TIDMACC

RNS Number : 5562Y

Access Intelligence PLC

17 January 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Access Intelligence plc

("Access Intelligence" or the "Company")

Trading Update

Access Intelligence (AIM: ACC), the technology innovator

delivering Software-as-a-Service (SaaS) solutions for the global

marketing and communications industries, announces an update on

trading for the year ended 30 November 2021.

Year to 30 November 2021: a transformative year

Access Intelligence has seen growth in its core business

accelerate, with Annual Contract Value ('ACV') increasing by 23%

compared to the prior year. Furthermore, the transformative

acquisition of Isentia in September 2021 has provided both scale in

the APAC market as well as broadening Access Intelligence's

platform for growth.

The Board expects total revenue for the financial year to be

approximately GBP33.1m (2020: GBP19.1m, 73% growth, 21% organic

growth). It is expected that Adjusted EBITDA loss will be

approximately GBP0.5m, in line with management's expectations. Net

cash at 30 November 2021 was approximately GBP13.0 million,

significantly ahead of management's expectations.

The Company's existing business excluding Isentia has delivered

year on year growth. Increased new business and higher renewal

rates have underpinned an increase in organic Annual Contract Value

('ACV') growth from GBP3.9m in 2020 to GBP5.0m for 2021. Total ACV

at 30 November 2021 was approximately GBP26.9m, compared to

GBP21.9m at 30 November 2020.

New client wins in the second half include BASF, Byte,

GivingTuesday, Jockey, Mary Kay Inc, Metro Bank, Pfizer, Savills,

Scope, Shelter, Siemens, Sony Music, Starling Bank, TalkTalk and

Twitch.

The integration of Isentia is progressing well, with a combined

management and financial structure across the Group and functional

alignment initiatives that are standardising how we operate as a

single business. Progress has been made in integrating product

offerings, including collaboration between the traditional media

and social insight functions to enable us to bring new products to

market. The release of Pulsar into the ANZ market during Q1 2022

brings significant opportunity to enhance the value that Access

Intelligence provides to clients in the region.

Including Isentia's ACV of approximately GBP32.0m, total ACV for

the Group at 30 November 2021 was GBP58.9m (30 November 2020:

GBP21.9m, 169% year on year growth, 23% organic year on year

growth).

Outlook

Access Intelligence continues to have a strong core business in

EMEA and North America and expects growth in these regions to

accelerate as they benefit from the investments made in sales and

marketing during 2021.

Prior to its acquisition, Isentia had seen ACV losses in

Australia and New Zealand as competitors entered the market.

Commercial performance has now been stabilised with no overall

reduction in ACV in this region post-acquisition.

In the South East Asia markets, the impact of COVID-19 has been

more severe and longer lasting than anticipated, particularly in

Isentia's key markets of Singapore, Malaysia and Indonesia. This

has been exacerbated by Omicron which has seen countries in the

region bring in further restrictive measures. Both corporate

customers and government departments have seen further pressure to

reduce spend which has resulted in an increase in cancelled or

consolidated contracts in the region.

As a result of the ongoing socio-economic climate in South East

Asia and its near term implications of higher than anticipated

churn and delayed opportunity to deliver new contract growth, the

Board has revised its expectations of revenue. In addition, the

strengthening of Sterling against currencies in the APAC region has

resulted in a translational impact on projected revenue.

The Directors anticipate that growth in the region will return

once the challenges of COVID-19 diminish and intends to continue to

invest in infrastructure in the region to ensure the Group is well

placed to take advantage.

Overall, the Board expects that the Group will continue to grow

and will deliver Adjusted EBITDA profitability as it strengthens

its position in EMEA, North America and ANZ. The current challenges

in South East Asia will affect the pace of overall growth and

result in EBITDA being impacted in 2022 and 2023, but the Group has

a robust ACV base of GBP58.9m, is seeing strong growth in its core

markets and has the infrastructure in place to take advantage of

any improvement in conditions in the South East Asia market.

Christopher Satterthwaite, Non-Executive Chairman of the

Company, said:

"During 2021 Access Intelligence delivered strong growth in its

core business and has completed a transformative acquisition in

Isentia to take its market leading products to the international

marketplace. The integration of Isentia is progressing well with

new product offerings already being made available to customers in

all markets.

The global market opportunity continues to grow as marketing and

communication budgets depend on the intelligence that the Group's

products provide. Market consolidation gives evidence of the

essential requirement of real time data to inform investment

decisions in marketing and communication budgets.

In the near term, the South East Asia region continues to

confront the economic and social challenges brought about by the

pandemic but Access Intelligence has an enviable market position

and the Board believes that the region will prove to be a growth

opportunity when it starts to recover from its current

challenges.

With an expanded footprint and an excellent suite of products,

Access Intelligence is well placed to take advantage of the global

opportunity by leveraging the model established in its core

business and the market leading innovation its products provide to

global clients."

For further information:

Access Intelligence plc 020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker)

020 7220 0500

Corporate Finance:

Marc Milmo / Kate Bannatyne / Fergus Sullivan

Corporate Broking:

Alice Lane / Sunila de Silva

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFMFMMEESEDF

(END) Dow Jones Newswires

January 17, 2022 02:00 ET (07:00 GMT)

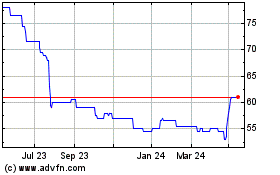

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Feb 2025 to Mar 2025

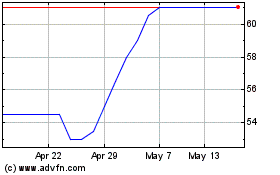

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Mar 2024 to Mar 2025