SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:

November 30, 2015

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to

__________

Commission File Number: 000-04465

|

PERVASIP CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

New York

|

|

13-2511270

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

430 North Street

White Plains, NY 10605

|

|

(Address of Principal Executive Offices)

|

|

(914) 750-9339

|

|

(Registrant’s telephone number, including area code)

|

Securities registered under Section 12(b) of

the Exchange Act:

None

Securities registered under Section 12(g) of

the Exchange Act:

Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No

ý

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨

No

ý

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing

requirements for the past 90 days. Yes

¨

No

ý

Indicate by checkmark whether the registrant

has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes

ý

No

¨

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K.

ý

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act:

|

Large accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

|

|

|

|

|

|

|

Accelerated filer

|

☐

|

|

Smaller reporting company

|

☒

|

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

¨

No

ý

The aggregate market value of registrant’s

voting and non-voting common equity held by non-affiliates (as defined by Rule 12b-2 of the Exchange Act) computed by reference

to the average bid and asked price of such common equity on May 31, 2015, was $4,777,985.

As of November 30, 2016, the registrant has

one class of common equity, and the number of shares outstanding of such common equity was 3,778,005,709.

Documents Incorporated By Reference: None.

ii

TABLE OF CONTENTS

|

PART I

|

|

|

|

|

|

|

|

|

Item 1.

|

Business.

|

|

2

|

|

Item 1A.

|

Risk Factors.

|

|

5

|

|

Item 1B.

|

Unresolved Staff Comments.

|

|

12

|

|

Item 2.

|

Properties.

|

|

13

|

|

Item 3.

|

Legal Proceedings.

|

|

13

|

|

Item 4.

|

Mine Safety Disclosures.

|

|

13

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

|

Item 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

20

|

|

Item 6.

|

Selected Financial Data.

|

|

21

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

|

21

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

|

19

|

|

Item 8.

|

Financial Statements.

|

|

19

|

|

Item 9.

|

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure.

|

|

19

|

|

Item 9A.

|

Controls and Procedures.

|

|

19

|

|

Item 9B.

|

Other Information.

|

|

20

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

|

22

|

|

Item 11.

|

Executive Compensation.

|

|

23

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

|

24

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

|

25

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

|

26

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

|

|

Item 15.

|

Exhibits, Financial Statements Schedules.

|

|

28

|

|

|

|

|

|

|

SIGNATURES

|

|

30

|

iii

Special Note Regarding Forward-Looking Statements

Included in this Form 10-K

are “forward-looking” statements, as well as historical information. Although we believe that the expectations

reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking

statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking

statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking

statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “project,” “plan,”

“will,” “shall,” “should,” and similar expressions, including when used in the negative. Although

we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements

involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. Important

factors that could cause our actual results, performance or achievements to differ from these forward-looking statements include

the following:

|

●

|

The availability of additional funds to successfully pursue our business plan;

|

|

●

|

The cooperation of our lenders;

|

|

●

|

The cooperation of industry service partners that have signed agreements with us;

|

|

●

|

Our ability to market our services to current and new customers and generate customer demand for our products and services in the geographical areas in which we operate;

|

|

●

|

The impact of changes in federal and state laws impacting the industries in which we operate;

|

|

●

|

Our ability to comply with provisions of our financing agreements;

|

|

●

|

The highly competitive nature of cloud-based products;

|

|

●

|

The acceptance of cloud-based technologies by mainstream consumers;

|

|

●

|

Our ability to retain key personnel;

|

|

●

|

Our ability to maintain adequate customer care and manage our churn rate;

|

|

●

|

The impact of adverse tax or regulatory rulings or actions affecting our operations, including the imposition of taxes, fees and penalties;

|

|

●

|

Our ability to maintain, attract and integrate internal management, technical information and management information systems;

|

|

●

|

Our ability to manage rapid growth while maintaining adequate controls and procedures;

|

|

●

|

The availability and maintenance of suitable vendor relationships, in a timely manner, at reasonable cost;

|

|

●

|

The decrease in prices to consumers brought about by intense competition in cloud-based products; and

|

|

●

|

General economic conditions.

|

|

|

|

|

These forward-looking statements

are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially different from

any future results expressed or implied by us in those statements.

These risk factors should

be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf

may issue. All written and oral forward-looking statements made in connection with this Report that are attributable

to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given

these uncertainties, we caution investors not to unduly rely on our forward-looking statements. We do not undertake

any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking

statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events. Further,

the statements about our intentions contained in this document are statements of our intentions as of the date of this document

and are based upon, among other things, the existing regulatory environment, industry conditions, market conditions and prices,

the economy in general and our assumptions as of such date. We may change our intentions, at any time and without notice,

based upon any changes in such factors, in our assumptions or otherwise.

1

PART I

In this Annual Report on Form

10-K, we will refer to Pervasip Corp., a New York corporation, as “our company,” “we,” “us”

and “our.”

Item 1. Business.

Overview

Our company was incorporated

in the State of New York in 1964. From 1999 to 2015 we were involved exclusively in the telecommunications business,

both as a reseller of telephone services and, after 2004, through our own IP telephone network. In December 2007, we changed our

name to Pervasip Corp. The word Pervasip is a contraction of the phrase “Pervasive IP” to signify a pervasive Internet

Protocol (“IP”) company with cloud-based technology that possessed a ubiquitous global presence.

During fiscal 2015 we transitioned

from our cloud-based telecommunications business to pursue a cloud-based business focused on the emerging cannabis industry. We

purchased Canalytix LLC, which is developing a cloud-based application to monitor and control greenhouse facilities, providing

real-time data on energy usage, HVAC systems, lighting and costs. On July 1, 2015, we purchased Plaid Canary Corporation (“PCC”),

a special purpose consolidation company organized to acquire companies and technologies in emerging agricultural markets. On July

6, 2015, PCC acquired 60% of the membership units of Grow Big Supply LLC (“Grow Big”), which operated a retail supply

store in Denver, Colorado targeted at those involved in growing cannabis.

