Post-qualification Amendment to a 1-a Offering Statement (1-a Pos)

March 23 2023 - 5:09PM

Edgar (US Regulatory)

|

Form 1-A Issuer Information

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

OMB APPROVAL

|

FORM 1-A

|

OMB Number:

3235-0286

Estimated average burden hours per response:

608.0

|

1-A: Filer Information

| Issuer CIK | 0001661039 |

| Issuer CCC | XXXXXXXX |

| DOS File Number | |

| Offering File Number | 024-11260 |

|

Is this a LIVE or TEST Filing?

| ☒

LIVE

☐

TEST

|

|

Would you like a Return Copy?

| ☐ |

|

Notify via Filing Website only?

| ☐ |

|

Since Last Filing?

| ☐ |

Submission Contact Information

|

| Name | |

| Phone | |

| E-Mail Address | |

1-A: Item 1. Issuer Information

Issuer Infomation

|

Exact name of issuer as specified in the issuer's

charter

| TPT GLOBAL TECH, INC. |

| Jurisdiction of Incorporation / Organization |

FLORIDA

|

| Year of Incorporation | 1988 |

| CIK | 0001661039 |

| Primary Standard Industrial Classification Code | COMMUNICATION SERVICES, NEC |

| I.R.S. Employer Identification Number | 81-3903357 |

| Total number of full-time employees | 40 |

| Total number of part-time employees | 0 |

Contact Infomation

Address of Principal Executive Offices

|

| Address 1 | 501 West Broadway, Suite 800 |

| Address 2 | |

| City | San Diego |

| State/Country |

CALIFORNIA

|

| Mailing Zip/ Postal Code | 92101 |

| Phone | 619-301-4200 |

Provide the following information for the person the

Securities

and Exchange Commission's staff should call in

connection with any

pre-qualification review of the offering

statement.

|

| Name | Michael A. Littman, Attorney |

| Address 1 | |

| Address 2 | |

| City | |

| State/Country | |

| Mailing Zip/ Postal Code | |

| Phone | |

Provide up to two e-mail addresses to which

the

Securities and

Exchange Commission's staff may send any comment

letters relating to

the offering statement. After qualification of

the offering

statement, such e-mail addresses are not required to

remain active.

|

Financial Statements

|

Industry Group (select one)

| ☐

Banking

☐

Insurance

☒

Other

|

Use the financial statements for the most recent period

contained in

this offering statement to provide the following

information about

the issuer. The following table does not include

all of the line

items from the financial statements. Long Term Debt

would include

notes payable, bonds, mortgages, and similar

obligations. To

determine "Total Revenues" for all companies

selecting "Other" for

their industry group, refer to Article

5-03(b)(1) of Regulation

S-X. For companies selecting "Insurance",

refer to Article 7-04 of

Regulation S-X for calculation of "Total

Revenues" and paragraphs 5

and 7 of Article 7-04 for "Costs and

Expenses Applicable to

Revenues".

Balance Sheet Information

|

| Cash and Cash Equivalents |

$

63399.00 |

| Investment Securities |

$

0.00 |

| Total Investments |

$

|

| Accounts and Notes Receivable |

$

295908.00 |

| Loans |

$

|

| Property, Plant and Equipment (PP&E): |

$

1091527.00 |

| Property and Equipment |

$

|

| Total Assets |

$

8547151.00 |

| Accounts Payable and Accrued Liabilities |

$

8683309.00 |

| Policy Liabilities and Accruals |

$

|

| Deposits |

$

|

| Long Term Debt |

$

2327219.00 |

| Total Liabilities |

$

32033108.00 |

| Total Stockholders' Equity |

$

-81735865.00 |

| Total Liabilities and Equity |

$

8683309.00 |

Statement of Comprehensive Income Information

|

| Total Revenues |

$

6145465.00 |

| Total Interest Income |

$

|

| Costs and Expenses Applicable to Revenues |

$

4493929.00 |

| Total Interest Expenses |

$

|

| Depreciation and Amortization |

$

941114.00 |

| Net Income |

$

-11352944.00 |

| Earnings Per Share - Basic |

$

-0.06 |

| Earnings Per Share - Diluted |

$

-0.06 |

| Name of Auditor (if any) | SADLER, GIBB AND ASSOCIATES, LLC |

Outstanding Securities

Common Equity

|

|

Name of Class (if any) Common Equity

| COMMON STOCK |

|

Common Equity Units Outstanding

| 1723749021 |

|

Common Equity CUSIP (if any):

