TIDMACC

RNS Number : 2808R

Access Intelligence PLC

05 July 2022

ACCESS INTELLIGENCE PLC

("Access Intelligence", the "Company" or the "Group")

INTERIM RESULTS

Access Intelligence Plc, (AIM: ACC) the technology innovator

delivering Software-as-a-Service ("SaaS") solutions for the global

marketing and communications industries, is pleased to announce its

unaudited half year results for the six months ended 31 May

2022.

Highlights:

-- The Group's first half revenue increased by approximately

198% to GBP32.7 million (H1 2021: GBP11.0 million). Excluding the

revenue delivered by Isentia which was acquired in September 2021,

revenue increased organically by 16.8% to GBP12.8 million.

-- Annual Recurring Revenue(1) ("ARR") increased by GBP0.7

million to GBP59.6 million (H1 2021: GBP24.7 million).

-- The Group delivered Adjusted EBITDA(2) in the period of

GBP0.3 million (H1 2021: loss of GBP0.14 million).

-- At 31 May 2022, the cash balance was GBP9.3 million (H1 2021:

GBP8.8 million and FY 2021: GBP13.5 million).

-- The Board remains very encouraged by the progress made in the

EMEA and North America markets which have demonstrated continued

growth. ARR in EMEA and North America at the period end was GBP28.1

million, showing growth of GBP1.2 million during the period.

-- The integration of Isentia continues to progress well. The

Group launched Pulsar into the Australia and New Zealand ("ANZ")

market in the period and the Board is pleased by the customer

engagement with the expanded global product offering.

Christopher Satterthwaite, non-executive Chairman,

commented:

"Access Intelligence has continued to make good progress during

the first half of 2022. The core business has delivered continued

growth in the EMEA and North America region, while the recent

acquisition of Isentia has created significant opportunity for the

Group in APAC. These results validate the Group's strategy to

enhance its product framework and global footprint to unlock land

and expand opportunities.

The Group won a substantial number of blue-chip clients in the

period, across every region, including significant win backs in

APAC. The launch of Pulsar in Australia and New Zealand has been

well received, leading to a healthy pipeline of both cross sell and

new business opportunities. The APAC business remains a key focus

for the second half; the Group is optimising its market position by

streamlining operations and continuing to realise the cost

synergies identified at the time of the acquisition.

As marketing and communications continue to converge, the Group

has continued to accelerate development of its products to meet

both the current and future needs of these disciplines. In 2022,

this has been supported by exciting new partnerships with NewsGuard

and Hootsuite.

Overall, the Board is pleased with the progress being made by

the Group and remains positive about the outlook."

1. ARR is the annual recurring revenue generated from deployed

contracts. The Group has decided to use ARR as its new KPI and is

broadly equivalent to the previously disclosed metric of Annual

Contract Value ("ACV").

2. Adjusted EBITDA is earnings before interest, tax,

depreciation and amortisation and adjusted for share based

payments, share of losses of an associate and non-recurring

expenses primarily relating to acquisition costs in respect of the

proposed Isentia transaction in the current and prior periods, in

addition to the acquisition and integration of Pulsar in the prior

period.

For further information:

Access Intelligence plc 020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker) 020 7220 0500

Corporate Finance:

Marc Milmo / Kate Bannatyne / Fergus Sullivan

Corporate Broking:

Alice Lane / Sunila de Silva

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ("MAR"). With the publication of this announcement,

this information is now considered to be in the public domain.

Chairman's statement

I am pleased to announce our unaudited interim results for the

six months ended 31 May 2022.

Access Intelligence continued its advancement in the first half

of 2022, delivering sustained organic growth in the core business

alongside its progress in the integration of Isentia and the

strategy to realise the cross sell opportunity in APAC. The results

support the Group's acquisition strategy, which has been developed

to serve the converging needs of the global marketing and

communications industries.

Continued growth

The Group's core business in the EMEA and North America markets

continue to demonstrate sustained growth, with H1 ARR reaching

GBP28.1m, showing growth of GBP1.2m. New client wins saw

international blue chip businesses onboarded in the period,

including Allianz, E.ON, John Lewis, Hasbro, HS2, KPMG, P&G,

Reddit, The Premier League, TP ICAP and Trust Pilot.

