracts in the period.

This positions the manufacturing business to quickly return to

growth following the well signalled normalisation in sales for this

six-month period against strong prior year comparatives."

Operational highlights

-- Strong growth momentum continued in our portfolio of

owned-brands, boosted by strong Christmas gifting performance,

further retail distribution gains in the UK and Western Europe, and

several successful new product launches.

-- Manufacturing business maintained % contribution margins as

cost optimisation programmes and drive category focus offset

materials and labour inflationary pressure.

-- A number of significant new manufacturing contracts have been

secured and work progressed in the period in readiness for launches

in the second half.

-- Increase in working capital driven by stock build to support

new launches and later Christmas deliveries.

-- Further increase in Brand Architekts products produced in Swallowfield sites.

-- Further investment in brand marketing support (particularly

digital), organisational capability and operating efficiencies that

positions the business for sustained future growth.

-- E-commerce sales continued to grow significantly, albeit from a relatively modest base.

For further information please contact:

----------------------------------------------------- --------------

Swallowfield plc

------------------------- -------------------------- --------------

01823 662

Chris How Chief Executive Officer 241

------------------------- -------------------------- --------------

01823 662

Matthew Gazzard Group Finance Director 241

------------------------- -------------------------- --------------

0207 496

Alex Price / Jen Boorer N+1 Singer 3000

------------------------- -------------------------- --------------

Josh Royston / Hilary

Buchanan / Sam Modlin Alma PR 07780 901979

------------------------- -------------------------- --------------

Business review

Group revenue growth in the period was 1% at GBP40.0m (2017:

GBP39.7m). This was driven by 25% growth in our owned brands

business offset by a 6% revenue decline in our manufacturing

business.

Branded sales growth was driven in particular by UK growth of

key brands Dirty Works, Dr.Salts and SuperFacialist and another

very successful Christmas gifting period. Internationally, good

growth in Western Europe was offset by softer sales in North

America. Increased focus on supply chain efficiency and an improved

mix resulting from a clearer brand portfolio prioritisation

strategy, supported an increase in contribution margin.

Sales in our manufacturing business reflect the well signalled

normalisation of volumes on a number of major new product launches

for global brand owners that peaked in the first half of the prior

year. Outside of this normalisation effect we were pleased to see

solid growth across the remainder of the customer base and a good

performance at the contribution margin level being maintained as

continued focus on our drive product categories and a series of

cost optimisation projects were able to offset broader inflationary

pressures on materials.

We are very pleased that during the period a number of

significant new contracts and product launches have been confirmed

and we have either commenced production or received purchase orders

in the weeks since the period end.

The net effect is that the Group made an underlying operating

profit of GBP3.40m, an 11% increase on the comparable period (2017:

GBP3.07m). Adjusted profit before tax increased by 19% to GBP2.84m

(2017: GBP2.38m).

The overall effective rate of Group taxation for the period was

19.0% (2017: 19.6%) of pre-tax profits. The current year tax charge

reflects standard UK and the Czech Republic rates of taxation.

This resulted in adjusted earnings per share of 13.7p (2017:

11.8p). An increase of 16%.

Progress vs strategy

Our business strategy, which is now well established, is to

drive growth by building two complementary value streams,

Manufacturing and Owned Brands, that leverage the common capability

platform of Group resources.

Our owned brands business develops and markets a portfolio of

personal care and beauty brands that are distributed across major

retailers in the UK and internationally. In this business we focus

on three strategic pillars:

-- New product development

-- Leverage Swallowfield resources

-- International expansion

Our manufacturing business formulates and manufactures personal

care and beauty products for a customer base that includes many of

the world's leading beauty brands. Within this business we also

focus on three strategic pillars:

-- Innovation, quality and service to global brand owners

-- Drive category focus

-- Cost base optimisation

The following is a review of progress against these strategic

pillars in the period:

Owned brands

The performance of The Brand Architekts portfolio acquired in

June 2016 continues to be very positive. The momentum is continuing

with all key brands in growth. The sell through of Christmas gift

ranges was particularly strong.

One of the key opportunities presented by the acquisition was

the critical mass it provided through a proven brand management

team. The original Swallowfield owned brands (Real Shaving Company,

Bagsy, MR., Tru) have prospered under this brand and retailer

focused environment and we are pleased to report strong combined

revenue growth of c. 50% across this part of the portfolio

New product development

Fast paced new product development that quickly identifies and

responds to market trends is a core element of the Brand Architekts

business model. 47 new products were launched in the reporting

period across 9 different brands. Particular successes include

SuperFacialist Hyluronic and Retinol ranges, Dirty Works Foaming

Sugar Scrub, which was one of only 3 winners in the Sainsbury's

Beauty Awards, and Quick Fix Facials Black Peel Mask.

Leverage Swallowfield resources

Further products in the Brand Architekts range have been

produced at Swallowfield Group sites in the period. A major

initiative to take further products into in-house manufacture is

already underway and will follow in the second half. On an

annualised basis we expect to be producing in excess of 1.5m units

of the acquired Brand Architekts brands at Swallowfield sites in

the next financial year.

