TIDMADF

RNS Number : 6813M

Facilities by ADF plc

18 September 2023

18 September 2023

Facilities by ADF plc

("Facilities by ADF", "ADF", the "Company" or the "Group")

Half year results for the six months ended 30 June 2023

Facilities by ADF, the leading provider of premium serviced

production facilities to the UK film and high-end television

industry ("HETV") announces its unaudited half year results for the

six months ended 30 June 2023 ("H1-FY23").

Financial highlights

GBPMs H1-FY23 H1-FY22 Change FY-22

-------------------- ----------- ----------- -------- ----------

Group revenue 21.8 12.6 +73% 31.4

Adjusted EBITDA* 5.8 2.6 +117% 8.0

Adjusted EBITDA % 27% 21% +540bps 25%

Profit Before Tax 2.7 1.3 +118% 4.6

Earnings per share 3.20 pence 1.52 pence +111% 6.1 pence

- basic

-- Interim dividend proposed of 0.5 pence per share (H1-FY22

- 0.46 pence per share) to be paid on 27(th) October to

shareholders on the register on close business on 6(th)

October 2023.

Percentages are based on underlying, not rounded, figures.

Operational highlights

Client Relationships:

-- Experienced increased demand for ADF's services from global

streaming brands such as Netflix, Apple, Disney and Amazon,

re-enforcing ADF's position as the UK's leading facilities

provider.

-- Supported 46 high-profile productions including The Crown

season 6, Slow Horses, Star Wars Andor, The Gentleman,

Rivals, The Diplomat, Industry, Paris Has Fallen, The

Famous Five, Back to Black and Sex Education.

Continued Growth:

-- Officially opened ADF's new flagship central hub at Longcross,

Surrey, highlighting the Company's commitment to its growth

strategy.

-- Added 108 units to the fleet in H1-FY23, bringing the

total to 700 units, fully leveraging the current enhanced

super-deduction capital allowance regime.

Location One Integration:

-- Acquired in Nov-22, Location One is now fully integrated

into the Group. During H1-FY23, Location One opened new

branches at Longcross, Bridgend, and Glasgow.

-- The enlarged Group is cross-selling to an increasing number

of HETV companies in the UK, delivering services in a

more efficient way, and moving the Company closer to its

goal of becoming a one-stop shop for film and HETV production.

Margin Improvement:

-- ADF worked on larger, longer productions in H1-FY23 compared

to H1-FY22, which were more geographically centred around

the main London studios making them more efficient from

a transport and mobilisation perspective. A sustained

effort was also made in H1-FY23 to increase the number

of 'employed' HGV drivers, as opposed to relying on more

costly agency HGV drivers.

-- Overall gross margins rose from 33.0% in H1-FY22 to 38.8%

in H1-FY23.

Outlook

-- Underlying market drivers still providing high confidence

that the demand for ADF's services will continue to expand

over the medium to long term.

-- As announced by the Company on 3 August 2023, the Group

remains strongly positioned in its markets with high quality

UK productions to sustain the business through the current

USA Writers (Writers Guild of America (WAG)) and Actors

(Screen Actors Guild - American Federation of Television

and Radio Artists (SAG-AFTR)) strikes which have been

impacting productions around the globe.

-- The Group remains committed to growth and will continue

to review acquisition opportunities in line with its strategy.

Commenting, Marsden Proctor, CEO, said: "The Group delivered a

strong first half, building on momentum from FY22. Whilst the

Writers Guild of America and Screen Actors Guild strikes are

causing a short-term impact on the business, we are confident the

Group is in a robust position to capitalise on the opportunity

ahead once previous production levels resume."

*Adjusted EBITDA is the adjusted profit before tax, prior to the

addition of finance income and deduction of depreciation,

amortisation, and finance expenses. The adjusted EBITDA measurement

removes non-recurring, irregular and one-time items that may

distort EBITDA. Adjusted EBITDA provides a more normalised metric

to make comparisons more meaningful across the Group and other

companies in the same industry.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

take responsibility for this announcement.

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser has

changed its name to Cavendish Securities plc following completion

of its own corporate merger.

For further enquiries:

Facilities by ADF plc via Alma PR

Marsden Proctor, Chief Executive Officer

Neil Evans, Chief Financial Officer

John Richards, Chairman

Cavendish Securities (Nominated Adviser Tel: +44 (0)20 7220

and Broker) 0500

Ben Jeynes / Charlie Combe / George Lawson

- Corporate Finance

Michael Johnson / George Budd - Sales

Alma PR (Financial PR) Tel: +44 (0)20 3405

Josh Royston 0205

Hannah Campbell facilitiesbyadf@almapr.co.uk

Robyn Fisher

OVERVIEW OF FACILITIES BY ADF

Facilities by ADF plc is the leading provider of premium

serviced production facilities to the UK film and high-end

television industry ("HETV"). Its production fleet is made up of

700 premium mobile make-up, costume and artiste trailers,

production offices, mobile bathrooms, diners, school rooms and

technical vehicles. The Group provides these production facilities

and additional services after a planning process with the customer

held well in advance of filming. In servicing productions, ADF

staff are available on site and each production is allocated an

account manager who acts as a single lead point of contact during

filming.

In November 2022, ADF acquired Location One Ltd, the UK's

largest integrated TV and film location service and equipment hire

company, bringing highly complementary services and providing cross

selling opportunities to the enlarged Group, as well as delivering

efficiencies through central services.

The Group serves customers in an industry that has experienced

significant growth in recent years, with additional demand driven

by a material rise in the consumption of film and HETV content via

streaming platforms such as Netflix, Disney+, Apple TV+ and Amazon

Prime. The UK film and TV industry has directly benefited during

this growth due to the quality of its production facilities and

studios, highly skilled domestic workforce, geography,

accessibility to Europe, English language environment and strong

governmental support. Major US streaming companies have now set up

permanent bases in the UK, with the UK now the film and TV

industry's second largest operation after North America.

CEO review

Overview

The Group delivered an outstanding first half, with high levels

of fleet utilisation. We achieved revenue growth of 73% to GBP21.8

million (H1-FY22 GBP12.6 million) and adjusted EBITDA of GBP5.8

million, growth of 117% (H1-FY22 GBP2.6 million). This evidences

the ongoing high level of demand for our products and services, the

contribution of Location One since its acquisition in November

2022, and the higher value productions worked on in H1-FY23.