These were added to in the APAC region by new clients and client

win backs including ABC, Estee Lauder, H&M, Huawei, Netflix,

Nestle, Ogilvy, SAS Group, StudioCanal and Tiffany & Co. ARR in

the region was down GBP0.5m to GBP31.5m, although the rate of

decline was significantly improved in comparison to pre-acquisition

and is largely attributable to the socio-economic challenges

experienced locally in South-East Asia. This near term performance

does not detract from the overall opportunity for the Group to

expand in APAC which is fuelled by the proliferation of audiences

and social media users in the region.

While some world economies are beginning to emerge from the

challenges created by the pandemic, the cost-of-living crisis, war

in Ukraine and shortages in raw materials are presenting new

challenges to enterprises against the backdrop of existing issues

such as the spread of misinformation and the propagation of content

through online channels. This requires organisations to be more

strategic in their approach and ensure their marketing

communications are efficient and effective in reaching the right

audiences and stakeholders at the right time.

All of the Group's buyer types have this need, which is only

increasing under the pressure of the current climate. That is why

the Group is focussed on ensuring it continues to enhance its suite

of products and is currently developing a next generation platform,

which will provide a greater understanding of audience impact,

underpinned by media, social, consumer and political

intelligence.

The Group has also focussed on expanding its offering and route

to market through integrations into its technology and channel

partners being a strategic focus for the Board. New partnerships in

H1 are already contributing to this future focus including the

integration of NewsGuard and the referral partnership with

Hootsuite.

NewsGuard rates the trustworthiness of news sources and the

integration will detect early signals of misinformation, measure

the impact of those narratives on public opinion and help PR and

marketing professionals respond quickly to protect their brands'

reputations. NewsGuard's journalistically trained analysts have

rated all the news and information sources that account for 95% of

engagement online, applying nine apolitical criteria of

journalistic practice to determine which sources are generally

reliable and which ones publish misinformation and hoaxes. These

ratings are available directly in the Group's platform and clients

can easily segment content and sources by their trust scores.

The partnership with Hootsuite strengthens the Group's overall

offering through referrals and collaborations with one of the

world's most successful social media management platforms. The

mutually beneficial relationship will support existing client

retention and growth with new opportunities, particularly in the

North American market.

Acquisition, integration and expansion

A key pillar in the Group's strategy is targeted acquisitions

that provide technological advancement, territory expansion and

synergy with our existing portfolio. The acquisition of Isentia

brought the Group all three, expanding the Group from circa 200

employees to over 1,000 and increasing the client base from 3,500

to over 6,000.

Isentia also immediately benefitted as the Group was able to

provide it with investment in marketing and technology, including

the launch of Pulsar into ANZ - which has made measurable

improvements to its media monitoring systems and sales

pipeline.

Whilst competition continues in the ANZ market and macroeconomic

conditions remain challenging, particularly in South East Asia, the

Group has made a number of positive developments in APAC. The

relocation of an EMEA sales director to head up a new Pulsar sales

team in ANZ has enabled us to leverage Isentia's exceptional

customer base through cross-sell and led to early new business wins

and an exciting pipeline for H2. We are increasingly positive about

the social media and audience intelligence opportunities in APAC

where the Group's offering is clearly differentiated from those of

its competitors.

Regional teams have been collaborating and sharing best

practice, a prime example of which is the alignment of the Group's

insights service that has rolled out at both a global and local

level.

The Group has also recognised cost synergies in line with its

pre-acquisition timeline expectations, streamlining operations and

improving systems and processes. This includes the ongoing

integration and migration of CRM and accounting systems, as well as

the merger of the marketing and insights departments under one

global umbrella headed up by our newly appointed CMIO.

The Group's buyer types

The Group targets three distinct buyer types, and focuses

development to meet their increasingly converging needs:

-- Marketing - Our social listening and audience intelligence

platform finds the story in the data for marketers around the

world. Patterns and trends in behaviours and conversations are

displayed in real-time from both social and news sources, so

marketers can understand what is impacting their reputation and

their customers, how trends and topics are evolving, and where

there are opportunities to innovate.

