FY

2024

--06-30

false

0000812306

0

0

1

1

1

1

0.10

0.373

0.373

10

10

0.373

10

10

5

1

5

10

10

10

0

2

2

2

0

0

0

0

0

0

false

false

false

false

00008123062023-07-012024-06-30

thunderdome:item

iso4217:USD

00008123062024-06-30

00008123062022-07-012023-06-30

xbrli:pure

utr:Y

00008123062015-06-302023-06-30

00008123062015-05-31

0000812306pcyn:OperatingLeaseForCertainOfficeEquipmentMember2021-05-312021-05-31

utr:M

0000812306pcyn:OperatingLeaseForCertainOfficeEquipmentMember2021-05-31

0000812306pcyn:OperatingLeaseForWarehouseMember2021-01-31

0000812306pcyn:OperatingLeaseForWarehouseMember2021-01-012021-01-31

0000812306pcyn:OperatingLeaseForOfficeSpaceMember2021-01-012021-01-31

0000812306pcyn:OperatingLeaseForOfficeSpaceMember2021-01-012021-01-01

0000812306pcyn:OperatingLeaseForCertainOfficeEquipmentMember2020-08-31

0000812306pcyn:OperatingLeaseForCertainOfficeEquipmentMember2020-08-012020-08-31

0000812306us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-07-012024-06-30

0000812306us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-07-012023-06-30

00008123062023-06-30

iso4217:USDxbrli:shares

xbrli:shares

0000812306srt:MinimumMember2024-06-30

0000812306us-gaap:ConvertiblePreferredStockMember2023-07-012024-06-30

0000812306us-gaap:ConvertiblePreferredStockMember2024-06-30

0000812306us-gaap:ConvertibleCommonStockMember2024-06-30

0000812306us-gaap:ConvertibleCommonStockMember1995-01-011995-01-31

0000812306us-gaap:ConvertiblePreferredStockMember1995-01-31

0000812306pcyn:LeaseForOfficeSpaceWarehouseSpaceAndCertainEquipmentMember2024-06-30

00008123062021-06-30

0000812306pcyn:FormulationOfCareLotionMember2016-07-012017-06-30

0000812306us-gaap:BuildingMember2023-06-30

0000812306pcyn:ProductionEquipmentMember2023-06-30

0000812306us-gaap:LeaseholdImprovementsMember2023-06-30

0000812306pcyn:SoftwareMember2023-06-30

0000812306us-gaap:FurnitureAndFixturesMember2023-06-30

0000812306us-gaap:OfficeEquipmentMember2023-06-30

0000812306us-gaap:BuildingMember2024-06-30

0000812306pcyn:ProductionEquipmentMember2024-06-30

0000812306us-gaap:LeaseholdImprovementsMember2024-06-30

0000812306pcyn:SoftwareMember2024-06-30

0000812306us-gaap:FurnitureAndFixturesMember2024-06-30

0000812306us-gaap:OfficeEquipmentMember2024-06-30

00008123062022-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:DirectorMember2023-07-012024-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:DirectorMember2022-07-012023-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:ChiefFinancialOfficerMember2021-06-302021-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:ChiefExecutiveOfficerMember2021-06-302021-06-30

0000812306us-gaap:EmployeeStockOptionMemberpcyn:The2009OptionPlanMemberpcyn:JusticeAndersonMember2017-07-012017-07-01

0000812306us-gaap:EmployeeStockOptionMemberpcyn:The2009OptionPlanMemberpcyn:JusticeAndersonMember2016-07-012016-07-01

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:MinimumMember2023-07-012024-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2020OptionPlanMembersrt:MaximumMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2020OptionPlanMember2024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2020OptionPlanMemberpcyn:TenPercentOwnersMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2020OptionPlanMembersrt:MinimumMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2020OptionPlanMembersrt:MaximumMemberpcyn:TenPercentOwnersMember2023-07-012024-06-30

0000812306pcyn:The2020OptionPlanMember2024-06-30

0000812306us-gaap:RestrictedStockUnitsRSUMemberpcyn:The2020OptionPlanMember2024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2009OptionPlanMemberpcyn:TenPercentOwnersMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2009OptionPlanMembersrt:MinimumMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2009OptionPlanMembersrt:MinimumMemberpcyn:TenPercentOwnersMember2023-07-012024-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2009OptionPlanMembersrt:MaximumMember2023-07-012024-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2009OptionPlanMembersrt:MinimumMember2023-07-012024-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2009OptionPlanMembersrt:MaximumMember2023-07-012024-06-30

0000812306pcyn:The2009OptionPlanMember2024-06-30

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2009OptionPlanMemberpcyn:JusticeAndersonMember2017-07-012017-07-01

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2009OptionPlanMember2016-09-272016-09-27

0000812306pcyn:NonQualifiedStockOptionsMemberpcyn:The2009OptionPlanMember2019-06-30

0000812306pcyn:IncentiveStockOptionsMemberpcyn:The2009OptionPlanMember2019-06-30

0000812306us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-07-012023-06-30

0000812306us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-012024-06-30

0000812306srt:MaximumMember2023-06-30

0000812306srt:MaximumMember2024-06-30

utr:D

0000812306pcyn:SeriesACumulativeConvertiblePreferredStockExchangedForCommonStockMember2023-07-012024-06-30

0000812306us-gaap:RetainedEarningsMember2023-06-30

0000812306us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000812306us-gaap:CommonStockMember2023-06-30

0000812306us-gaap:PreferredStockMember2023-06-30

00008123062023-04-012023-06-30

0000812306us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000812306us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0000812306us-gaap:CommonStockMember2023-04-012023-06-30

0000812306us-gaap:PreferredStockMember2023-04-012023-06-30

00008123062023-03-31

0000812306us-gaap:RetainedEarningsMember2023-03-31

0000812306us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000812306us-gaap:CommonStockMember2023-03-31

0000812306us-gaap:PreferredStockMember2023-03-31

00008123062023-01-012023-03-31

0000812306us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000812306us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000812306us-gaap:CommonStockMember2023-01-012023-03-31

0000812306us-gaap:PreferredStockMember2023-01-012023-03-31

00008123062022-12-31

0000812306us-gaap:RetainedEarningsMember2022-12-31

0000812306us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000812306us-gaap:CommonStockMember2022-12-31

0000812306us-gaap:PreferredStockMember2022-12-31

00008123062022-10-012022-12-31

0000812306us-gaap:RetainedEarningsMember2022-10-012022-12-31

0000812306us-gaap:AdditionalPaidInCapitalMember2022-10-012022-12-31

0000812306us-gaap:CommonStockMember2022-10-012022-12-31

0000812306us-gaap:PreferredStockMember2022-10-012022-12-31

00008123062022-09-30

0000812306us-gaap:RetainedEarningsMember2022-09-30

0000812306us-gaap:AdditionalPaidInCapitalMember2022-09-30

0000812306us-gaap:CommonStockMember2022-09-30

0000812306us-gaap:PreferredStockMember2022-09-30

00008123062022-07-012022-09-30

0000812306us-gaap:RetainedEarningsMember2022-07-012022-09-30

0000812306us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0000812306us-gaap:CommonStockMember2022-07-012022-09-30

