UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C

(RULE

14C-101)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

☒

Preliminary Information Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule

14a-5(d)

(1))

☐

Definitive Information Statement

SUN

PACIFIC HOLDING CORP.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check appropriate box):

| ☒

|

No

fee required. |

| |

|

| ☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(1) and 0-11. |

| . |

(1) |

Title

of each class of securities to which transaction applies: Not Applicable |

| |

(2) |

Aggregate

number of securities to which transaction applies: Not Applicable |

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): Not Applicable |

| |

(4) |

Proposed

maximum aggregate value of transaction: Not Applicable |

| |

(5) |

Total

fee paid: Not Applicable |

| |

|

|

| ☐

|

Fee

paid previously with preliminary materials. |

| |

|

| ☐

|

Check

box if any part of the fee is offset as provided by the Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing: |

| |

|

|

| |

|

Amount

Previously Paid: Not Applicable

Form,

Schedule or Registration Statement No.: Not Applicable

Filing

Party: Not Applicable

Date

Filed: Not Applicable |

SUN

PACIFIC HOLDING CORP.

345

Highway 9 South

Suite 388

Manalapan,

New Jersey, 07726

October 13, 2023

Dear

Stockholder:

This

Information Statement is furnished to holders of shares of common stock, par value $0.001 per share (the “Common Stock”),

of Sun Pacific Holding Corp. (the “Company”). Our Board of Directors (the “Board”) approved on October 13, 2023

and recommended the approval by our stockholders, of the following corporate actions (“Corporate Actions”):

| 1. |

To authorize the Board the Option to effectuate a reverse stock split of

our issued and outstanding shares of Common Stock (the “Reverse Stock Split Option”), at the sole discretion of the Board

at a ratio of 4,000:1. |

Certain

of our stockholders, holding a majority of our voting power on October 13, 2023 (the “Record Date”), approved the Corporate

Actions by written consent in lieu of a special meeting of stockholders.

As

a matter of regulatory compliance, we are sending to you this Information Statement which describes the purpose and provisions of the

contemplated Corporate Actions.

| |

For

the Board of Directors of |

| |

SUN

PACIFIC HOLDING CORP. |

| |

|

|

| |

By:

|

/s/

Nicholas Campanella |

| |

|

Nicholas

B. Campanella |

| |

|

Chairman

and CEO |

SUN

PACIFIC HOLDING CORP.

345

Highway 9 South

Suite 388

Manapalan,

New Jersey, 07726

October

13, 2023

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 14C-2 THEREUNDER

NO

VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS

REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY

GENERAL

We

are sending you this Information Statement to inform you of the adoption of the Corporate Actions and the amendment to the Company’s

Articles of Incorporation (the “Amendment”), on October 13, by a vote of stockholders holding a majority of the Company’s

voting power. The purpose of this Information Statement is to provide notice that the Company’s majority stockholders, holding

an aggregate of 1,500,000,000 votes, representing 84.1% of the voting power of the Company as of the Record Date, executed a written consent

authorizing and approving the following corporate actions (the “Corporate Actions”):

1.

The Reverse Stock Split;

The

Certificate of Amendment to the Company’s Articles of Incorporation for the Corporate Actions is attached hereto as Exhibit

A.

The

adoption of the foregoing Corporate Actions will become effective 20 calendar days after the posting of this Information Statement. The

Board of Directors is not soliciting your proxy in connection with the adoption of these Corporate Actions and proxies are not being

requested from stockholders.

The

Company is distributing this Information Statement to its stockholders in full satisfaction of any notice requirements it may have under

the Nevada Revised Statutes. No additional action will be undertaken by the Company with respect to the receipt of written consents,

and no dissenters’ rights with respect to the receipt of the written consents, and no dissenters’ rights under the Nevada

Revised Statutes are afforded to the Company’s stockholders as a result of the adoption of this Corporate Actions.

Expenses

in connection with the distribution of this Information Statement, will be paid by the Company.

This

Information Statement is being posted on or about October 13, 2023, to all Stockholders of record as of the Record Date.

VOTE

REQUIRED; MANNER OF APPROVAL

Approval

to amend and restate the current Articles of Incorporation of the Company under the Nevada Revised Statutes (“NRS”) requires

the affirmative vote of the holders of a majority of the voting power of the Company.

