VANCOUVER, BC, June 13, 2022 /PRNewswire/ -- Silver One

Resources Inc. (TSXV: SVE) (OTCQX: SLVRF) (FSE: BRK1) - "Silver

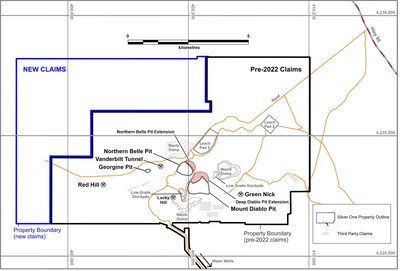

One" or the "Company") has identified new targets and continues to

expand ground holdings at its flagship property, the past-producing

Candelaria Silver Mine in

Nevada. Recent and historical

work, including geology, rock and soil geochemical sampling, IP and

3D magnetic data modelling, have revealed new exploration targets

and expanded previously known targets. As a result, the Company has

staked an additional 336 claims in the north and western part of

the property (see Figure 1). To date, the Company controls 20,376

acres (8,246 hectares) of patented and Bureau of Land Management

("BLM") ground covering the areas of historic mining, leach pads,

new targets and potential along-strike extensions to the known

mineralized systems. Silver One is also continuing its

metallurgical diamond drilling program in anticipation of an update

to the historical resource completed by Silver Standard in 2001

(visit the Company's website at www.silverone.com) and the

Company's first economic study.

Highlights:

- New zones of surface copper oxide mineralization found west of

the Georgine Pit. Four rock chip samples report between 0.7% to

over 1% copper in brecciated jasperoids at the Red Hill target (See

Figure 2 and Photos 1 and 2 below).

- New zones of skarn related copper mineralization found to the

south of the Georgine Pit. Here soil and surface rock sampling have

identified anomalous copper (>500 ppm), silver and gold covering

a 500 m x 1,000 m area. This is near Silver One's drill

holes SO-C-21-076 and SO-C-21-080 that encountered skarn

mineralization with anomalous copper (including 0.17% Cu over 18

meters from 208.79 meters depth in hole SO-C-21-080), as well as

near the Vanderbilt tunnel dump where a

grab sample of chalcopyrite rich material returned values to 2.76%

copper, 24 g/t silver and 0.67 g/t gold (see Company news releases

of October 15, 2020 and July 15, 2021 and Photo 3).

- Metal Factor ("MF" – associated high IP chargeability and low

resistivity) anomalies detected beneath the Northern Belle and

Mount Diablo silver-oxide pits. These anomalies continue down-dip

from the pits as well as eastwards and westwards covering

significant copper showings at Green Nick to the east, and Red Hill

to the west. These geophysical anomalies extend for over 10

kilometers east-west (See Figure 2).

- A second Metal Factor anomaly identified in the northwest part

of the property is buried under volcanic cover (See Figure 2).

- Magnetization Vector Inversion ("MVI") anomalies generally

coincide with MF anomalies and, in the highest priority targets,

with copper, silver and gold geochemical anomalies (see Figures

2-5).

- Recently staked claims cover new targets identified by

geophysics and surface geochemistry.

- Metallurgical diamond drilling continues in the area of the

past producing silver-oxide open pits in anticipation of an

upcoming historical in-situ resource update and economic study. The

company is still awaiting assay results from the recently completed

7,500 m reverse circulation drill

program completed marginal to the open pits (see Company news

release of April 22, 2022).

Greg Crowe, President and CEO of

Silver One Resources commented, "The geophysical and

geochemical surveys completed by Silver One, in combination with

historical data, strongly validate the potential for

porphyry-related copper-silver-gold zones beneath and along strike

from the known silver oxide mineralization at Candelaria. The

implications of this are a significant increase in the potential

for the discovery of new mineralized systems at Candelaria. The

most promising targets to date occur beneath the two past-producing

silver-oxide pits, at Red Hill to the west, and Green Nick to the

east. Additionally, an area of identified skarn mineralization

occurs both at surface and in recent drilling near the Georgine

Pit. These will be assessed in future exploration programs.

The Company also continues to aggressively evaluate the

potential for recovery of silver from the historic leach pads

and/or in combining this leach pad material with near-surface,

fresh mineralization marginal to the past producing open pits. To

date, Silver One has completed over 25,000 meters of diamond and

reverse circulation drilling. This information, along with the

metallurgical information obtained from the ongoing diamond

drilling program, will be used in an upcoming resource update and

in the Company's first economic study. Additional drilling is also

planned to examine the potential for higher-grade oxide and/or

sulphide silver mineralization down-dip from both the Northern

Belle and Mount Diablo open pits."