We planned to use part of the

Grow Big facility to provide laboratory testing and oil extraction services. The facility, however, was in a warehouse district

and it was too difficult to maintain the cleanliness required for laboratory work. In February 2016, we were provided significant

financial incentives from Grow Big’s landlord to close our Grow Big store and move it to another location. We laid off our

staff at the store, except for our Chief Science Officer and Chief Operating Officer, and we moved our inventory to temporary storage

while we searched for a location that would allow us to perform scientific work and sell off our remaining inventory. In November

2016, we secured a verbal agreement with a licensed grower and dispensary and we moved inventory from storage into its warehouse.

When our existing inventory is sold, we do not plan to continue the sale of gardening products. We believe there is more value

in providing scientific analysis and extraction services to entities that are operating under a cannabis license.

We have developed scientific

methods for the analysis of cannabinoids in flowers, concentrates, and edibles through the use of available instruments. As

our operations expand, we plan to assist medical marijuana specialty production facilities in order to better regulate, calculate

proper dosage, and improve consistency in the product.

Available Information

We

maintain a corporate website with the address www.canalytix.com

.

We have not incorporated

by reference into this Report on Form 10-K the information on any of our websites and you should not consider any of such information

to be a part of this document. Our website addresses are included in this document for reference only.

We make available free of charge

through our corporate website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

and amendments to these reports through a link to the EDGAR database as soon as reasonably practicable after we electronically

file such material with, or furnish such material to, the U.S. Securities and Exchange Commission (the “SEC”). You

can also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC

20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1.800.SEC.0330.

In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC, including all of our filings.

2

The Industry

Marijuana, a derivative of

the cannabis plant,is classified as a Schedule I controlled substance under the U.S. Controlled Substances Act. A Schedule I controlled

substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under

medical supervision, and a high potential for abuse. The Department of Justice defines Schedule 1 controlled substances

as “the most dangerous drugs of all the drug schedules with potentially severe psychological or physical dependence.” Possession

of marijuana is illegal under federal law. Possession with an intent to distribute marijuana is a felony under federal law, potentially

punishable by fines up to $50 million and terms of imprisonment up to life.

Nevertheless, commencing

with California in 1996, a succession of states have decriminalized the use of marijuana for medical purposes. Although the

medical uses of marijuana deemed acceptable vary from state to state, decriminalization of use for relief of nausea during

chemotherapy, to induce appetite among cancer and AIDs patients, and to relieve chronic pain and muscle spasms is common. At

present, 27 states and the District of Columbia had decriminalized some or all medical uses of marijuana. In December 2015

Congress directed the U.S. Justice Department that it may not interfere with the medical use of marijuana in states where

such use is authorized. The number of Americans living in states in which recreational marijuana is legal more than tripled

as a result of the November 2016 elections. Seven states have legalized recreational marijuana, and a recent Gallup poll

suggests that almost 60% of Americans support the idea.

Our Business Plan

Our business plan is to expand

our product and service offerings to meet the full panoply of requirements for marijuana production, and expand our geographic

scope as the criminal proscription of commercial marijuana recedes. Our Chief Science Officer, Dr. Kenneth Hughes, is leading our

research and development activities directed towards development of technologies that will yield products and services useful to

the cannabis industry. Dr. Hughes is a specialist in the realization of products for agricultural and cleantech applications based

on complex technology. Dr. Hughes is exploring technologies currently used by our affiliates for extraction of corn oil during

the production of ethanol, and is adapting that know-how to enable the cost-effective extraction of oil from the cannabis plant.

Success in that endeavor would provide us a leading-edge position in the expanding marijuana production industry, as the extraction

technology could be marketed to the larger scale producers that are likely to emerge as the industry expands and matures.

Once we have established our

position as a known source for leading edge technologies in the cannabis industry, we intend to build on that position by accumulating

a portfolio of technologies and services that will enable us to offer clients a resolution for any technical issue in growing cannabis

they may encounter.

Software

and Analytics

Early in 2015 we acquired 90%

of Canalytix LLC. Canalytix was organized to market a software solution for the cannabis growing industry - specifically a cloud-based

method of offsite monitoring of an indoor growing facility. Our plan is to use that platform as our entry into a position as a

known "think-tank" for the cannabis growing industry, offering a full complement of technologies and services that will

enhance the profitabilty of our client growers.

The core Canalytix software

enables growers, both commercial or hobbyist, to monitor and control greenhouse facilities through a system of sensors that transfer

to the cloud real-time data regarding energy usage, efficiency of HVAC systems, lighting and related expense items. The systems

also permit the grouwers to measure, test and properly extract and rate their product to allow users to know the potency of the

product they consume. We can also assist medical marijuana specialty production facilities in order to better regulate, calculate

proper dosage, and maintain consistency in their product.

Our

staff is currently working on developing laboratory bench top equipment for the analysis of compounds that are important to the

cannabis industry, including cannabinoids and terpenes. We are also engaged in developing field portable equipment to allow on-site

analytics.

3

Going forward, we plan to offer

consumers the data/analytics from laboratory testing services to assist consumers in finding the cannabis product that meets their

needs. We also plan to us the data/analytics to assist with formulation projects for our customers or other companies

requiring that capability.

Implementation of advanced

instrumentation is a major key to efficient operations where plant yields are maximized, costs are reduced, and impacts on the

environment are minimized. We have identified several areas where tremendous opportunity exists for portable chemical sensing

instrumentation.

|

|

·

|

Plant chemical signals (released to the atmosphere)

are important in understanding plant stage of lifecycle, production of valuable plant components including cannabinoids, and terpenes,

and indicating when pests are present. We believe we can both “tune” and organize a chemical sensing system to

detect and monitor these chemicals to provide guidance on when to harvest plants, and when to provide nutrient and pesticide treatment.