| 87265T103 |

|

Common Equity Units Name of Trading Center or Quotation Medium (if any)

| OTC |

Preferred Equity

|

Preferred Equity Name of Class (if any)

| Series A, B, C, D & E |

|

Preferred Equity Units Outstanding

| 5678849 |

|

Preferred Equity CUSIP (if any)

| 000000000 |

|

Preferred Equity Name of Trading Center or Quotation Medium (if any)

| NONE |

Debt Securities

|

Debt Securities Name of Class (if any)

| NONE |

|

Debt Securities Units Outstanding

| 0 |

|

Debt Securities CUSIP (if any):

| 000000000 |

|

Debt Securities Name of Trading Center or Quotation Medium (if any)

| NONE |

1-A: Item 2. Issuer Eligibility

Issuer Eligibility

Check this box to certify that all of the following statements

are true for the issuer(s)

☒

-

Organized under the laws of the United States or Canada, or any

State, Province, Territory or possession thereof, or the District

of Columbia.

- Principal place of business is in the United States or Canada.

-

Not subject to section 13 or 15(d) of the Securities Exchange

Act of 1934.

-

Not a development stage company that either (a) has no specific

business plan or purpose, or (b) has indicated that its business

plan is to merge with an unidentified company or companies.

-

Not an investment company registered or required to be

registered under the Investment Company Act of 1940.

-

Not issuing fractional undivided interests in oil or gas rights,

or a similar interest in other mineral rights.

-

Not issuing asset-backed securities as defined in Item 1101 (c)

of Regulation AB.

-

Not, and has not been, subject to any order of the Commission

entered pursuant to Section 12(j) of the Exchange Act (15 U.S.C.

78l(j)) within five years before the filing of this offering

statement.

-

Has filed with the Commission all the reports it was required to

file, if any, pursuant to Rule 257 during the two years immediately

before the filing of the offering statement (or for such shorter

period that the issuer was required to file such reports).

1-A: Item 3. Application of Rule 262

Application Rule 262

Check this box to certify that, as of the time of this filing,

each person described in Rule 262 of Regulation A is either not

disqualified under that rule or is disqualified but has received a

waiver of such disqualification.

☒

Check this box if "bad actor" disclosure under Rule 262(d) is

provided in Part II of the offering statement.

☐

1-A: Item 4. Summary Information Regarding the Offering and Other

Current or Proposed Offerings

Summary Infomation

|

Check the appropriate box to indicate whether you are

conducting

a Tier 1 or Tier 2 offering

| ☐

Tier1

☒

Tier2

|

|

Check the appropriate box to indicate whether the

financial statements

have been audited

| ☒

Unaudited

☐

Audited

|

|

Types of Securities Offered in this Offering Statement

(select

all that apply)

| |

| ☒Equity (common or preferred stock) |

|

Does the issuer intend to offer the securities on a

delayed or continuous basis pursuant to Rule 251(d)(3)?

| ☐

Yes

☒

No

|

|

Does the issuer intend this offering to last more than

one year?

| ☐

Yes

☒

No

|

|

Does the issuer intend to price this offering after

qualification

pursuant to Rule 253(b)?

| ☐

Yes

☒

No

|

|

Will the issuer be conducting a best efforts offering?

| ☒

Yes

☐

No

|

|

Has the issuer used solicitation of interest

communications in

connection with the proposed offering?

| ☐

Yes

☒

No

|

|

Does the proposed offering involve the resale of

securities by

affiliates of the issuer?

| ☐

Yes

☒

No

|

|

Number of securities offered

| 7600000 |

|

Number of securities of that class outstanding

| 0 |

The information called for by this item below may be omitted if

undetermined at the time of filing or submission, except that if a

price range has been included in the offering statement, the midpoint

of that range must be used to respond. Please refer to Rule 251(a)

for the definition of "aggregate offering price" or "aggregate sales"

as used in this item. Please leave the field blank if undetermined at

this time and include a zero if a particular item is not applicable

to the offering.

