Yangaroo Reports Annual and Fourth Quarter Results

April 10 2014 - 9:00AM

Marketwired

Yangaroo Reports Annual and Fourth Quarter Results

Annual Revenues up 30%, Q4 Revenues up 39%, Fourth Quarter Cash

Flow Positive

TORONTO, ONTARIO--(Marketwired - Apr 10, 2014) - YANGAROO Inc.

(TSX-VENTURE:YOO)(OTCBB:YOOIF), the leading secure digital media

management and distribution company, today announced its results

for the year and fourth quarter ended December 31, 2013.

Revenue for the fiscal year 2013 was $3,494,490, 30% higher than

in fiscal 2012. Revenue for the fourth quarter was $1,059,481, 39%

higher than the revenue for the same period in 2012 and 27% higher

than the previous quarter. The fourth quarter of 2013 was the first

operating cash flow positive quarter in the company's history. The

increase in revenue is primarily a result of greater use of

YANGAROO Advertising by new and existing customers, to deliver SD

and HD ads to television broadcasters. Growth also continued for

music video delivery by the major and independent record labels in

the US and Canada, driven by the addition of P-Diddy's Revolt

Network, There was also significant growth from YANGAROO Awards,

with new revenue from The Emmys and the Latin GRAMMYS. YANGAROO is

also benefiting from having increasing revenues in $US, while the

cost base remains primarily in $Canadian.

"The fourth Quarter was a major milestone for YANGAROO," stated

Gary Moss, President and CEO. "Not only was revenue in excess of

$1M, but cash flow from normal operations for the quarter was

positive for the first time, as well. Growth continues in all areas

of the business, but we are starting to see results from the scale

that we have built in the Advertising division. We expect to see

this growth continue, year on year, with the full benefit of recent

signings impacting in the second half of 2014. We have also

continued to invest in the sales and support infrastructure in the

first quarter, to ensure that we maintain our industry leading

service levels during this period of growth."

Total operating expenses for the year ended December 31, 2013

was $560,547 higher than the previous year, primarily relating to

the financing, restructuring and issuance of stock options. The

loss from operations for 2013 was $724,986, down from $968,715 in

2012 while revenue for the same period increased by $804,276. Total

operating expenses for the fourth quarter of 2013 were 25% higher

than the same period in fiscal 2012, primarily due to stock options

costs. The loss from operations was down 32% ($62,310) and revenue

was up 39% ($298,201) for the fourth quarter of 2013 compared to

the same period in 2012. Excluding the impact of non-cash and

non-operating costs, the fourth quarter of 2013 was the first

quarter with positive cash flow of $29,221.

Summary of operating results for the years and fourth quarters

ended December 31:

|

$CDN |

Year |

|

4th Quarter |

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

Revenue |

3,494,490 |

|

2,690,214 |

|

1,059,481 |

|

761,280 |

|

|

Adjusted EBITDA (loss) |

(649,084 |

) |

(877,829 |

) |

(119,886 |

) |

(179,055 |

) |

|

Net loss for the period |

(1,630,434 |

) |

(2,235,052 |

) |

(2,081,643 |

) |

(400,579 |

) |

|

Loss per share (basic & diluted) |

(0.074 |

) |

(0.161 |

) |

(0.053 |

) |

(0.025 |

) |

The full text of the financial statements and Management

Discussion & Analysis is available at www.yangaroo.com and at

www.sedar.com.

About YANGAROO:

YANGAROO, founded in 1999, is a company dedicated to digital

media management. YANGAROO's patented Digital Media Distribution

System (DMDS) is a secure cloud-based platform that provides users

the ability to leverage technology; automating dozens of steps to

eliminate errors and streamline content delivery efficiently.

Content, such as music, music videos, and advertising can be

quickly distributed to a network of over 11,000 television, radio,

media, retailers, and other authorized recipients. The YANGAROO

Awards platform is the industry standard and powers most of North

America's major awards shows.

YANGAROO has offices in Toronto, New York, and Los Angeles.

YANGAROO trades on the TSX Venture Exchange (TSX-V) under the

symbol YOO and in the U.S. under OTCBB: YOOIF.

The statements contained in this release that are not purely

historical are forward-looking statements and are subject to risks

and uncertainties that could cause such statements to differ

materially from actual future events or results. Such

forward-looking statements are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

For Industry Inquiries:Celia Vine, LLCDeanna Kennedy1 (413)

219-7588deannakennedy@celiavine.comFor Investor Inquiries:The

Howard Group Inc.Dave Burwell1 (403)

221-0915dave@howardgroupinc.com

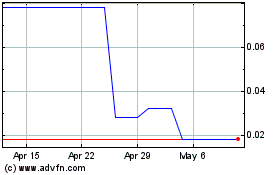

Yangaroo (PK) (USOTC:YOOIF)

Historical Stock Chart

From Apr 2024 to May 2024

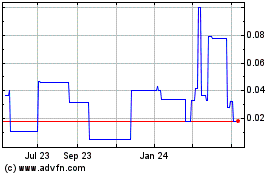

Yangaroo (PK) (USOTC:YOOIF)

Historical Stock Chart

From May 2023 to May 2024