Embargoed: 0700hrs, 21 February 2007

Avingtrans Plc

("Avingtrans," the "Group or the "Company")

Interim Results for the Six Months Ended 30 November 2006

Highlights Six months to 30 Six months to 30 Change

November 2006 November 2005

Turnover �17,159,000 �15,701,000 +9.3%

Operating Profit �1,505,000 �1,349,000 +11.7%

Profit after tax �901,000 �804,000 +12.1%

Earnings per share before 7.6p 6.9p +10%

goodwill

Dividend 0.5p 0.5p -

* Avingtrans has again recorded its highest level of first half order intake,

turnover, profitability, net assets and earnings per share since joining

AIM in June 2002

* Acquisitions during the period of 75% of Sigma from Group's cash reserves

and 100% of B&D have added significant weight to the Company's Aerospace

Division, which now includes an operational component manufacturing

facility in China

* C&H Precision Finishers enjoyed record order intake and sales

* Jena Companies' order book stands at its highest level to date

* Metalcraft receive UK sign off for Vista Telescope Coating Plant project

Chairman, Ken Baker, commented,

"The most significant development during the first half was the full

establishment of a strong aerospace component manufacturing and servicing

division. This has been achieved not only through the acquisitions of Sigma and

B&D, and the Chinese facility subsequently coming on-stream, but through the

continuous organic growth of C&H and the synergies and cross-selling

opportunities that arise from the coming together of these businesses."

For further information please contact,

Avingtrans Plc

Ken Baker, Chairman

Stephen King, Finance Director

Tel. 01159 499 020

Hansard Group

Ben Simons

Tel. 020 7245 1100

KBC Peel Hunt Ltd

Julian Blunt

David Anderson

Tel 020 7418 8900

Chairman's Statement

I am pleased to announce the results of Avingtrans Plc for the six months

ending 30 November 2006.

Demand for the Group's products was generally strong throughout the period with

order intake, sales, profitability, net assets and earnings per share higher

than in the corresponding period last year. The order book also increased

during the period to its highest level since joining AIM in June 2002. Sales of

some low margin medical equipment were replaced by higher margin work in the

same field with sales from acquisitions making up the difference and increasing

total output by some 9.3%.

Two acquisitions were completed in the period. A 75% holding in Sigma Precision

Components Limited on 19 June 2006 and 100% of B&D Patterns Limited on 21

September 2006. The process of integrating the two within the Group's Aerospace

Division is well underway and together with C&H they form a strong basic

aerospace components manufacturing and servicing division within Avingtrans.

Sigma's plan was to build and develop a new 30,000 sq. ft manufacturing

facility in Chengdu, China for the supply of precision components to the

adolescent Chinese aerospace industry and to cover existing and increasing

demand from the EU and USA. This facility was built and became operational in

December 2006 and has now produced and sold its first components. It is

anticipated that full aerospace accreditation will be gained in March 2007.

B&D is a manufacturer and supplier of critical jet engine components. It

specialises in precision engineered gas and fuel carrying rigid pipe

assemblies, which require manufacturing to the highest quality levels using

computer numerically controlled machining as well as non-destructive testing

and X-Ray procedures. It has prestigious customers such as Rolls Royce, Messier

Dowty and Dunlop Aerospace.

Financial performance

Turnover for the six months ended 30 November 2006 was �17,159,000 (2005: �

15,701,000) an increase of 9.3%. Earnings before interest, tax depreciation and

goodwill amortisation (EBITDA) were �2,398,000 (2005: �1,974,000 as restated)

an increase of 21.5%.

Operating Profit for the period was �1,505,000 (2005: �1,349,000 as restated)

an increase of 11.7%. Profit after tax for the period increased by 12.1% to �

901,000 (2005: �804,000 as restated).

The Company had a positive cash flow from operations during the period of �

671,000 (2005: �987,000). During the period, the Company made bank debt

repayments of �342,000. Primarily as a result of the two acquisitions in the

period the net debt at 30 November 2006 rose to �11,185,000 (2005: �4,584,000),

with gearing 71% (2005: 42%). Management expects gearing to reduce by the year

end.

The comparative figures for the 6 months ended 30 November 2005 and for the

year ended 31 May 2006 have been adjusted in respect of the adoption of FRS 20

'Share based payments' to the extent of �9,000 and �25,000 respectively.

During the period the Group incurred �535,000 on capital projects in particular

in the manufacturing facility in China.

Earnings per share

Earnings per share, for the period ended 30 November 2006, before goodwill

amortisation was 7.6p (2005: 6.9p as restated) a 10% increase. Basic earnings

per share was 5.6p (2005: 5.6p as restated) and fully diluted earnings per

share was 5.5p (2005: 5.3p as restated).