In addition to the reverse circulation (RC) drilling completed

in April (see Company's news release of April 25, 2022) and the ongoing core drilling

program for metallurgical testing, Silver One has been busy

conducting other important surveys at Candelaria. Over the last few

months, the company reprocessed, and 3D modeled detailed airborne

magnetic data, conducted an induced polarization (IP) survey over

the entire extent of the property, and conducted extensive surface

sampling as well as expanded geological mapping along highly

prospective areas of interest.

Coincidental geophysical anomalies and other

geological/geochemical features represent four potentially

mineralized areas within the property (Figure 2). These include, in

order of priority, the area beneath the past producing open pits,

the recently discovered Red Hill copper showings, the area of

surface skarn mineralization to the south of the Georgine Pit and

the Green Nick showings to the east of the Mount Diablo open pit.

All have coincidental IP (Metal Factor) and magnetization vector

inversion (MVI) anomalies together with strongly elevated copper,

silver and gold in select rocks and/or soil samples. Another area

of coincidental, anomalous IP (Metal Factor) and MVI anomalies is

located 3 kilometers north of the Georgine pit and comprises deep

targets (500-1000 meters depth) under post-mineral volcanic

cover.

Magnetic Data 3D Modelling

Airborne gradient magnetic data from a detailed survey

commissioned by Silver One in 2019 was reprocessed and modeled

using Magnetization Vector Inversion (MVI). This process has been

effective in mineral exploration and has been especially successful

in modelling porphyry copper deposits in the Americas. The

technique has been refined and utilized at Candelaria to identify

magnetic bodies and alteration areas potentially associated with

productive intrusive bodies. It has also been useful in identifying

structures which can typically control the silver and other

mineralization in the district.

The modelling reveals a series of anomalies interpreted as

apophyses (near-surface extensions to potentially mineralized,

larger intrusive bodies at depth) and alteration possibly

associated with porphyry-style mineralized systems. Depth of these

anomalies are interpreted by the geophysical MF and MVI data to

vary from near surface (100 m) to

over 1,000 meters.

The modelling has also been used to characterize the Candelaria

silver-oxide and deeper oxide-sulphide mineralization, which is

well known between the Mount Diablo and Northern Belle pits. The

identified features have then been utilized to search for similar

characteristics elsewhere on the property, revealing anomalies

often associated with the top of apophyses and/or margins of

interpreted alteration/intrusive zones. These anomalies also form

part of the targets shown in Figure 2. MVI anomalies were followed

up with additional geophysics and were the focus of the IP surveys

that cover the entire property.

Induced Polarization ("IP") surveys

An IP survey was conducted to further investigate the magnetic

anomalies and revealed strong metal factor (MF) anomalies, (low

resistivity and high chargeability) around the Candelaria

historical resource area. MF anomalies persist down-dip from the

mineralized pits, suggesting continuity of the mineralization

beyond the limits of the historic Mount Diablo and Northern Belle

pits and beyond the area of Silver One's recent drilling. Despite

the fact that the majority of the mineralization mined at

Candelaria is oxidized, a strong metal factor anomaly persists

around the resource area and may be representative of more

sulphide-rich mineralization at depth. Similar MF values continue

east and west from the Northern Belle and Diablo pits to the Green

Nick prospect to the east, to the area south of the Georgine pit,

and to the Red Hill showing to the west of the pits (see Figure

2).

Sampling

Extensive (over 1300 samples) surface rock and soil sampling

conducted by Silver One and SSR reveal several clusters of high

silver, gold, copper and other trace elements which delineate

significant anomalies. These anomalies, in combination with

coinciding geophysical anomalies, are considered promising drilling

targets (Fig. 2, 3, 4, and 5).

Around the historic pits, the surface assays have expanded the

footprint of the mineralization about a kilometer east and west of

the Mt. Diablo and Northern Belle pits, and around 400 meters west

of Georgine pit. Additionally, Silver One's recently completed

7,500 m reverse circulation drilling

has visually further expanded the area of the historic resource

mineralization 300 meters east of the Mt. Diablo pit. The total

expansion gained with all Silver One's drilling to date is

approximately 500 meters west and 400 meters east of the Mt. Diablo

pit. Assays from the 7,500 program are pending.

Other relevant targets identified to date include the Red Hill

target (where four rock chip samples report copper grades between

0.7% and 1.5% over widths between 1 to 1.5 meters), the Green Nick

target (where multiple assays from select rock chip samples report

highly anomalous gold between 0.20 to 0.88 g/t, silver between 84

to 585 g/t, and copper between 397 to 1,526 ppm), and the Georgine

target located south of the Georgine pit (with gold values between

0.55 to 2.78 g/t, silver between 215 to 557 g/t and copper between

0.1 to 4.5%).