More recently however, the widely published USA Writers (Writers

Guild of America (WAG)) and Actors (Screen Actors Guild - American

Federation of Television and Radio Artists (SAG-AFTR)) strikes have

been impacting productions around the globe. Since July 2023,

several film and TV productions in the UK, on which ADF was

engaged, have seen stoppages or delays to production, and several

others that were scheduled to start filming in Autumn 2023 have now

been pushed into early 2024 commencement.

Notwithstanding, the Group's unaffected productions and pipeline

are expected to generate revenues for the full year ending 31

December 2023 of no less than GBP35 million. This assumes there is

no resolution to the strikes in H2-FY23. We are continuing to

assess the impact on our planned work programme for the remainder

of the financial year in conjunction with our production company

contacts. Any alleviation of the prevailing strike action may

provide the potential for further upside in the current financial

year, assuming productions are able to recommence filming

relatively soon thereafter.

The Board is confident there will be significant levels of

pent-up demand for film and high-end television productions as the

situation normalises and with Location One now fully embedded into

the Group, we are well placed to benefit given our scale and market

leading position.

Market opportunity

We operate in an industry that has experienced significant

growth and investment in recent years, underpinned by the success

of HETV. Whilst the industrial action has caused a short-term

impact, the Board is confident that the underlying market drivers

will continue to accelerate once the situation normalises and there

will be significant levels of pent-up demand for film and HETV

productions akin to that seen after the lifting of the lockdowns

imposed during the COVID-19 pandemic. The Group is well placed to

benefit given its market leading position.

The significant rise of global streaming platforms such as Apple

TV+, HBO Max, Netflix, Disney +, Sky TV and Amazon Prime has

culminated in a material increase in the consumption of films and

HETV. It is estimated that paid-for streaming services from these

companies will exceed GBP4.2 billion in the UK by 2025 and will

overtake, for the first time, traditional paid-for TV packages from

Sky, BT, Virgin etc (Source: KPMG). In comparison, streaming spend

in the UK was less than GBP1 billion in 2018.

Investment in new infrastructure in the UK to support demand

continues at pace with a number of new studio developments in 2023.

Developments at some of the studios where ADF frequently works

include:

-- Shinfield Studios, Berkshire - 5 new stages were added plus

workshop and production offices.

-- Pioneer Studios, Glasgow - where ADF has already established

a joint base with Location One, are opening more studios.

-- Pyramid Studios, Edinburgh - new studio development.

-- Sky Studios, Elstree - continued development of an already major complex.

Industry Performance

In terms of the overall performance of film and TV production in

the UK, the British Film Institute ("BFI") recently reported for

the first half of 2023, the following facts:

-- The combined total spend on film and HETV production in the

UK for H1-2023 was GBP2.5 billion from 188 productions.

o 85 films started shooting during H1-2023. The total UK

production spend for these films was GBP0.8 billion.

o 103 HETV productions began principal photography in H1-2023

with a total UK spend of GBP1.7 billion.

-- The combined total UK spend on film and HETV productions for

the 12 months from July 2022 to June 2023 was GBP5.4 billion. This

is the third highest figure seen since records began. Inward

investment productions accounted for GBP4.5 billion or 83% of the

total.

In the first six months of 2023 government tax credits for HETV

production in the UK exceeded those for film for the first time

since the credits were introduced.

The total production across film and HETV was down on the

(record) comparative period in 2022 due in part to the availability

of studio space at the start of 2023 with a number of large

overruns. In addition, there were some uncertainty over reforms to

the tax credit regime for film and TV production at the end of last

year. These were however, allayed by Jeremey Hunt in his Spring

budget in March 2023 when he re-affirmed the UK government's total

commitment to the sector by increasing the overall rate of

relief.

Competitive strength

We are already the provider of choice in the UK for large scale

and quality productions. This, in the main, has allowed us to

select the highest value production contracts available. This

market position has taken several years to build, and we have the

right infrastructure in place to support continued expansion. The

addition of Location One has also made us strategically stronger,

evidenced by our financial performance in H1-FY23 and has

positioned us well to capture a growing proportion of the expanding

market.

The Group experienced an increase in the average revenue per

production in H1-FY23 of 32% to GBP361k (H1-FY22 GBP274k). ADF's

forward order book and pipeline, prior to the onset of the strikes,

was full of high value projects, and hence we were very confident

of achieving our forecast revenue for the year.

With the onset of the strikes, we have drawn on our strong

relationships with both customers and suppliers, and this has been

vital during this period of industrial action to understand the

impact on our planned programme of work for the remainder of the

year.

Notwithstanding the current headwinds, we continue to have a

relentless focus on doing the basic things well. Our net promoter

score (NPS) continues to be at an exceptional level and is

currently at +87, up from +83 at the date of the January 2022

IPO.

The Group continued to support several premier productions

throughout H1-FY23, including Black Mirror, Star Wars, Celebrity

Bake off, Industry and Slow Horses. Having visibility on such

highly acclaimed projects is imperative as we grow and whilst the

industrial action has temporarily impacted a number of productions,

we still have good visibility of the number of opportunities

available to us. Whilst timing is unclear, there have been more

positive signs recently from the parties involved in the

disputes.

Delivering against growth strategy

The Group continued to successfully execute on our organic

growth strategy through further investment into revenue-generating

fleet equipment. We added 108 assets to our fleet, bringing the

total to 700.

We continue to work closely with our key suppliers, including

General Coach Canada, who supply the artists trailers and

production offices, DAF, who supply our technical vehicles, tractor

units & generators, and Expandable NL, who provide our flagship

double expandable production offices, costume and make-up vehicles,

thus ensuring that we continue to deliver the high-quality level of

service to our customers.

At IPO, we also emphasised our intention to grow through

acquisitions. We approach acquisitions with a robust set of

criteria, working within demanding multiples having an element of

the consideration that is both deferred and contingent, and, in

most circumstances, retaining the management and keeping the brand

name unchanged as it serves its customer base.