Section

78.320 of the NRS provides, in substance, that, unless the Company’s Articles of Incorporation provides otherwise, stockholders

may take action without a meeting of stockholders and without prior notice if a consent or consents in writing, setting forth the action

so taken, is signed by the holders of outstanding voting stock holding not less than the minimum number of votes that would be necessary

to approve such action at a stockholders meeting. Under the applicable provisions of the NRS, this action is effective when written consents

from holders of record of a majority of the outstanding voting power are executed and delivered to the Company.

In

accordance with the NRS, the affirmative vote on the Corporate Actions of at least a majority of the outstanding voting power has been

obtained. As a result, no vote or proxy is required by the stockholders to approve the Corporate Actions.

Under

Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Act”), the Corporate Actions cannot take

effect prior to the filing of a Certificate of Amendment with the Nevada Secretary of State approximately twenty (20) days after the

Mailing Date, which is anticipated to be on or about April 21, 2022.

OTHER

INFORMATION REGARDING THE COMPANY

As

of the record date, there were 974,728,678 shares of our Common Stock issued and outstanding, 12,000,000 shares of Series A Preferred

Stock issued and outstanding, no shares of Series B Preferred Stock issued and outstanding, and 175,000 shares of Series C Preferred

Stock issued and outstanding. The holders of Series C Preferred Stock are not entitled to voting rights. The total aggregate of all of

the shares of Series A Preferred Stock as a group are entitled to take action by written consent or vote equal to 84.1% of the total voting

shares outstanding. For the approval of the Corporate Actions, the Company received written consents from 1 stockholder of the Company

together holding 84.1% of the voting power of the Company.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information concerning the number of shares of the Company’s stock owned beneficially as of

the Record Date by: (i) each person (including any group) known by the Company to own more than five percent (5%) of any class of its

voting securities, (ii) each of the Company’s directors and each of its named executive officers, and (iii) officers and directors

as a group. Unless otherwise indicated, the stockholders listed possess sole voting and investment power with respect to the shares shown.

For

purposes of this table, a person is deemed to be the beneficial owner of any shares of Common Stock (i) over which the person has or

shares, directly or indirectly, voting or investment power, or (ii) of which the person has a right to acquire beneficial ownership at

any time within 60 days after the Record Date. “Voting power” is the power to vote or direct the voting of shares and “investment

power” includes the power to dispose or direct the disposition of shares.

| Name | |

Shares

of Stock Beneficially Owned | | |

Percent

of Class | | |

Voting

Rights | | |

Total

Voting

% | |

| Common

Stock | |

| | | |

| | | |

| | | |

| | |

| Nicholas

Campanella (1) | |

| 33,897,166 | | |

| 11.95 | % | |

| — | | |

| 1.4 | % |

| Vincent

Randazzo(2) | |

| 44,150 | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| All

beneficial owners as a group (2 persons) | |

| 33,941,316 | | |

| 11.95 | % | |

| 33,941,316 | | |

| 1.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Series

A Preferred Stock (3) | |

| | | |

| | | |

| | | |

| | |

| Nicholas

Campanella (1) | |

| 12,000,000 | | |

| 100 | % | |

| 1,500,000,000 | | |

| 60.6 | % |

| Vincent

Randazzo (2) | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| All

directors and executive officers as a group (1 person) | |

| 12,000,000 | | |

| 100 | % | |

| 1,500,000,000 | | |

| 70.0 | % |

| Total

Voting Rights of Beneficial Owners | |

| | | |

| | | |

| | | |

| 70.0 | % |

Notes

| |

(1) |

Nicholas

Campanella is the Chairman and Chief Executive Officer of the Company. |

| |

(2) |

Vincent

Radazzo is a Director of the Company |

| |

(3) |

Shares of Series A Preferred Stock have voting rights equal to 125 votes on all matters submitted to a vote to the

stockholders of the Company, does not have conversion, dividend, or distribution upon liquidation rights. |

PROPOSAL

NUMBER ONE

APPROVAL

OF THE REVERSE STOCK SPLIT OPTION

GENERAL

The Board approved a resolution to give to the Board of Directors of the

Company the option to effectuate a reverse stock split at a ratio of 4,000 to 1 after the filing of this Form 14(c). Our stock price has

made it difficult to attract new investors and potential business candidates and opportunities. The Board of Directors believes that a

reverse stock split will help prepare the Company to meet the listing requirements of the OTCQB or other exchanges.