Soil sampling has been conducted in the Georgine and Red Hill

areas where assays results reveal anomalous values generally

coinciding with rock geochemistry anomalies.

Analytical Details

Grab and chip samples collected by Silver One varied from

1 kg to 5 kg and were assayed by American Assay

Laboratories ("AAL") in Sparks,

NV, USA (ISO accredited Laboratory, ISO/IEC 17025:2017).

Samples were analyzed for thirty-seven elements by ICP-MS. Over

limit copper, lead and zinc were analyzed by ore-grade volumetric

analysis. Silver One inserted commercial standard and blanks

in the sample batches. AAL inserts blanks, standards and

includes duplicate analyses to ensure proper sample preparation and

equipment calibration.

About Candelaria

Candelaria was historically the highest-grade silver producer in

the state of Nevada, averaging

over 1,250 g/t AgEq (40 oz/ton AgEq) from high-grade vein

mining between the mid-1800s and the mid-1900s. Open pit

mining operations were undertaken in the 1970s through 1998 by

several companies, including Nerco Inc. and Kinross Gold

Corporation ("Kinross").

Kinross closed the open pit and

leach operation in 1998 due to low silver prices. Leaching of

the historic pads was not fully completed, leaving a substantial

amount of silver unprocessed. It is estimated that the

property has produced over 68 million ounces of silver.

Historical information was obtained from "Geology of the Candelaria

Mining District, Mineral County,

Nevada, 1959, Nevada Bureau of Mines, Bulletin 56", and the

2001 SSR Mining Inc. technical report titled "Candelaria

Project".

Qualified Person The technical content of

this news release has been reviewed and approved by Robert M. Cann, P. Geo, and a Qualified Person

as defined by National Instrument 43-101.

About Silver One

Silver One is focused on the exploration and development of

quality silver projects. The Company holds an option to

acquire a 100%-interest in its flagship project, the past-producing

Candelaria Mine located in Nevada. Potential reprocessing of

silver from the historic leach pads at Candelaria provides an

opportunity for possible near-term production. Additional

opportunities lie in previously identified high-grade silver

intercepts down-dip and potentially increasing the substantive

silver mineralization along-strike from the two past-producing open

pits.

The Company has staked 636 lode claims and entered into a

Lease/Purchase Agreement to acquire five patented claims on its

Cherokee project located in Lincoln

County, Nevada, host to multiple silver-copper-gold vein

systems, traced to date for over 11 km along-strike.

Silver One holds an option to acquire a 100% interest in the

Silver Phoenix Project. The Silver Phoenix Project is a very

high-grade native silver prospect that lies within the "Arizona

Silver Belt", immediately adjacent to the prolific copper producing

area of Globe, Arizona.

For more information, please contact:

Silver One Resources Inc.

Gary Lindsey - VP, Investor

Relations

Phone: 604-974–5274

Mobile: (720) 273-6224)

Email: gary@strata-star.com

Forward-Looking Statements

Information set forth in this news release contains

forward-looking statements that are based on assumptions as of the

date of this news release. These statements reflect management's

current estimates, beliefs, intentions and expectations. They are

not guarantees of future performance. Silver One cautions that all

forward-looking statements are inherently uncertain, and that

actual performance may be affected by a number of material factors,

many of which are beyond Silver One's control. Such factors

include, among other things: risks and uncertainties relating to

Silver One's limited operating history, ability to obtain

sufficient financing to carry out its exploration and development

objectives on the Candelaria Project, obtaining the necessary

permits to carry out its activities and the need to comply with

environmental and governmental regulations. Accordingly, actual and

future events, conditions and results may differ materially from

the estimates, beliefs, intentions and expectations expressed or

implied in the forward-looking information. Except as required

under applicable securities legislation, Silver One undertakes no

obligation to publicly update or revise forward-looking

information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

Image 1:

https://mma.prnewswire.com/media/1837993/Figure_1__Original.jpg

Image 2: https://mma.prnewswire.com/media/1837994/Figure_2.jpg

Image 3:

https://mma.prnewswire.com/media/1837998/Photos_1_and_2.jpg

Image 4:

https://mma.prnewswire.com/media/1837999/Photo_3.jpg

Image 5:

https://mma.prnewswire.com/media/1837995/Figure_3_Original.jpg

Image 6:

https://mma.prnewswire.com/media/1837996/Figure_4_original.jpg

Image 7:

https://mma.prnewswire.com/media/1837997/Figure_5_original.jpg