The acquisition of Location One met all of these criteria and

the team is now fully integrated into the Group. During H1-FY23,

Location One opened branches at the Group's new operational base in

Longcross, Surrey, and also depots in Bridgend, South Wales and

Pioneer Studios, Glasgow. It therefore now provides the enlarged

Group with both the ability to cross-sell our services to the

increasing number of HETV companies with sites in the UK, and also

to deliver services in a more efficient way. These new branches

have expanded Location One's geographic reach and logistical

capabilities, strengthened the enlarged Group's position across the

UK, moving the company closer to becoming a one stop shop for film

and HETV production.

The IPO raised the Group's profile, and we are now seeing more

acquisitive opportunities. We are in discussions with several

parties and will continue to review opportunities for complementary

additions as they arise.

ESG

ADF is committed to activities that have a positive impact on

our employees and society, and we aim to reduce our environmental

impact through collaboration with stakeholders towards a low carbon

production industry. To achieve this, we are now developing our own

ESG strategy, led by our Chair, John Richards, along with the rest

of the ADF Board. This is being achieved through the development of

a new ESG Governance structure. An external consultant,

EthicallyBE, has been retained to assist with the refinement and

implementation of the strategy developed by the Board. They will be

taking a commercial approach to sustainability and the ESG strategy

provides an opportunity to use sustainability as a differentiator

and to align our brand, values and purpose - and effectively

integrate future acquisitions into the Group.

As part of our journey to ultimately become a carbon-neutral

operator in the future, last year we partnered with Creative Zero,

a sustainability organisation, to undergo a carbon audit to better

understand our impact on the environment. Internal interviews and

research are almost complete and Creative Zero has presented the

results of the Carbon Audit. This sets out our impact as a business

across Scopes 1 and 2, and some of 3, and makes recommendations on

potential areas of focus for our path to net zero. These

opportunities will be maximised moving forward and the carbon audit

footprint will provide the data required for the SECR submission to

be prepared by April 2024.

We were proud to have been the first facilities provider in

Europe that was approved by Albert, the authority on environmental

sustainability for the film and television industry, a clear

endorsement of the Group's ESG strategy. Maintaining our Albert

approval is as important as ever with many studios only allowing

Albert approved vehicles on site. Location One is also an approved

Albert supplier.

In H1-FY23, we launched our first Employee Satisfaction Survey

to measure and improve employee wellbeing. As part of our ESG

strategy, we are in the process of re-launching our Company Values

and Mission Statement, to ensure our employees can reach their full

potential.

The ESG strategy will drive high levels of compliance across

environmental, social and governance factors, and set out where ADF

also has the opportunity to lead the market in key areas. Our early

strategic focus is on the environment, most specifically the carbon

footprint of our business and the drive to net zero; the continuing

development of innovative client solutions; health and wellbeing,

and an increased focus on knowledge, training, and upskilling.

The Group intends to finalise its ESG strategy in H2-FY23 and

will provide an update on progress in due course.

Outlook

The Group delivered an outstanding H1-FY23 performance, with

encouraging revenue growth and margin improvement, where we

supported a record number of premium productions across the UK.

Whilst the widely publicised writers and actors strike is

impacting the Group's H2-FY23 performance, as the filming of

several ADF productions have now been delayed until 2024, we

believe the impact will only be short-term, and the Group is ready

to capitalise on the pent-up demand once the situation

normalises.

Marsden Proctor

Chief Executive Officer

Financial performance

Summary

The financial results for the 6 months ended 30 June 2023

reflect a continuation of the strong performance in the second half

of FY22. Revenue in the first half of the FY23 of GBP21.8 million

was 73% ahead of the same period in 2022 (GBP12.6 million), coming

in slightly ahead of the Board's expectations.

The revenue of GBP21.8 million includes GBP5.2 million from

location equipment hire specialist, Location One Limited, our new

acquisition in November 2022. Like-for-like sales for the core

facilities business, excluding Location One Ltd, were 32% ahead of

the same period in 2022.

With the continued high level of revenue visibility from our

pipeline and order book, we had forecast, and budgeted, sales for

H1-FY23 to be broadly in line with what we achieved. The order book

for the second half of FY23 was similarly very strong, however the

announcement of USA Writers (Writers Guild of America (WAG)) and

Actors (Screen Actors Guild - American Federation of Television and

Radio Artists (SAG-AFTR)) strikes has reduced our work programme

and pipeline for the remainder of the year.

Profit margins also improved in H1-FY23. The productions ADF

worked on in the period were more geographically centred around the

main London studios and other studios close to our operational hubs

in Wales, Manchester and Glasgow which therefore made them more

efficient from a transport and mobilisation perspective.

Furthermore, a sustained effort was made over H1-FY23 to

increase the number of employed HGV drivers as opposed to relying

on agency HGV drivers. This is reflected in agency driver costs

reducing to 9.6% of revenue in H1-FY23 compared to 16.0% in

H1-FY22.

Nevertheless, overall direct labour costs remained relatively

static at approximately 29% of revenue in both periods. There was

some upwards pressure on pay rates at the start of the 2023, and

some (below inflation) pay awards were made at that time for a

number of employee groups including HGV drivers, mechanics and

trailer manufacturing staff. Overheads remained in line with

expectation at 12.3% of revenue, slightly up on H1-FY22 of

11.9%.

Net interest expense increased from GBP284K in H1-FY22 to

GBP625K in H1-FY23. The increase is made up of three elements -

additional HP interest of GBP122K from new HP leases to fund

organic growth, GBP58K from Location One's existing and new HP

leases, and GBP161K interest from the capitalisation of the

Longcross lease under IFRS16. Interest rates on HP leases are not

variable and fixed at the date the leases are taken out.

Location One continue to integrate into ADFs systems, processes

and operating model with the consolidation of IT systems,

insurances, HR support, finance procedures and reporting, sales and

CRM systems, thus delivering the expected efficiencies. Having one

integrated platform for sales has led to successful joint bids for

nine productions in H1-FY23. Location One also expanded their

geographical footprint with three new locations - two at existing

ADF sites (Wales and Longcross) and one at a new site in Glasgow,

alongside ADF.

As a result of the above, profit before tax for H1-FY23 was

GBP2.7 million, an increase of 118% over the same period one year

earlier (H1-FY22: GBP1.3 million).

