Securities Registration Statement (s-1/a)

July 06 2021 - 6:01AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 6, 2021

Registration No. 333-257314

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Amendment No. 1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

VNUE, INC.

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

|

Nevada

|

|

7829

|

|

98-0543851

|

|

(State or jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

104 West 29th St, 11th floor, New York, NY 10001

Telephone: (833) 937-5493

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Corporate Services Center, Inc.

5605 Riggins Court, Suite 200

Reno, Nevada 89502

Name, address, including zip code, and telephone number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer:

|

☐

|

Accelerated filer:

|

☐

|

|

Non-accelerated filer:

|

☐

|

Smaller reporting company:

|

☒

|

|

|

|

Emerging Growth Company:

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed Maximum Aggregate Offering

Price(1)(2)

|

|

|

Amount of

Registration

Fee (3)

|

|

|

|

|

|

|

|

|

|

|

Shares of common stock

|

|

$

|

2,500,000

|

|

|

$

|

272.75

|

|

_________

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”) the registrant is also registering an indeterminate number of additional shares of common stock that may be issued as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(2)

|

Consists of up to 250,000,000 shares of common stock to be offered by the Company in the Offering. As of June 23, 2021, the Company had 1,108,423,770 shares of common stock in the public float and 1,269,633,963 shares of common stock outstanding. The 250,000,000 shares being registered represent approximately 22% of the shares in the public float as of June 23, 2021. Assuming all of these shares are sold, the Company’s total number of issued and outstanding shares of common stock will be 1,019,633,963 calculated on the total number of shares issued and outstanding on June 23, 2021, of 1,269,633,963. The total number of registered shares will then represent 24% of the issued and outstanding shares.

|

|

|

|

|

(3)

|

Registrant previously paid a registration fee of $272.75 for the registration statement on Form S-1 filed with the Securities and Exchange Commission on June 23, 2021.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

References throughout this Amendment No. 1 to “we,” “us,” the “Company” or “our company” are to VNUE, Inc., unless the context otherwise indicates.

This Amendment No. 1 (“Amendment No. 1”) to Form S-1 is filed solely for the purpose of filing Exhibit 5.1 to the Regist ration Statement on Form S-1 (Registration Statement No. 33-257314) filed by VNUE, Inc. with the Securities and Exchange Commission (the “Registration Statement”) . The Amendment No. 1 consists of this explanatory note as well as the revised versions of the cover page and Part II of the Registration Statement. It does not contain a copy of the preliminary prospectus included in the Re gistration Statement, nor is it intended to amend or delete any part of the preliminary prospectus.

PART II – INFORMATION NOT REQ UIRED IN PROSPETUS

Indemnification of Officers and Directors

Subject to the provisions of the Companies Law and in the absence of fraud or wil l ful default, the Company may indemnify against all expenses, including legal fees, and against all judgments, fines and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings any person who:

(a) is or was a party or is threatened to be made a party to any threatened, pending or completed proceedings, whether civil, criminal, administrative or investigative, by reason of the fact that the person is or was a Director, managing director, agent, auditor, secretary and other officer for the time being of the Company; or

(b) is or was, at the request of the Company, serving as a Director, managing director, agent, auditor, secretary and other officer for the time being of, or in any other capacity is or was acting for, another company or a partnership, joint venture, trust or other enterprise.

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

In accordance with the provisions in our articles of incorporation, we will indemnify an officer, director, or former officer or director, to the full extent permitted by law.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by us of expenses incurred or paid by a director, officer or controlling person of us in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Recent Sales Of Unregistered Securities

Over the past three years, we have issued and sold the following securities without registration under the Securities Act:

The offers, sales, and issuances of the securities described above were exempt from the registration requirements under the Securities Act, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, including Regulation D promulgated thereunder, regarding transactions by an issuer not involving a public offering. All purchasers of securities in the above transactions represented that they were accredited investors and were acquiring the securities for investment purposes only and not with a view to, or for sale in connection with, any distribution thereof and that they could bear the risks of the investment and could hold the securities for an indefinite period of time. The purchasers received written disclosures that the securities had not been registered under the Securities Act and that any resale must be made pursuant to a registration statement or an available exemption from the registration under the Securities Act. All certificates representing the securities in the transactions described in this Item 15 included appropriate legends setting forth that the securities had not been offered or sold pursuant to a registration statement and describing the applicable restrictions on transfer of the securities.

