UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February 25, 2016

ROI

LAND INVESTMENTS LTD.

(Exact name of registrant as specified in

its charter)

|

Nevada

(State or other jurisdiction of incorporation

or organization) |

333-152002

(Commission File Number) |

26-1574051

(I.R.S. Employer

Identification No.) |

999 Maisonneuve Blvd. West, Suite 750

Montreal, Quebec H3A 3L4

(Address of principal

executive offices with Zip Code)

888-351-7004

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Agreement

Contract to Invest in Project

On February 25, 2016, ROI Land Investments

Ltd. (“ROI”) entered into a Binding Memorandum of Agreement (“MOA”) with Alternative Strategy Partners

Pte. Ltd., a Singapore limited company with offices at 10 Collyer Quay Level 40 #40-53, Ocean Financial Centre, Singapore 049315

(“ASP”), pursuant to which ASP is willing to invest at least $3.5 million, and at ASP’s discretion up to $5.0

million, in the ROI’s Acquisition and Development Project located in Sobha Hartland, Dubai, UAE (the “Project”),

in exchange for an issuance of bonds designed for ASP (the “Bonds”), and certain other consideration described below.

ASP and its affiliates currently are shareholders of ROI, but collectively own less than 5% of ROI’s outstanding common stock.

ASP is one of a number of paid foreign intermediaries which ROI has engaged for raising capital outside of the United States.

The MOA is legally binding unless and until superseded by more

definitive agreements and instruments, containing the terms and conditions set forth therein with such changes, and such additional

terms and conditions, as the parties mutually may agree (the “Closing Documents”), together with issuance of the Bonds.

Under the terms of the MOA, ASP is investing the sum of $1,000,000 (the “Initial Investment”), $500,000 upon signing

of the MOA and $500,000 not less than seven (7) days later. ROI shall wire to ASP, immediately upon receipt of the second $500,000

payment, the amount which ROI owes ASP for commissions, which amount was previously invoiced by ASP to ROI (approximately $250,000).

ROI will use the balance for the Project.

ASP is to invest at least $2,500,000 more, and at most $4,000,000

more (collectively, the “Second Investment”), upon signing of the Closing Documents and issuance of the Bonds, or earlier

at ASP’s discretion. Such amounts shall be placed in escrow, with an escrow agent mutually acceptable to ASP and ROI, and

shall not be released to ROI unless and until (a) the Closing Documents have been executed, and the Bonds are ready to be issued

to ROI; (b) at least $10,000,000 total has been invested in the Project, regardless of the nature of such investment as debt, equity

or otherwise (and such investment includes amounts raised by ASP and contributed by ROI and $3,000,000 already contributed to the

Project by ROI); and (c) ROI has received, and disclosed to ASP, a preliminary, non-binding letter of interest from at least one

reasonably qualified purchaser of the First Plot (as defined below). In the event that, by May 24, 2016, the Closing Documents

have not been agreed upon and executed, and the Bonds issued to ASP, then ASP may, at its sole discretion, either (a) extend that

deadline as it sees fit, or (b) convert all or a part of the Initial Investment and Second Investment hereunder to Common Stock

of ROI, at a rate of one share per One U.S. Dollar ($1.00), or (c) have all or a part of the Second Investment (but not the Initial

Investment) refunded to ASP by the escrow agent in cash wired to a designated bank account specified by ASP.

The Bonds shall be a special series designed for ASP, shall

mature three years from the date of issuance and shall bear interest at 8% per annum, which shall be paid on a regular quarterly

basis. In addition, the holders of the Bonds shall be entitled to receive a Profits Participation of the first of the three plots

comprising the Project which ROI shall designate for initial development (the “First Plot”). The Profits Participation

shall equal all net profits upon sale of the First Plot, after all costs of acquisition, development and ongoing costs and expenses

of maintenance and the sale itself (collectively, the “Project Costs”), computed in accordance with International Financial

Reporting Standards, multiplied by the “Profits Percentage” defined below. If the full $5,000,000 is invested by ASP,

then the “Profits Percentage” shall be 50% of the Cash-on-Cash Fraction (defined below); if only $3,500,000 is invested

by ASP, then the “Profits Percentage” shall be 35% of the Cash-on-Cash Fraction; if an amount above $3,500,000 and

below $5,000,000 is invested, then the “Profits Percentage” shall be likewise prorated. As used here, the “Cash-on-Cash

Fraction” shall be a fraction, the numerator of which is the amount of ASP’s investment hereunder, and the denominator

of which is the total Project Costs. The first Profits Participation shall be paid by ROI to ASP by August 24, 2017, and the second

Profits Participations shall be paid by ROI to ASP at the maturity of the Bonds. ASP will the right, in the event such Profits

Participations are not made to convert all or a part of the Initial Investment and Second Investment hereunder to Common Stock

of ROI, at a rate of one share per One U.S. Dollar ($1.00), or have all or a part of the Second Investment (but not the Initial

Investment) refunded to ASP by the ROI in cash wired to a designated bank account specified by ASP.