Currently, plant harvesting is determined by visual information and destructive analysis. The use of non-destructive high sensitivity

instrumentation could yield hundreds of thousands of dollars to the bottom-line of large growing operations.

|

|

|

·

|

Greenhouse and warehouse optimization reduces

costs and increases product yields. Precise and accurate control of environmental conditions allows for greater optimization.

We have the ability to perform advanced environmental monitoring through a range of third-party licensed advanced technology sensing

instrumentation and software monitoring tools. The combination of this technology and in-house technical expertise will allow

grow facility managers as well as Canalytix personnel to monitor growing operations remotely, identify problems immediately, minimize

energy use, and reduce environmental impacts.

|

Marketing

Our

marketing approach is focused on working with industry participants to create awareness of the services and products we provide.

Word-of-mouth has proven to be our most valuable form of marketing. We also post information on websites

to attract potential customers within the geographical area that we serve.

Our target market segments

include Home Growers of organic vegetable and fruit Growers (small farms, home garden growers, restaurants growers, farmer markets),

the Do-it Yourselfers (home flower and plant growers/ mass market and growers in the cannabis related market (Dispensaries, Cultivators,

Caregivers).

Indoor growing techniques have

primarily been used to cultivate plant-based medicines. Plant-based medicines often require high-degree of regulation and controls

including government compliance, security, and crop consistency, making indoor growing techniques a preferred method. Cultivators

of plant-based medicines often make a significant investment to design and build-out their facilities. They look to work with companies

such as ours that understand their specific needs and can help mitigate risks that could jeopardize their crops. Plant-based medicines

are believed to be among the fastest-growing market in the U.S. and several industry pundits believe that plant-based medicines

may even displace prescription pain medication by providing patients with a safer, more affordable alternative.

Competition

All

of the Company’s planned distribution channels will compete for customers and sales with many different companies and products

that are competitive today and likely to be even more competitive in the future. Accordingly, we believe it is essential that the

Company continues to develop, improve, and refine the value propositions that are offered to its customers.

Competition

in the legal cannabis industry is significant, as competing companies continually open, and medical dispensaries search for a consistent

source for oil products. With regard to competition in the California, Colorado, Oregon and Washington markets, there are numerous

extraction facilities that we believe will compete with us for business.

The

Company’s size relative to its competition is difficult to gauge as most of our competition is privately held and does not

publicly report their earnings. We do know of several competitors who have been in operations longer than us, but they are privately

held and, therefore, we are unable to determine their size in terms of annual revenue.

4

We

also face competition from other public companies that offer equipment and expendables. Moreover, as the negative stigma associated

with some types of urban gardening such as legal cannabis plants diminishes, it is very possible that other better capitalized

public and private companies may enter the market and may effectively challenge the value proposition offered by the Pervasip subsidiaries.

These competitors may be able to attract customers more easily because of their financial resources. Our larger competitors can

also devote substantially more resources to business development and may adopt more aggressive pricing policies. We plan to compete

on the strength of multiple product offerings, controlled production and scientific analysis to ensure high-quality and consistency

in the products that we plan to offer.

Government Regulation

Twenty-seven states and

the District of Columbia currently have laws legalizing marijuana in some form. Seven states and the District of Columbia have

adopted more expansive laws legalizing marijuana for recreational use. Most recently, California, Massachusetts and Nevada all

passed measures in November 2016 legalizing recreational marijuana. California’s Prop. 64 measure allows adults 21 and

older to now possess up to one ounce of marijuana and grow up to six plants in their homes. Other tax and licensing provisions

of the law will not take effect until January 2018. In Nevada, adults will be able to legally possess up to one ounce of marijuana

beginning January 1, 2017. A similar ballot measure in Massachusetts allows for possession of marijuana starting on December 15,

2016.

A

number of states have also decriminalized the possession of small amounts of marijuana. Other states have passed medical marijuana

laws allowing for limited use of cannabis. Some medical marijuana laws are broader than others, with types of medical conditions

that allow for treatment varying from state to state. Others states have passed laws allowing residents to possess

cannabis

oil if they suffer from certain medical illnesses.

The state laws are in conflict

with the federal Controlled Substances Act, which makes marijuana use and possession illegal on a national level. The Obama administration

stated that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding

by state-designated laws allowing the use and distribution of medical marijuana, and the U.S. Congress concurred. However,

there is no guarantee that the Trump administration which comes to office in 2017 will not change federal policy regarding the

enforcement of the Controlled Substances Act. Any change to more strict enforcement of current federal laws could cause significant

financial damage to Pervasip and its shareholders. While Pervasip and its subsidiaries do not intend to harvest, distribute

or sell cannabis, more strict enforcement of federal law would be likely to reduce the demand for our products and services.

Employees

As of November 30, 2016 we

have 3 full-time employees. We are not subject to any collective bargaining agreement and we believe our relationship

with our employees is good. We plan to operate with a small number of employees until our revenues increase further

or until we are able to attract additional financing that has money earmarked for sales and marketing expense.

Item 1A. Risk Factors

You should carefully consider

the risks below, as well as all of the other information contained in this Annual Report on Form 10-K and our financial statements

and the related notes included elsewhere in this Annual Report on Form 10-K, in evaluating our company and our business. Any of

these risks could materially adversely affect our business, financial condition and results of operations and the trading price

of our common stock.

I. Risks Related To Our

Financial Condition

Our business will not be viable unless we obtain

significant amounts of additional capital.

At November 30, 2015 we had

$8,978 in cash and $7,183 in accounts receivable, balanced against $1,622,649 in accounts payable and many millions in debt. It

is unlikely that we can sustain current operations, and it is impossible that we can expand current operation, unless we obtain

additional capital. Because of our poor financial condition, it will be very difficult to obtain additional capital. If we fail

to do so, it is likely that our business will fail and our shareholders will lose most or all of their investment in our company.

5

Our negative net worth will

make it unlikely that we can obtain conventional financing for our business during the forseeable future.

