TIDMADME

RNS Number : 9860U

ADM Energy PLC

29 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

29 November 2023

ADM Energy PLC

("ADM" or the "Company")

Energy Technology Investment

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a

natural-resources investing company, is pleased to announce that,

in line with its Investing Policy and its announcement of 14

November 2023, it has made a further investment in an energy

technology company focused on providing technology solutions to the

upstream sector of the U.S. oil and gas business.

Highlights

-- Acquisition of approximately 53.1% economic interest in OFX

Technologies, LLC ("OFXT") 100% owner of Efficient Oilfield

Solutions, LLC, a revenue generative, technology company focused on

delivering technology solutions that increase efficiency, lower

costs and aid in the management of regulatory requirements of the

U.S. upstream oil and gas industry ("the Investment")

-- Total Maximum Consideration of US$1,285,000 comprised of the

issue of 86,035,489 new ordinary shares at 1p each; 39,959,017

3-year, 1p warrants and US$235,000 in cash.

-- The Total Maximum Consideration implies a value of OFXT of

approximately US$2.3 million or 4.5x the annualised monthly

recurring revenue target of OFXT for the end of Q1 2024.

-- This oilfield technology investment positions the Company to

take advantage of the rapid growth in technology spending by the

upstream industry. Barclays cited in an article from Oilprice.com

in April 2023 estimated upstream technology spending at US$30

billion by 2025, up over 6x from 2020 levels.

-- Subscription of US$225,000 of the amended Secured Convertible

Loan Notes (as announced on 14 November 2023) and US$10,000

previously funded by the Company will fully fund the Company's cash

commitments associated with the investment.

-- The investment is consistent with the mandate of new

non-executive Chairman Lord Henry Bellingham to position ADM with

investments focused on technologies related to the energy industry

in addition to the more traditional investments in oil and gas

production that the Company has historically pursued.

Investment Summary

The Company has acquired 650,000 Class A Units of OFXT from OFX

Holdings, LLC ("OFXH"), a substantial shareholder of the Company.

In addition, the Company acquired 150,000 Class A Units in OXFT

from parties unrelated to OFXH and directly subscribed for 120,000

Class A Units and 200,000 Class B Units from OFXT (together "the

Transactions").

The result of the Transactions is that ADME, upon completion,

will hold 920,000 Class A Units and 200,000 Class B Units of OFXT

representing approximately 53.1% of the economic interest of

OFXT.

Total consideration for the investments is US$1,285,000

comprised of (i) the issue of 86,035,489 new ordinary shares at a

price of 1p per share (the "Consideration Shares"); (ii) US$235,000

in cash and (iii) 39,959,018 3-year, 1p warrants. The Company has

the option, at its sole discretion, to purchase an additional

100,000 Class A Units at US$1.50 per Unit or US$150,000 on or

before February 28, 2024. Additionally, ADM will issue a total of

16 million incentive warrants to the management team and other key

persons of OFXT (the "Incentive Warrants").

Of the Total consideration associated with the investment,

US$975,000 is to be paid to OFXH, a substantial shareholder of the

Company. OFXH will be issued 79,918,033 ordinary shares and

39,959,018 3-year, 1p warrants. Adjusted for the issuance of shares

to OFXH, OFXH will hold 82,469,367 ordinary shares representing 17%

of the enlarged share capital of the Company.

Concurrent with the oilfield technology investment, ADM has

accepted a subscription for US$225,000 gross proceeds of its

amended 15% secured convertible loan notes with an equity

conversion price of 1p per share. The Secured Convertible Loan

Notes will only be issued upon funding and the proceeds will be

used to fund the Company's cash commitments associated with the

OFXT investment. No commissions or fees were paid in relation to

the subscription which will result in net proceeds to the Company

of US$235,000.

