Orsted Backs Renewable Capacity Target and Sets Profitability Goals,

June 08 2023 - 3:40AM

Dow Jones News

By Dominic Chopping

Orsted late Wednesday confirmed its target of around 50

gigawatts of installed renewable capacity by 2030 and said it

expects to invest around 475 billion Danish kroner ($68.22 billion)

between 2023 and 2030.

In a statement ahead of an investor day, the Danish

renewable-energy company said it is targeting group-wide earnings

before interest, tax, depreciation and amortisation excluding new

partnerships of DKK50 billion-DKK55 billion in 2030, corresponding

to a targeted annual average increase of 13%-14%.

Orsted targets an average return on capital employed in the

period 2023-2030 of around 14% and confirmed its dividend policy of

an annual high single-digit percentage increase in dividends until

2025, extending the dividend policy to 2030 with an annual

mid-level single-digit percentage increase in dividends paid from

2026 to 2030.

The company added that it is on track to outperform previous

financial targets of an average return on capital employed of

11%-12% between 2020 and 2027, now expecting around 15%, while

annual Ebitda growth from offshore and onshore assets in operation

of around 12% between 2020 and 2027 is now seen at 15%.

The previously expected gross investment of around DKK350

billion between 2020 and 2027 is trending higher at DKK380 billion,

it added.

In a separate announcement, Orsted said it has launched a

commercial sustainability partnership with Vestas Wind Systems that

will see Orsted procure low-carbon steel wind turbine towers and

blades made from recycled materials from Vestas in all joint

offshore wind projects.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

June 08, 2023 03:25 ET (07:25 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

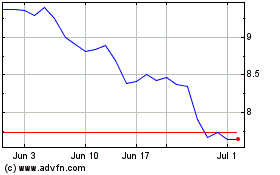

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Feb 2024 to Feb 2025