Conventional financing generally

consists of debt secured by assets or of equity financing. At the present time, we have secured debt outstanding in amounts that

far exceed the book value of our assets. We also have a shareholders’ deficit that is approximately 19 times the book value

of our assets - which means that our company has no equity. For those reasons, we will not be able to obtain conventional financing

unless and until these conditions are substantially alleviated, which is unlikely to happen in the near future. Until then, the

only financing that will be available to us will involve the sale of securities convertible into common stock at floating rates,

so that our investors can liquidate their investment by selling into the market for our common stock. Our ability to obtain such

financing will depend on the continued liquidity of the market for our common stock. If the trading volume in the market for our

common stock diminishes, we may be unable to attract investors of any kind, in which case our business would be likely to fail

for want of capital resources.

The $3,832,659 in debt that

we owe to our lenders will add high interest expenses to our statement of operations, which will make it difficult for us to report

profits.

During the year ended November

30, 2015 we recorded $1,414,029 in interest expense, or 234% of our revenues in that period. During the year ended November 30,

2014, we recorded $1,838,375 in interest expense, or 374% of our revenues for the year. At November 30, 2015 we had $3,832,659

in debt on our balance sheet, before taking into consideration any debt discounts. That debt, until it is satisfied, will result

in interest expense in amounts that far exceed our current revenue level. This situation will make it difficult for us to realize

net income in the coming periods (except for net income that may occasionally result from changes in the value of our outstanding

derivative liabilities). And, in turn, our inability to report net income will make it difficult for us to obtain capital financing

that might replace the high interest debt on our balance sheet.

The debt agreements

governing our financing contain restrictions that may limit our flexibility in operating our business

In October 2015 we entered

into a Securities Purchase Agreement with TCA Global Credit Master Fund, LP, which is the Selling Security Holder in this offering.

Under the terms of the Securities Purchase Agreement, we sold to TCA a secured convertible debenture in the principal amount of

$500,000. The Securities Purchase Agreement contains covenants that limit our ability to enter into specified types of transactions.

These covenants will prevent us from undertaking, without the consent of TCA, transactions of the following nature:

|

|

·

|

merger or consolidation;

|

|

|

·

|

grant of liens on our assets;

|

|

|

·

|

sale or disposal of assets outside the ordinary course of business;

|

|

|

·

|

consummation of acquisitions;

|

|

|

·

|

payment of dividends or other distributions.

|

These covenants may prevent us from taking

actions that we consider to be in the Company's best interests and in the interest of its shareholders, but that TCA does not perceive

to be in its own interest. In addition, we are in default of our lending agreement with TCA.

We

do

not

expect

to

pay

dividends

and

investors

should

not

buy

our

common

stock

expecting

to

receive

dividends.

We

have

not

paid

any

dividends

on

our

common

stock

in

the

past,

and

do

not

anticipate that we

will

declare

or

pay

any dividends

in

the foreseeable

future.

Consequently,

investors

will

only

realize

an

economic

gain

on

their

investment

in

our

common

stock

if

the

price

appreciates.

Investors

should

not

purchase

our

common

stock expecting

to receive cash

dividends.

Because

we do

not

pay

dividends, and

there

may

be

limited

trading,

investors

may

not

have

any

manner

to

liquidate

or

receive

any payment on

their

investment.

Therefore,

our

failure

to pay

dividends

may

cause investors to

not

see

any return on

investment

even

if

we are

successful

in

our

business operations.

In addition, because

we do

not

pay

dividends we

may

have

trouble raising

additional

funds,

which

could

affect

our

ability to expand our

business

operations.

6

II.

Risks

Related

To

Our Business Operations

We have

a limited operating history and operate in a new industry, and we may not succeed.

We

have a limited operating history in our current line of business. We are subject to all risks inherent in a developing

business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties,

complications, and delays frequently encountered in the competitive and regulatory environment in which we operate. For example,

the recreational and medical marijuana industry is a new industry that as a whole may not succeed, particularly should the Federal

government change course and decide to prosecute those dealing in medical and recreational marijuana in violation of Federal law. If

that happens, the market for our products and services would be likely to disappear.

Since

we participate in a new industry, there are no established entities whose business model we can follow or build on the success

of. Similarly, there is limited information about comparable companies available for potential investors to review in

making a decision about whether to invest in Pervasip. Further, as the medical and recreational marijuana industry is a new

market, it is ripe for technological advancements that could limit or eliminate the need for our services and products.

You

should consider, among other factors, the risks and uncertainties encountered by companies that, like Pervasip, are in their early

stages. For example, unanticipated expenses, problems, and technical difficulties may occur and they may result in material

delays in the operation of our business, in particular with respect to our services and products. We may not successfully

address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could

materially harm our business to the point of having to cease operations and could impair the value of our capital stock to the

point investors may lose their entire investment.

The

long term success of our business will depend on our ability to develop new technologies for the cannabis industry.

Pervasip

will only be successful as a vehicle for public investment if we are able to achieve a market position that generates substantial

profits. Our plan to achieve that market position is based on our ambition to develop technologies that will enhance the profitablity

of our clients in the cannabis industry. We are active in developing those technologies; but the success of our development efforts

is by no means assured. Moreover, any new products or services that we develop and offer to the industry may be subject to significant

competition from offerings by new and existing competitors in the legal cannabis industry. In addition, new products, services

and enhancements may pose a variety of technical challenges and require us to attract additional qualified employees. The failure

to successfully develop and market these new products, services or enhancements could prevent Pervasip from becoming profitable.

Our

computer systems and operations may be vulnerable to security breaches.

