TIDMATG

RNS Number : 3035C

Auction Technology Group PLC

17 June 2021

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE INFORMATION

CONTAINED HEREIN ARE RESTRICTED AND ARE NOT FOR PUBLICATION,

RELEASE, DISTRIBUTION OR FORWARDING, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA,

THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN

WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE

UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE AN OFFER OF SECURITIES IN ANY JURISDICTION.

PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

Auction Technology Group plc Press Release

17 June 2021

Auction Technology Group plc

("ATG", the "Company", or the "Group")

Proposed placing of Ordinary Shares

ATG, the operator of world-leading online auction marketplaces

("Marketplaces") and proprietary global auction platform technology

for curated online auctions, today announces its intention to

conduct a non-pre-emptive placing of 19,999,990 new ordinary shares

of 0.01 pence each in the capital of the Company (the "Placing

Shares"), at the Placing Price (as defined below) representing just

less than 20.0% of the current issued ordinary share capital of the

Company (the "Placing"). Certain directors and executive management

of the Company intend to participate in the Placing.

ATG proposes to use the net proceeds of the Placing to partly

fund the acquisition of Platinum Parent, Inc., the holding company

of LiveAuctioneers (the "Acquisition"), a leading curated online

North American Arts & Antiques ("A&A") Marketplace, as

separately announced today.

The Placing will be conducted through an accelerated

bookbuilding process (the "Bookbuilding Process") which will be

launched immediately following this announcement. The Placing is

subject to the terms and conditions set out in Appendix 1 to this

announcement (which forms part of this Announcement, such

announcement and its Appendices together being this

"Announcement").

Reasons for the placing

The net proceeds of the Placing will be predominantly used to

fund the acquisition of LiveAuctioneers for a total consideration

of approximately $525 million, as separately announced today.

Details of the Placing

J.P. Morgan Securities plc, which conducts its UK investment

banking activities as J.P. Morgan Cazenove ("J.P. Morgan

Cazenove"), and Numis Securities Limited ("Numis") are acting as

Joint Global Coordinators and Joint Bookrunners (the "Joint Global

Coordinators" or the "Banks") in connection with the Placing.

The Placing is subject to the terms and conditions set out in

the Appendix 1 to this Announcement.

The Banks will commence the Bookbuilding Process immediately

following the release of this Announcement in respect of the

Placing. The price at which the Placing Shares are to be placed

(the "Placing Price") will be determined at the close of the

Bookbuilding Process by agreement between the Company and the

Banks.

The book will open with immediate effect following this

Announcement. The timing of the closing of the book, pricing and

allocations are at the absolute discretion of the Banks and the

Company. Details of the Placing Price and the number of Placing

Shares to be allotted and issued will be announced as soon as

reasonably practicable after the close of the Bookbuilding

Process.

The Placing Shares, when issued, will be fully paid and will

rank pari passu in all respects with each other and with the

existing ordinary shares of the Company, including, without

limitation, the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Applications will be made to (i) the Financial Conduct Authority

(the "FCA") for admission of the Placing Shares to listing on the

premium listing segment of the Official List; and (ii) London Stock

Exchange plc for admission of the Placing Shares to trading on its

main market for listed securities (together, "Admission").

Settlement for, and Admission of, the Placing Shares is expected

to take place on or before 8.00 a.m. on 22 June 2021. The Placing

is conditional upon, among other things, Admission becoming

effective. The Placing is also conditional upon the placing

agreement between the Company and the Banks (the "Placing

Agreement") becoming unconditional and not being terminated in

accordance with its terms. Appendix 1 to this Announcement sets out

further information relating to the terms and conditions of the

Placing.

ATG acknowledges that it is seeking to issue Placing Shares

amounting to up to just less than 20.0 per cent. of its existing

issued ordinary share capital on a non-pre-emptive basis and

therefore members of its Board of Directors and senior management

have consulted with the Company's major institutional shareholders

ahead of the release of this Announcement. Given the expected

revenue accretion of the Acquisition to be funded in part with

proceeds from the Placing, the Company believes the structure of

the Placing, including its issue of shares on a non-pre-emptive

basis, is very much aligned with shareholder and other stakeholder

interests. The Placing structure has been chosen as it minimises

time to signing of the Acquisition reducing both the complexity and

time required to provide certainty of funds to the Company in the

context of the Acquisition. The consultation has confirmed the

Board's view that the Placing is in the best interests of

shareholders, as well as wider stakeholders in the Company and will

promote the success of the Company.

To permit the Placing, J.P. Morgan Cazenove and Numis have

waived the 180 day lock-up arrangement put in place at the time of

the ATG IPO. Following the placing, the Company shall be subject to

a new lock-up for a period of 180 days following the date of the

Placing Agreement, subject to certain customary carve-outs agreed

between the Joint Global Coordinators and the Company.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement. The Appendix to

this Announcement sets out further information relating to the

terms and conditions of the Placing. Unless otherwise stated,

capitalised terms in this Announcement have the meanings ascribed

to them in the Appendix (which forms part of this

Announcement).

Investors who have chosen to participate in the Placing, by

making an oral or written offer to acquire Placing Shares, will be

deemed to have read and understood this Announcement in its

entirety (including the Appendices) and to be making such offer on

the terms and subject to the conditions herein, and to be providing

the representations, warranties, agreements, acknowledgements and

undertakings contained in Appendix 1.

Background, strategy and reasons for the Acquisition

ATG operates world-leading Marketplaces and a proprietary

auction Platform for curated online auctions, connecting bidders

with auctioneers. The Group was founded approximately 50 years ago

and is headquartered in London, UK, with offices across three

countries (UK, US and Germany). As a key partner to and advocate

for auctioneers, the Company creates value by providing them with

access to robust online marketplace capabilities, a global bidder

base and a range of value-added tools and services that enable them

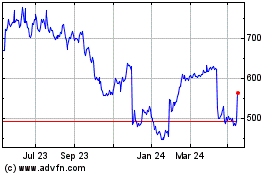

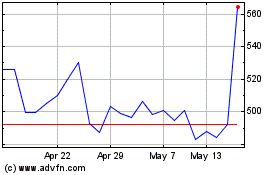

to maximise value on lots sold. The Group's pro forma revenue for

FY20 was GBP52.3 million. In February 2021, the Company completed

its successful listing on the premium listing segment of the

Official List and on the London Stock Exchange's main market for

listed securities at a market capitalisation of GBP600 million. In

the IPO Prospectus, the Company clearly conveyed its strategic

direction to its Shareholders and the key pillars for its future

growth, including its overall M&A strategy. The Company has a

strong track record of M&A following on from the notable

acquisition of Proxibid in February 2020 as well other smaller

acquisitions such as Auction Mobility, BidSpotter US and

Lot-tissimo.

LiveAuctioneers is an operator of a leading North American

A&A Marketplace, connecting bidders with more than 6,000

auctioneers since inception (including approximately 1,600

auctioneers as at 31 March 2021) via its online platform, helping

auctioneers to realise operational efficiencies and bidders to

access a wide range of exceptional items through secure online

auctions. LiveAuctioneers is headquartered in New York City. The

Directors believe there is a strong strategic rationale for the

Acquisition of the LiveAuctioneers Group.

