TIDMAURA

RNS Number : 6887R

Aura Energy Limited

30 October 2023

30 October 2023

Quarterly Report for the Period Ending 30 September 2023

KEY POINTS:

* Tiris Uranium Project continued to advance across all

development workstreams:

* Front-End Engineering Design (FEED) remains on track

for completion in Q4 2023;

* Existing Tiris Uranium Resource of 58.9Mlbs U(3) O(8)

(113Mt at grade of 236ppm U(3) O(8) ) with additional

upside under investigation in an Exploration Target

announced subsequent to the period end [1] ;

* Offtake discussions continue in the environment of a

strongly appreciating uranium spot market - the World

Nuclear Association releasing increased demand growth

projections; and

* The process of tenement renewal and granting of the

Tiris exploitation agreement continues in line with

expectations.

* Häggån Project Scoping Study ("Scoping

Study") released, indicating significant scale and

optionality:

* Post-tax Net Present Value ("NPV") range of

US$380M-US$1,231M (before U(3) O(8) by-product);

* Vanadium, potash, nickel, molybdenum, zinc and

potentially uranium amongst a diversified suite of

future-facing commodities;

* Works for application of a 25-year Exploitation

Permit is underway; and

* The Scoping Study covers less than 3% of

Häggån's known 2.0B tonne Mineral Resource

Estimate.

* Subsequent to the Reporting Period, the Swedish

Government has introduced legislation to the

parliament supporting the transition towards 100%

fossil-free energy production by allowing the

expansion of nuclear energy.

=============================================================

Aura Energy Limited (ASX: AEE, AIM: AURA) ("Aura" or the

"Company") is pleased to provide an overview of activities for the

period ended 30 September 2023 ("Quarter" or "Reporting Period") to

accompany the Appendix 5B. Aura remains focused on fast-tracking

the development of its Tiris Uranium Project in Mauritania ("Tiris"

or the "Tiris Project") and the advancement of the Häggån

Polymetallic Project in Sweden ("Häggån" or the "Häggån

Project").

To view Appendix 5B please click here:

http://www.rns-pdf.londonstockexchange.com/rns/6887R_1-2023-10-30.pdf

Company Activities

During the Quarter, the Tiris Project continued to advance, with

good progress made on the FEED study due in Q4 2023. The Company

continues to engage with the National Authority for Radiation

Protection, Safety and Nuclear Security (ARSN) in order to secure

an export permit, and Orano NPS has been appointed to finalise the

logistics solution to deliver yellowcake into the global markets.

Negotiations continued with utilities over the award of offtake

agreements ("Offtake"), supported by an improvement in the uranium

spot price, which has risen by nearly 30% from US$56.10/lb to

US$71.58/lb U(3) O(8) . Discussions on securing finance continued

during the Quarter to support the advancement of the Tiris

Project's development.

Post the end of the Quarter, Aura announced its intention to

commence an exploration program at its Tiris Project, targeting

additional resources to progress towards a potential 100 Mlbs U(3)

O(8) Inferred Resource. Pre-construction works, including the

geotechnical drilling of the proposed plant site and trial mining

will also be undertaken as part of this program, which will provide

valuable data in the production planning for the Tiris Project.

Figure 1 - Nouakchott Port

During the Quarter, Aura's Executives had meetings in Sweden to

discuss the government's legislative process, as the country

transitions towards a 100% fossil-free energy strategy including

the removal of the uranium mining ban. The Company provided a

briefing on the Häggån Scoping Study, with subsequent discussion

about how Aura intends to develop the Häggån Project. The Company

made progress on key activities required for the application for

the exploitation permit, with baseline environmental monitoring and

community consultation due to commence in Q4 2023. This will see

the application for the exploitation permit being submitted during

Q3 2024.

Managing Director and CEO, David Woodall, was interviewed by two

of the local newspapers, presenting the strategy that would be

adopted by Häggån Project which would deliver no negative impact on

the local lakes and water supply, establish operations with a small

environmental footprint, progressive rehabilitation, direct

employment and business opportunities and the potential of

downstream business within the region. This will be a key focus

throughout the December 2023 quarter with ongoing consultation and

interactions with stakeholders about the Häggån Project as part of

the exploitation permitting process.