0000812306us-gaap:PreferredStockMember2022-07-012022-09-30

0000812306us-gaap:RetainedEarningsMember2022-06-30

0000812306us-gaap:AdditionalPaidInCapitalMember2022-06-30

0000812306us-gaap:CommonStockMember2022-06-30

0000812306us-gaap:PreferredStockMember2022-06-30

0000812306us-gaap:RetainedEarningsMember2024-06-30

0000812306us-gaap:AdditionalPaidInCapitalMember2024-06-30

0000812306us-gaap:CommonStockMember2024-06-30

0000812306us-gaap:PreferredStockMember2024-06-30

00008123062024-04-012024-06-30

0000812306us-gaap:RetainedEarningsMember2024-04-012024-06-30

0000812306us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0000812306us-gaap:CommonStockMember2024-04-012024-06-30

0000812306us-gaap:PreferredStockMember2024-04-012024-06-30

00008123062024-03-31

0000812306us-gaap:RetainedEarningsMember2024-03-31

0000812306us-gaap:AdditionalPaidInCapitalMember2024-03-31

0000812306us-gaap:CommonStockMember2024-03-31

0000812306us-gaap:PreferredStockMember2024-03-31

00008123062024-01-012024-03-31

0000812306us-gaap:RetainedEarningsMember2024-01-012024-03-31

0000812306us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0000812306us-gaap:CommonStockMember2024-01-012024-03-31

0000812306us-gaap:PreferredStockMember2024-01-012024-03-31

00008123062023-12-31

0000812306us-gaap:RetainedEarningsMember2023-12-31

0000812306us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000812306us-gaap:CommonStockMember2023-12-31

0000812306us-gaap:PreferredStockMember2023-12-31

00008123062023-10-012023-12-31

0000812306us-gaap:RetainedEarningsMember2023-10-012023-12-31

0000812306us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-31

0000812306us-gaap:CommonStockMember2023-10-012023-12-31

0000812306us-gaap:PreferredStockMember2023-10-012023-12-31

00008123062023-09-30

0000812306us-gaap:RetainedEarningsMember2023-09-30

0000812306us-gaap:AdditionalPaidInCapitalMember2023-09-30

0000812306us-gaap:CommonStockMember2023-09-30

0000812306us-gaap:PreferredStockMember2023-09-30

00008123062023-07-012023-09-30

0000812306us-gaap:RetainedEarningsMember2023-07-012023-09-30

0000812306us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0000812306us-gaap:CommonStockMember2023-07-012023-09-30

0000812306us-gaap:PreferredStockMember2023-07-012023-09-30

0000812306us-gaap:ConvertiblePreferredStockMember2023-06-30

0000812306pcyn:NondesignatedPreferredStockMember2023-06-30

0000812306pcyn:NondesignatedPreferredStockMember2024-06-30

00008123062024-09-28

00008123062024-09-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

For the fiscal year ended June 30, 2024 |

| |

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

For the transition period from __________ to ____________

|

| |

|

Commission file number 0-17449 |

PROCYON CORPORATION

(Exact name of registrant as specified in its charter)

| |

Colorado |

59-3280822 |

|

| |

(State of incorporation) |

(I.R.S. Employer ID No.) |

|

164 Douglas Rd, Oldsmar, Florida 34677

(Address of principal executive offices)(Zip Code)

Issuer’s telephone number, including area code: (727) 447-2998

| |

Securities registered pursuant to Section 12(b) of the Act: None

|

| |

Securities registered pursuant to Section 12(g) of the Act: Common Stock

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by checkmark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,”“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| ☐ Large accelerated filer |

☐ Accelerated filer |

| ☐ Non-accelerated filer |

☒ Smaller reporting company |

| |

☐ Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepare or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter:

The aggregate market value of the 3,916,652 shares of Common Stock held by non-affiliates was $1,018,330 on September 24, 2024, the date of the last sale of common stock, based on the average bid and asked price of $.26 on such date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As of September 28, 2024, there were 8,120,388 shares of the issuers Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

INDEX

| |

Title |

Page |

| |

|

|

| ITEM 1. |

BUSINESS |

3 |

| |

|

|

| ITEM 2. |

PROPERTIES |

8 |

| |

|

|

| ITEM 3. |

LEGAL PROCEEDINGS |

8 |

| |

|

|

| ITEM 5. |

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER |

8 |

| |

MATTERS AND PURCHASES OF EQUITY SECURITIES |

|

| |

|

|

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

10 |

| |

|

|

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

15 |

| |

|

|

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

15 |

| |

|

|

| ITEM 9A. |

CONTROLS AND PROCEDURES |

15 |

| |

|

|

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

17 |

| |

|

|

| ITEM 11. |

EXECUTIVE COMPENSATION |

20 |

| |

|

|

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

24 |

| |

|

|

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

13 |

| |

|

|

| ITEM 14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES |

26 |

| |

|

|

| ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

26 |

PART I

ITEM 1. BUSINESS

History and Organization

Procyon Corporation ("Procyon" or the "Company") consolidates the operations of Procyon with AMERX® Health Care Corporation("AMERX") and Sirius Medical Supply, Inc. ("Sirius"), its wholly-owned subsidiaries, for financial purposes. Collectively throughout this report, Procyon, Amerx and Sirius may be referred to as the "Company," "us," or "we" or "our."

Procyon, a Colorado corporation, was incorporated on March 19, 1987, and was deemed a development stage company until May 1996, when we acquired Amerx, a corporation based in Oldsmar, Florida, which was wholly owned by John C. Anderson, our deceased Chief Executive Officer. AMERX® develops and markets proprietary medical products used in the treatment of pressure ulcers, stasis ulcers, wounds, dermatitis, inflammation and other skin problems. Historically, AMERX's products are sold through distributors to healthcare institutions including hospitals, wound care clinics, nursing homes and home health care agencies and to retailers including national and regional chain stores and pharmacies and to healthcare practitioners who treat wounds. Sirius no longer has any material operations.

Products

Major product lines - AMERX®, AMERIGEL® , HELIX3 Bioactive Collagen®, EXTREMIT-EASE® Compression Garment and Advantagen® Surgical Collagen.

AMERX markets a proprietary line of AMERIGEL® advanced skin and wound care products made with Oakin®, proven to promote healing in wound and problematic skin conditions, including AMERIGEL Hydrogel Wound Dressing, AMERIGEL Post Op Surgical Kits, AMERIGEL Saline Wound Wash, AMERIGEL Care Lotion, and AMERIGEL Barrier Lotion. These products have become the core foundation for AMERX's growth.

In fiscal 2015, AMERX expanded its product brands by introducing HELIX3 Bioactive Collagen. HELIX3 is available in Collagen Powder (HELIX3 CP) and Collagen Matrix (HELIX3 CM); developed to address market segments previously unavailable to AMERX. In 2022, HELIX3 Collagen Gel was added to expand this line of products.

In fiscal 2016, AMERX continued its brand expansion by introducing the AMERX wound care product line. The line consists of: AMERX Calcium Alginate Dressing, AMERX Foam Dressing, AMERX Gauze Dressing, AMERX Hyrdocolloid Dressing, and AMERX Wound Care Kits, including AMERX Calcium Alginate Wound Care Kit, AMERX Collagen Matrix Wound Care Kit, AMERX Collagen Powder Wound Care Kit, AMERX Foam Wound Care Kit and AMERX Hydrogel Wound Care Kit.

In fiscal 2017, AMERX expanded its product line to include a new segment of the wound care market by introducing the EXTREMIT-EASE Compression Garment line. Extremit-Ease received a patent in June of 2022. These new products have demonstrated early success and product expansion has made it possible for AMERX to provide treatments outside its historical niche.

In fiscal 2021, AMERX introduced AMERIGEL Hand Sanitizer, a premium product containing 70% alcohol to be effective against germs and moisturizers to keep the skin from drying out from heavy use.

In fiscal 2022, AMERX expanded its product line with the introduction of Advantagen, a surgical collagen powder that promotes wound closure and decreases the potential for surgical site infection. AMERX also introduced AMERX Rolled Gauze Wound Care Kits. These kits provide alternative dressing options for patients when traditional bandage applications are problematic. AMERX also updated its AMERX Dressing product line, including Calcium Alginate, Foam and Gauze Dressings used in the treatment of wounds. AMERX also added Retention tape to this product line furthering the Companies breadth of wound care product.

In fiscal 2023, AMERX expanded it product line with the introduction of Helix Collagen Gel. Helix Collagen Gel addresses wounds that are dry to moderate in drainage.

AMERX wound care products sold under the brand names AMERIGEL, HELIX3, AMERX and EXTREMIT-EASE, have received approval for Medicare reimbursement, assigned by the Pricing, Data Analysis and Coding contractor for Medicare and Medicaid ("PDAC"). We believe this reimbursement code is beneficial to AMERX's business, allowing customers on Medicare to seek coverage for use of these products. AMERX will continue to evaluate product line expansion in fiscal 2025.

AMERX spent approximately $30,100 towards research and development efforts over the past fiscal year. These efforts were directed towards new product offerings.

The AMERIGEL product line with OAKIN is based on proprietary formulations which are protected as trade secret information and with registered trademarks. AMERX filed for patent protection on the Extremit-Ease Compression Garment in 2017. The patent was approved in June 2022. HELIX3, HELIX3 CP, HELIX3 CM and HELIX3 Bioactive Collagen, OAKIN and EXTREMIT-EASE are registered trademarks of AMERX Health Care. All products are registered with the Food and Drug Administration ("FDA").

AMERX product lines continue to gain acceptance within the health care community. AMERX owns and operates four different websites. The sites can be viewed at www.amerigel.com, www.amerxhc.com, www.extremitease.com and www.amerxstore.com. These websites provide viewer-focused information about AMERX's products to consumers (amerigel.com and extremitease.com) and health care providers (amerxhc.com). Amerxstore.com, amerigel.com and extremitease.com are equipped to handle direct sales to the public.

Market for Products

We have expanded our product line over the years to address a broader range of wound applications. Our core AMERIGEL product line containing Oakin® established our presence in the physician market to address skin and wound care treatment needs. HELIX3 Bioactive Collagen was added to our product line in fiscal 2015 and AMERX Kits, dressings and bandages in fiscal 2016 to address the broader wound care market needs for an increasing number of people with diabetes and obesity. This market is primarily comprised of hospitals, wound care centers, nursing homes, home health care agencies and health care practioners. The EXTREMIT-EASE® Compression Garment, introduced in 2017, enables AMERX Health Care to compete in the global compression therapy market, a multi-billion market that is projected to escalate as a result of aging populations, rising prevalence of diabetes, lymphatic diseases,

cancer surgeries, venous diseases and sports injuries. In fiscal 2019, the Company continued expanding its sales channel designed to reduce inventory costs while increasing access to AMERX full line of products, through existing markets. Amerx grew its Wound Care product line with the addition of Retention Tape, additional Bordered Foam sizes and additional sizes of Calcium Alginate products. The HELIX Collagen line grew with the addition of a 1" x 1", 4" x 4" and 7" x 7" Matrix pad. In fiscal 2021, AMERX added a 1" x 6" and 1" x 10" matrix pad to HELIX Collagen lline. In fiscal 2020, AMERX's Extremit-Ease Compression Garment line expanded with the introduction of a Tan version of the garment and matching liner. Extremit-Ease continues to gain momentum in the wound care, edema and lymphedema markets with plans to further expand the line. In fiscal 2021, AMERX introduced AMERIGEL Hand Sanitizer, a premium product containing 70% alcohol to be effective against germs and moisturizers to keep the skin from drying out from heavy use. In fiscal 2022, AMERX expanded its Collagen line with the introduction of Advantagen®, to bring its line of products into hospital and surgery center settings. AMERX also repackaged its AMERX Dressing product line, including Calcium Alginate, Foam and Gauze Dressings; and added Retention Tape as a secondary dressing option.

We believe AMERX Health Care's products offer quality, efficacious treatment options for acute and chronic wounds, ulcers and recurring skin conditions, and therapy options for edema most often treated by health care professionals. The retail market for AMERX products is comprised of national and regional chain stores, independent retail pharmacies and medical supply stores.

Distribution and Sales

AMERX's traditional method of distribution has been through retail and institutional distributors. We expect to continue increasing our distributor base, particularly with distributors capable of introducing AMERX's products in new medical specialty markets, in new geographical areas and to new retail chains. Distributors typically purchase products from AMERX on standard credit terms (2%10, Net 30). AMERX supports its distributors through product literature, advertising and participation at industry trade shows. All existing distributors sell AMERX products on a non-exclusive basis. Amerx continues to show significant growth in its internet channel of sales, which includes all or their products, excluding kits (exclusive to the professional market).

We periodically receive inquiries about international market distribution for the AMERIGEL product line. These inquiries have been generated by our advertising, market presence and web sites (www.amerxhc.com, www.amerigel.com and www.extremitease.com). We respond to and pursue all such inquiries, while complying with applicable international regulatory guidelines.

In fiscal 2024, AMERX generated all of our net sales of approximately $4,984,000.

Significant Customer(s)

During the year ended June 30, 2024 sales from one customer accounted for approximately more than 10% of AMERX’s sales. In fiscal 2023 one customer accounted for more than 10% of AMERX’s sales.

Manufacturing

During fiscal 2024, the majority of manufacturing of AMERX's products was completed by non-affiliated manufacturing facilities. AMERX has written contracts with its manufacturers (and there are no minimum purchase requirements). The agreements / arrangements made with multiple manufacturers reduces the potential risk associated with relying on a single manufacturer. AMERX believes there are additional companies that could manufacture AMERX products according to specifications, if necessary.

AMERX's manufacturing and packaging activities are performed pursuant to Current Good Manufacturing Practices ("CGMP") as defined under the United States Federal Food, Drug and Cosmetic Act, as amended (the "FFDC Act") and the regulations promulgated under the FFDC Act. All manufacturing activities are required to comply with the product specifications, supplies and test methods developed by AMERX specifically for its products, as well as the CGMP.

A single source currently furnishes a proprietary ingredient contained in the AMERIGEL products. AMERX does not have a written contract with this supplier; however, management believes that, if necessary, an alternative supplier could be secured within a reasonable period of time. The manufacturer generally provides other raw materials and ingredients and we believe there are numerous other sources for these materials and ingredients. However, there can be no assurance that AMERX would be able to timely secure an alternative supplier and the failure to replace this supplier in a timely manner could materially harm AMERX's results of operations.

Proprietary Rights

The United States Patent and Trademark Office registered the Company's AMERIGEL trademark in January 1999. OAKIN, the principal proprietary ingredient used in AMERIGEL products, became a registered trademark in 2007. In fiscal 2016, AMERX received registered trademarks for the OAKIN logo, HELIX3, HELIX3 CM, HELIX3 CP and the HELIX3 logo. In fiscal 2017, AMERX received registered trademark approval for the EXTREMIT-EASE Compression Garment name, logo and mark "WHERE COMPRESSION MEETS COMPLIANCE". All registered trademarks have been periodically renewed, when required, and are currently in effect. In 2017 AMERX Health Care filed a patent application related to our EXTREMIT-EASE compression product. This patent was approved in June 2022. In fiscal 2023, AMERX received registered trademark approval for the ADVANTAGEN logo. AMERX relies on a combination of trademarks, patents, trade secret protection and confidentiality agreements to establish and protect its proprietary rights.

Competition

The market for skin and wound care treatment products in which AMERX operates is highly competitive. Competition is based on product efficacy, brand recognition, loyalty, quality, price and availability of shelf space in the retail market. AMERX competes against several well-capitalized companies offering a range of skin treatment products as well as small competitors having a limited number of products. AMERX has successfully established its products efficacy and value within specialized health care markets and expects to continue to expand this marketplace.

Order Placement and Backlog

There were back orders of $4,483 as of June 30, 2024 and $0 as of June 30, 2023, respectively.

Governmental Approvals and Regulations

The production and marketing of our products are subject to regulation for safety, efficacy and quality by numerous governmental authorities in the United States. AMERX's advertising and sales practices are subject to regulation by the Federal Trade Commission (the "FTC"), the FDA and state agencies. The FFDC Act, as amended, the regulations promulgated thereunder, and other federal and state statutes and regulations govern, among other things, the testing, manufacture, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion of AMERX's products. The FDA regulates the contents, labeling and advertising of AMERX's products. AMERX may be required to obtain FDA approval for proposed nonprescription products. This procedure involves extensive clinical research, and separate FDA approvals are required at various stages of product development. The approval process requires, among other things, presentation of substantial evidence to the FDA, based on clinical studies, as to the safety and efficacy of the proposed product. After approval, manufacturers must continue to expend time, money and effort in production and quality control to assure continual compliance with the Current Good Manufacturing Practices (CGMP) regulations.

We believe that, as of June 30, 2024, we are in compliance with all applicable laws and regulations relating to our operations in all material respects. Compliance with the various provisions of national, state and local laws and regulations has had a material adverse effect upon the capital expenditures, earnings, financial position, liquidity and competitive position of the Company. We have incurred and will continue to incur costs in order to remain compliant with applicable securities laws and regulations of the U.S. Securities and Exchange Commission (“SEC”) and the FDA.

Employees

As of September 1, 2024, the Company and its subsidiary employ a total of 19 full time employees and 1 part time employee, consisting of 10 management employees, 3 sales-related employees and 7 administrative employees. One employee works under Procyon and nineteen employees work under the AMERX subsidiary.

ITEM 1C. CYBERSECURITY

Cybersecurity threats and cybersecurity incidents could adversely affect our business and disrupt our operations. Cybersecurity incidents include an intentional attack or unintentional event allowing unauthorized access to systems impacting the confidentiality, integrity and/or availability of our information sources. Cybersecurity threats are any potential unauthorized occurrence on or conducted through our information systems that may result in adverse effects on the confidentiality, integrity, or availability of our information systems or the information therein.

To date, Cybersecurity threats have not had a material impact nor, are they anticipated to significantly affect the Company, including our business strategy, results of operations or financial condition.

We rely extensively on information technology (IT) services to conduct our business. We also rely on networks and services, including internet sites, cloud and software solutions, data hosting and processing facilities and tools and other hardware, software and technical applications and platforms to assist in conducting our business.

Procyon Corporation has processes in place for identifying, assessing and managing material risks from potential unauthorized access to electronic information held by the Company for business and/or commercial purposes. We have safeguards in place to protect the confidentiality of information residing on the systems that include controls, mechanisms and technologies designed to prevent, detect and/or mitigate data theft or misuse. The data includes proprietary information that we routinely collect, process, store and transmit while conducting business with our customers. We contract third party consultants to assist providing security hardware and software, as well as providing reporting and recommendations to strengthen our systems.

As part of our risk management process, cybersecurity risks and mitigations are evaluated by senior leadership and presented to the Board of Directors.

As methods of cybersecurity attacks are varied and constantly evolving, we regularly review and update systems, processes and procedures to safeguard against potential threats. However, there is no guarantee that the measures we undertake will be adequate to safeguard against all threats presented; and we may be unable to anticipate these techniques or implement adequate preventative measures. These attacks are also reviewed by our third party consultants.

Regulatory requirements related to data privacy and cybersecurity are also changing, presenting new and increasingly rigorous requirements that may be applicable to our business. Implementation of and maintaining compliance with the evolving changes requires significant effort and cost for a company of our size which may limit our ability to comply and our cyber insurance coverage may not be adequate for liabilities or costs actually incurred.

The Company has current insurance coverage for Cybersecurity attacks. This coverage however, may not cover be enough to cover substantial attacks, if they occur. We also cannot be certain that insurance will be available to us with reasonable terms or that any insurer will not deny coverage of a future claim. These risks could substantially increase our operating costs, expose us to fraud or theft, subject us to potential liability and disrupt our business.

Acceptance of current payment options also subjects us to rules, regulations, contractual obligations and compliance requirements which may change over time or be reinterpreted, making compliance even more difficult, costly or uncertain. We cannot guarantee that our financial results will not be negatively impacted by complying with these requirements.

We will continue to mitigate risks by employing physical, administrative and technical measures including employee training, logical access controls, monitoring and testing, and maintenance of protective systems and contingency plans but remain potentially vulnerable to additional known or unknown cybersecurity threats and cannot be assured that the impact from such threats will not be material.

Management is in the process of starting an outside third party audit of our systems, to review if there are any improvements needed from either a security aspect or personnel training to safeguard against the internal human factor that can unintentionally cause harm. Management will report on these findings in the future.

ITEM 2. PROPERTIES

We currently maintain our corporate office, and those of AMERX and Sirius, at 164 Douglas Road East, Suite 164, Oldsmar, Florida 34677. Our office consists of approximately 18,000 square feet of space. We have entered into a five year lease which commenced in January 2021.

On January 13, 2021 the Company entered into a lease agreement to lease 18,000 square feet of warehouse space in Oldsmar, FL. The lease is is for a five year term starting May 1, 2021 and ending April 30, 2026. The lease payment begins at $14,165 per month and will increase annually based on the Consumer Price Index, and will be no less then 2% or exceed 5% per year.

ITEM 3. LEGAL PROCEEDINGS

The Company and its subsidiaries are not a party to any pending material legal proceedings nor is our property the subject of a pending legal proceeding.

PART II

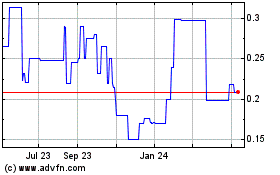

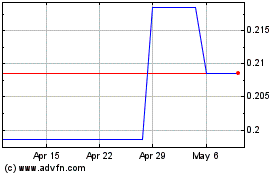

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES.

The Company’s Common Stock is quoted on the OTCQB electronic quotations system run by OTC Markets Group, Inc. Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark down or commission and may not necessarily represent actual transactions.

As of September 23, 2024, there were approximately 107 record holders of the Company’s Common Stock.

Holders of Common Stock are entitled to receive such dividends if declared by the Company’s Board of Directors. We have not declared any dividends on our Common Stock and have no current plans to declare a dividend in the immediate future.

Holders of the Series A Cumulative Convertible Preferred Stock (the “Preferred Stock”) are entitled to receive, if declared by the Board of Directors, quarterly dividends at an annual rate of $.10 per share. Dividends accrue without interest, from the date of issuance, and are payable in arrears in cash or common stock, when and if declared by the Board of Directors. No dividends had been declared or paid at June 30, 2024, and dividends, if ever declared, in arrears at such date total $421,736.

Holders of the Preferred Stock have the right to convert their shares of Preferred Stock into an equal number of shares of Common Stock of the Company. In addition, every holder of preferred stock is entitled to that number of votes equal to the number of shares of common stock into which the preferred stock is convertible. Such preferred shares will automatically convert into one share of Common Stock at the close of a public offering of Common Stock by the Company provided the Company receives gross proceeds of at least $1,000,000, and the initial offering price of the Common Stock sold in such offering is equal to or in excess of $1 per share. No shares were converted during fiscal 2023. Three shareholders converted their stock in fiscal 2024. So long as any shares of Series A Preferred Stock are outstanding, the Company is prohibited from declaring dividends or other distributions related to its Common Stock or purchasing, redeeming or otherwise acquiring any of the Common Stock.

There have been price fluctuations in the Company’s Common Stock during the period covered by this report. Factors that may have caused or can cause market prices to fluctuate include the number of shares available in the public float, any purchase or sale of a significant number of shares during a relatively short time period, quarterly fluctuations in results of operations, issuance of additional securities, entrance of such securities into the public float, market conditions specific to the Company’s industry and market conditions in general, and the willingness of broker-dealers to effect transactions in low priced securities. In addition, the stock market in general has experienced significant price and volume fluctuations in recent years. These fluctuations, may have had a substantial effect on the market price for many small capitalization companies such as the Company. Factors such as those cited above, as well as other factors that may be unrelated to the operating performance of the Company, may significantly affect the price of the Common Stock.

Equity Compensation Plan Information

The following table contains information regarding Procyon’s equity compensation plans as of June 30, 2024. The Company maintained the Procyon Corporation 2009 Stock Option Plan (the "2009 Option Plan"), which expired by its terms on December 8, 2019. In November 2020, our shareholders approved the Procyon Corporation 2020 Stock Option and Incentive Plan (the “2020 Option Plan”).

Equity Compensation Plan Information

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

| |

(a)

|

(b)

|

(c)

|

|

Equity compensation plans approved by security holders:

|

|

|

|

| |

|

|

|

| 2009 Option Plan |

65,000 |

.17 |

435,000 shares of Common Stock for Non-Qualified Stock Options (250,000 of which have been issued) and Stock Appreciation Rights and 500,000 shares of Common Stock for Incentive Stock Options. |

| |

|

|

|

| 2020 Option Plan |

75,432 |

.29 |

1,911,720 shares of Common Stock for Stock Options, Restricted Stock or Restricted Stock Units and Other Stock-Based Awards. |

Effective June 30, 2021, the Company granted 25,000 non-qualified stock options to Justice W. Anderson and 25,000 non-qualified stock options to James B. Anderson for exceeding certain performance standards in fiscal 2021, pursuant to the terms of their respective Restated and Amended Executive Employment Agreements dated July 1, 2020. Each of the options were dated September 24, 2021, but were granted and effective as of June 30, 2021 for a ten year term and have an exercise price of .373 per share.

Effective June 30, 2024, the Company awarded 12,848 Options to purchase Common Shares to Fred Suggs, Jr. The Company also issued 20,800 Restricted Common shares to Joseph Treshler, Monica McCullough and Steven McComas. These respective Options and Restricted shares were issued for services provided in the 2024 fiscal year pursuant to the Company’s Compensation Plan for Outside Directors and our 2020 Stock Option Plan. The Options and Restricted Shares were issued or granted on July 31, 2024.

Effective June 30, 2023, the Company awarded 25,432 Options to purchase Common Shares to Fred Suggs, Jr. The Company also issued 20,800 Restricted Common shares to Joseph Treshler, Monica McCullough and Steven McComas. These respective Options and Restricted shares were issued for services provided in the 2023 fiscal year pursuant to the Company’s Compensation Plan for Outside Directors and our 2020 Stock Option Plan. The Options and Restricted Shares were issued or granted on July 31, 2023.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This Report on Form 10-K, including Management’s Discussion and Analysis or Plan of Operation, contains forward-looking statements. When used in this report, the words “may”, “will”‚ “expect”‚ “anticipate”‚ “continue”‚ “estimate”‚ “project”‚ “intend”‚ “seek”, “hope”‚ “believe” and similar expressions, variations of these words or the negative of those words, and, any statement regarding possible or assumed future results of operations of the Company’s and its subsidiaries’ business, the markets for its products, anticipated expenditures, regulatory developments or competition, or other statements regarding matters that are not historical facts, are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 regarding events, conditions and financial trends including, without limitation, business conditions in the skin and wound care market and the general economy, competitive factors, changes in product mix, production delays, manufacturing capabilities, the loss of any significant customers or suppliers, general supply chain delays, new and unanticipated governmental regulations, the impact of the COVID-19 pandemic on the Company’s sales, operations and supply chain and other risks or uncertainties detailed in other of the Company’s Securities and Exchange Commission filings. Such statements are based on management’s current expectations and are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company’s actual plan of operations, business strategy, operating results and financial position could differ materially from those expressed in, or implied by, such forward-looking statements.

Our business in general is subject to certain risks including but not limited to the following:

-we may not be able to produce or obtain, or may have to obtain at excessive prices, the raw materials and finished goods we need;

-the vendors on whom we rely for manufacturing certain products may go out of business, fail to meet demand or provide shipments on an untimely basis;

-competitive pressures may require us to lower our prices on certain products, thereby adversely affecting operational results;

-we may not be able to obtain, or obtain at uneconomic expense and protracted time, the regulatory approval of new products;

-no assurance can be given that we will remain in compliance with applicable FDA and other regulatory requirements once clearance or approval has been obtained for a product. We must incur expense and spend time and effort to ensure compliance with these complex regulations. Possible regulatory actions could include warning letters, fines, damages, injunctions, civil penalties, recalls, seizures of our products, and criminal prosecution;

-consumers or distributors may not favorably receive our new or existing products;

-we may not be able to obtain adequate financing to fund our operations or expansion;

-a relatively small group of products may represent a significant portion of our net revenues or net earnings from time to time; if the volume or pricing of any of these products declines, it could have a material adverse effect on our business, financial position and results of operations;

-we could experience reduced revenues and profits if Medicare or other government programs change, delay or deny reimbursement claims;

-we are subject to various federal, state, and international laws and regulations pertaining to government benefit program reimbursement, price reporting and regulation, and health care fraud and abuse, including anti-kickback and false claims laws, the Medicaid Rebate Statute, the Veterans Health Care Act, and individual state laws relating to pricing and sales and marketing practices; violations of these laws may be punishable by criminal and/or civil sanctions, including, in some instances, substantial fines, imprisonment, and exclusion from participation in federal and state health care programs, including Medicare, Medicaid, and Veterans Administration health programs; violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our revenues, profitability, and financial condition;

-the loss of senior management or other key personnel, or our inability to attract and retain additional senior management or other key personnel, could adversely affect our ability to execute our business plan;

-we could become subject to new unanticipated governmental regulations or fail to comply with regulations applicable to our products, which could materially and adversely affect our business, financial position and results of operations; and

-legislative or regulatory programs that may influence prices of medical devices could have a material adverse effect on our business;

-the demand for our products may decrease because of various factors, such as adverse business conditions and a sluggish U.S. economy;

-our product supply and related patient access to products could be negatively impacted by, among other things: (i) seizure or recalls of products or forced closings of manufacturing plants, (ii) supply chain continuity including from natural or man-made disasters at one of our facilities or at a critical supplier or vendor, as well as our failure or the failure of any of our vendors or suppliers to comply with Current Good Manufacturing Practices and other applicable regulations and quality assurance guidelines that could lead to manufacturing shutdowns, product shortages and delays in product manufacturing, (iii) manufacturing, quality assurance/quality control, supply problems or governmental approval delays, (iv) the failure of a sole source or single source supplier to provide us with necessary raw materials, supplies or finished goods for an extended period of time, (v) the failure of a third-party manufacturer to supply us with finished product on time, (vi) construction or regulatory approval delays related to new facilities or the expansion of existing facilities (vii) the failure to meet new and emerging regulations requiring products to be tracked throughout the distribution channels using unique identifiers and (viii) other manufacturing or distribution issues including limits to manufacturing capacity due to regulatory requirements; changes in the types of products produced; physical limitations or other business interruptions;

-we may experience an increase in the number and magnitude of delinquent or uncollectible customer accounts during periods of economic downturn.

| |

-

|

We may be impacted by pandemics or other serious health conditions that could adversely affect our financial conditon and results of operations.

|

| |

-

|

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

|

| |

-

|

We or the third parties upon whom we depend may be adversely affected by natural disasters and our business continuity and disaster recovery plans may not adequately protect us from a serious disaster.

|

-Our cost to manufacture our products could be adversly affected by rising inflation and the increase in interest rates.

-Our business may be adversely impacted by disruptions caused by tropical storms.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our financial statements have been prepared in accordance with standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), which require us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosures. A summary of those significant accounting policies can be found in the Notes to the Consolidated Financial Statements included in this annual report. The estimates used by management are based upon our historical experiences combined with management’s understanding of current facts and circumstances. Certain of our accounting policies are considered critical as they are both important to the portrayal of our financial condition and the results of its operations and require significant or complex judgments on the part of management. We believe that the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our financial statements.

Deferred Income Taxes

Deferred income taxes are recognized for the expected tax consequences in future years for differences between the tax bases of assets and liabilities and their financial reporting amounts, based upon exacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. The Company accounts for income taxes under Topic 740 - Income Tax in the Accounting Standards Codification. A valuation allowance is used to reduce deferred tax assets to the net amount expected to be recovered in future periods. The estimates for deferred tax assets and the corresponding valuation allowance require us to exercise complex judgments. We periodically review and adjust those estimates based upon the most current information available. Valuation allowances for periods ending June 30, 2023 and June 30, 2024, were $0 and $209,003 respectively.

Revenue Recognition

The Company recognizes revenue in accordance with Securities and Exchange Commission Staff Accounting Bulletin Topic 13, “Revenue Recognition”, which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the seller’s price to the buyer is fixed or determinable; and, (4) collectibility is reasonably assured. We recognize revenue related to product sales upon the shipment of such orders to customers.

Revenue from Contracts with Customers (Topic 606)

In May 2014, the FASB issued a new standard related to revenue recognition. Under the new standard, recognition of revenue occurs when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The standard became effective for the Company beginning after December 15, 2017, including interim reporting periods within that reporting period. There has been no material effect to our financial results of operations based on this standard.

Stock Based Compensation

Stock based compensation is accounted for in accordance with Topic 718 - Compensation - Stock Compensation in the Accounting Standards Codification. All share-based payments to employees, including grants of employee stock options, are to be recognized in the statement of operations based upon their fair values and rescinds the acceptance of pro forma disclosure.

General

Our continuing operations and revenues consist of the operations of and revenues generated by AMERX, our wholly-owned subsidiary. AMERX skin and wound care products, marketed under the trademark AMERIGEL® and containing the proprietary ingredient OAKIN®, promote wound healing and healthy skin through moderately priced products for treatment of problematic skin and wound conditions.

AMERX markets AMERIGEL®, HELIX3®, AMERX® wound care products and EXTREMIT-EASE® compression garments to institutional customers such as hospitals, wound care clinics, skilled nursing facilities, home health agencies and to physicians and other health care practitioners. AMERIGEL® and EXTREMIT-EASE® products are also marketed to retail customers through direct sales, internet sales and through independent and retail chain drug stores and to physicians and other health care practitioners.

AMERX’s products are distributed to institutions and to retail stores through national, regional and local distributors as well as through direct sales and internet sales.

Future Expectations

AMERX expects to further penetrate the health care market through its participation in industry trade shows, advertisements in trade journals, development of additional distributor relationships and by opening new geographical territories (including international markets). AMERX management is trying new methods of marketing to support its multiple product lines, with multiple channels. AMERX management seeks to develop new markets as the AMERIGEL, HELIX3, AMERX and EXTREMIT-EASE product lines gain broader acceptance. AMERX management continues to seek for new products to develop in fiscal 2025.

Impact of COVID-19 on Our Business

The Company has not identified any issues in fiscal year 2024, that could be directly associated with the COVID-19 pandemic.

Results of Operations

Comparison of Fiscal 2024 and 2023.

During fiscal 2024 and 2023, our results of operations related solely to the operations of AMERX. Net sales during fiscal 2024 were approximately $4,984,000 as compared to approximately $4,687,000 in fiscal 2023, an increase of approximately $297,000 or 6%. The increase in sales was a result of expanding new markets offset by reductions and purchasing trends in traditional markets. AMERX believes the new market expansion will continue in fiscal 2025 with further plans to expand our traditional market channels.

Cost of sales were approximately $1,093,000 in fiscal 2024, as compared to approximately $1,117,000 in fiscal 2023, a decrease of approximately $24,000 or 2%. Cost of sales in fiscal 2024, as a percentage of net sales, was 22%, from 24% in the previous fiscal year ending 2023.

Gross profit increased to approximately $3,891,000 during fiscal 2023, as compared to approximately $3,570,000 during fiscal 2023, an increase of about $321,000, or 9%. As a percentage of net sales, gross profit was approximately 78% in fiscal 2024 and 76% in fiscal 2023.

Operating expenses during fiscal 2024 were approximately $4,123,000, consisting of approximately $2,085,000 in salaries and benefits and $2,038,000 in selling, general and administrative expenses. Operating expenses in fiscal 2023 were approximately $3,667,000 and consisted of approximately $1,860,000 in salaries and benefits and approximately $1,807,000 in selling, general and administrative expenses. This represents an increase in expenses of approximately $456,000 in fiscal 2024 over the operating expenses in fiscal 2023. As a percentage of net sales, operating expenses during fiscal 2024 were 83% as compared to 78% during fiscal 2023; as gross profit increased approximately $321,000 for the year on an approximately $456,000 increase in operating expenses. Salaries and Benefits increased when compared to previous year with fluctuations in personnel . Selling, General and Administrative expenses increased primarily due to increases in marketing efforts, expenses related to selling our products on the internet, and shipping expenses.

Losses from operations finished at approximately $232,000 in 2024, as compared to losses of approximately $97,000 in fiscal 2023. Losses before income taxes finished at approximately $171,000 in 2024, as compared to losses of approximately $65,000 in 2023. Net loss (after dividend requirements for Preferred Shares) was approximately $67,000 during fiscal 2023, compared to approximately $313,000 of net loss during fiscal 2024. The Company recorded approximately $170,000 of income tax expense when determining the net loss available to common shares in fiscal 2024, compared to $15,000 income tax benefit when determining the net income available in common shares in fiscal 2023.

Liquidity and Capital Resources

Historically, we have financed our operations through revenues from operations. As of June 30, 2024, our principal sources of liquidity included inventories of approximately $510,000, net accounts receivable of approximately $513,000, cash of approximately $326,000, and certificates of deposit of approximately $583,000. We had net working capital of approximately $1,597,000 at June 30, 2024.

Operating activities used cash of approximately $61,000 during fiscal 2024, and provided approximately $145,000 during fiscal 2023, consisting primarily of an increase in valuation allowance of $209,000, in fiscal 2024 and a decrease in inventory, in fiscal 2023. Cash used by investing activities during fiscal 2024 was approximately $64,000 as compared to cash used in investing activities in fiscal 2023 of approximately $455,000, respectively. Cash used in financing activities during fiscal 2024 was $0 compared cash used by financing activities of $0 during fiscal 2023, respectively.

During fiscal year 2024, we had no material cash requirements, including commitments for capital expenditures. In the 2025 fiscal year, the Company does not anticipate having any external cash needs. The Company has adequate funds to cover any planned capital expenditures. The Company also believes that it will continue to generate enough funds through its operations in the short and long term future to meet its capital needs. Although the Company plans to leave cash balances in insured bank accounts that have no risk of loss, from time to time the cash balance may exceed insured limits.

During fiscal 2024, three holders of shares of Preferred Stock converted their shares to Common Stock.

Commitments of Capital Expenditures

At June 30, 2024, the Company had no commitments for capital expenditures.

Off-Balance Sheet Arrangements

During fiscal years 2024 and 2023, we did not have any relationships or arrangements with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated financial statements as of June 30, 2024, and 2023 were audited by Ferlita, Walsh, Gonzalez and Rodriguez, P.A., the Company’s independent auditors, as indicated in their report included appearing at page F-1.

INDEX TO FINANCIAL STATEMENTS

| |

Page |

| |

|

| Report of Independent Registered Public Accounting Firm |

F-1 |

| |

|

| Consolidated Balance Sheets |

F-2 |

| |

|

| Consolidated Statements of Operations |

F-3 |

| |

|

| Consolidated Statements of Changes in Stockholders’ Equity |

F-4 |

| |

|

| Consolidated Statements of Cash Flows |

F-5 |

| |

|

| Notes to Consolidated Financial Statements |

F-6 |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

ITEM 9A. CONTROLS AND PROCEDURES.

Management of the Company, with the participation of the Chief Executive Officer and the Chief Financial Officer, has conducted an evaluation of the effectiveness of the Company’s disclosure controls and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as of the end of the period covered by this report. Based on that evaluation, management, including the Chief Executive Officer and Chief Financial Officer, concluded that, as of the date of this report, the Company’s disclosure controls and procedures were not effective in ensuring that all material information relating to the Company required to be disclosed in this report has been made known to management in a timely manner and ensuring that this information is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and regulations, because of the identification of a certain material weakness in our internal controls over financial reporting which is identified below, which we view as an integral part of our disclosure controls and procedures.

Our management, including our Chief Executive Officer and our Chief Financial Officer, does not expect that our disclosure controls and procedures or our internal controls over financial reporting will, in all instances, prevent all errors and all fraud. A control system, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met. While our control systems provide a reasonable assurance level, the design of our control systems reflects the fact that there are resource constraints, and the benefits of such controls were considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the financial reports of the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple errors or mistakes. Additionally, a control can be circumvented by the individual act of some person, by collusion of two or more persons, or by management’s override of a specific control. The design of any system of controls is also based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

(a) Management’s annual report on internal control over financial reporting. Our management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. The Company’s internal controls system was designed to provide reasonable assurance to the Company’s management and board of directors regarding the preparation and fair presentation of published financial statements.

All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

The Company’s management assessed the effectiveness of the Company’s internal control over financial reporting as of June 30, 2024. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control—Integrated Framework, Guidance for Smaller Public Companies. Our assessment based on those criteria concludes that, as of June 30, 2024, the Company’s internal control over financial reporting was not effective to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with Generally Accepted Accounting Principles (“GAAP”) rules as more fully described below. This was due to a deficiency that existed in the design or operation of our internal controls over financial reporting that adversely affected our internal controls and that may be considered to be a material weakness. The matter involving internal controls and procedures that the Company’s management considers to be a material weakness under the standards of the Public Company Accounting Oversight Board in fiscal 2024 is inadequate segregation of duties consistent with control objectives. Management believes that this material weakness did not have an adverse effect on the Company’s financial results reported herein. We believe that this material weakness will be remedied with growth of the Company in the future and hiring of additional personnel.

The Company is committed to continuous improvement of our internal control environment and financial organization. As part of this commitment, we intend to increase our personnel resources and technical accounting expertise within the accounting function through outside assistance from accounting experts and increase our segregation of duties within the company within the limits of our existing personnel. In addition, we intend to continually evaluate our policies and procedures to keep up with and expand our internal controls and quality of financial reporting within our personnel as our company grows. We expect to involve the board of directors more during the year regarding Company operations, including annual and quarterly risk assessments, strategic planning, and financial oversight and reporting. We expect to strengthen the expertise of the board by adding future members that have financial and business expertise in our industry. We intend to add additional members to the audit committee and require the audit committee members to further their understanding of applicable rules and requirements and continue their oversight responsibility of implementing necessary and effective internal control policies and procedures. We intend to monitor and evaluate the effectiveness of our internal controls and procedures over financial reporting on an ongoing basis and are committed to taking further action and implementing additional improvements as necessary and as resources allow.

(b) Attestation report of the independent registered public accounting firm. This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s independent registered public accounting firm pursuant to Item 308(b) of Regulation S-K.