Further investment and improvements in relation to our

e-commerce capability for key brands such as Dirty Works,

SuperFacilaist, Dr.Salts, Kind Natured and Quick Fix, is in place

with a dedicated team based in our new Exeter office driving strong

sales growth and developing engaging digital marketing

activities.

We continue to leverage our materials and packaging sourcing

network (including our China purchasing office), our knowledge of

best practice production processes, and our expertise in product

design and formulation to drive cost improvements. Further, we have

identified significant annual savings in freight and duty on

shipments from China by combining our expertise and our buying

power.

International Expansion

Highlights in the period include the launch of Dirty Works in

France and Belgium and the extension of our Bagsy brand in France.

This growth has been more than offset by some trading challenges in

North America.

Following our participation in major trade shows in 2017 there

are a number of new opportunities being progressed that we expect

will bring new customers and geographies in the months ahead.

Manufacturing

Innovation

Our manufacturing business relies on our ability to bring a

steady stream of innovative new products to our customer base. In

the period, we again increased the number of Swallowfield developed

new products introduced. Our innovation capability has been key in

securing our first orders with a major US global consumer group

who, like others, are extending their search for fast to market New

Product Development by partnering with third parties such as

Swallowfield.

Sales of plastic aerosol products continued to grow in the

period and we are pleased that this technology will be extended to

another brand in the second half of the financial year.

A significant refurbishment of our R&D laboratory in

Wellington has been completed including investment in specialist

equipment which will underpin future innovation activities.

Drive category focus

Personal Care Aerosols, Cosmetic Pencils, and hot pour products

remain our key focus. Further contract wins within the period,

supported by new product launches, will deliver ongoing growth.

Following new business wins last year, capital investment to

increase wood pencil capacity and cost efficiency at our Bideford

site has been fully completed. Further investment to deliver

improvements in capacity and cost competitiveness are scheduled,

with particular focus on Personal Care Aerosols which, although

recording a sales decrease in the period due to a peak period of

launches last year, continue to offer strong growth opportunities

based on our industry leading capabilities and reputation.

Cost base optimisation

Investment in line efficiency and automation programmes continue

to contribute to margin improvement across all sites. Of particular

note has been the introduction of robotics technology at our Tabor

site to manage labour costs and increase reliability. The expertise

of the supply chain has delivered real cost savings in the

Company's logistic requirements which have assisted in offsetting

ongoing material inflationary pressures. The agility within our

Group sites has led to global brand leaders recognising the value

of our established expertise and manufacturing capabilities which

has led to a further strengthening of our established

partnerships.

We have continued to steadily increase the number of Brand

Architekts products produced in-house and expect this to gain

further momentum in the second half.

Net debt and cash flow

Net debt increased from a year-end position of GBP3.6m to

GBP7.0m (2017: GBP5.5m) following the final contingent payment

(GBP1.85m) in relation to the 2016 acquisition of The Brand

Architekts. Working capital increased as material and component

inventory increased in the manufacturing business to support future

launches and ensure optimum customer service. Within the branded

business there was also an increase as finished goods stocks

increased to support continued growth and debtors peaked in line

with the timing of Christmas gifting deliveries.

Financing costs of GBP0.17m (2017: GBP0.16m) comprised interest

expense of GBP0.09m (2017: GBP0.09m) plus a pension scheme notional

finance charge of GBP0.08m (2017: charge GBP0.07m).

Capital expenditure was GBP1.1m which was GBP0.4m above

depreciation. We expect capital expenditure to be higher than

depreciation in this financial year as we have made a number of

investments to improve line efficiencies and support incremental

new customer contracts which will positively impact the second-half

and beyond.

Defined benefit pension scheme

The defined benefit pension scheme underwent its last triennial

valuation as of 5 April 2017. The deficit on a statutory funding

basis was GBP2.6m and the Group is entering into a revised deficit

recovery plan and schedule of contributions. The deficit reduction

payment will continue to be GBP108k per annum for the current year.

Whilst contributions are likely to increase next year, any increase

is expected to be offset in part by the reduction in the PPF

levy.

For accounting purposes at 6 January 2018, the Group recognised

under IAS19 'employee benefits', a deficit of GBP5.7m (June 2017:

GBP6.13m). The Accounting Standards require the discount rate to be

based on yields on high quality (usually AA-rated) corporate bonds

of appropriate currency, taking into account the term of the

relevant pension scheme's liabilities. Corporate bond indices are

used as a proxy to determine the discount rate. At the reporting

date, the yields on bonds of all types were slightly higher than

they were at 24 June 2017. This has resulted in marginally higher

discount rates being adopted for accounting purposes compared to

last year, which has been coupled with a small increase in

expectations of long term inflation, the combined effect leaving

the fair value of the scheme liabilities materially unchanged, with

the strong investment return performance increasing the value of

the schemes assets. This has translated into a decrease in

liability under the IAS19 methodology.

Dividends

The Board is pleased to announce that it has approved an interim

dividend of 2.0 pence per share (2017: 1.7 pence). This dividend

will be paid on 26 May 2018 to shareholders on the register on 4

May 2018.

The Directors' intention is to have a progressive dividend

policy that aligns future dividend payments to the underlying

earnings and cash flow of the business, taking in to account the

gearing and the operational requirements of the business.