Aura's Executives also visited Mauritania to update the

government on the progress of the Tiris Project, the progress of

the uranium export permit , and other activities to support the

project development.

In September 2023, the Company boosted its team in Mauritania

with the recruitment of Abdoullah Samoury as non-board Business and

Exploration Director, based in Nouakchott.

Abdoullah has vast experience in geology, project development,

mining and production geology and exploration in several African

countries (Togo, Burkina Faso and Mauritania). Most recently, he

was the Exploration Manager at the Tasiast-Kinross gold mine and

prior to that worked for First Quantum Minerals, World Bank and

Société Nationale Industrielle et Minière.

Cash on hand as at 30 September 2023 was A$8.55 million.

Tiris Project Update

Over the last Quarter, the Company maintained steady progress

towards "development-ready" status. This included the ongoing FEED

study focused on identifying and securing long-lead items to ensure

timely delivery. Additional negotiations regarding Offtake have

been advanced with multiple counterparties in different geographic

markets against the favourable background of a rising uranium spot

price. This rise has been consistent with previous Company

forecasts, and it is pleasing to see ongoing strength in the price

rise since the end of the Quarter.

Following the Quarter end, Aura has identified significant

exploration targets at both the Tiris East and Tiris West areas.

The potential quantity of the exploration targets are conceptual in

nature, and there has not yet been sufficient exploration of these

targets to estimate a Mineral Resource. It is uncertain whether

these exploration efforts will result in an estimation of a Mineral

Resource, but Aura is targeting the expansion of the Inferred

Mineral Resource at the Tiris Project to approximately 100 Mlbs U O

, a threshold of globally important significance.

Already, the Tiris Project has defined a low-cost, long-life

mine due to the simple mining method and the easy beneficiation

process that allows the upgrade of the ore to a 2,000ppm leach feed

grade. The ability to significantly grow the resource through the

expansion of existing ore bodies shows excellent potential for

scale.

Negotiations with the government of Mauritania concerning the

renewal of existing tenements and the granting of the Exploitation

Licence are ongoing but have advanced during the Quarter.

The Company has continued to collaborate with regional

communities and local governments to maintain the relationships

that have been established. The communities have recognised the

positive contribution in terms of jobs and infrastructure that the

Tiris Project will bring to the region as it moves to the

construction phase.

Häggån Project Update

During the Quarter, the Company announced the Scoping Study for

the Häggån Project in Sweden. The results indicated a large

poly-metallic deposit containing economically significant levels of

V (vanadium), SOP (sulphate of potash), Ni (nickel), Zn (zinc), and

Mo (molybdenum).

Aura has made considerable progress on the Häggån Project with

the completion of the Scoping Study outlining the extraordinary

opportunity of the Häggån Project. The study covered 65 Mt of the

resource, which represents less than 3% of the known 2.0B tonne

Mineral Resource Estimate of the broader Häggån Project. Within

this boundary, the ore body displayed a richly endowed polymetallic

structure containing significant quantities of vanadium, potash,

nickel, zinc, molybdenum, and uranium. A projected post-tax Base

Case NPV of US$380-US$1,231 million has been estimated, dependent

on final plant construction and the forward price assumptions.

Since the current legislation in Sweden prevents the extraction

of uranium, the base case scenario of the Scoping Study assumes

that uranium is not extracted from the ore and instead is returned

to the ground ("Base Case Scenario").

The Base Case Scenario proposes mining the high-grade zone at

5.9Mtpa, producing approximately:

-- 10,400 tpa V(2) O(5) high-quality vanadium flake;

-- 217,000 tpa sulphate of potash (SOP) by-product for sale as fertiliser; and

-- 3,000 tpa mixed sulphide product.

Aura intends to pursue a 25-year exploitation agreement and

recognises the potential value that could be added by recovering

uranium from the Häggån ore, subject to changes in Swedish

legislation and demonstration that the proposed operation will not

have a negative impact on the water quality or the environment.