Dividend

The Board has decided to pay a dividend of 0.5p for the half year to be paid on

14 May 2007 to shareholders on the register at 13 April 2007.

Acquisitions and investments

The acquisition of 75% of Sigma for a consideration of �0.3 million was

completed on 19 June 2006. The funding for the acquisition and the subsequent

investment in the manufacturing facility in Chengdu, Sichuan Province, China

was satisfied from the Group's cash reserves.

Deferred consideration of up to �6.0m for the remaining 25% interest is payable

in October 2011 dependant on Sigma's earnings before interest, tax,

depreciation and amortisation for the year ended 31 May 2011 and the level of

net debt at that date. As at 30 November 2006 creditors due after more than one

year includes �3.9m for the Directors estimation of this deferred

consideration.

On 21 September 2006 the Group completed the acquisition of B&D Patterns

Limited for consideration of up to �10.5 million, of which an initial �6.6m was

paid in cash and �0.4m satisfied by the issue of shares to the vendors. The

funding of the �6.6m was through the placing of 1,426,000 shares with an

institutional investor raising �1.8 million at �1.25 per share, with the

remainder funded through debt. The deferred consideration is subject to an

earn-out calculated by reference to B&D's profit before tax for the years ended

31 May 2007 and 31 May 2008.

Six months review

Stainless Metalcraft, the Group's largest operating subsidiary, continued to

broaden its customer base and tendered for and secured several new projects

during the period. The continued weakening of the US dollar slowed growth in

its traditional MRI scanner markets although new opportunities continue to be

developed.

The UK sign off for the VISTA Telescope Coating Plant was received prior to

shipping to the ESO facility at Paranal in Chile, with on-site completion due

in the second half of this financial year. On this project Metalcraft was

responsible for the design, manufacture, factory assembly, testing, and

installation together with subsequent commissioning & training on site.

Activity at Crown UK was higher than in the corresponding period last year.

Although the railway work continued to be delayed, three sections of the West

Coast line were tendered for. During the period further overseas roadside speed

camera markets were developed. Several new Crown designs for the next

generation of digital speed cameras were introduced and adopted by the camera

manufacturers.

Product development continued with the Vehicle Occupancy Limited prototype

camera system for the detection of occupancy levels in motor vehicles.

Order intake and sales at Jena, through its operations in Germany the UK and

USA, continued to increase during the period largely due to the ongoing

improvement in the German economy and the development and continued expansion

of the Jena industrial products division. We are also investing in productivity

enhancing and range extending equipment in Germany for delivery in second half

of the current year. Several new customers have been won.

C&H sales and order intake grew strongly across all areas of its business

during the six months under review with the emphasis on developing and

expanding the recently introduced airframe business.

Two acquisitions in the aerospace division were completed with Sigma UK

subsequently relocating its offices to B&D in Hinckley. Sigma was founded in

2004 by two widely experienced aerospace professionals who saw an opportunity

to create a business from the globalisation into emerging markets of the $7

billion aerospace precision components market. Throughout their first year of

operation Sigma provided consultancy services from its offices in the UK and

China but following customer commitment from Umeco plc it has established a

30,000 sq. ft. precision component manufacturing facility in Chengdu, China.

The new facility has been equipped with an initial phase of CNC machine tools

and employed some 20 personnel. There have been no sales from Sigma in the

first half.

B&D Patterns Ltd, the manufacturer of critical jet engine components to the

aerospace industry has recorded improved sales on the corresponding period last

year and has opened a second facility to position itself for future growth.

Directors and senior management

There was no change in the composition of the main board of directors in the

period. However, Avingtrans has continued to strengthen its senior management

and welcomes Mark Johnson Managing Director of Avingtrans' Aerospace Division,

Nigel Spring Managing Director of B&D and Kevin Donnelly General Manager of

Chengdu Sigma Precision Components, China and their respective teams.

After the successful development of Avingtrans under the current executive

team, the Board and I have been planning my succession and I have indicated my

desire to stand down as Chairman with effect from 31 May 2007. The Board

following discussion with key shareholders and management has invited Jeremy

Hamer to take over as Non-Executive Chairman of the Group and I have agreed to

act as a consultant for a 12 month follow up period. Jeremy the Senior

Non-Executive Director since June 2002 is currently Non-Executive Chairman of

Inter Link Foods plc, Glisten plc and Access Intelligence plc and was awarded

Quoted Company Awards Chairman of the year in 2006 on behalf of Glisten plc.

Together with the existing Executive Directors I know I leave the guidance of

Avingtrans in strong and capable hands for the next stage of its development.

