UK's Financial Services Authority Looking Into Solvency II Approach

October 03 2011 - 10:06AM

Dow Jones News

The U.K. Financial Services Authority said Monday it will look

into its approach to Solvency II, the Europe-wide capital regime

for insurers which appears under threat of being delayed by a year

to 2014.

"We are currently considering our approach, taking into account

industry feedback, our obligations as regulator and our work with

other member-state regulators. We will communicate our approach

shortly," a spokesman for the FSA told Dow Jones Newswires.

The comments come after the Financial Times reported earlier

Monday that the Association of British Insurers and the Lloyd's of

London insurance market have asked the FSA to push ahead with some

parts of Solvency II at the start of 2013.

The aim of starting in 2013 is to save U.K. insurers the cost of

having to run their old capital assessment models alongside the new

models developed for the incoming Solvency II regime.

-By Vladimir Guevarra, Dow Jones Newswires. Tel. +44 (0)

2078429486, vladimir.guevarra@dowjones.com

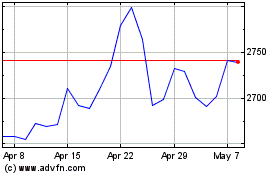

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024