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTEREST IN THE COMPANY, EXCEPT AS MAY RESULT FROM THE ISSUANCE

OR CANCELLATION OF SHARES PURSUANT TO THE FRACTIONAL SHARES.

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL NOT HAVE ANY EFFECT ON THE NUMBER OF AUTHORIZED SHARES.

MATERIAL

EFFECTS OF THE REVERSE STOCK SPLIT

When

a company engages in a reverse stock split, it substitutes one share of stock for a predetermined amount of shares of stock. It does

not increase the market capitalization of the company. Under this optional reverse stock split each 4,000 shares of our Common Stock

will be automatically converted into 1 share of Common Stock. To avoid the issuance of fractional shares of Common Stock, the Company

will issue an additional share to all holders of fractional shares.

However,

the effect of the Reverse Stock Split upon the market price for our Common Stock cannot be predicted, and the history of similar stock

split combinations for companies in like circumstances is varied. There can be no assurance that the market price per share of our Common

Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of Common Stock outstanding resulting

from the reverse split. The market price of our Common Stock may also be based on our performance and other factors, some of which may

be unrelated to the number of shares outstanding.

The

Reverse Stock Split will affect all of our stockholders of Common Stock uniformly and will not affect any stockholder’s percentage

ownership interests in the Company or proportionate voting power, except to the extent that the Reverse Stock Split results in any of

our stockholders owning a fractional share. All stockholders holding a fractional share shall be issued an additional share. The principal

effect of the Reverse Stock Split will be that the number of shares of Common Stock issued and outstanding will be reduced from 974,728,678

shares of Common Stock as of the Record Date to approximately 243,682 shares (depending on the number of fractional

shares that are issued or cancelled and depending on the range chosen by the Board). The Reverse Stock Split will not affect the shares

of Series A Preferred Stock of which 12,000,000 are issued and outstanding and/or the shares of Series C Preferred Stock of which 275,000

are issued and outstanding. The number of authorized shares of Common Stock and its par value will not be affected.

FRACTIONAL

SHARES

We

will not issue fractional certificates for post- Reverse Stock Split shares in connection with the Reverse Stock Split. Instead, an additional

share shall be issued to all holders of a fractional share. To the extent any holders of pre- Reverse Stock Split shares are entitled

to fractional shares as a result of the Reverse Stock Split, the Company will issue an additional share to all holders of fractional

shares.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES WITHOUT BEING ASKED TO DO SO.

FEDERAL

INCOME TAX CONSEQUENCES

The

following discussion is a summary of certain United States federal income tax consequences of the Reverse Stock Split to us and stockholders

of our common stock. It does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse

Stock Split and is included for general information only. This discussion is based on laws, regulations, rulings, and decisions in effect

on the date hereof, all of which are subject to change (possibly with retroactive effect) and to differing interpretations. This discussion

only applies to stockholders that are U.S. persons as defined in the Internal Revenue Code of 1986, as amended, and does not describe

all of the tax consequences that may be relevant to a stockholder in light of his particular circumstances or to stockholders subject

to special rules (such as dealers in securities, financial institutions, insurance companies, tax-exempt organizations, foreign individuals

and entities, and persons who acquired their common stock as compensation). In addition, this summary is limited to stockholders that

hold their common stock as capital assets. This discussion also does not address any tax consequences arising under the laws of any state,

local or foreign jurisdiction or alternative minimum tax consequences. The tax treatment of each stockholder may vary depending upon

the particular facts and circumstances of such stockholder.

We

have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue

Service regarding the federal income tax consequences of the Reverse Stock Split. We believe,

however, that because the Reverse Stock Split is not part of a plan to periodically increase

or decrease any stockholder’s proportionate interest in the assets or earnings and

profits of our company, the Reverse Stock Split should have the federal income tax effects

described below:

| |

● |

The

exchange of pre-split shares for post-split shares should not result in recognition of gain or loss for federal income tax purposes. |

| |

● |

The

stockholder’s aggregate tax basis in the post-split shares would equal that stockholder’s aggregate tax basis in the

pre-split shares. |

| |

● |

The

stockholder’s holding period for the post-split shares will include such stockholder’s holding period for the pre-split

shares. |

| |

● |

Provided

that a stockholder held the pre-split shares as a capital asset, the post-split shares received in exchange therefor would also be

held as a capital asset. |

We

believe that our Company should not recognize gain or loss because of the Reverse Stock Split. Our view regarding the tax consequences

of the Reverse Stock Split is not binding on the Internal Revenue Service or the courts. We urge all stockholders to consult their own

tax advisers to determine the federal, state, local and foreign tax consequences to each of them of the Reverse Stock Split.