Outlook

Order intake continues to be encouraging and the Group now enjoys record order

books. The second half has already seen the 'maiden' sales from China, new

products being manufactured at Stainless Metalcraft and the opening of a site

in Bristol by C&H to satisfy growing demand. Alongside our organic developments

we continue to seek out suitable acquisitions particularly for our Aerospace

Division. Whilst needing to be constantly aware of raw material price

fluctuations and currency movements I remain confident of further success in

the second half.

In closing I should like once again on behalf of the Board to thank all of the

employees and co-workers for their ongoing successful efforts which gives rise

for optimism for the remainder of the year and the longer term future.

K.M.Baker

Chairman

21 February 2007

Consolidated Profit and Loss Account

6 mths to 6 mths to 12 mths to

30 Nov 30 Nov 31 May

2006 2005 2006

Note Unaudited Unaudited Audited

As As

�'000 restated restated

�'000 �'000

Turnover

Continuing operations 14,617 15,701 32,490

Current period acquisitions 2,542 - -

Group turnover 17,159 15,701 32,490

Operating profit before

amortisation

Continuing operations 1,578 1,528 3,163

Current period acquisitions 251 - -

Amortisation of goodwill (324) (179) (393)

Group operating profit 1,505 1,349 2,770

Profit on ordinary activities 1,505 1,349 2,770

before interest

Net interest payable and similar (222) (190) (345)

charges

Profit on ordinary activities 1,283 1,159 2,425

before taxation

Tax on profit on ordinary 3 (382) (355) (489)

activities

Profit on ordinary activities 901 804 1,936

after taxation

Equity minority interests 6 - -

Profit for the financial period 907 804 1,936

Earnings per share 4

Basic 5.6p 5.6p 13.3p

Diluted 5.5p 5.3p 12.4p

Statement of Total Recognised Gains and Losses

6 mths to 30 Nov 6 mths to 30 Nov 12 mths

2006 Unaudited 2005 Unaudited to

�'000 As restated 31 May

�'000 2006

Audited

As

restated

�'000

Profit for the 907 804 1,936

financial period

Other recognised

gains and losses

Currency translation (37) 52 8

(losses)/gain

Total recognised 870 856 1,944

gains/(loss)

relating to the

period

Summarised Consolidated Balance Sheet

At 30 Nov 2006 At 30 Nov At 31

Unaudited 2005 May

Unaudited 2006

�'000 As restated Audited

�'000 As

restated

�'000

Fixed assets

Intangible assets 15,000 6,560 6,777

Tangible assets 10,568 6,113 6,203

Investments 15 26 15

25,583 12,699 12,995

Current assets

Stocks 4,972 4,935 3,190

Debtors due within one year 8,310 5,270 4,931

Cash at bank and in hand 580 682 1,398

13,862 10,887 9,519

Creditors: Amounts falling due (11,728) (8,561) (6,284)

within one year

Net current assets 2,134 2,326 3,235

Total assets less current 27,717 15,025 16,230

liabilities

Creditors: Amounts falling due (11,575) (3,801) (3,334)

after

more than one year

Provisions for liabilities and (281) (190) (250)

charges

Net assets 15,861 11,034 12,646

Capital and reserves

Called up share capital 866 713 771

Share premium account 6,542 3,783 4,310

Capital redemption reserve 813 813 813

Other reserves 180 180 180

Profit and loss account 7,394 5,542 6,572

Equity shareholders' funds 15,795 11,034 12,646

Equity minority interests 66 - -

15,861 11,034 12,646

Consolidated Cash Flow Statement

6 mths to 6 mths to 12 mths to 31

30 Nov 30 Nov May

2006 2005 2006 Audited

Unaudited Unaudited �'000

�'000 �'000

Net cash inflow from operating 671 987 2,710

activities

Returns on investment and servicing

of finance

Net interest (227) (206) (365)

Net cash outflow from returns on (227) (206) (365)

investment and servicing of finance

Taxation paid (171) (275) (529)

Capital expenditure and financial

investment

Purchase of fixed assets (535) (57) (393)

Sale of fixed assets 127 3 6

Development costs (86) - (9)

Net cash outflow from capital (494) (54) (396)

expenditure

and financial investment

Acquisitions and disposals

Purchase of subsidiary undertakings (7,185) (100) (100)

Net overdraft acquired with (1,413) - -

subsidiaries

Net cash outflow from acquisitions (8,598) (100) (100)

and disposals

Equity dividends (77) (71) (148)

Financing

Issue of share capital 2,327 - 585

New Loans 4,643 - -

Repayment of loan capital (342) (292) (608)