OFX Technologies, LLC ( www.ofxtechnologies.com )

OFXT owns 100.0% of the membership interest of Efficient

Oilfield Solutions, LLC, a revenue generating Louisiana limited

liability company ("EOS") which currently offers a free to download

mobile phone app supported on both iOS and Android platforms that

is used to track and manage produced water resulting from oil and

gas operations and to fulfil regulatory requirements associated

with the disposal of oilfield waste-water in the State of Louisiana

as well as data storage requirements necessary to comply with state

regulations. EOS's business model is to provide

Software-as-a-Service ("SaaS") with a near-term focus of expanding

its service offering to other U.S. states and add additional

functionality to increase average revenue per user.

OFXT's near-term business plan is focused on:

1. Releasing user "Dashboards" which will provide users with

data analytics to better plan, lower costs and increase efficiency

associated with logistics, storage and disposal of produced

water.

2. Completing its "E-Ticketing" solution which will streamline

and increase efficiency in the management of trucking operations.

Release of the E-Ticketing solution is an important milestone and

the starting point for marketing efforts to large commercial users

of the platform.

3. Expand into the Texas market, Texas is the largest oil producing state in the United States.

4. Evaluate joint venture and cross sale opportunities with

other SaaS providers to leverage capabilities without requiring

substantial capital investment.

5. Explore opportunities to integrate blockchain, artificial

intelligence and internet-of-things (IoT) technologies to allow

users to improve collection, management, analysis and application

of data that can improve operations, lower costs and automate

regulatory compliance.

OFXT is led by Mr. Thomas Bower, Chief Executive Officer, who

has spent over 20 years in the Defense, Oil and Gas, and Commercial

Real Estate Industries, primarily focused on technology or

efficiency initiatives. Mr Bower's strengths include building

robust teams, streamlining processes, and integrating technology to

maximize an organisation's effectiveness. Mr. Bower has a

Bachelor's in Accounting from Strayer University, a Masters of

Intelligence Analysis from Johns Hopkins University, and a Masters

of Business Administration from The University of Notre Dame. Mr

Bower is a Veteran of the United States Army and resides in

Houston, Texas.

Market Opportunity

According to the Texas Railroad Commission (which regulates oil

& gas in Texas), approximately 10 barrels of salt-water are

produced for each barrel of oil production. With more than 12.6

million barrels per day of crude oil production (per U.S. Energy

Information Administration), the U.S. oil industry must manage in

excess of 120 million barrels (5+ billion gallons) of waste-water

each day. Oil producing states currently regulate the disposal of

produced water to protect the environment and the general trend

continues to be towards greater regulation. Greater regulation

required of operators, transportation companies and water disposal

companies results in lost time, less efficiency and increased

costs.

In an oilprice.com article from 30 April 2023, "How New

Technology Will Disrupt the Oil and Gas Industry", author Alex

Kimani states: "Barclays estimates that the upstream market digital

services industry will grow from less than $5 billion in 2020 to a

more than $30 billion annual tab by 2025, thus enabling $150

billion in annual savings for oil producers. Opportunities for cost

savings include cutting capital expenditures (CAPEX) as well as

selling, general and administrative (SG&A) costs and

transportation operating costs."

Application of Investing Policy

The Investment is in-line with the Investing Policy of the

Company which states: " The Company will seek to invest in

opportunities within the natural resources sector, the oil

services, power and energy sectors and in technology opportunities

related to these sectors that the Directors believe either are of

strategic value or represent a significant value opportunity. The

Company is prepared to take an active role in its investments where

it is deemed to be appropriate."

Rationale for Undertaking the Investment

In undertaking the Investment the Board of Directors of ADM have

paid special attention to the following considerations:

1. The combined oil and gas experience of the Directors, its

major shareholders and U.S. partners give it a solid basis to

understand the changes and initiatives driving growth in technology

spending and associated business potential in the United

States.

2. The well documented and rapid growth in technology spending

by upstream oil & gas companies creates a favourable

environment and opportunistic time for the Company to have exposure

to energy technology.

3. The Directors believe that within its area of focus in

upstream Exploration and Production (specifically the

transportation, tracking and disposal of produced water), OFXT has

a legitimate early-mover advantage and the potential to strongly

position in a significant geographic area which will make it an

attractive acquisition target for larger companies seeking to

establish a strong market position in the U.S. upstream technology

space.