The taxation charge for H1-FY23 of GBP192k is deferred tax only

as the Group currently has excess (super deduction) capital

allowances to cover its current taxable profits.

EBITDA

We also measure performance based on EBITDA and Adjusted EBITDA.

EBITDA is a common measure used by investors and analysts to

evaluate the operating financial performance of companies.

We consider EBITDA and Adjusted EBITDA to be useful measures of

operating performance because they approximate the underlying

operating cash flow by eliminating depreciation and amortisation.

EBITDA and Adjusted EBITDA are not direct measures of our

liquidity, which is shown by our cash flow statement, and need to

be considered in the context of our financial commitments.

A reconciliation of reported profit before tax for the period, a

direct comparable IFRS measure, to Adjusted EBITDA, is set out

below.

Adjusted EBITDA H1-FY23 H1-FY22 FY-22

GBP000's

------------------------ -------- -------- -------

Revenue 21,777 12,620 31,414

------------------------ -------- -------- -------

Profit before tax 2,737 1,253 4,615

Add back:

Finance expenses 625 284 702

Depreciation 2,350 1,093 2,510

Amortisation 9 0 3

Non-recurring expenses 23 0 78

Share based payments 29 29 59

Adjusted EBITDA 5,773 2,659 7,967

------------------------ -------- -------- -------

Adjusted EBITDA

% 26.5% 21.1% 25.4%

------------------------ -------- -------- -------

Revenue

ADF's overall revenue increased by 73% in the first half of 2023

compared to 2022. This includes a full 6 months' sales for our new

group member Location One Limited. Adjusting for this, ADF's

like-for-like facilities sales increased by 32% the first half of

2022.

The table below shows the revenue between the two main

facilities hire categories, being Main Packages and Additional

Sales, plus other miscellaneous sales. Revenue for Location One is

shown separately. The table also shows the percentage uplift in

facilities revenue from post-main package 'additional' sales, which

has remained relatively consistent at approximately 75% over the

relevant periods shown. This is further explained in the following

sections.

Turnover GBPM's H1-FY23 H1-FY22 % Inc FY22

----------------------------------- -------- -------- ------ --------

Facilities - Main packages GBP10.1 GBP7.2 40% GBP18.5

Facilities - Additional sales GBP6.4 GBP5.3 21% GBP11.9

Facilities - Other income GBP0.1 GBP0.1 0% GBP0.3

----------------------------------- -------- -------- ------ --------

Facilities - Total GBP16.6 GBP12.6 32% GBP30.7

Location Equipment hire (Location GBP5.2 GBP0.0 0% GBP0.7

One)

Total Revenue GBP21.8 GBP12.6 73% GBP31.4

----------------------------------- -------- -------- ------ --------

Uplift on main packages % (see

explanation below) 73.7% 73.9% 75.2%

----------------------------------- -------- -------- ------ --------

Main Package sales

Main packages are agreed with ADF's clients, in most cases

several months in advance for the hire of specific items of

equipment over a set timeframe. Each type of equipment has a set

daily hire rate. The cost of ADF staff required to be onsite to

manage and service the equipment is also calculated by reference to

a set daily hire rate. The rate card is set and adjusted annually.

Main packages are purely to secure and 'pre-book' the equipment and

staff. These packages are split into equal fortnightly payments

beginning two weeks before commencement of principal filming.

Additional sales

ADF's trailers and staff are typically booked six or more months

in advance, and client requirements invariably change in the run up

to filming. Often, at the time of booking, scripts have not been

finalised and locations have not been agreed. Any additional

equipment and staff required closer to and during the filming

period, plus the labour & transport cost to move equipment, are

then charged out weekly during the filming period. Additional sales

include such items as:

-- Labour recharges - this is the largest component of

additional revenue (typically more than half) and is principally

payments for drivers to move trailers and equipment around the

various locations on each production.

-- Additional trailer hire - incremental ad-hoc vehicles required during the project.

-- Fuel recharges - ADF recharges fuel used on productions (with a c.10% admin fee).

-- Sundry recharges - consumable products, hand sanitisers, toiletries etc.

Revenue Mix

ADF worked on 46 productions in H1-FY23, the same number as in

H1-FY22.

However, there was a significant increase in revenue per

production during the period, with the average revenue per

production (excluding Location One) in H1-FY23 being GBP361k, a 32%

increase over H1-FY22 (GBP274k), which reflects working on a number

of specific higher value productions with Netflix (Crown season 6),

Disney+ (Star Wars Andor) and Apple TV+ (Slow Horses) during

H1-FY23.

H1-FY23 H1-FY22

Revenue by Platform GBP000's % GBP000's %

--------------------- ----------- ------- ---------- -------

Amazon GBP747 3.4% GBP686 5.4%

Apple TV+ GBP2,378 10.9% GBP234 1.9%

BBC GBP3,059 14.0% GBP2,431 19.3%

Disney+ GBP3,037 13.9% GBP1,449 11.5%

Fox GBP0 0% GBP315 2.5%

ITV GBP2,671 12.2% GBP2,246 17.8%

Marvel GBP0 0% GBP952 7.5%

Netflix GBP4,578 21.0% GBP2,614 20.7%

Other Productions GBP4,265 19.5% GBP714 5.7%

Sky GBP607 2.7% GBP702 5.6%

--------------------- ----------- ------- ---------- -------

Total invoiced GBP21,342 98.0% GBP12,343 97.8%

Cross Hire & Other GBP435 1.8% GBP277 2.2%

-----------

Total revenue GBP21,777 100.0% GBP12,620 100.0%

--------------------- ----------- ------- ---------- -------

Split

ADF GBP16,617 76% GBP12,620 100%

Location One GBP5,160 24% GBP0 0%

GBP21,777 100% GBP12,620 100%

------------------------ ---------- ----- ---------- -----

ADF Productions (No.) 46 46

ADF Ave Per Production GBP361 GBP274

------------------------ ---------- ----- ---------- -----

The split of productions across the revenue bands is shown

below:

H1-FY23 H1-FY22 FY22

Production value

------------------- -------- -------- -----

GBP0 - GBP500k 37 39 54

GBP500k - GBP1.0m 4 6 16

GBP1.0m - GBP1.5m 2 1 4

GBP1.5m - GBP2.0m 2 0 1

GBP2.0m - GBP2.5m 0 0 0

GBP2.5m - GBP3.0m 1 0 1

46 46 76

------------------- -------- -------- -----

Share Based Payments & Non-Recurring Expenses

The share-based payments relate to certain options granted to

the two current executive directors. The non-recurring expenses

relate to the advisory costs in relation to the acquisition of

Location One Limited.

Dividend & EPS

The Company declared a final dividend of 0.90 pence per share in

June 2023 in relation to the year ended 31(st) December 2022. This

took the total dividend for that year to 1.36 pence per share, with

the interim dividend of 0.46 pence per share in October 2022.

Basic earnings per share for H1-FY23 was 3.20 pence per share,

an increase of 111% over H1-FY22 (1.52 pence per share).

The Group proposes to pay an interim dividend of 0.5 pence per

share in relation to FY-23 (0.46 interim dividend FY-22) to be paid

on 27(th) October 2023 to shareholders on the register on close

business on 6(th) October 2023

Cash Flow & Net Debt

Net cash generated from operating activities was GBP4.5 million

in H1-FY23 compared to GBP0.3 million in H1-FY22.

Trade and other receivables increased by GBP0.5 million due to

the inclusion of the balances in Location One Ltd, which has a much

broader client base.

During the 6 months to 30 June 2023, ADF spent GBP9.4 million on

new equipment, of which GBP6.0 million was financed by hire

purchase and GBP3.4 million was paid for with cash. This comprised

the majority of our planned capital expenditure for FY23 which was

accelerated to maximise claims under the very favourable super

deduction capital allowance regime. There was a risk this capital

allowance regime would be withdrawn from April 2023, but it was

extended on a similar but slightly lower level by the Chancellor in

his Spring budget. The Company now has significant excess capital

allowances to offset its corporation tax liabilities.

At 30 June 2023, the Group had committed, un-delivered capex

orders of GBP6.2 million for FY-23. Some GBP1.0 million of this was

delivered in Jul-23, however the remaining GBP5.2 million has been

put on hold, in agreement with our suppliers, for delivery after

the writers and artist strikes have been resolved.

In addition, new property leases with an inception value of

GBP0.8 million were capitalised under IFRS16, being the renewal of

the lease at the factory unit in Brynmenyn, additional space at the

corporate Head Office in Bridgend, and additional capacity at

Location One's main operational base in Barking.

Since the onset of the WAG and SAG-AFTR strikes all further

capital expenditure has been put on hold until this is

resolved.

FACILITIES BY ADF PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Six months ended Six months ended

Note 30 June 2023 (unaudited) GBP'000 30 June 2022 (unaudited) GBP'000

--------------------------------- ---------------------------------

Revenue 3 21,777 12,620

Cost of sales (13,332) (8,454)

--------------------------------- ---------------------------------

Gross profit 8,445 4,166

Administrative expenses (5,031) (2,600)

Non-recurring expenses 5 (23) -

Share based payment expense (29) (29)

Operating profit 3,362 1,537

Finance expense 8 (625) (284)

Profit before taxation 2,737 1,253

Taxation (192) (112)

--------------------------------- ---------------------------------

Profit for the period 2,545 1,141

================================= =================================

Earnings per share for profit

attributable to the owners

--------------------------------- ---------------------------------

Basic earnings per share (GBP) 6 0.0320 0.0152

Diluted earnings per share (GBP) 6 0.0298 0.0141

================================= =================================

FACILITIES BY ADF PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

As at

30 June As at

2023 31 December 2022

(unaudited) (audited)

Note GBP'000 GBP'000

------------- ------------------

Assets

Current assets

Inventories 475 417

Trade and other receivables 3,577 3,045

Cash and cash equivalents 7,251 9,518

------------- ------------------

Total current assets 11,303 12,980

------------- ------------------

Non-current assets

Property, plant and equipment 7 11,901 10,680

Right-of-use assets 8 32,341 25,901

Intangible assets 9 7,280 7,289

Total non-current assets 51,522 43,870

------------- ------------------

Total assets 62,825 56,850

============= ==================

Liabilities

Current liabilities

Trade and other payables 5,464 6,322

Lease liabilities 8 5,732 3,705

Total current liabilities 11,196 10,027

------------- ------------------

Non-current liabilities

Other provisions 39 38

Lease liabilities 8 20,221 17,524

Contingent consideration 878 878

Deferred tax liabilities 3,388 2,966

------------- ------------------

Total non-current liabilities 24,526 21,406

------------- ------------------

Total liabilities 35,722 31,433

------------- ------------------

Net Assets 27,103 25,417

============= ==================

Equity

Called up share capital 11 806 794

Share premium 15,547 15,492

Share based payment reserve 1,681 1,652

Merger reserve (400) (400)

Retained earnings 9,469 7,879

------------- ------------------

Total equity 27,103 25,417

============= ==================

FACILITIES BY ADF PLC

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Share

Based

Share Share Payment Merger Retained Total

Capital Premium Reserve Reserve Earnings Equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- ---------- --------- ---------- ----------- ----------

Balance at 01 January

2022 455 787 1,332 (400) 3,322 5,496

Comprehensive Income

Profit for the year - - - - 4,612 4,612

Transactions with

owners

Issue of shares

on AIM listing 11 300 14,700 - - - 15,000

Costs of issue of

shares on AIM listing - (1,457) - - - (1,457)

Exercise of options 11 5 - - - - 5

Share based payment

charge on AIM listing - (261) 261 - - -

Share based payment

charge on long term

incentive program - - 59 - - 59

Deferred tax adjustment 295 295

Business acquisition 34 1,846 - - - 1,880

Costs of issue of

shares - (123) - - - (123)

Dividends - - - - (350) (350)

----------- ---------- --------- ---------- ----------- ----------

Balance at 31 December

2022 (audited) 794 15,492 1,652 (400) 7,879 25,417

----------- ---------- --------- ---------- ----------- ----------

Balance at 01 January

2023 794 15,492 1,652 (400) 7,879 25,417

Comprehensive Income

Profit for the year - - - - 2,545 2,545

Transactions with

owners

Issue of share capital 11 12 55 - - - 67

Share based payment

charge - - 29 - - 29

Share based payment

deferred tax charge - - - - - (230) (230)

Dividends - - - - (725) (725)

Balance at 30 June

2023 (unaudited) 806 15,547 1,681 (400) 9,469 27,103

----------- ---------- --------- ---------- ----------- ----------

FACILITIES BY ADF PLC

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Six months ended

30 June Year ended

2023 31 December 2022

(unaudited) (audited)

Note GBP'000 GBP'000

----------------- ------------------

Cash flows from operating activities

Profit before taxation from continuing activities 2,737 4,615

Adjustments for non-cash/non-operating items:

Depreciation of property, plant and equipment 7 879 611

Depreciation of right-of-use assets 8 1,471 1,899

Amortisation of intangible assets 9 9 3

Loss on disposal of property, plant and equipment and

right-of-use assets 7/8 183 52

Share based payment charge 29 59

Finance expense 8 625 702

5,933 7,941

Increase in inventories (58) (417)

(Increase)/decrease in trade and other receivables (532) 259

(Decrease)/increase in trade and other payables (858) (3,517)

Cash from operations 4,485 4,266

Net cash generated from operating activities 4,485 4,266

----------------- ------------------

Cash flows from investing activities

Purchase of property, plant and equipment 7 (2,455) (4,056)

Purchase of intangible assets - (81)

Purchase of right-of-use assets (972) (964)

Increase in amounts due from directors - (180)

Cost of business acquisition - (3,595)

Net cash used in investing activities (3,427) (8,876)

----------------- ------------------

Cash flows from financing activities

Proceeds from issue of shares 67 15,005

Cost of share issue - (1,580)

Repayment of borrowings - (342)

Cash movements on lease liabilities 8 (2,042) (2,890)

Interest paid on lease liabilities 8 (625) (695)

Other interest paid - (7)

Dividends paid (725) (350)

Net cash used in financing activities (3,325) 9,141

----------------- ------------------

Net (decrease)/increase in cash and cash equivalents (2,267) 4,531

Cash and cash equivalents at beginning of period 9,518 4,987

Cash and cash equivalents at end of period 7,251 9,518

================= ==================

FACILITIES BY ADF PLC

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2023

1 General Information

The principal activity of Facilities by ADF Plc (the "Company")

and its subsidiaries (together, the "Group") is the supply of

mobile facilities and location equipment hire for television and

film productions.

The Company is a public company limited by shares, incorporated,

domiciled and registered in England and Wales in the UK. The

registered number is 13761460 and the registered address is Ground

Floor, 31 Oldfield Road, Bocam Park, Pencoed, Bridgend, United

Kingdom, CF35 5LJ.

2 Summary of significant accounting policies

2.1 Basis of preparation

The unaudited interim financial information presents the

financial results of the Group for the six-month period to 30 June

2023. This financial information has been prepared in accordance

with UK-adopted International Accounting Standards and are

presented on a condensed basis. All values are rounded to the

nearest thousand (GBP'000) except where otherwise indicated.

The financial information presented in this interim financial

report for the period ended 30 June 2023 does not constitute

statutory accounts, within the meaning of section 434 of Companies

Act 2006. These interim financial statements do not include all of

the information required for a complete set of financial statements

prepared in accordance with IFRS Standards. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

consolidated financial statements.

The Annual Report and Financial Statements for the year ending

31 December 2022 have been filed with the Registrar of Companies.

The Independent Auditor's Report on the Annual Report and Financial

Statement ended 31 December 2022 was unqualified.

2.2 Accounting policies

The accounting policies are consistent with those followed in

the preparation of the Annual Report and Financial Statements for

the year ending 31 December 2022, which are filed with the

Registrar of Companies.

2.3 Going concern

The interim financial statements have been prepared on the going

concern basis, which the directors believe to be appropriate for

the following reasons. The directors have prepared cash flow

forecasts for a 12-month period from the date of approval of these

interim financial statements and such forecasts have indicated that

sufficient funds should be available to enable the Group to

continue in operational existence for the foreseeable future by

meeting its liabilities as they fall due for payment.

Furthermore, the Directors have considered the ongoing impact of

the current macro-economic factors on the Group's forecast

cashflows and liabilities, concluding that these have no material

impact on the Group due to the nature of its operations.

2.4 Critical accounting judgements and estimates

The preparation of the interim financial information requires

the use of certain critical accounting estimates. It also requires

management to exercise judgement and use assumptions in applying

the Group's accounting policies. The resulting accounting estimates

calculated using these judgements and assumptions will, by

definition, seldom equal the related actual results but are based

on historical experience and expectations of future events.

Management believe that the estimates utilised in preparing the

interim financial information are reasonable and prudent.

Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions.

The judgements and key sources of estimation uncertainty that

have a significant effect on the amounts recognised in the interim

financial information are consistent with those followed in the

preparation of the Annual Report and Financial Statements for the

year ending 31 December 2022 which are filed with the Registrar of

Companies .

3 Revenue from contracts with customers

All of the Group's revenue was generated from the provision of

services in the UK, apart from hire of facilities revenues

totalling GBP314,371 (2022: GBPNil) which were generated in the

European Union. Five customers make up 10% or more of revenue in

the period ending 30 June 2023 (2022: 4 ). Management considers

revenue is derived from one business stream being that of hire of

facilities. As at 30 June 2023 the Group had ceased trading of fuel

cards. Fuel cards by ADF was still identified as a separate

reporting segment up until this date, as fuel cards were sold in

the period to 30 June 2022.

Revenue from customers

Six months Six months

ended ended

30 June 30 June

2023 (unaudited) 2022 (unaudited)

GBP'000 GBP'000

----------------- -----------------

Hire of facilities

================= =================

Customer 1 3,059 2,431

================= =================

Customer 2 4,578 2,614

================= =================

Customer 3 2,378 234

================= =================

Customer 4 2,671 2,246

================= =================

Customer 5 3,037 1,449

================= =================

All other customers 6,054 3,646

----------------- -----------------

21,777 12,620

================= =================

Six months Six months

ended ended

30 June 30 June

2023 (unaudited) 2022 (unaudited)

Timing of transfer of goods or services GBP'000 GBP'000

----------------- -----------------

Services transferred over time 21,777 12,530

================= =================

At a point in time - 90

----------------- -----------------

21,777 12,620

================= =================

4 Segmental reporting

The Group has one reporting segment, being the hire of

facilities . During the comparative period, the Group had another

reporting segment, being fuel cards by ADF. At 30 June 2023 the

Group had ceased trading of fuel cards. Fuel cards by ADF was still

identified as a separate reporting segment up until this date.

Total assets and liabilities are not provided to the Chief

Operations Decision Maker (CODM) in the Group 's internal

management reporting by segment and therefore are not presented

below and information on segments is reported at a gross profit

level only. All non-current assets are held in the UK.

Six months ended Six months ended

30 June 2023 (unaudited) GBP'000 30 June 2022 (unaudited) GBP'000

--------------------------------- ---------------------------------

Revenue

Hire of facilities 21,777 12,530

Fuel by ADF - 90

--------------------------------- ---------------------------------

21,777 12,620

================================= =================================

Cost of sales profit

Hire of facilities (13,332) (8,372)

Fuel by ADF - (82)

--------------------------------- ---------------------------------

(13,332) (8,454)

--------------------------------- ---------------------------------

Gross Profit 8,445 4,166

================================= =================================

Revenue by geographical destination

Six months ended Six months ended

30 June 2023 (unaudited) GBP'000 30 June 2022 (unaudited) GBP'000

--------------------------------- ---------------------------------

United Kingdom 21,463 12,620

EU 314 -

--------------------------------- ---------------------------------

21,777 12,620

================================= =================================

5 Non-recurring expenses

The Group incurred GBP23,023 non-recurring expenses during the

period to 30 June 2023 (2022: GBPNil). The costs in the period

relate to additional expenditure in respect of the acquisition of

Location 1 Group Limited.

Six months Six months

ended ended

30 June 30 June

2023 (unaudited) 2022 (unaudited)

GBP'000 GBP'000

------------------ ------------------

Non-recurring expenses 23 -

================== ==================

6 Earnings per share

The calculation of the basic earnings per share (EPS) is based

on the results attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year. Diluted

EPS includes the impact of outstanding share options.

Six months Six months

ended ended

30 June 30 June

2023 (unaudited) 2022 (unaudited)

GBP GBP

------------------ ------------------

Profit used in calculating basic diluted

EPS 2,545,160 1,142,573

Weighted average number of shares 79,546,645 74,964,087

Diluted weighted average number of shares 85,497,418 80,910,717

Earnings per share 0.0320 0.0152

------------------ ------------------

Diluted earnings per share 0.0298 0.0141

================== ==================

7 Property, plant, and equipment

Computer Leasehold Assets

Plant Hire Motor equipment improvement under

and machinery Fleet vehicles GBP'000 GBP'000 construction Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

Cost

At 1 January

2022 -126 5,569 492 11 - - 6,198

Additions 33 1,984 221 - - 1,818 4,056

Additions on

acquisition - 2,524 560 - - 69 3,153

Transfers - 677 401 - - (1,078) -

Disposals - (91) (58) - - - (149)

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

At 31 December

2022 159 10,663 1,616 11 - 809 13,258

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

Depreciation

At 1 January

2022 58 1,951 48 4 - - 2,061

Charge for the

year 19 516 74 2 - - 611

Disposals - (63) (31) - - - (94)

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

At 31 December

2022 77 2,404 91 6 - - 2,578

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

Cost

At 1 January

2023 -159 10,663 1,616 11 - 809 13,258

Additions 75 1,098 180 5 95 1,002 2,455

Transfers - 1,114 368 - - (1,666) (184)

Disposals - (485) (173) - - - (658)

At 30 June 2023 234 12,390 1,991 16 95 145 14,871

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

Depreciation

At 1 January

2023 77 2,404 91 6 - - 2,578

Charge for the

year 15 683 172 1 8 - 879

Disposals - (349) (138) - - - (487)

At 30 June 2023 92 2,738 125 7 8 - 2,970

--------------- ---------- ---------- ------------ -------------- ---------------- -----------

Net book amount

At 31 December

2022 82 8,259 1,525 5 - 809 10,680

=============== ========== ========== ============ ============== ================ ===========

At 30 June 2023 142 9,652 1,866 9 87 145 11,901

=============== ========== ========== ============ ============== ================ ===========

Depreciation is charged to administrative expenses within the

statement of comprehensive income.

Leasehold improvements in the period to 30 June 2023, are in

respect of improvements made to Kitsmead, Kitsmead Lane, Longcross

KT16 0EF. These have been depreciated using a 25% reducing balance

rate.

8 Leases

Right-of-use assets

Hire Fleet Assets

Leasehold Motor and Motor under

Property Leasehold Vehicles Equipment construction Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2022 1,397 137 16,313 22 - 17,869

Additions 6,863 - 3,108 - 1,812 11,783

Business acquisitions 808 24 - 87 - 919

Transfers - - 1,085 - (1,082) 3

At 31 December

2022 9,068 161 20,506 109 730 30,574

---------- ----------- ----------- ------------ -------------- -----------

Depreciation

At 1 January 2022 840 57 1,871 6 - 2,774

Charge for the

period 251 38 1,602 8 - 1,899

At 31 December

2022 1,091 95 3,473 14 - 4,673

---------- ----------- ----------- ------------ -------------- -----------

Cost

At 1 January 2023 9,068 161 20,506 109 730 30,574

Additions 760 - 1,094 - 5,885 7,739

Transfers - - 5,005 - (4,821) 184

Disposals (17) - (14) - - (31)

At 30 June 2023 9,811 161 26,591 109 1,794 38,466

---------- ----------- ----------- ------------ -------------- -----------

Depreciation

At 1 January 2023 1,091 95 3,473 14 - 4,673

Charge for the

period 433 30 985 23 - 1,471

Disposal (17) - (2) - - (19)

At 30 June 2023 1,507 125 4,456 37 - 6,125

---------- ----------- ----------- ------------ -------------- -----------

Net book amount

At 31 December

2022 7,977 66 17,033 95 730 25,901

========== =========== =========== ============ ============== ===========

At 30 June 2023 8,304 36 22,135 72 1,794 32,341

========== =========== =========== ============ ============== ===========

Lease liabilities

Hire Fleet

Leasehold Motor and Motor

Property Leasehold Vehicles Equipment Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------ ----------- ------------ -----------

At 1 January 2022 583 91 11,574 17 12,265

Additions 6,770 - 4,165 - 10,935

Business acquisitions 808 24 - 87 919

Interest expense 106 3 585 1 695

Lease payments (including

interest) (172) (28) (3,376) (9) (3,585)

At 31 December 2022 8,095 90 12,948 96 21,229

---------- ------------ ----------- ------------ -----------

At 1 January 2023 8,095 90 12,948 96 21,229

Additions 759 - 6,007 - 6,766

Interest expense 224 1 399 1 625

Lease payments (including

interest) (425) (32) (2,186) (24) (2,667)

---------- ------------ ----------- ------------ -----------

At 30 June 2023 8,653 59 17,168 73 25,953

---------- ------------ ----------- ------------ -----------

9 Intangible assets

Software Goodwill Total

GBP'000 GBP'000 GBP'000

----------- --------- -----------

Cost

At 1 January 2022 - - -

Additions through business acquisitions - 7,211 7,211

Additions 81 - 81

-----------

At 31 December 2022 81 7,211 7,292

----------- --------- -----------

Amortisation

At 1 January 2022 - - -

Charge for the year 3 - 3

-----------

At 31 December 2022 3 - 3

----------- --------- -----------

Cost

At 1 January 2023 81 7,211 7,292

At 30 June 2023 81 7,211 7,292

----------- --------- -----------

Amortisation

At 1 January 2023 3 - 3

Charge for the period 9 - 9

----------- --------- -----------

At 30 June 2023 12 - 12

----------- --------- -----------

Net book amount

At 30 June 2023 69 7,211 7,280

=========== ========= ===========

At 31 December 2022 78 7,211 7,289

=========== ========= ===========

10 Capital commitments and contingencies

Capital and financial commitments

The Group commits to lease agreements in respect of hire

facilities over six months in advance, this is due to the nature of

the facilities leased.

As at 30 June 2023 the Group committed to new fleet capital

expenditure orders of GBP6.2 million for 2023 and GBP0.6 million

for 2024.

The Group held no other additional capital, financial and or

other commitments at 30 June 2023.

11 Share capital

As at As at

30 June 31 December

2023 2022

(unaudited) (audited)

GBP'000 GBP'000

----------------- -------------

Allotted, called up and fully paid

Ordinary Shares of 1p each (2023: 79.4m; 2022: 45.5m) 794 455

30 million issued Ordinary Shares of 1p in respect of AIM listing - 300

1.2 million issued Ordinary Shares of 1p in respect of exercised options (2022: 0.5

million) 12 5

3.407 million issued Ordinary Shares of 1p in respect of business acquisition - 34

----------------- -------------

Ordinary Shares of 1p each 806 794

================= =============

All classes of shares have full voting, dividends, and capital

distribution rights.

On the 5 January 2022 the shares of the Company were admitted to

the London Stock Exchange trading on the UK AIM market. Admission

and dealings of the ordinary shares of Facilities by ADF Plc became

effective on this date. As part of the listing, and on this date,

30,000,000 new ordinary shares were placed at a price of 50p.

On 4 April 2022 500,000 new ordinary share were issued in

respect of options exercised. The options exercised were

outstanding prior to the Company's January 2022 IPO, as detailed in

the Company's Admission Document, with the majority having been

issued in 2016 as part of the Company's Enterprise Management

Incentive ("EMI") scheme.

On 30 November 2022, the Group completed the acquisition of 100%

of the share capital of Location 1 Group Ltd for consideration of

an initial cash payment of GBP4,429,646 and GBP1,879,575

consideration paid in shares, through Facilities by ADF Plc. The

shares were issued at the share price on the day of the transaction

being GBP0.55p, resulting in an issue of 3,407,400 Ordinary Shares

of 1p.

On 9 June 2023 1,200,000 new ordinary shares were issued in

respect of options exercised. The options exercised were

outstanding prior to the Company's January 2022 IPO, as detailed in

the Company's Admission Document, with the majority having been

issued in 2020 as part of the Company's Enterprise Management

Incentive ("EMI") scheme.

No other options were issued, exercised, or forfeited during the

period ending 30 June 2023.

12 Post balance sheet events

On 5 July 2023, a total of 300,000 share options over new

Facilities by ADF ordinary shares of GBP0.01 each were exercised.

The options exercised were outstanding prior to the Company's

January 2022 IPO, as detailed in the Company's Admission Document,

with the majority having been issued in 2020 as part of the

Company's Enterprise Management Incentive ("EMI") scheme.

The USA Writers (Writers Guild of America (WAG)) and Actors

(Screen Actors Guild - American Federation of Television and Radio

Artists (SAG-AFTR)) strikes have continued post the interim period

end to impact productions around the globe. As the strikes have

drawn on, several film and TV productions in the UK, on which ADF

is currently engaged, have seen stoppages or delays to productions

that were scheduled to start filming in autumn 2023, having now

been pushed into early 2024 commencement.

Notwithstanding the above effects on productions affected by the

USA strikes, revenues from the Group's unaffected productions and

pipeline are expected to generate revenues for the full year ending

31 December 2023 of no less than GBP35 million, assuming there is

no resolution to the strikes in the current financial year. ADF

continues to assess the impact on its planned work programme for

the remainder of the financial year in conjunction with its

production company contacts. Any alleviation of the prevailing

strike action will provide the potential for further upside in the

current financial year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFIAVIDLIV

(END) Dow Jones Newswires

September 18, 2023 02:00 ET (06:00 GMT)

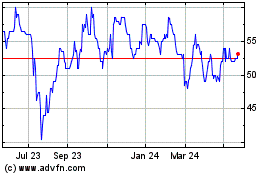

Facilities By Adf (LSE:ADF)

Historical Stock Chart

From Oct 2024 to Nov 2024

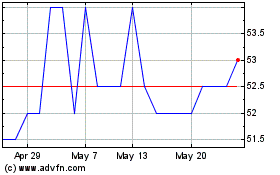

Facilities By Adf (LSE:ADF)

Historical Stock Chart

From Nov 2023 to Nov 2024