Board succession

After five successful years leading Swallowfield, Chris How,

Chief Executive Officer, has informed the Board of his intention to

step down from his role in order to pursue a non-executive

portfolio career subject to the company finding a suitable

successor.

Advanced notice of Chris's intentions enabled the Board,

including Chris, to engage in a thorough search for his successor

and we are pleased to announce that Chris will be succeeded by Tim

Perman.

Tim will be appointed Chief Executive Officer with effect from 1

July 2018. He is currently Group Category & Brand Director and

Divisional Director, Global Beauty at PZ Cussons and has more than

30 years' experience in the consumer products industry. Previously,

he has held senior leadership roles at Seven Seas Healthcare,

Campbells Grocery Products and Bristol Myers Squibb. Tim will join

the business on 2 May 2018 and work for 2 months alongside Chris to

affect a smooth transition.

Chris How will continue full time until the end of the current

financial year on 30 June 2018 and will be available to help and

support the business in the following months.

Brendan Hynes, Non-Executive Chairman commented:

"Chris has been instrumental in the transformation of the

Swallowfield Group into a successful and growing business with

strong complimentary value streams in both owned brands and

contract manufacturing. He has also built a strong team who have

the skills and experience to scale the business further. I would

like to thank him for his outstanding contribution to the

development and growth of our Company during the last five years

and wish him every success as he moves into a new phase in his

career.

I am delighted that Tim Perman will succeed Chris. Tim's deep

understanding of personal care and beauty brands, combined with

first-hand experience of running high quality manufacturing

operations, means that he is well positioned to drive our continued

success, while ensuring a seamless transition."

Chris How, Chief Executive, commented:

"After five happy years with the Swallowfield Group, I have

taken the difficult decision to leave a highly successful business

and move onto the next stage of my career. The business has changed

beyond all recognition over the last five years and it has been a

real pleasure to have worked with a great team and to have played a

part in building the strong, successful business that we are today.

I am sure that Tim will continue to develop the business further

with great success."

Acquisition Update

As separately announced today, the Group has completed the

earnings enhancing acquisition of the men's grooming brand

'Fish'.

'Fish' is a well-established, authentic, contemporary brand with

a 'born in Soho' positioning reflecting a close connection with

London style trends through its link to the original Fish salon in

D'Arblay Street. This heritage underpins a range of high

performance men's hair styling products which were launched more

than 15 years ago and currently retail in Boots, Superdrug, Tesco

and Waitrose and therefore have a good complementary fit to the

rest of our owned brand portfolio.

All related trademarks have been acquired from Fish London

Limited and stock, website domains, and other marketing collateral

has been acquired from KMI Brands Limited.

The consideration for the acquisition involves an upfront cash

consideration of GBP2.7m, with a further GBP0.3m 12 month

performance based earn out, and was financed via a new term loan.

For the year to 31 December 2017, the 'Fish' brand generated net

sales of GBP1.7m and achieved GBP0.4m EBITDA.

The brand will be managed by our team at Brand Architekts in

Teddington who will seek to leverage our growing expertise in male

grooming products where our portfolio of MR., The Real Shaving

Company and Tru is seeing good growth. We see many opportunities to

accelerate the growth of the brand in the UK and beyond both in

terms of adding innovative new products to the brand and also

broadening retail distribution.

As we work to deliver these growth opportunities we are

delighted to confirm that we have engaged the founder of the brand,

Paul Burfoot, to work with us as a consultant. Paul continues to

own and operate the iconic 'Fish' salon in Soho and is renowned for

his innovative creativity as a trend setter in hair styling. His

expertise and passion for style and product will help us drive and

develop credible, ongoing innovation as well as taking an active

role in supporting the digital and social media brand

communication.

The brand's product formulations and packaging formats have a

strong fit with the technical and production expertise in our

manufacturing business and therefore offer further value creation

opportunities on the supply side.

Chris How, Chief Executive Officer, commented:

"Following the acquisitions of Real Shaving Company in 2015 and

The Brand Architekts in 2016 we have been delighted to have seen

strong growth momentum in our owned brand portfolio. This segment

of our business showed sales growth of 25% in the first half of our

current financial year and in that same period contributed 31% of

Group sales. The addition of 'Fish' to this vibrant portfolio will

add further strength and growth potential."

Outlook

The Board is pleased to report that trading since the end of the

reporting period has been in line with expectations.

We expect the positive momentum seen in our owned brands

business to continue, albeit without the boost from Christmas

gifting experienced in the first half. Further new product launches

and retail distribution gains have been secured in the UK and

internationally which will contribute to growth in the second half

and into the next financial year. The earnings enhancing

acquisition of the 'Fish' brand will add further to this

momentum,

In our manufacturing business, the second half will see the

start-up of production on a number of significant new contract wins

which will contribute positively to the second half of this year

and next.

We are seeing upward pressure on material and operational costs

but have put in place a range of projects to mitigate. This

combined with strong trading momentum, leaves us well placed to

achieve planned profits for the full year.