We

expect that the cloud-based monitoring systems offered by our subsidiary, Canalytix, to the cannabis industry will be an important

foundation for establishing our company as a leading source of technology for that industry. For that reason, among others, the

safety of our network and our secure transmission of confidential information over the Internet will be essential to our operations

and our services. Although we have developed systems and processes that are designed to protect our network and the consumer information

stored on our network, our network and our computer infrastructure are potentially vulnerable to physical breaches or to the introduction

of computer viruses, abuse of use and similar disruptive problems and security breaches that could cause loss (both economic and

otherwise), interruptions, delays or loss of services to our users. We rely on licensed encryption and authentication technology

to effect secure transmission of confidential information, including credit card numbers. It is possible, however, that advances

in computer capabilities or new technologies could result in a compromise or breach of the technology we use to protect user transaction

data. A party that is able to circumvent our security systems could misappropriate proprietary information, cause interruptions

in our operations or utilize our network without authorization. Security breaches also could damage our reputation and expose us

to a risk of loss, litigation and possible liability. While we have experienced isolated instances of unauthorized use of our network,

and have responded to such events by taking steps to increase our network security, we cannot guarantee you that our security measures

will prevent future security breaches.

7

Third

parties might infringe upon our technology.

We

cannot assure you that the steps we have taken to protect our property rights will prevent misappropriation of our technology.

To protect our rights to our intellectual property, we rely on a combination of trade secrets, confidentiality agreements and other

contractual arrangements with our employees, affiliates, strategic partners and others. However, we may be unable to detect inappropriate

use of our technology. Moreover, in the event of misappropriation, we may lack the financial resources necessary to successfully

prosecute an enforcement action. Failure to adequately protect our intellectual property could materially harm our brand, devalue

our proprietary content and adversely affect our ability to compete effectively. Further, defending our technology rights could

result in significant financial expenses and managerial resources.

Third

parties may claim that our services infringe upon their intellectual property rights.

Third

parties may assert claims that we have violated a patent or infringed a copyright, trademark or other proprietary right belonging

to them and subject us to expensive and disruptive litigation. We incorporate licensed technology in some of our products

and services. In these license agreements, the licensors have agreed to indemnify us with respect to any claim by a third party

that the licensed software infringes any patent or other proprietary right so long as we have not made changes to the licensed

software. We cannot assure you that these provisions will be adequate to protect us from infringement claims. Any infringement

claims and lawsuits, even if not meritorious, could be expensive and time consuming to defend; divert management’s attention

and resources; require us to redesign our products and services, if feasible; require us to pay royalties or enter into licensing

agreements in order to obtain the right to use necessary technologies; and/or may materially disrupt the conduct of our business.

We may face difficulties

related to entry into joint ventures or the future acquisition or integration of additional businesses, which could harm our growth

or operating results

Because we have entered into

an industry that is rapidly developing, it is crucual to our future success that we keep pace with the growth. Toward that end,

we will be aggressively pursuing opportunities to enter into joint venture arrangements with other industry participants or to

acquire additional businesses or assets. Any such events will require substantial management time and resources, which may distract

from our core operations to their detriment. In addition, acquisitions of existing businesses involve substantial risks, including

the risk that we may not be able to integrate the operations, personnel, services, or technologies, the potential disruption of

our ongoing businesses, the diversion of management attention, the maximization of financial and strategic opportunities, the difficulty

in developing or maintaining controls and procedures, and the dilution to our existing stockholders from the issuance of additional

shares of common stock. As a result of these and other risks, we may not produce anticipated revenue, profitability, or synergies.

Because of our limited financial

resources, acquisitions will likely require us to issue equity securities. Such transactions often result in significant expenses,

such as the amortization of intangibles, write-down of goodwill, and write-off of acquisition-related expenses. If we are unable

to successfully integrate any acquired businesses or assets we may not receive the intended benefits of such acquisition. In addition,

we cannot predict market reactions to any acquisitions we may make.

While we conduct due diligence

in connection with acquisition and joint venture opportunities, there will be a risk that such due diligence efforts fail to discover

undisclosed liabilities or that we inadequately assess known liabilities. The discovery of material liabilities associated with

acquisitions or joint venture opportunities, economic risks faced by joint venture partners, or any failure of joint venture partners

to perform their obligations could adversely affect our business, results of operations, and financial condition.

If we are

able to expand our operations, we may be unable to successfully manage our future growth

.

Even

if we are successful in expanding our operations in the United States, as planned, we may experience periods of rapid growth, which

will require additional resources. Any such growth could place increased strain on our management, operational, financial

and other resources, and we will need to train, motivate, and manage employees, as well as attract management, sales, finance and

accounting, international, technical, and other professionals. In addition, we will need to expand the scope of our

infrastructure and our physical resources. Any failure to expand these areas and implement appropriate procedures and controls

in an efficient manner and at a pace consistent with our business objectives could have a material adverse effect on our business

and results of operations.

8

III. Risks Relating To

Our Industry

Our

success will be dependent on additional states legalizing medical and recreational marijuana.

Continued

development of the medical and recreational marijuana market is dependent upon continued legislative authorization of marijuana

at the state level. Any number of factors could slow or halt the progress. Further, progress is not assured and the process

can be expected to encounter set-backs. Even in states where there is public support for a legislative proposal, key support

must be created in the relevant legislative committee or a bill may never advance to a vote. Numerous factors can interfere

with success in the legislative process. Any one of these factors could slow or halt the progress and adoption of marijuana

for recreational and medical purposes, which would limit the market for our products and negatively impact our business and revenues.

Marijuana

remains illegal under federal law. Even in those jurisdictions in which the use of medical marijuana has been legalized at the

state level, its use and prescription are violations of federal law, which may disrupt the on going business of Pervasip.

Possession

and distribution of marijuana remain illegal under federal law. Marijuana is a schedule-I controlled substance. Even

in those jurisdictions in which the use of medical and recreational marijuana have been legalized at the state level, its possession,

prescription or distributions remains a violation of federal law. The United States Supreme Court has ruled in

United

States v. Oakland Cannabis Buyers’ Coop.

and

Gonzales v. Raich

that the federal government has the right to regulate

and criminalize cannabis, even for medical and recreational purposes, notwithstanding state or local de-regulation. Therefore,

federal law criminalizing the use of marijuana trumps state laws that legalize its use for medicinal purposes. At present,

certain states are decriminalizing possession of marijuana, either for medical use or in general. This may be because the Obama

administration made a policy decision to allow states to implement these laws and not prosecute anyone operating in accordance

with applicable state law. However, we faced another presidential election cycle in 2016, and a new administration could

introduce a less favorable policy. A change in the federal attitude towards enforcement could cripple the industry.