(c) Changes in internal control over financial reporting. The Company has eliminated all material weaknesses with the exception of the segregation of duties weakness noted above. The Company will not be able to eliminate this material weakness until such time as growth in the numbers of employees permits. As the Company grows this will be addressed.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Directors and Executive Officers

| |

|

|

Capacities in |

Director |

| NAME |

Age |

|

Which Served |

Since |

| Regina W. Anderson |

77 |

|

Chairwoman of the Board |

2005 |

| Fred W. Suggs, Jr. |

77 |

|

Director |

1995 |

| James B. Anderson |

54 |

|

Director, Chief Financial Officer; Procyon |

2006 |

| |

|

|

Vice President - Operations, AMERX |

|

| |

|

|

Health Care Corp. |

|

| Justice W. Anderson |

47 |

|

Director, Chief Executive Officer; |

2006 |

| |

|

|

Procyon, President; AMERX Health |

|

| |

|

|

Care Corp. |

|

| Joseph R. Treshler |

71 |

|

Director |

2013 |

| Monica L. McCullough |

53 |

|

Director |

2019 |

| Steven McComas |

57 |

|

Director |

2021 |

| George O. Borak |

63 |

|

Vice President - Sales, AMERX Health Care Corp. |

|

Regina Anderson. Ms. Anderson has served as Chairwoman of the Board of Directors since September 2005, and as our Chief Executive Officer from November 2005 through December 2017. Ms. Anderson has 39 years experience in the medical field and 32 years of management experience. Ms. Anderson worked at Health South Rehabilitation Hospital for ten years as Outpatient Director, in charge of the main outpatient center plus four satellite offices. Prior to her work at HealthSouth, Regina was Vice-President of Operations at Stuffit Direct Marketing Company from 1980 through 1989. Regina received her Masters Degree from Kansas State University in 1970.

Fred W. Suggs, Jr. Mr. Suggs has served on our Board of Directors since 1995. He is a member of the Compensation committee and Chairman of the Ethics committee. He has been a practicing attorney since 1975. He is a founding member and Of Counsel in the Greenville, South Carolina office of Ogletree, Deakins, Nash, Smoak & Stewart, specializing in labor and employment law. He has been certified as a specialist in labor and unemployment law by the South Carolina Supreme Court and is a frequent lecturer on labor and employment law issues. Mr. Suggs graduated from Kansas State University with a B.S. degree and he received his J.D. degree from the University of Alabama.

James B. Anderson. Mr. Anderson, a Director since 2006, has served as our Chief Financial Officer since June 2005. In addition, from September 22, 2005, until that position was filled by Regina Anderson on November 1, 2005, Mr. Anderson served as Interim Chief Executive Officer. On June 28, 2005, Mr. Anderson was appointed to serve as the President of Sirius Medical Supply, Inc. Since 1993, Mr. Anderson has been involved with AMERX Health Care Corporation as its Chief Information Officer until 2005, when he was appointed VP of Operations. In 1996, Mr. Anderson became involved with Procyon Corporation after its merger and has since performed the duties of Vice President of Operations. Prior to Mr. Anderson’s work with the Company, he was involved with importing and exporting to Russia and Direct Mail Marketing. He received a B.S. from the University of South Florida. Mr. Anderson is the son of John C. Anderson, our late President, Chief Executive Officer and Chairman of the Board, the son of Regina Anderson, the Company’s Chairwoman of the Board and former Chief Executive Officer of Procyon, and the brother of Justice W. Anderson, our Chief Executive Officer/President of Procyon and Vice President of Marketing and the President of AMERX Health Care Corporation.

Justice W. Anderson. Mr. Anderson currently serves as the Chief Executive Officer/ President for Procyon and President and V.P. of Marketing for AMERX Health Care Corporation. He has served on Procyon's Board of Directors since 2006. Mr. Anderson served as the Vice President of Sales for AMERX from January of 2001 until June of 2012 when the new V.P. of Sales was hired. Mr. Anderson has served on the Corporate Advisory Board of the American Academy of Podiatric Practice Management. Mr. Anderson joined AMERX in 2000 after receiving his B.A. degree from the University of Florida. Mr. Anderson is the son of John C. Anderson, our late President, Chief Executive Officer and Chairman of the Board, son of Regina Anderson, the Company's Chairwoman of the Board and former Chief Executive Officer/President of Procyon and the brother of James B. Anderson, our Chief Financial Officer.

Joseph R. Treshler. Mr. Treshler has served on the Board of Director’s since January 2013 and is a member of the Audit and Compensation Committees. Mr. Treshler served for over 25 years (until June of 2018) as the Vice President of Business Management & Development of Covanta Energy Corporation, responsible for Covanta’s asset management, business development, project implementation, client community relations, community affairs and Clean World Initiative efforts in Florida. Mr. Treshler currently serves as President & CEO of JRT Consulting Services, LLC providing consulting services to public & private clients in the Waste -to-Energy Industry. Mr. Treshler earned his B.S. degree in Chemical Engineering in 1974 from Iowa State University of Science and Technology. He is a Professional Engineer registered to practice in the State of Florida. Mr. Treshler was appointed by the Company’s Board of Directors to serve on the Audit Committee on January 8, 2013 and to serve on the Ethics Committee on June 7, 2013.

Monica L. McCullough. Ms. McCullough serves as Chairman of the Audit Committee. Ms. McCullough has 26 years of accounting experience in various capacities. Her experience includes the management of several accounting functions, implementation and maintenance of Sarbanes-Oxley policies and procedures, SEC reporting, coordination of quarterly and annual audits, as well as implementing and maintaining accounting systems. She has spent the last 8 years as Facility Controller in the waste to energy industry. Ms. McCullough graduated from the University of South Florida with a B.S. degree in Accounting and is a Certified Public Accountant.

Steven McComas. Mr. McComas was appointed to the Board of Directors by a unanimous vote of the Board on July 17, 2021. He was also appointed to serve on the Ethics Committee. Mr. McComas is a graduate in Economics from the University of Florida. He also received a MBA from Mercer University and a Master of Public Administration from Jacksonville State University. Mr. McComas brings to the Company’s Board significant experience acting as an executive officer of several companies. Mr. McComas is an executive with thirty years of global experience in a variety of financial management, business leadership and corporate strategy. Currently, Mr. McComas is the Chief Executive Officer for Responsive Technology Partners, Inc. a managed information technology consulting and services firm operating throughout the Southeastern United States with offices in Metter, Vidalia, Atlanta, Athens, and Milledgeville Georgia, Raleigh, North Carolina and Tampa, Florida. Under Mr. McComas’ leadership, Responsive Technology Partners, Inc. has quickly grown to a ranking by Inc. Magazines’ 5000 as the 630 fastest-growing private companies in America in 2020. Mr. McComas also serves as the Chief Financial Officer for Pineland Telephone Cooperative, Inc., a rural telephone, and broadband cooperative based in Metter, Georgia and is responsible for all the company’s financial functions. Before Pineland, Mr. McComas had served as a Vice President of Finance for an operating subsidiary of the world’s largest publicly traded Thailand-based company engaged in the manufacturing and exporting of pet foods in the world. He was also the North American Director of Indirect Purchasing for a publicly traded world leader in outdoor power products for forestry, lawn and garden care headquartered in Stockholm, Sweden. Mr. McComas also was the Chief Financial Officer in commercial banking and private equity.