Group Statement of Comprehensive Income

28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

Continuing operations Notes GBP'000 GBP'000 GBP'000

Revenue 2 39,962 39,708 74,314

Cost of sales (32,012) (32,264) (60,404)

------------------------------- ------ ------------ ------------ ----------

Gross profit 7,950 7,444 13,910

Commercial and administrative

costs (4,953) (4,905) (10,235)

------------------------------- ------ ------------ ------------ ----------

Operating profit

before exceptional

items 2,997 2,539 3,675

Exceptional items 3 (25) (343) (343)

------------------------------- ------ ------------ ------------ ----------

Operating profit 2,972 2,196 3,332

Finance income - 1 97

Finance costs 4 (175) (163) (314)

Profit before taxation 2,797 2,034 3,115

Taxation (532) (398) (543)

------------------------------- ------ ------------ ------------ ----------

Profit after taxation 2,265 1,636 2,572

Other comprehensive

income / (loss) for

the period:

Re-measurement of

defined benefit liability 407 (3,469) (1,697)

Items that will be

reclassified subsequently

to profit or loss

Exchange differences

on translating foreign

operations 54 79 148

Gain on available

for sale financial

assets 158 256 675

Other comprehensive

income / (loss) for

the period 619 (3,134) (874)

------------------------------- ------ ------------ ------------ ----------

Total comprehensive

income / (loss) for

the period 2,884 (1,498) 1,698

=============================== ====== ============ ============ ==========

Profit attributable

to:

------------------------------- ------ ------------ ------------ ----------

Equity shareholders 2,205 1,636 2,554

------------------------------- ------ ------------ ------------ ----------

Non-controlling interests 60 - 18

Total comprehensive

income / (loss) attributable

to:

------------------------------- ------ ------------ ------------ ----------

Equity shareholders 2,824 (1,498) 1,680

------------------------------- ------ ------------ ------------ ----------

Non-controlling interests 60 - 18

Earnings per share

- basic 5 13.1p 9.7p 15.2p

- diluted 5 12.7p 9.5p 14.7p

Dividend

Paid in period (GBP'000) 590 388 675

Paid in period (pence

per share) 3.5p 2.3p 4.0p

Proposed (GBP'000) 337 287 590

Proposed (pence per

share) 6 2.0p 1.7p 3.5p

Group Statement of Changes in Equity

Share Share Revaluation Exchange Pension Retained Non-controlling Total

Capital Premium of Reserve re-measurement Earnings interest Equity

investment reserve

reserve

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as

at June 2017 844 11,744 1,091 (142) (3,894) 12,404 18 22,065

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Dividends - - - - - (590) - (590)

Non-controlling

interest - - - - - - 60 60

Share based

payments - - - - - 47 - 47

Transactions

with owners - - - - - (543) 60 (483)

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Profit for

the period - - - - - 2,205 - 2,205

Other

comprehensive

income:

Re-measurement

of defined

benefit

liability - - - - 407 - - 407

Exchange

difference

on translating

foreign

operations - - - 54 - - - 54

Gain on

available

for sale

financial

assets - - 158 - - - - 158

Total

comprehensive

income for

the year - - 158 54 407 2,205 - 2,824

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as

at 6 January

2018 844 11,744 1,249 (88) (3,487) 14,066 78 24,406

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as

at June 2016 566 3,830 416 (290) (2,197) 10,467 - 12,792

--------------------- ------ --------- ------ -------- ---------- --------- ---- ---------

Dividends - - - - - (388) - (388)

Issue of new

shares 278 7,914 - 8,192

Share based

payments - - - - - 28 - 28

Transactions

with owners 278 7,914 - - - (360) - 7,832

--------------------- ------ --------- ------ -------- ---------- --------- ---- ---------

Profit for

the period - - - - - 1,636 - 1,636

Other comprehensive

income:

Re-measurement

of defined

benefit liability - - - - (3,469) - - (3,469)

Exchange difference

on translating

foreign operations - - - 79 - - - 79

Gain on available

for sale financial

assets - - 256 - - - - 256

Total comprehensive

income for

the year - - 256 79 (3,469) 1,636 - (1,498)

--------------------- ------ --------- ------ -------- ---------- --------- ---- ---------

Balance as

at 7 January

2017 844 11,744 672 (211) (5,666) 11,743 - 19,126

--------------------- ------ --------- ------ -------- ---------- --------- ---- ---------

Balance as at

June 2016 566 3,830 416 (290) (2,197) 10,467 - 12,792

--------------------- ---- ------- ------ ------ -------- ------- --- --------

Dividends - - - - - (675) - (675)

Issue of new

shares 278 7,914 - - - - - 8,192

Non-controlling

interest - - - - - - 18 18

Share based

payments - - - - - 58 - 58

Transactions

with owners 278 7,914 - - - (617) 18 7,593

--------------------- ---- ------- ------ ------ -------- ------- --- --------

Profit for the

year - - - - - 2,554 - 2,554

Other comprehensive

income:

Re-measurement

of defined benefit

liability - - - - (1,697) - - (1,697)