-- PR & Communications - Recognising where PR can and should

feed into the news cycle is vital, which is why practitioners

depend on the Group's news, political and social media monitoring

to track coverage and show how trends develop across different

media. Real-time analysis highlights opportunities for proactive

communications, measures share of voice against key competitors and

tracks the impact of clients' PR activity.

-- Insights - Our award-winning Insights teams combine deep

expertise in our market-leading tools with human intelligence and

industry expertise. They work in partnership with our clients to

drive audience understanding and improve every stage of their

marketing and communications strategy, from planning through

execution to results.

Results for the half year

The primary key performance indicator monitored by the Board is

the growth in ARR year-on-year. This reflects the annual value of

new business won, together with upsell into the Company's existing

customer base as it delivers against its land and expand strategy,

less churn. It is an important metric for the Group as it is a

leading indicator of future revenue.

During the period, the Group's ARR grew by GBP0.7 million to

GBP59.6 million (H1 2021: growth of GBP2.7 million to GBP24.7

million). ARR in EMEA and North America increased by GBP1.2m to

GBP28.1m, whilst ARR in APAC reduced by GBP0.5 million to GBP31.5

million. This remains a marked improvement to the performance from

the region pre-acquisition where the rate of decline was

significantly higher and reflects the Company's focus on winning

long-term recurring revenue contracts.

Revenue for the period grew by 198% to GBP32.7 million (H1 2021:

GBP11.0 million). Excluding the revenue delivered by Isentia which

was acquired in September 2021, revenue increased organically by

16.8% to GBP12.8 million. The organic year-on-year increase was

primarily driven by ARR growth between June 2021 and May 2022.

Recurring revenue comprised 93% of total revenue (H1 2021:

94%).

Gross profit increased by over 200% year-on-year to GBP24.5

million (H1 2021: GBP8.1 million) with the Group delivering a gross

margin of 75% (H1 2021: 74%). Gross margin improved compared to the

prior period as the Group is able to leverage fixed cost data feeds

more effectively with an expanded revenue base.

Adjusted earnings before interest, tax, depreciation and

amortisation ("EBITDA") were GBP0.3 million, compared to a loss of

GBP0.1 million in H1 2021. Adjusted EBITDA excludes certain

non-recurring items totalling GBP1.4 million for the period (H1

2021: GBP1.3 million), in addition to the Group's share of loss of

an associate of GBP0.1 million (H1 2021: GBP0.1 million) and a

share-based payments charge of GBP0.6 million (H1 2021: GBP0.1

million).

Non-recurring items in the period included transition and

migration costs in respect of acquisitions of GBP0.9 million (H1

2021: GBPNil), legal costs in respect of the Australian copyright

tribunal of GBP0.4 million (H1 2021: GBPNil), and acquisition

related legal and due diligence costs of GBPNil (H1 2021: GBP1.3

million). Reported EBITDA loss was GBP1.7 million (H1 2021: loss of

GBP1.6 million).

The Group has continued to increase investment in its software

platforms with identifiable new product development activity being

capitalised. The Group capitalised development costs of GBP3.5

million for the period (H1 2021: GBP1.2 million), with a further

GBP1.4 million (H1 2021: GBP0.7 million) of product, research and

development costs being expensed through profit and loss.

The Group's operating loss was GBP7.4 million (H1 2021: loss

GBP3.3 million). The Group incurred GBP5.7 million of depreciation

and amortisation charges (H1 2021: GBP1.7 million).

The basic loss per share was 1.50p (H1 2021: loss 4.07p).

The Group held cash at the end of the period of GBP9.3 million

(H1 2021: GBP8.8 million).

Outlook

During 2022, Access Intelligence has focused its activities in

three key areas: advancing its market leading products; the

continued integration of Isentia; and evaluation of current

business operations to ensure that the Group can fully leverage its

market positioning.

The ongoing investment in products and operations will provide

customers across the Group's markets with an enhanced user

experience and an expanded global content offering. These

improvements will support the continued scaling of the business

through increased sales and improved customer retention.

The integration of Isentia continues to progress well and the

Group has launched Pulsar into Australia and New Zealand. Customer

engagement with the expanded global product offering has been

pleasing and Pulsar has created a clear differentiation from

competitors' products in the region.

The Group has also undertaken a comprehensive analysis of the

current market dynamics across its regional presence to ensure that

it is optimally structured to capture the undoubted global market

opportunity. The Board remains highly confident about realising the

cost synergies identified at the time of the acquisition.