|

Price per security

|

$

5.0000 |

|

The portion of the aggregate offering price

attributable to securities being offered on behalf of the issuer

|

$

5.00 |

|

The portion of the aggregate offering price

attributable to securities being offered on behalf of selling

securityholders

|

$

0.00 |

|

The portion of the aggregate offering price

attributable to all the securities of the issuer sold pursuant to a

qualified offering statement within the 12 months before the

qualification of this offering statement

|

$

0.00 |

|

The estimated portion of aggregate sales attributable

to securities that may be sold pursuant to any other qualified

offering statement concurrently with securities being sold under

this offering statement

|

$

0.00 |

|

Total (the sum of the aggregate offering price and

aggregate sales in the four preceding paragraphs)

|

$

5.00 |

Anticipated fees in connection with this offering and names of

service providers

|

Underwriters - Name of Service Provider

| |

Underwriters - Fees

|

$

0.00 |

|

Sales Commissions - Name of Service Provider

| |

Sales Commissions - Fee

|

$

0.00 |

|

Finders' Fees - Name of Service Provider

| |

Finders' Fees - Fees

|

$

0.00 |

|

Audit - Name of Service Provider

| |

Audit - Fees

|

$

0.00 |

|

Legal - Name of Service Provider

| |

Legal - Fees

|

$

0.00 |

|

Promoters - Name of Service Provider

| |

Promoters - Fees

|

$

0.00 |

|

Blue Sky Compliance - Name of Service Provider

| |

Blue Sky Compliance - Fees

|

$

0.00 |

|

CRD Number of any broker or dealer listed:

| |

|

Estimated net proceeds to the issuer

|

$

0.00 |

|

Clarification of responses (if necessary)

| |

1-A: Item 5. Jurisdictions in Which Securities are to be Offered

Jurisdictions in Which Securities are to be Offered

Using the list below, select the jurisdictions in which

the

issuer intends to offer the securities

|

Selected States and Jurisdictions

|

CALIFORNIA

|

Using the list below, select the jurisdictions in which the

securities are to be offered by underwriters, dealers or sales

persons or check the appropriate box

|

None

| ☐ |

|

Same as the jurisdictions in which the issuer intends

to offer the securities

| ☒ |

|

Selected States and Jurisdictions

|

CALIFORNIA

|

1-A: Item 6. Unregistered Securities Issued or Sold Within One

Year

Unregistered Securities Issued or Sold Within One Year

None

☐

Unregistered Securities Issued

As to any unregistered securities issued by the issuer of any of

its predecessors or affiliated issuers within one year before the

filing of this Form 1-A, state:

| (a)Name of such issuer | TPT Global Tech, Inc. |

| (b)(1) Title of securities issued | Common |

| (2) Total Amount of such securities issued | 1723749021 |

|

(3) Amount of such securities sold by or for the

account of any person who at the time was a director, officer,

promoter or principal securityholder of the issuer of such

securities, or was an underwriter of any securities of such issuer.

| 20833333 |

|

(c)(1) Aggregate consideration for which the securities

were issued and basis for computing the amount thereof.

| 0 |

|

(2) Aggregate consideration for which the securities

listed in (b)(3) of this item (if any) were issued and the basis

for computing the amount thereof (if different from the basis

described in (c)(1)).

| 0.012 |

Unregistered Securities Act

|

(e) Indicate the section of the Securities Act or

Commission rule or regulation relied upon for exemption from the

registration requirements of such Act and state briefly the facts

relied upon for such exemption

| All of the sales by us of our unregistered securities were made by us in reliance upon Rule 506 of the Securities Act of 1933, as amended (the "1933 Act"). |

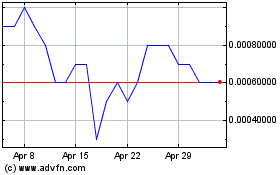

TPT Global Tech (PK) (USOTC:TPTW)

Historical Stock Chart

From Jun 2024 to Jul 2024

TPT Global Tech (PK) (USOTC:TPTW)

Historical Stock Chart

From Jul 2023 to Jul 2024