The legal cannabis industry is our target market, and if this industry is unable to operate, we would lose the majority of our

potential clients, which would have a negative impact on our business, operations and financial condition.

Our subsidiaries

may have difficulty accessing the service of banks, which may make it difficult to conduct our business operations.

As

discussed above, the distribution of marijuana is illegal under federal law. Therefore, there is a compelling argument

that banks cannot accept for deposit funds from the legal cannabis industry, and therefore cannot do business with the Company. While

efforts are underway in the U.S. Congress to amend banking regulations and laws in order to allow banks to transact business with

state-authorized medical and recreational marijuana businesses, there can be no assurance these legislative efforts will be successful,

that banks will agree to do business with medical marijuana and recreational marijuana industry participants, or that in the absence

of legislation state and federal banking regulators will not strictly enforce current prohibitions on banks handling funds generated

from an activity that is illegal under federal law. If we are unable to open accounts and otherwise use the service

of banks, the result could be a material adverse effect on our business operations.

Pervasip may

be

unable to respond

to

the rapid technological change

in

its

industry, and such change may increase costs and competition

that

may

adversely

affect

our

business.

Rapidly changing technologies,

frequent

new product and

service

introductions and

evolving industry standards

characterize

the

Company’s

market.

The

continued

growth of

the

Internet

and

intense

competition in the

Company’s

industry exacerbate

these

market

characteristics.

The Company’s

future

success

will

depend on its ability to adapt to rapidly changing technologies by continually improving the performance

features

and reliability of its products and services. The Company may experience

difficulties

that could delay or

prevent

the

successful

development,

introduction or

marketing

of its products

and

services.

In

addition, any new enhancements

must

meet

the

requirements of its

current

and

prospective

users

and

must achieve

significant

market

acceptance. The Company

could

also

incur

substantial

costs if it

needs

to

modify

its products

and

services

or

infrastructures

to adapt to

these

changes.

9

The Company also expects that

new competitors may introduce products,

systems

or services

that

are directly or indirectly competitive

with

the

Company.

These competitors

may

succeed

in developing,

products,

systems

and

services

that

have

greater

functionality or are less costly than the Company’s products,

systems

and

services,

and may be

more

successful

in

marketing such

products, systems

and

services.

Technological

changes

have

lowered the cost of operating

communications

and computer

systems

and

purchasing

software.

These

changes

reduce

the

Company’s

cost of providing

services

but also

facilitate

increased competition by reducing competitors’ costs in

providing

similar

services.

This competition

could

increase

price

competition

and

reduce

anticipated

profit

margins.

The cannabis

industry is highly competitive and we have less capital and resources than many of our competitors, which may give them an advantage

in developing and marketing products similar to ours or make our products obsolete

.

We

are involved in a highly competitive industry where we will compete with numerous other companies that offer alternative methods

or approaches, that may have far greater resources, more experience, and personnel perhaps more qualified than we do. Such resources

may give our competitors an advantage in developing and marketing products similar to ours or products that make our products obsolete.

There can be no assurance that we will be able to successfully compete against these other entities.

IV. Risks Related To Our

Management

Our

Series E preferred shareholder has voting control of our company and has the ability to exercise control over all matters submitted

to a stockholder vote.

Our

Chief Executive Officer, Paul Riss, currently owns 10 shares of our Series E Preferred Stock, which gives him 51% of the voting

power at any meeting of our shareholders or if shareholder consents are collected. He is therefore able to control the outcome

of any matter submitted to the shareholders for approval, which would include the election of directors, recapitalizations, mergers

or other significant corporate transactions.

TCA

may obtain voting control of the Company and exercise it for its own purposes.

In

October 2015 the Company sold a $500,000 promissory note to TCA Global Credit Master Fund, LP. The Note matures in April 2017 and

bears interest at 18% per annum. In connection with the sale of the Note, the Company issued to TCA Series J Preferred Stock. The

certificate that created the Series J Preferred Stock provides that, if the Company incurs a default under the terms of the Note,

TCA may declare its rights as a holder of Series J Preferred Stock effective. Those rights include the right to exercise voting

control of the Company. The Company has defaulted under the Note, and accordingly, TCA could take control of the Company. It is

possible that TCA would use that control to protect its investment in the Company in ways that may not be in the best interests

of the other shareholders of the Company.

Because

we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders have

limited protections against interested director transactions, conflicts of interest and similar matters.

The

Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York Stock Exchange and the Nasdaq

Stock Market as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These

measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which

are listed on the New York Stock Exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many

of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with

such compliance any sooner than necessary, we have not yet adopted these measures.

Because

none of our directors is independent, we do not currently have independent audit or compensation committees. This situation means

that the Board will determine the direction of our company with only limited contribution of insights from outside observers with

an objective perspective. This may limit the quality of the decisions that are made. In addition, the members of our board who

are also officers have the ability, among other things, to determine their own levels of compensation. Until we comply with such

corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance

may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters

and investors may be reluctant to provide us with funds necessary to expand our operations.

10

We depend

upon key personnel, the loss of which could seriously harm our business

.

Our

operating performance is substantially dependent on the continued services of our executive officers and key employees. In particular,

Dr. Kenneth Hughes, our Chief Science Officer, possesses valuable knowledge about and experience in extraction technologies and

patent applications. We have not entered into an employment agreement with Dr. Hughes and, although we are considering doing

so, have not acquired key-person life insurance on him or any of our executive officers. The unexpected loss of the

services of Dr.Hughes could have a material adverse effect on our business, operations, financial condition and operating results,

as well as the value of our common stock.

The

C

ompany’s

failure

to

a

ttract,

train,

or

retain

highly

qualified

personnel

could

harm

the

Company’s

business.