Following Completion, LiveAuctioneers' Chief Executive Officer,

Phil Michaelson and Chief Technology Officer, Rob Cummings, will

remain involved in the business and will continue to run

LiveAuctioneers in North America. Under the terms of the

Acquisition, Phil Michaelson, Rob Cummings and certain other

Management Sellers have agreed to retain an ongoing Share ownership

in ATG in order to support the delivery of the full strategic,

operational and financial benefits of the Acquisition. This

includes agreeing to lock-up arrangements relating to the

Consideration Shares receivable by them.

The acquisition of LiveAuctioneers is in line with the M&A

and growth strategies laid out at IPO

As set out in the IPO Prospectus, the Directors believe future

growth is important to the ongoing success of the Group and that

expanding the Group's geographical and industry footprint is

important to allow it to efficiently invest in key elements of the

online buying experience (payments, delivery, improved buyer

experience) that will enable its Marketplaces to remain competitive

with the many other forms of online buying. The Directors believe

that the acquisition of LiveAuctioneers is directly in line with

this strategy, developing the Group's footprint in the North

American A&A vertical / geography. ATG expects the Combined

Group to benefit from similar operational and technical benefits

that have been realised from the acquisitions of Proxibid,

BidSpotter US and Lot-tissimo such as through the Group's 'hub and

spoke' model and, in due course, technological redundancy of legacy

systems.

The Acquisition also demonstrates ATG's commitment to the growth

strategy laid out at the IPO addressing all of the key pillars,

including:

-- Increasing total addressable market

-- Expansion into a market in the early stages of online adoption

-- Increased auctioneer and bidder client base

-- Efficient investment in value enhancing end-to-end UX,

features, and functionality for auctioneers and bidders

-- Adding highly accretive businesses to the group via M&A

-- Enhancing and accelerating the value-add proposition for auctioneers and customers

Increasing total addressable market ("TAM")

The Acquisition adds a significant incremental piece to the

Group's total addressable market with the addition of one of the

leading curated online A&A marketplaces in North America.

The Directors believe that the US A&A segment (the

LiveAuctioneers Group's US TAM) was worth $21.0 billion in 2020 and

the value of goods sold through the auction channel overall in the

US A&A segment (excluding Christie's and Sotheby's) will be

worth $6.6 billion in 2023 (Source: Company estimates based on

internal data). The Directors estimate that the US A&A online

auction segment (excluding Christie's and Sotheby's) was worth $1.8

billion in 2019 and believe this will grow to an estimated $4.0

billion by 2023, with an estimated CAGR of approximately 22 per

cent. per annum between 2021-23 (Source: Company estimates based on

internal data). The differential between the current size of the US

A&A online auction segment and the US A&A TAM represents a

significant growth opportunity for the Group.

The LiveAuctioneers Marketplace is a leading US A&A online

auction marketplace with more than 50 million website visits

(growing at a CAGR of 23.5 per cent. since FY18), more than one

million registered bidders (growing 18.9 per cent. since FY18) and

almost 120,000 active bidders (growing 34.8 per cent. since FY18)

in FY20 and the Directors believe that these factors mean that the

LiveAuctioneers Group is well-positioned to capture an increasing

portion of the US A&A TAM.

LiveAuctioneers is well positioned in North American A&A and

has carved out a differentiated proposition from its competitors,

most notably:

-- LiveAuctioneers has c.1,600 auctioneers

-- LiveAuctioneers charges a transparent headline commission

-- LiveAuctioneers has a highly engaging website with strong functionality (e.g. payments, personalisation and item categorisation)

-- LiveAuctioneers has a highly competitive service offering,

with further scope to expand into other adjacencies, e.g. shipping,

financing, insurance, restoration/repair

-- LiveAuctioneers has a wide ranging category focus and covers

all key A&A categories, whilst also having one of the highest

number of lots on its site vs key peers

Expansion into a market in the early stages of online

adoption

The Acquisition brings greater access to a market with

relatively low online penetration and with a considerable scope to

grow online share in the market as more bidders move online. By way

of illustration, as of its FY20, online share (i.e. gross

merchandise value (GMV) of goods sold online via the

LiveAuctioneers Marketplace as a percentage of total hammer value

(THV) for the auctions listed by LiveAuctioneers) was 15.4 per

cent., up from 12.0 per cent. in its FY18. In the auctions listed

on ATG's European-focused A&A Marketplaces (The Saleroom and

Lot-tissimo), online share was 17 per cent. in ATG's FY20,

highlighting the clear headroom available. The Directors believe

that these A&A Marketplaces have a similar capacity for growth

as that experienced by the online segment for I&C, where online

share for the auctions listed on ATG's I&C Marketplaces

(Proxibid, BidSpotter US and BidSpotter UK) was 39 per cent. in

ATG's FY20. A&A auctions have traditionally been carried out in

an offline, in-person setting where there is less accessibility for

bidders whilst also incurring higher costs to the auctioneers and

thus the shift to online has significant benefits for both

auctioneers and bidders. There are also a significant number of

North American A&A auctioneers that do not have a meaningful

online presence and thus there is a further growth opportunity due

to the number of auctioneers that could be added to the Combined

Group's current auctioneer base. LiveAuctioneers have seen strong

growth both from auctioneers moving online but also from revenue

retained from historic cohorts. LiveAuctioneers auctioneer net

revenue retention was 108% in its FY18, 104% in FY19 and 119% in

FY20.

Increasing the auctioneer and bidder client base

The Acquisition will add approximately 1,600 new auctioneer

clients (as at 31 March 2021) who operate approximately 27,000

auctions per year (for the 12 months ending 31 December 2020) and

collectively deliver winning bidders on approximately 1.3 million

lots (for the 12 months ending 31 December 2020). It also expands

the bidder base by more than 120,000 (as at 31 March 2021) in the

North American A&A vertical / geography who conducted over 56

million sessions (for the 12 months ending 31 December 2020),

further expanding the footprint currently provided by Proxibid and

Auction Mobility. The Acquisition will have significant benefits

for both the Existing Group's and the LiveAuctioneers Group's

auctioneers, providing them with a more integrated service, whilst

also saving them time and reducing their costs, enabling them to

compete more effectively and efficiently, particularly against

other online channels for secondary, unique, and specialised items,

such as eBay and Etsy. The Directors believe that the

LiveAuctioneers Group's auctioneers will also benefit from the

ability of the Combined Group to offer Auction Mobility's

capabilities, which will enable auctioneers to further build out

their white label offering, giving auctioneers the ability to build

their brands alongside the Existing Group's brands, and thus

enhancing the overall auctioneer value-add proposition.

The incremental inventory from the combination of the Existing

Group's premium white label offering plus Marketplace sales with

that of the LiveAuctioneers Marketplace will increase the appeal

and value for bidders at auction. The incremental bidder base will

also help to increase competition in auctions, providing greater

revenue to the consignors and auctioneers as well as enabling

auctions on those Marketplaces to provide a truer reflection of the

market price for those goods. This translates into higher benefits

to consignors of the goods to the auctioneers, which should in turn

lead to more items being sold at auction.