Aura continues to work with the Swedish Government, local

community and relevant authorities and notes recent Swedish

Government legislation introduced to the parliament that proposes

the removal of restrictions on new nuclear power stations. The

adoption of the new energy target, changing from "100% renewable"

to "100% fossil-free" electricity by the Swedish parliament, is

part of the shift in sentiment towards the use of nuclear power due

to its stability, reliability and lack of greenhouse emissions.

Uranium Market - Growing Global Support

The Quarter has seen a continuation of governments

internationally acknowledging nuclear energy as a key part of the

carbon-free energy transition. Multiple governments continue to

announce plans to construct or upgrade existing nuclear power

plants to provide stable, zero-carbon baseload generation capacity.

The growing realisation that renewable energy solutions are unable

to provide the scalability or instantaneous demand continues to

drive this sentiment.

During the Quarter, the following highlights have been

noted:

-- China is looking to develop its nuclear power sector at a

rate of six to eight new plants per year for the foreseeable future

[2] ;

-- Japanese nuclear power plants are planning to restart

production next year as the country seeks to reduce reliance on

fuel imports [3] ;

-- The United States, France, Japan, Canada, and the United

Kingdom formed the Nuclear Fuel Alliance (NFA) to develop a shared

supply chain for nuclear fuel [4] ;

-- U.S. House of Representatives subcommittee for Energy,

Climate and Grid Security pledged bipartisan support for the

development of nuclear energy [5] ; and

-- The World Nuclear Association published updated supply and

demand forecasts, which show a more rapid growth trajectory of

uranium demand.

This growing sentiment towards nuclear energy is starting to

impact the uranium spot price. Subsequent to the end of the quarter

, the spot price has exceeded US$73/lbs, a 13 year high.

David Woodall and Nigel Jones also attended the recent World

Nuclear Fuels Market (WNFM) conference in Ljubljana, Slovenia ,

where meetings were held with potential offtake partners for the

Tiris Project.

Corporate

The Company's cash position as of 30 September 2023 was A$8.55m.

The Company's major cashflow movements for the Q uarter

included:

-- Investments in the Company's Exploration and Evaluation assets of A$1.80m; and

-- Administration and corporate costs of A$0.63m.

Forecasted net operating cash outflow, including the investment

in exploration and evaluation, for the coming quarter is A$2. 82m .

Based on this, and with a closing cash balance of A$8.55m, the

Company has sufficient cash for 3.03 quarters.

Tenement Summary

The Company holds the following interest in mining tenements,

farm-in and farm-out agreements as at the end of the Quarter:

Table 1 - Tenement Summary

Tenement No. Name Grant / Application Expiry Km(2) Holder Equity

Date

Mauritania

2491C4 Ain Sder 8/02/2019 2/8/2049 207 Tiris Ressources SA 85%

====================== ======================== =========== ====== ======================= =======

2492C4 Oued El Foule 8/02/2019 2/8/2049 190 Tiris Ressources SA 85%

====================== ======================== =========== ====== ======================= =======

2365B4 Oued El Foule Sud* 18/05/2015 pending 166 Aura Energy Limited 100%

====================== ======================== =========== ====== ======================= =======

2490C4 Oum Ferkik* 16/04/2008 pending 60 Aura Energy Limited 100%

====================== ======================== =========== ====== ======================= =======

Tiris International

2457B2 Hadeibet Belaa* 2/04/2019 pending 41 Mining Co. 100%

====================== ======================== =========== ====== ======================= =======

Tiris International

2458B2 Touerig Taet* 2/04/2019 pending 134 Mining Co. 100%

====================== ======================== =========== ====== ======================= =======

2688B2 Nderik* Joint Venture 9/7/2019 pending 260 Nomads Mining Co** 70%

====================== ======================== =========== ====== ======================= =======

Sweden

Vanadis Battery Metals

2007-243 Häggån nr 1 28/08/2007 28/08/2024 18 AB 100%

====================== ======================== =========== ====== ======================= =======

Vanadis Battery Metals

2018-9 Mockelasen nr 1 21/01/2019 21/01/2024 18 AB 100%

====================== ======================== =========== ====== ======================= =======

Vanadis Battery Metals

2018-7 Skallbole nr 1 20/01/2019 20/01/2024 8 AB 100%

====================== ======================== =========== ====== ======================= =======

* Renewal applications have been submitted and are being

processed.

