Golden Anvil Enters LOI With TSX Venture Company

November 16 2011 - 4:01PM

Marketwired

Royal Mines and Minerals Corp. (OTCBB: RYMM) ("Royal Mines") is

pleased to announce that Golden Anvil S.A. de C.V. ("Golden Anvil")

has entered into a letter of intent ("LOI") with Gainey Capital

Corp ("Gainey Capital"), a Toronto Stock Exchange Venture ("TSX-V")

company.

Under the terms of the LOI, Gainey Capital has agreed to acquire

from Golden Anvil, directly or indirectly, certain assets (the

"Assets") comprising of certain mineral concessions located in the

western portion of the Sierra Madre occidental mountain range in

Mexico (the "El Colomo Concessions"), a concentration plant located

in Huajicori, Nayarit, and other associated assets and equipment,

including a tailing reservoir, a mine site housing camp and a mine

site industrial facility.

It is intended that the acquisition of the Assets (the

"Acquisition") will be Gainey Capital's Qualifying Transaction in

accordance with the policies of the TSX-V. Upon completion of the

Transaction, it is expected that the Company will be a Tier 2

mining issuer.

As consideration for the acquisition of Assets, Gainey Capital

has agreed to pay Golden Anvil aggregate consideration as

follows:

a. the issue of 12,000,000 previously unissued common shares in

the capital of Gainey Capital (the "Shares") to Golden Anvil, which

shall be issued on the day of the completion of the Acquisition

(the "Closing Date"); and

b. the issue of a special warrant of the Company (the "Special

Warrant") to Golden Anvil or its nominee, which shall be issued

effective as of the Closing Date. The Special Warrant will be

convertible, for no additional consideration, from time to time,

subject to an aggregate maximum of 3,000,000 common shares, into

that number of common shares equal to the number of ounces of gold

or gold equivalent, categorized as "proven mineral reserves" (as

such terms are defined by the Canadian Institute of Mining,

Metallurgy and Petroleum), upon receipt by the Company and/or

Golden Anvil of a technical report prepared in accordance with

National Instrument 43-101 Standards of Disclosure for Mineral

Projects ("NI 43-101") by an independent qualified person (as

defined in NI 43-101) in relation to the El Colomo Concessions on

or before October 21, 2015.

Royal Mines has loaned Golden Anvil a total of $1,000,000 over

the last couple years, and if the acquisition is completed Royal

Mines expects to either receive common shares in the capital of

Gainey Capital in satisfaction of the loan or to receive full

payment of the loan, plus interest from the date of advance of the

funds at 18% per annum. Royal Mines views this acquisition

positively, believes the mineral concessions have significant

mineral reserves based on past exploration and geological reports,

and has full confidence in the directors and officers of Gainey

Capital and Golden Anvil to create additional value for their

shareholders.

For additional information, please see the October 21, 2011

Gainey Capital news release posted on our website at

www.royalmmc.com.

About Royal Mines and Minerals Corp.: Royal Mines and Minerals

Corp. is a minerals exploration and process-based technology

company focused on the development of mining technology and

projects in North America, and on the proficient extraction of

precious metals. Our primary objectives are to 1) commercially

extract and refine precious metals from specific ores, fly ash and

other leachable assets, 2) use our lixiviation processes (Cholla

and thiourea) to convert specific ore bodies and fly ash landfills

into valuable assets, and 3) joint venture, acquire and develop

mining projects in North America. We have not yet realized

significant revenues from our primary objectives. Additional

information is available on Royal Mines' website at

www.royalmmc.com and in its filings with the U.S. Securities and

Exchange Commission.

Forward-Looking Statements Statements in this news release that

are not historical facts are forward-looking statements that are

subject to risks and uncertainties. Words such as "expects,"

"intends," "plans," "may," "could," "should," "anticipates,"

"likely," "believes" and words of similar import also identify

forward-looking statements. Forward-looking statements are based on

current facts and analyses and other information that are based on

forecasts of future results, estimates of amounts not yet

determined and assumptions of management. There is no assurance

that the acquisition of Golden Anvil will be completed as

contemplated or at all.

Cautionary Note to Investors The United States Securities and

Exchange Commission permits mining companies, in their filings with

the SEC, to disclose only those mineral deposits that a company can

economically and legally extract or produce. We use certain terms

on this press release, such as "reserves," "resources," "geologic

resources," "proven," "probable," "measured," "indicated," and

"inferred," that the SEC guidelines strictly prohibit us from

including in our filings with the SEC. Investors are urged to

consider closely the disclosure in our SEC filings, File No.

000-52391. You can review and obtain copies of these filings from

the SEC's website at http://www.sec.gov/edgar.shtml.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: For more information contact: Royal Mines and

Minerals Corp. Jason S. Mitchell CFO, Secretary and Treasurer (702)

588-5973 jmitchell@royalmmc.com

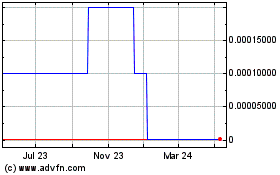

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Dec 2024 to Jan 2025

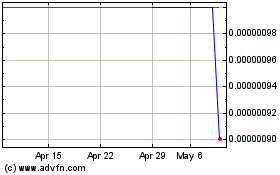

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Jan 2024 to Jan 2025