By Nina Trentmann

Some of the companies that are once again hosting their annual

shareholder meetings virtually this year are hoping to improve the

experience for investors, many of whom felt muted last year after

the sudden shift to remote technology.

Warren Buffett's Berkshire Hathaway Inc., pharmaceutical giant

Pfizer Inc. and Dutch software and services company Wolters Kluwer

NV are among the companies working to increase interaction with

their shareholders, from allowing investors to pose live questions

and interact with management, allocating more time for questions to

incorporating new videoconferencing tools.

The bulk of annual investor meetings -- which take months of

preparation -- usually is held between mid-April and June. Last

spring, many businesses abruptly switched to remote events after

lockdown orders and restrictions were put in place to slow the

spread of the coronavirus pandemic. The last-minute changes to a

virtual format resulted in shorter meetings, fewer direct questions

and technical glitches that prevented some shareholders from

voting.

This year, 346 companies, or 86% of a total of 403 in the

S&P 500 that filed their proxy statement through April 22, said

they would hold their annual shareholder meeting remotely as large

physical gatherings remain restricted, according to data provider

MyLogIQ.

Many of these companies say they are better prepared for virtual

meetings. Their efforts also come as many investor-relations

departments look for new ways to connect with more shareholders to

address the recent surge in individual investing.

"Investors expect public companies to do a better job this year

of providing meaningful ways for their shareholders to participate

in virtual annual meetings," said Amy Borrus, executive director at

the Council of Institutional Investors, an investor group

representing pension funds and other big money managers. "Unlike

last proxy season, corporate executives have had a year to plan and

work out any kinks."

Berkshire Hathaway, which used to welcome tens of thousands of

investors a year to Omaha, Neb., for instance, will allocate 3 1/2

hours for Q&A during its annual event on May 1.

That amount of time is unusual, said Miriam Schwartz-Ziv, a

senior lecturer at the Hebrew University in Jerusalem who has

researched virtual shareholder meetings. Still, for Berkshire, the

2 1/2 hours of Q&A at last year's event was less than half the

time it allocated for previous in-person events, she said. The

company didn't immediately respond to a request for comment.

U.S. securities regulators also are watching closely, even

though annual shareholder meetings are largely governed by state

law. "We strongly encourage companies to look at virtual meetings

as an opportunity to enhance but not stifle shareholder

participation and voting," John Coates, acting director of the

corporate finance division at the Securities and Exchange

Commission, said at a conference last week.

New York-based Pfizer accepted both live questions and advance

submissions during its meeting on Thursday, an improvement from

last year, when questions had to be filed ahead using an online

platform. Pfizer also offered a video stream of the chairman's and

management team's speeches, as opposed to the audio-only platform

last year, according to a spokeswoman. "We have designed our

meeting to align with the in-person meeting as much as possible,"

she said.

Netherlands-based Wolters Kluwer last week allowed shareholders

to ask questions in real time. In 2020, people had to submit

questions in advance with a moderator reading all of them during

the meeting, Chief Financial Officer Kevin Entricken said.

The shift to a virtual format last year resulted in overall

shorter meetings with less time for questions from investors.

Shareholder meetings at a sample 125 companies in the S&P 500

in 2020 lasted about 32.7 minutes on average, 17% shorter than the

physical event the year before, according to a recent study by the

Hebrew University of Jerusalem.

The time allocated for questions and answers went down by 16%

and companies on average spent 2 minutes answering a question,

compared with 2.6 minutes during the prior year, the study found.

"The quality of the participation at online meetings is very

limited," said Ms. Schwartz-Ziv, the author of the study. "There is

no dialogue in an online meeting."

Companies that provide the technology used for the meetings

point to improvements, including better live video streams and the

ability to identify shareholders more easily. "A year later, we are

all experts in virtual meetings," said Sherry Moreland, chief

operating officer at Mediant Communications Inc., one of the

technology providers. "We now know how to use the technology."

Broadridge Financial Solutions Inc., a provider of investing,

governance and communications tools, recently overhauled its

platform to offer Zoom-like video functionality, better planning

instruments and more options for Q&A. Most of the company's

U.S. clients have been transferred to the new product, Broadridge

said.

Virtual shareholder meetings have several advantages for

companies. They cost less and don't take up as much time in

executive calendars as in-person events. Hosting the event remotely

also can make it easier for more investors to attend.

Some companies already are exploring new formats to communicate

with individual investors, including hosting events on Clubhouse,

the audio-discussion app. "We called it an 'ask me anything'

meeting," CarParts. Com Inc. CFO and COO David Meniane said. The

auto-parts retailer said about 2,100 investors and others attended

its 40-minute-long session.

Oral-care company SmileDirectClub Inc. plans to host an event

via Clubhouse around its next earnings release, CFO Kyle Wailes

said. "There are a variety of Q&A sessions that we have seen

work well for other companies," he said.

Many companies still haven't decided how their investor events

will look like once the pandemic has abated. Some of them plan to

return to an in-person meeting, while others are leaning toward

hosting a hybrid or an online-only event.

Toy maker Hasbro Inc. expects to go back to a physical event,

said CFO Deborah Thomas. "We think it's good practice," Ms. Thomas

said, referring to having an in-person shareholder meeting.

-- Mark Maurer contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

April 26, 2021 08:14 ET (12:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

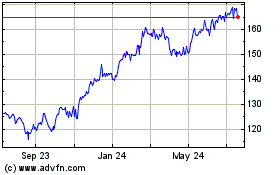

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Feb 2025 to Mar 2025

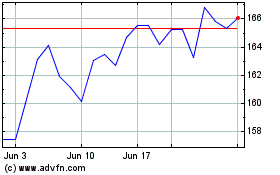

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Mar 2024 to Mar 2025