** At 30 June 2023, the Company had fulfilled its exploration

obligation thereby earning a 70% equity interest in Nomads Mining

Sarl and is currently in the process of completing the necessary

documentation to formalise this arrangement.

This Announcement contains inside information for the purposes

of the UK version of the

market abuse regulation (EU No. 596/2014) as it forms part of

United Kingdom domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("UK

MAR").

For further information, please contact:

David Woodall Paul Ryan

Managing Director and CEO Citadel-MAGNUS

Aura Energy Limited Investor & Media Relations

info@auraenergy.com.au pryan@citadelmagnus.com

+61 (0)3 9101 8551 +61 409 296 511

SP Angel Corporate Finance LLP

(Nominated Advisor and Joint

Broker)

David Hignell

Kasia Brzozowska

+44 (0) 203 470 0470

----------------------------

About Aura Energy (ASX: AEE, AIM: AURA)

Aura Energy is an Australian-based minerals company that has

major uranium and polymetallic projects with large resources in

Africa and Europe. The Company is now focused on uranium production

from the Tiris Project, a major greenfield uranium discovery in

Mauritania.

A recent Enhanced Feasibility Study has increased the project

NPV significantly which reconfirms Tiris as potentially one of the

lowest capex, lowest operating cost uranium projects that remain

undeveloped in the world.

In October 2021, the Company entered a US$10m Offtake Financing

Agreement with Curzon, which includes an additional up to US$10m

facility, bringing the maximum available under the agreement to

US$20m.

In 2023, Aura will continue to transition from a uranium

explorer towards becoming a uranium producer, to capitalise on the

rapidly growing demand for nuclear power as the world continues to

shift towards a decarbonised energy sector.

Disclaimer Regarding Forward-Looking Statements

This ASX announcement (Announcement) contains various

forward-looking statements. All statements other than statements of

historical fact are forward-looking statements. Forward-looking

statements are inherently subject to uncertainties in that they may

be affected by a variety of known and unknown risks, variables and

factors which could cause actual values or results, performance, or

achievements to differ materially from the expectations described

in such forward-looking statements. The Company does not give any

assurance that the anticipated results, performance, or

achievements expressed or implied in those forward-looking

statements will be achieved.

Mineral Resource and Ore Reserve Estimates

The information in this announcement that relates to Mineral

Resources or Ore Reserves is extracted from the reports titled '

Tiris Uranium Project - Resource Upgrade of 10% ' released to the

Australian Securities Exchange (ASX) on 27 August 2021 and 'Tiris

Uranium Project DFS Update' released to the ASX on 18 August 2021

and for which Competent Persons' consents were obtained. Each

Competent Person's consent remains in place for subsequent releases

by the Company of the same information in the same form and

context, until the consent is withdrawn or replaced by a subsequent

report and accompanying consent. The Company confirms that it is

not aware of any new information or data that materially affects

the information included in the original ASX announcements and, in

the case of estimates of Mineral Resources or Ore Reserves, that

all material assumptions and technical parameters underpinning the

estimates in the original ASX announcements continue to apply and

have not materially changed.

The Company confirms that the form and context in which the

Competent Person's findings are presented have not been materially

modified from the original ASX announcements.

In respect to Resource statements, there is a low level of

geological confidence associated with the inferred mineral resource

and there is no certainty that further exploration work will result

in the determination of indicated measured resource or that the

production target will be realised.

Notes to Project Description

The Company confirms that the material assumptions underpinning

the Tiris Uranium Production Target and the associated financial

information derived from the Tiris production target as outlined in

the Aura Energy release dated 18 August 2021 for the Tiris Uranium

Project Definitive Feasibility Study continue to apply and have not

materially changed.

