TIDMACC

RNS Number : 5276K

Access Intelligence PLC

02 September 2021

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE PROHIBITED BY ANY APPLICABLE LAW.

UNLESS OTHERWISE INDICATED, CAPITALISED TERMS IN THIS

ANNOUNCEMENT HAVE THE MEANINGS GIVEN TO THEM IN THE ANNOUNCEMENT OF

15 JUNE 2021.

Access Intelligence PLC

("Access Intelligence" or the "Company")

Completion of Acquisition and Re-Admission

Access Intelligence Plc, (AIM: ACC) the technology innovator

delivering Software-as-a-Service (SaaS) solutions for the global

marketing and communications industries, is pleased to announce

that further to the announcement of 1 September 2021, it has

completed the Acquisition of Isentia Group Limited and re-admission

of the Enlarged Group to trading on AIM is now effective.

Highlights

- Completed acquisition of Isentia, a market leading Asia

Pacific focused media intelligence and award winning insights

company for the corporate communications market, headquartered in

Sydney, Australia

- Isentia operates in eight geographical markets across

Australia, New Zealand and South-East Asia working with c.2,400

customers

- The Enlarged Group has greater scale, an improved and wider

ranging product offering and greater geographic reach. With minimal

overlap between the two large client bases, the Enlarged Group has

significant revenue synergy opportunities through substantial

cross-sell and up-sell opportunities

- The Enlarged Group anticipates approximately 90 per cent. of its revenues is recurring

- The Acquisition is expected to be earnings enhancing in the

first full year following completion

Rationale for the Acquisition and strategy for the Enlarged

Group

Following the Acquisition, the Enlarged Group has the potential

to benefit from greater scale, a superior product offering and

greater geographic reach, in addition to delivering potential cost

and revenue synergies.

Isentia's market leading position in APAC is underpinned by a

sales and operational infrastructure across ANZ as well as the

major South East Asian economies. The Acquisition therefore aligns

with a key element of Access Intelligence's strategy to continue

expanding and diversifying revenues globally to complement its

market leading position in Europe and growing presence in the

US.

The Vuelio and Pulsar products have already been proven and

successful in APAC and the Middle East, with blue-chip customers in

these regions. As Isentia's current product portfolio is limited to

media monitoring, entry-level social listening and manual insights,

this represents significant cross-sell and up-sell opportunities

for Vuelio's wider communications campaign management platform and

influencer database, as well as Pulsar's advanced audience analysis

and social media intelligence. Isentia recognises that its existing

social offering is limited and as a result Isentia and Access

Intelligence are already working together on potential

opportunities to provide Access Intelligence's Pulsar offering to

Isentia's existing customer base.

The Acquisition provides Access Intelligence with the

opportunity to scale its sales infrastructure across eight

countries in the Asia-Pacific region. This is an ideal platform for

cross-selling opportunities of the Pulsar audience intelligence and

social listening platform. APAC is the fastest growing market for

social media analytics, with a projected CAGR of 33.2 per cent.

between 2019 and 2024, rising from US$1.4bn to US$6bn. In contrast

to consumer adoption of social in the region, the Directors believe

that there is a significant opportunity to increase investment in

Isentia's existing product to meet the growing sophistication of

marketing communication professionals in the region.

The Enlarged Group's strategy is to seek to capitalise on its

leading position as a provider of SaaS solutions for the PR,

communications and marketing industries. The Board of Access

Intelligence's strategic vision is to apply technology and insight

to transform the relationships between business, media, government

and the public through the provision of a next-generation

intelligence marketplace.

The Enlarged Group will be able to offer customers a broader

suite of technology products serving the traditional and social

media monitoring markets with strong analytic capabilities. This

will provide significant cross-selling and upselling opportunities

amongst Isentia's 2,400 customers and Access Intelligence's 3,500

customers with limited cross over between them, helping to drive

revenue growth.

Re-Admission and Total Voting Rights

Re-Admission and dealings in the entire issued share capital of

the Enlarged Group commenced at 8.00 a.m. today.

Following Re-Admission, the total number of Ordinary Shares in

issue is 130,524,386, including 2,966,666 held in treasury.

Accordingly, the total number of Ordinary Shares in the Company

with voting rights is 127,557,720. This figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the applicable legal and regulatory

requirements.

Joanna Arnold, CEO of Access Intelligence, commented:

"I am delighted that the acquisition of Isentia is complete and

look forward to delivering our broader services and capabilities to

customers around the world. Having now relocated to Australia to

oversee the integration on the ground, I am already excited by the

potential and opportunities for our business. By integrating

Isentia, a leading media intelligence company in Australia and

across the Asia- Pacific region, our customers will now benefit

from an offering that gives them more choice and greater

geographical reach. We will continue to invest in our capabilities

and drive further innovation, harnessing technology and insight, to

deliver our strategic vision of building the leading intelligence

provider for the global marketing and communications industry."

For further information:

Access Intelligence plc

Joanna Arnold (CEO) / Mark Fautley (CFO) 020 3426 4024

finnCap Limited (Nominated Adviser and Broker)

Corporate Finance - Marc Milmo / Kate Bannatyne / Fergus

Sullivan 020 7220 0500

Corporate Broking - Alice Lane / Sunila de Silva

About Access Intelligence

Access Intelligence PLC is an AIM-listed martech leader, helping

marketers and communicators anticipate, react and adapt to what's

important to customers, stakeholders and their brand as they

navigate a constantly changing world of influence and reputation

online. Its technology is used by 6,000 global organisations every

day, from blue-chip enterprises and communications agencies to

public sector organisations and not-for-profits.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUURBRABUKRRR

(END) Dow Jones Newswires

September 02, 2021 03:15 ET (07:15 GMT)

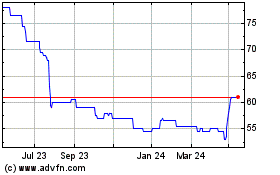

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Feb 2025 to Mar 2025

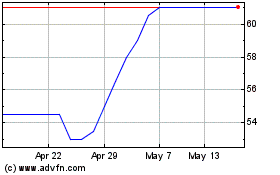

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Mar 2024 to Mar 2025