The Bonds shall be secured by a lien upon the First Plot, subordinated

to loans (the proceeds of which are used for the Project) from banks or other institutional lenders, and other bonds upon the Project,

if such a lien is determined to be valid and enforceable under Dubai law; otherwise, the Bonds shall be secured by a lien, similarly

subordinated, upon all of the stock of the ROI United States subsidiary which is the beneficial owner of the Project.

ROI has agreed to pay ASP, at the time of the release from escrow

of the Second Investment, cash commissions equal to Four Percent (4%) on the funds invested by ASP in the Initial Investment and

Second Investment, and also shall issue to ASP shares of ROI’s Common Stock at a rate of one share per $1.50 for every Four

Percent (4%) of the funds invested by ASP in the Initial Investment and Second Investment. So, for example, if ASP invests $5,000,000,

ASP would receive $200,000 in cash commissions and 133,333 shares of ROI’s Common Stock.

The foregoing summary is qualified in its entirety by reference

to the full text of the Binding Memorandum of Agreement, a copy of which is set forth as Exhibit 10.1 to this Form 8-K and made

a part hereof.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit |

Description |

| |

|

| 10.1 |

Binding Memorandum of Agreement between ROI and Alternative Strategy Partners Pte. Ltd.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 2, 2016 |

ROI LAND INVESTMENTS LTD. |

| |

|

| |

By: |

/s/ Dr. Sami Chaouch |

| |

|

Dr. Sami Chaouch, |

| |

|

Executive Chairman |

Exhibit 10.1

BINDING MEMORANDUM OF AGREEMENT

This Memorandum of

Agreement (this “MOA”) is intended to be legally binding, and is made and entered into by and between Alternative

Strategy Partners Pte. Ltd., a Singapore limited company with offices at 10 Collyer Quay Level 40 #40-53, Ocean Financial Centre,

Singapore 049315 (“Buyer”) and ROI Land Investments, Ltd., a Nevada, United States of America corporation (“Seller”).

RECITALS:

1. Seller, directly

or through subsidiaries, is developing a property located at Plot Nos. 283 (MA15), 284 (MA16) and 285 (MA17) in Sobha Hartland,

Al Merkadh, Dubai, United Arab Emirates (the “Property”). The Property is in Mohammed Bin Rashid Al Maktoum

City, Dubai, is being acquired from PNC Investments LLC, and is being developed in partnership with Sobha Hartland, the developer.

Such acquisition and development is referred to herein as the “Project.”

2. Buyer is willing

to invest at least $3.5 million, and at Buyer’s discretion up to $5.0 million, in the Project, with two initial wires, one

immediately upon the execution of this MOA, and the other within a week thereafter, in exchange for an issuance of bonds designed

for the Buyer (the “Bonds”), and certain other consideration described below.

3. Due to the urgency

of the financing, the parties are entering into this binding MOA, with the expectation of more formal documentation following later,

all as provided below.

AGREEMENT:

Article I.

Execution of Definitive Closing Documents and Issuance of the Bonds

This MOA shall be legally

binding unless and until superseded by more definitive agreements and instruments, containing the terms and conditions set forth

herein with such changes, and such additional terms and conditions, as the parties mutually may agree (the “Closing Documents”),

together with issuance of the Bonds.

Article II.

Terms of Investment

The Buyer and Seller

agree to the following terms and conditions, which shall remain in effect until superseded by the Closing Documents:

1. Initial Investment. Buyer shall

invest the sum of $1,000,000 (the “Initial Investment”) promptly, half upon signing of this MOA and the remainder

not less than seven (7) days hereafter.

2. Payment of Commissions. Seller

shall wire to Buyer, immediately upon receipt of the second $500,000 payment described above, the amount which Seller owes Buyer

for commissions, which amount was previously invoiced by Buyer to Seller (approximately $250,000). Seller will use the balance

for the Project.