TO

ENSURE COMPLIANCE WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES

IN THIS INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR THE PURPOSE

OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED HEREIN BY

THE COMPANY IN CONNECTION WITH THE PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) BY THE COMPANY OF THE TRANSACTIONS OR

MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

Stockholders

of record of the Common Stock as of the exercise of the Reverse Stock Split Option shall have their total shares reduced on the basis

of one post-split share of Common Stock for every 4,000 pre-split shares outstanding.

This

action has been approved by the Board and the written consents of the holders of the majority of the outstanding voting capital stock

of the Company.

AMENDED

CERTIFICATE OF INCORPORATION

Upon

the effectiveness and on the date that is twenty (20) days following the mailing of this Information Statement, the Board of Directors

shall have the Company’s Amendment to the Certificate of Incorporation filed with the State of Nevada in order to effect the Reverse

Stock Split.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

CORPORATION

ACTIONS AND EFFECTIVE TIME

The

Corporate Actions will become effective on the date that we file the Certificate of with the Secretary of State of the State of Nevada.

We intend to file the Amendment to the Certificate of Incorporation of the Company (the “Amendment”) with the Secretary of

State of the State of Nevada promptly after the twentieth (20th) day following the date on which this Information Statement is mailed

to the Stockholders.

INTEREST

OF CERTAIN PERSONS IN OR IN OPPOSITION TO THE MATTERS TO BE ACTED UPON

No

director, executive officer, associate of any officer or director or executive officer, or any other person has any interest, direct

or indirect, by security holdings or otherwise, in the amendment to the Certificate of Incorporation referenced herein which is not shared

by the majority of the stockholders.

OTHER

MATTERS

If

you and others who share your mailing address own Common Stock in street name, meaning through bank or brokerage accounts, you may have

received a notice that your household will receive only one annual report and proxy statement from each company whose stock is held in

such accounts. This practice, known as “householding” is designed to reduce the volume of duplicate information and reduce

printing and postage costs. Unless you responded that you did not want to participate in householding, you were deemed to have consented

to it, and a single copy of this Information Statement has been sent to your address. Each stockholder will continue to receive a separate

notice.

If

you would like to receive an individual copy of this Information Statement, we will promptly send a copy to you upon request by mail

to the Company at 345 Highway 9 South, Suite 388, Manapalan, New Jersey, 07726, or by calling (732) 845-0906. This document is also available

in digital form for download or review by visiting the website of the Securities and Exchange Commission at www.sec.gov.

ADDITIONAL

INFORMATION

We

are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the requirements

thereof, file reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Copies

of these reports, proxy statements and other information can be obtained at the SEC’s public reference facilities at Judiciary

Plaza, Room 1024, 450 Fifth Street, N.W., Washington, D.C., 20549. Additionally, these filings may be viewed at the SEC’s website

at http://www.sec.gov.

The

following documents as filed with the Commission by the Company are incorporated herein by reference:

| |

1. |

Quarterly

Reports on Form 10-Q for the quarter ended March 31, 2023 and June 30, 2023; and |

| |

2. |

Annual Report on Form 10-K for the year ended December 31, 2022 |

SPACE

LEFT INTENTIONALLY BLANK. SIGNATURES TO FOLLOW.

SIGNATURE

Pursuant

to the requirements of the Exchange Act of 1934, as amended, the Registrant has duly caused this Information Statement to be signed on

its behalf by the undersigned hereunto authorized.

| |

BY

ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

SUN

PACIFIC HOLDING CORP |

| |

|

|

| |

By: |

/s/Nicholas

Campanella |

| |

|

Nicholas

Campanella

Chairman

and CEO |

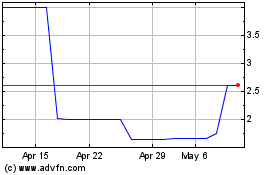

Sun Pacific (PK) (USOTC:SNPW)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sun Pacific (PK) (USOTC:SNPW)

Historical Stock Chart

From Dec 2023 to Dec 2024