Table of Exhibits

|

Exhibit Number

|

|

Description of Document

|

|

|

|

|

|

3.1

|

|

Articles of Incorporation (1)

|

|

3.2

|

|

Amendment to Articles of Incorporation (2)

|

|

3.3

|

|

Bylaws (2)

|

|

4.1

|

|

2012 Stock Incentive Plan (3)

|

|

5.1*

|

|

Opinion of The Crone Law Group P.C.

|

|

10.1 * *

|

|

License Agreement by and between VNUE, Inc. and RockHouse Media Productions, Inc., dated July 10, 2017 (4)

|

|

10.2* *

|

|

Experimental Joint Venture and Development Agreement by and between VNUE, Inc. and Music Reports, Inc., dated September 1, 2018

|

|

10.3* *

|

|

Bill of Sale and Assignment and Assumption Agreement by and between VNUE, Inc. and MusicPlay Analytics, LLC (d/b/a Soundstr, LLC) dated April 23, 2018

|

|

10.4* *

|

|

Promissory Note dated as of November 13, 2017 in the original principal Amount of $36,750 issued to GoLock Capital, LLC

|

|

10.5* *

|

|

Promissory Note dated as of February 2, 2018 in the original principal Amount of $40,000 issued to GoLock Capital, LLC

|

|

10.6* *

|

|

Promissory Note dated as of September 1, 2018 in the original principal Amount of $105,000 issued to GoLock Capital, LLC

|

|

10.7* *

|

|

Promissory Note dated January 11, 2021 in the original principal amount of $50,000 issued to Jeffery Baggett

|

|

10.8* *

|

|

Promissory Note dated February 16, 2021 in the original principal amount of $165,000 issued to GHS Investments, LLC

|

|

10.9* *

|

|

Conversion and Cancellation of Debt Agreement by and between VNUE, Inc. and Jeffery Baggett, dated June 11, 2021

|

|

10.10* *

|

|

Amendment to Original Secured Convertible Promissory Note issued to YLimit, LLC dated January 15, 2021

|

|

10.11* *

|

|

Conversion and Cancellation of Debt Agreement by and between VNUE, Inc. and YLimit, LLC, dated May 17, 2021

|

|

10.12* *

|

|

Form of Artist Agreement by and between VNUE, Inc. and Artist dated January 9, 2020

|

|

10.13* *

|

|

Securities Purchase Agreement by and between VNUE, Inc. and GHS Investments, LLC, dated June 21, 2021

|

|

21.1* *

|

|

List of subsidiaries of VNUE, Inc.

|

|

23.1* *

|

|

Consent of BF Borgers CPA PC

|

___________

* Filed herein

* * Incorporated by reference to Registration Statement on Form S-1 filed June 23 , 202 1

|

(1)

|

Included as an exhibit with our Form SB-2 filed October 13, 2006.

|

|

|

|

|

(2)

|

Included as an exhibit with our Form 8-K filed February 1, 2011.

|

|

|

|

|

(3)

|

Included as an exhibit with our Form 8-K filed April 11, 2013.

|

|

|

|

|

(4)

|

Included as an exhibit with our Form 8-K filed on July 14, 2017.

|

ITEM 17. UNDERTAKINGS.

The undersigned Registrant hereby undertakes:

(A) (1) To file, during any period in which offers, or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(B) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, thereunto duly authorized in the City of New York, State of New York on July 6, 2021.

|

|

VNUE, INC.

|

|

|

|

|

|

|

|

Date: July 6, 2021

|

By:

|

/s/ Zach Bair

|

|

|

|

|

Zach Bair

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

(Principal Executive Officer)

|

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Zach Bair

|

|

Chairman, Chief Executive Officer and Principal

|

|

July 6, 2021

|

|

Zach Bair

|

|

Accounting Officer

|

|

|

|

|

|

|

|

|

|

/s/ Anthony Cardenas

|

|

Director, Chief Financial Officer and Vice President of Artist Development

|

|

July 6, 2021

|

|

Anthony Cardenas

|

|

|

|

|

|

/s/ Louis Mann

|

|

Director, Executive Vice President

|

|

July 6, 2021

|

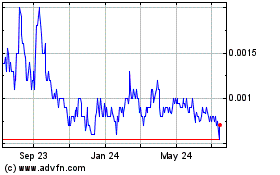

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Feb 2025 to Mar 2025

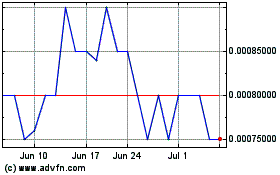

VNUE (PK) (USOTC:VNUE)

Historical Stock Chart

From Mar 2024 to Mar 2025