3. Escrowed Second Investment. Buyer

shall invest at least $2,500,000 more, and at most $4,000,000 more (collectively, the “Second Investment”),

upon signing of the Closing Documents and issuance of the Bonds, or earlier at Buyer’s discretion. Such amounts shall be

placed in escrow, with an escrow agent mutually acceptable to Buyer and Seller, and shall not be released to Seller unless and

until (a) the Closing Documents have been executed, and the Bonds are ready to be issued to Buyer; (b) at least $10,000,000 total

has been invested in the Project, regardless of the nature of such investment as debt, equity or otherwise (and such investment

includes amounts raised by Buyer and contributed by Seller; the parties acknowledging that such investment includes $3,000,000

already contributed to the Project by Seller); and (c) Seller has received, and disclosed to Buyer, a preliminary, non-binding

letter of interest from at least one reasonably qualified purchaser of the First Plot (as defined below).

4. Default on Initial and Second Investment.

In the event that, within three (3) months from the date hereof, the Closing Documents have not been agreed upon and executed,

and the Bonds issued to the Buyer, then the Buyer may, at its sole discretion, either (a) extend that deadline as it sees fit,

or (b) convert all or a part of the Initial Investment and Second Investment hereunder to Common Stock of Seller, at a rate of

one share per One U.S. Dollar ($1.00), or (c) have all or a part of the Second Investment (but not the Initial Investment) refunded

to Buyer by the escrow agent in cash wired to a designated bank account specified by Buyer.

5. Description of the Bonds. The

Bonds shall be a special series designed for Buyer and compliant with local legal requirements, and shall have the following additional

characteristics:

a. Maturity and Coupon. The Bonds

shall mature after three (3) years from the date of issuance and shall bear interest at 8% per annum, which shall be paid on a

regular quarterly basis.

b. Profits Participation. In

addition, the holders of the Bonds shall be entitled to receive a Profits Participation of the first of the three plots comprising

the Property which the Seller shall designate for initial development (the “First Plot”). The Profits Participation

shall equal all net profits upon sale of the First Plot, after all costs of acquisition, development and ongoing costs and expenses

of maintenance and the sale itself (collectively, the “Project Costs”), computed in accordance with International

Financial Reporting Standards, multiplied by the “Profits Percentage” defined below. If the full $5,000,000 is invested

by the Buyer, then the “Profits Percentage” shall be 50% of the Cash-on-Cash Fraction (defined below); if only

$3,500,000 is invested by the Buyer, then the “Profits Percentage” shall be 35% of the Cash-on-Cash Fraction;

if an amount above $3,500,000 and below $5,000,000 is invested, then the “Profits Percentage” shall be likewise

prorated. As used here, the “Cash-on-Cash Fraction” shall be a fraction, the numerator of which is the amount

of Buyer’s investment hereunder, and the denominator of which is the total Project Costs.

c. The Seller expects the Project to be

profitable within twelve months following the execution of this MOA and the sale of the First Plot to be completed prior to the

maturity of the Bonds. The first Profits Participation shall be paid by the Seller to the Buyer within eighteen (18) months of

the signing of this MOA, and the second Profits Participations shall be paid by the Seller to the Buyer at the maturity of the

Bonds, in which failing of such, will give a right for the Buyer to convert all or a part of the Initial Investment and Second

Investment hereunder to Common Stock of Seller, at a rate of one share per One U.S. Dollar ($1.00), or have all or a part of the

Second Investment (but not the Initial Investment) refunded to Buyer by the Seller in cash wired to a designated bank account specified

by Buyer.

6. Security Interest. The Bonds

shall be secured by a lien upon the First Plot, subordinated to loans (the proceeds of which are used for the Project) from banks

or other institutional lenders, and other bonds upon the Project, if such a lien is determined to be valid and enforceable under

Dubai law; otherwise, the Bonds shall be secured by a lien, similarly subordinated, upon all of the stock of the United States

parent company as the ultimate beneficial owner of the Property.

7. Commissions. Seller hereby agrees

to pay Buyer, at the time of the release from escrow of the Second Investment, cash commissions equal to Four Percent (4%) on the

funds invested by Buyer in the Initial Investment and Second Investment, and also shall issue to Buyer shares of Seller’s

Common Stock at a rate of one share per $1.50 for every Four Percent (4%) of the funds invested by Buyer in the Initial Investment

and Second Investment. So, for example, if Buyer invests $5,000,000, he would receive $200,000 in cash commissions and 133,333

shares of Seller’s Common Stock.

Article III Miscellaneous

Provisions.

1. Expenses.

The parties shall bear their own legal and other expenses in connection with the matters contemplated herein.

2. Publicity.

So long as this Agreement shall be in effect, no party hereto shall issue or cause the publication of any press release or other

announcement with respect to this Agreement or the transactions contemplated hereby without the consent of the other parties, which

consent shall not be unreasonably withheld, except where such release or announcement is required by applicable law (as may be

the case with the Seller, it being publicly traded in the United States).