Overall, t he Board is pleased with the progress being made with

the Company continuing to trade in line with expectations and

remains positive about the outlook for the Group.

Christopher Satterthwaite

Non-executive Chairman

Access Intelligence Plc

Consolidated Statement of Comprehensive Income

for the six months ended 31 May 2022

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended

31-May-22 31-May-21 30-Nov-21

GBP'000 GBP'000 GBP'000

Revenue 32,731 11,000 33,296

Cost of sales (8,280) (2,875) (8,243)

--------- --------- -----------

Gross profit 24,451 8,125 25,053

Recurring administrative expenses (24,131) (8,260) (25,581)

--------- --------- -----------

Adjusted EBITDA 320 (135) (528)

Non-recurring administrative expenses (1,369) (1,332) (3,855)

Share of loss of associate (125) (71) (228)

Share-based payments (564) (72) (383)

--------- --------- -----------

EBITDA (1,738) (1,610) (4,994)

Depreciation of tangible fixed assets (324) (110) (336)

Depreciation of right-of-use assets (1,168) (325) (1,006)

Amortisation of intangible assets

- internally generated (932) (672) (1,520)

Amortisation of intangible assets

- acquisition related (3,263) (546) (1,371)

--------- --------- -----------

Operating loss (7,425) (3,263) (9,227)

Financial income 5 10 10

Financial expense (151) (169) (340)

--------- --------- -----------

Loss before tax (7,571) (3,422) (9,557)

Taxation credit 572 50 842

--------- --------- -----------

Loss for the period (6,999) (3,372) (8,715)

Other comprehensive income

Items that will or may be reclassified

to profit or loss 5,085 (13) 309

--------- --------- -----------

Total comprehensive loss for the

period attributable to the owners

of parent company (1,914) (3,385) (8,406)

--------- --------- -----------

Earnings per share:

Basic loss per share (1.50)p (4.07)p (8.73)p

Diluted loss per share (1.50)p (4.07)p (8.73)p

Access Intelligence Plc

Consolidated Statement of Financial Position

at 31 May 2022

Unaudited Unaudited Audited

As at As at As at

31-May-22 31-May-21 30-Nov-21

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 67,358 15,786 63,234

Investment in associate 591 873 716

Right-of-use assets 2,661 2,005 3,538

Property, plant and equipment 975 411 1,080

Deferred tax assets 4,325 18 4,144

--------- --------- ---------

Total non-current assets 75,910 19,093 72,712

--------- --------- ---------

Current assets

Trade and other receivables 14,772 7,786 13,695

Current tax receivables 783 548 1,346

Cash and cash equivalents 9,291 8,773 13,456

Total current assets 24,846 17,107 28,497

--------- --------- ---------

TOTAL ASSETS 100,756 36,200 101,209

--------- --------- ---------

Current liabilities

Trade and other payables 7,649 3,516 7,735

Accruals 7,604 2,138 6,888

Contract liabilities 13,824 9,928 12,144

Provisions 632 - 537

Lease liabilities 1,831 796 2,184

Interest bearing loans and

borrowings - 667 -

Total current liabilities 31,540 17,045 29,488

--------- --------- ---------

Non-current liabilities

Provisions 382 213 372

Lease liabilities 1,644 2,003 2,187

Interest bearing loans and

borrowings - 1,064 -

Deferred tax liabilities 7,578 474 8,153

--------- --------- ---------

Total non-current liabilities 9,604 3,754 10,712

--------- --------- ---------

TOTAL LIABILITIES 41,144 20,799 40,200

--------- --------- ---------

NET ASSETS 59,612 15,401 61,009

--------- --------- ---------

Equity

Share capital 6,528 4,382 6,528

Treasury shares (148) (148) (148)

Share premium account 74,372 26,247 74,419

Capital redemption reserve 395 395 395

Share option reserve 1,465 590 901

Foreign exchange reserve 5,394 (13) 309

Other reserve 502 502 502

Retained earnings (28,896) (16,554) (21,897)