4. The Directors believe that the senior management of OFX

Technologies, LLC are highly knowledgeable, motivated and capable

of executing the business plan of OFXT.

5. The Directors believe that the valuation is attractive at

4.5x estimated Q1 run-rate recurring revenue and a little over 3x

estimated recurring revenue for the full-year 2024. In making this

determination the Directors considered the following:

a. The Board of Members of OFXT has established two performance milestones for 2024:

i. Achieving a monthly sales level in the first quarter

consistent with US$500,000 per year in annual recurring revenue;

and,

ii. Achieving a monthly sales level before the end of the year

consistent with US$1 million+ in annual recurring revenue.

Achieving the two performance milestones will directly impact

the 2024 compensation of CEO Tom Bower.

b. A business valuation by The Vant Group of Dallas Texas was

commissioned by the Company as part of its due diligence and

indicated an estimated private company value of approximately

US$2.4 million based on a sales growth profile of US$184,000 for

the full-year 2023 and $702,000 for the full-year 2024.

c. Through the middle of November 2023, OFXT has reported

unaudited cash receipts from customers of approximately US$156,000

with a growth trajectory since appointment of Tom Bower as CEO that

the Directors believe is consistent with the 2023 sales forecast

used in The Vant Group analysis.

d. OFXT has provided a detailed schedule to the Directors of

near-term sales growth driven by existing clients expanding usage

of the platform or new clients be "on boarded" to the platform that

it expects to add incremental monthly recurring revenue in excess

of US$21,000+ per month by end of Q1 2024.

e. The Directors note that publicly available information

suggests value multiples of annual recurring revenue for growing

public SaaS companies have historically tended to be in a range of

6x to 8x annual recurring revenue.

Investment Structure

OFX Technologies, LLC Capital Structure Description

OFX Technologies, LLC is a limited liability company ("LLC")

formed under the laws of the State of Texas. An LLC is a form of

business organisation that combines the limitations on liability to

its owners of a corporation with "pass through" tax treatment of a

partnership (the LLC itself is not subject to state or federal

income tax) and the structuring flexibility of a partnership. The

equity interest of a limited liability company is referred to as

"membership interest" and in place of shares, ownership is

represented by "units". An LLC can have more than one class of

units. In the case of the Class A Units of OFX Technologies, the

Class A Units are intended to provide a preferential return to

holders (typically the investors providing capital) prior to

significant distributions to other parties. The Class B Units

typically represent an incentive interest. The Class A and Class B

Units split future distributable cash based on the Class A Units

achieving certain payout thresholds.

The Class A Units of OFXT each have one (1) vote per Unit, will

receive 85.0% of the distributable cash of OFXT until each Class A

Unit has been paid cumulative distributions equal to US$1.50 per

Unit. Thereafter, the Class A Units will receive 70% of

distributable cash. The balance of distributable cash will be paid

to the Class B Units which are non-voting units.

Adjusted for the terms of the investment, OFXT has 5,000,000

Class A Units Authorised; 2,000,000 Class A Units approved for

issuance and 1,720,000 Class A Units issued. OFXT has 500,000 Class

B Units authorised and 390,625 Class B Units issued. The Class A

Units authorised but not issued are approved for use in future

fundraisings and the Class B Units authorised but not issued are

reserved for issuance at the discretion of OFXT's Board to future

employees or other parties associated with incentive compensation

packages.

As a result of the Transactions, ADME will be interested in

920,000 Class A Units (representing 53.49% of the Class A Units)

and 200,000 Class B Units (representing 51.20% of the Class B

Units).

ADM has the right, at its sole discretion, to direct OFXT to

issue an additional 25,000 Class B Units to directors or employees

as part of incentive compensation. The remaining Class B Units are

reserved for issuance to future employees of OFXT by the Board of

OFXT as part with incentive compensation programs.