The

Company’s

success

also depends

on the Company’s ability to attract,

train,

and retain

qualified personnel, specifically those

with

management

and

product

development

skills.

In particular,

the

Company

must

hire

additional

skilled

personnel

to

further

the Company’s

research and development

efforts.

Competition

for

such

personnel

is intense. If

the

Company does

not

succeed

in attracting

new personnel or retaining and

motivating

the

Company’s

current

personnel,

the

Company’s

business

could

be

harmed.

If

we

fail

to establish

and

maintain an

effective

system

of

internal controls, we

may

not

be

able to

report

our

financial

results

accurately or to

prevent

fraud.

Any

inability

to

report

and

file our

financial

results

accurately

and

timely

could

harm our reputation

and

adversely impact the trading price of our

common

stock.

Effective

internal

controls are necessary

for

us

to provide

reliable

financial

reports

and

prevent

fraud.

If we

cannot

provide reliable

financial

reports or

prevent

fraud,

we will

not

be able

to

manage

our

business

as

effectively as we

would

if an

effective

control

environment

existed,

and

our

business

and

reputation

with

investors

may be

harmed.

As

a

result,

our

small

size

and

any

current

internal

control

deficiencies

may adversely affect

our

financial

condition,

results

of operation

and

access

to capital.

We

currently

have

insufficient

written policies

and

procedures

for

accounting

and

financial reporting

with

respect

to

the

requirements

and

application of US GAAP

and

SEC disclosure

requirements.

Additionally,

there is a lack of

formal

process

and

timeline

for

closing

the

books

and records at

the

end

of each reporting period. Such weaknesses restrict

the

Company’s ability to

timely

gather,

analyze

and

report

information

relative

to

the

financial

statements.

Because

of

the

Company’s limited

resources,

there

are

limited

controls

over

information

processing.

There is

inadequate

segregation

of

duties

consistent

with

control objectives. Our Company’s

management

is composed

of

a

small

number

of

individuals

resulting in a

situation

where

limitations

on

segregation

of

duties exist. In order

to remedy this situation we would

need

to

hire

additional

staff.

Currently,

the Company

is

unable

to

hire

additional

staff

to facilitate

greater

segregation

of

duties

but

will

continue to reassess its capabilities as it gains access to additional capital

.

V. Risks Related To Ownership

Of Our Common Stock

The market price of our common stock has been

and will continue to be adversely affected by our outstanding convertible debentures.

Several

third-party investors currently hold convertible debentures issued by the Company that allow them to convert principal and interest

into shares of our common stock at conversion prices that approximate a 30% to 60% discount to the trading price of our common

stock. At November 30, 2015, the balance of the convertible debentures outstanding payable to such convertible debenture holders

amounted to $3,470,211. If those debentures were converted in full, the shares that would be issued would far exceed the number

of shares of our common stock currently outstanding. When those debentures are converted, the shares that are issued are usually

immediately sold by the debenture holders into the public market. These sales, and the anticipation of such sales in the future,

exerts a downward pressure on our stock price. When a lender converts the debt into shares of our common stock and resells those

shares into the market, the result is often a reduction in the market price of our common stock. Until we are able to replace the

convertible debentures with debt or equity financing that does not exert a continuing pressure on the market price of our common

stock, the market price will continue to be volatile, and investors in our stock will bear a significant risk of reductions in

the market value of our common stock.

11

Our

common stock is quoted on the OTC Pink Market, which may increase the volatility of our stock and make it harder to sell shares

of our stock.

Our

common stock is quoted on the OTC Pink Market, which is the lower tier of the markets maintained by OTC Markets. There

is a greater chance of market volatility for securities that trade on the OTC Pink (as opposed to a national exchange or quotation

system), as a result of which stockholders may experience wide fluctuations and a depressed price in the market price of our securities.

Thus, stockholders may be required to either sell our securities at a market price which is lower than their purchase price or

to hold our securities for a longer period of time than they planned. Because our common stock falls under the definition

of “penny stock,” trading in our common stock may be limited because broker-dealers are required to provide their customers

with disclosure documents prior to allowing them to participate in transactions involving our common stock. These rules impose

additional sales practice requirements on broker-dealers that sell low-priced securities to persons other than established customers

and institutional accredited investors; and require the delivery of a disclosure schedule explaining the nature and risks of the

penny stock market. As a result, the ability or willingness of broker-dealers to sell or make a market in our common stock may

be limited, and stockholders could find it more difficult to sell their stock.

There is limited trading

of our common stock,

and

there

can

be

no

assurance

that

there

will be

an

active

market

for

our shares

of

common

stock

either

now

or

in

the future.

Our shares of common stock

have limited trading, and the price if traded may not reflect the value of our Company. There can be no assurance that there will

be an active market for shares of our common stock either now or in the future. The market liquidity will be dependent on the perception

of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be

no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment

or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly

volatile. Because there may be a low price for our shares of common stock or because we are involved in the legal cannabis industry,

many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to

effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any,

and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares

of common stock as collateral for any loans.

You may experience

dilution

of your ownership interest because

of

the future issuance

of

additional

shares

of our common stock and

our preferred stock.

In the

future,

we

may

issue

our

authorized

but

previously

unissued

equity securities,

resulting

in

the

dilution

of

the

ownership

interests of our

present

stockholders.

We are currently

authorized to issue

an

aggregate

of

9,000,000,000

shares

of

capital

stock

consisting

of

8,978,999,990

shares

of

common

stock,

par

value

$0.00001 per share

and

21,000,010

shares

of

blank check preferred

stock,

par

value

$0.00001 per share.

We

may

also

issue

additional

shares

of

our

common stock

or

other

securities that

are

convertible

into

or

exercisable

for

common stock

in

connection

with

hiring

or retaining

employees

or

consultants,

future

acquisitions,

future

sales of

our

securities

for

capital raising purposes,

or

for

other

business

purposes. The

future

issuance

of

any

such

additional shares of

our

common

stock

or

other

securities

may create

downward

pressure

on

the

trading

price of

our

common

stock.