The Tiris Uranium Project Resource was released on 27 August

2021 "Resource Upgrade of 10% - Tiris Uranium Project". The Company

confirms that it is not aware of any new information or data that

materially affects the information included in the relevant market

announcement and that all material assumptions and technical

parameters underpinning the estimates in the relevant market

announcements continue to apply and have not materially

changed.

In respect to Resource statements, there is a low level of

geological confidence associated with the inferred mineral resource

and there is no certainty that further exploration work will result

in the determination of indicated measured resource or that the

production target will be realised.

Competent Persons

The Competent Person for the portion of the 2022 Tiris Vanadium

Mineral Resource Estimate and classification relating to the

Hippolyte, Hippolyte South, Lazare North, and Lazare South deposits

is Mr Arnold van der Heyden of H&S Consulting Pty Ltd. The

information in the report to which this statement is attached that

relates to the 2018 Mineral Resource Estimate is based on

information compiled by Mr van der Heyden. Mr van der Heyden has

sufficient experience that is relevant to the resource estimation

to qualify Mr van der Heyden as a Competent Person as defined in

the 2012 edition of the 'Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves. Mr van der

Heyden is an employee of H&S Consultants Pty Ltd, a

Sydney-based geological consulting firm. Mr van der Heyden is a

Member and Chartered Professional of The Australasian Institute of

Mining and Metallurgy (AusIMM) and consents to the inclusion in the

report of the matters based on his information in the form and

context in which it appears.

The Competent Person for the portion of the 2022 Tiris Vanadium

Resource Estimate and classification relating to all other deposits

within the resource (Sadi South, Sadi North, Marie, Hippolyte West,

Oum Ferkik East, Oum Ferkik West deposits) is Mr Oliver Mapeto, an

independent resources consultant.

The information in the report to which this statement is

attached that relates to the 2018 Resource Estimate is based on

information compiled by Mr Mapeto. Mr Mapeto has sufficient

experience that is relevant to the resource estimation to qualify

Mr Mapeto as a Competent Person as defined in the 2012 edition of

the 'Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves. Mr Mapeto is a Member of The

Australasian Institute of Mining and Metallurgy (AusIMM) and

consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

The Competent Person for drill hole data and for integrating the

different resource estimates is Mr Neil Clifford. The information

in the report to which this statement is attached that relates to

compiling resource estimates and drill hole data is based on

information compiled by Mr Neil Clifford. Mr Clifford has

sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify Mr Clifford as a

Competent Person as defined in the 2012 edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves. Mr Clifford is a consultant to Aura

Energy. Mr Clifford is a Member of the Australasian Institute of

Geoscientists. Mr Clifford consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

The information in this report that relates to Mineral Resource

Estimates for the Häggån Polymetallic Project in Sweden is based on

information compiled Mr Arnold van der Heyden, a Competent Person

who is a Member and Chartered Professional of The Australasian

Institute of Mining and Metallurgy (AusIMM). Mr van der Heyden is a

full-time employee of H&S Consultants Pty Limited, a

Sydney-based independent geological consulting firm. Mr van der

Heyden has sufficient experience that is relevant to mineral

resource estimation to qualify as a Competent Person as defined in

the 2012 edition of the 'Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves'. Mr van

der Heyden consents to the inclusion in the report of the matters

based on his information in the form and context in which it

appears.

The Competent Person for drill hole data, cut-off grade and

prospects for eventual economic extraction is Mr Neil Clifford MSc.

The information in the report to which this statement is attached

that relates to drill hole data for both existing and new drill

holes (with the new drill holes are from 18DDHG070 to 19DDHG091 and

the results set out in Table 2), cut-off grade and prospects for

eventual economic extraction is based on information compiled by Mr

Neil Clifford. Mr Clifford has sufficient experience that is

relevant to the style of mineralisation and type of deposit under

consideration and to the activity which he is undertaking to

qualify as a Competent Person as defined in the 2012 edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr Clifford is an independent

consultant to Aura. Mr Clifford is a Member of the Australasian

Institute of Mining and Metallurgy (AusIMM). Mr Clifford consents

to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

Appendix 1: Resources and Reserves

Table 2 - Tiris Uranium Project Updated Mineral Resource

Estimate (100% basis)