Capital element of finance lease (484) (273) (664)

payments

Net cash inflow/(outflow) from 6,144 (565) (687)

financing

(Decrease)/increase in cash (2,752) (284) 485

Reconciliation of Operating Profit to Net Cash Flow from Operating Activities

6 mths to 6 mths to 12 mths to

30 Nov 30 Nov 31 May 2006

2006 2005 Audited

Unaudited Unaudited As restated

As restated �'000

�'000 �'000

Operating profit 1,505 1,349 2,770

Depreciation of tangible fixed assets 569 446 898

Amortisation of intangible assets and 324 179 393

goodwill

Share based payment 29 9 25

(Profit) on disposal of tangible fixed (121) (3) (6)

assets

Impairment of Investment - - 11

(Increase)/decrease in stocks (662) (314) 1,127

(Increase)/decrease in debtors (1,147) 261 595

Increase/(decrease) in creditors 174 (940) (3,103)

Net cash inflow from operating 671 987 2,710

activities

NOTES

1.This interim report was neither audited nor reviewed by the

auditors. It was approved by the Board on 20 February 2006. It has been

prepared using accounting policies that are consistent with those adopted in

the statutory accounts for the year ended 31 May 2006, with the exception of

the adoption of FRS 20 "Share-based payments".

The comparative figures for the 6 months ended 30 November 2005

and for the year ended 31 May 2006 have been adjusted in respect of the

adoption of FRS 20 'Share based payments' of �9,000 and �25,000 respectively.

The cumulative prior year adjustment at the close of the year ended 31 May 2006

was �42,000

The figures for the year to 31 May 2006 were derived from the

statutory accounts for that year. The statutory accounts for the year ended 31

May 2006 have been delivered to the Registrar of Companies and received an

audit report which was unqualified and did not contain statements under s237(2)

or (3) of the Companies Act 1985.

2.This statement is being sent to shareholders of the Company and

will be available at the Company's Registered Office.

3. The taxation charge is based upon the expected rate for the year

ended 31 May 2007.

4.Earnings per share has been calculated using the weighted average

number of 16,154,181 Ordinary Shares in issue during the period (2005:

14,262,086) (Audited 2006: 14,544,793).

The weighted average number of Ordinary Shares used in the

calculation of diluted earnings per share is 16,624,725 (2005: 15,263,598)

(Audited 2006 15,574,603). This has been adjusted to assume conversion of all

dilutive potential ordinary shares, being the warrants and EMI share options.

Basic earnings per share before goodwill amortisation was 7.6p

(2005: 6.9p as restated) (Audited 2006: 16.0p as restated)

5.Capitalised goodwill amounting to �4,013,000 and �4,447,000

arising from the purchase of Sigma Precision Components Limited and B&D

Patterns Limited respectively is being amortised over twenty years on a

straight line basis. Goodwill has been calculated on book value pending a

review of the fair value of assets acquired during the period.

6. Analysis of Net Debt

1 June Cash Acquisition Inception Exchange 30 Nov

2006 flow of of movement 2006

�'000 �'000 subsidiary loans �'000 �'000

excluding and

cash and finance

overdraft leases

�'000 �'000

Cash at 1,398 (1,145) 325 - 2 580

bank and

in hand

Bank (175) (194) (1,738) - 3 (2,104)

overdraft

Cash 1,223 (1,339) (1,413) - 5 (1,524)

Debt (2,860) 342 - (4,643) - (7,161)

Hire (1,654) 484 (1,271) (65) 6 (2,500)

purchase

leases

(4,514) 826 (1,271) (4,708) 6 (9,661)

Net debt (3,291) (513) (2,684) (4,708) 11 (11,185)

7. Reconciliation of movements in Shareholders' Funds

6 mths to 6 mths to 12 mths to

30 30 Nov 31 May

Nov 2006 2005 2006

Unaudited Unaudited Audited

�'000 As restated As restated

�'000 �'000

Opening shareholders' funds 12,646 10,240 10,240

Profit for the financial 907 804 1,936

period

Other recognised gains and

losses relating to the period (37) 52 8

Dividends (77) (71) (148)

Proceeds of share issue 2,327 - 585

Charge for share based payment 29 9 25

Increase in shareholders' 3,149 794 2,406

funds

Closing shareholders' funds 15,795 11,034 12,646

END

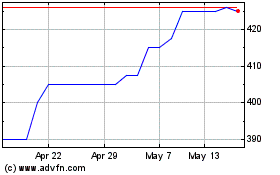

Avingtrans (LSE:AVG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avingtrans (LSE:AVG)

Historical Stock Chart

From Nov 2023 to Nov 2024