Anglo-Eastern Plantations PLC Trading Statement (1962P)

November 15 2016 - 4:00AM

UK Regulatory

TIDMAEP

RNS Number : 1962P

Anglo-Eastern Plantations PLC

15 November 2016

15 November 2016

Anglo-Eastern Plantations Plc

("AEP" or the "Group")

Trading Statement

Anglo-Eastern Plantations Plc and its subsidiaries, which owns,

operates and develops plantations in Indonesia and Malaysia,

amounting to some 128,600 hectares producing mainly palm oil and

some rubber of which approximately 65,500 hectares are planted,

today announces a trading update in respect of the period since 30

June 2016.

Operational and financial performance

For the first nine months ended 30 September 2016, our own

production of fresh fruit bunches ("FFB") was 628,700mt, a decrease

of 5% compared to the same period in 2015 (9M15: 660,500mt). FFB

bought-in was 509,250mt, which represents a decrease of 4% in

comparison with the same period in 2015 (9M15: 532,100mt). Total

Crude Palm Oil ("CPO") produced was 235,350mt, 2% lower than the

corresponding period in 2015 (9M15: 239,700mt) due to both lower

FFB production and external FFB purchase.

CPO CIF Rotterdam price averaged $688/mt for the first nine

months to 30 September 2016. This represents an increase of 9% from

the average price of $630/mt recorded in the comparative period of

2015 and is above the price of $570/mt at the start of 2016.

The Group's balance sheet remains strong with the Company

continuing to generate positive cash flow. The Company's Long Term

Development Loans totalled $35.5m as at 30 September 2016 (3Q15:

$34.75m). The Group had net cash of $72.7m as at 30 September 2016

(3Q15: $68.3m).

Development

The Group's new planting for nine months ended 30 September 2016

totalled 1,003 hectares, of which replanting made up 309 hectares.

As reported previously the Group is facing difficulty in concluding

land compensation settlement with villagers in Sumatera due to

unreasonably high land prices. These negotiations are continuing

and the Management is confident that some of these negotiations

will be concluded successfully.

The construction of the two biogas plants for the mills in

Bengkulu and Kalimantan are in the final stages of construction.

Membranes have been installed to trap the biogas emitted from the

palm oil mill effluents ("POME"). Various equipment are being

progressively installed and should be ready by the end of the year.

The biogas plants when completed are expected to generate a

combined 3 Megawatt of electrical power. A surplus of 15.6 million

kilowatt hour of electricity is projected to be generated which the

Group intends to sell to the State Electricity Company. The mills

will further reduce their reliance on fossil fuels and at the same

time reduce the Group's carbon foot print.

Outlook

CPO closed at the price of $770/mt on 11 November 2016,

representing a 35% increase from $570/mt from the start of the

year. The El Nino weather phenomenon which resulted in severe

drought last year has reduced the FFB production in both Indonesia

and Malaysia leading to a gradual increase in price.

The CPO price outlook for the remainder of the year should

remain stable especially with the coming monsoon which is expected

to disrupt FFB production.

For further enquiry, contact:

Anglo-Eastern Plantations

Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon

Andrew Godber +44 (0)20 7886 2500

Note: This announcement contains inside information which is

disclosed in accordance with the Market Abuse Regulation which came

into effect on 3 July 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTGIBDBBDBBGLU

(END) Dow Jones Newswires

November 15, 2016 04:00 ET (09:00 GMT)

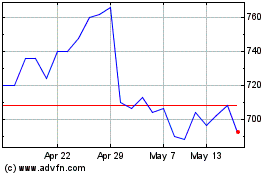

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Oct 2024 to Nov 2024

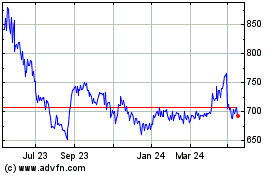

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Nov 2023 to Nov 2024