Mineral Resource Estimate February Mineral Resource Estimate February

2022 [6] 2023

Resource Location Category Tonnes U(3) O(8) U(3) O(8) Tonnes U(3) O(8) U(3) O(8)

(Mt) (ppm) (Mlbs) (Mt) (ppm) (Mlbs)

=============== ============ =========== =========== =========== ============ ============

Hippolyte North Measured 5.7 225 2.8 8.0 236 4.2

=============== ============ =========== =========== =========== ============ ============

Indicated 6.5 217 3.1 5.8 217 2.8

==================================== ============ =========== =========== =========== ============ ============

Inferred 7.4 281 4.6 4.7 212 2.2

==================================== ============ =========== =========== =========== ============ ============

Sub-Total 19.6 245 10.5 18.5 224 9.1

==================================== ============ =========== =========== =========== ============ ============

Hippolyte Marie &

West Inferred 8.2 310.0 5.6 8.2 310 5.6

=============== ============ =========== =========== =========== ============ ============

Hippolyte South Indicated 4.8 192 2.0 4.6 192 2.0

=============== ============ =========== =========== =========== ============ ============

Inferred 3.1 176 1.2 2.7 176 1.1

==================================== ============ =========== =========== =========== ============ ============

Sub-Total 7.9 177 3.2 7.4 186 3.0

==================================== ============ =========== =========== =========== ============ ============

Lazare North Measured 1.1 284 0.7 1.0 282 0.6

=============== ============ =========== =========== =========== ============ ============

Indicated 10.6 229 5.4 10.1 229 5.1

==================================== ============ =========== =========== =========== ============ ============

Inferred 3.9 210 1.8 3.7 210 1.7

==================================== ============ =========== =========== =========== ============ ============

Sub-Total 15.6 224 7.9 14.8 228 7.4

==================================== ============ =========== =========== =========== ============ ============

Lazare South Measured 3.4 239 1.8 8.6 233 4.4

=============== ============ =========== =========== =========== ============ ============

Indicated 2.6 219 1.3 5.2 226 2.6

==================================== ============ =========== =========== =========== ============ ============

Inferred 9.1 214 4.3 4.8 222 2.3

==================================== ============ =========== =========== =========== ============ ============

Sub-Total 15.1 225 7.4 18.6 228 9.3

==================================== ============ =========== =========== =========== ============ ============

Sadi Measured 11.5 189 4.8

=============== ============ =========== =========== =========== ============ ============

Indicated 4.5 240 2.4 7.4 200 3.2

==================================== ============ =========== =========== =========== ============ ============

Inferred 14.8 266 8.7 10.3 228 5.2

==================================== ============ =========== =========== =========== ============ ============

Sub-Total 19.3 301 11.1 29.2 206 13.2

==================================== ============ =========== =========== =========== ============ ============

Total Tiris East

Resource Measured 10.2 235 5.3 29.1 218 14.0

=============== ============ =========== =========== =========== ============ ============

Indicated 29.0 248 14.2 33.0 215 15.6

==================================== ============ =========== =========== =========== ============ ============

Inferred 46.5 254 26.2 34.5 237 18.0

==================================== ============ =========== =========== =========== ============ ============

Total 85.7 242 45.7 96.6 224 47.7

==================================== ============ =========== =========== =========== ============ ============

Oum Ferkik Resource Inferred 16.4 305 11.2 16.4 305 11.2

=============== ============ =========== =========== =========== ============ ============

Total Tiris Project Resource [7] 102.1 253 56.9 113.0 236 58.9

============ =========== =========== =========== ============ ============

The declared Ore Reserve, at a 110 ppm U(3) O(8) cut off is

shown in Table 3 .