Bidders will have access to a far wider range of items from a

wider universe of auctioneers and can benefit from the enhanced

customer service auctioneers will be able to provide as a result of

efficiencies realised through the Combined Group's expanded service

offering. The Acquisition will enable bidders around the world to

gain access to approximately 1.3 million lots in a secure, easy,

and engaging online environment. The Directors also believe that

bidders will buy with more confidence and believe they are playing

a role in sustainable buying and a greener planet.

Fully integrated payments solution

The Acquisition adds the ability to provide a fully integrated

payments solution to the Combined Group, helping to simplify the

fragmented payments process for auctioneers and bidders.

LiveAuctioneers provides bidders the functionality to pay

auctioneers through: (i) third-party payment processors, (ii)

LiveAuctioneers invoicing; (iii) credit and debit card payments and

pre-authorisation; and (iv) Automated Clearing House payments. For

successful bidders, payments can be taken automatically from card

details saved to the LiveAuctioneers Group's system via an

"autopay" functionality. This helps to ensure quicker remittance of

funds to auctioneers and consignors, as payment is deducted

automatically 72 hours after the issue of an invoice following an

auction. The Directors believe that the addition of

LiveAuctioneers' payments processing functionality will

significantly accelerate the Existing Group's payments

functionality. This adds significant value-add functionality for

the auctioneer helping to mitigate compliance risk whilst also

helping auctioneers to comply with their obligations to collect

taxes. Historically, bidders would have to make payments via less

efficient methods, which would increase the likelihood of defaults

in payment and increase the time-period between the auction and a

consignor receiving the proceeds of the sale. The addition of a

fully integrated payments solution will also add functionality for

the bidder, helping to enhance the wider bidder end-to-end

experience and provide a buying experience more in line with bidder

expectations and wider e-commerce transactions. The Directors

believe that LiveAuctioneers payments solution, which has been

developed on a modular basis, will be integrated into the Combined

Group's North American Marketplaces (Proxibid and BidSpotter US)

within six to twelve months of Completion,

enabling quick availability across the North American

Marketplaces, with integration across the UK and DACH region

Marketplaces within twelve to fifteen months of Completion.

Additional investment would be required to extend the solution to

the UK and Europe. LiveAuctioneers' payments function has

experienced notable increase in volumes over the three months ended

31 March 2021, following initial launch in December 2020, due to

its enhanced focus on communicating the benefits of the same to

auctioneers, with more than 450 auction houses using the

service.

The Acquisition enhances ATG's shared success value proposition

with real value delivered to all participants in the

marketplace

Management believe that the Acquisition will deliver real value

to the three core participants in their marketplace.

For auctioneers, the Acquisition will bring an incremental

bidder base that increases competition for each lot, driving higher

asset sale prices for auctioneers; a fully integrated payments

solution that improves security, reduces chargeback risk, improves

bidder confidence; and gets consignors their money faster and

simpler payments that reduces hassle and increases collection

efficiency for auctioneers leading lowering operating costs.

For consignors, the Acquisition will bring an incremental bidder

base that increases competition for each lot, driving higher asset

sale prices for consignors; higher values for assets sold that

increases the number of items consignors will choose to sell online

at auction; incremental geography for A&A that justifies more

rapid investment in value-added services, further enhancing value

for consignors; and proven value of online auctions that means more

consignors will use it as a channel for disposal of assets,

reducing waste, and further enhancing ATG's role in the

circular/sustainable economy.

For bidders, the Acquisition will bring access to 1.3 million

lots in a secure, easy, and engaging online environment that

responds to bidder desire for sustainable shopping; investment

efficiencies that give ATG the ability to invest in more ecommerce

basics, providing a more familiar end-to-end user experience; and

buildout of the auction ecosystem that increases the appeal of

auctions, opening up new revenue streams for the service providers

in the auction ecosystem and making it easier for bidders to find

them.

Compelling financial benefits

The Acquisition adds a significant bidder and auctioneer base to

the Combined Group. The Acquisition will add approximately 1,600

new auctioneers, taking the total number between the Existing Group

and the LiveAuctioneers Group to approximately 3,600. In light of

LiveAuctioneers' North American A&A focus, ATG and

LiveAuctioneers have a very limited shared auctioneer base and the

Directors believe them to be highly complementary. The Acquisition

also adds a notable bidder base, with LiveAuctioneers having more

than one million registered bidder accounts, taking the total

number of registered bidder accounts for the Combined Group to

approximately six million as at 31 March 2021 and the Directors

believe them to also be highly complementary.

The Directors believe the Acquisition will enhance the growth

and profitability profile of the Combined Group and will support

and accelerate the Company's strategy laid out in the IPO

Prospectus. The Existing Group's unaudited pro forma revenue for

FY20 was GBP52.3 million having grown from GBP37.0 million in FY18

at a CAGR of 19%. LiveAuctioneers' revenue as at FY20 was $30.7

million, having grown at a CAGR of 23% since FY18. LiveAuctioneers

also brings a strong track record of profitability with Adjusted

EBITDA of $16.5 million in their FY20, at an Adjusted EBITDA margin

of 54%. LiveAuctioneers' operating cash flow (adjusted

EBITDA-Capex) in FY20 was $14.8 million with cash generation of 89%

(operating cash flow / adjusted EBITDA).

The Acquisition is expected to be very materially earnings per

Share accretive immediately post Completion, before the realisation

of any synergies. The Directors expect the Combined Group will be

highly cash generative with low capital intensity and significant

operating leverage, given the largely fixed costs base.

Overview of Acquisition terms, financing and approvals

-- Acquisition of LiveAuctioneers for an enterprise value of up

to $525 million, with $500m consideration due on Completion and

Earn Out consideration of up to $25 million

-- The acquisition will be financed by way of:

o Cash consideration:

-- An equity financing by way of a cashbox placing via

accelerated bookbuild for just less than 20.0% of the issued share

capital of ATG (the "Capital Raising")

-- New debt financing of approximately $204 million resulting in

pro-forma leverage of up to c.3.0x

o Key LiveAuctioneers management will be rolling not less than

35% of their existing holding into ATG Shares. Based on current

estimates this represents approximately $19 million which is

subject to change based on the timing of completion and closing

mechanics

o Any remaining consideration to be funded via cash or

additional vendor equity issuance at Completion

-- The Acquisition is a Class 1 transaction for ATG under the

Listing Rules of the FCA. A Circular and Prospectus containing

further details on the Acquisition, the recommendation of ATG's

board of directors and the notice of the general meeting of the

Company (to be held to approve, amongst other matters, the

Acquisition, agreement to pay the Reverse Termination Fee of $25m

if triggered and to authorise the Directors to allot shares in

connection with the Acquisition) will be issued in due course

-- TA Associates, ECI Partners, the Directors, Senior Management

and Jupiter Investment Management Limited, who collectively hold

46% of the Enlarged Share Capital of ATG, have irrevocably

committed to vote in favour of the resolutions

-- Completion is also conditional, amongst other things, upon

approval of the Acquisition by relevant antitrust authorities,

including approval in the UK and US

Summary key performance indicators and historical financial

information on LiveAuctioneers

FY18 (for twelve FY19 (for twelve FY20 (for twelve

months to 31 months to 31 months to 31 December

$ million December 2018) December 2019) 2020)

