Trading Statement

December 15 2004 - 2:01AM

UK Regulatory

RNS Number:4129G

Moneybox PLC

15 December 2004

Moneybox Trading Update

Moneybox plc, the cash machine and payment services business, is today issuing

an updated end of year trading statement.

The Board gave updated guidance on the likely profit before tax, exceptional

items and goodwill amortisation for the year ending 31st December 2004 when

reporting interim results on 13th September and, with the year's trading now

almost completed, sees no reason to alter that guidance.

The new management team have successfully taken steps to improve the group's

trading since the end of August. We have conducted a thorough and detailed

review of the business. This together with exceptional items already announced

will give rise to around #4m of exceptional items which we envisage recognising

in 2004. We have reorganised and streamlined our whole organisation with a view

to lowering operating costs at every level and we have examined opportunities to

develop new profitable business, both in the UK and in Europe. While all this

has been going on, transaction levels in the final quarter are showing an

increase over Q3. We will end the year with transaction levels more than 15%

ahead of 2003.

Moneybox has a successful business which remains strongly positioned

strategically, with a major share of the fast growing independently deployed ATM

market and as a leader in the development of complementary access control and

cashless payment systems. We are now also lean and hungry, with the new

management team focusing its full attention on the delivery of shareholder

value. We are therefore well set to show a much stronger performance in 2005.

UK ATM Estate

Moneybox has seen further rapid expansion of its UK ATM estate during 2004. The

total number of machines deployed has grown from 2,471 at the beginning of the

year to currently 2,830. This includes the installation of over 150 freestanding

kiosks. These are able to offer 24-hour cash availability and their greater

visibility has proved highly effective in helping us win new contracts that have

created a pipeline of new ATM sites.

We are necessarily investing in the updating of our entire estate for "Chip and

Pin" and improved encryption technology, and this also enables us to introduce

new features, including a mobile phone top-up feature. This upgrade programme

will be substantially completed by April 2005. We are beginning to see the

roll-out of mobile phone top-up: the market has developed rapidly in recent

months and now more than 50% of bank cards offer the facility of a mobile phone

top-up at an ATM. We believe this will radically change the nature of the top-up

market, especially as the 3G revolution gathers pace next year.

Our expansion in the UK to date has been very largely by organic development,

and we now have a strong pipeline of new ATM sites that will enable us to

redeploy ATMs to further improve overall estate quality. A large programme to

increase the number of self-fill ATMs is under way. The roll-out of our own ATM

maintenance operation is now complete and gives us full coverage of the UK. We

have also recently replaced third party providers with our own installation

teams delivering both logistical and cost benefits. Our own teams will have

installed 70 machines by the end of 2004. Both of these new capabilities will

drive costs lower and will achieve further improvements in ATM availability.

Rest of Europe ATMs

In Germany, which we entered for the first time mid 2002 and where we see

particularly exciting prospects for expansion, we have increased the number of

machines deployed from 178 to over 400.

Our German ATM business has delivered consistent growth in terms of machine

installations and revenue through the second half of the year. Our business

relationship with GE Money Bank has enabled us to continue to install ATMs in

transport and other high frequency locations. This remote network is now being

complemented by machines installed in GE Money Bank branches following GE's

decision to outsource this activity. This programme will be complete by Q1 2005.

In the Netherlands, we have increased our estate to 170 ATMs, and have

significantly reduced our operating costs. In addition, we are now exploring

expansion into self-fill machines in major retailers.

G2

During 2004, G2 has successfully installed a number of its innovative cashless

payment system, Myriad, in public and private organisations throughout the UK

and Europe. This new product has received a very positive reception in the

catering and vending industry. With the launch of further Myriad products and

services in the first half 2005, we anticipate strong progress from G2 in 2005.

Access control and cashless payment card system sales form the core area of G2's

activity and business has continued to show some major contract wins in the

current year, with recent orders from Johnson & Johnson, Unilever, Addenbrooke's

Hospital and the University of Durham.

Through G2, Moneybox has its own manufacturing and software development

capability and has recently secured contracts for the provision of PIN change at

ATMs for other banks.

Prospects for 2005

The management team has made some substantial improvements and this will

continue through 2005. The recent thorough review of the Group and its

operations identified immediate cost savings which are now being implemented.

Next year will be a year of consolidation and this will put us firmly back on

track to deliver acceptable returns from our market leading ATM estate.

We recently announced a series of agreements with the UK and Ireland division of

Compass Group, the world's largest food services company, to supply and maintain

an estate of ATMs within the UK. Under the terms of the deal, Moneybox will be

the preferred supplier of both fully managed and merchant replenished cash

machines to Compass in 9,000 potential locations across the UK.