Table 3 - Updated Ore Reserve (100% basis)

Description Mt U(3) O(8) (ppm) U(3) O(8) (Mlb)

===== ================ ================

Lazare North

Proved 0.9 298 0.6

===== ================ ================

Probable 7.9 251 4.4

===== ================ ================

Lazare South

Proved 6.5 264 3.8

===== ================ ================

Probable 2.6 291 1.7

===== ================ ================

Hippolyte

Proved 5.7 270 3.4

===== ================ ================

Probable 7.1 231 3.6

===== ================ ================

Sadi

Proved 6.1 232 3.1

===== ================ ================

Probable 3.3 261 1.9

===== ================ ================

Total Ore Reserve

Proved 19.3 257 11.0

===== ================ ================

Probable 21.3 251 11.6

===== ================ ================

Total Tiris East Reserve 40.3 254 22.6

===== ================ ================

Notes:

1. Ore Reserves are a subset of Mineral Resources.

2. Ore Reserves conform with and use the JORC Code 2012 definitions.

3. Ore Reserves are calculated using a uranium price of US$65 /lb.

4. Ore Reserves are calculated using a cut-off grade of 110 ppm U3O8.

5. Tonnages are reported including mining dilution.

6. All figures are rounded to reflect appropriate levels of

confidence which may result in apparent errors of summation.

Table 4 - 2019 Häggån Mineral Resource Statement [8]

V(2) O(5) Cut-Off Class Mt Ore V(2) O(5) Mo Ni Zn K(2) O Million lbs

% % ppm ppm ppm % V(2) O(5)

========== ======= ========== ==== ==== ==== ======= ============

0.10 Indicated 45 0.34 213 365 501 4.11 332

========== ======= ========== ==== ==== ==== ======= ============

Inferred 2,503 0.27 200 312 433 3.73 14,873

========== ======= ========== ==== ==== ==== ======= ============

0.20 Indicated 42 0.35 217 375 512 4.13 320

========== ======= ========== ==== ==== ==== ======= ============

Inferred 1,963 0.30 212 337 463 3.80 13,010

========== ======= ========== ==== ==== ==== ======= ============

0.30 Indicated 61 0.38 223 398 536 4.22 258

========== ======= ========== ==== ==== ==== ======= ============

Inferred 954 0.35 226 374 503 3.95 7,390

========== ======= ========== ==== ==== ==== ======= ============

0.40 Indicated 11 0.44 225 429 580 4.46 101

========== ======= ========== ==== ==== ==== ======= ============

Inferred 113 0.43 232 419 562 4.25 1,072

========== ======= ========== ==== ==== ==== ======= ============

[1] ASX and AIM Announcement, 17 Oct 2023, Aura identifies new

uranium Exploration Target extending from existing Tiris Project

Resources

[2] China expects to OK 6-8 nuclear power units per year in

green energy drive | Reuters

[3] Nuclear Power in Japan | Japanese Nuclear Energy - World

Nuclear Association (world-nuclear.org)

[4] Statement on Civil Nuclear Fuel Cooperation Between the

United States, Canada, France, Japan, and the United Kingdom |

Department of Energy

[5] Energy Subcommittee Chair Duncan Opening Statement on

Securing America's Nuclear Energy Future (house.gov)

[6] ASX & AIM Release 16 February 2022 "Aura Defines

Vanadium JORC Resource at Tiris Uranium Project "

[7] Totals may vary due to rounded figures.

[8] ASX Release: Häggån Battery Metal Project Resource Upgrade

Estimate Successfully Completed, 10 October 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFEAXEEDLKDFEA

(END) Dow Jones Newswires

October 30, 2023 03:49 ET (07:49 GMT)

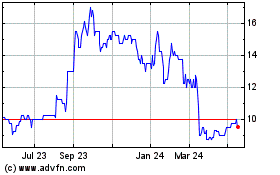

Aura Energy (LSE:AURA)

Historical Stock Chart

From Sep 2024 to Oct 2024

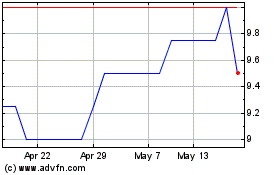

Aura Energy (LSE:AURA)

Historical Stock Chart

From Oct 2023 to Oct 2024