------------------------ ------------------ ------------------ ------------------------

THV 1,844 2,087 2,438

------------------------ ------------------ ------------------ ------------------------

THV growth (%) n.a 13% 17%

------------------------ ------------------ ------------------ ------------------------

Online share

(%) 12% 13% 15%

------------------------ ------------------ ------------------ ------------------------

GMV 221 261 375

------------------------ ------------------ ------------------ ------------------------

GMV growth (%) n.a. 18% 44%

------------------------ ------------------ ------------------ ------------------------

Take-rate (%) 8.4% 8.3% 7.5%

------------------------ ------------------ ------------------ ------------------------

FY18 (for twelve FY19 (for twelve FY20 (for twelve

months to 31 months to 31 months to 31 December

$ million December 2018) December 2019) 2020)

------------------------ ------------------ ------------------ ------------------------

Revenue 21.1 23.7 30.7

------------------------ ------------------ ------------------ ------------------------

% growth n.a 13% 30%

------------------------ ------------------ ------------------ ------------------------

Adjusted EBITDA 12.2 12.1 16.5

------------------------ ------------------ ------------------ ------------------------

% margin 58% 51% 54%

------------------------ ------------------ ------------------ ------------------------

Capex (including

capitalized software

costs) 0.2 0.0 1.8

------------------------ ------------------ ------------------ ------------------------

% of sales 1% 0% 6%

------------------------ ------------------ ------------------ ------------------------

OpFCF 12.0 12.1 14.8

------------------------ ------------------ ------------------ ------------------------

% cash conversion 98% 100% 89%

------------------------ ------------------ ------------------ ------------------------

LiveAuctioneers, LLC is the trading entity of the

LiveAuctioneers Group. Prior to 21st May 2019, LiveAuctioneers, Inc

was the majority owner of LiveAuctioneers, LLC. On 21st May 2019,

Platinum Parent, Inc., through its subsidiary Platinum

Intermediate, Inc., purchased LiveAuctioneers, Inc and its

subsidiaries, including LiveAuctioneers, LLC (the "2019

LiveAuctioneers Acquisition").

The financial information included within this announcement has

been extracted from the LiveAuctioneers Group's available

historical audited financial statements for the three years ended

31 December 2018, 2019 and 2020, which have been prepared in

accordance with accounting principles generally accepted in the

United States ("US GAAP") (the "Historical Audited US GAAP

Financial Statements").

The Historical Audited US GAAP Financial Statements have been

prepared at the LiveAuctioneers, LLP level for the year ended 31

December 2018, and at the Platinum Intermediate, Inc level for the

two years ended 31 December 2019, and 2020. In the case of the year

ended 31 December 2019, which included the 2019 LiveAuctioneers

Acquisition, the period prior to the 2019 LiveAuctioneers

Acquisition reflects the results of operations and cash flows of

LiveAuctioneers, LLC, and the period subsequent to the 2019

LiveAuctioneers Acquisition reflects the Platinum Intermediate, Inc

operations, including LiveAuctioneers, Inc and LiveAuctioneers,

LLC.

In accordance with the Listing Rules, the Circular when

published will include full historical financial information on the

LiveAuctioneers Group for the three years ended 31 December 2018,

2019 and 2020, prepared in accordance with International Financial

Reporting Standards as adopted by the European Union ("IFRS"), in a

form consistent with the accounting policies adopted by ATG in its

latest annual consolidated accounts (the "Historical IFRS Financial

Statements"). The basis for the Historical IFRS Financial

Statements will differ from the Historical Audited US GAAP

Financial Statements as prior to the 2019 LiveAuctioneers

Acquisition the Historical IFRS Financial Statements will be

consolidated at the LiveAuctioneers, Inc level, and subsequent to

the 2019 LiveAuctioneers Acquisition the Historical IFRS Financial

Statements will be consolidated at the Platinum Parent, Inc level.

Whilst not acting as trading entities, consolidating at the

LiveAuctioneers, Inc and Platinum Parent Inc level in the

Historical IFRS Financial Statements will lead to the additional

recognition of certain cash, working capital, tax and professional

expenses amounts in the periods presented.

US GAAP differs in several respects from IFRS. The IFRS

transition exercise remains incomplete at the date of this

presentation.

ATG has identified what it believes to be the material

difference between ATG's IFRS policies and LiveAuctioneers'

accounting policies below. As the IFRS transition exercise is

incomplete there may be additional differences not noted below:

a) Income Statement, Balance Sheet and Cashflow Statement Presentation

The presentation of certain income statement, balance sheet and

cashflow financial statement items may be realigned to conform to

ATG presentation.

b) IFRS first-time adoption (IFRS 1)

For first-time adopters of IFRS, full retrospective application

is subject to certain optional exemptions, designed to reduce the

burden where the cost of retrospective application might exceed the

benefits. Certain exemptions are applicable and may be applied to

the ATG historical financial information under IFRS, including

electing to use a previous valuation of property, plant, and

equipment as the deemed cost for IFRS.

c) Share-based payments

Differences can occur between the US GAAP and IFRS treatment of

share-based payments, including valuation methodology at each

balance sheet date and the option of recognising share-based

payment expense over the vesting period using a straight-line

method rather than using a graded-vesting schedule as required by

IFRS.

d) Income taxes

There are differences that exist between US GAAP and IFRS in the

accounting for income taxes, including the presentation of deferred

taxes.

e) Purchase price accounting and goodwill

There are differences that exist between US GAAP and IFRS in the

accounting for business combinations, including the identification

of intangible assets. Further, under US GAAP goodwill arising from

business combinations can be amortised annually whereas at least

annual impairment reviews are required under IFRS.

f) Capitalised development costs

There are differences that exist between US GAAP and IFRS in the

criteria for capitalising development costs.

g) Lease accounting

There are differences that exist between US GAAP and IFRS in

accounting for leases, in particular IFRS requires the recognition

of a lease liability and right of use asset for all leases and no

longer permits the recognition of lease expenses in the income

statement on an annual basis.

h) Accounting for debt

There are differences that exist between US GAAP and IFRS in

accounting for debt, specifically debt modifications

IMPORTANT INFORMATION

Sources, Bases and Important Notes

1. Unless otherwise stated:

a. Financial information relating to ATG has been extracted from

the audited results for the twelve months ended 31 September

2020

b. Financial information relation to LiveAuctioneers have been

extracted or derived from the audited results for the twelve months

ended 31 December 2020

c. References to FY18, FY19, FY20 and FY21 mean:

i. In the case of ATG, the financial years ended 31 September

2018, 2019, 2020 and 2021, and H1 FY21 means the 6-month period

ended 31 March 2021.

ii. In the case of LiveAuctioneers, the financial years ended 31

December 2018, 2019, 2020 and 2021.