We are already developing this business with both ATM and cashless payment

installations. Our initial estimate is that there will be at least 100 suitable

sites for ATM deployment during 2005. In addition, we anticipate opening a

further 15 in motorway sites operated by Compass's Moto subsidiary, where there

are no existing machines.

We are also developing new business and access products for the cashless payment

market. Current projects include access trials under way with schools and

universities in England and Scotland, the completion of a number of

installations of our new Myriad cashless payment system and the development of

new car park ticketing applications for a major UK airport. This demonstrates

the group's breadth of payment applications.

Our German business is now profitable and in 2004 we extended our outsourcing

business relationship with GE Money Bank. The Netherlands has been slower to

reach a critical mass, but we have significantly reduced our cost of operations

and are hopeful of achieving break-even towards the end of next year. Both

estates will see further expansion in 2005.

The Board considers that the most appropriate response to a changing market

background, and the possible slowing of consumer spending in 2005, will be to

maintain the pressure to reduce costs and increase efficiency of the business,

while continuing to improve the quality of the group's ATM estate. We will focus

on improving shareholder value, rather than expansion for its own sake.

Other developments

Since the company's last announcement on 11th October 2004, the Treasury Select

Committee (TSC) has announced that it will conduct a short investigation of ATM

charges. We have made a detailed submission to the Committee and are confident

that we can demonstrate that independent ATM deployers (IADs) provide choice and

a service which is valued by consumers. Charges could be lower if IADs were able

to recover an interchange fee through the existing LINK network system. We have

also pointed out that the transparency of our charges is in marked contrast to

other card-based transactions.

The Board of Moneybox believes that the TSC's decision to examine ATM charges

provides an opportunity to encourage wider scrutiny of the current regulatory

regime governing ATMs. We believe strongly that changes in the structure of

charges made by LINK, the monopoly supplier of switching services between

card-issuers and ATM deployers, would potentially be of benefit to consumers and

would significantly improve the competitive position of IADs.

In the light of this, and in view of the nature of approaches so far received,

the Board has decided it would be inappropriate to continue talks with any

potential offerors.

Peter McNamara, Executive Chairman of Moneybox plc, said:

"Trading in the final quarter has shown an improvement. Our ATM estate is now

being managed for better value through a determined programme to reduce costs

throughout the business. 2005 will be a year of consolidation but will also see

the beneficial impact of these measures, and the strong new business pipeline.

Moneybox has established a strong and valuable position in the value-added end

of the ATM deployment sector, with our combination of software development,

third party contracts and high quality estate. We are also a leader in the

development of applications for convergent technologies of ATMs, access control

and cashless payment.

The Board will continue to focus on delivering shareholder value."

Moneybox plc

Peter McNamara, Executive Chairman 020 7452 5400

Reputation Inc

Tom Wyatt 020 7758 2800 (mobile 07776 240145)

Notes to Editors:

About Moneybox

The Moneybox Group deploys, manages and maintains cash machines (ATMs) in the

UK, Netherlands and Germany. The Group also operates cashless payment and

access control systems in the UK through its G2 subsidiary, which was acquired

in March 2004, when Moneybox floated on AIM.

Moneybox launched its first convenience ATM in June 1999. In December 2004,

Moneybox operated 2,830 ATMs in the UK, 170 ATMs in the Netherlands and 402 ATMs

in Germany. In the UK, Moneybox's cashless payment and access control systems

are used by over 400 customers at more than 1,700 sites.

Moneybox deploys ATMs at points of convenience, with consumers paying a

convenience fee per cash transaction. This enables the ATM to be located in

places that do not attract enough cardholders to support a traditional cash

machine, promoting consumer choice and wider accessibility to their cash.

Virtually every bankcard and credit card is acceptable through Moneybox ATMs as

a result of Moneybox's membership of the LINK network.

The G2 Group was established in 1991. G2 processes ATM, credit and debit card,

direct debit, internet and stored value card transactions. G2 also develops,

sells and maintains cashless payment and access control systems and in 2003

supplied approximately 300,000 smart cards and 300,000 magnetic strip cards to

the workplace market.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTEANALFAFLFFE

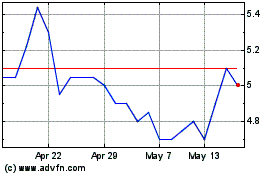

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jun 2024 to Jul 2024

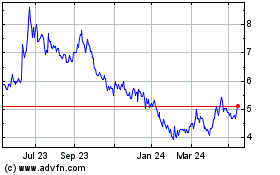

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jul 2023 to Jul 2024