3. Brokerage.

Each party agrees to indemnify and hold the other party harmless against any claims for any other brokers' or finders' fees or

compensation in connection with the transaction herein provided for by any person, firm or corporation claiming a right to same

because of having been engaged by or having served such party, except for the previously invoiced commissions owing to Buyer by

Seller and the fees agreed to be paid by Seller to Buyer pursuant to Article II, Section 7 hereunder.

4. Benefit.

This Agreement shall be binding upon and inure to the benefit of the parties hereto, and their respective heirs, executors, administrators,

successors and assigns. This Agreement may not be assigned without the written consent of both parties hereto.

5. Tax Reporting.

The parties hereto agree and acknowledge that the determination of the price and terms of the Bonds is the result of arms-length

negotiations between the parties. The parties further agree that each party shall be responsible for the payment of its own taxes

(whether local, regional, or country), if any, resulting from the purchase and sale of the shares hereunder.

6. Legends.

All certificates evidencing any Bonds or shares of Common Stock issued pursuant to this 6MOA shall bear legends substantially as

follows during the term of this Agreement (in addition to any other legends required by applicable Japanese or other laws:

“The securities represented by this

certificate have not been registered under the Securities Act of 1993 of the United States of America or under applicable state

securities laws, and may not be sold, assigned, pledged, hypothecated, mortgaged or transferred in the absence of an effective

registration statement under said Act and laws, or the prior delivery to the Corporation of an opinion of counsel reasonably satisfactory

to the Corporation that such registration is not required under the circumstances.”

“The holder of this security must not trade the security

in or from a jurisdiction of Canada unless the conditions in section 13 of Regulation 51-105 respecting Issuers Quoted in the U.S.

Over-the-Counter Markets (chapter V-1.1, r. 24.1) are met.”

7. Notices.

All notices and waivers must be by written instrument executed by the party to be bound thereby. Notices are deemed given when

received, regardless of the means of transmission, except that notices sent via electronic mail (e-mailed) or faxed notices shall

be valid only if their receipt is thereafter confirmed by the receiving party by return transmission or otherwise.

8. Headings.

The headings of any paragraph, section or article of this Agreement are for convenience of reference only and do not form a part

hereof and in no way modify, interpret or construe the meanings of the parties.

9. Entire Agreement,

Amendments and Waivers. This Agreement sets forth the entire agreement and understanding between the parties as to the subject

matter hereof and merges and supersedes all prior discussions, agreements and understandings with respect hereto. This Agreement

may not be amended, changed or modified except by a written instrument duly executed by the parties hereof, and no provision hereunder

may be waived except in a written instrument signed by the waiving party. If any provisions of this Agreement shall be invalid

or unenforceable to any extent or in any application, then the remainder of this Agreement, except to such extent or in such application,

shall not be affected thereby, and each and every term and condition of this Agreement shall be valid and enforced to the fullest

extent and in the broadest application permitted by law.

10. Governing

Law. This Agreement shall be governed and construed in accordance with the laws of the State of New York in the United States

of America, and shall be enforceable exclusively in any court of competent jurisdiction located in New York City, New York.

11.

Counterparts. This Agreement may be signed in any number of counterparts, each of which shall be deemed an original, but

all of which shall constitute one and the same instrument.

[Signatures on following page]

IN WITNESS WHEREOF, the parties have executed this Agreement under seal as of the day and year first above written.

| Seller: |

ROI LAND INVESTMENTS LTD. |

|

| |

|

|

| |

By: /s/ Sami Chaouch |

|

| |

Sami Chaouch, Executive Chairman |

|

| Dated: |

February 25, 2016 |

|

| |

|

|

| |

|

|

| Buyer: |

ALTERNATIVE STRATEGY PARTNERS PTE. LTD. |

|

| |

|

|

| |

By: /s/ Yuhi Horiguchi |

|

| |

Yuhi Horiguchi |

|

| Title: |

Managing Director |

|

| Dated: |

February 25, 2016 |

|

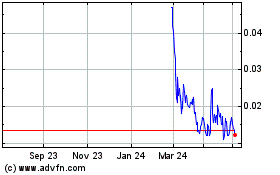

RiskOn (PK) (USOTC:ROII)

Historical Stock Chart

From Jun 2024 to Jul 2024

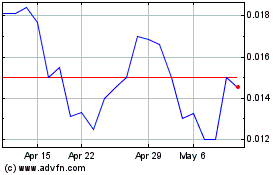

RiskOn (PK) (USOTC:ROII)

Historical Stock Chart

From Jul 2023 to Jul 2024