--------- --------- ---------

TOTAL EQUITY ATTRIBUTABLE

TO EQUITY SHAREHOLDERS 59,612 15,401 61,009

--------- --------- ---------

Access Intelligence Plc

Consolidated Statement of Changes in Equity

for the six months ended 31 May 2022

Share Treasury Share Capital Share Foreign Other Retained Total

capital shares premium redemption option exchange reserve earnings

account reserve reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 December

2020 3,757 (148) 17,242 395 518 - 502 (13,182) 9,084

Loss for the

period - - - - - - - (3,372) (3,372)

Other comprehensive

loss for the

period - - - - - (13) - - (13)

Issue of share

capital 625 - 9,005 - - - - - 9,630

Share-based payments - - - - 72 - - - 72

At 31 May 2021 4,382 (148) 26,247 395 590 (13) 502 (16,554) 15,401

------- -------- ------- ---------- ------- -------- ------- --------- -------

Loss for the

period - - - - - - - (5,343) (5,343)

Other comprehensive

income for the

period - - - - - 322 - - 322

Issue of share

capital 2,146 - 48,172 - - - - - 50,318

Share-based payments - - - - 311 - - - 311

At 30 November

2021 6,528 (148) 74,419 395 901 309 502 (21,897) 61,009

------- -------- ------- ---------- ------- -------- ------- --------- -------

Loss for the

period - - - - - - - (6,999) (6,999)

Other comprehensive

income for the

period - - - - - 5,085 - - 5,085

Expenses related

to issue of share

capital - - (47) - - - - - (47)

Share-based payments - - - - 564 - - - 564

At 31 May 2022 6,528 (148) 74,372 395 1,465 5,394 502 (28,896) 59,612

------- -------- ------- ---------- ------- -------- ------- --------- -------

Access Intelligence Plc

Consolidated Statement of Cash Flow

for the six months ended 31 May 2022

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31-May-22 31-May-21 30-Nov-21

GBP'000 GBP'000 GBP'000

Loss for the year attributable

to shareholders (6,999) (3,372) (8,715)

Adjustments for:

Taxation (572) (50) (842)

Financial expense 151 169 340

Financial income (5) (10) (10)

Depreciation and amortisation 5,687 1,653 4,233

Share based payments 564 72 383

Share of loss of associate 125 71 228

Operating cash outflow before

working capital changes (1,049) (1,467) (4,383)

Increase in trade and other receivables (1,079) (1,823) (938)

Increase in trade and other payables 835 32 1,426

Increase in contract liabilities 1,680 1,806 1,830

Increase/(decrease) in provisions 61 - (9)

----------- ----------- ---------

Net cash inflow/(outflow) from

operations 448 (1,452) (2,074)

Tax received/(paid) 166 - (305)

----------- ----------- ---------

Net cash inflow/(outflow) from

operating activities 614 (1,452) (2,379)

----------- ----------- ---------

Investing

Interest received 5 10 10

Acquisition of property, plant

and equipment (211) (26) (106)

Acquisition of software licences

and other intangible assets - (19) (83)

Cost of software development (3,478) (1,248) (3,428)

Investment in associate - (887) (887)

Acquisition of Isentia - - (39,744)

----------- ----------- ---------

Net cash outflow from investing

activities (3,684) (2,170) (44,238)

----------- ----------- ---------

Financing

Interest paid (144) (169) (350)

Drawdown of loans - 2,000 2,000

Repayment of loans - (269) (2,000)

Lease liabilities paid (1,198) (200) (952)

Issue of shares - 10,000 61,465

Cost associated with share issue (47) (370) (1,517)

Net cash (outflow)/inflow from

financing activities (1,389) 10,992 58,646

----------- ----------- ---------

Net (decrease)/increase in cash (4,459) 7,370 12,029

Opening cash and cash equivalents 13,456 1,403 1,403

Exchange gains on cash and cash

equivalents 294 - 24

----------- ----------- ---------

Closing cash and cash equivalents 9,291 8,773 13,456

----------- ----------- ---------

Notes

1. Unaudited notes

Basis of preparation and accounting policies

The financial information for the six months to 31 May 2022 is

unaudited and was approved by the Board of Directors on Monday

4(th) July 2022.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements for the year ended 30 November 2021.

The interim financial information for the six months ended 31

May 2022, including comparative financial information has been

prepared on the basis of the accounting policies set out in the

last annual report and accounts.