2. All LiveAuctioneers financial information in this

announcement is presented in accordance with US GAAP and may differ

from the financial information to be included in due course in the

Circular and Prospectus, as further detailed above under the

heading "Summary key performance indicators and historical

financial information on LiveAuctioneers".

3. The economic effect of the Management RSUs is that the

Rollover Management Sellers will, following the expiry of the

Acquisition Lock-Up Period, receive Shares at an effective price of

750p per Share.

4. The maximum number of new Shares required will only be known

on Completion depending on, amongst other things, (i) how many

options over Platinum Parent, Inc. shares are exchanged at

Completion pursuant to the terms of the Rollover, (ii) the per

share Acquisition value of a Platinum Parent, Inc. share, (iii) the

closing share price of the Shares on the date of Completion and

(iv) the US $ to pound sterling exchange rate at Completion.

5. Certain figures in this announcement have been subject to rounding adjustments.

Enquiries

ATG

For investor enquiries investorrelations@auctiontechnologygroup.com

For media enquiries press@auctiontechnologygroup.com

Tulchan Communications +44 207 353 4200

(Public relations advisor to ATG@tulchangroup.com

ATG)

Tom Murray, Sunni Chauhan, Matt

Low

Numis Securities Limited

(Sponsor, Joint Global Co-ordinator,

Joint Financial Adviser and Debt

Adviser) +44 207 260 1205

Nick Westlake, Matt Lewis, William

Baunton

J.P. Morgan Securities plc

(Joint Global Co-ordinator and

Joint Financial Adviser) +44 207 134 8765

Bill Hutchings, Barry Meyers,

Beau Freker

The preceding summary should be read in conjunction with the

full text of the following announcement and its appendices,

together with the Circular and Prospectus which will be published

in due course.

IMPORTANT NOTICES

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE TERMS AND

CONDITIONS SET OUT HEREIN (TOGETHER, THIS "ANNOUNCEMENT") IS FOR

INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE OR FORM ANY PART

OF AN OFFER TO SELL OR ISSUE, OR A SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY SECURITIES IN THE UNITED

STATES (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE

UNITED STATES AND THE DISTRICT OF COLUMBIA (COLLECTIVELY, THE

"UNITED STATES")), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION

WOULD BE UNLAWFUL OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE

SUCH OFFER OR SOLICITATION. NO PUBLIC OFFERING OF THE PLACING

SHARES IS BEING MADE IN ANY SUCH JURISDICTION. ANY FAILURE TO

COMPLY WITH THESE RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE

SECURITIES LAWS OF SUCH JURISDICTIONS.

This Announcement is not for public release, publication,

distribution or forwarding, in whole or in part, directly or

indirectly, in or into the United States, Australia, Canada, the

Republic of South Africa, Japan or any other jurisdiction in which

such release, publication, distribution or forwarding would be

unlawful. No public offering of the securities referred to herein

is being made in any such jurisdiction or elsewhere.

The securities referred to herein have not been and will not be

registered under the US Securities Act of 1933, as amended (the

"Securities Act"), or under the securities laws of any state or

other jurisdiction of the United States, and may not be offered or

sold in the United States, except pursuant to an exemption from the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. No public offering of the

Placing Shares is being made in the United States.

No action has been taken by the Company, J.P. Morgan Securities

plc ("JPM") or Numis Securities Limited ("Numis") or any of their

respective affiliates, or any of its or their respective directors,

officers, partners, employees, advisers or agents (collectively,

"Representatives") that would, or is intended to, permit an offer

of the Placing Shares or possession or distribution of this

Announcement or any other publicity material relating to such

Placing Shares in any jurisdiction where action for that purpose is

required. Persons receiving this Announcement are required to

inform themselves about and to observe any restrictions contained

in this Announcement. The distribution of this Announcement, and

the Placing and/or the offer or sale of the Placing Shares, may be

restricted by law in certain jurisdictions. Persons (including,

without limitation, nominees and trustees) who have a contractual

or other legal obligation to forward a copy of this Announcement

should seek appropriate advice before taking any action. Persons

distributing any part of this Announcement must satisfy themselves

that it is lawful to do so.

This Announcement has not been approved by the Financial Conduct

Authority or the London Stock Exchange.

Members of the public are not eligible to take part in the

Placing. This Announcement is directed at and is only being

distributed to persons: (a) if in member states of the European

Economic Area, "qualified investors" within the meaning of Article

2(e) of Regulation (EU) 2017/1129 (the "Prospectus Regulation")

("Qualified Investors"); or (b) if in the United Kingdom, Qualified

Investors within the meaning of Article 2(e) of the UK version of

Regulation (EU) 2017/1129 as it forms part of UK law by virtue of

the European Union (Withdrawal) Act 2018 (the "UK Prospectus

Regulation") who are (i) persons who fall within the definition of

"investment professionals" in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order"), or (ii) persons who fall within Article

49(2)(a) to (d) of the Order; or (c) persons to whom they may

otherwise lawfully be communicated (each such person above, a

"Relevant Person"). No other person should act or rely on this

Announcement and persons distributing this Announcement must

satisfy themselves that it is lawful to do so. By accepting the

terms of this Announcement, you represent and agree that you are a

Relevant Person, if in the United Kingdom, or a Qualified Investor,

if in a member state of the EEA. This Announcement must not be

acted on or relied on by persons who are not Relevant Persons, if

in the United Kingdom, or Qualified Investors, if in a member state

of the EEA. Any investment or investment activity to which this

Announcement or the Placing relates is available only to Relevant

Persons, if in the United Kingdom, and Qualified Investors, if in a

member state of the EEA, and will be engaged in only with Relevant

Persons, if in the United Kingdom, and Qualified Investors, if in a

member state of the EEA.

No offering document or prospectus will be made available in any

jurisdiction in connection with the matters contained or referred

to in this Announcement or the Placing and no such offering

document or prospectus is required (in accordance with the

Prospectus Regulation or UK Prospectus Regulation) to be

published.

This Announcement does not constitute, or purport to include the

information required of, a disclosure document under Chapter 6D of

the Australian Corporations Act 2001 (Cth) ("Corporations Act") and

will not be lodged with the Australian Securities and Investments

Commission. No offer of Placing Shares is or will be made to

persons in Australia pursuant to this Announcement, except to a

person who is a "sophisticated investor" within the meaning of

section 708(8) of the Corporations Act or a "professional investor"

within the meaning of section 708(11) of the Corporations Act and a

wholesale client under section 761G(7) of the Corporations Act . If

any Placing Shares are issued, they may not be offered for sale (or

transferred, assigned or otherwise alienated) to investors in

Australia for at least 12 months after their issue, except in

circumstances where disclosure to investors is not required under

Part 6D.2 of the Corporations Act.

Certain statements in this Announcement are forward-looking

statements with respect to the Company's expectations, intentions

and projections regarding its future performance, strategic

initiatives, anticipated events or trends and other matters that

are not historical facts and which are, by their nature, inherently

predictive, speculative and involve risks and uncertainty because

they relate to events and depend on circumstances that may or may

not occur in the future. All statements that address expectations

or projections about the future, including statements about

operating performance, strategic initiatives, objectives, market

position, industry trends, general economic conditions, expected

expenditures, expected cost savings and financial results are

forward -- looking statements. Any statements contained in this

Announcement that are not statements of historical fact are, or may

be deemed to be, forward -- looking statements. These

forward-looking statements, which may use words such as "aim",

"anticipate", "believe", "could", "intend", "estimate", "expect",

"may", "plan", "project" or words or terms of similar meaning or

the negative thereof, are not guarantees of future performance and

are subject to known and unknown risks and uncertainties. There are

a number of factors including, but not limited to, commercial,

operational, economic and financial factors, that could cause

actual results, financial condition, performance or achievements to

differ materially from those expressed or implied by these forward

-- looking statements. Many of these risks and uncertainties relate

to factors that are beyond the Company's ability to control or

estimate precisely, such as changes in taxation or fiscal policy,

future market conditions, currency fluctuations, the behaviour of

other market participants, the actions of governments or

governmental regulators, or other risk factors, such as changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including inflation, recession and consumer confidence, on a

global, regional or national basis. Given those risks and

uncertainties, readers are cautioned not to place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date of this Announcement. Each of the Company, JPM and

Numis expressly disclaims any obligation or undertaking to update

or revise publicly any forward-looking statements, whether as a

result of new information, future events or otherwise unless

required to do so by applicable law or regulation.

In particular, no statement in this Announcement is intended to

be a profit forecast or profit estimate and no statement of a

financial metric (including estimates of adjusted EBITDA, profit

before tax, free cash flow or net debt) should be interpreted to

mean that any financial metric for the current or future financial

years would necessarily match or exceed the historical published

position of the Company and its subsidiaries. Certain statements in

this Announcement may contain estimates. The estimates set out in

this Announcement have been prepared based on numerous assumptions

and forecasts, some of which are outside of the Company's influence

and/or control, and is therefore inherently uncertain and there can

be no guarantee or assurance that it will be correct. The estimates

have not been audited, reviewed, verified or subject to any

procedures by the Company's auditors. Undue reliance should not be

placed on them and there can be no guarantee or assurance that they

will be correct.

JPM is authorised by the Prudential Regulation Authority ("PRA")

and regulated in the United Kingdom by the PRA and the Financial

Conduct Authority ("FCA"). Numis is authorised and regulated in the

United Kingdom by the FCA. Each of JPM and Numis is acting

exclusively for the Company and for no one else in connection with

the Placing and will not regard any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Placing or any other matter referred to in this Announcement and

will not be responsible to anyone other than the Company for

providing the protections afforded to its clients or for giving

advice in relation to the Placing or any other matter referred to

in this Announcement.

This Announcement is being issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by or on

behalf of JPM or Numis (apart from the responsibilities or

liabilities that may be imposed by the Financial Services and

Markets Act 2000, as amended ("FSMA") or the regulatory regime

established thereunder) or by their respective affiliates or any of

their respective Representatives as to, or in relation to, the

accuracy, adequacy, fairness or completeness of this Announcement

or any other written or oral information made available to or

publicly available to any interested party or its advisers or any

other statement made or purported to be made by or on behalf of JPM

or Numis or any of their respective affiliates or any of their

respective Representatives in connection with the Company, the

Placing Shares or the Placing and any responsibility and liability

whether arising in tort, contract or otherwise therefor is

expressly disclaimed. No representation or warranty, express or

implied, is made by JPM or Numis or any of their respective

affiliates or any of their respective Representatives as to the

accuracy, fairness, verification, completeness or sufficiency of

the information or opinions contained in this Announcement or any

other written or oral information made available to or publicly

available

to any interested party or its advisers, and any liability

therefor is expressly disclaimed.

The information in this Announcement may not be forwarded or

distributed to any other person and may not be reproduced in any

manner whatsoever. Any forwarding, distribution, reproduction or

disclosure of this Announcement, in whole or in part, is

unauthorised. Failure to comply with this directive may result in a

violation of the Securities Act or the applicable laws of other

jurisdictions.

This Announcement does not constitute a recommendation

concerning any investor's options with respect to the Placing.

Recipients of this Announcement should conduct their own

investigation, evaluation and analysis of the business, data and

other information described in this Announcement. This Announcement

does not identify or suggest, or purport to identify or suggest,

the risks (direct or indirect) that may be associated with an

investment in the Placing Shares. The price and value of securities

can go down as well as up and investors may not get back the full

amount invested upon the disposal of the shares. Past performance

is not a guide to future performance. The contents of this

Announcement are not to be construed as legal, business, financial

or tax advice. Each investor or prospective investor should consult

with his or her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, business, financial or

tax advice.

Any indication in this Announcement of the price at which the

Company's shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings, earnings

per share or income, cash flow from operations or free cash flow

for the Company for the current or future financial periods would

necessarily match or exceed the historical published earnings,

earnings per share or income, cash flow from operations or free

cash flow for the Company.

All offers of the Placing Shares will be made pursuant to an

exemption under the UK Prospectus Regulation from the requirement

to produce a prospectus. This Announcement is being distributed and

communicated to persons in the United Kingdom only in circumstances

in which section 21(1) of FSMA does not apply.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than the main

market for listed securities of the London Stock Exchange.

In connection with the Placing, JPM and Numis and any of their

respective affiliates or any of their respective Representatives,

acting as investors for their own account, may take up a portion of

the Placing Shares in the Placing as a principal position and in

that capacity may retain, purchase, sell, offer to sell for the own

accounts or otherwise deal for their own account in such Placing

Shares and other securities of the Company or related investments

in connection with the Placing or otherwise. Accordingly,

references to Placing Shares being offered, acquired, placed or

otherwise dealt in should be read as including any issue or offer

to, or acquisition, placing or dealing by, JPM and Numis and any of

their respective affiliates and their respective Representatives

acting in such capacity. In addition, JPM and Numis and any of

their respective affiliates or their respective Representatives may

enter into financing arrangements (including swaps, warrants or

contracts for difference) with investors in connection with which

JPM and Numis and any of their respective affiliates may from time

to time acquire, hold or dispose of shares. JPM and Numis do not

intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligations to do so.

The Appendix to this Announcement sets out the terms and

conditions of the Placing. By participating in the Placing, each

Placee will be deemed to have read and understood this Announcement

(including the Appendix) in its entirety, to be participating in

the Placing and making an offer to acquire and acquiring Placing

Shares on the terms and subject to the conditions set out in the

Appendix to this Announcement and to be providing the

representations, warranties, undertakings and acknowledgements

contained in the Appendix to this Announcement.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any 'manufacturer' (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that such Placing Shares are: (a)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each as defined in Chapter 3 of the FCA

Handbook Conduct of Business Sourcebook ("COBS"); and (b) eligible

for distribution through all permitted distribution channels (the

"UK target market assessment"). Notwithstanding the UK target

market assessment, distributors should note that: the price of the

Placing Shares may decline and investors could lose all or part of

their investment; the Placing Shares offer no guaranteed income and

no capital protection; and an investment in the Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The UK target market assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the UK target market assessment, the JPM and

Numis will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the UK target market assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of COBS 9A and COBS 10A, respectively; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase or take any other action whatsoever with respect to the

Placing Shares. Each distributor is responsible for undertaking its

own UK target market assessment in respect of the Placing Shares

and determining appropriate distribution channels.

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any 'manufacturer' (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that such Placing Shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, JPM and Numis will only procure investors who meet the

criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

APPIX I: TERMS AND CONDITIONS OF THE PLACING

IMPORTANT INFORMATION FOR INVITED PLACEES ONLY REGARDING THE

PLACING

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT (INCLUDING APPIX 1 ) AND THE TERMS AND

CONDITIONS SET OUT HEREIN (TOGETHER, THIS "ANNOUNCEMENT") ARE FOR

INFORMATION PURPOSES ONLY AND ARE DIRECTED ONLY AT PERSONS WHOSE

ORDINARY ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING, MANAGING

AND DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR THE

PURPOSES OF THEIR BUSINESS AND WHO HAVE PROFESSIONAL EXPERIENCE IN

MATTERS RELATING TO INVESTMENTS AND ARE : (A) IF IN MEMBER STATES

OF THE EUROPEAN ECONOMIC AREA (THE "EEA"), PERSONS WHO ARE

QUALIFIED INVESTORS WITHIN THE MEANING OF ARTICLE 2(E) OF

REGULATION (EU) 2017/1129 (THE "PROSPECTUS REGULATION") ("QUALIFIED

INVESTORS"); OR (B) IF IN THE UNITED KINGDOM, QUALIFIED INVESTORS

WITHIN THE MEANING OF ARTICLE 2(E) OF THE UK VERSION OF REGULATION

(EU) 2017/1129 AS IT FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 (THE "UK PROSPECTUS REGULATION") WHO

ARE (I) PERSONS WHO FALL WITHIN THE DEFINITION OF "INVESTMENT

PROFESSIONALS" IN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND

MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMED (THE

"ORDER"), OR (II) PERSONS WHO ARE HIGH NET WORTH COMPANIES,

UNINCORPORATED ASSOCIATIONS OR PARTNERSHIPS OR TRUSTEES OF HIGH

VALUE TRUSTS AS DESCRIBED IN ARTICLE 49(2)(A) TO (D) OF THE ORDER;

OR (c) OTHERWISE, PERSONS TO WHOM IT MAY OTHERWISE BE LAWFUL TO

COMMUNICATE IT TO (EACH SUCH PERSONS IN (B) REFERRED TO AS

"RELEVANT PERSONS"). NO OTHER PERSON SHOULD ACT OR RELY ON THIS

ANNOUNCEMENT. BY ACCEPTING THE TERMS OF THIS ANNOUNCEMENT YOU

REPRESENT AND AGREE THAT YOU ARE EITHER A QUALIFIED INVESTOR OR A

RELEVANT PERSON. THIS APPIX AND THE TERMS AND CONDITIONS SET OUT

HEREIN MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT

QUALIFIED INVESTORS IN THE EEA AND RELEVANT PERSONS IN THE UNITED

KINGDOM. PERSONS DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY

THEMSELVES THAT IT IS LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT

ACTIVITY TO WHICH THIS ANNOUNCEMENT AND THE TERMS AND CONDITIONS

SET OUT HEREIN RELATE IS AVAILABLE ONLY IN MEMBER STATES OF THE EEA

TO QUALIFIED INVESTORS AND IN THE UNITED KINGDOM TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH QUALIFIED INVESTORS IN

MEMBER STATES OF THE EEA AND RELEVANT PERSONS IN THE UNITED

KINGDOM. THE INFORMATION CONTAINED HEREIN IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES (INCLUDING ITS TERRITORIES AND

POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE DISTRICT OF

COLUMBIA (COLLECTIVELY, THE "UNITED STATES")), AUSTRALIA, CANADA,

THE REPUBLIC OF SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

OR REQUIRE A PROSPECTUS OR SIMILAR DOCUMENT TO BE FILED. THIS

ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN DO NOT CONSTITUTE

AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR IN ANY OTHER

JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT (INCLUDING APPIX) DOES NOT ITSELF CONSTITUTE

AN OFFER FOR SALE OR SUBSCRIPTION OF ANY SECURITIES IN THE

COMPANY.

THE PLACING SHARES HAVE NOT BEEN AND WILL NOT BE REGISTERED

UNDER THE US SECURITIES ACT OF 1933, AS AMED (THE "SECURITIES

ACT"), OR UNDER THE APPLICABLE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES, AND MAY NOT BE OFFERED OR

SOLD, DIRECTLY OR INDIRECTLY WITHIN, INTO OR IN THE UNITED STATES,

EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS

OF THE SECURITIES ACT AND IN COMPLIANCE WITH THE SECURITIES LAWS OF

ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES. THERE WILL BE

NO PUBLIC OFFER OF THE PLACING SHARES IN THE UNITED STATES, THE

UNITED KINGDOM OR ELSEWHERE.

EACH PLACEE SHOULD CONSULT ITS OWN ADVISERS AS TO LEGAL,

BUSINESS, FINANCIAL, TAX AND RELATED ASPECTS OF ACQUIRING THE

PLACING SHARES.

All offers of the Placing Shares will be made pursuant to an

exemption under the Prospectus Regulation and the UK Prospectus

Regulation from the requirement to produce a prospectus. This

Announcement is being distributed and communicated to persons in

the UK only in circumstances to which section 21(1) of the

Financial Services and Markets Act 2000, as amended ("FSMA") does

not apply.

Persons who are invited to and who choose to participate in the

placing (the "Placing") of the Placing Shares (as defined below) by

making an oral or written offer to acquire Placing Shares

(including any individuals, funds or others on whose behalf a

commitment to acquire Placing Shares is given) ("Placees") will be

deemed to have read and understood this Announcement in its

entirety and to be making such offer on the terms and conditions,

and to be providing (and shall only be permitted to participate in

the Placing on the basis that they have provided) the

representations, warranties, indemnities, acknowledgements,

undertakings and agreements, contained in this Appendix. In

particular, each such Placee represents, warrants, acknowledges and

agrees to each of Auction Technology Group plc (the "Company"),

J.P. Morgan Securities plc ("JPM") and Numis Securities Limited

("Numis" and, together with JPM, the "Joint Bookrunners") that:

1. If it is in the United Kingdom it is a Relevant Person and if

it is in the member state of the EEA it is a Qualified Investor,

and undertakes that it will acquire, hold, manage or dispose of any

Placing Shares that are allocated to it for the purposes of its

business;

2. If it is in Australia, it is a "sophisticated investor"

within the meaning of section 708(8) of the Corporations Act or a

"professional investor" within the meaning of section 708(11) of

the Corporations Act and a wholesale client under section 761G(7)

of the Corporations Act;

3. it is acquiring the Placing Shares for its own account or is

acquiring the Placing Shares for an account with respect to which

it exercises sole investment discretion and has the authority to

make and does make the representations, warranties, indemnities,

acknowledgments, undertakings and agreements contained in this

Announcement;

4. it understands (or if acting for the account of another

person, such person has confirmed that such person understands) the

resale and transfer restrictions set out in this Announcement

(including this Appendix);

5. if it is a financial intermediary, as that term is used in

Article 5(1) of the Prospectus Regulation and the UK Prospectus

Regulation, that it understands that any Placing Shares subscribed

for by it in the Placing will not be acquired on a

non-discretionary basis on behalf of, nor will they be acquired

with a view to their offer or resale to, persons in circumstances

which may give rise to an offer of securities to the public other

than an offer or resale in a member state of the EEA to Qualified

Investors or in the United Kingdom to Relevant Persons, or in

circumstances in which the prior consent of the Joint Bookrunners

has been given to each such proposed offer or resale;

6. it understands that the Placing Shares have not been and will

not be registered under the Securities Act or with any securities

regulatory authority of any state or other jurisdiction of the

United States and may not be offered or sold, directly or

indirectly, within the United States except pursuant to an

exemption from the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States;

7. it and the person(s), if any, for whose account or benefit it

is acquiring the Placing Shares are either (a)(i) outside the

United States and will be outside the United States at the time the

Placing Shares are acquired by it and (ii) acquiring the Placing

Shares in an "offshore transaction" within the meaning of

Regulation S; or (b) a "qualified institutional buyer" as defined

in Rule 144A under the Securities Act (a "QIB") who has executed

and delivered to the Company and the Joint Bookrunners a US

investor letter substantially in the form provided to it;

8. if it is resident in Canada, it is resident in either the

province of Ontario, Quebec, Alberta or British Columbia; is

purchasing as principal, or is deemed to be purchasing as principal

in accordance with applicable Canadian securities laws, for

investment only and not with a view to resale or redistribution; is

not an individual; is an "accredited investor" as such term is

defined in section 1.1 of National Instrument 45-106 - Prospectus

Exemptions ("NI 45-106") or, in Ontario, as such term is defined in

section 73.3(1) of the Securities Act (Ontario); and is a

"permitted client" as such term is defined in section 1.1 of

National Instrument 31-103 Registration Requirements, Exemptions

and Ongoing Registrant Obligations ("NI 31-103"); and

9. the Company and the Joint Bookrunners will rely upon the truth and accuracy of the foregoing representations, warranties, acknowledgements and agreements.

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States.

No representation is made by either of the Joint Bookrunners or

their respective affiliates to any Placees regarding an investment

in the Placing Shares.

IMPORTANT INFORMATION FOR PLACEES ONLY REGARDING THE PLACING

Bookbuild

Following this Announcement, the Joint Bookrunners will today

commence the bookbuilding process in respect of the Placing (the

"Bookbuild") to determine demand for participation in the Placing

by Placees. This Appendix gives details of the terms and conditions

of, and the mechanics of participation in, the Placing. No

commissions will be paid to Placees or by Placees in respect of any

Placing Shares. Members of the public are not entitled to

participate.

The Joint Bookrunners and the Company shall be entitled to

effect the Placing by such alternative method to the Bookbuild as

they may, in their absolute discretion, determine.

Details of the Placing Agreement and of the Placing Shares

The Company has today entered into an agreement (the "Placing

Agreement") with the Joint Bookrunners under which, subject to the

terms and conditions set out therein, each of the Joint Bookrunners

has agreed, severally and not jointly or jointly and severally, as

agent for and on behalf of the Company, to use its reasonable

endeavours to procure Placees for up to 19,999,990 ordinary shares

of 0.01 pence each in the capital of the Company (the "Placing

Shares") representing up to just less than 20.0 per cent. of the

Company's existing issued share capital, at a price to be

determined following completion of the Bookbuild and, to the extent

that any Placee defaults in paying the Placing Price (as defined

below) in respect of any of the Placing Shares allocated to it,

each of the Joint Bookrunners has agreed, severally and not jointly

or jointly and severally, to subscribe for such Placing Shares at

the Placing Price. JPM and Numis are acting as joint global

co-ordinators and joint bookrunners in connection with the

Placing.

The Placing Shares will, when issued, be credited as fully paid

and will rank pari passu in all respects with the existing ordinary

shares of 0.01 pence each in the capital of the Company (the

"Ordinary Shares"), including the right to receive all dividends

and other distributions declared, made or paid in respect of such

Ordinary Shares after the date of issue of the Placing Shares.

The allotment and issue of the Placing Shares will be effected

by way of a placing of new Ordinary Shares in the Company for

non-cash consideration. JPM will subscribe for ordinary shares and

redeemable preference shares in Project Haka Limited ("JerseyCo"),

a Jersey incorporated wholly owned subsidiary of the Company, for

an amount approximately equal to the net proceeds of the Placing.

The Company will allot and issue the Placing Shares on a

non-pre-emptive basis to Placees in consideration for the transfer

to the Company by JPM of the ordinary shares and redeemable

preference shares in JerseyCo that will be issued to JPM.

Applications for listing and admission to trading

Applications will be made to the Financial Conduct Authority

(the "FCA") for admission of the Placing Shares to listing on the

premium listing segment of the Official List of the FCA (the

"Official List") and to London Stock Exchange plc (the "London

Stock Exchange") for admission of the Placing Shares to trading on

its main market for listed securities (together, "Admission").

It is expected that Admission will become effective at or around

8.00 a.m. on 22 June 2021 and that dealings in the Placing Shares

will commence at that time. The Placing is conditional upon, among

other things, Admission becoming effective and the Placing

Agreement not being terminated in accordance with its terms.

Participation in, and principal terms of, the Placing

1. Each of JPM and Numis is acting as a joint global

co-ordinator, joint bookrunner and agent of the Company in

connection with the Placing.

2. Participation in the Placing will only be available to

persons who may lawfully be, and are, invited to participate by the

Joint Bookrunners. Each of the Joint Bookrunners and their

respective agents and affiliates are each entitled to enter bids in

the Bookbuild as principal.

3. The Bookbuild will establish a single price per Placing Share

payable to the Joint Bookrunners by all Placees whose bids are

successful (the "Placing Price"). The final number of Placing

Shares and the Placing Price will be determined by the Company (in

consultation with the Joint Bookrunners) following completion of

the Bookbuild. Any discount to the market price of the existing

Ordinary Shares will be determined in accordance with the FCA's

Listing Rules. The Placing Price and the final number of Placing

Shares to be issued will be announced on a FCA-listed regulatory

information service (a "Regulatory Information Service") following

the completion of the Bookbuild.

4. To bid in the Bookbuild, prospective Placees should

communicate their bid by telephone or in writing to their usual

sales contact at either of the Joint Bookrunners. Each bid should

state the number of Placing Shares which the prospective Placee

wishes to subscribe for at either the Placing Price which is

ultimately established by the Company and the Joint Bookrunners or

at prices up to a price limit specified in its bid. Bids may be

scaled down by the Joint Bookrunners on the basis referred to in

paragraph 11 below.

5. A bid in the Bookbuild will be made on the terms and subject

to the conditions in this Appendix and will be legally binding on