There

can be

no

assurance

that

we

will

not

be

required

to

issue

additional

shares,

warrants

or

other

convertible

securities

in

the

future

in conjunction

with

hiring

or

retaining

employees or

consultants,

future

acquisitions,

future

sales

of

our securities

for

capital

raising purposes or

for

other

business

purposes, including

at a price (or exercise prices) below the price at

which

shares of

our

common

stock

are

trading.

Item 1B. Unresolved Staff Comments.

Not applicable.

12

Item 2. Properties.

The following table sets forth pertinent facts concerning our office

leases as of March 15, 2016

|

Location

|

|

Use

|

|

|

Approximate Square Feet

|

|

|

Annual Rent

|

|

|

430 North Street

White Plains, NY 10605

|

|

Office

|

|

|

|

650

|

|

|

$

|

8,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The lease for our office

space in White Plains, NY is $725 per month and is renewable annually. We maintain one employee at this location.

In addition to office space we rent a server room and storage space at this facility.

Item 3. Legal Proceedings.

We are currently not involved

in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There

is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory

organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened

against or affecting our company, our common stock, any of our subsidiaries or of our company’s or our company’s subsidiaries’

officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

13

PART II

Item 5. Market for Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

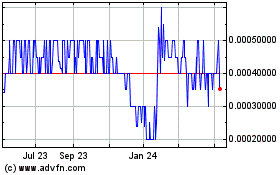

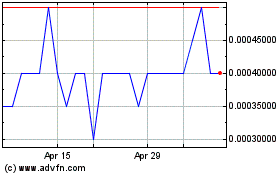

Our common stock is currently

quoted on the OTC Pink marketplace under the symbol PVSP. Until May 1, 2014, it was listed for quotation on the OTCQB.

The high and low quoted closing price for each quarterly period of our last two fiscal years are listed below:

The following table sets

forth the high and low trade information for our common stock for each quarter during the past two fiscal years. The

prices reflect inter-dealer quotations, do not include retail mark-ups, markdowns or commissions and do not necessarily reflect

actual transactions.

|

Quarter ended

|

|

High Price

|

|

|

Low Price

|

|

|

1

st

Quarter 2014

|

|

$

|

0.0024

|

|

|

$

|

0.0008

|

|

|

2

nd

Quarter 2014

|

|

$

|

0.0016

|

|

|

$

|

0.0006

|

|

|

3

rd

Quarter 2014

|

|

$

|

0.0008

|

|

|

$

|

0.0002

|

|

|

4

th

Quarter 2014

|

|

$

|

0.0003

|

|

|

$

|

0.0001

|

|

|

1

st

Quarter 2015

|

|

$

|

0.0004

|

|

|

$

|

0.0001

|

|

|

2

nd

Quarter 2015

|

|

$

|

0.0035

|

|

|

$

|

0.0002

|

|

|

3

rd

Quarter 2015

|

|

$

|

0.0023

|

|

|

$

|

0.0003

|

|

|

4

th

Quarter 2015

|

|

$

|

0.0005

|

|

|

$

|

0.0002

|

|

Recent Issuances of Unregistered Securities

None

(b) Holders

As of November 30, 2015 a total of 3,652,005,709

shares of the Company’s common stock were outstanding, held by 363 shareholders of record.

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is Worldwide Stock Transfer, LLC with its business address at One University Plaza, Suite 505, Hackensack, NJ 07601.

(c) Dividends

We have not declared or paid any dividends on

our common stock and intend to retain any future earnings to fund the development and growth of our business. Therefore, we do

not anticipate paying dividends on our common stock for the foreseeable future. Our secured term loans with our primary lender

prohibit us from paying dividends to stockholders.

(d) Securities Authorized for Issuance under Equity Compensation

Plans

The following table provides

information as of November 30, 2015, with respect to shares of our common stock that are issuable under equity compensation plans.

14

|

Plan Category

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

|

|

Weighted-average exercise price of outstanding options, warrants and rights

(b)

|

|

Number of securities remaining available to future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|

Equity compensation plans approved by security holders:

|

|

|

|

|

|

|

|

1996 Restricted Stock Plan

(1)

|

|

|

—

|

|

|

|

|

|

|

|

40,000

|

|

|

2007 Equity Incentive Plan

(2)

|

|

|

—

|

|

|

|

|

|

|

|

152,500

|

|

|

2010 Equity Incentive Plan

(2)

|

|

|

—

|

|

|

|

|

|

|

|

24,650,253

|

|

|

Subtotal

|

|

|

—

|

|

|

|

|

|

|

|

24,842,753

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans not approved by security holders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 Equity Incentive Plan

(2)

|

|

|

—

|

|

|

|

|

|

|

|

171,000

|

|

|

2011 Equity Incentive Plan

(2)

|

|

|

4,000,000

|

|

|

$

|

.01

|

|

|

|

16,000,000

|

|

|

Subtotal

|

|

|

4,000,000

|

|

|

|

|

|

|

|

16,171,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

4,000,000

|

|

|

|

|

|

|

|

41,013,753

|

|

___________________________

|

(1)

|

Our Restricted Stock Plan provides for the issuance of restricted share grants to officers and non-officer employees.

|

|

(2)

|

Our 2007, 2009, 2010 and 2011 Equity Incentive Plans allow for the granting of share options to members of our board of directors, officers, non-officer employees and consultants.

|

Item 6. Selected Financial Data.

We are a smaller reporting

company as defined by Rule 12b-2 of the Exchange Act and are not required to provide information under this item.

Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations.

THE FOLLOWING DISCUSSION OF OUR PLAN OF OPERATION

AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS AND RELATED NOTES TO THE FINANCIAL STATEMENTS

INCLUDED ELSEWHERE IN THIS ANNUAL REPORT. THIS DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS THAT RELATE TO FUTURE EVENTS OR OUR

FUTURE FINANCIAL PERFORMANCE. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT