TIDMAQSG

RNS Number : 6024U

Aquila Services Group PLC

26 November 2019

For immediate release

26 November 2019

Aquila Services Group plc

Unaudited Interim Results for the six months ended 30 September

2019

Aquila Services Group plc ("the Company"), is the holding

company for Altair Consultancy & Advisory Services Ltd

("Altair"), Aquila Treasury and Finance Solutions Ltd ("ATFS") and

Oaks Consultancy Ltd ("Oaks") which form the Group ("the

Group").

The Group works in the UK and internationally. Its expertise is

in the provision, financing and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations, high level business advice to the

property sector and support for organisations including

multi-academy education trusts and sports foundations working in

communities to improve health and well-being opportunities.

Results highlights

6 months to 6 months to Year ended

30 September 30 September 31 March

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP000s GBP000s GBP000s

Revenue 3,891 3,592 7,656

Gross Profit 980 773 1,867

Operating Profit 254 222 607

EPS 0.55p 0.47p 1.32p

Declared Dividend per

Share 0.30p 0.29p 0.89p

Cash Balances 1,127 1,029 1,720

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014.

For further information please visit

www.aquilaservicesgroup.plc.co.uk or contact:

Aquila Services Group plc

Claire Banks

Group Finance Director and Company Secretary

Tel: 020 7934 0175

Beaumont Cornish Limited, Financial Adviser

Roland Cornish

Tel: 020 7628 3396

Chair's statement

Dear Shareholder,

I am pleased to present the half-year report and the interim

results for the 6 months to 30 September 2019.

Aquila Services Group plc ('the Company') is the holding company

for Altair Consultancy & Advisory Services Ltd ('Altair') and

Aquila Treasury & Finance Solutions Ltd ('ATFS') and Oaks

Consultancy Ltd ('Oaks') which form the group ('the Group').

The Group is an independent consultancy specialising in the

provision, financing and management of affordable housing by

housing associations, local authorities, government agencies and

other non-profit organisations, high level business advice to the

commercial property sector and support for organisations including

multi-academy education trusts and sports foundations working in

communities to improve health and well being opportunities.

The half-year results for the Group demonstrates the continuing

sustainability of our business model and the benefits of investment

in longer term planned growth, both organic and targeted

acquisitions. The period included the acquisition of our newest

trading subsidiary, Oaks, the continuing expansion of our

development services offering, and our international work.

The six months has seen a continuation of the strategy described

in the annual report for the previous financial year. Our

governance and executive team have been streamlined to concentrate

on our particular specialisms. We have now moved from the

integration of the 'pod' property consultancy business into an

expansion phase. We now have a solid base to grow our international

business and the brand has been renamed Altair International to

reflect our growth beyond Africa. Responding to market forces, we

are reshaping our traditional interim support services to a short

term placement model specialising in support at higher skills

levels, building on the success of this model for our development

expertise.

The results of this balanced strategy are allowing both our

longer term objectives to be matched with the targets of increasing

turnover and higher operating profit which are reflected in the

results for the period. The acquisition of Oaks in June 2019 and

the need to integrate that business into the Group means that there

was only a marginal contribution to both turnover and operating

profit from the new business in the period, but we anticipate

benefits gradually being realised in the second half of the year.

Despite the uncertainty that much of the economy faces and

reflected in our operating environment, our business model enables

us to enter this new period with expectations of continuing

progress and this confidence is reflected in the continuation of

our progressive dividend policy for the half-year.

There are likely to be further acquisition opportunities in the

coming years that could fit our business model. To date we have

utilised new equity and cash generated from retained profits as

consideration and avoided debt, in particular to provide comfort to

those accepting our equity. As opportunities become larger, we will

seek to continue this approach but for the right business fit, we

may need to look at other financing structures.

Trading results

The Group saw an increase in turnover of 8.3% for the 6 months

to 30 September 2019 compared to the 6 months ended 30 September

2018. Gross profit was GBP980k (September 2018: GBP773k; March

2019: GBP1,867k) with operating profits before share option charges

of GBP306k (September 2018: GBP281k; March 2019: GBP724k).

6 months 6 months Year ended

to to 31 March

2019

30 September 30 September (GBP000's)

2019 2018

(GBP000's) (GBP000's)

Turnover 3,891 3,592 7,656

Gross Profit 980 773 1,867

Operating profit (before

share options charge) 306 281 724

Share option charge 52 59 117

Operating profit (after

share option charge) 254 222 607

EPS 0.55p 0.47p 1.32p

The Group has a strong net asset position with over GBP1.1m in

cash held at the 30 September 2019.

Dividend

The Directors propose to declare an interim dividend of 0.30p

(2018: 0.29p) per share, an increase of 3.5% which will be paid on

20 December 2019 to shareholders on the register at 6 December

2019.

Business review

Our business streams and investments

The underlying business of Altair remains robust and we have

seen significant growth in both demand and our client base for most

of our consultancy business, specifically our development, project

management and recruitment services. This reflects the relaxation

of government restraints on local authorities entering into direct

supply of homes, the historically cheap borrowing available to our

clients and the potential surpluses to be made from development of

residential accommodation for market sale or rent which supports

cross-subsidy for affordable housing. With some evidence of a

downturn in residential property values in London and the South

East, it is yet to be seen whether this will make our clients more

cautious and how this impacts on the private investors, mainly

institutions and private equity houses, who are looking for long

term investments in the sector and whom we have been supporting.

Historically, downturns in the property market have been seen as

opportunities by our clients, many of whom tend to act on a

counter-cyclical business model, and we are not expecting this to

have a major impact on the demand for our services.

Our business streams that provide support with governance,

management structures, financial modelling and business planning

have seen steady demand during the period. With government's

attention diverted to other matters, there have been few serious

new initiatives or regulatory change that supports demand for these

specialisms. We continue to grow our client base, now working with

an increasing number of the large-scale investors in social housing

such as L&G and the Man Group. We would expect that with a

period of stable government concentrating on wider domestic issues,

there will be a more dynamic environment for these business streams

to support.

Our specialist treasury management subsidiary (ATFS) has had a

quiet period with cheap debt and both investors and institutions

only too willing to lend to the sector. Most have already satisfied

the forward funding requirements in advance of the possible Brexit

outcome. The focus of client demand has moved to portfolio

management from fundraising. For this business it is a period of

transformation as it concentrates on providing ongoing services and

is now looking to widen its offering to more than debt management.

In particular for both the Finance and Treasury teams the increase

in the cost of borrowing for local authorities, as a result of a 1%

rise in their principle funder mechanism, the Public Works Loan

Board (PWLB) means that local authorities may now look to

non-government borrowing to deliver their programmes. This is seen

as a major opportunity and we are actively looking to support our

local authority clients in remodelling their business plans and

seeking alternative forms of finance.

Traditionally, the Group has included a team of associate

consultants available to cover as locums or interims for gaps in

senior staffing at clients, resulting from staff turnover,

maternity/paternity leave or initial staffing for new initiatives.

The restriction on the expansion of this business was always the

pressure on finding suitable associates, particularly when our

interims were often recruited as permanent staff by our clients.

Over the last 12 months there has been a rapid change as our client

base is increasingly dominated by larger organisations who can fill

gaps from redeploying existing staff. This service was also at a

cost disadvantage because many of our clients cannot recover the

VAT charged and larger clients with a continuing requirement can

and do use social media to recruit directly or in some cases keep a

team within their own establishment. At the same time, demand for

more short term but full time support for specific projects has

increased where high level expertise is needed and the timeframe is

not long enough to provide internal 'climatization' to the

organisation or the sector. This is referred to as the 'placement'

model and uses a mix of associates with higher skill levels and

in-depth familiarisation with the sector, as well as our own

specialist staff. This model has been particularly successful

within our development business stream and we are increasingly

rolling it out to other parts of the business, as a variation of

the interim model.

Altair Africa has now been rebranded as Altair International, as

we work with clients in other parts of the world. The business

continues to grow and during the period significant new contracts

were signed in Rwanda, Nigeria and Kyrgyz Republic, as well as a

contract to review the role of Real Estate Investment Trusts

(REITs) internationally for the Centre For Affordable Housing

Finance (CAHF). We have also been successful in being added to

framework procurement arrangements in a number of countries such as

Kenya and those

operated by pan national organisations. Some contracts are

directly between Altair and the client but most are part of a

consortium covering a wider range of activities. We are now in the

process of looking to formalise arrangements to bid for larger

contracts as part of joint ventures with other major international

operators, such as Sweco, an architectural and engineering

consultancy, and a UK based consultancy that specialises in

economic advice. At the same time, we are building a 'book' of

smaller, local consultancies as many contracts require a minimum

percentage of local content. Our aim is to continue to build this

business stream as part of our client diversification strategy.

In June 2019 we acquired the entire share capital of Oaks

Consultancy Ltd, a sport and education consultancy whose main

client base is the UK community and voluntary sector, local

authorities, membership organisations and socially minded private

sector business. They are growing this client base and recently

achieved some international contracts particularly as part of the

Worldwide Grass Roots Football initiatives. Oaks business focuses

on three core areas: strategy, business planning and income

generation; many strands of which are complementary to our existing

Altair services. Oaks have recently been awarded their first

contract with housing providers, since acquisition. The commission

is to provide income generation support for 14 BME Housing

Associations in support of the Leadership 2025, diverse sector

leadership Foundation programme. We expect that for our UK and

international clients this will enable businesses to deliver a

wider service offering to a broader range of clients.

Oaks are based in offices in Birmingham City Centre employing 18

staff. The financial statements for Oaks at 31 March 2019 showed

turnover for the 12 months of GBP909k with profit before taxation

of GBP251k. This latter needs to be adjusted for senior management

salaries, as like many smaller private companies, managers relied

on dividends for much of their remuneration. The consideration for

the purchase has recently been finalised as it depended on

confirming the values of certain assets and liabilities. The agreed

total, excluding any additional deferred consideration is

GBP1,144,679 of which 35% was paid in cash and 65% in new shares in

the Aquila Group. As the acquisition was only completed part way

through the period, and the weeks following were, in the main, a

period of integration, the benefit of the acquisition will start to

be generated in the second period.

Lastly, we continue to hold our equity stake in 3C Consultancy

and AssetCore, respectively a specialist IT consultancy and a

company building a financial debt management platform for the

affordable housing sector. We hold 25% of the equity of 3C which

continues to see a growing business, and around 8% of the equity of

AssetCore which now has 12 live housing association clients and

continues to develop its platform. AssetCore is currently in the

process of a rights issue to existing shareholders for additional

equity to assist in funding the future product development. Our

Group Chief Executive Steven Douglas CBE continues to act as a

non-executive director of 3C Consultancy and I remain as a

non-executive director of AssetCore. Richard Wollenberg, a

non-executive director of Aquila, and myself hold shares in

AssetCore amounting to approximately a total of 8% each of the

issued equity. Both of us have agreed to contribute to the current

fundraising through a rights issue by the company.

Risks and uncertainties

The Directors do not consider that the Group's principal risks

and uncertainties have changed since the publication of the annual

report for the year ended 31 March 2019, which contains a detailed

explanation of the risks relevant to the Group on Page 9 and is

available at

https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/AQSG/14126154.html

Outlook

The continuing success of the Group is to be responsive to our

client base whilst at the same time growing the range of services

and further exploiting our technical expertise. As can be seen from

my report, there are always continuing subtle changes in our market

place to which we have to respond. The history of the Group as one

of the major providers of these services is that we are constantly

listening and adjusting our offering. Nowhere is this more

emphasised than in our recognition of the trends in the 'interim'

services and the movement towards the placement model.

The acquisition of Oaks, the widening of our service offering

and the diversification of our client base, particularly in the

international sector, is part of our longer term planning and we

anticipate this will be a recurring theme.

The sectors in which we work are essential elements of developed

and developing economies that wish to make a better and more

socially sustainable world. They reflect basic needs, not fashion

or transient technology, and providing we continue to offer the

relevant high quality support, there will always be a demand for

our services. For the benefit of both our clients and our

shareholders, it is important that we remain a robust, growing and

dynamic organisation. We believe we have the right business model

and that all our stakeholders, particularly our shareholders, will

see progress reflected in our financial results.

Lastly, I cannot end without thanking the staff and my fellow

directors for all their efforts during the period and hope that we

continue to provide them with an exciting and rewarding place to

work.

I look forward to reporting to you further after the year

end.

Derek Joseph - Chair

25 November 2019

Directors' Report

Substantial shareholdings

As at 30 September 2019, the Company was aware of the following

notifiable interests in its voting rights:

Number of Percentage of Nature of

Ordinary shares Voting rights holding

Richard Wollenberg* 3,808,406 10.8% Direct

Chris Wood 3,279,440 9.3% Direct

Susan Kane 3,279,440 9.3% Direct

Fiona Underwood** 3,279,440 9.3% Direct

Steven Douglas 3,144,305 8.9% Direct

Derek Joseph 3,005,538 8.5% Direct

Jeffrey Zitron 2,798,403 7.9% Direct

Matt Carroll 1,307,229 3.7% Direct

Hannah Breitschadel 1,307,229 3.7% Direct

*Includes shares held by immediate family members of Richard

Wollenberg

**Fiona Underwood's shares are held in a nominee account at Old

Mutual plc.

Related party transactions

During the 6 months to 30 September 2019, the non-executive

directors were paid fees of GBP7,000 (6 months to September 2018:

GBP5,054).

During the 6 months to 30 September 2019, the Group charged

GBPNil (6 months to September 2018: GBP5,214) to DMJ Consultancy

Services Limited for office costs and secretarial services, a

company in which Derek Joseph is a director and shareholder.

Remuneration of Directors and key management personnel

The remuneration of the directors, who are the key management

personnel of the Group, is set out below.

6 months to 6 months to Year ended

30 September 30 September 31 March

2019 (unaudited) 2018 (unaudited) 2019

(audited)

GBP GBP GBP

Short-term employee

benefits 295,833 283,592 655,495

Share-based payments 26,973 31,351 64,232

Post-retirement benefits 9,600 10,378 21,900

------------------ ------------------ -----------

332,406 325,321 741,627

================== ================== ===========

Corporate Governance

The UK Corporate Governance Code (the code), as appended to the

listing rules, sets out Principles of Good Corporate Governance and

Code provisions which are applicable to listed companies

incorporated in the United Kingdom. As a standard listed company,

the Company is not subject to the UK Corporate Governance Code, but

the Board recognises the value of applying the principles of the

code where appropriate and proportionate and endeavours to do so

where practicable.

Responsibility Statement

The Directors, whose names and functions are set out at the end

of this report, are responsible for preparing the Unaudited Interim

Condensed Consolidated Financial Statements in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority ('DTR') and with International

Accounting Standard 34 on Interim Financial reporting (IAS34). The

Directors confirm that, to the best of their knowledge, this

Unaudited Interim Condensed Consolidated Report has been prepared

in accordance with IAS34 as adopted by the European Union. The

interim management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8 namely:

-- an indication of key events occurred during the period and

their impact on the unaudited interim condensed consolidated

financial statements and a description of the principal risks and

uncertainties for the second half of the financial year, and

-- related party transactions that have taken place during the

period and that have materially affected the financial position or

the performance of the business during that period.

Claire Banks - Group Finance Director

25 November 2019

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2019

Six months to 30 September 2019 Six months to 30 September 2018 Year ended

31 March

2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

Revenue 3,891,381 3,592,129 7,655,632

Cost of sales (2,910,891) (2,818,980) (5,788,472)

-------------------------------- -------------------------------- ------------

Gross profit 980,490 773,149 1,867,160

Administrative expenses (726,713) (551,460) (1,259,523)

-------------------------------- -------------------------------- ------------

Operating profit 253,777 221,689 607,637

Finance income 175 22 1,860

Profit before taxation 253,952 221,711 609,497

Income tax expense (59,286) (55,640) (143,460)

-------------------------------- -------------------------------- ------------

Profit and total comprehensive

income for the period 194,666 166,071 466,037

================================ ================================ ============

Earnings per share attributable to

owners of the parent

Weighted average number of shares:

* Basic 35,307,776 35,265,461 35,272,301

* Diluted 40,688,624 39,989,368 40,353,113

Basic earnings per share 0.55p 0.47p 1.32p

Diluted earnings per share 0.48p 0.42p 1.15p

Condensed Consolidated Statement of Financial Position

As at 30 September 2019

30 September 2019 30 September 2018 31 March

2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

Non-current assets

Goodwill 3,778,748 2,027,688 2,027,688

Property, plant and equipment 94,232 90,458 72,270

Investment in associates 226,620 226,620 226,620

Investments 121,104 121,104 121,104

------------------ ------------------ ------------

4,220,704 2,465,870 2,447,682

Current assets

Trade and other receivables 2,260,888 2,192,146 2,193,927

Cash and bank balances 1,126,850 1,028,951 1,719,068

------------------ ------------------ ------------

3,387,738 3,221,097 3,912,995

Current liabilities

Trade and other payables 2,701,882 1,143,599 1,594,632

Corporation tax 268,306 197,415 162,691

2,970,188 1,341,014 1,757,323

Net current assets 417,550 1,880,083 2,155,672

------------------ ------------------ ------------

Net assets 4,638,254 4,345,953 4,603,354

================== ================== ============

Equity

Share capital 1,765,389 1,763,273 1,765,389

Share premium account 1,487,512 1,487,512 1,487,512

Merger reserve 2,412,861 2,412,861 2,412,861

Share-based payment reserve 719,959 617,136 667,878

Retained losses (1,747,467) (1,934,829) (1,730,286)

------------------ ------------------ ------------

Equity attributable to the owners of the parent 4,638,254 4,345,953 4,603,354

Condensed Consolidated Statement of Changes in Equity

Share capital Share premium Merger relief Share based Retained losses Total equity

account reserve payments

reserve

GBP GBP GBP GBP GBP GBP

As at 1 April

2018 1,763,273 1,487,512 2,412,861 557,653 (1,906,940) 4,314,359

Total

comprehensive

income - - - - 166,071 166,071

Share based

payment - - - 59,483 - 59,483

Dividend - - - - (193,960) (193,960)

-------------- ---------------- ---------------- --------------- ---------------- -------------

As at 30

September 2018 1,763,273 1,487,512 2,412,861 617,136 (1,934,829) 4,345,953

============== ================ ================ =============== ================ =============

Issue of shares 2,116 - - - - 2,116

Transfer of

exercise of

options - - - (6,846) 6,846 -

Total

comprehensive

income - - - - 299,966 299,966

Share based

payment - - - 57,588 - 57,588

Dividend - - - - (102,269) (102,269)

-------------- ---------------- ---------------- --------------- ---------------- -------------

As at 31 March

2019 1,765,389 1,487,512 2,412,861 667,878 (1,730,286) 4,603,354

-------------- ---------------- ---------------- --------------- ---------------- -------------

Total

comprehensive

income - - - - 194,666 194,666

Share based

payment - - - 52,081 - 52,081

Dividend - - - - (211,847) (211,847)

-------------- ---------------- ---------------- --------------- ---------------- -------------

As at 30

September 2019 1,765,389 1,487,512 2,412,861 719,959 (1,747,467) 4,638,254

============== ================ ================ =============== ================ =============

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2019

Six months to 30 September Six months to 30 September Year ended

31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flow from operating activities

Profit for the period 194,666 166,071 466,037

Interest received (175) (22) (1,860)

Income tax expense 59,286 55,640 143,460

Share based payment charge 52,081 59,483 117,071

Depreciation 29,052 25,149 51,692

--------------------------- --------------------------- -----------

Operating cash flows before movement in

working capital 334,910 306,321 776,400

(Increase)/decrease in trade and other

receivables (66,961) (82,468) (84,249)

(Decrease)/increase in trade and other

payables (389,596) 114,679 565,712

--------------------------- --------------------------- -----------

Cash generated by operations (121,647) 338,532 1,257,863

Income taxes paid 46,329 - (122,544)

Net cash inflow/(outflow) from operating

activities (75,318) 338,532 1,135,319

Cash flow from investing activities

Interest received 175 22 1,860

Purchase of property, plant and equipment (51,014) (19,860) (28,215)

Acquisition of Goodwill (254,214) - -

Acquisition of investment in an associate - (65,770) (65,770)

Net cash outflow from investing activities (305,053) (85,608) (92,125)

Cash flows from financing activities

Proceeds of share issue - - 2,116

Dividends paid (211,847) (193,960) (296,229)

Net cash outflow from financing activities (211,847) (193,960) (294,113)

--------------------------- --------------------------- -----------

Net increase/(decrease) in cash and cash

equivalents (592,218) 58,964 749,081

Cash and cash equivalents at beginning of the

period 1,719,068 969,987 969,987

--------------------------- --------------------------- -----------

Cash and cash equivalents at end of the period 1,126,850 1,028,951 1,719,068

=========================== =========================== ===========

Notes to the Condensed set of Financial Statements

for the six months ended 30 September 2019

1. General information

The Company and its subsidiaries (together "the Group") are a

major provider of consultancy services to organisations that

develop, fund or manage affordable housing.

The Company is a public limited company domiciled in the United

Kingdom and incorporated under registered number 08988813 in

England and Wales. The Company's registered office is Tempus Wharf,

29a Bermondsey Wall West, London, SE16 4SA.

2. Basis of preparation

The Unaudited Condensed Consolidated Interim Financial

Statements of the Group have been prepared on the basis of the

accounting policies, presentation, methods of computation and

estimation techniques used in the preparation of the audited

accounts for the period ended 31 March 2019 and expected to be

adopted in the financial information by the Company in preparing

its annual report for the year ending 31 March 2020.

This Interim Consolidated Financial Information for the six

months ended 30 September 2019 has been prepared in accordance with

IAS 34, 'Interim Financial Reporting'. This Interim Consolidated

Financial Information is not the Group's statutory financial

statements and should be read in conjunction with the annual

financial statements for the year ended 31 March 2019, which have

been prepared in accordance with International Financial Reporting

Standard (IFRS) and have been delivered to the Registrar of

Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The Interim Consolidated Financial Information for the six

months ended 30 September 2019 is unaudited. In the opinion of the

Directors, the Interim Consolidated Financial Information presents

fairly the financial position, and results from operations and cash

flows for the period.

The Directors have made an assessment of the Group's ability to

continue as a going concern and are satisfied that the Group has

adequate resources to continue in operational existence for the

foreseeable future. The Group, therefore, continues to adopt the

going concern basis in preparing its consolidated financial

statements.

The financial statements are presented in sterling, which is the

Group's functional currency as the UK is the primary environment in

which it operates.

3. Operating segments

The Group has three reportable segments being: consultancy,

interim management and treasury management services, the results of

which are included within the financial information. In accordance

with IFRS8 'Operating Segments', information on segment assets is

not shown, as this is not provided to the chief operating

decision-maker.

The principal activities of the Group are as follows:

Consultancy - a range of services to support the business needs

of a diverse range of organisations (including housing associations

and local authorities) across the housing sector. Most consultancy

projects run over one to two months and on-going business

development is required to ensure a full pipeline of consultancy

work for the employed team.

Interim Management - individuals are embedded within housing

organisations (normally housing associations, local authorities and

ALMOs) in a substantive role, normally for a specified period.

Interim management provides the Group with a more extended forward

sales pipeline as the average contract is for six months. This

section of the business provides low risk as the interim

consultants are placed on a rolling contractual basis and provides

minimal financial commitment as associates to the business, rather

than using employees for these roles.

Treasury Management - a range of services providing treasury

advice and fund-raising services to non-profit making organisations

working in the affordable housing and education sectors. Within

this segment of the business several client organisations enter

fixed period retainers to ensure immediate call-off of the required

services.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment profit represents the

profit earned by each segment, without allocation of central

administration costs, including Directors' salaries, finance costs

and income tax expense. This is the measure reported to the Group's

Chief Executive for the purpose of resource allocation and

assessment of segment performance.

2019 2018

GBP GBP

Revenue from Consultancy 3,320,072 2,532,640

Revenue from Interim Management 398,680 752,578

Revenue from Treasury Management 172,629 306,911

---------- ----------

3,891,381 3,592,129

========== ==========

Within consultancy revenues, approximately 6% (2018: 7%) has

arisen from the segment's largest customer; within interim

management 18% (2018: 13%); within treasury management 34% (2018:

36%).

Geographical information

Revenues from external customers, based on location of the

customer, are shown below:

2019 2018

GBP GBP

UK 3,643,400 3,387,891

Republic of Ireland 180,732 155,322

Rest of World 67,249 48,916

---------- ----------

3,891,381 3,592,129

========== ==========

4. Business Combinations

On 11 June 2019, the Group acquired 100% of the issued share

capital of Oaks Consultancy Ltd, a company incorporated in the UK.

The principal activity of Oaks is that of consultancy within the

sport and education sector.

The transaction has been accounted for by the acquisition method

of accounting. This comprises an initial consideration of

GBP1,144,679 being GBP414,432 in cash and GBP730,247 in ordinary

shares and a maximum deferred contingent consideration of

GBP555,321 to be satisfied 35% cash and 65% shares, which is

payable on the annual recurring revenue (ARR) growth of the

acquired business. Deferred contingent consideration that becomes

due shall be satisfied in the period from March 2020 to March

2022.

Due to the timing of the acquisition, the acquisition accounting

adjustments were not complete as at 30 September 2019, however will

be finalised prior to 31 March 2020.

The Board is continuing its evaluation of to what extent any

additional identifiable assets acquired in relation to Oaks exist

and need to be shown separately from goodwill. The evaluation will

be completed and reported on in the annual report and financial

statements to 31 March 2020.

The provisional carrying amount of each class of Oaks

Consultancy Limited's assets before combination is set out

below:

Book value

GBP

Tangible assets 34,273

Trade and other receivables 315,395

Cash and cash equivalents 181

Trade and other payables (348,707)

-----------

1,142

Goodwill arising on acquisition 1,751,060

-----------

Consideration:

Satisfied by:

Initial cash consideration 202,012

Deferred cash consideration 212,420

Deferred consideration of Ordinary Shares 730,247

Deferred contingent consideration 555,321

1,700,000

===========

Acquisition-related costs capitalised as part of the investment

total GBP52,202.

Included within the Condensed Consolidated Statement of

Comprehensive Income are the following amounts in relation to Oaks

Consultancy Limited.

GBP

Revenue 265,629

Loss (1,474)

5. Share capital

The Company has one class of share in issue being ordinary

shares with a par value of 5p. Allotted, issued and called up

ordinary shares of GBP0.05 each:

Number Amount called up and fully paid

GBP

As at 1 April 2018 35,265,461 1,763,273

Issued during the period - -

----------- --------------------------------

As at 30 September 2018 35,265,461 1,763,273

Issued during the period 42,315 2,116

----------- --------------------------------

As at 31 March 2019 35,307,776 1,765,389

Issued during the period - -

----------- --------------------------------

As at 30 September 2019 35,307,776 1,765,389

=========== ================================

As at 1 April 2019 and 30 September 2019 a total of 5,438,532

options were held by Directors and employees of the Group. The

exercise price of the options outstanding at 30 September 2019

range between GBP0.05 and GBP0.42.

6. Going concern

The Group has sufficient financial resources to enable it to

continue its operational activities for the foreseeable future.

Accordingly, the Directors consider it appropriate to adopt the

going concern basis in preparing these interim accounts.

7. Dividend

An interim dividend of 0.30p will be paid on 20 December 2019 to

shareholders on the register at 6 December 2019 at a cost of

GBP105,923.

8. Related party disclosures

Balances and transactions between the Group and other related

parties are disclosed below:

Dividends totalling GBP98,292 (2018: GBP90,100) were paid in the

period in respect of Ordinary Shares held by the Company's

directors.

During the period to 30 September 2019 the Group charged GBPNil

(2018: GBP5,000) to DMJ Consultancy Services Limited for

administrative services, a company in which Derek Joseph serves as

a director. At 30 September 2019, the balance owed to the Group by

DMJ Consulting Limited was GBPNil (2018: GBP5,000).

At 30 September 2019, the balance owed to Richard Wollenberg for

services as a non-executive director were GBP6,000 (2018:

GBP2,000).

Financial Calendar

Year Date Comments

2019 26 November Interim results 2019 announced

5 December Ex-dividend date

6 December Record date

20 December Payment date for interim dividend

2020 31 March End of accounting year

By 31 July 2020 Annual Financial Report to

be published and announced

July Annual General Meeting

August Final dividend to be paid

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DELFLKFFZFBE

(END) Dow Jones Newswires

November 26, 2019 02:00 ET (07:00 GMT)

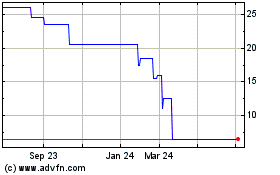

Aquila Services (LSE:AQSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aquila Services (LSE:AQSG)

Historical Stock Chart

From Feb 2024 to Feb 2025