Swallowfield PLC Trading Update (2582K)

July 06 2017 - 2:00AM

UK Regulatory

TIDMSWL

RNS Number : 2582K

Swallowfield PLC

06 July 2017

6 July 2017

Swallowfield plc

("Swallowfield" or the "Group")

Trading update and notice of results

Swallowfield plc, a market leader in the development,

formulation, and supply of personal care and beauty products,

including its own portfolio of brands, is pleased to provide a

trading update for the 52 weeks ended on 24 June 2017.

Trading update

The Board is pleased to confirm that the business has continued

to trade strongly. Overall revenues for the full year are expected

to show growth of 36% (30% on a constant currency basis) to

approximately GBP74.1m (2016: GBP54.5m). Revenues excluding

acquisitions are expected to show a growth of 7% (2% on a constant

currency basis).

Revenue growth has been bolstered by the continuing strong

performance of owned brands, in particular, the Brand Architekts'

portfolio acquired in June 2016. In the Group's manufacturing

business, revenues continued to perform solidly on the back of a

stream of innovative new product launches.

As a result, underlying business performance* is expected to be

significantly ahead of the previous year and in line with market

forecasts.

The Group's balance sheet has further strengthened during the

period with strong cash generation and working capital controls

leading to a net debt position of GBP3.7m as at 24 June 2017 (2016:

GBP4.3m). This figure includes a term loan of GBP2.0m used as part

of the financing for the acquisition of The Brand Architekts.

Chris How, Chief Executive of Swallowfield, commented:

"Whilst the retail and consumer markets remain challenging, it

has been a year of tremendous progress for the Group with the

successful execution of our stated strategy driving us to record

levels of sales and underlying profitability. The acquisition of

The Brand Architekts has delivered fully against our expectations

and has been integrated smoothly and effectively into the Group.

The manufacturing business continues to perform solidly in its own

right and provide crucial support to the growth of our owned

brands."

Notice of results

The Company expects to announce its results for the 52-week

period ended 24 June 2017 on 19 September 2017.

* Underlying business performance is adjusted for the impact of

provisions made in relation to long term share based incentives

(anticipated to be approximately GBP1.7m) and amortisation of

acquisition-related intangibles. The majority of the charge on

share based incentives relates to awards made in 2014 and become

exercisable towards the end of 2017. These share options were put

in place in order to incentivise the Group's wider management team

(including the executive directors of Swallowfield) and to ensure

that their interests are aligned with shareholders. At the time,

this incentive plan was introduced the average share price was 95p

and since that time shareholders have been rewarded with a capital

improvement of over 300% in addition to progressive dividend

income.

For further information please contact:

Swallowfield plc

01823 662

Chris How Chief Executive Officer 241

01823 662

Mark Warren Group Finance Director 241

020 7496

Alex Price N+1 Singer 3000

Josh Royston / 020 8004

Hilary Buchanan Alma PR 4218

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTRAMMTMBMMTBR

(END) Dow Jones Newswires

July 06, 2017 02:00 ET (06:00 GMT)

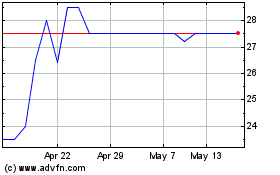

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Nov 2023 to Nov 2024