UPDATE: Admiral '08 Net Profit Up 14%; Plans US Expansion

March 03 2009 - 5:16AM

Dow Jones News

Admiral Group PLC (ADM.LN) Tuesday posted a 14% rise in 2008 net

profit, helped by continued good underwriting business in the U.K.

as well as higher sales from its ancillary services.

After entering several markets in Europe, the company said it is

planning to enter the U.S. market to help boost revenue.

The Wales-based motor insurer said net profit was at GBP144.9

million, up from GBP127.4 million in 2007.

Pretax profit was up 11% at GBP202.5 million from GBP182.1

million previously. The pretax profit was inline with the GBP199

million average forecast from 12 analysts.

"For the fifth year out of five since becoming a listed company,

Admiral delivered record profits and the 2008 dividend will be the

biggest in our history," said Chief Executive Henry Engelhardt.

"As the U.K. business goes from strength to strength, we are

planting the seeds of our long-term future by taking what we know

and do well - Internet and phone delivery of car insurance to other

countries," Engelhardt said.

In a briefing, Engelhardt said he was "not bullish or bearish"

about prospects for the U.K. business because higher insurance

premiums could be offset by possible higher claims.

The company is recommending a final dividend of 26.5 pence a

share, making a total dividend of 52.5 pence a share for 2008, up

from 43.8 pence in 2007.

At 0938 GMT, Admiral shares were up 1.4% at 888 pence, slightly

outperforming the FTSE 100 index.

"This is a good set of results, ahead of already high

expectations," Oriel Securities analyst Tom Dorner said.

"Admiral's business model of providing cheap motor insurance in

a very price sensitive market should ensure that the group

continues to grow strongly," Dorner said, keeping his add rating on

the stock.

On the other hand, Shore Capital analyst Eamonn Flanagan kept

his sell rating, saying that Admiral's ancillary sales could be hit

by the economic downturn.

"We remain concerned that there is a greater element of

discretionary aspect about these sales which could negatively

impact as the recession begins to bite," Flanagan said.

Total net revenue rose 16% to GBP422.8 million, supported mainly

by a 29% rise in insurance premium revenue GBP301.5 million.

Revenue from ancillary services, which involve offering extra

services like breakdown coverage on top of core car insurance

services, rose 17% in 2008 to GBP109.8 million.

Meanwhile, revenue from the Confused.com price-comparison Web

site fell 4.4% to GBP66.1 million as "fierce competition" squeezed

margins, the company said.

In a briefing, Engelhardt said the company is planning to enter

the U.S. market either later this year or early next year by

launching initially in two U.S. states, with the head office in

Richmond, Virginia.

He said other details of the plan are still being worked

out.

The company also has operations in Spain, Germany and Italy.

Company Web site: www.admiralgroup.co.uk

-By Vladimir Guevarra, Dow Jones Newswires, Tel. +44 (0)

2078429486, vladimir.guevarra@dowjones.com

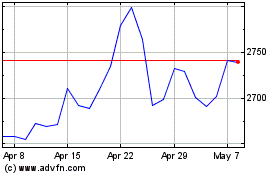

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024