Exchange difference

on translating

foreign operations - - - 148 - - - 148

Gain on available

for sale financial

assets - - 675 - - - - 675

Total comprehensive

income for the

year - - 675 148 (1,697) 2,554 - 1,680

--------------------- ---- ------- ------ ------ -------- ------- --- --------

Balance as at

June 2017 844 11,744 1,091 (142) (3,894) 12,404 18 22,065

--------------------- ---- ------- ------ ------ -------- ------- --- --------

Group Statement of Financial Position

As at As at As at

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant

and equipment 11,491 10,754 11,076

Intangible assets 9,042 9,231 9,145

Deferred tax assets 666 1,472 1,088

Investments 1,442 816 1,235

--------------------------- ------ ------------ ------------ ----------

Total non-current

assets 22,641 22,273 22,544

--------------------------- ------ ------------ ------------ ----------

Current assets

Inventories 13,537 12,096 11,430

Trade and other

receivables 17,325 15,892 16,345

Cash and cash equivalents 425 825 4,057

Current tax receivable 70 166 88

--------------------------- ------ ------------ ------------ ----------

Total current assets 31,357 28,979 31,920

--------------------------- ------ ------------ ------------ ----------

Total assets 53,998 51,252 54,464

--------------------------- ------ ------------ ------------ ----------

LIABILITIES

Current liabilities

Trade and other

payables 21,521 18,728 21,674

Deferred consideration - 1,850 1,850

Interest-bearing

loans and borrowings 541 529 534

Current tax payable 552 426 243

--------------------------- ------ ------------ ------------ ----------

Total current liabilities 22,614 21,533 24,301

--------------------------- ------ ------------ ------------ ----------

Non-current liabilities

Interest-bearing

loans and borrowings 1,242 1,783 1,559

Post-retirement

benefit obligations 8 5,665 8,745 6,132

Deferred tax liabilities 71 65 407

Total non-current

liabilities 6,978 10,593 8,098

--------------------------- ------ ------------ ------------ ----------

Total liabilities 29,592 32,126 32,399

--------------------------- ------ ------------ ------------ ----------

Net assets 24,406 19,126 22,065

--------------------------- ------ ------------ ------------ ----------

EQUITY

Share capital 844 844 844

Share premium 11,744 11,744 11,744

Revaluation of investment

reserve 1,249 672 1,091

Exchange reserve (88) (211) (142)

Re-measurement of

defined benefit

liability (3,487) (5,666) (3,894)

Retained earnings 14,066 11,743 12,404

--------------------------- ------ ------------ ------------ ----------

Total equity 24,328 19,126 22,047

--------------------------- ------ ------------ ------------ ----------

Non-controlling

interest 78 - 18

--------------------------- ------ ------------ ------------ ----------

Total equity 24,406 19,126 22,065

--------------------------- ------ ------------ ------------ ----------

Group Cash Flow Statement

28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Profit before taxation 2,797 2,034 3,115

Depreciation 651 661 1,249

Amortisation 122 123 239

Finance income - (1) (97)

Finance cost 175 163 314

(Increase) in inventories (2,107) (637) (2,387)

(Increase) / decrease

in trade and other receivables (540) 1,974 (995)

(Decrease) / increase

in trade and other payables (310) (2,818) 2,074

(Decrease) / increase

in share-based payments

provision (48) 246 1,755

Contributions to defined

benefit plan (54) (54) (108)

Cash generated from

operations 686 1,691 5,159

---------------------------------- ------------ ------------ ----------

Finance expense paid (97) (89) (165)

Taxation (paid) (321) (724) (1,142)

---------------------------------- ------------ ------------ ----------

Net cash flow from operating

activities 268 878 3,852

---------------------------------- ------------ ------------ ----------

Cash flow from investing

activities

Dividend income received - 1 97

Purchase of property,

plant and equipment (1,067) (432) (1,367)

Purchase of intangibles (18) - (8)

Purchase of subsidiary (1,925) (9,378) (9,401)

Net cash flow from investing

activities (3,010) (9,809) (10,679)

---------------------------------- ------------ ------------ ----------

Cash flow from financing

activities

Proceeds / (repayment)

of invoice discounting

facility 10 (575) 1,059

Proceeds from new loan - 2,000 2,000

Issue of new share capital - 8,192 8,192

Repayment of loans (310) (271) (490)

Dividends paid (590) (388) (675)

---------------------------------- ------------ ------------ ----------

Net cash flow from financing

activities (890) 8,958 10,086

---------------------------------- ------------ ------------ ----------

Net (decrease) / increase

in cash and cash equivalents (3,632) 27 3,259

Cash and cash equivalents

at beginning of period 4,057 798 798

---------------------------------- ------------ ------------ ----------

Cash and cash equivalents

at end of period 425 825 4,057

---------------------------------- ------------ ------------ ----------

Notes to the Accounts

Note 1 Basis of preparation

The Group has prepared its interim results for the 28-week

period ended 6 January 2018 in accordance with the recognition and

measurement principles of International Financial Reporting

Standards (IFRS) as adopted by the European Union and also in

accordance with the recognition and measurement principles of IFRS

issued by the International Accounting Standards Board.

The Directors have considered trading and cash flow forecasts

prepared for the Group, and based on these, and the confirmed

banking facilities, are satisfied that the Group will continue to

be able to meet its liabilities as they fall due for at least one

year from the date of approval of the Interim Report. On this

basis, they consider it appropriate to adopt the going concern

basis in the preparation of these accounts.

As permitted, this interim report has been prepared in

accordance with the AIM rules and not in accordance with IAS34

'Interim Financial Reporting'.

These interim financial statements do not constitute full

statutory accounts within the meaning of section 434 of the

Companies Act 2006 and are unaudited. The unaudited interim

financial statements were approved by the Board of Directors on 21

February 2018.

The consolidated financial statements are prepared under the

historical cost convention as modified to include the revaluation

of certain non-current assets. The accounting policies used in the

interim financial statements are consistent with IFRS and those

which will be adopted in the preparation of the Group's Annual

Report and Financial Statements for the year ended June 2018.

The statutory accounts for the year ended June 2017, which were

prepared under IFRS, have been filed with the Registrar of

Companies. These statutory accounts carried an unqualified Auditors

Report and did not contain a statement under Section 498(2) or

498(3) of the Companies Act 2006.

Note 2 Segmental analysis

The Group is a market leader in the development, formulation,

and supply of personal care and beauty products.

The reportable segments of the Group are aggregated as

follows:

-- Brands - we leverage our skilled resources to develop and

market a growing portfolio of Swallowfield owned and managed

brands. These include organically developed Bagsy, MR. and Tru,

plus the acquisitions of The Real Shaving Company (in 2015) and the

portfolio of brands included in The Brand Architekts acquisition

(in 2016).

-- Manufacturing - the development, formulation and production

of quality products for many of the world's leading personal care

and beauty brands.

-- Eliminations and Central Costs - other Group-wide activities

and expenses, including defined benefit pension costs (closed

defined benefit scheme), LTIP expenses, amortisation of

acquisition-related intangibles, interest, taxation and

eliminations of intersegment items, are presented within

'Eliminations and central costs'.

This is the basis on which the Group presents its operating

results to the Board of Directors, which is considered to be the

CODM for the purposes of IFRS 8.

a) Principal measures of profit and loss - Income Statement segmental information:

28 weeks ended 6 January 2018 28 weeks ended 7 January

2017

Brands Manufacturing Eliminations Total Brands Manufacturing Eliminations Total

and Central and Central

Costs Costs

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

UK revenue 10,111 17,734 - 27,845 7,543 17,283 - 24,826

International

revenue 2,186 9,931 - 12,117 2,289 12,593 - 14,882

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Revenue

- External 12,297 27,665 - 39,962 9,832 29,876 - 39,708

Revenue

- Internal - 1,037 (1,037) - - 605 (605) -

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Total revenue 12,297 28,702 (1,037) 39,962 9,832 30,481 (605) 39,708

--------------------- -------- ------------- -------- -------------

Underlying

operating

profit/(loss) 2,575 1,918 (1,089) 3,404 1,845 2,104 (882) 3,067

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Charge for

share based

payments - - (307) (307) - - (434) (434)

Amortisation

of

acquisition-related

intangibles - - (100) (100) - - (94) (94)

Exceptional

costs - - (25) (25) - - (343) (343)

Net borrowing

costs - - (175) (175) - - (162) (162)

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Profit/(loss)

before taxation 2,575 1,918 (1,696) 2,797 1,845 2,104 (1,915) 2,034

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Tax charge - - (532) (532) - - (398) (398)

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Profit/(loss)

for the

period 2,575 1,918 (2,228) 2,265 1,845 2,104 (2,313) 1,636

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

The segmental Income Statement disclosures are measured in

accordance with the Group's accounting policies as set out in note

1.

Inter segment revenue earned by Manufacturing from sales to

Brands is determined on normal commercial trading terms as if

Brands were any other third party customer.

All defined benefit pension costs and LTIP expenses are

recognised for internal reporting to the CODM as part of Group-wide

activities and are included within 'Eliminations and central costs'

above. Other costs, such as Group insurance and auditors'

remuneration which are incurred on a Group-wide basis are recharged

by the head office to segments on a reasonable and consistent basis

for all periods presented and are included within segment results

above.

b) Other Income Statement segmental information

The following additional items are included in the measures of

profit and loss reported to the CODM and are included within (a)

above:

28 weeks ended 6 January Brands Manufacturing Eliminations Total

2018 and Central

Costs

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- --------------------- -------------------- ---------------

Depreciation 6 645 - 651

Amortisation - 22 - 22

c) Principal measures of assets and liabilities

The Groups assets and liabilities are managed centrally by the

CODM and consequently there is no reconciliation between the

Group's assets per the statement of financial position and the

segment assets.

d) Additional entity-wide disclosures

The distribution of the Group's external revenue by destination

is shown below:

Geographical segments 28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------ ------------ ----------

UK 27,845 24,826 44,732

Other European Union

countries 9,156 11,619 23,012

Rest of the World 2,961 3,263 6,570

------------ ------------ ----------

39,962 39,708 74,314

------------ ------------ ----------

In the 28 weeks ended 6 January 2018, the Group had two

customers that exceeded 10% of total revenues, being 12.7% and

10.4% respectively. In the 28 weeks ended 7 January 2017, the Group

had two customers that exceeded 10% of total revenues, being 11.8%

and 11.2% respectively.

Note 3 Exceptional items

There was an exceptional item for the period ended 6 January

2018 of GBP25k. This is in relation to the applicable proportion of

the first consolidated period of trading for Sterling Shave Club

Limited which amounted to a loss of GBP25k.

The prior year exceptional items charge represents the costs

associated with The Brand Architekts acquisition which completed on

27 June 2016.

Note 4 Finance costs 28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------ ------------ ----------

Finance costs

Bank loans and overdrafts 97 89 165

Notional pension scheme

costs 78 74 149

------------ ------------ ----------

175 163 314

------------ ------------ ----------

Note 5 Earnings per share 28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

------------ ------------ -----------

Basic and diluted

Profit for the period

(GBP'000) 2,205 1,636 2,554

Basic weighted average

number of

ordinary shares in issue

during the period 16,865,401 16,865,401 16,834,773

Diluted number of shares 17,413,330 17,182,330 17,382,702

Basic earnings per share 13.1p 9.7p 15.2p

---------------------------- ------------ ------------ -----------

Diluted earnings per

share 12.7p 9.5p 14.7p

---------------------------- ------------ ------------ -----------

Basic earnings per share has been calculated by dividing the

profit for each financial period by the weighted average number of

ordinary shares in issue in the period. There is a difference at 7

January 2017 between the basic net earnings per share and the

diluted net earnings per share due to the LTIP share options

awarded in July 2016, to give a total of 316,929 share options. The

difference at 6 January 2018 includes the LTIP share options

awarded in June 2017, to give a total of 547,929 share options that

could be issued.

Adjusted earnings per share

Profit for the period

(GBP'000) 2,205 1,636 2,554

Add back: Exceptional

items 25 343 343

Add back: Amortisation

of Acquisition Related

Intangibles 100 94 187

Notional tax charge on

above items (24) (83) (105)

--------------------------- ------------------------- ------------------------- -----------

Adjusted profit before

exceptional items 2,306 1,990 2,979

--------------------------- ------------------------- ------------------------- -----------

Basic weighted average

number of

ordinary shares in issue

during the period 16,865,401 16,865,401 16,834,773

Diluted number of shares 17,413,330 17,182,330 17,382,702

--------------------------- ------------------------- ------------------------- -----------

Adjusted basic earnings

per share 13.7p 11.8p 17.7p

--------------------------- ------------------------- ------------------------- -----------

Adjusted diluted earnings

per share 13.2p 11.6p 17.1p

--------------------------- ------------------------- ------------------------- -----------

Adjusted earnings per share has been calculated by dividing the

adjusted profit (after allowing for the notional tax charge on

exceptional items) by the weighted average number of shares in

issue in the period. There is a difference at 7 January 2017

between the basic net earnings per share and the diluted net

earnings per share due to the LTIP share options awarded in July

2016, to give a total of 316,929 share options. The difference at 6

January 2018 includes the LTIP share options awarded in June 2017,

to give a total of 547,929 share options that could be issued.

Note 6 Dividends

The Directors have declared an interim dividend payment of 2.0p

per share (2017: Interim: 1.7p; Final: 3.5p).

Note 7 Reconciliation of cash and cash equivalents to movement

in net debt

28 weeks 28 weeks 12 months

ended ended ended

6 Jan 2018 7 Jan 2017 24 June

2017

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

------------ ------------ ----------

(Decrease) / increase

in cash and cash equivalents

in the period (3,632) 27 3,259

Net cash outflow / (inflow)

from decrease / (increase)

in borrowings 300 (1,154) (2,569)

------------------------------- ------------ ------------ ----------

Change in net debt resulting

from cash flows (3,332) (1,127) 690

Net debt at the beginning

of the period (3,641) (4,331) (4,331)

------------------------------- ------------ ------------ ----------

Net debt at the end of

the period (6,973) (5,458) (3,641)

------------------------------- ------------ ------------ ----------

Note 8 IAS 19 'Employee Benefits'

Expected future cash flows to and from the Scheme:

The Scheme is subject to the scheme funding requirements

outlined in UK legislation. The last scheme funding valuation of

the Scheme was as at 5 April 2017 and revealed a funding deficit of

GBP2.6m. The liabilities of the Scheme are based on the current

value of expected benefit payment cash flows to members of the

Scheme over the next 60 to 80 years. The average duration of the

liabilities is approximately 20 years.

In accordance with the schedule of contributions dated 3 July

2015 the Company is expected to pay contributions to the Scheme to

make good any shortfalls in funding and has agreed to pay GBP108k

per annum for the current year. Contributions will subsequently

increase from FY19 to a sufficient level to eliminate the deficit

over the established 10 year recovery period. The magnitude of such

payments will be reviewed following the next scheme funding

valuation as at April 2020.

In addition, the Company has agreed to meet the cost of

administrative expenses and Pension Protection Fund insurance

premiums for the Scheme.

Payments made by the Company to the Scheme and in respect of

Scheme liabilities were:

28 weeks 28 weeks 12 months

ended ended ended

6 January 7 January 24 June 2017

2018 2017 GBP000's

GBP000's GBP000's

----------- ----------- --------------

Company pension - - -

contributions

Deficit recovery

payments 54 54 108

Scheme administrative

expenses 51 71 144

Pension Protection

Fund premium 222 240 240

----------------------- ----------- ----------- --------------

Total 327 365 492

----------------------- ----------- ----------- --------------

The amounts expensed in the Group Statement of Comprehensive

Income were:

28 weeks 28 weeks 12 months

ended ended ended

6 January 7 January 24 June 2017

2018 2017 GBP000's

GBP000's GBP000's

----------- ----------- --------------

In Operating profit:

Company pension - - -

contributions

Scheme administrative

expenses 88 71 154

Pension Protection

Fund premium 119 120 240

----------- ----------- --------------

207 191 394

In Finance costs:

Unwinding of notional

discount factor 78 74 149

----------------------- ----------- ----------- --------------

Total 285 265 543

----------------------- ----------- ----------- --------------

IAS 19 requires a separate valuation of the Scheme on a

different basis to the funding valuation referred to above.

The effects of the application of IAS19 on the statement of

financial position at 6 January 2018 are:

6 January

2018

GBP000's

----------

Reduction in net pension and

other benefit obligations 467

Increase in deferred tax (79)

Increase in equity 388

-------------------------------- ----------

The Accounting Standards require the discount rate to be based

on yields on high quality (usually AA-rated) corporate bonds of

appropriate currency, taking into account the term of the relevant

pension scheme's liabilities. Corporate bond indices are often used

as a proxy to determine the discount rate. At the reporting date,

the yields on bonds of all types were lower than they were at June

2017. This has resulted in lower discount rates being adopted for

accounting purposes compared to last year, this was coupled by an

increase in expectations of long term inflation, the combination of

these two factors has translated into a marginally increased

liability. The growth in the Fair Value of scheme assets has offset

this to result in a reduction in net liability.

The key assumptions used were:

As at 6 January As at 7 January As at 24 June

2018 2017 2017

---------------- ---------------- --------------

Discount Rate 2.60% 2.80% 2.55%

Rate of inflation

(RPI) 3.10% 3.45% 3.00%

Rate of inflation

(CPI) 2.10% 2.45% 2.00%

The amounts recognised in the Group statement of financial

position were:

As at 6 January As at 7 January As at 24 June

2018 2017 2017

GBP000's GBP000's GBP000's

---------------- ---------------- --------------

Present value of

funded obligations (29,471) (30,891) (29,438)

Fair value of scheme

assets 23,806 22,146 23,306

---------------------- ---------------- ---------------- --------------

(Deficit) (5,665) (8,745) (6,132)

---------------------- ---------------- ---------------- --------------

Note 9 Announcement of results

The Interim Report will be sent to shareholders and is available

to members of the public at the Company's Registered Office at

Swallowfield House, Station Road, Wellington, Somerset, TA21 8NL

and on the Company's website.

Regulatory disclosures

In accordance with Schedule 2(g) of the AIM Rules, Timothy James

Perman (aged 55) holds or has held in the past 5 years the

following directorships and partnerships:

Current Past

------------------------------- ---------------------------

PZ Cussons Beauty LLP Beauty Source Spray Booths

Ltd

------------------------------- ---------------------------

St Tropez Acquisition Co St Tropez Associates Ltd

Limited

------------------------------- ---------------------------

St Tropez Holdings Limited

------------------------------- ---------------------------

Thermocool Engineering Company

Limited

------------------------------- ---------------------------

Beauty Source Limited

------------------------------- ---------------------------

Save for the disclosures above, there are no further disclosures

to be made in accordance with Rule 17 and Schedule 2(g) of the AIM

Rules.

Independent review report to Swallowfield plc

Introduction

We have been engaged by the company to review the financial

information in the half-yearly financial report for the

twenty-eight weeks ended 6 January 2018 which comprises the Group

statement of comprehensive income, the Group statement of changes

in equity, the Group statement of financial position, the Group

cash flow statement and the related explanatory notes. We have read

the other information contained in the half yearly financial report

which comprises the Chief Executive's Statement and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

This report is made solely to the Group in accordance with

guidance contained in ISRE (UK and Ireland) 2410, 'Review of

Interim Financial Information performed by the Independent Auditor

of the Entity'. Our review work has been undertaken so that we

might state to the Group those matters we are required to state to

it in a review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Group for our review work, for this

report, or for the conclusion we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The AIM rules of the London

Stock Exchange require that the accounting policies and

presentation applied to the financial information in the

half-yearly financial report are consistent with those which will

be adopted in the annual accounts having regard to the accounting

standards applicable for such accounts.

As disclosed in Note 1, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The financial information in the half-yearly

financial report has been prepared in accordance with the basis of

preparation in Note 1.

Our responsibility

Our responsibility is to express to the Group a conclusion on

the financial information in the half-yearly financial report based

on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the financial information in the

half-yearly financial report for the twenty-eight weeks ended 6

January 2018 is not prepared, in all material respects, in

accordance with the basis of accounting described in Note 1.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Bristol

27 February 2018

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FKADDOBKDNBB

(END) Dow Jones Newswires

February 27, 2018 02:00 ET (07:00 GMT)

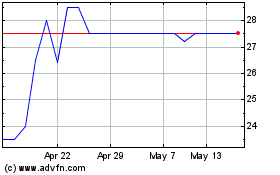

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Nov 2023 to Nov 2024