Total Consideration

The Total Consideration of the Transactions is US$1,285,000,

using an effective exchange rate of US$1.22, consisting of share

consideration of the issue of 86,035,489 new ordinary shares at a

price of 1p per share of ADM Energy plc Additionally, OFX Holdings

will receive 39,959,018 3-year, 1 p warrants and US$75,000 will be

paid in consideration to two other parties. In addition to the

interests acquired from third-party sellers, the Company will

acquire 120,000 newly issued Class A Units from OFX Technologies,

LLC by making cash investments totalling US$160,000.00 with

proceeds to be paid directly to OFXT to use to fund software

development and general working capital. The following table

summarizes the share, warrant and cash consideration associated

with the investment.

Summary of OFXT Interests Acquired

Seller OFX Holdings Other Parties OFXT Total

----------------------------- ------------------------ ------------------------ --------------------- ------------

Class A Units 650,000 150,000 120,000 920,000

Class B Units - - 200,000 200,000

Total Maximum Consideration $ 975,000 $ 150,000 $ 160,000 $1,285,000

----------------------------- ------------------------ ------------------------ --------------------- ------------

Ordinary Shares 79,918,033 6,117,456 - 86,035,489

Warrants 39,959,018 - - 39,959,018

Cash $ - $ 75,000 $ 160,000 $ 235,000

Future Capital Requirements of OFXT

OFXT expects to fund future capital requirements from private

U.S. investors through sale of 280,000 authorised and unissued

Class A Units. ADM has the option, at its sole discretion, to

acquire an additional 100,000 Class A Units at US$1.50 per Unit

until February 28, 2024. The Company may also, but is not required

to, purchase additional Class A Units in the future on terms to be

agreed to by and between OFXT and ADM. If OFXT places the remaining

280,000 authorized and unissued Class A Units to private investors

and ADM does not exercise its option or participate, ADM's economic

interest will decline to approximately 46.8% from 53.1% at

Closing.

Issuance of Incentive Warrants

As an incentive and to align the interests of the senior

management and other key parties of OFXT with ADM Energy plc, the

Board has authorised the issuance of 16 million incentive warrants

to employees or other key persons of OFXT. The warrants will vest

immediately on closing of the investment. The Incentive Warrants

will have a 3-year term and are exercisable at a price of 1p per

share. The Incentive Warrants will be issued as follows: 4 million

to Mr. Thomas Bower and 2 million each to six other key persons

affiliated with EOS.

Participation of Certain ADM Energy plc Directors and Employees

in OFXT Class B Units

As part of his compensation for serving as a director of OFXT to

represent the interests of the Company, Mr. Stefan Olivier will be

awarded 25,000 Class B Units by the board of OFXT. Mr Olivier's

position will not otherwise be remunerated. Additionally, ADM has

reserved 25,000 Class B Units for future issue, at direction of the

Board of ADM Energy plc, to certain directors or employees of ADM

as part of incentive compensation programs. If assigned, the

purpose of the participation is to incentivise management

performance in proactively enhancing the value of the investment

for the benefit of all shareholders. When issued, the Class B Units

will vest immediately in full.

Advisory Fee

Ventura Energy Advisors, LLC, ("VEA") a related party of OFX

Holdings, LLC, is to be paid a GBP50,000.00 structuring and

advisory fee ("M&A Fee") in conjunction with its services

related to the investment transactions described above, will serve

as the exclusive advisor to the Company related to other energy

technology investments for a period of two years and will be paid

an Exit Fee of 3% of proceeds received by the Company on its exit

(including sale, spin-off or listing) from the OFXT investment.

Further Creditor Settlement

Further to the RNS dated 14 November 2023, Financing Update and

Debt and Asset Restructuring, the Company has settled one

additional creditor in the amount of US$15,000.00 through the

issuance of 1,229,508 ordinary shares (the "Settlement Shares") at

a nominal value of 1p per share based on an effective exchange rate

of United States Dollars to British Pound Sterling of 1.22.