The preparation of the interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expense. Actual results

may subsequently differ from those estimates.

In preparing the interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and key sources of estimation uncertainty were the same,

in all material respects, as those applied to the consolidated

financial statements for the year ended 30 November 2021.

The Group has elected to present comprehensive income in one

statement.

Going concern assumption

The Group meets its day to day working capital requirements

through its cash balance but also maintains relationships with a

number of financial institutions and believes that, should it be

required, it would be able to put in place an appropriate working

capital facility. It did not have a bank loan or overdraft at 31

May 2022 and had a net cash balance of GBP9,291,000.

Consequently, after making enquires, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason, they continue to adopt the going concern basis of

accounting in preparing the interim financial statements.

Information extracted from the Group's 2021 Annual Report

The financial figures for the year ended 30 November 2021, as

set out in this report, do not constitute statutory accounts but

are derived from the statutory accounts for that financial

year.

The statutory accounts for the year ended 30 November 2021 were

prepared under IFRS and have been delivered to the Registrar of

Companies. The auditors reported on those accounts. Their report

was unqualified, did not draw attention to any matters by way of

emphasis and did not include a statement under Section 498(2) or

498(3) of the Companies Act 2006.

2. Revenue

The Group's revenue is primarily derived from the rendering of

services. The Group's revenue was generated from the following

territories:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31-May-22 31-May-21 30-Nov-21

GBP'000 GBP'000 GBP'000

United Kingdom 10,396 9,160 19,073

North America 1,480 493 1,987

Europe 611 975 1,201

Australia and New Zealand 15,852 91 8,145

Asia 4,284 42 2,374

Rest of the world 108 239 516

32,731 11,000 33,296

3. Earnings per share

The calculation of earnings per share is based upon the loss

after tax for the respective period. The weighted average number of

ordinary shares used in the calculation of basic earnings per share

is based upon the number of ordinary shares in issue in each

respective period.

The impact of share options granted under the company's share

option scheme are anti-dilutive due to the Group being in a

loss-making position, so the weighted average number of ordinary

shares used in the calculation of diluted earnings per share is the

same as for basic earnings per share.

This has been computed as follows:

6 months 6 months 6 months 6 months Year Year

ended ended ended ended ended ended

31-May-22 31-May-22 31-May-21 31-May-21 30-Nov-21 30-Nov-21

----------- ----------- ----------- ----------- ---------- ----------

Basic Diluted Basic Diluted Basic Diluted

----------- ----------- ----------- ----------- ---------- ----------

Loss after

tax (GBP'000) (1,914) (1,914) (3,385) (3,385) (8,406) (8,406)

----------- ----------- ----------- ----------- ---------- ----------

Number of

shares ('000)* 127,597 127,597 83,190 83,190 96,237 96,237

----------- ----------- ----------- ----------- ---------- ----------

Loss per

share (pence) (1.50) (1.50) (4.07) (4.07) (8.73) (8.73)

----------- ----------- ----------- ----------- ---------- ----------

4. Events after the reporting date

On 14 June 2022, the Group announced that it had received notice

of exercise ("Exercise") from an employee in relation to options

over 53,351 ordinary shares of 5 pence each in the Company and had

transferred 53,351 shares previously held in treasury to satisfy

the Exercise. As a result, the Company's issued share capital

consists of 130,524,386 Ordinary Shares, 2,873,964 of which remain

held in treasury. The total number of Ordinary Shares in the

Company with voting rights is 127,650,422.

5. Availability of interim results

The interim results will not be sent to shareholders but will be

available at the Company's registered office at The Johnson

Building, 79 Hatton Garden, London, EC1N 8AW and on the Company's

website: www.accessintelligence.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDDEISIIF

(END) Dow Jones Newswires

July 05, 2022 02:00 ET (06:00 GMT)

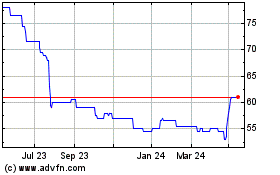

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Nov 2024 to Dec 2024

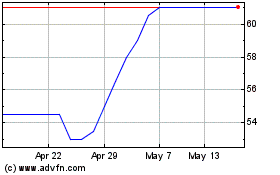

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Dec 2023 to Dec 2024