Related Party Transaction

The acquisition of the holding of OFXT shares from OFXH and the

payment of the advisory fee for VEA constitutes related party

transactions for the purposes of AIM Rule 13. With the exception of

Stefan Oliver and Claudio Coltellini, the Company's Directors

consider, having consulted with the Company's nominated adviser,

Cairn Financial Advisers LLP, that the terms of the transaction are

fair and reasonable insofar as the Company's shareholders are

concerned.

Admission to AIM and Total Voting Rights

Application will be made for the Consideration Shares and the

Settlement Shares, which total 87,264,997 new ordinary shares and

which will rank pari passu with the Company's existing ordinary

shares, to be admitted to trading on AIM ("Admission"). It is

expected that Admission of the New Ordinary Shares will become

effective and that dealings will commence at 08.00 am on or around

5 December 2023.

Following Admission, the Company's enlarged issued share capital

("Enlarged Issued Share Capital") will comprise 484,938,611

ordinary shares of GBP0.01 each with voting rights in the Company.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in the

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

Following issuance of the Consideration Shares, OFX will hold

82,469,367 ordinary shares of ADM Energy plc representing 17% of

the Enlarged Issued Share Capital of the Company on Admission.

Commenting on the OFX Technologies Investment Stefan Olivier

said, "The oil and gas digital services market is in a period of

rapid growth, the investment in Efficient Oilfield Solutions gives

ADM shareholders exposure to this sector through a company with

momentum in the industry led by an impressive and focused

management team. ADM intends to maximize the value of its

traditional upstream oil and gas interests and consistent with its

Investing Policy will continue to look at a range of opportunities

within the natural resources space, however the Board of ADM have

resolved to focus on energy technology as we believe the

opportunities available to the Company are very attractive in terms

of driving growth in both value and cash flow per share."

Enquiries:

ADM Energy plc +44 7495 779520

Stefan Olivier, Chief Executive Officer

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria

and the United States. ADM Energy holds a 9.2% profit interest in

the oil producing Aje Field, part of OML 113, which covers an area

of 835km(2) offshore Nigeria. Aje has multiple oil, gas, and gas

condensate reservoirs in the Turonian, Cenomanian and Albian

sandstones with five wells drilled to date. ADM also has interest

in an oil and gas lease in the U.S. State of California.

ADM Energy is committed to maximizing long-term value from its

existing asset base in Nigeria while targeting other investment

opportunities in the oil and gas sector with attractive risk reward

profiles such as proven nature of reserves, level of historic

investment, established infrastructure and route to early cash

flow.

About OFX Holdings, LLC

Formerly, Tennessee Black Gold LLC, OFX Holdings is a private

U.S. investment company led by Claudio Coltellini, an Italian

national who for the last 15 years has invested in U.S. oil and gas

and leads four private companies with assets in the states of

Texas, Louisiana, Kansas and California.

About OFX Technologies, LLC and Efficient Oilfield Solutions,

LLC

OFX Technologies, LLC is a newly formed Texas limited liability

company that owns 100% of the membership interest of Efficient

Oilfield Solutions, LLC ("EOS"). In addition to serving as the

holding company for EOS, OFXT is exploring other technology

applications and joint ventures in the energy space. OFX

Technologies website is www.ofxtechnologies.com and EOS' website is

www.efficientoilfieldsolutions.com . Thomas Bower is Chief

Executive Officer of OFX Technologies.

Forward Looking Statements

Certain statements in this announcement are, or may be deemed to

be, forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements reflect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQNKFBNNBDBFDB

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

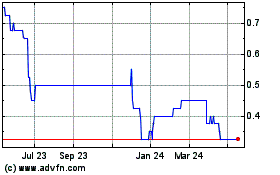

Adm Energy (LSE:ADME)

Historical Stock Chart

From Oct 2024 to Nov 2024

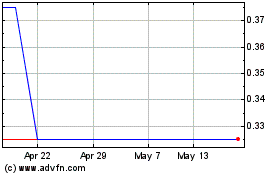

Adm Energy (LSE:ADME)

Historical Stock Chart

From Nov 2023 to Nov 2024